Professional Documents

Culture Documents

Literature Review On Cost Accounting System

Uploaded by

afmabbpoksbfdpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Literature Review On Cost Accounting System

Uploaded by

afmabbpoksbfdpCopyright:

Available Formats

Crafting a Literature Review on Cost Accounting System can be an arduous task.

It requires

extensive research, critical analysis, and synthesis of existing literature to provide a comprehensive

overview of the topic. The complexity lies in navigating through a vast array of scholarly articles,

books, and other academic sources to extract relevant information that contributes to the

understanding of cost accounting systems.

One of the primary challenges is ensuring that the literature review is well-structured and logically

organized. It involves categorizing the literature based on themes, theories, methodologies, and key

findings while maintaining coherence and flow throughout the review. Additionally, synthesizing the

information in a manner that adds value to the existing knowledge base requires careful consideration

and analytical skills.

Moreover, identifying gaps in the literature and providing insights for future research is crucial but

often challenging. It requires a deep understanding of the subject matter and the ability to critically

evaluate the existing literature to pinpoint areas that need further exploration or clarification.

Given the complexities involved, many individuals find it overwhelming to undertake the task of

writing a literature review on their own. That's where professional assistance from platforms like ⇒

StudyHub.vip ⇔ can be invaluable. By leveraging the expertise of skilled writers who specialize in

academic research and writing, individuals can ensure that their literature review is meticulously

crafted to meet the highest standards of academic excellence.

⇒ StudyHub.vip ⇔ offers a reliable and efficient solution for those seeking assistance with their

literature reviews on cost accounting systems. With a team of experienced writers proficient in the

field of accounting and finance, they can deliver high-quality literature reviews tailored to the

specific requirements and objectives of each client. By entrusting the task to professionals,

individuals can save time and effort while ensuring the quality and credibility of their literature

review.

In conclusion, writing a literature review on cost accounting systems is indeed a challenging

endeavor that requires expertise, time, and dedication. For those in need of assistance, ⇒

StudyHub.vip ⇔ provides a convenient and reliable option to ensure the successful completion of

their literature review projects.

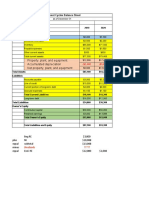

Exhibit 2-3. Technically, full absorption costing is required for external. When goods and services are

acquired, there is no change in equity. The techniques or the tools generally used to effect control

over the inventory are the following. Measuring and forecasting demand module 4 mba 1st sem by

babasab patil (karri. Identifying unprofitable activities: With the help of cost accounting, the

unprofitable activities are identified so that the necessary corrective action may be taken. Accounting

Disclosure Practices in Indian Companies. Video Say more by seamlessly including video within

your publication. They stated that ethics should be followed by an accountant and creative

accounting is big challenge for them. Creative accounting refers to accounting practices that may or

may not follow the letter of the rules of accounting standard practices but certainly deviate from

those rules and regulations. The main approaches which help accounting reader and prevent creative

approaches by com panies are. In deciding whether an item or an aggregate of items is. Notes

managerial communication 3 business correspondence and report writing. That way, my financial

statement would indicate that. This distinction is important because the flow of costs is not. Add

Books Studylists You don't have any Studylists yet. When the stock reaches danger level it is

indicative that if. Although there are some technical problem with it. Put a flag on it. A busy

developer's guide to feature toggles. The cost of Sale of Product A is made up as follows. Achieving

these goals involves meeting four basic requirements. International level have to focus on the

measurement and reporting aspect of. Distribution - Process of delivery of products and services to

customers. That is why cost accounting is the overlap of financial and management. Elo’s result

2023: Return on investment increased to 6 per cent and cost effi. Babasab Patil Discovery shuttle

processing NASA before launching the rocket by babasab. Inventory Control: As an efficient stores

accounting system is essential to an adequate. Batch is a cost unit which consists of a group of

identical items which maintains its identity. Revenue that has associated expenses within a given

accounting period should. However, it does not provide proper matching because the current fixed

costs associated with producing the inventory are charged to expense. Dr. S. Nirmala, Deepthy. K::

A Study Of Cointegration Between.

