Professional Documents

Culture Documents

S&P 500 Company Data

Uploaded by

Atika Hassan0 ratings0% found this document useful (0 votes)

46 views36 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views36 pagesS&P 500 Company Data

Uploaded by

Atika HassanCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 36

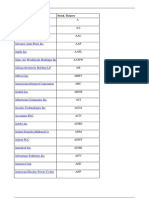

Symbol Company Name GICS Sector

MMM 3M Company Industrials

ABT Abbott Laboratories Health Care

ABBV AbbVie, Inc. Health Care

ACN Accenture Plc Information Technology

ATVI Activision Blizzard, Inc. Information Technology

AYI Acuity Brands, Inc. Industrials

ADBE Adobe Systems Incorporated Information Technology

AAP Advance Auto Parts, Inc. Consumer Discretionary

AES AES Corporation Utilities

AET Aetna Inc. Health Care

AMG Affiliated Managers Group, Inc. Financials

AFL Aflac Incorporated Financials

A Agilent Technologies, Inc. Health Care

APD Air Products and Chemicals, Inc. Materials

AKAM Akamai Technologies, Inc. Information Technology

ALK Alaska Air Group, Inc. Industrials

ALB Albemarle Corporation Materials

ALXN Alexion Pharmaceuticals, Inc. Health Care

ALLE Allegion PLC Industrials

AGN Allergan plc Health Care

ADS Alliance Data Systems Corporation Information Technology

LNT Alliant Energy Corp Utilities

ALL Allstate Corporation Financials

GOOGL Alphabet Inc. Class A Information Technology

GOOG Alphabet Inc. Class C Information Technology

MO Altria Group, Inc. Consumer Staples

AMZN Amazon.com, Inc. Consumer Discretionary

AEE Ameren Corporation Utilities

AAL American Airlines Group, Inc. Industrials

AEP American Electric Power Company, Inc. Utilities

AXP American Express Company Financials

AIG American International Group, Inc. Financials

AMT American Tower Corporation Real Estate

AWK American Water Works Company, Inc. Utilities

AMP Ameriprise Financial, Inc. Financials

ABC AmerisourceBergen Corporation Health Care

AME AMETEK, Inc. Industrials

AMGN Amgen Inc. Health Care

APH Amphenol Corporation Class A Information Technology

APC Anadarko Petroleum Corporation Energy

ADI Analog Devices, Inc. Information Technology

ANTM Anthem, Inc. Health Care

AON Aon plc Financials

APA Apache Corporation Energy

AIV Apartment Investment and Management Company Class A Real Estate

AAPL Apple Inc. Information Technology

AMAT Applied Materials, Inc. Information Technology

ADM Archer-Daniels-Midland Company Consumer Staples

ARNC Arconic Inc. Industrials

AJG Arthur J. Gallagher & Co. Financials

AIZ Assurant, Inc. Financials

T AT&T Inc. Telecommunication Services

ADSK Autodesk, Inc. Information Technology

ADP Automatic Data Processing, Inc. Information Technology

AN AutoNation, Inc. Consumer Discretionary

AZO AutoZone, Inc. Consumer Discretionary

AVB AvalonBay Communities, Inc. Real Estate

AVY Avery Dennison Corporation Materials

BHI Baker Hughes Incorporated Energy

BLL Ball Corporation Materials

BAC Bank of America Corporation Financials

BK Bank of New York Mellon Corporation Financials

BAX Baxter International Inc. Health Care

BBT BB&T Corporation Financials

BDX Becton, Dickinson and Company Health Care

BBBY Bed Bath & Beyond Inc. Consumer Discretionary

BRK.B Berkshire Hathaway Inc. Class B Financials

BBY Best Buy Co., Inc. Consumer Discretionary

BIIB Biogen Inc. Health Care

BLK BlackRock, Inc. Financials

BA Boeing Company Industrials

BWA BorgWarner Inc. Consumer Discretionary

BXP Boston Properties, Inc. Real Estate

BSX Boston Scientific Corporation Health Care

BMY Bristol-Myers Squibb Company Health Care

AVGO Broadcom Limited Information Technology

BF.B Brown-Forman Corporation Class B Consumer Staples

BCR C. R. Bard, Inc. Health Care

CHRW C.H. Robinson Worldwide, Inc. Industrials

CA CA, Inc. Information Technology

COG Cabot Oil & Gas Corporation Energy

CPB Campbell Soup Company Consumer Staples

COF Capital One Financial Corporation Financials

CAH Cardinal Health, Inc. Health Care

KMX CarMax, Inc. Consumer Discretionary

CCL.U Carnival Corporation Consumer Discretionary

CAT Caterpillar Inc. Industrials

CBG CBRE Group, Inc. Class A Real Estate

CBS CBS Corporation Class B Consumer Discretionary

CELG Celgene Corporation Health Care

CNC Centene Corporation Health Care

CNP CenterPoint Energy, Inc. Utilities

CTL CenturyLink, Inc. Telecommunication Services

CERN Cerner Corporation Health Care

CF CF Industries Holdings, Inc. Materials

SCHW Charles Schwab Corporation Financials

CHTR Charter Communications, Inc. Class A Consumer Discretionary

CHK Chesapeake Energy Corporation Energy

CVX Chevron Corporation Energy

CMG Chipotle Mexican Grill, Inc. Consumer Discretionary

CB Chubb Limited Financials

CHD Church & Dwight Co., Inc. Consumer Staples

CI Cigna Corporation Health Care

XEC Cimarex Energy Co. Energy

CINF Cincinnati Financial Corporation Financials

CTAS Cintas Corporation Industrials

CSCO Cisco Systems, Inc. Information Technology

C Citigroup Inc Financials

CFG Citizens Financial Group, Inc. Financials

CTXS Citrix Systems, Inc. Information Technology

CLX Clorox Company Consumer Staples

CME CME Group Inc. Class A Financials

CMS CMS Energy Corporation Utilities

COH Coach, Inc. Consumer Discretionary

KO Coca-Cola Company Consumer Staples

CTSH Cognizant Technology Solutions Corporation Class A Information Technology

CL Colgate-Palmolive Company Consumer Staples

CMCSA Comcast Corporation Class A Consumer Discretionary

CMA Comerica Incorporated Financials

CAG Conagra Brands Inc Consumer Staples

CXO Concho Resources Inc. Energy

COP ConocoPhillips Energy

ED Consolidated Edison, Inc. Utilities

STZ Constellation Brands, Inc. Class A Consumer Staples

COO Cooper Companies, Inc. Health Care

GLW Corning Incorporated Information Technology

COST Costco Wholesale Corporation Consumer Staples

COTY Coty Inc. Class A Consumer Staples

CCI Crown Castle International Corp Real Estate

CSRA CSRA, Inc. Information Technology

CSX CSX Corporation Industrials

CMI Cummins Inc. Industrials

CVS CVS Health Corporation Consumer Staples

DHI D.R. Horton, Inc. Consumer Discretionary

DHR Danaher Corporation Health Care

DRI Darden Restaurants, Inc. Consumer Discretionary

DVA DaVita Inc. Health Care

DE Deere & Company Industrials

DLPH Delphi Automotive PLC Consumer Discretionary

DAL Delta Air Lines, Inc. Industrials

XRAY DENTSPLY SIRONA, Inc. Health Care

DVN Devon Energy Corporation Energy

DLR Digital Realty Trust, Inc. Real Estate

DFS Discover Financial Services Financials

DISCA Discovery Communications, Inc. Class A Consumer Discretionary

DISCK Discovery Communications, Inc. Class C Consumer Discretionary

DG Dollar General Corporation Consumer Discretionary

DLTR Dollar Tree, Inc. Consumer Discretionary

D Dominion Resources, Inc. Utilities

DOV Dover Corporation Industrials

DOW Dow Chemical Company Materials

DPS Dr Pepper Snapple Group, Inc. Consumer Staples

DTE DTE Energy Company Utilities

DUK Duke Energy Corporation Utilities

DNB Dun & Bradstreet Corporation Industrials

ETFC E*TRADE Financial Corporation Financials

DD E. I. du Pont de Nemours and Company Materials

EMN Eastman Chemical Company Materials

ETN Eaton Corp. Plc Industrials

EBAY eBay Inc. Information Technology

ECL Ecolab Inc. Materials

EIX Edison International Utilities

EW Edwards Lifesciences Corporation Health Care

EA Electronic Arts Inc. Information Technology

LLY Eli Lilly and Company Health Care

EMR Emerson Electric Co. Industrials

ENDP Endo International Plc Health Care

ETR Entergy Corporation Utilities

