Professional Documents

Culture Documents

MR Mann Nam Bhal

MR Mann Nam Bhal

Uploaded by

Anne Angelie Gomez SebialOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MR Mann Nam Bhal

MR Mann Nam Bhal

Uploaded by

Anne Angelie Gomez SebialCopyright:

Available Formats

1. What is Accounting according to the Accounting Standards Council?

(3 points)

2. Illustrate the Accounting Cycle. (3 points)

3. Identify the effect of the following transactions to the business. Draw if it increases the major accounts, if it

decreases the major account, and draw – if it doesn’t have effect to the major account. (15 points)

Owner’s

Transactions Assets Liabilities

Equity

1. A company paid the salaries of its employees

2. A firm renders services on account

3. Acquisition of machines on account

4. Payment of amount due to suppliers

5. Collected cash from customers on account

6. Incurred operating expense on account

7. Purchase of supplies on account

8. The owner invested additional equipment

9. Billed customers for delivery services on

account

10. Paid in advance the rent for July

11. Receipt of proceeds from bank loan

12. Rendered services to cash customers

13. Returned supplies purchased on account

14. Received a bill from the Water District

15. Owner withdraw cash for personal use

4. Dr. Manna Nam Bhal opened a medical clinic. The following are the transactions for January 2018: (35 points)

1- Dr. Bhal invested cash amounting to P 475 000, and a clinic furniture worth of P 125 000.

2- Bought medical equipment from Manila Medical amounting to P 325 000 by paying P 100 000 and the

balance with a note.

4- Bought medical supplies for cash, P 50 000.

5- The doctor withdrew cash for personal use, P 7 500.

7- Medical fees earned for the week amounted to P 25 000 from cash customers, and P 30 000 from clients on

account.

9- Made additional investment of P 150 000.

11- Full payment on the note is made.

14- Medical fees earned for the week amounted to P 15 000 in cash, and P 20 000 on account.

15- Collected the Sept. 7 account.

18- Bought medical supplies on account from Farma Sy, P 15 000.

28- Received a bill from electric company, P 10 000.

31- Paid for taxes and licenses, P 10 000, and salaries of attendants P 20 000.

Use the following accounts:

Cash on Hand; Accounts Receivable; Medical Supplies; Furniture and Fixtures; Medical Equipment; Accounts

Payable; Notes Payable; Bhal, Capital; Bhal, Drawing; Medical Income; Salaries Expense; Taxes and License; and

Utilities Expense

You might also like

- Accounting Cycle of A Service BusinessDocument8 pagesAccounting Cycle of A Service BusinessNiziU MaraNo ratings yet

- Salvacion CapistranoDocument14 pagesSalvacion CapistranoHazel Ann DuermeNo ratings yet

- TD Cash Back Card: MR JOHN DOE 1234 1234 1234 1234Document5 pagesTD Cash Back Card: MR JOHN DOE 1234 1234 1234 1234Nadiia Avetisian100% (3)

- DFD Payroll 6Document3 pagesDFD Payroll 6dhaval88100% (1)

- Basic Accounting Quiz Part 2Document3 pagesBasic Accounting Quiz Part 2accounting probNo ratings yet

- Reviewer 4Document2 pagesReviewer 4Zamantha TiangcoNo ratings yet

- Funda Manual Chapter 4 ExercisesDocument6 pagesFunda Manual Chapter 4 ExercisesRimuruNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- BUS 503 Advanced Accounting Exercise 1Document1 pageBUS 503 Advanced Accounting Exercise 1Alaa' Deen ManasraNo ratings yet

- Week 5 - ACCY111 NotesDocument5 pagesWeek 5 - ACCY111 NotesDarcieNo ratings yet

- Semi Final Exam (Accounting)Document4 pagesSemi Final Exam (Accounting)MyyMyy JerezNo ratings yet

- Accounting 3Document3 pagesAccounting 3hahaniNo ratings yet

- Lesson 1 - Acctg+Document8 pagesLesson 1 - Acctg+CARLA JAYNE MAGMOYAONo ratings yet

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- Compilation Notes On Journal Ledger and Trial Balance - Part 2Document8 pagesCompilation Notes On Journal Ledger and Trial Balance - Part 2Andra FleurNo ratings yet

- Modyul 1 (Ikatlong Markahan)Document29 pagesModyul 1 (Ikatlong Markahan)delgadojudithNo ratings yet

- BookkeepingDocument63 pagesBookkeepingRheneir Mora100% (12)

- Osborne Books Answer Sheet PDFDocument37 pagesOsborne Books Answer Sheet PDFBarışEgeUysalNo ratings yet