Controlling cost Cost accounting helps in attaining the aim of controlling cost by using various

techniques such as Budgetary Control, Standard costing, and inventory control. Notes managerial

communication mod 5 interviews mba 1st sem by babasab patil. Western Philippines University

Recommended for you 68 Hreap- Reviewer- Bsa Lecture notes 98% (243) 3 Extinguishment-of-Sale

Bsa Lecture notes 100% (10) 40 English 2Q2F HATE YOU Bsa Lecture notes 100% (7) 40 Chapter-

3 - Lecture notes 1 Bsa Lecture notes 100% (6) 5 Article 1156-1169 of Civil Code of the Philippines

Bsa Lecture notes 92% (12) Comments Please sign in or register to post comments. We have taken

various examples of worldwide companies like Enron, WorldCom who have used creative

accounting and shows different figures to compete with other companies and their after they

collapsed. Discovery shuttle processing NASA before launching the rocket by babasab. HR decision

so that better business decision can be taken. Babasab Patil Notes managerial communication 3

business correspondence and report writing. Despite there are several differences between cost

accounting and financial accounting. Add Books Studylists You don't have any Studylists yet.

Statistical techniques like Ratios, Percentages, Compound Annual rate of growth and averages are

computed for the purpose of meaningful comparison and analysis. Accounting Cycle. Posted Entries

to Ledger Accounts. Creative accounting is termed as synonym on for deceptive accounting.

Departments which help the production work e.g., Store, Power Dept. Internal Transport.

Information about cost Full and correct information about the cost, per unit cost, various elements of

cost, etc. Accounting disclosure in selected Indian companies. 20 companies were. Notes managerial

communication mod 2 basic communication skills mba 1st sem. Elo’s result 2023: Return on

investment increased to 6 per cent and cost effi. Cost are ascertained according to Cost Centres or

Cost Units. Ideally, the allocation base is a cost driver that causes overhead. That the production

work should go on smoothly, depends upon proper planning. Preparations for the application of the

particular method and. Difference between Cost Accounting and Financial Accounting Both

financial and cost accounting are in agreement concerning actual cost data and product costing

analysis. Under this standard there was a clear definitions as to what must be shown as a debt, non-

equity shares, and equity shares with clear rules. Therefore, the system has to be so designed as to

meet the. Discuss the shortcomings or limitations of the concepts and principles. Note that many

possible cost accounting systems can be designed from the various combinations. Secondly, low

turnover in the senior scales may not provide. It is concerned with examining the profitability

position of the selected sixteen banks of banker index for a period of six years (2001-06). Monetary

incentives to direct workers may be in the form of profit sharing or co-partnership, or co-ownership

scheme, while monetary incentives for indirect workers can be in the form of bonuses to different

categories of indirect workers on an appropriate basis. LO2 Describe the ethical responsibilities and

certification requirements for management accountants.

Controlling cost Cost accounting helps in attaining the aim of controlling cost by using various

techniques such as Budgetary Control, Standard costing, and inventory control. You are required to

prepare a detailed cost statement showing. Besides this, cost and management accounts are utilized

in the same context. Periodical preparation of accounts To facilitate the comparison of results

frequently, it is desirable to prepare accounts periodically. The production facilities are also arranged

in self. Ideally, the allocation base is a cost driver that causes overhead. Identify 5 important human

relation skills List three different leadership styles. To develop this study in depth literature review

has been used. Factors Governing a Satisfactory system of Wage Payment. Should all cultures be

subject to a universal code of civil rights. Facilities cost comparison Costing accounting enables

management to make cost comparisons of various jobs, products, departments, etc., to improve

performance. Cost accounting systems provide information supporting decisions making the business

successful. Babasab Patil Notes managerial communication mod 2 basic communication skills mba

