Professional Documents

Culture Documents

Data Di Olah

Uploaded by

tiresmike0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

Data di Olah

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesData Di Olah

Uploaded by

tiresmikeCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

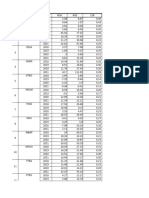

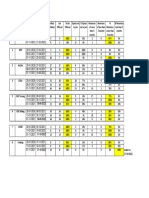

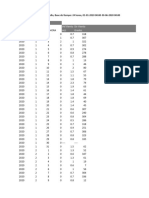

Struktur Modal DER Kebijakan Dividen Profitabilitas Harga Saham

No Kode Tahun

(X1) DPR (X2) ROA (X3) (Y)

1 ACST 2018 5.26 0.40 0.00 1.555

2019 35.47 0.14 0.11 970

2020 8.43 - 0.44 440

2021 1.22 - 0.28 157

2022 2.15 - 0.21 210

2 ADHI 2018 1.40 0.20 2.10 1.39

2019 1.50 0.10 1.80 1.167

2020 1.70 - 0.10 895

2021 1.90 - 0.22 895

2022 1.20 - 0.40 484

3 JKON 2018 0.86 0.20 0.06 364

2019 0.83 0.20 0.04 500

2020 0.70 - 0.01 400

2021 0.56 - 0.01 119

2022 0.51 - 0.05 124

4 SSIA 2018 0.77 0.08 0.50 500

2019 0.91 0.86 1.10 655

2020 0.90 0.25 (1.10) 575

2021 1.03 - (2.60) 484

2022 1.05 - 2.10 274

5 TOTL 2018 206.88 69.70 6.46 545

2019 175.14 65.37 5.92 426

2020 153.61 19.41 0.04 327

2021 121.39 31.25 0.04 327

2022 141.13 83.84 0.03 314

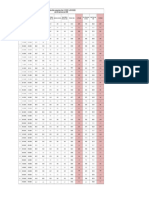

6 WIKA 2018 2.44 0.20 3.95 1.655

2019 2.23 0.20 4.32 1.99

2020 3.09 0.20 0.34 1.985

2021 2.98 - 0.31 1105

2022 3.29 - 0.02 810

7 WSKT 2018 3.31 0.75 3.71 1680

2019 3.21 0.50 0.84 1485

2020 7.82 0.25 9.22 1440

2021 5.70 - 0.70 742

2022 5.90 - 0.15 360

8 PPRE 2018 1.20 0.30 5.20 318

2019 1.50 0.30 4.30 240

2020 1.40 0.20 0.90 262

2021 1.40 0.20 1.10 174

2022 1.40 0.10 1.30 124

9 WEGE 2018 1.76 0.30 7.55 240

2019 1.52 0.25 7.36 306

2020 1.77 0.25 2.57 256

2021 1.51 0.20 3.62 190

2022 1.14 0.20 4.24 149

You might also like

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Bagian 1Document1 pageBagian 1Julia JunaediNo ratings yet

- Tabulasi Laila Upi 2023Document24 pagesTabulasi Laila Upi 2023Laila NajmiNo ratings yet

- PBV Sektor Makanan Dan Minuman Yang Terdaftar Di BEI 2016-2020Document5 pagesPBV Sektor Makanan Dan Minuman Yang Terdaftar Di BEI 2016-2020Kodok ngorekNo ratings yet

- Tabel 1Document3 pagesTabel 1Kurniawan Eka putraNo ratings yet

- Data Collectiion FormDocument4 pagesData Collectiion FormMARGARET WAKABANo ratings yet

- Weekly Sale ComparisionDocument1 pageWeekly Sale Comparisionpbujji.1216No ratings yet

- Tata PowerDocument18 pagesTata PowerAyan ChatterjeeNo ratings yet

- Analsis of Scotch FocastDocument24 pagesAnalsis of Scotch FocastRichard Osahon EseleNo ratings yet

- Data Meteorológica PDFDocument281 pagesData Meteorológica PDFFCISA FENIXNo ratings yet

- Group 07 22657 Sandeep S SDocument21 pagesGroup 07 22657 Sandeep S SSandeep ShirasangiNo ratings yet

- MAY Monthly Report PDFDocument1 pageMAY Monthly Report PDFAmmar NazhanNo ratings yet

- Lampiran SkripsiDocument7 pagesLampiran SkripsiAlip Ba TaNo ratings yet

- FIM TPDocument7 pagesFIM TPAfroza VabnaNo ratings yet

- Finance Assignment 1Document10 pagesFinance Assignment 1shilpee yadavNo ratings yet

- CronogramaDocument1 pageCronogramacristian Ronald Meza RojasNo ratings yet

- Pesto AssignmentDocument11 pagesPesto AssignmentakshiNo ratings yet

- Klinbac 1-2Document14 pagesKlinbac 1-2Compras BPacificoNo ratings yet

- Caja CuscoDocument1 pageCaja Cuscogenesis yamamoto montesNo ratings yet

- Formato - Múltiple - de - Pago - de - La - Tesorería - VER ANEXODocument3 pagesFormato - Múltiple - de - Pago - de - La - Tesorería - VER ANEXOomar.serrano.ubbjNo ratings yet

