Professional Documents

Culture Documents

Formular MT 2019

Uploaded by

5658780qazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formular MT 2019

Uploaded by

5658780qazCopyright:

Available Formats

FORMULAR

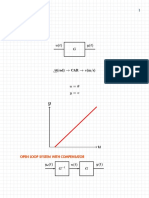

FV = C0×(1 + r)T Perpetuity Annuity

PV =

CT

( 1+r )T

PV =

C

r

PV =

C

r[1−

1

(1+r )T ]

( )

mT

r C C

FV =C 0 × 1+ PV =

r−g

FV =

r

[ (1+r )T −1 ]

m

Stock valuation

Model 1 Model 2 Model 3

( )

DT +1

[ ]

T R−g 2

Div Div D1 (1+g1 )

P0 = P0 = P0 = 1− +

R R−g R−g1 (1+R )

T

(1+R)

T

Bond valuation

[ ]

C 1 F Growth Rate = Retention Rate X Return on New Investment

PV = 1− +

r (1+r )T (1+r )T

You might also like

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Formula SheetDocument2 pagesFormula SheetkaylovelluNo ratings yet

- Formulas For QuizzesDocument3 pagesFormulas For QuizzesSufyan KhanNo ratings yet

- For Mel BladDocument1 pageFor Mel BladRasmus SjövillNo ratings yet

- Formula Sheet (With Notation of Class Materials)Document7 pagesFormula Sheet (With Notation of Class Materials)Maxime Lepetit LapinNo ratings yet

- FIN2074 FormulaDocument15 pagesFIN2074 FormulaBrendan YapNo ratings yet

- FORMULADocument1 pageFORMULAMoe kurdiNo ratings yet

- Formulae SheetDocument1 pageFormulae Sheetsolid_foxNo ratings yet

- Annuity Formulas PDFDocument1 pageAnnuity Formulas PDFKaviya KuganNo ratings yet

- Finance Formula SheetDocument4 pagesFinance Formula Sheetdjlyfe100% (1)

- Gestão Financeira 2 / Corporate Finance 2 / Advanced Corporate Finance – FORMULAEDocument4 pagesGestão Financeira 2 / Corporate Finance 2 / Advanced Corporate Finance – FORMULAEJoana MouraNo ratings yet

- Finance Exam Formula SheetDocument2 pagesFinance Exam Formula SheetMindaugas PinčiukovasNo ratings yet

- Formula Sheet FinanceDocument2 pagesFormula Sheet Financemostafa daherNo ratings yet

- Derive Diesel Cycle Efficiency ExpressionDocument3 pagesDerive Diesel Cycle Efficiency ExpressionME-Pratham JainNo ratings yet

- CFA Level II Cheat Sheet: Equity Fixed IncomeDocument1 pageCFA Level II Cheat Sheet: Equity Fixed Incomeapi-19918095No ratings yet

- Bandpass Receiver StructuresDocument4 pagesBandpass Receiver Structures朱柏林No ratings yet

- Financial Management Formula Sheet N12403Document3 pagesFinancial Management Formula Sheet N12403Abdullah ShahNo ratings yet

- Formula Sheet (Handed Out On Exam)Document5 pagesFormula Sheet (Handed Out On Exam)cheif sNo ratings yet

- Controls Combined Lecture NotesDocument312 pagesControls Combined Lecture NotesA FNo ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- Thermal Stresses in Thin DiskDocument2 pagesThermal Stresses in Thin DiskndmiraqNo ratings yet

- Exercise Solutions for Fixed Income and Credit RiskDocument5 pagesExercise Solutions for Fixed Income and Credit RiskjeanboncruNo ratings yet

- Chapter03.Modeling in The Time DomainDocument25 pagesChapter03.Modeling in The Time Domainehddn09990% (1)

- Common transform pairs tableDocument6 pagesCommon transform pairs tableKakitani MusicNo ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- Note 2Document7 pagesNote 2Jolaosho AbdulbateenNo ratings yet

