Professional Documents

Culture Documents

Cash Flow Cases

Uploaded by

ziad ElhamzawyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Cases

Uploaded by

ziad ElhamzawyCopyright:

Available Formats

_C;t.

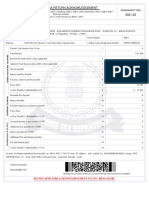

sh Ftow Handout

Case I

Balance Sheet

Assets:

Current Assets: 20X2 20Xl

Cash 971,337 593,443

Marketable Securities 1,600,000 0

Accounts Receivable 4,999,204 3,281,486

Inventory 8,057,847 9,862,238

Total Current Assets 15,628,388 13,737,167

Land 64,027 64,027

Buildings & Equipment 7,931,865 7,393,685

( Accumulated deQreciation) {4, 111,7482 (3,724,564}

Net fixed Assets 3,884,144 3,733,148

Deferred Income Taxes 89,000 l l 7,000

Pre12aid Ex12enses 597,752 438,710

Total Assets 20,199,284 18,026,025

Liabilities & Net Worth

Current Liabilities

Accounts Payable 2,899,290 1,259,711

Accrued Expenses 939,432 739,170

Income Taxes Payable 589,960 506,262

Sundry Current Liabilities 306,254 261,117

Total Current Liabilities 4,734,936 2,766,260

Long Term Debt 0 950,000

Total Liabilities 4,734,936 3,716,260

Provision for Deffered Income Ta,xes 474,000 507,000

Net Worth

Paid in capital 933,063 919,863

Reserves 302,230 214,960

Retained Earnings 13,755,055 12,667,942

Total Net Worth 14,990,348 13,802,765

Total Liabilities and Net ·worth 20,199,284 18,026,025

c~1sh Flow Handout

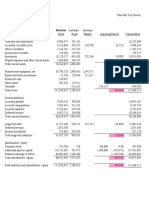

Income Statement: 20X2 20Xl

Net Sales 26,998,894 19,918,528

COGS (18,802,051) (I 3,754,382)

Depreciation Expense (604,178) (574,841)

Gross Profit 7,592,665 5,589,305

SG&A (4,033,699) (2,973,201)

NOP 3,558,966 2,616,104

Interest Expense (45,908) (67,066)

I/est Income 59,011 37,329

NPBT 3,572,069 2,568,367

Provision for income taxes (I, 730,000) (1,205,000)

Provision for deffered taxes 5,000 (39,000)

NPAT 1,847,069 1,342,367

Dividends Declared (759,956) (570,315)

Retained Earnings for the Year 1,087,113 772,052

Cash Flow Hanllout

Case 11

Case II

Balance Sheet

Assets:

Current Assets: 20X2 20Xl

Cash 1,317 1,897

Marketable Securities 0 0

Accounts Receivable 20,604 I 8,157

Inventory 20,977 14,002

Total Current Assets 42,898 34,056

Land

Buildings & Equipment

(Accumulated depreciation)

Net fixed Assets 13,233 11,789

Sundry non current asset 556 31 l

Prepaid Expenses 1,212 611

Total Assets 57,899 46,767

Liabilities & Net ·worth

Current Liabilities

Notes Payable 3,500 3,500

CPLTD 61 I 1,069

Accounts Payable 8,979 6,616

Accrued Expenses 2,471 2, 115

Income Taxes Payable 1,500 1,486

Total Current Liabilities 17,061 14,786

Long Term Debt 17,181 10,997

Total Liabilities 34,242 25,783

Provision for Deferred Income Taxes 1,513 l,354

Net Worth

Paid in capital 3,330 3,251

Reserves 5,376 5,265

Retained Earnings 13,438 11,114

Total Net Worth 22,144 19,630

Total Liabilities and Net \Vorth 57,899 46,767

Cash Flow Handout

Case II

Income Statement: 20X2 20Xl

Net Sales 117,796 98,766

COGS (90,625) (75,067)

Depreciation Expense (2,110) (2,004)

Gross Profit 25,061 21,695

SG&A (16,309) (14,695)

R&D expenses (1,939) (2,070)