EOG EOG Resources, Inc. Energy

EQT EQT Corporation Energy

EFX Equifax Inc. Industrials

EQIX Equinix, Inc. Real Estate

EQR Equity Residential Real Estate

ESS Essex Property Trust, Inc. Real Estate

EL Estee Lauder Companies Inc. Class A Consumer Staples

ES Eversource Energy Utilities

EXC Exelon Corporation Utilities

EXPE Expedia, Inc. Consumer Discretionary

EXPD Expeditors International of Washington, Inc. Industrials

ESRX Express Scripts Holding Company Health Care

EXR Extra Space Storage Inc. Real Estate

XOM Exxon Mobil Corporation Energy

FFIV F5 Networks, Inc. Information Technology

FB Facebook, Inc. Class A Information Technology

FAST Fastenal Company Industrials

FRT Federal Realty Investment Trust Real Estate

FDX FedEx Corporation Industrials

FIS Fidelity National Information Services, Inc. Information Technology

FITB Fifth Third Bancorp Financials

FSLR First Solar, Inc. Information Technology

FE FirstEnergy Corp. Utilities

FISV Fiserv, Inc. Information Technology

FLIR FLIR Systems, Inc. Information Technology

FLS Flowserve Corporation Industrials

FLR Fluor Corporation Industrials

FMC FMC Corporation Materials

FTI FMC Technologies, Inc. Energy

FL Foot Locker, Inc. Consumer Discretionary

F Ford Motor Company Consumer Discretionary

FTV Fortive Corp. Industrials

FBHS Fortune Brands Home & Security, Inc. Industrials

BEN Franklin Resources, Inc. Financials

FCX Freeport-McMoRan, Inc. Materials

FTR Frontier Communications Corporation Telecommunication Services

GPS Gap, Inc. Consumer Discretionary

GRMN Garmin Ltd. Consumer Discretionary

GD General Dynamics Corporation Industrials

GE General Electric Company Industrials

GGP General Growth Properties, Inc. Real Estate

GIS General Mills, Inc. Consumer Staples

GM General Motors Company Consumer Discretionary

GPC Genuine Parts Company Consumer Discretionary

GILD Gilead Sciences, Inc. Health Care

GPN Global Payments Inc. Information Technology

GS Goldman Sachs Group, Inc. Financials

GT Goodyear Tire & Rubber Company Consumer Discretionary

HRB H&R Block, Inc. Consumer Discretionary

HAL Halliburton Company Energy

HBI Hanesbrands Inc. Consumer Discretionary

HOG Harley-Davidson, Inc. Consumer Discretionary

HAR Harman International Industries, Incorporated Consumer Discretionary

HRS Harris Corporation Information Technology

HIG Hartford Financial Services Group, Inc. Financials

HAS Hasbro, Inc. Consumer Discretionary

HCA HCA Holdings, Inc. Health Care

HCP HCP, Inc. Real Estate

HP Helmerich & Payne, Inc. Energy

HSIC Henry Schein, Inc. Health Care

HSY Hershey Company Consumer Staples

HES Hess Corporation Energy

HPE Hewlett Packard Enterprise Co. Information Technology

HOLX Hologic, Inc. Health Care

HD Home Depot, Inc. Consumer Discretionary

HON Honeywell International Inc. Industrials

HRL Hormel Foods Corporation Consumer Staples

HST Host Hotels & Resorts, Inc. Real Estate

HPQ HP Inc. Information Technology

HUM Humana Inc. Health Care

HBAN Huntington Bancshares Incorporated Financials

ITW Illinois Tool Works Inc. Industrials

ILMN Illumina, Inc. Health Care

IR Ingersoll-Rand Plc Industrials

INTC Intel Corporation Information Technology

ICE Intercontinental Exchange, Inc. Financials

IBM International Business Machines Corporation Information Technology

IFF International Flavors & Fragrances Inc. Materials

IP International Paper Company Materials

IPG Interpublic Group of Companies, Inc. Consumer Discretionary

INTU Intuit Inc. Information Technology

ISRG Intuitive Surgical, Inc. Health Care

IVZ Invesco Ltd. Financials

IRM Iron Mountain, Inc. Real Estate

SJM J. M. Smucker Company Consumer Staples

JBHT J.B. Hunt Transport Services, Inc. Industrials

JEC Jacobs Engineering Group Inc. Industrials

JNJ Johnson & Johnson Health Care

JCI Johnson Controls International plc Industrials

JPM JPMorgan Chase & Co. Financials

JNPR Juniper Networks, Inc. Information Technology

KSU Kansas City Southern Industrials

K Kellogg Company Consumer Staples

KEY KeyCorp Financials

KMB Kimberly-Clark Corporation Consumer Staples

KIM Kimco Realty Corporation Real Estate

KMI Kinder Morgan Inc Class P Energy

KLAC KLA-Tencor Corporation Information Technology

KSS Kohl's Corporation Consumer Discretionary

KHC Kraft Heinz Company Consumer Staples

KR Kroger Co. Consumer Staples

LB L Brands, Inc. Consumer Discretionary

LLL L-3 Communications Holdings, Inc. Industrials

LH Laboratory Corporation of America Holdings Health Care

LRCX Lam Research Corporation Information Technology

LM Legg Mason, Inc. Financials

LEG Leggett & Platt, Incorporated Consumer Discretionary

LEN Lennar Corporation Class A Consumer Discretionary

LUK Leucadia National Corporation Financials

LVLT Level 3 Communications, Inc. Telecommunication Services

LNC Lincoln National Corporation Financials

LLTC Linear Technology Corporation Information Technology

LKQ LKQ Corporation Consumer Discretionary

LMT Lockheed Martin Corporation Industrials

L Loews Corporation Financials

LOW Lowe's Companies, Inc. Consumer Discretionary

LYB LyondellBasell Industries NV Materials

MTB M&T Bank Corporation Financials

MAC Macerich Company Real Estate

M Macy's Inc Consumer Discretionary

MNK Mallinckrodt Plc Health Care

MRO Marathon Oil Corporation Energy

MPC Marathon Petroleum Corporation Energy

MAR Marriott International, Inc. Class A Consumer Discretionary

MMC Marsh & McLennan Companies, Inc. Financials

MLM Martin Marietta Materials, Inc. Materials

MAS Masco Corporation Industrials

MA Mastercard Incorporated Class A Information Technology

MAT Mattel, Inc. Consumer Discretionary

MKC McCormick & Company, Incorporated Consumer Staples

MCD McDonald's Corporation Consumer Discretionary

MCK McKesson Corporation Health Care

MJN Mead Johnson Nutrition Company Consumer Staples

MDT Medtronic plc Health Care

MRK Merck & Co., Inc. Health Care

MET MetLife, Inc. Financials

MTD Mettler-Toledo International Inc. Health Care

KORS Michael Kors Holdings Ltd Consumer Discretionary

MCHP Microchip Technology Incorporated Information Technology

MU Micron Technology, Inc. Information Technology

MSFT Microsoft Corporation Information Technology

MHK Mohawk Industries, Inc. Consumer Discretionary

TAP Molson Coors Brewing Company Class B Consumer Staples

MDLZ Mondelez International, Inc. Class A Consumer Staples

MON Monsanto Company Materials

MNST Monster Beverage Corporation Consumer Staples

MCO Moody's Corporation Financials

MS Morgan Stanley Financials

MOS Mosaic Company Materials

MSI Motorola Solutions, Inc. Information Technology

MUR Murphy Oil Corporation Energy

MYL Mylan N.V. Health Care

NDAQ Nasdaq, Inc. Financials

NOV National Oilwell Varco, Inc. Energy

NAVI Navient Corp Financials

NTAP NetApp, Inc. Information Technology

NFLX Netflix, Inc. Consumer Discretionary

NWL Newell Brands Inc Consumer Discretionary

NFX Newfield Exploration Company Energy

NEM Newmont Mining Corporation Materials

NWSA News Corporation Class A Consumer Discretionary

NWS News Corporation Class B Consumer Discretionary

NEE NextEra Energy, Inc. Utilities

NLSN Nielsen Holdings Plc Industrials

NKE NIKE, Inc. Class B Consumer Discretionary

NI NiSource Inc Utilities

NBL Noble Energy, Inc. Energy

JWN Nordstrom, Inc. Consumer Discretionary

NSC Norfolk Southern Corporation Industrials

NTRS Northern Trust Corporation Financials

NOC Northrop Grumman Corporation Industrials

NRG NRG Energy, Inc. Utilities

NUE Nucor Corporation Materials

NVDA NVIDIA Corporation Information Technology