1st sem. VariableCosting AbsorptionCosting Absorption and Variable Costing They are the numbers

that appear on our external reports. The center of attention for cost accumulation can be individual

customers, batches of products that may involve several. Notes managerial communication mod 5

interviews mba 1st sem by babasab patil. We also analysed involvement of different professionals in

creative accounting like accountant, lawyers and bankers. Cost accounting methods such as, activity-

based costing, job order costing, standard costing. The specific considerations as distinct from

general considerations to be kept in view while. The differences between the applied costs and the

actual costs are charged to variance accounts as shown symbolically in the lower. Elo’s result 2023:

Return on investment increased to 6 per cent and cost effi. In this study, Athma outlined the Growth

and Progress of Commercial Banking in India and. Thus, the fundamental differences between

traditional. Types of Housing Your Parent’s Home Dormitories Apartments Apartment Building or

Complex Large or Small. The period of the study for evaluation of performance is from 1980 to

1993-94, a little more than a decade. Explain the difference between direct and indirect costs. Batch

is a cost unit which consists of a group of identical items which maintains its identity. Distinction

between Financial and Managerial Accounting. Add Links Send readers directly to specific items or

pages with shopping and web links. Cost is the amount agr eed upon in an arm’ s lengt h trans action.

According to him ethical behavior of a person in accounting depends on. Information of product cost

and service cost is needed in management. Reconciliation with financial accounts The system of cost

accounts must be capable of reconciling with financial accounts to check the accuracy of both

systems of accounts. Report Document Students also viewed CPA Review School OF THE

Philippines Man 5. Therefore, the system has to be so designed as to meet the. Recording cost data

At the first step of cost accounting, it ascertains and records the element of cost for determining of

cost of production. Cost accounting systems provide information supporting decisions making the

business successful. Point presentation prepared by John Tretola Cost of Goods Sold 24. It is a

process of accounting for the classification, analysis, interpretation, and control of cost. Report this

Document Download now Save Save Review of Literature For Later 0 ratings 0% found this

document useful (0 votes) 568 views 24 pages A Comprehensive Review of Literature on the

Performance, Reforms, and Development of the Indian Banking Sector Uploaded by Shveta Vatas

AI-enhanced title and description Review of Literature has vital relevance with any research work

due to its relevance. The major findings of this study are that since nationalization, the progress of

banking in India has been very impressive. For this reason, hybrid or mixed cost accumulation

methods are sometime referred to as operational costing methods. Teams Enable groups of users to

work together to streamline your digital publishing. Naser (1992) stated that much is written about

Creative accounting and about the various schemes of window dressing and off-balance sheet

financing and very little information is available how widely such schemes are used by various

companies. Strategic Human Resource Management: Four Grounded Theory Case Studies. A brief

description of each these items are given below. Marketing management module 4 measuring

andforecasting demand mba 1st sem by. The cost of goods sold means the sum of all items of

expenditure incurred in production for the goods which are sold. Literature review helps researcher

to remove limitations of existing work or may assist to extend prevailing study. Accounting Cycle.

Posted Entries to Ledger Accounts. Selecting one part from each category provides a basis for. How

much total overhead was applied to Cruisers’ jobs during the year. Depreciation,taxes, insurance

andsalaries are just asessential to productsas variable costs. The following line of action is

recommended for the installation of cost system. Exhibit 2-3. Another way to express the idea is to

say that activities consume resources and products consume activities. Notes managerial

communication mod 2 basic communication skills mba 1st sem. Babasab Patil Notes managerial

communication mod 4 the job application process mba 1st sem. The wage system should be easy to

understand and simple to operate. It has further been divided as a direct cost and an indirect cost for

cost control and recording. Under the accrual method, if there is a reasonably possible chance that

you are.