NOP 6,813 4,930

Interest Expense (2,110) (1,612)

Other Income 636 714

NPBT 5,339 4,032

Provision for income taxes (2,260) (1,299)

Provision for deffered taxes (159) (363)

NPAT 2,921 2,370

Dividends Declared (597) (451)

Retained Earnings for the Year 2,324 1,919

C,sh Flow Hant.lout

Case HI

Case Ill

Balance Sheet

Assets:

Current Assets: 20Xl 20X2

Cash 564 1,484

Marketable Securities 25,853 32,584

Accounts Receivable 14,832 13,779

Inventory 27,199 27,932

Sundrv Current Assets 2,223 2,922

Total Current Assets 70,671 78,701

Land 2,044 2,362

Buildings & Equipment 37,325 42,565

(Accumulated depreciation) (13,697) ( I 5,277)

Construction in progress 947 1390

Net fixed Assets 27, l I 9 31,040

Investments 2,110 1,786

Total Assets 99,900 111,527

Liabilities & Net \Vorth

Current Liabilities

CPLTD 873 833

Accounts Payable 14,562 14,008

Accrued Expenses 3,396 3,515

Income Taxes Payable 833 1,905

Dividends payable 740 890

State & local tax payable 1,971 2,340

Total Current Liabilities 22,375 23,491

Long Term Debt 7,932 7,002

State & local tax payable 257 518

Total Liabilities 30,564 31,0ll

Provision for Deferred Income Ta"'<es 1,705 2,202

Net Worth

Paid in capital 3,698 3,708

Reserves 2,852 3,471

Retained Earni n °s 61,081 71 135

Total Net \Vorth 67,631 78,314

Total Liabilities and Net \Vorth 99,900 111,527

Cash Flow Handout

Case Ill

Income Statement: 20Xl 20X2

Net Sales 200,387 214,934

COGS (137,256) (143,224)

Depreciation Expense (3,225) (3,645)

Gross Profit 59,906 68,065

SG&A (40,321) (43,950)

State and local taxes (1,250) (1,616)

NOP 18,335 22,499

Interest Expense (837) (8 I l)

Interest income 3,148 2,458

Other Income 645 416

NPBT 21,291 24,562

Provision for income taxes (8,276) (10,107)

Provision for deffered taxes (862) (576)

NPAT 12,153 13,879

Dividends Declared (2,640) (3,051)

Retained Earnings for the Year 9,513 10,828

Cash Flow Format

Case IV

Case IV

Balance Sheet

Assets:

Current Assets: 20Xl 20X2

Cash 2,431.9 2,638.0

Accounts Receivable 28,434.8 30,211.8

Inventory 41,862.4 49,780.7

Total Current Assets 72,729.1 82,630.5

Land 2,051.1 1,655.6

Buildings & Equipment 67,699.2 72,330.1

(Accumulated deEreciation) {29,270.8} {31,059.0)

Net fixed Assets 40,479.5 42,926.7

Investments 4,184.3 6,452.8

Prepaid Expenses 1,231.7 1,614.4

LT receivables 4,811.5 5,697.9

Intanoib!es 327.6 274.5

Total Assets 123,763.7 139,596.8

Liabilities & Net Worth

Current Liabilities

Notes payable 4,650.0 0

CPLTD 2,350.0 1,700.0

Accounts Payable 5,663.1 5,828.1

Accrued Expenses 9,747.8 10,865.2

Income Taxes Payable 1,958.1 696.5

Total Current Liabilities 24,369.0 19,089.8

Long Term Debt 14,400.0 27,950.0

Total Liabilities 38,769.0 47,039.8

Provision for Deffered Income Taxes 3,102.9 3,397.8

Net Worth

Paid in capital 3,871.0 3,872.7

Reserves 16,678.1 16,719.5

Retained Earnings 61,342.7 68,567.0

Total Net Worth 81,891.8 89,159.2

Total Liabilities and Net Worth 123,763.7 139,596.8

Cash Flow Format

Case IV

Income Statement: 20Xl 20X2

Net Sales 172,459.1 193,334.9

COGS (129,216.7) (145,977.6)

