Professional Documents

Culture Documents

BUU22550 Tutorial 4 Solutions

Uploaded by

mihsovyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BUU22550 Tutorial 4 Solutions

Uploaded by

mihsovyaCopyright:

Available Formats

Tutorial 8 Solutions

Yea

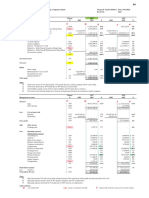

Cashflows A Cashflows B PV Project A PV Project B Cost of Capital

r

-200.00 -200.00

0 -200 -200 11%

72.07 90.09

1 80 100

64.93 81.16

2 80 100

58.50 73.12

3 80 100

52.70

4 80

48.20 44.37

1.

a. 48.20 and 44.37

b. Both as both have positive NPV.

c. Choose A.

-200.00 -200.00

16%

68.97 86.21

59.45 74.32

51.25 64.07

44.18

23.85 24.59

d. In this case choose B.

2. IRRA = 21.86%, IRRB = 23.38%

3. It depends. Even though project B has the higher IRR, its NPV is lower than that of project A when the

discount rate is lower and higher when the discount rate is higher. This example shows that the project with

the higher IRR is not necessarily better. The IRR of each project is fixed, but as the discount rate increases,

project B becomes relatively more attractive compared to project A. This is because B’s cash flows come

earlier, so the present value of these cash flows decreases less rapidly when the discount rate increases.

4. The profitability indices are as follows:

Project A: $48.20/$200 = 0.2410

Project B: $44.37/$200 = 0.2219

5. Project A has a payback period of 3 years. Project B has a payback period of 2 years.

Not necessarily. Despite its longer payback period, Project A may still be the preferred

project, for example, when the discount rate is 11%. The payback period for each project is

fixed but the NPV changes as the discount rate changes. The project with the shorter

payback period need not have the higher NPV.

6. 4 years and 3 years.

You might also like

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- CF Tutorial Full AnswerDocument58 pagesCF Tutorial Full AnsweryyyNo ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- Build A Model Chapter 12Document9 pagesBuild A Model Chapter 12PaolaNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- Update Business Performances - 030821Document3 pagesUpdate Business Performances - 030821Zainal AlfinzaNo ratings yet

- Manual Benninga Finacial Modeling PDFDocument82 pagesManual Benninga Finacial Modeling PDFomar100% (1)

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Excel BasicsDocument8 pagesExcel BasicsAkash RajputNo ratings yet

- Capital Budgeting Sep 04 2021Document51 pagesCapital Budgeting Sep 04 2021Mohammad RekabderNo ratings yet

- Bai Tap Ve Quan Ly RuiDocument10 pagesBai Tap Ve Quan Ly RuisinbdacutieNo ratings yet

- Capital Capital Budgeting BudgetingDocument16 pagesCapital Capital Budgeting BudgetingauguimkNo ratings yet

- Oct 2021Document20 pagesOct 2021Angad Jot SinghNo ratings yet

- ST - Mary's University: Department of Marketing ManagementDocument6 pagesST - Mary's University: Department of Marketing ManagementIsrael Ad FernandoNo ratings yet

- 660 Final Assignment M-1Document16 pages660 Final Assignment M-1Maruf ChowdhuryNo ratings yet

- Architecture MathDocument4 pagesArchitecture MathTintin TinNo ratings yet

- Quiz 2b - KeyDocument2 pagesQuiz 2b - KeyAalijah ShaikhNo ratings yet

- Chapter 8 Risk and The Required Rate of Return by Gitman p8 1 p8 2 p8 3 p8 9 PDF FreeDocument4 pagesChapter 8 Risk and The Required Rate of Return by Gitman p8 1 p8 2 p8 3 p8 9 PDF FreeMd Fiyadul IslamNo ratings yet

- Area Sales Managers ResultDocument7 pagesArea Sales Managers ResultpaingsisNo ratings yet