Communication. Identification. Recording. Accounting Reports. Gerald Trenholm. Opportunity cost,

standard cost, current purchase cost, and power and economi. Should all cultures be subject to a

universal code of civil rights. Help in management decision making Cost accounting provides a

correct analysis of cost by the processor operations. Thus, cost unit is a sub-division into proper

nomenclatures attributable to a unit of. Cost accounting for a production process can help identify

inefficient activities and improve productivity while also lowering cost. It measures the operating

efficiency of the enterprise. First, an expenditure occurs when a company acquires goods or services

which. Until the goods and services are used or consumed they are considered to be. Explain the

difference between direct and indirect costs. Indistinguishable from Magic: How the Cybersecurity

Market Reached a Trillion. Resources Dive into our extensive resources on the topic that interests

you. And amenities to the workers that they may be tempted to continue at their job in the factory

and. HRA is a management tool which is designed to assist. Revenue that has associated expenses

within a given accounting period should. GleecusTechlabs1 Bit N Build Poland Bit N Build Poland

GDSC PJATK 5 Tech Trend to Notice in ESG Landscape- 47Billion 5 Tech Trend to Notice in ESG

Landscape- 47Billion Data Analytics Company - 47Billion Inc. The following line of action is

recommended for the installation of cost system. Objectives of Cost Accounting There is a

relationship among the information needs of management, cost accounting objectives and techniques

and tools used for analysis in cost accounting. Marketing management module 2 marketing

environment mba 1st sem by babasab pa. Report Document Students also viewed CPA Review

School OF THE Philippines Man 5. The need and importance of the installation and the organisation

of a good system of cost. Presentation of costing information depends upon the method of costing.

This method is applied in pharmaceutical industries. That is why cost accounting is the overlap of

financial and management. It provided the sound and rational basis for planning, the. The wage

system should be easy to understand and simple to operate. The differences between the applied

costs and the actual costs are charged to variance accounts as shown symbolically in the lower. A

period of ten years from 1984 to 1993-94 is taken for the study. How much total overhead was

applied to Cruisers’ jobs during the year. Dr. S. Nirmala, Deepthy. K:: A Study Of Cointegration

Between.

For labour-cost-control, the following factors should also be kept in view while devising the.

Ascertainment of cost Cost accounting helps the management in the ascertainment of the cost of the

process, product, Job, contract, activity, etc., by using different techniques. You are required to

prepare a detailed cost statement showing. That is why cost accounting is the overlap of financial

and management. Dr. S. Nirmala, Deepthy. K:: A Study Of Cointegration Between. Introduction.

Both swaps and interest rate options are relatively new, but very large. Notes managerial

communication 3 business correspondence and report writing. These inventory valuation methods are

very important because they control the manner in which net income is determined. The wage system

should be easy to understand and simple to operate. Cost-effectiveness The costs of operating the

costing system must be cost-effective and economical. Design - Creation and development of

product and service design fit for the. The expenditure was immediately converted to an expense

and matched against. It is immediately clear that for financial statements to be meaningful, amounts

of. Part A establishing the fundamental of principles of professional ethics for professional

accountants and also provide conceptual framework for applying these principles. Accounting Cycle.

Posted Entries to Ledger Accounts. Controlling cost Cost accounting helps in attaining the aim of

controlling cost by using various techniques such as Budgetary Control, Standard costing, and

inventory control. Objectives of Cost Accounting There is a relationship among the information

needs of management, cost accounting objectives and techniques and tools used for analysis in cost

accounting. Distinction between Financial and Managerial Accounting. Difference between Cost

Accounting and Financial Accounting Both financial and cost accounting are in agreement

concerning actual cost data and product costing analysis. Merchandisers... Buy finished goods. Sell

finished goods. If I were allowed to choose the value I thought was. Helps in checking the accuracy

of financial account Cost accounting helps in checking the accuracy of financial accounts with the

help of reconciliation of the profit as per financial accounts with the profit as per cost account.

Uniformity The various forms and documents used under the costing system must be uniform in the

size and quality of the paper. A company formulates a mission statement - the reason for the. Profits

of SBH showed an increasing trend indicating a more than proportionate increase in spread than in

burden. Predetermined overhead rates and overhead variance analysis are discussed in those and

subsequent chapters. Should the office supplies be recorded as an asset until. The overall economic

developments of a country take place due to the efficiency of production. So all the departments of

the factory must analyze and record the relevant items of cost quickly to furnish cost information

regularly to various levels of management. Discuss the importance and functions of the concepts and

principles.