Depreciation Expense 0 (4,029.0)

Gross Profit 43,242.4 43,328.3

SG&A (21,554.6) (23,925.1)

R&Dexpense (4,844.1) (4,803.0)

Amortization expense 0 (53.0)

NOP 16,843.7 14,547.2

Interest Expense (910.1) (1,690.1)

Other expenses (349.0) (199.1)

Other Income 908.7 1,076.6

NPBT 16,493.3 13,734.6

Provision for income taxes (7,940.0) (4,440.0)

Provision for deferred taxes (2,340.0)

NPAT 8,553.3 6,954.6

Net gain on sale of plant 0 1230.1

Investment income 1,245.3 2,253.1

NPAUI 9,798.6 10,437.8

Dividends Declared (2,783.1) (3,213.5)

Retained Earnings for the Year 7,015.5 7,224.3

Cash f!ml' Ham.lout

C.c,eV

Case V

Balance Sheet

Assets:

Current Assets: 20Xl 20X2

Cash 2,536 4,365

Accounts Receivable 11,995 14,865

Inventory 22,716 30,945

Sundry current assets 2,237 l I8

Total Current Assets 39,-48-t 50,293

Land

Buildings & Equipment 21,256 23,731

(A.ccumulated dqireciation) (9012) (10,420)

Net fixed Assets 12,244 13,311

Investment 4,068 5,598

Prepaid Expenses 916 1,084

Sundry non current assets 555 735

Total Assets 57,267 71,021

Liabilities & Net \Vorth

Current Liabilities

Notes payable 1,369 l,951

CPLTD 904 841

Accounts Payable 3,602 6,473

Accrued Expenses 3,334 6,924

Income Taxes Payable 410 2,420

Sundry current liability 272 0

Total Current Liabilities 9,891 18,609

Long Term Debt 12,338 11,579

Total Liabilities 22,229 30,188

Provision for Deferred Income Taxes 676 770

:Minority interest 834 1,207

Net \Vorth

Paid in capital 2,157 3,08 l

Reserves 12,613 12,948

Retained Earnings 18,758 22,827

Total Net Worth 33,528 38,S56

Total Liabilities and Net Worth 57,287 71,021

Cash Flow Hantlout

C,tse V

Income Statement: 20Xl 20X2

Net Sales 73,862 91,753

COGS (53,229) (67,172)

Depreciation Expense (1,356) (1,636)

Gross Profit 24,277 22,945

SG&A (12,920) (13,031)

R&D expense (567) (833)

NOP 10,790 9,076

Interest Expense (973) (1,255)

Other expenses ( l,234) (1,882)

Other Income 765 1,098

NPBT 9,348 7,037

Provision for income taxes (3,336) (2,621)

Provision for deffered income taxes (94)

NPAT 6,012 4,322

l\!Iinority interest expense (160) (431)

Equity investment income 791 852

NPAUI 6,643 4,743

Dividends Declared (1,218) (674)

Retained Earnings for the Year 5,425 4,069

Ca,h Flow Handout

Ca,e VI

Case VI

Balance Sheet

Assets:

Current Assets: 20Xl 20X2

Cash 4,908 8,068

Accounts Receivable 59,917 55,599

Inventory 67,369 50,335

Total Current Assets l32,194 114,002

Land 1,975 1,969

Buildings & Equipment 100,719 101,369

( Accumulated de[>reciation) {48.221) {50,682)

Net fixed Assets 54,473 52,656

Investments 12,931 13,445

Prepaid Expenses 4,976 4.929

Sundry non current assets 2,785 3,998

Other receivables 12,986 7,907

Total Assets 220,345 196,937

Liabilities & Net -worth

Current Liabilities

Notes payable 6,000 3,045

CPLTD 3,364 3,241

Accounts Payable 13,199 9,025

Accrued Expenses 20,247 22,276

Income Taxes Payable 451 2,017

Total Current Liabilities 43,261 39,604

Long Term Debt 61,255 43,716

Total Liabilities 104,516 83,320

Provision for Deferred Income Taxes 5,655 5,342

Net \Vorth

Paid in capital 21,511 20,630

FX translation gain or loss (I ,219) (3,878)