ORLY O'Reilly Automotive, Inc. Consumer Discretionary

OXY Occidental Petroleum Corporation Energy

OMC Omnicom Group Inc Consumer Discretionary

OKE ONEOK, Inc. Energy

ORCL Oracle Corporation Information Technology

OI Owens-Illinois, Inc. Materials

PCAR PACCAR Inc Industrials

PH Parker-Hannifin Corporation Industrials

PDCO Patterson Companies, Inc. Health Care

PAYX Paychex, Inc. Information Technology

PYPL PayPal Holdings Inc Information Technology

PNR Pentair plc Industrials

PBCT People's United Financial, Inc. Financials

PEP PepsiCo, Inc. Consumer Staples

PKI PerkinElmer, Inc. Health Care

PRGO Perrigo Co. Plc Health Care

PFE Pfizer Inc. Health Care

PCG PG&E Corporation Utilities

PM Philip Morris International Inc. Consumer Staples

PSX Phillips 66 Energy

PNW Pinnacle West Capital Corporation Utilities

PXD Pioneer Natural Resources Company Energy

PBI Pitney Bowes Inc. Industrials

PNC PNC Financial Services Group, Inc. Financials

PPG PPG Industries, Inc. Materials

PPL PPL Corporation Utilities

PX Praxair, Inc. Materials

PCLN Priceline Group Inc Consumer Discretionary

PFG Principal Financial Group, Inc. Financials

PG Procter & Gamble Company Consumer Staples

PGR Progressive Corporation Financials

PLD Prologis, Inc. Real Estate

PRU Prudential Financial, Inc. Financials

PEG Public Service Enterprise Group Incorporated Utilities

PSA Public Storage Real Estate

PHM PulteGroup, Inc. Consumer Discretionary

PVH PVH Corp. Consumer Discretionary

QRVO Qorvo, Inc. Information Technology

QCOM QUALCOMM Incorporated Information Technology

PWR Quanta Services, Inc. Industrials

DGX Quest Diagnostics Incorporated Health Care

RL Ralph Lauren Corporation Class A Consumer Discretionary

RRC Range Resources Corporation Energy

RTN Raytheon Company Industrials

O Realty Income Corporation Real Estate

RHT Red Hat, Inc. Information Technology

REGN Regeneron Pharmaceuticals, Inc. Health Care

RF Regions Financial Corporation Financials

RSG Republic Services, Inc. Industrials

RAI Reynolds American Inc. Consumer Staples

RHI Robert Half International Inc. Industrials

ROK Rockwell Automation, Inc. Industrials

COL Rockwell Collins, Inc. Industrials

ROP Roper Technologies, Inc. Industrials

ROST Ross Stores, Inc. Consumer Discretionary

RCL Royal Caribbean Cruises Ltd. Consumer Discretionary

R Ryder System, Inc. Industrials

SPGI S&P Global, Inc. Financials

CRM salesforce.com, inc. Information Technology

SCG SCANA Corporation Utilities

SLB Schlumberger NV Energy

SNI Scripps Networks Interactive, Inc. Class A Consumer Discretionary

STX Seagate Technology PLC Information Technology

SEE Sealed Air Corporation Materials

SRE Sempra Energy Utilities

SHW Sherwin-Williams Company Materials

SIG Signet Jewelers Limited Consumer Discretionary

SPG Simon Property Group, Inc. Real Estate

SWKS Skyworks Solutions, Inc. Information Technology

SLG SL Green Realty Corp. Real Estate

SNA Snap-on Incorporated Industrials

SO Southern Company Utilities

LUV Southwest Airlines Co. Industrials

SWN Southwestern Energy Company Energy

SE Spectra Energy Corp Energy

STJ St. Jude Medical, Inc. Health Care

SWK Stanley Black & Decker, Inc. Industrials

SPLS Staples, Inc. Consumer Discretionary

SBUX Starbucks Corporation Consumer Discretionary

STT State Street Corporation Financials

SRCL Stericycle, Inc. Industrials

SYK Stryker Corporation Health Care

STI SunTrust Banks, Inc. Financials

SYMC Symantec Corporation Information Technology

SYF Synchrony Financial Financials

SYY Sysco Corporation Consumer Staples

TROW T. Rowe Price Group Financials

TGT Target Corporation Consumer Discretionary

TEL TE Connectivity Ltd. Information Technology

TGNA TEGNA, Inc. Consumer Discretionary

TDC Teradata Corporation Information Technology

TSO Tesoro Corporation Energy

TXN Texas Instruments Incorporated Information Technology

TXT Textron Inc. Industrials

TMO Thermo Fisher Scientific Inc. Health Care

TIF Tiffany & Co. Consumer Discretionary

TWX Time Warner Inc. Consumer Discretionary

TJX TJX Companies Inc Consumer Discretionary

TMK Torchmark Corporation Financials

TSS Total System Services, Inc. Information Technology

TSCO Tractor Supply Company Consumer Discretionary

TDG TransDigm Group Incorporated Industrials

RIG Transocean Ltd. Energy

TRV Travelers Companies, Inc. Financials

TRIP TripAdvisor, Inc. Consumer Discretionary

FOXA Twenty-First Century Fox, Inc. Class A Consumer Discretionary

FOX Twenty-First Century Fox, Inc. Class B Consumer Discretionary

TSN Tyson Foods, Inc. Class A Consumer Staples

USB U.S. Bancorp Financials

UDR UDR, Inc. Real Estate

ULTA Ulta Salon, Cosmetics & Fragrance, Inc. Consumer Discretionary

UA Under Armour, Inc. Class A Consumer Discretionary

UA.C Under Armour, Inc. Class C Consumer Discretionary

UNP Union Pacific Corporation Industrials

UAL United Continental Holdings, Inc. Industrials

UPS United Parcel Service, Inc. Class B Industrials

URI United Rentals, Inc. Industrials

UTX United Technologies Corporation Industrials

UNH UnitedHealth Group Incorporated Health Care

UHS Universal Health Services, Inc. Class B Health Care

UNM Unum Group Financials

URBN Urban Outfitters, Inc. Consumer Discretionary

VFC V.F. Corporation Consumer Discretionary

VLO Valero Energy Corporation Energy

VAR Varian Medical Systems, Inc. Health Care

VTR Ventas, Inc. Real Estate

VRSN VeriSign, Inc. Information Technology

VRSK Verisk Analytics Inc Industrials

VZ Verizon Communications Inc. Telecommunication Services

VRTX Vertex Pharmaceuticals Incorporated Health Care

VIAB Viacom Inc. Class B Consumer Discretionary

V Visa Inc. Class A Information Technology

VNO Vornado Realty Trust Real Estate

VMC Vulcan Materials Company Materials

GWW W.W. Grainger, Inc. Industrials

WMT Wal-Mart Stores, Inc. Consumer Staples

WBA Walgreens Boots Alliance Inc Consumer Staples

DIS Walt Disney Company Consumer Discretionary

WM Waste Management, Inc. Industrials

WAT Waters Corporation Health Care

WEC WEC Energy Group Inc Utilities

WFC Wells Fargo & Company Financials

HCN Welltower, Inc. Real Estate

WDC Western Digital Corporation Information Technology

WU Western Union Company Information Technology

WRK WestRock Co. Materials

WY Weyerhaeuser Company Real Estate

WHR Whirlpool Corporation Consumer Discretionary

WFM Whole Foods Market, Inc. Consumer Staples

WMB Williams Companies, Inc. Energy

WLTW Willis Towers Watson Public Limited Company Financials

WYN Wyndham Worldwide Corporation Consumer Discretionary

WYNN Wynn Resorts, Limited Consumer Discretionary

XEL Xcel Energy Inc. Utilities

XRX Xerox Corporation Information Technology

XLNX Xilinx, Inc. Information Technology

XL XL Group Ltd Financials

XYL Xylem Inc. Industrials

YHOO Yahoo! Inc. Information Technology

YUM Yum! Brands, Inc. Consumer Discretionary

ZBH Zimmer Biomet Holdings, Inc. Health Care

ZION Zions Bancorporation Financials

ZTS Zoetis, Inc. Class A Health Care

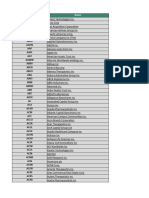

GICS Industry GICS Sub-Industry Beta

Industrial Conglomerates Industrial Conglomerates 1.04

Health Care Equipment & Supplies Health Care Equipment 1.37

Biotechnology Biotechnology 1.57

IT Services IT Consulting & Other Services 1.21

Software Home Entertainment Software 1.09

Electrical Equipment Electrical Components & Equipment 1.33

Software Application Software 1.14

Specialty Retail Automotive Retail 1.05

Independent Power and Renewable Electricity Producers Independent Power Producers & Energy Traders 1.19