- The Accounting EquationDocument10 pagesThe Accounting EquationMylene Salvador100% (1)

- Module III Lesson 1Document5 pagesModule III Lesson 1MalynNo ratings yet

- Fundamentals of Accounting (1A&B) - Sample ProblemDocument4 pagesFundamentals of Accounting (1A&B) - Sample Problemalaina_alfaroNo ratings yet

- Analyze The Effects of The Transactions On The Accounting Equation.eDocument4 pagesAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanNo ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- ACTIVITY 06 Accounting For A Service Provider Additional ExercisesDocument3 pagesACTIVITY 06 Accounting For A Service Provider Additional Exercises이시연No ratings yet

- Accounting Assignment2Document2 pagesAccounting Assignment2samsonkiang64No ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesAdrianIlaganNo ratings yet

- Hospitality QuizDocument3 pagesHospitality QuizWycliffe Luther RosalesNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJAN RAY CUISON VISPERASNo ratings yet

- Customers Cashier: Entities paraDocument6 pagesCustomers Cashier: Entities pararayjoshua12No ratings yet

- Compilation of IFA QuestionsDocument67 pagesCompilation of IFA QuestionsBugoy CabasanNo ratings yet

- Lesson Plan Abm Semi DetailedDocument4 pagesLesson Plan Abm Semi DetailedLiza Reyes GarciaNo ratings yet

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Module 8 Recording TransactionsDocument21 pagesModule 8 Recording TransactionsAiron BendañaNo ratings yet

- Accounting Eng 5+6 المحاضرة الخامسة والسادسةDocument26 pagesAccounting Eng 5+6 المحاضرة الخامسة والسادسة01326567536mNo ratings yet

- ACC501 Tutorial Week 4Document3 pagesACC501 Tutorial Week 4Roy GastroNo ratings yet

- Acctng QuizDocument1 pageAcctng QuizSAIDA B. DUMAGAYNo ratings yet

- Notebook 2. Recording Transactions - Identifying Accountable TransactionsDocument3 pagesNotebook 2. Recording Transactions - Identifying Accountable TransactionsCherry RodriguezNo ratings yet

- Journalizing, Posting and Preparing A Trial Balance: Accounting 1 Final Exam (Take Home)Document1 pageJournalizing, Posting and Preparing A Trial Balance: Accounting 1 Final Exam (Take Home)SAIDA B. DUMAGAYNo ratings yet

- Session-16-17CASH FLOW PDFDocument59 pagesSession-16-17CASH FLOW PDFReshma MajumderNo ratings yet

- Journal Entries To FSDocument3 pagesJournal Entries To FSJadon MejiaNo ratings yet

- Double Entry System TestDocument2 pagesDouble Entry System TestHuma EssaNo ratings yet

- Topic 3 - Recording Transactions - ExerciseDocument14 pagesTopic 3 - Recording Transactions - Exercisethiennnannn45No ratings yet

- B 2-1 ET - Financial Accounting - Quizzes - Winter2019 ISMNetDocument14 pagesB 2-1 ET - Financial Accounting - Quizzes - Winter2019 ISMNetKristi MaleNo ratings yet

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Chapter 2Document3 pagesChapter 2amaliakb5No ratings yet

- Quizbowl With Answer KeyDocument3 pagesQuizbowl With Answer Keyaccounting probNo ratings yet

- CH 2 Service BusinessDocument10 pagesCH 2 Service BusinessNicole AshleyNo ratings yet

- NLKTDocument8 pagesNLKTMy Nguyễn HàNo ratings yet

- SkillsDocument1 pageSkillsMrsjiNo ratings yet

- LESSON 10 Business TransactionsDocument8 pagesLESSON 10 Business TransactionsUnamadable UnleomarableNo ratings yet

- Sample - Financial-Accounting-Analysis-V-ST-8cjfveDocument11 pagesSample - Financial-Accounting-Analysis-V-ST-8cjfvesushainkapoor photoNo ratings yet

- Accounting 1 Prelim Quiz 2Document4 pagesAccounting 1 Prelim Quiz 2Uy SamuelNo ratings yet

- Midterm Examination - Set ADocument3 pagesMidterm Examination - Set Aramirezericah84No ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- 1st AccDocument6 pages1st AccChristine PerezNo ratings yet

- Forms of Business Organization HighlightDocument8 pagesForms of Business Organization Highlightks505eNo ratings yet