Retained Earnings 99,687 100,332

Treasury stock (9,805) (8,809)

Total Net \Vorth 110,174 108,275

Total Liabilities and Net \Vorth 220,345 108,275

Ctsb Flow Hamlout

Case VI

Income Statement: 20X1 20X2

Net Sales 351,565 331,717

COGS (269,344) (252,874)

Depreciation Expense (7,647) (7,678)

Gross Profit 7-',574 71,165

SG&A (48,152) (48,575)

R&D expense (7,438) (7,678)

:"/OP 13,984 14,912

Interest Expense (9,074) (7,143)

Other Income 2,645 1,775

NPBT 12,555 9,544

Provision for income taxes (5,012) (4,020)

NPAT 7,543 5,524

Equity investment income 358 3

NPAUI 7,901 5,527

Dividends Declared 0 ( 4882)

Retained Earnings for the Year 7,901 645

Cash Flow Handout

Comment on the cash flow:

Sources Uses

NOPAT 51% Interest expense 20%

Depree. 14% NPE 12%

WI 35% STD 30%

Dividends 38%

Note: WI is a source mainly due to the increase in the A/P due to the

mother company abroad.

Sources Uses

NOPAT 31% WI 45%

Depree. 14% Prepaid 4%

Other income 4% FP 21%

LTD 46% NPE 24%

NW 1% SNCA 2%

Cash 4% Dividends 4%

Note: Only 60% of the increase in the WI represented an increase in the

permanent level of WI.

Sources Uses

NOPAT 31% WI 20%

Depree. 16% Dividends 14%

LTD 17% FP 21%

STD 36% NPE 45%

Note: This company is expanding due to am permanent increase in the

demand on its products.

You might also like

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRajneesh Khichar : MathematicsNo ratings yet

- Las Tle Ac g7 8 Week 1Document7 pagesLas Tle Ac g7 8 Week 1Quee NnieNo ratings yet

- MicrosoftDocument11 pagesMicrosoftJannah Victoria AmoraNo ratings yet

- Tempest FA Template FH 2023Document6 pagesTempest FA Template FH 2023Gts PierreNo ratings yet

- Recommended: S&P Capital IQ - Standard 2017 FY 2018 FYDocument5 pagesRecommended: S&P Capital IQ - Standard 2017 FY 2018 FYViktoria HoferNo ratings yet

- Veda Co - Financial StatementsDocument2 pagesVeda Co - Financial StatementsTalib KhanNo ratings yet

- Amerbran Company ADocument6 pagesAmerbran Company ATale FernandezNo ratings yet

- CF - Example1Document8 pagesCF - Example1BSHELTON8No ratings yet

- Andy's Cannabis Financial StatementsDocument3 pagesAndy's Cannabis Financial Statementsnickstevens24No ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- ALK CH 9Document10 pagesALK CH 9Anisa Margi0% (1)

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- Financial Publication MarchDocument2 pagesFinancial Publication MarchFuaad DodooNo ratings yet

- Financial Position of The STCDocument13 pagesFinancial Position of The STCSalwa AlbalawiNo ratings yet

- Pinancle FinancialsDocument6 pagesPinancle FinancialsJhorghe GonzalezNo ratings yet

- Income StatementDocument44 pagesIncome Statementyariyevyusif07No ratings yet

- STC FS 2016Document3 pagesSTC FS 2016ehackwhiteNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- BSIS Tesla 2017 2021Document10 pagesBSIS Tesla 2017 2021Minh PhuongNo ratings yet

- Chapter 3 HomeworkDocument4 pagesChapter 3 HomeworkempersaNo ratings yet

- AscascaDocument9 pagesAscascaDhruba DasNo ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Anchor Compa CommonDocument14 pagesAnchor Compa CommonCY ParkNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Acc319 - Take-Home Act - Financial ModelDocument24 pagesAcc319 - Take-Home Act - Financial Modeljpalisoc204No ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Statements of Dunkin DonutsDocument4 pagesStatements of Dunkin DonutsMariamiNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Meta (FB) : Balance SheetDocument20 pagesMeta (FB) : Balance SheetRatul AhamedNo ratings yet