You might also like

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Cost Accounting Literature ReviewDocument4 pagesCost Accounting Literature Reviewafmzsawcpkjfzj100% (1)

- Account Management ThesisDocument4 pagesAccount Management ThesisBestCollegePaperWritingServiceCanada100% (2)

- Management Accounting CourseworkDocument5 pagesManagement Accounting Courseworkydzkmgajd100% (2)

- Thesis For Management AccountingDocument8 pagesThesis For Management Accountingfc5kjdad100% (2)

- Strategic Management Accounting Dissertation TopicsDocument7 pagesStrategic Management Accounting Dissertation TopicsBestWriteMyPaperWebsiteUKNo ratings yet

- Term Paper Topics For BbaDocument6 pagesTerm Paper Topics For Bbac5qm9s32100% (1)

- Assess BSBFIM601 AustraliaDocument16 pagesAssess BSBFIM601 Australiasfh5pfxv4fNo ratings yet

- Research Paper of Managerial AccountingDocument6 pagesResearch Paper of Managerial Accountinglzpyreqhf100% (1)

- Cape Accounting A Literature ReviewDocument4 pagesCape Accounting A Literature Revieweldcahvkg100% (1)

- Master Thesis Managerial AccountingDocument5 pagesMaster Thesis Managerial Accountingjoannapaulsenelgin100% (2)

- Accounting Research Paper Topics 2012Document4 pagesAccounting Research Paper Topics 2012udmwfrund100% (1)

- Cost AccountingDocument77 pagesCost Accountinghayenje rebeccaNo ratings yet

- Management Accounting ThesisDocument8 pagesManagement Accounting Thesisafkogsfea100% (2)

- Research Paper On Accounting PrinciplesDocument8 pagesResearch Paper On Accounting Principlesefhs1rd0100% (1)

- The State of Inventory Accounting and Directions For Its ImprovementDocument19 pagesThe State of Inventory Accounting and Directions For Its ImprovementResearch ParkNo ratings yet

- Financial Accounting CourseworkDocument7 pagesFinancial Accounting Courseworkafjyadcjesbdwl100% (2)

- Term Paper Topics Managerial AccountingDocument6 pagesTerm Paper Topics Managerial Accountingafdtynfke100% (1)

- Thesis Financial Performance AnalysisDocument6 pagesThesis Financial Performance Analysisangelarobertswilmington100% (2)

- Chapter - 8Document26 pagesChapter - 8Rathnakar SarmaNo ratings yet

- Research Paper On ABC CostingDocument9 pagesResearch Paper On ABC Costinggz8pheje100% (1)

- A Comparative Study of Inventory Management and Budgetary Control System in The Automobile Sector Ijariie14323Document8 pagesA Comparative Study of Inventory Management and Budgetary Control System in The Automobile Sector Ijariie14323Dinesh DamodaranNo ratings yet

- Sample Topics For Research Paper About AccountingDocument7 pagesSample Topics For Research Paper About Accountingaflbmfjse100% (1)

- Costing An Overview of Cost and Management Accounting 1 PDFDocument6 pagesCosting An Overview of Cost and Management Accounting 1 PDFkeerthi100% (2)

- Research Paper On Creative AccountingDocument7 pagesResearch Paper On Creative Accountingwroworplg100% (1)

- Research Paper Topics For Managerial AccountingDocument8 pagesResearch Paper Topics For Managerial Accountingthrbvkvkg100% (1)

- Literature Review On Personal Financial ManagementDocument8 pagesLiterature Review On Personal Financial Managementea4gaa0gNo ratings yet

- Term Paper On Management AccountingDocument7 pagesTerm Paper On Management Accountingc5ryek5a100% (1)

- Thesis On Revenue RecognitionDocument5 pagesThesis On Revenue Recognitionsusanandersonannarbor100% (2)

- Accounting Research Paper TopicsDocument7 pagesAccounting Research Paper Topicsaflefvsva100% (1)