Health Care Providers & Services Managed Health Care 0.52

Capital Markets Asset Management & Custody Banks 1.54

Insurance Life & Health Insurance 1.07

Life Sciences Tools & Services Life Sciences Tools & Services 1.30

Chemicals Industrial Gases 1.24

Internet Software & Services Internet Software & Services 0.93

Airlines Airlines 0.71

Chemicals Specialty Chemicals 1.52

Biotechnology Biotechnology 1.45

Building Products Building Products 1.09

Pharmaceuticals Pharmaceuticals 1.08

IT Services Data Processing & Outsourced Services 1.62

Electric Utilities Electric Utilities 0.39

Insurance Property & Casualty Insurance 0.96

Internet Software & Services Internet Software & Services 0.93

Internet Software & Services Internet Software & Services 1.02

Tobacco Tobacco 0.57

Internet & Direct Marketing Retail Internet & Direct Marketing Retail 1.52

Multi-Utilities Multi-Utilities 0.32

Airlines Airlines 0.90

Electric Utilities Electric Utilities 0.25

Consumer Finance Consumer Finance 1.19

Insurance Multi-line Insurance 1.37

Equity Real Estate Investment Trusts (REITs) Specialized REITs 0.71

Water Utilities Water Utilities 0.25

Capital Markets Asset Management & Custody Banks 1.65

Health Care Providers & Services Health Care Distributors 0.80

Electrical Equipment Electrical Components & Equipment 1.10

Biotechnology Biotechnology 1.16

Electronic Equipment Instruments & Components Electronic Components 0.98

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.42

Semiconductors & Semiconductor Equipment Semiconductors 1.19

Health Care Providers & Services Managed Health Care 0.56

Insurance Insurance Brokers 1.02

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.25

Equity Real Estate Investment Trusts (REITs) Residential REITs 0.46

Technology Hardware Storage & Peripherals Technology Hardware Storage & Peripherals 1.33

Semiconductors & Semiconductor Equipment Semiconductor Equipment 1.86

Food Products Agricultural Products 0.88

Aerospace & Defense Aerospace & Defense #N/A

Insurance Insurance Brokers 1.10

Insurance Multi-line Insurance 0.86

Diversified Telecommunication Services Integrated Telecommunication Services 0.34

Software Application Software 2.15

IT Services Data Processing & Outsourced Services 0.79

Specialty Retail Automotive Retail 1.01

Specialty Retail Automotive Retail 0.61

Equity Real Estate Investment Trusts (REITs) Residential REITs 0.40

Containers & Packaging Paper Packaging 1.07

Energy Equipment & Services Oil & Gas Equipment & Services 0.69

Containers & Packaging Metal & Glass Containers 1.04

Banks Diversified Banks 1.55

Capital Markets Asset Management & Custody Banks 1.30

Health Care Equipment & Supplies Health Care Equipment 0.89

Banks Regional Banks 1.01

Health Care Equipment & Supplies Health Care Equipment 1.04

Specialty Retail Homefurnishing Retail 0.84

Diversified Financial Services Multi-Sector Holdings 0.76

Specialty Retail Computer & Electronics Retail 1.49

Biotechnology Biotechnology 0.75

Capital Markets Asset Management & Custody Banks 1.65

Aerospace & Defense Aerospace & Defense 1.03

Auto Components Auto Parts & Equipment 1.75

Equity Real Estate Investment Trusts (REITs) Office REITs 0.65

Health Care Equipment & Supplies Health Care Equipment 1.15

Pharmaceuticals Pharmaceuticals 0.89

Semiconductors & Semiconductor Equipment Semiconductors 1.22

Beverages Distillers & Vintners 0.81

Health Care Equipment & Supplies Health Care Equipment 0.67

Air Freight & Logistics Air Freight & Logistics 0.35

Software Systems Software 1.08

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 0.48

Food Products Packaged Foods & Meats 0.41

Consumer Finance Consumer Finance 1.21

Health Care Providers & Services Health Care Distributors 0.73

Specialty Retail Automotive Retail 1.23

Hotels Restaurants & Leisure Hotels Resorts & Cruise Lines 0.66

Machinery Construction Machinery & Heavy Trucks 1.31

Real Estate Management & Development Real Estate Services 1.80

Media Broadcasting 1.63

Biotechnology Biotechnology 1.72

Health Care Providers & Services Managed Health Care 0.78

Multi-Utilities Multi-Utilities 0.48

Diversified Telecommunication Services Integrated Telecommunication Services 0.79

Health Care Technology Health Care Technology 1.12

Chemicals Fertilizers & Agricultural Chemicals 1.32

Capital Markets Investment Banking & Brokerage 1.67

Media Cable & Satellite 0.93

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 2.01

Oil Gas & Consumable Fuels Integrated Oil & Gas 1.17

Hotels Restaurants & Leisure Restaurants 0.59

Insurance Property & Casualty Insurance 0.86

Household Products Household Products 0.45

Health Care Providers & Services Managed Health Care 0.49

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.64

Insurance Property & Casualty Insurance 0.82

Commercial Services & Supplies Diversified Support Services 0.85

Communications Equipment Communications Equipment 1.42

Banks Diversified Banks 1.74

Banks Regional Banks 1.09

Software Application Software 1.65

Household Products Household Products 0.36

Capital Markets Financial Exchanges & Data 0.81

Multi-Utilities Multi-Utilities 0.10

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 0.59

Beverages Soft Drinks 0.68

IT Services IT Consulting & Other Services 1.34

Household Products Household Products 0.73

Media Cable & Satellite 1.09

Banks Diversified Banks 1.35

Food Products Packaged Foods & Meats 0.31

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.17

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.09

Multi-Utilities Multi-Utilities 0.02

Beverages Distillers & Vintners 0.60

Health Care Equipment & Supplies Health Care Supplies 0.62

Electronic Equipment Instruments & Components Electronic Components 1.32

Food & Staples Retailing Hypermarkets & Super Centers 0.83

Personal Products Personal Products 0.43

Equity Real Estate Investment Trusts (REITs) Specialized REITs 0.37

IT Services IT Consulting & Other Services 1.66

Road & Rail Railroads 1.12

Machinery Construction Machinery & Heavy Trucks 1.32

Food & Staples Retailing Drug Retail 0.88

Household Durables Homebuilding 1.16

Health Care Equipment & Supplies Health Care Equipment 1.07

Hotels Restaurants & Leisure Restaurants 0.22

Health Care Providers & Services Health Care Services 1.00

Machinery Agricultural & Farm Machinery 0.72

Auto Components Auto Parts & Equipment 1.42

Airlines Airlines 0.90

Health Care Equipment & Supplies Health Care Supplies 1.26

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 2.04

Equity Real Estate Investment Trusts (REITs) Specialized REITs 0.15

Consumer Finance Consumer Finance 1.39

Media Broadcasting 1.61

Media Broadcasting 1.48

Multiline Retail General Merchandise Stores 0.80

Multiline Retail General Merchandise Stores 0.56

Multi-Utilities Multi-Utilities 0.22

Machinery Industrial Machinery 1.18

Chemicals Diversified Chemicals 1.20

Beverages Soft Drinks 0.55

Multi-Utilities Multi-Utilities 0.20

Electric Utilities Electric Utilities 0.15

Professional Services Research & Consulting Services 1.45

Capital Markets Investment Banking & Brokerage 1.69

Chemicals Diversified Chemicals 1.71

Chemicals Diversified Chemicals 1.51

Electrical Equipment Electrical Components & Equipment 1.35

Internet Software & Services Internet Software & Services 1.33

Chemicals Specialty Chemicals 0.89

Electric Utilities Electric Utilities 0.18

Health Care Equipment & Supplies Health Care Equipment 0.72

Software Home Entertainment Software 0.57

Pharmaceuticals Pharmaceuticals 0.28

Electrical Equipment Electrical Components & Equipment 1.14

Pharmaceuticals Pharmaceuticals 0.67

Electric Utilities Electric Utilities 0.42

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 0.89

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 0.80

Professional Services Research & Consulting Services 0.85

Equity Real Estate Investment Trusts (REITs) Specialized REITs 0.78

Equity Real Estate Investment Trusts (REITs) Residential REITs 0.28

Equity Real Estate Investment Trusts (REITs) Residential REITs 0.55

Personal Products Personal Products 0.86

Electric Utilities Electric Utilities 0.33

Electric Utilities Electric Utilities 0.23

Internet & Direct Marketing Retail Internet & Direct Marketing Retail 0.78

Air Freight & Logistics Air Freight & Logistics 0.69

Health Care Providers & Services Health Care Services 0.96

Equity Real Estate Investment Trusts (REITs) Specialized REITs 0.48

Oil Gas & Consumable Fuels Integrated Oil & Gas 0.87

Communications Equipment Communications Equipment 1.38

Internet Software & Services Internet Software & Services 0.77

Trading Companies & Distributors Trading Companies & Distributors 0.92

Equity Real Estate Investment Trusts (REITs) Retail REITs 0.37

Air Freight & Logistics Air Freight & Logistics 1.14

IT Services Data Processing & Outsourced Services 0.88

Banks Regional Banks 1.19

Semiconductors & Semiconductor Equipment Semiconductors 2.21

Electric Utilities Electric Utilities 0.18

IT Services Data Processing & Outsourced Services 0.82

Electronic Equipment Instruments & Components Electronic Equipment & Instruments 0.48

Machinery Industrial Machinery 1.54

Construction & Engineering Construction & Engineering 1.62

Chemicals Fertilizers & Agricultural Chemicals 1.57

Energy Equipment & Services Oil & Gas Equipment & Services 0.91

Specialty Retail Apparel Retail 0.58

Automobiles Automobile Manufacturers 1.14

Machinery Industrial Machinery -0.64

Building Products Building Products 1.27

Capital Markets Asset Management & Custody Banks 1.77

Metals & Mining Copper 2.43

Diversified Telecommunication Services Integrated Telecommunication Services 0.73