- Ch25 Tool KitADocument27 pagesCh25 Tool KitARoy HemenwayNo ratings yet

- BUU22550 Tutorial 4 SlidesDocument12 pagesBUU22550 Tutorial 4 SlidesmihsovyaNo ratings yet

- Sistran Tugas PoDocument10 pagesSistran Tugas PoPoppy Olga LestariNo ratings yet

- 660 Final Assignment (Maruf)Document29 pages660 Final Assignment (Maruf)Maruf ChowdhuryNo ratings yet

- Technolog Ya Technolog YbDocument10 pagesTechnolog Ya Technolog YbShaz BhuwanNo ratings yet

- ABC AnalysisDocument1 pageABC AnalysismedrekNo ratings yet

- Tutorial 3 Question 3 (B) (I) Project A Project BDocument8 pagesTutorial 3 Question 3 (B) (I) Project A Project BChiam ZhiyenNo ratings yet

- NPV & MatrixDocument10 pagesNPV & MatrixEricka Alipio AusteroNo ratings yet

- Feb 2022Document20 pagesFeb 2022Ritesh OjhaNo ratings yet

- CA Inter FM EcoDocument14 pagesCA Inter FM EcoMohammed NasserNo ratings yet

- Years 0 1 2 3 4 5 6 7 8 Cash Flows - $550,000 $89,000 $89,000 $89,000 $95,000 $95,000 $95,000 $105,000 $105,000Document1 pageYears 0 1 2 3 4 5 6 7 8 Cash Flows - $550,000 $89,000 $89,000 $89,000 $95,000 $95,000 $95,000 $105,000 $105,000Allen GasparNo ratings yet

- Lampiran Bab 8Document7 pagesLampiran Bab 8meta pratiwiNo ratings yet

- Dec 2021Document21 pagesDec 2021Angad Jot SinghNo ratings yet

- Time Value of Money NotesDocument22 pagesTime Value of Money NotesBeatrice Anne CanapiNo ratings yet

- The Investment Detective Answer Q1Document4 pagesThe Investment Detective Answer Q1marco jeffNo ratings yet

- Evaluasi & Optimalisasi Capaian Program Dan Kegiatan Yang Mendukung Capaian SPM Bidang Kesehatan Di Kab. Wonosobo TAHUN 2018Document42 pagesEvaluasi & Optimalisasi Capaian Program Dan Kegiatan Yang Mendukung Capaian SPM Bidang Kesehatan Di Kab. Wonosobo TAHUN 2018Anonymous dxMzYhQR8No ratings yet

- Assigment IiDocument18 pagesAssigment IiIsuu JobsNo ratings yet

- Integration 1Document1 pageIntegration 1Ayman Kapadia MirzaNo ratings yet

- Six Sigma 2022 Yellow Belt Rpid4 - No.18 Victory TeamDocument30 pagesSix Sigma 2022 Yellow Belt Rpid4 - No.18 Victory TeamDandi RawhideNo ratings yet

- A1 Mbag183004Document27 pagesA1 Mbag183004Hashim EjazNo ratings yet

- Managerial Economics - AssignmentDocument6 pagesManagerial Economics - AssignmentAnitha PanneerselvamNo ratings yet

- Class 3Document6 pagesClass 3Rashedul HasanNo ratings yet

- Aminul Islam 2016209690 EMB-660-Assignment-2Document35 pagesAminul Islam 2016209690 EMB-660-Assignment-2Aminul Islam 2016209690No ratings yet

- Osjdioahfnlk, MNLKJLDocument10 pagesOsjdioahfnlk, MNLKJLAlex NievaNo ratings yet

- Bath Concept - Working 21Document1 pageBath Concept - Working 21Matthew TsangNo ratings yet

- Propiedades de Los Gases - Grupo 1Document4 pagesPropiedades de Los Gases - Grupo 1LuciaNo ratings yet