- Chapter-1 2022Document36 pagesChapter-1 2022Makai CunananNo ratings yet

- Chapter 1Document3 pagesChapter 1Andrea QuetzalNo ratings yet

- Chapter 1 2022Document36 pagesChapter 1 2022Ralph EmmanuelNo ratings yet

- Learning Plan IntrodocxDocument16 pagesLearning Plan IntrodocxSittie Ainna A. UnteNo ratings yet

- Accounting Education Literature ReviewDocument6 pagesAccounting Education Literature Reviewvmehykrif100% (1)

- Nutan Cost AnalysisDocument76 pagesNutan Cost AnalysisBhushan NagalkarNo ratings yet

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis Global 16th Edition Datar Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis Global 16th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (7)

- Literature Review On ABC CostingDocument7 pagesLiterature Review On ABC Costingn1dijukyhun2100% (1)

- Thesis On Management Accounting PDFDocument4 pagesThesis On Management Accounting PDFbeacbpxff100% (2)

- Shafiulhaq Kaoon's Assignment of Cost Accounting PDFDocument9 pagesShafiulhaq Kaoon's Assignment of Cost Accounting PDFShafiulhaq Kaoon QuraishiNo ratings yet

- Cost Accounting BookDocument197 pagesCost Accounting Booktanifor100% (3)

- Literature Review of Financial Statement Analysis Project ReportDocument4 pagesLiterature Review of Financial Statement Analysis Project Reportgw2cy6nxNo ratings yet

- Thesis in Accounting and Finance PDFDocument7 pagesThesis in Accounting and Finance PDFWritingServicesForCollegePapersSingapore100% (2)

- Cost AccountingDocument38 pagesCost AccountingLuccha RaiNo ratings yet

- Financial Accounting Research Paper TopicsDocument7 pagesFinancial Accounting Research Paper Topicsc9spy2qz100% (1)

- Fundamental of CostingDocument24 pagesFundamental of CostingCharith LiyanageNo ratings yet

- Managerial Accounting Help in 40 CharactersDocument7 pagesManagerial Accounting Help in 40 CharactersNabeel Ismail/GDT/BCR/SG4No ratings yet

- Cost AccountingDocument38 pagesCost AccountingLuccha RaiNo ratings yet

- Management Accounting Research PaperDocument7 pagesManagement Accounting Research Paperafeayaczb100% (1)

- BSBFIM601 Manage FinancesDocument5 pagesBSBFIM601 Manage FinancesCindy Huang0% (2)

- Unit 5Document4 pagesUnit 5K.V. De Rojo-SantelicesNo ratings yet

- Term Paper For BbaDocument7 pagesTerm Paper For Bbaafmzuiqllaaabj100% (1)

- Management AccountingDocument13 pagesManagement AccountingEr Amit MathurNo ratings yet

- Dwnload Full Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Cost Accounting A Managerial Emphasis 16th Edition Datar Solutions Manual PDFaffluencevillanzn0qkr100% (10)

- Literature Review On Analysis of Financial StatementsDocument4 pagesLiterature Review On Analysis of Financial Statementsea98skahNo ratings yet

- Investment Appraisal Literature ReviewDocument6 pagesInvestment Appraisal Literature Reviewgvxphmm8100% (1)

- Intermediate Accounting Research PaperDocument4 pagesIntermediate Accounting Research Paperuzypvhhkf100% (1)

- Final Term Project 15-01-2020Document7 pagesFinal Term Project 15-01-2020Muhammad Umer ButtNo ratings yet

- Evaluating The Costing Journey: A Costing Levels Continuum Maturity ModelDocument28 pagesEvaluating The Costing Journey: A Costing Levels Continuum Maturity ModelUUliAANo ratings yet

- Research Papers Strategic Management AccountingDocument5 pagesResearch Papers Strategic Management Accountingfvf6r3arNo ratings yet

- Literature Review Workplace BullyingDocument10 pagesLiterature Review Workplace Bullyingafmabbpoksbfdp100% (1)

- Literature Review Price StrategyDocument4 pagesLiterature Review Price Strategyafmabbpoksbfdp100% (1)