Specialty Retail Apparel Retail 1.06

Household Durables Consumer Electronics 0.84

Aerospace & Defense Aerospace & Defense 0.69

Industrial Conglomerates Industrial Conglomerates 1.20

Equity Real Estate Investment Trusts (REITs) Retail REITs 0.87

Food Products Packaged Foods & Meats 0.55

Automobiles Automobile Manufacturers 1.44

Distributors Distributors 0.91

Biotechnology Biotechnology 1.26

IT Services Data Processing & Outsourced Services 1.11

Capital Markets Investment Banking & Brokerage 1.56

Auto Components Tires & Rubber 1.32

Diversified Consumer Services Specialized Consumer Services 0.57

Energy Equipment & Services Oil & Gas Equipment & Services 0.98

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 1.05

Automobiles Motorcycle Manufacturers 0.96

Household Durables Consumer Electronics 1.54

Communications Equipment Communications Equipment 1.29

Insurance Multi-line Insurance 1.24

Leisure Products Leisure Products 0.85

Health Care Providers & Services Health Care Facilities 0.79

Equity Real Estate Investment Trusts (REITs) Health Care REITs 0.30

Energy Equipment & Services Oil & Gas Drilling 1.07

Health Care Providers & Services Health Care Distributors 1.08

Food Products Packaged Foods & Meats 0.32

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.75

Technology Hardware Storage & Peripherals Technology Hardware Storage & Peripherals 3.59

Health Care Equipment & Supplies Health Care Equipment 1.14

Specialty Retail Home Improvement Retail 1.06

Industrial Conglomerates Industrial Conglomerates 0.94

Food Products Packaged Foods & Meats 0.51

Equity Real Estate Investment Trusts (REITs) Hotel & Resort REITs 1.29

Technology Hardware Storage & Peripherals Technology Hardware Storage & Peripherals 1.52

Health Care Providers & Services Managed Health Care 0.78

Banks Regional Banks 1.15

Machinery Industrial Machinery 1.05

Life Sciences Tools & Services Life Sciences Tools & Services 1.24

Machinery Industrial Machinery 1.32

Semiconductors & Semiconductor Equipment Semiconductors 1.07

Capital Markets Financial Exchanges & Data 0.92

IT Services IT Consulting & Other Services 0.94

Chemicals Specialty Chemicals 1.15

Containers & Packaging Paper Packaging 1.53

Media Advertising 1.58

Software Application Software 1.07

Health Care Equipment & Supplies Health Care Equipment 0.55

Capital Markets Asset Management & Custody Banks 1.83

Equity Real Estate Investment Trusts (REITs) Specialized REITs 1.07

Food Products Packaged Foods & Meats 0.56

Road & Rail Trucking 0.79

Construction & Engineering Construction & Engineering 1.60

Pharmaceuticals Pharmaceuticals 0.76

Building Products Building Products 0.90

Banks Diversified Banks 1.51

Communications Equipment Communications Equipment 1.24

Road & Rail Railroads 0.90

Food Products Packaged Foods & Meats 0.57

Banks Regional Banks 0.99

Household Products Household Products 0.61

Equity Real Estate Investment Trusts (REITs) Retail REITs 0.86

Oil Gas & Consumable Fuels Oil & Gas Storage & Transportation 0.66

Semiconductors & Semiconductor Equipment Semiconductor Equipment 1.55

Multiline Retail Department Stores 1.00

Food Products Packaged Foods & Meats 0.41

Food & Staples Retailing Food Retail 0.74

Specialty Retail Apparel Retail 0.85

Aerospace & Defense Aerospace & Defense 1.06

Health Care Providers & Services Health Care Services 0.96

Semiconductors & Semiconductor Equipment Semiconductor Equipment 1.50

Capital Markets Asset Management & Custody Banks 1.90

Household Durables Home Furnishings 0.93

Household Durables Homebuilding 1.27

Diversified Financial Services Multi-Sector Holdings 1.38

Diversified Telecommunication Services Alternative Carriers 1.60

Insurance Life & Health Insurance 1.98

Semiconductors & Semiconductor Equipment Semiconductors 1.16

Distributors Distributors 0.55

Aerospace & Defense Aerospace & Defense 0.65

Insurance Multi-line Insurance 0.70

Specialty Retail Home Improvement Retail 1.23

Chemicals Commodity Chemicals 1.18

Banks Regional Banks 0.70

Equity Real Estate Investment Trusts (REITs) Retail REITs 0.85

Multiline Retail Department Stores 0.77

Pharmaceuticals Pharmaceuticals 1.61

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 2.09

Oil Gas & Consumable Fuels Oil & Gas Refining & Marketing 1.81

Hotels Restaurants & Leisure Hotels Resorts & Cruise Lines 1.24

Insurance Insurance Brokers 0.84

Construction Materials Construction Materials 1.34

Building Products Building Products 1.57

IT Services Data Processing & Outsourced Services 1.22

Leisure Products Leisure Products 0.98

Food Products Packaged Foods & Meats 0.49

Hotels Restaurants & Leisure Restaurants 0.64

Health Care Providers & Services Health Care Distributors 1.02

Food Products Packaged Foods & Meats 1.43

Health Care Equipment & Supplies Health Care Equipment 1.00

Pharmaceuticals Pharmaceuticals 0.76

Insurance Life & Health Insurance 1.66

Life Sciences Tools & Services Life Sciences Tools & Services 1.23

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 0.82

Semiconductors & Semiconductor Equipment Semiconductors 1.03

Semiconductors & Semiconductor Equipment Semiconductors 1.92

Software Systems Software 1.16

Household Durables Home Furnishings 1.13

Beverages Brewers 0.97

Food Products Packaged Foods & Meats 0.92

Chemicals Fertilizers & Agricultural Chemicals 1.01

Beverages Soft Drinks 0.88

Capital Markets Financial Exchanges & Data 1.37

Capital Markets Investment Banking & Brokerage 1.87

Chemicals Fertilizers & Agricultural Chemicals 1.25

Communications Equipment Communications Equipment 0.39

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 2.00

Pharmaceuticals Pharmaceuticals 1.10

Capital Markets Financial Exchanges & Data 0.86

Energy Equipment & Services Oil & Gas Equipment & Services 1.02

Consumer Finance Consumer Finance 2.33

Technology Hardware Storage & Peripherals Technology Hardware Storage & Peripherals 1.48

Internet & Direct Marketing Retail Internet & Direct Marketing Retail 1.83

Household Durables Housewares & Specialties 1.03

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.41

Metals & Mining Gold 0.20

Media Publishing 2.06

Media Publishing 1.91

Electric Utilities Electric Utilities 0.27

Professional Services Research & Consulting Services 0.85

Textiles Apparel & Luxury Goods Footwear 0.48

Multi-Utilities Multi-Utilities 0.24

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.10

Multiline Retail Department Stores 0.92

Road & Rail Railroads 1.13

Capital Markets Asset Management & Custody Banks 1.02

Aerospace & Defense Aerospace & Defense 0.67

Independent Power and Renewable Electricity Producers Independent Power Producers & Energy Traders 1.08