- Modeling and analysis of linear dynamic systemsDocument10 pagesModeling and analysis of linear dynamic systemssanjay_dutta_5No ratings yet

- Discrete-Time Linear, Time Invariant Systems and Z-TransformsDocument16 pagesDiscrete-Time Linear, Time Invariant Systems and Z-TransformsSai KiranNo ratings yet

- Practica 5 DesarrolloDocument3 pagesPractica 5 DesarrolloFrancisco PeñaNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetinspiredbysims4No ratings yet

- Laplace Transform TableDocument5 pagesLaplace Transform TableMahmut KILIÇNo ratings yet

- DKUT - Circuit Network Theory Solved TestDocument4 pagesDKUT - Circuit Network Theory Solved TestmwangiNo ratings yet

- FormulaeDocument1 pageFormulaeArnab HazraNo ratings yet

- Integration L 5Document7 pagesIntegration L 5Devansh KhetanNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- Formule Investicije 2018Document3 pagesFormule Investicije 2018aldinaNo ratings yet

- Managerial Fin 2Document5 pagesManagerial Fin 2api-3698549No ratings yet

- Applied Thermodynamics ME250: Submitted ToDocument12 pagesApplied Thermodynamics ME250: Submitted Tomad eye m00dyNo ratings yet

- CFFM Formula Sheet 2017Document1 pageCFFM Formula Sheet 2017Thibault MHNo ratings yet

- First Order Systems: e T C T R T eDocument1 pageFirst Order Systems: e T C T R T eravi raviNo ratings yet

- Finance 2 Formula Sheet FinalDocument2 pagesFinance 2 Formula Sheet Final9bpj6qfyhwNo ratings yet

- Calculating initial and subsequent actual marginDocument1 pageCalculating initial and subsequent actual marginRizki MaulanaNo ratings yet

- New AssignDocument4 pagesNew AssignQianyu GuNo ratings yet

- Formula sheet finance and valuation formulasDocument2 pagesFormula sheet finance and valuation formulasmarwin73No ratings yet

- Interest and Bond PriceDocument22 pagesInterest and Bond PriceTram NguyenNo ratings yet

- Control Systems - State Space ModelDocument8 pagesControl Systems - State Space ModelVivek PatilNo ratings yet

- 1527249771E-textofChapter4Module3Document11 pages1527249771E-textofChapter4Module3animationindia3No ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- AMA1 Lecture2Document23 pagesAMA1 Lecture2D. KNo ratings yet

- Summary of Velocity, Acceleration, and CurvatureDocument1 pageSummary of Velocity, Acceleration, and CurvatureJohn NelsonNo ratings yet

- Formula sheetDocument2 pagesFormula sheetmihsovyaNo ratings yet

- FIN10670 - Formula Sheet - Final TestDocument2 pagesFIN10670 - Formula Sheet - Final TestSean ZhangNo ratings yet

- Tabla Derivadas e IntegralesDocument2 pagesTabla Derivadas e IntegralespatvelizNo ratings yet

- CSTR Runaway ReactionsDocument17 pagesCSTR Runaway Reactionsjeas grejoyNo ratings yet

- Formula Sheet Midterm 222Document2 pagesFormula Sheet Midterm 222NawwafNo ratings yet

- Comprehensive guide to common transform pairsDocument6 pagesComprehensive guide to common transform pairssisoNo ratings yet

- Ae2235 Exercises Topic I.4Document10 pagesAe2235 Exercises Topic I.4Sarieta SarrahNo ratings yet

- Formulas (Weeks 1 To 6)Document5 pagesFormulas (Weeks 1 To 6)Stenley RoyceNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetgeyoxi5098No ratings yet

- Thursday, November 10: Green's TheoremDocument5 pagesThursday, November 10: Green's TheoremRutendo ChihotaNo ratings yet