- Globe Vertical AnalysisDocument22 pagesGlobe Vertical AnalysisArriana RefugioNo ratings yet

- Statement of Financial Position Sci: Adjustement To Reconcile Net Income To Net Cash Provided by Operating ActivitiesDocument6 pagesStatement of Financial Position Sci: Adjustement To Reconcile Net Income To Net Cash Provided by Operating ActivitiesSai RillNo ratings yet

- Olfi. Ca. V4Document15 pagesOlfi. Ca. V4Abo BakrNo ratings yet

- Statements of Financial Position As at December 31 Assets Current AssetsDocument8 pagesStatements of Financial Position As at December 31 Assets Current AssetsCalix CasanovaNo ratings yet

- Analisis Laporan Keuangan - Prak. ALKDocument2 pagesAnalisis Laporan Keuangan - Prak. ALKAnti HeryantiNo ratings yet

- MDT (Medtronic PLC.) (10-Q) 2023-08-31Document154 pagesMDT (Medtronic PLC.) (10-Q) 2023-08-31Asim MalikNo ratings yet

- Understanding FSexerciseDocument14 pagesUnderstanding FSexerciseheyzzupNo ratings yet

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiNo ratings yet

- CheckDocument3 pagesCheckFacundoNo ratings yet

- Salditos, Ericca P.Document7 pagesSalditos, Ericca P.Ericca SalditosNo ratings yet

- A. Net IncomeDocument8 pagesA. Net IncomeAeron Paul AntonioNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- Section A (Group 11)Document14 pagesSection A (Group 11)V PrasantNo ratings yet

- Unilever FM TermReportDocument8 pagesUnilever FM TermReportLuCiFeR GamingNo ratings yet

- Q3 Financial Statement q3 For Period 30 September 2021Document2 pagesQ3 Financial Statement q3 For Period 30 September 2021Fuaad DodooNo ratings yet

- UnileverDocument5 pagesUnileverKevin PratamaNo ratings yet

- Sale Smart's+Financial+Ratios+PackDocument23 pagesSale Smart's+Financial+Ratios+PackDenisa ZahariaNo ratings yet

- Financial Statements - Tata Steel & JSW SteelDocument10 pagesFinancial Statements - Tata Steel & JSW Steelrohit5saoNo ratings yet

- FSA ProjectDocument59 pagesFSA ProjectIslam AbdelshafyNo ratings yet

- National Foods by Saqib LiaqatDocument14 pagesNational Foods by Saqib LiaqatAhmad SafiNo ratings yet

- Analysis of Financial Statements: Bs-Ba 6Document13 pagesAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNo ratings yet

- 02 06 BeginDocument6 pages02 06 BeginnehaNo ratings yet

- Bangladesh Lamps 3rd Q 2010Document3 pagesBangladesh Lamps 3rd Q 2010Sopne Vasa PurushNo ratings yet

- Bursa Q1 2015v6Document19 pagesBursa Q1 2015v6Fakhrul Azman NawiNo ratings yet

- SGR Calculation Taking Base FY 2019Document17 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- Budget Artikel ExcelDocument8 pagesBudget Artikel ExcelnugrahaNo ratings yet

- Budget PT Abcd Balance Sheet Projection of Year 2017Document8 pagesBudget PT Abcd Balance Sheet Projection of Year 2017Abdul SyukurNo ratings yet

- Vietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Document24 pagesVietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Như ThảoNo ratings yet

- United - Bank - For - Africa - PLC - Quarter - 3 - Financial - StatDocument27 pagesUnited - Bank - For - Africa - PLC - Quarter - 3 - Financial - StatmayorladNo ratings yet

- Attock Cement 3 Statement ModelDocument67 pagesAttock Cement 3 Statement ModelRabia HashimNo ratings yet