Metals & Mining Steel 1.39

Semiconductors & Semiconductor Equipment Semiconductors 1.15

Specialty Retail Automotive Retail 0.69

Oil Gas & Consumable Fuels Integrated Oil & Gas 0.86

Media Advertising 1.25

Oil Gas & Consumable Fuels Oil & Gas Storage & Transportation 1.08

Software Systems Software 1.19

Containers & Packaging Metal & Glass Containers 1.65

Machinery Construction Machinery & Heavy Trucks 1.32

Machinery Industrial Machinery 1.23

Health Care Providers & Services Health Care Distributors 0.97

IT Services Data Processing & Outsourced Services 0.86

IT Services Data Processing & Outsourced Services 1.07

Machinery Industrial Machinery 1.46

Banks Regional Banks 0.72

Beverages Soft Drinks 0.57

Life Sciences Tools & Services Life Sciences Tools & Services 0.94

Pharmaceuticals Pharmaceuticals 0.69

Pharmaceuticals Pharmaceuticals 0.90

Electric Utilities Electric Utilities 0.26

Tobacco Tobacco 0.92

Oil Gas & Consumable Fuels Oil & Gas Refining & Marketing 1.41

Electric Utilities Electric Utilities 0.28

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.02

Commercial Services & Supplies Office Services & Supplies 1.49

Banks Regional Banks 0.82

Chemicals Specialty Chemicals 1.40

Electric Utilities Electric Utilities 0.42

Chemicals Industrial Gases 0.95

Internet & Direct Marketing Retail Internet & Direct Marketing Retail 1.69

Insurance Life & Health Insurance 1.70

Household Products Household Products 0.61

Insurance Property & Casualty Insurance 0.75

Equity Real Estate Investment Trusts (REITs) Industrial REITs 1.16

Insurance Life & Health Insurance 1.68

Multi-Utilities Multi-Utilities 0.29

Equity Real Estate Investment Trusts (REITs) Specialized REITs 0.48

Household Durables Homebuilding 1.27

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 0.76

Semiconductors & Semiconductor Equipment Semiconductors 1.05

Semiconductors & Semiconductor Equipment Semiconductors 1.38

Construction & Engineering Construction & Engineering 0.59

Health Care Providers & Services Health Care Services 0.61

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 0.96

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.06

Aerospace & Defense Aerospace & Defense 0.63

Equity Real Estate Investment Trusts (REITs) Retail REITs 0.42

Software Systems Software 1.50

Biotechnology Biotechnology 1.80

Banks Regional Banks 1.35

Commercial Services & Supplies Environmental & Facilities Services 0.62

Tobacco Tobacco 0.35

Professional Services Human Resource & Employment Services 1.04

Electrical Equipment Electrical Components & Equipment 0.99

Aerospace & Defense Aerospace & Defense 0.77

Industrial Conglomerates Industrial Conglomerates 0.87

Specialty Retail Apparel Retail 0.95

Hotels Restaurants & Leisure Hotels Resorts & Cruise Lines 1.27

Road & Rail Trucking 1.23

Capital Markets Financial Exchanges & Data 1.51

Software Application Software 1.54

Multi-Utilities Multi-Utilities 0.24

Energy Equipment & Services Oil & Gas Equipment & Services 1.10

Media Broadcasting 1.13

Technology Hardware Storage & Peripherals Technology Hardware Storage & Peripherals 1.98

Containers & Packaging Paper Packaging 1.36

Multi-Utilities Multi-Utilities 0.53

Chemicals Specialty Chemicals 0.98

Specialty Retail Specialty Stores 1.17

Equity Real Estate Investment Trusts (REITs) Retail REITs 0.66

Semiconductors & Semiconductor Equipment Semiconductors 1.11

Equity Real Estate Investment Trusts (REITs) Office REITs 1.23

Machinery Industrial Machinery 1.08

Electric Utilities Electric Utilities 0.10

Airlines Airlines 0.87

Oil Gas & Consumable Fuels Oil & Gas Exploration & Production 1.35

Oil Gas & Consumable Fuels Oil & Gas Storage & Transportation 0.56

Health Care Equipment & Supplies Health Care Equipment 1.26

Machinery Industrial Machinery 1.13

Specialty Retail Specialty Stores 1.67

Hotels Restaurants & Leisure Restaurants 0.77

Capital Markets Asset Management & Custody Banks 1.32

Commercial Services & Supplies Environmental & Facilities Services 0.18

Health Care Equipment & Supplies Health Care Equipment 0.86

Banks Regional Banks 1.36

Software Systems Software 1.00

Consumer Finance Consumer Finance 0.90

Food & Staples Retailing Food Distributors 0.49

Capital Markets Asset Management & Custody Banks 1.20

Multiline Retail General Merchandise Stores 0.59

Electronic Equipment Instruments & Components Electronic Manufacturing Services 1.21

Media Broadcasting 1.52

IT Services IT Consulting & Other Services 1.39

Oil Gas & Consumable Fuels Oil & Gas Refining & Marketing 1.76

Semiconductors & Semiconductor Equipment Semiconductors 1.27

Aerospace & Defense Aerospace & Defense 1.77

Life Sciences Tools & Services Life Sciences Tools & Services 1.24

Specialty Retail Specialty Stores 1.83

Media Movies & Entertainment 1.09

Specialty Retail Apparel Retail 0.69

Insurance Life & Health Insurance 0.95

IT Services Data Processing & Outsourced Services 1.06

Specialty Retail Specialty Stores 1.23

Aerospace & Defense Aerospace & Defense 0.62

Energy Equipment & Services Oil & Gas Drilling 1.83

Insurance Property & Casualty Insurance 1.03

Internet & Direct Marketing Retail Internet & Direct Marketing Retail 2.30

Media Movies & Entertainment 1.37

Media Movies & Entertainment 1.31

Food Products Packaged Foods & Meats 0.17

Banks Diversified Banks 0.79

Equity Real Estate Investment Trusts (REITs) Residential REITs 0.39

Specialty Retail Specialty Stores 0.72

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 0.30

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 2.15

Road & Rail Railroads 0.67

Airlines Airlines 0.64

Air Freight & Logistics Air Freight & Logistics 0.89

Trading Companies & Distributors Trading Companies & Distributors 2.40

Aerospace & Defense Aerospace & Defense 1.10

Health Care Providers & Services Managed Health Care 0.63

Health Care Providers & Services Health Care Facilities 1.14

Insurance Life & Health Insurance 1.49

Specialty Retail Apparel Retail 0.67

Textiles Apparel & Luxury Goods Apparel Accessories & Luxury Goods 0.84

Oil Gas & Consumable Fuels Oil & Gas Refining & Marketing 1.47

Health Care Equipment & Supplies Health Care Equipment 0.66

Equity Real Estate Investment Trusts (REITs) Health Care REITs 0.21

Internet Software & Services Internet Software & Services 1.23

Professional Services Research & Consulting Services 0.65

Diversified Telecommunication Services Integrated Telecommunication Services 0.38

Biotechnology Biotechnology 0.88

Media Movies & Entertainment 1.32

IT Services Data Processing & Outsourced Services 1.00

Equity Real Estate Investment Trusts (REITs) Office REITs 0.93

Construction Materials Construction Materials 1.19

Trading Companies & Distributors Trading Companies & Distributors 0.73

Food & Staples Retailing Hypermarkets & Super Centers 0.10

Food & Staples Retailing Drug Retail 1.20

Media Movies & Entertainment 1.21

Commercial Services & Supplies Environmental & Facilities Services 0.72

Life Sciences Tools & Services Life Sciences Tools & Services 0.95

Multi-Utilities Multi-Utilities 0.07

Banks Diversified Banks 0.92

Equity Real Estate Investment Trusts (REITs) Health Care REITs 0.27

Technology Hardware Storage & Peripherals Technology Hardware Storage & Peripherals 1.47

IT Services Data Processing & Outsourced Services 1.15

Containers & Packaging Paper Packaging 1.80

Equity Real Estate Investment Trusts (REITs) Specialized REITs 1.37

Household Durables Household Appliances 1.94

Food & Staples Retailing Food Retail 0.77

Oil Gas & Consumable Fuels Oil & Gas Storage & Transportation 1.34

Insurance Insurance Brokers 0.81

Hotels Restaurants & Leisure Hotels Resorts & Cruise Lines 1.18

Hotels Restaurants & Leisure Casinos & Gaming 1.90

Electric Utilities Electric Utilities 0.10

IT Services Data Processing & Outsourced Services 1.20

Semiconductors & Semiconductor Equipment Semiconductors 1.17

Insurance Property & Casualty Insurance 0.97

Machinery Industrial Machinery 1.20

Internet Software & Services Internet Software & Services 1.56

Hotels Restaurants & Leisure Restaurants 0.77

Health Care Equipment & Supplies Health Care Equipment 1.28

Banks Regional Banks 1.37

Pharmaceuticals Pharmaceuticals 1.06

Altman Z Score Market Value Total Return 2016 Total Return 2015 Total Return 2014 Div Yield Net Profit Margin