- FM Assignment 22021241198Document14 pagesFM Assignment 22021241198Sanchit GoteNo ratings yet

- HomeworkDocument27 pagesHomeworkHồ Ngọc HàNo ratings yet

- Calculation of Z ScoreDocument2 pagesCalculation of Z ScoreSk Jannatun Naeim Begum ChyNo ratings yet

- Anual All India Institute of Medical Sciences, Bathinda Annual 2020Document4 pagesAnual All India Institute of Medical Sciences, Bathinda Annual 2020IpassNo ratings yet

- Luxury Fashion Fullpagedownload StatistaDocument11 pagesLuxury Fashion Fullpagedownload StatistaZoë PóvoaNo ratings yet

- Presentation OnDocument15 pagesPresentation OnSlantx EvanNo ratings yet

- Istoric Valori Facturi: Perioada 2018-2022Document2 pagesIstoric Valori Facturi: Perioada 2018-2022Liliana AndreiNo ratings yet

- 03a2050 Portfolio 22-23Document1 page03a2050 Portfolio 22-23f20213093No ratings yet

- Data SkripsiDocument52 pagesData SkripsiShafirah AdilahNo ratings yet

- Klinbac 3Document14 pagesKlinbac 3Compras BPacificoNo ratings yet

- Project ValuesDocument30 pagesProject ValueshariharanpNo ratings yet

- Libro CDocument151 pagesLibro CAlberto Garcia AvellanedaNo ratings yet

- CorrelationDocument21 pagesCorrelationraviNo ratings yet

- Education and Health Sector in PakistanDocument17 pagesEducation and Health Sector in PakistanMuhammad UmairNo ratings yet

- UntitledDocument45 pagesUntitledfdwfwffNo ratings yet

- Teja WorkDocument12 pagesTeja WorkSiddhant SrivastavaNo ratings yet

- VeviaDocument18 pagesVeviaarya ankaNo ratings yet

- Total 3,698.00 550.77 22,399.60 652.42Document5 pagesTotal 3,698.00 550.77 22,399.60 652.42Babamu Kalmoni JaatoNo ratings yet

- Formato Múltiple de Pago de La Tesorería VER ANEXODocument3 pagesFormato Múltiple de Pago de La Tesorería VER ANEXOJorge Joshua Nieto MuñozNo ratings yet

- Istoric Valori Facturi: Perioada 2018-2021Document2 pagesIstoric Valori Facturi: Perioada 2018-2021Liliana AndreiNo ratings yet

- Computation of Taxable Income For The F.Y 01.04.13 To 31.03.14 of Mr. RDocument10 pagesComputation of Taxable Income For The F.Y 01.04.13 To 31.03.14 of Mr. RAshutosh SinghNo ratings yet

- BAtata IPSDocument1,295 pagesBAtata IPSBouziane BeldjilaliNo ratings yet

- FMT Project - ACC CementDocument7 pagesFMT Project - ACC CementMridula HariNo ratings yet

- Alibaba Valuation (2020-2030)Document6 pagesAlibaba Valuation (2020-2030)ckkeicNo ratings yet

- FinancialsDocument2 pagesFinancialsclendeavourNo ratings yet

- Book 1Document10 pagesBook 1Gunjan ChoureNo ratings yet

- Activity 1Document5 pagesActivity 1GutsNo ratings yet

- Report Mature Estate Feb 2021Document5 pagesReport Mature Estate Feb 2021Christina WahyuNo ratings yet

- Calculo Del Indicador RSIDocument49 pagesCalculo Del Indicador RSIJEAN MARCO CAJA ALVAREZNo ratings yet

- PD Account Statement List Thu, April 7, 2022Document3 pagesPD Account Statement List Thu, April 7, 2022MADALAVARIGUDEM SACHIVALAYAMNo ratings yet

- ValuationDocument27 pagesValuationPragati ChaudharyNo ratings yet

- View RepaymentDocument1 pageView Repaymentjituthange89No ratings yet

- Natural Rubber Statistics 2022Document1 pageNatural Rubber Statistics 2022ftk uctatiNo ratings yet

- Annexure 1Document1 pageAnnexure 1Saurav MitraNo ratings yet

- QuispeDocument5 pagesQuispeCarlos Quispe RondonNo ratings yet

- SWB Jan 2023Document2 pagesSWB Jan 2023Ammar NazhanNo ratings yet

- Keekonomian Pod Ogip2 NewDocument63 pagesKeekonomian Pod Ogip2 NewRizky Putra GustamanNo ratings yet

- Datos Iboca Suba Enero-Junio 2020Document6 pagesDatos Iboca Suba Enero-Junio 2020Juan Esteban Moreno GarzonNo ratings yet

- Monocal Trade AlertDocument10 pagesMonocal Trade AlertYusmanizam YusofNo ratings yet

- Soal Uas Statistik Bisnis Prodi Komputeriasi Akuntansi Politeknik Lp3I JakartaDocument2 pagesSoal Uas Statistik Bisnis Prodi Komputeriasi Akuntansi Politeknik Lp3I JakartaKomputerisasi AkuntansiNo ratings yet