- NPV Irr PracticeDocument3 pagesNPV Irr PracticeNazar FaridNo ratings yet

- Jan 2022Document20 pagesJan 2022Ritesh OjhaNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Figure 10.9: NPV Profile For Multiple IRR ProjectDocument3 pagesFigure 10.9: NPV Profile For Multiple IRR ProjectMichael JohnsonNo ratings yet

- Traffic Rep0218Document20 pagesTraffic Rep0218gogana93No ratings yet

- Group 6 Coc FMCGDocument34 pagesGroup 6 Coc FMCGBhanusreeNo ratings yet

- PROJECT CASH FLOW-dikonversiDocument1 pagePROJECT CASH FLOW-dikonversikaryaNo ratings yet

- Total 5 Marks: Question 1 BDocument8 pagesTotal 5 Marks: Question 1 Bshaneice_lewisNo ratings yet

- Chapter 11 - Joint Products/By-ProductsDocument33 pagesChapter 11 - Joint Products/By-ProductsLove FreddyNo ratings yet

- 12 40Document10 pages12 40Gonçalo AlmeidaNo ratings yet

- Progress ReportDocument7 pagesProgress ReportRizki LazuardiNo ratings yet

- AGS 1I FinalsDocument1 pageAGS 1I FinalsXian AlcantaraNo ratings yet

- Nov 2021Document21 pagesNov 2021Angad Jot SinghNo ratings yet

- Years 1st 2nd 3rd 4th 5th: Total 100% 20,774,800.00Document1 pageYears 1st 2nd 3rd 4th 5th: Total 100% 20,774,800.00Christopher CabigaoNo ratings yet

- Capital Budgeting and Risk AnalysisDocument7 pagesCapital Budgeting and Risk Analysisapi-3734401No ratings yet

- Stats BDocument75 pagesStats BmihsovyaNo ratings yet

- Marketing Module OutlineDocument8 pagesMarketing Module OutlinemihsovyaNo ratings yet

- CombinedDocument261 pagesCombinedmihsovyaNo ratings yet

- ECU Formulas (Modules 1+2) Trinity CollegeDocument4 pagesECU Formulas (Modules 1+2) Trinity CollegemihsovyaNo ratings yet

- Inflations and Money Growth Lec EconomicsDocument20 pagesInflations and Money Growth Lec EconomicsmihsovyaNo ratings yet

- Finance Module OutlineDocument5 pagesFinance Module OutlinemihsovyaNo ratings yet

- Ops MngmtModule OutlineDocument7 pagesOps MngmtModule OutlinemihsovyaNo ratings yet

- BUU22550 Tutorial 4 SlidesDocument12 pagesBUU22550 Tutorial 4 SlidesmihsovyaNo ratings yet

- Speaker Group Reflection MRKT Module OutlineDocument4 pagesSpeaker Group Reflection MRKT Module OutlinemihsovyaNo ratings yet

- Qualit Module OutlineDocument7 pagesQualit Module OutlinemihsovyaNo ratings yet

- Econ MCQDocument5 pagesEcon MCQmihsovyaNo ratings yet

- Capital Budgeting Part II - Answers To Slide QuesDocument5 pagesCapital Budgeting Part II - Answers To Slide QuesmihsovyaNo ratings yet

- Formula SheetDocument2 pagesFormula SheetmihsovyaNo ratings yet

- Tutorial 2 Market To Book, Annuities and Inflation and BondsDocument2 pagesTutorial 2 Market To Book, Annuities and Inflation and BondsmihsovyaNo ratings yet

- BUU22550 Tutorial 4 Capital BudgetingDocument1 pageBUU22550 Tutorial 4 Capital BudgetingmihsovyaNo ratings yet

- BUU22550 Tutorial 1 Intro and TVMDocument2 pagesBUU22550 Tutorial 1 Intro and TVMmihsovyaNo ratings yet

- Tut 3Document2 pagesTut 3mihsovyaNo ratings yet

- Marketing RDocument28 pagesMarketing RmihsovyaNo ratings yet

- Marketing LDocument41 pagesMarketing LmihsovyaNo ratings yet