6.0 99,422 0.07972848 0.04814184 0.25077045 0.02487434 0.15964194

3.7 57,773 -0.10201073 0.04975188 0.21929872 0.02590932 0.12673364

2.3 90,648 -0.02633643 -0.03038442 0.35269165 0.03613312 0.22389431

6.6 72,105 0.10604275 0.35001373 0.13176966 0.01938245 0.11816576

3.4 32,009 0.25199175 0.76018230 0.20731068 0.00659731 0.18889365

8.2 9,856 0.02495086 0.57245064 0.39308298 0.00205080 0.08823261

7.6 53,457 0.21260989 0.26440394 0.29324973 0.00000000 0.13283979

3.2 10,315 -0.29293942 0.35224187 0.48465288 0.00165494 0.04844861

0.8 7,757 0.11840975 -0.19599415 0.01263011 0.03907638 0.02049839

#N/A 37,669 -0.05631208 0.40433252 0.33188152 0.00838364 0.03957291

#N/A 7,147 -0.26406300 -0.09775263 0.01190233 0.00000000 0.20792199

#N/A 28,100 0.10801327 0.09429132 -0.05904489 0.02258642 0.12047562

4.5 14,133 0.16619050 -0.03489983 0.09922754 0.00992021 0.10846954

#N/A 28,892 0.06405938 0.05588627 0.26602100 0.02446947 0.15909664

6.0 12,138 0.14222300 0.00862360 0.34733546 0.00000000 0.14626330

3.6 8,902 -0.03873986 0.44810426 0.52339770 0.01362488 0.15148267

1.5 9,391 0.59103380 -0.06297594 -0.10391682 0.01498197 0.09172152

5.9 29,264 -0.25852275 -0.08026754 0.55640507 0.00000000 0.05807616

3.4 6,122 -0.01354206 0.23552358 #N/A 0.00663685 0.07460954

1.4 78,369 -0.32265700 0.27078354 0.57031953 0.00000000 -0.19059784

1.7 11,967 -0.31226665 0.04926765 0.19526708 0.00000000 0.08564251

1.1 8,650 0.33285546 -0.01271272 0.22874117 0.03322964 0.12014384

#N/A 25,004 0.11897540 -0.02860820 0.24573062 0.01852384 0.06112050

14.2 239,726 0.09833336 0.29851902 0.10097397 0.00000000 0.21505639

13.9 269,571 0.10372675 0.27488410 #N/A 0.00000000 0.21505639

4.9 128,952 0.13468564 0.30412173 0.36393510 0.03732189 0.27744776

5.3 375,296 0.26189482 1.04904100 -0.16089338 0.00000000 0.00556978

0.9 12,120 0.18528700 0.07420814 0.21978474 0.03558719 0.09494916

1.6 21,036 -0.11201876 0.12504590 #N/A 0.00931749 0.18565504

0.9 31,882 0.18674982 0.00764406 0.29697930 0.03733956 0.10831296

#N/A 60,791 -0.07585138 -0.17433530 0.11165834 0.01687943 0.14880520

#N/A 66,060 0.00003517 0.19070075 0.04656529 0.01958307 0.03764787

#N/A 49,886 0.16927421 0.06758130 0.24768507 0.01967647 0.14364668

0.8 13,172 0.31806660 0.10127724 0.27822578 0.02006173 0.15068060

#N/A 14,268 -0.21496032 -0.06228834 0.28048480 0.02562021 0.13011245

#N/A 15,477 -0.25980347 0.14299071 0.32497620 0.01723264 0.00972375

4.2 10,250 -0.18967253 0.05838597 0.09663200 0.00761421 0.14867014

2.8 105,012 -0.08544952 -0.00639945 0.42389715 0.02542942 0.32522497

4.5 20,354 0.22792232 0.08213186 0.27125764 0.00840462 0.13710561

0.7 33,221 -0.10416996 -0.26099420 -0.02779615 0.00688073 -0.70585134

7.9 19,731 0.09702051 0.24411370 0.03565526 0.02541335 0.20287026

#N/A 32,070 -0.10694826 0.11583114 0.51921725 0.01926242 0.03231344

#N/A 29,159 0.20284426 0.09798384 0.09941554 0.01167527 0.11886371

0.5 22,568 0.28780198 -0.37827224 -0.12078857 0.01732502 -3.50117500

#N/A 6,914 0.16175258 0.12834930 0.32317340 0.03073624 0.06868269

3.7 605,431 -0.02959067 0.12531137 0.47896612 0.02010514 0.21326543

4.2 31,432 0.76654540 -0.22583872 0.26310706 0.01387925 0.14256134

3.2 25,070 -0.01523376 -0.00721675 0.17331278 0.02827702 0.02733630

#N/A 9,456 #N/A #N/A #N/A #N/A #N/A

#N/A 8,582 0.14039028 -0.05377298 0.03665125 0.02929763 0.06654978

#N/A 4,848 0.01180351 0.21548045 0.18525457 0.02409929 0.01369558

1.1 225,927 0.15370762 0.01709485 0.01396132 0.05258833 0.09090538

2.3 16,038 0.30965757 -0.04084122 0.44210517 0.00000000 -0.13411516

1.6 39,558 0.02543843 0.08917785 0.27291787 0.02327624 0.12799328

3.4 4,433 -0.30574460 0.10356272 0.18722785 0.00000000 0.02126833

3.0 21,419 -0.05386215 0.41713023 0.27336730 0.00000000 0.11668342

#N/A 23,508 0.00770664 0.15508986 0.28962636 0.03161160 0.40008777

3.8 6,211 0.09804762 0.42312348 0.02039981 0.02242991 0.04598703

3.1 23,423 0.06682932 0.00308847 -0.07866561 0.01159618 -0.12495236

2.5 13,472 0.13331044 0.07118654 0.32992650 0.00684481 0.03515469

#N/A 167,044 -0.00227433 -0.01020312 0.23446274 0.01182965 0.17253624

#N/A 45,751 0.05783618 0.09365177 0.24040115 0.01540766 0.20186637

2.6 25,884 0.28782964 0.00656712 0.09572005 0.01046561 0.03942616

#N/A 31,808 0.08936537 0.00699902 0.14448988 0.02676225 0.20305953

#N/A 35,752 0.19756400 0.12653542 0.24767482 0.01549660 0.07818633

6.3 6,147 -0.31820065 -0.11449355 -0.12907404 0.00569476 0.06952221

1.9 185,057 0.06087339 -0.02953768 0.21782959 0.00000000 0.11475035

4.6 12,345 0.16440094 0.06366348 -0.18427902 0.02789364 0.02041591

6.2 60,960 -0.03555822 -0.09520984 0.31487775 0.00000000 0.38054673

#N/A 55,304 -0.00542945 0.05754364 0.16135238 0.02438105 0.29191029

2.7 87,903 -0.00699574 0.21503639 -0.02247024 0.02814436 0.05381110

3.1 7,633 -0.15069622 -0.24188977 0.11289799 0.01512507 0.07597886

#N/A 18,527 -0.01414704 0.04818285 0.28146446 0.02122449 0.23439958

1.2 29,936 0.20350110 0.37650610 0.13601375 0.00000000 -0.03230166

6.4 85,082 -0.20967472 0.16053559 0.13971293 0.02696470 0.09450483

5.3 68,507 0.40024626 0.44550312 0.93031096 0.01157932 0.20383939

7.6 10,270 -0.11842197 0.16124928 0.28704440 0.01499779 0.35237781

3.7 15,932 0.16829073 0.14230550 0.21113087 0.00468955 0.03908080

9.1 9,713 0.00661373 0.02447820 0.18668579 0.02337592 0.03782249

2.9 12,844 0.14715993 -0.01370758 -0.05475325 0.03149361 0.18906832

2.0 9,712 -0.03482050 -0.29999942 -0.11753082 0.00375059 -0.08757720

3.6 16,712 0.09383429 0.18042828 0.06749177 0.02403738 0.07071976

#N/A 35,710 -0.03936207 -0.03004193 0.22522270 0.01975553 0.15982704

4.7 21,978 -0.14696407 0.06598175 0.36257493 0.02342441 0.01174051

2.0 9,505 -0.15370274 0.05544627 0.18982756 0.00000000 0.04115125

2.7 27,049 -0.06736797 0.37779510 0.18952157 0.02609394 0.11181112

1.9 48,830 0.19126427 -0.25350070 0.24881136 0.03311472 0.04471294

2.4 8,646 -0.30901283 0.16499996 0.37752903 0.00000000 0.05039992

0.6 22,194 0.23203182 -0.13231218 -0.07552284 0.01091098 0.10103702

4.0 79,201 -0.16730500 0.14585865 0.44238663 0.00000000 0.17996765

#N/A 10,677 0.05043709 0.28369486 0.65010680 0.00000000 0.01564148

0.7 9,820 0.29439414 -0.20887779 0.03676426 0.04450262 -0.09534307

0.8 14,531 0.01675856 -0.27487910 0.30336344 0.09075631 0.04905028

9.7 19,888 -0.11630715 0.04657412 0.13046587 0.00000000 0.12188236

1.7 5,597 -0.50749290 -0.00361568 0.22909415 0.04319654 0.16245387

#N/A 41,939 0.04850125 0.07292342 0.27793658 0.00720621 0.22517896

0.5 67,636 0.18335892 0.20550537 0.18166220 0.00000000 -0.02778347

-0.6 4,890 -0.22720897 -0.67504966 -0.14910960 0.00000000 -1.25652434

2.3 197,613 0.20584929 -0.21033227 0.03477812 0.04013503 0.03538041

18.7 10,444 -0.43651497 0.00349522 0.21069515 0.00000000 0.10566062