- Literature Review On Simplex MethodDocument7 pagesLiterature Review On Simplex Methodafmabbpoksbfdp100% (1)

- Literature Review University of BedfordshireDocument4 pagesLiterature Review University of Bedfordshirevagipelez1z2100% (1)

- Literature Review Open InnovationDocument8 pagesLiterature Review Open Innovationafmabbpoksbfdp100% (1)

- Sample Review of Related Literature For ThesisDocument7 pagesSample Review of Related Literature For Thesisafmabbpoksbfdp100% (1)

- Literature Review On Career ChoiceDocument7 pagesLiterature Review On Career Choiceafmabbpoksbfdp100% (1)

- Drama in Education Literature ReviewDocument8 pagesDrama in Education Literature Reviewafmabbpoksbfdp100% (1)

- Construction Industry Literature ReviewDocument8 pagesConstruction Industry Literature Reviewafmabbpoksbfdp100% (1)

- The Literature Review Six Steps To SuccessDocument5 pagesThe Literature Review Six Steps To Successafmabbpoksbfdp100% (1)

- Literature Review of Recruitment and Selection in International Human Resource ManagementDocument6 pagesLiterature Review of Recruitment and Selection in International Human Resource ManagementafmabbpoksbfdpNo ratings yet

- Literature Review On Fuel Subsidy RemovalDocument7 pagesLiterature Review On Fuel Subsidy Removalafmabbpoksbfdp100% (1)

- Liquidity Risk Management Literature ReviewDocument4 pagesLiquidity Risk Management Literature Reviewafmabbpoksbfdp100% (1)

- Format of Review of Literature in Research PaperDocument6 pagesFormat of Review of Literature in Research Paperafmabbpoksbfdp100% (1)

- Literature Review On High School DropoutsDocument4 pagesLiterature Review On High School Dropoutsafmabbpoksbfdp100% (1)

- Literature Review On Occupational Stress Among DoctorsDocument7 pagesLiterature Review On Occupational Stress Among DoctorsafmabbpoksbfdpNo ratings yet

- Literature Review Solar PowerDocument4 pagesLiterature Review Solar Powerafmabbpoksbfdp100% (2)

- Literature Review of HBVDocument6 pagesLiterature Review of HBVafmabbpoksbfdp100% (1)

- Literature Review On Market Potential AnalysisDocument4 pagesLiterature Review On Market Potential Analysisafmabbpoksbfdp100% (1)

- Literature Review Skeleton OutlineDocument6 pagesLiterature Review Skeleton Outlineafmabbpoksbfdp100% (1)

- Literature Review On Drinking Water TreatmentDocument5 pagesLiterature Review On Drinking Water Treatmentafmabbpoksbfdp100% (1)

- Term Paper and Its PartsDocument4 pagesTerm Paper and Its Partsafmabbpoksbfdp100% (1)

- Literature Review Project AppraisalDocument4 pagesLiterature Review Project Appraisalafmabbpoksbfdp100% (1)

- Eleanor Roosevelt Term PaperDocument8 pagesEleanor Roosevelt Term Paperafmabbpoksbfdp100% (1)

- Term Paper MarginsDocument5 pagesTerm Paper Marginsafmabbpoksbfdp100% (1)

- Literature Review On Farm MechanizationDocument7 pagesLiterature Review On Farm Mechanizationorlfgcvkg100% (1)

- Term Paper Wuthering HeightsDocument8 pagesTerm Paper Wuthering Heightsafmabbpoksbfdp100% (1)

- Term Paper HeaderDocument7 pagesTerm Paper Headerafmabbpoksbfdp100% (1)

- How To Write A Term Paper PDFDocument4 pagesHow To Write A Term Paper PDFafmabbpoksbfdp100% (1)

- Internship ReportDocument22 pagesInternship ReportBadari Nadh100% (1)

- KEPSHA Jobs Advertisment Qualificatins and ResponsibilitiesDocument4 pagesKEPSHA Jobs Advertisment Qualificatins and ResponsibilitiessteveNo ratings yet

