Professional Documents

Culture Documents

Formula Sheet

Uploaded by

mihsovya0 ratings0% found this document useful (0 votes)

2 views2 pagesFinance Trinity College

Original Title

Formula sheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance Trinity College

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesFormula Sheet

Uploaded by

mihsovyaFinance Trinity College

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

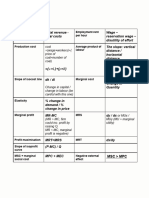

Formula sheet

FV = PV(1 + r)t

PV = FV / (1 + r)t

1 1

PV = C − t

r r (1 + r )

(1 + r ) t − 1

FV = C

r

Annuity PV = C/r

PV of a Growing Annuity = C/r-g

When interest is compounded more than once a year.

mt

r

FV = PV 1 +

m

𝑖 𝑛

𝑟 = (1 + ) − 1

𝑛

Fisher equation (1 + R) = (1 + r)(1 + h)

Bond price

T

Ct P

= +

(1 + r ) (1 + r )

t T

t =1

Calculating the YTM of a bond

Dividend discount model

◼

Case 1 no growth

Case 2 constant growth

Case 3 non constant growth

Div1 Div 2 Div H PH

P0 = + + ... + +

(1 + r )1 (1 + r ) 2 (1 + r ) H (1 + r ) H

Equity rate of return

𝑁𝑃𝑉

Profitability index = 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡

𝑆𝑢𝑚 𝑜𝑓 𝑎𝑙𝑙 ℎ𝑖𝑡𝑜𝑟𝑖𝑐 𝑟𝑒𝑡𝑢𝑟𝑛𝑠

Average return = 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑦𝑒𝑎𝑟𝑠

Expected risk

∑(𝑅𝑖 − 𝑅̅)2

𝜎=√

𝑛

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Formula Sheet FinanceDocument2 pagesFormula Sheet Financemostafa daherNo ratings yet

- Formula SheetDocument2 pagesFormula SheetkaylovelluNo ratings yet

- Finance MathDocument1 pageFinance MathDiana CañasNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- Formulas For QuizzesDocument3 pagesFormulas For QuizzesSufyan KhanNo ratings yet

- Annuity Formulas PDFDocument1 pageAnnuity Formulas PDFKaviya KuganNo ratings yet

- Time Value of Money: CFA Level 1 2006 - Formula SheetDocument18 pagesTime Value of Money: CFA Level 1 2006 - Formula SheetGautam MehtaNo ratings yet

- Formula SheetDocument4 pagesFormula Sheetinspiredbysims4No ratings yet

- Công thức IM tự luận- cho finalDocument6 pagesCông thức IM tự luận- cho finalTuấn NguyễnNo ratings yet

- TMV Practice ProblemsDocument3 pagesTMV Practice ProblemsPrometheus SmithNo ratings yet

- ACST252 - Formula SheetDocument5 pagesACST252 - Formula Sheetyolejosh479No ratings yet

- Formulas (Weeks 1 To 6)Document5 pagesFormulas (Weeks 1 To 6)Stenley RoyceNo ratings yet

- Formula Sheet: Short-Term Solvency RatiosDocument2 pagesFormula Sheet: Short-Term Solvency RatiosNgô Hoàng Bích Kha100% (1)

- Principles of Finance Formulae SheetDocument4 pagesPrinciples of Finance Formulae SheetAmina SultangaliyevaNo ratings yet

- Formula Sheet FMDocument3 pagesFormula Sheet FMAbdullah ShahNo ratings yet

- FormulaDocument2 pagesFormulamarwin73No ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- List of Corporate Finance FormulasDocument9 pagesList of Corporate Finance FormulasYoungRedNo ratings yet

- Formula Sheet in Final Exam Paper (FIN3IPM 2018 Semester 2)Document2 pagesFormula Sheet in Final Exam Paper (FIN3IPM 2018 Semester 2)An VyNo ratings yet

- Mock Final 2021 - 2Document5 pagesMock Final 2021 - 2anthony.schzNo ratings yet

- Formula Sheet (Handed Out On Exam)Document5 pagesFormula Sheet (Handed Out On Exam)cheif sNo ratings yet

- Exam Formulas To Memorize and Not Provided On ExamDocument1 pageExam Formulas To Memorize and Not Provided On ExamYeji KimNo ratings yet

- Midterm Exam Formula Sheet: R C G R CDocument2 pagesMidterm Exam Formula Sheet: R C G R Cleafsfan85No ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- Formula SheetDocument3 pagesFormula SheetAshley ShaddockNo ratings yet

- Formula Sheet-Coporate FinanceDocument3 pagesFormula Sheet-Coporate FinanceWH JeepNo ratings yet

- Adms3530f18 Final Exam Formula Sheet PDFDocument6 pagesAdms3530f18 Final Exam Formula Sheet PDFSandy SandNo ratings yet

- FINA 1310 - Lecture 3 NotesDocument6 pagesFINA 1310 - Lecture 3 NotesAayushi ReddyNo ratings yet

- Formula Sheet-2nd QuizDocument6 pagesFormula Sheet-2nd QuizEge MelihNo ratings yet

- Sample Level 1 Wiley Formula Sheets PDFDocument10 pagesSample Level 1 Wiley Formula Sheets PDFMuhammed RafiudeenNo ratings yet