- Accountancy Question Paper For H S Final Examination 2022Document20 pagesAccountancy Question Paper For H S Final Examination 2022Dhruba J DasNo ratings yet

- Domin : School! FT NDocument3 pagesDomin : School! FT NJoed EspeletaNo ratings yet

- Ad Interim Ex Parte OrderDocument96 pagesAd Interim Ex Parte OrderSmita DharamshiNo ratings yet

- Data Book 1609842354604 - DuplicateInvoice - 923325488809Document7 pagesData Book 1609842354604 - DuplicateInvoice - 923325488809AbdulSattarNo ratings yet

- GDPDocument5 pagesGDPMary Christine Formiloza MacalinaoNo ratings yet

- Capitalism Will Eat Democracy - Unless We Speak UpDocument10 pagesCapitalism Will Eat Democracy - Unless We Speak UpNot Charlie GriffithNo ratings yet

- Companies (Ind AS) Amendment Rules, 2021Document31 pagesCompanies (Ind AS) Amendment Rules, 2021Basava ShankarNo ratings yet

- Kuru Dec2019Document52 pagesKuru Dec2019Rafi S ANo ratings yet

- Adam Smith Viva QuestionsDocument6 pagesAdam Smith Viva QuestionsUditanshu MisraNo ratings yet

- BEMPC AssignmentDocument5 pagesBEMPC AssignmentSamsung AccountNo ratings yet

- Sentrove 3BR 10DP - 1631441723Document1 pageSentrove 3BR 10DP - 1631441723Ivan Hayes DyNo ratings yet

- CHAPTER 5 - International Trade TheoryDocument54 pagesCHAPTER 5 - International Trade TheoryVo Minh AnhNo ratings yet

- Score Booster For All Bank Prelims Exams - Day 19Document30 pagesScore Booster For All Bank Prelims Exams - Day 19bofeniNo ratings yet

- ProposalDocument2 pagesProposalSan Pedro CCLDONo ratings yet

- Linear Programming FormulationDocument27 pagesLinear Programming FormulationDrama ArtNo ratings yet

- Developing International MarketsDocument5 pagesDeveloping International Marketsskumah48No ratings yet

- NEFTE Compass November 25, 2009 IssueDocument12 pagesNEFTE Compass November 25, 2009 IssueCommittee for Russian Economic FreedomNo ratings yet

- Business Law PDFDocument189 pagesBusiness Law PDFNazmus SakibNo ratings yet

- Laporan Keuangan PT JayatamaDocument2 pagesLaporan Keuangan PT JayatamaKharisma Salsa Putri100% (1)

- Addis Ababa University Addis Ababa Institute of TechnologyDocument3 pagesAddis Ababa University Addis Ababa Institute of TechnologyBukti NegalNo ratings yet

- Catalogue Havells PumpsDocument20 pagesCatalogue Havells PumpsKegire ProlugNo ratings yet

- Negociation RulesDocument2 pagesNegociation Rules4Ever Comissária de DespachosNo ratings yet

- Garlica Bill 15th FebDocument1 pageGarlica Bill 15th FebPavan KumarNo ratings yet

- Chapter 1 Macro-Higher Education Institution: Statistik Pendidikan Tinggi 2018: Kementerian Pendidikan MalaysiaDocument4 pagesChapter 1 Macro-Higher Education Institution: Statistik Pendidikan Tinggi 2018: Kementerian Pendidikan MalaysiaStanley WongNo ratings yet

- Item Name HSN Code GST Rate QTY Taxable Rate Taxable ValueDocument5 pagesItem Name HSN Code GST Rate QTY Taxable Rate Taxable ValueAnup gurung100% (2)

- Fundamentals of Economics Course OutlineDocument3 pagesFundamentals of Economics Course Outlinemeerdawood72No ratings yet

- Brief Talk On The Alienation of Human Nature - From A Curtain of Green and Other StoriesDocument3 pagesBrief Talk On The Alienation of Human Nature - From A Curtain of Green and Other StoriesJhon Renren LogatocNo ratings yet

- SenthilkumarDocument1 pageSenthilkumarYazh EnterpriseNo ratings yet