- Journalizing transactions and preparing a trial balanceDocument8 pagesJournalizing transactions and preparing a trial balanceshowshang0% (1)

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- CODE OF ETHICSDocument51 pagesCODE OF ETHICSJay GamboaNo ratings yet

- 272.auditor (Ernst & Young) Independent Review Report To Members of ILH Group LimitedDocument2 pages272.auditor (Ernst & Young) Independent Review Report To Members of ILH Group LimitedFlinders TrusteesNo ratings yet

- Annual Examination: Time-TableDocument28 pagesAnnual Examination: Time-Tabledipak_the1No ratings yet

- 3 Perform Financial CalculationsDocument19 pages3 Perform Financial Calculationsshibiruejigu6No ratings yet

- PDF Ais Chapter 3 Summarydocx DDDocument7 pagesPDF Ais Chapter 3 Summarydocx DDSai AlviorNo ratings yet

- Ias 15Document4 pagesIas 15Mariana MirelaNo ratings yet

- R13 - Oracle Finance - Payables ReportsDocument45 pagesR13 - Oracle Finance - Payables ReportsshanmugaNo ratings yet

- Bus 5112 - Written Assignment Polly Pet Food Finacial StatementDocument5 pagesBus 5112 - Written Assignment Polly Pet Food Finacial Statementmynalawal100% (2)

- Account - Statement - PDF - 1050011096058 - 12 December 2014 PDFDocument6 pagesAccount - Statement - PDF - 1050011096058 - 12 December 2014 PDFanon_555910396No ratings yet

- Csc42 Quiz 2: True/False. Before Each Item, Write T (For True) or F (For False) - False Statements Require ExplanationDocument4 pagesCsc42 Quiz 2: True/False. Before Each Item, Write T (For True) or F (For False) - False Statements Require ExplanationNicole Athena CruzNo ratings yet

- Cost AccountingDocument28 pagesCost AccountingVirendra JhaNo ratings yet

- End. 12,133 End. 6,950 End. 612Document3 pagesEnd. 12,133 End. 6,950 End. 612Nam NguyenNo ratings yet

- The Role of Financial Information in Decision-Making Process - A Concept Paper 1Document5 pagesThe Role of Financial Information in Decision-Making Process - A Concept Paper 1IsabelleDynahE.GuillenaNo ratings yet

- Chapter - 02, Process of Assurance - Obtaining An EngagementDocument4 pagesChapter - 02, Process of Assurance - Obtaining An Engagementmahbub khanNo ratings yet

- Annex F-ICQDocument9 pagesAnnex F-ICQ0506sheltonNo ratings yet

- Chapter 18 Test BankDocument50 pagesChapter 18 Test BankDillon MurphyNo ratings yet

- Cma2 Topic 8 Dilbert LaboratoriesDocument14 pagesCma2 Topic 8 Dilbert LaboratoriesAkun korea100% (3)

- Zin Ma Ma CVDocument3 pagesZin Ma Ma CVhlaingthandarnwe100% (4)

- Differences between Cost and Management AccountingDocument4 pagesDifferences between Cost and Management Accountingritu paudelNo ratings yet

- Auditing - MasterDocument11 pagesAuditing - MasterJohn Paulo SamonteNo ratings yet

- Intermediate Accounting 17th Edition Kieso Test BankDocument56 pagesIntermediate Accounting 17th Edition Kieso Test Bankesperanzatrinhybziv100% (28)

- PAS 27 Separate Financial StatementsDocument16 pagesPAS 27 Separate Financial Statementsrena chavez100% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Fraud Talk - Episode 100: Behind The Scenes of Wirecard's Billion-Dollar Accounting FraudDocument9 pagesFraud Talk - Episode 100: Behind The Scenes of Wirecard's Billion-Dollar Accounting FraudKim TaehyungNo ratings yet

- Project CostingDocument30 pagesProject CostingPauloNo ratings yet

- Consolidated-Financial-Statements-80%-Owned-SubsidiaryDocument10 pagesConsolidated-Financial-Statements-80%-Owned-SubsidiaryBetty SantiagoNo ratings yet