- FNCE Cheat Sheet Midterm 1Document1 pageFNCE Cheat Sheet Midterm 1carmenng1990No ratings yet

- Formula Sheet MAF 302 Corporate FinanceDocument2 pagesFormula Sheet MAF 302 Corporate FinanceWill LeeNo ratings yet

- Executive Summary of Finance 430Document31 pagesExecutive Summary of Finance 430Ein LuckyNo ratings yet

- FNCE 623 Formulae For Mid Term ExamDocument3 pagesFNCE 623 Formulae For Mid Term Examleili fallahNo ratings yet

- Formula Sheet - Time Value of Money PDFDocument11 pagesFormula Sheet - Time Value of Money PDFJainil ShahNo ratings yet

- Formulae SheetDocument1 pageFormulae Sheetsolid_foxNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- Time Value of Money FormulasDocument3 pagesTime Value of Money FormulasRahat IslamNo ratings yet

- Financial Market Problems and FormulasDocument3 pagesFinancial Market Problems and FormulasNufayl KatoNo ratings yet

- Cheat Sheet FinanceDocument1 pageCheat Sheet FinanceGhitaNo ratings yet

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Cash Flow PV R CF PV RG: FCF NPV Initial T RDocument2 pagesCash Flow PV R CF PV RG: FCF NPV Initial T RMindaugas PinčiukovasNo ratings yet

- FIN10670 - Formula Sheet - Final TestDocument2 pagesFIN10670 - Formula Sheet - Final TestSean ZhangNo ratings yet

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- FormulasDocument2 pagesFormulasKalid JCNo ratings yet

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- FIN205 Formula SheetDocument5 pagesFIN205 Formula SheetAamir SaeedNo ratings yet

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- FINA1221 Formula SheetDocument2 pagesFINA1221 Formula SheetTjia Hwei ChewNo ratings yet

- Formulae Final ExamDocument3 pagesFormulae Final ExamAmal MobarakiNo ratings yet

- Week 2Document25 pagesWeek 2ziyue wangNo ratings yet

- Formular MT 2019Document1 pageFormular MT 20195658780qazNo ratings yet

- Seminar 2Document5 pagesSeminar 2EnnyNo ratings yet

- Formula Sheet Midterm2021Document5 pagesFormula Sheet Midterm2021Derin OlenikNo ratings yet

- Fin All Formula - Docx 1Document9 pagesFin All Formula - Docx 1Marcus HollowayNo ratings yet

- Corporate Finance Theory: Formula SheetDocument6 pagesCorporate Finance Theory: Formula SheetteratakbalqisNo ratings yet

- Helpful Formulas For Finance 1Document2 pagesHelpful Formulas For Finance 1Falguni ShomeNo ratings yet

- FM Formula Sheet 01Document2 pagesFM Formula Sheet 01Aninda DuttaNo ratings yet

- Formula SheetDocument7 pagesFormula SheetAbraham RodriguezNo ratings yet

- ECU Formulas (Modules 1+2) Trinity CollegeDocument4 pagesECU Formulas (Modules 1+2) Trinity CollegemihsovyaNo ratings yet

- Inflations and Money Growth Lec EconomicsDocument20 pagesInflations and Money Growth Lec EconomicsmihsovyaNo ratings yet

- Finance Module OutlineDocument5 pagesFinance Module OutlinemihsovyaNo ratings yet

- Marketing Module OutlineDocument8 pagesMarketing Module OutlinemihsovyaNo ratings yet

- CombinedDocument261 pagesCombinedmihsovyaNo ratings yet

- Stats BDocument75 pagesStats BmihsovyaNo ratings yet

- Speaker Group Reflection MRKT Module OutlineDocument4 pagesSpeaker Group Reflection MRKT Module OutlinemihsovyaNo ratings yet

- Ops MngmtModule OutlineDocument7 pagesOps MngmtModule OutlinemihsovyaNo ratings yet

- Qualit Module OutlineDocument7 pagesQualit Module OutlinemihsovyaNo ratings yet

- ps4 SolDocument9 pagesps4 SolPinky PinkyNo ratings yet

- Econ MCQDocument5 pagesEcon MCQmihsovyaNo ratings yet

- BUU22550 Tutorial 4 SolutionsDocument2 pagesBUU22550 Tutorial 4 SolutionsmihsovyaNo ratings yet

- BUU22550 Tutorial 4 SlidesDocument12 pagesBUU22550 Tutorial 4 SlidesmihsovyaNo ratings yet

- Capital Budgeting Part II - Answers To Slide QuesDocument5 pagesCapital Budgeting Part II - Answers To Slide QuesmihsovyaNo ratings yet

- BUU22550 Tutorial 4 Capital BudgetingDocument1 pageBUU22550 Tutorial 4 Capital BudgetingmihsovyaNo ratings yet

- Tut 3Document2 pagesTut 3mihsovyaNo ratings yet

- Tutorial 2 Market To Book, Annuities and Inflation and BondsDocument2 pagesTutorial 2 Market To Book, Annuities and Inflation and BondsmihsovyaNo ratings yet

- Marketing LDocument41 pagesMarketing LmihsovyaNo ratings yet

- Marketing RDocument28 pagesMarketing RmihsovyaNo ratings yet

- BUU22550 Tutorial 1 Intro and TVMDocument2 pagesBUU22550 Tutorial 1 Intro and TVMmihsovyaNo ratings yet