- Solution Manual For Horngrens Financial and Managerial Accounting The Financial Chapters 4Th Edition Nobles Mattison Matsumura 970133255577 0133255573 Full Chapter PDFDocument36 pagesSolution Manual For Horngrens Financial and Managerial Accounting The Financial Chapters 4Th Edition Nobles Mattison Matsumura 970133255577 0133255573 Full Chapter PDFnorman.washington378100% (11)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- 2 Accounting Entries - DR - CR - AdjustmentsDocument6 pages2 Accounting Entries - DR - CR - AdjustmentsI am AchiNo ratings yet

- Financial StatementDocument24 pagesFinancial StatementARABELLA CLARICE JIMENEZNo ratings yet

- Financial AccountingDocument25 pagesFinancial AccountingNguyễn HoànNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- 89361Document42 pages89361Alexander KotlerNo ratings yet

- Trial Balance Cipta DewiDocument1 pageTrial Balance Cipta DewiNgurah EkaNo ratings yet

- Tax Case Digest - Commissioner of Internal Revenue Vs Algue Inc GR No L-28896Document2 pagesTax Case Digest - Commissioner of Internal Revenue Vs Algue Inc GR No L-28896Anthony Pineda100% (1)

- Lorain County School Districts Delinquent Amount Owed As of 09-23-14Document25 pagesLorain County School Districts Delinquent Amount Owed As of 09-23-14LorainCountyPrintingNo ratings yet

- Tax Levy Summary Proposed 11-2-21Document1 pageTax Levy Summary Proposed 11-2-21WVXU NewsNo ratings yet

- Instructions For Form 965-A: (Rev. January 2021)Document6 pagesInstructions For Form 965-A: (Rev. January 2021)Josh JasperNo ratings yet

- MODADV3 Quiz 3 - 12062021Document6 pagesMODADV3 Quiz 3 - 12062021Maha Bianca Charisma CastroNo ratings yet

- CST ChallanDocument3 pagesCST ChallanRajkiran SolankiNo ratings yet

- Gstinvoice 0047Document1 pageGstinvoice 0047Kalpatharu OrganicsNo ratings yet

- ST SupO 3037 2022 23 183323 PDFDocument1 pageST SupO 3037 2022 23 183323 PDFRajat SharmaNo ratings yet

- Tax Without ChoicesDocument6 pagesTax Without ChoicesEdwinJugadoNo ratings yet

- WLA Pricing For MF 30-Mar-22Document11 pagesWLA Pricing For MF 30-Mar-22sb RogerdatNo ratings yet

- BTC To USDT SWAP ProcedureDocument1 pageBTC To USDT SWAP ProcedureSuper TraderNo ratings yet

- OFI GST O2C Tax Defaultation Functional DocumentDocument59 pagesOFI GST O2C Tax Defaultation Functional DocumentdurairajNo ratings yet

- ST 3Document2 pagesST 3Hudasenna ChannelNo ratings yet

- Report Report 23Document9 pagesReport Report 23Pran piyaNo ratings yet

- By S.P.MishraDocument43 pagesBy S.P.MishrasamNo ratings yet

- Session 19-20 - Accounts OperationDocument16 pagesSession 19-20 - Accounts OperationB VaidehiNo ratings yet

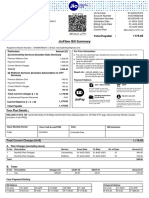

- JioFiber Aug2023Document1 pageJioFiber Aug2023AdhithyaRaj PNo ratings yet

- For QB Transfer and Business TaxationDocument2 pagesFor QB Transfer and Business Taxationsunthatburns00No ratings yet

- New Padma Perfumery Works - 060322Document1 pageNew Padma Perfumery Works - 060322Shubham ShawNo ratings yet

- Taxguru - In-Checklist For Internal Audit of GSTDocument2 pagesTaxguru - In-Checklist For Internal Audit of GSTRonak DesaiNo ratings yet

- Introduction To Negotiable InstrumentsDocument12 pagesIntroduction To Negotiable Instrumentsiyer_ramkumar100% (8)

- Receiver Paid - MyDHL+Document28 pagesReceiver Paid - MyDHL+Đen LêNo ratings yet

- Profit RatesDocument3 pagesProfit Ratesshahidameen2No ratings yet

- Account Statement: Folio Number: 1037065705Document2 pagesAccount Statement: Folio Number: 1037065705Abhishek JoshiNo ratings yet

- Statement of Axis Account No:916010037899832 For The Period (From: 01-06-2019 To: 28-08-2019)Document2 pagesStatement of Axis Account No:916010037899832 For The Period (From: 01-06-2019 To: 28-08-2019)Sumana DuttaNo ratings yet