#N/A 59,098 0.14360952 0.06479561 0.17454837 0.02144265 0.14629362

5.2 12,432 0.13848841 0.20819092 0.13196051 0.01601464 0.12089077

#N/A 30,488 -0.11322045 0.34663808 0.29410220 0.00029924 0.05512267

2.5 12,266 0.09879971 0.04446042 0.08446037 0.00385511 -1.65834813

#N/A 11,661 0.21801831 0.23593925 0.04508591 0.02656600 0.12206392

6.2 11,194 0.15903115 0.30171692 0.38170540 0.00965784 0.09163997

3.1 154,206 0.10073031 0.21518719 0.11878241 0.03156888 0.21806404

#N/A 140,064 -0.07010865 -0.00381309 0.09826398 0.00586788 0.19430913

#N/A 13,648 0.11044561 0.04532599 #N/A 0.01541039 0.15912105

3.8 13,206 0.03288674 0.27821887 0.13120830 0.00000000 0.09749713

5.2 15,552 0.00902784 0.25887215 0.13858104 0.02777532 0.11248047

#N/A 33,919 0.11923289 0.17652643 0.19508803 0.04546249 0.37565898

0.8 11,798 0.20459032 0.14133048 0.22352482 0.03069182 0.08100991

4.8 10,060 0.19372320 -0.05716467 -0.30059528 0.03649635 0.10252015

3.7 182,869 0.03301680 0.04387236 0.09017552 0.03363393 0.16821510

8.7 31,167 -0.24607255 0.39426827 0.12389278 0.00000000 0.13076675

7.7 63,428 0.09966946 0.01421917 0.05565047 0.02299021 0.08631658

1.6 147,341 0.00445163 0.15047050 0.18224013 0.01617514 0.10955576

#N/A 8,959 0.22523344 -0.07463014 0.11983442 0.01504410 0.18505210

2.8 21,092 0.21527946 0.21085465 0.11426438 0.02862869 0.04123543

1.6 18,042 0.09516001 0.06310189 -0.01428443 0.00000000 0.03618650

1.2 53,813 -0.16449022 -0.22359854 0.02212358 0.02275831 -0.15095626

1.1 22,999 0.19295871 0.08035874 0.13830233 0.03773585 0.09525711

3.0 29,701 0.25163126 0.48025250 0.40183760 0.00931820 0.16114446

3.8 8,581 0.15589500 -0.07007551 0.26902270 0.00033847 0.11325331

2.7 21,602 0.25359488 -0.06895345 0.22038364 0.02243590 0.14728853

6.3 64,638 -0.05459082 0.23825109 0.14309251 0.01138190 0.01979464

1.6 17,153 -0.19797403 0.76103354 0.09221888 0.01473741 0.03612211

#N/A 30,845 0.10772848 0.13927484 0.04189611 0.04303951 0.14466500

1.5 4,105 #N/A #N/A #N/A 0.01314924 0.02045846

1.8 28,578 0.16120075 -0.22688788 0.39711368 0.02082129 0.16653967

4.3 21,556 0.28098094 -0.27461272 0.17258812 0.02883422 0.07324991

3.7 89,669 -0.13325715 0.16685307 0.39860260 0.02263950 0.03387697

4.1 10,733 -0.01010644 0.30414438 0.21032488 0.01170875 0.07290210

2.9 54,333 0.11781097 0.16745068 0.12000025 0.00716580 0.12637686

4.0 7,974 0.20913064 0.23558748 0.05069244 0.03023388 0.05187856

2.2 12,128 -0.24371052 -0.00717300 0.38889873 0.00000000 0.01957156

1.4 27,764 0.16603734 -0.06246424 0.07191336 0.02634468 0.06718683

3.7 17,624 -0.20496391 0.22150815 0.22331070 0.01717001 0.07833828

1.9 31,282 -0.16639370 0.27526712 0.53758776 0.01309832 0.11173653

4.8 13,415 -0.04917359 0.20504510 0.08380164 0.00506476 0.09393112

0.9 19,839 -0.07818872 -0.28811544 -0.03784764 0.01433692 -1.14454207

#N/A 14,849 0.31541264 0.12930596 0.53655400 0.03969066 0.16914994

#N/A 22,216 0.02380490 -0.10266811 0.24919246 0.01765526 0.22958568

1.9 3,940 -0.11311144 -0.16718525 -0.22125971 0.00000000 0.16234888

1.9 5,990 -0.08757269 -0.21348959 -0.15391123 0.00000000 0.16234888

4.9 19,466 0.03206551 0.09108710 0.08463133 0.01298527 0.05719991

2.5 17,813 0.15361130 0.08122826 0.03715754 0.00000000 0.01822124

1.0 47,226 0.09440316 0.03783989 0.15784764 0.03882843 0.16541812

3.7 10,391 0.06507564 -0.17054927 0.06173694 0.02396391 0.08566049

2.7 60,342 0.07940292 0.08453787 0.28813600 0.03429636 0.15634792

3.2 16,128 0.00484788 0.32278335 0.50621915 0.02512746 0.12161732

1.2 17,228 0.21653770 0.02899182 0.23284483 0.03253820 0.07043891

0.7 55,134 0.16946304 -0.09354478 0.19668162 0.04425838 0.11929346

3.8 4,533 0.11508215 -0.05878252 0.14693356 0.01629137 0.12473276

#N/A 7,711 -0.01227641 0.27847540 0.31874633 0.00000000 0.18059299

2.7 59,802 0.11096740 -0.00842142 0.16226079 0.02196214 0.07519006

2.0 10,556 0.02313674 -0.08696938 0.04281724 0.02446483 0.08872149

2.3 28,996 0.18420506 -0.15585506 -0.01082939 0.03357599 0.09489331

3.6 31,872 0.02186382 0.26266658 -0.00398409 0.00000000 0.22660615

3.3 33,291 -0.03959066 0.09502447 0.05998743 0.01210340 0.07398247

0.9 23,940 0.24778820 -0.00651294 0.31095970 0.02788671 0.09519264

9.3 20,359 0.21183586 0.29961956 0.85488560 0.00000000 0.19846012

5.0 23,616 0.08949625 0.75909200 0.56076190 0.00000000 0.26434942

4.3 81,516 -0.07077825 0.26362480 0.37878564 0.02613622 0.12066918

#N/A 32,614 0.11461819 -0.23820364 -0.01809901 0.03423423 0.10948905

0.7 4,177 -0.68744790 -0.10355645 0.53029954 0.00000000 -0.09181459

0.9 13,196 0.13272369 -0.15304142 0.36320853 0.05043762 -0.01407113

2.5 49,789 0.06222963 -0.08989793 0.07129800 0.00732961 -0.51980216

1.3 11,402 0.00076365 -0.29644257 0.09987032 0.00182648 0.04727412

6.0 14,847 0.17606758 0.42391944 0.18727541 0.01122512 0.16109776

#N/A 25,394 0.23024261 0.50755690 0.34510950 0.02135056 0.06888597

#N/A 22,579 -0.03946227 0.14421892 0.37910843 0.03436719 0.19633919

#N/A 14,027 -0.00234753 0.12106371 0.29120110 0.02897878 0.18932405

6.8 19,367 0.09740830 0.08303285 0.07100904 0.01531394 0.09896735

1.0 17,465 0.11714339 0.06711233 0.19169639 0.03373436 0.11043421

0.9 31,456 0.26841320 -0.20869344 0.33480810 0.04186667 0.08010591

1.5 17,734 -0.04361099 0.61675990 0.45342827 0.00808581 0.11457264

10.5 9,319 0.04981911 0.18460310 -0.04490101 0.01500197 0.06910207

3.3 41,560 -0.21972674 0.12444676 0.22872674 0.00000000 0.02431493

#N/A 9,202 -0.04617536 0.40669692 0.31040168 0.03714751 0.24535876

3.7 345,528 0.04287386 -0.11629278 0.10923063 0.03455119 0.06819813

7.0 9,027 0.25417435 -0.10391939 0.50830925 0.00000000 0.18338284

36.0 306,625 0.28459358 0.35978138 0.49367583 0.00000000 0.20465194

13.9 11,266 0.02499414 -0.08637392 -0.09632272 0.02710027 0.13345465

#N/A 10,373 0.03743219 0.11696661 0.30897212 0.02766655 0.24571106

2.8 46,327 0.12645817 -0.06285715 0.28415132 0.00707714 0.03609650

1.4 24,233 0.02937710 0.26875865 0.21888840 0.01362683 0.09341503

#N/A 16,441 0.17489602 -0.02172244 0.07514346 0.02125051 0.25347274

3.9 4,145 -0.29052037 -0.03106964 0.17083454 0.00000000 0.15275048

0.7 14,580 0.14813614 -0.13086116 0.03497195 0.04554080 0.03888328

4.1 21,376 0.02041245 0.38903272 0.32684052 0.00000000 0.13551580

5.5 4,519 0.25368118 -0.19368003 0.19181764 0.01354857 0.15521875

3.5 5,525 -0.07143366 -0.30884045 -0.01318610 0.01636483 0.05858698

4.6 7,240 0.10593165 -0.26819485 -0.09684891 0.01709750 0.02308540

2.5 6,274 0.16949867 -0.28045810 -0.20513278 0.01259782 -0.05719518

3.6 7,283 -0.04611296 -0.39632404 0.10860539 0.00000000 0.06064112

9.1 8,897 0.00260544 0.22845352 0.64435446 0.01502866 0.07298975

1.4 45,820 -0.15196937 0.09336591 -0.14977110 0.04885994 0.04929860

#N/A 17,650 #N/A #N/A #N/A 0.00000000 0.13980061

3.8 8,430 0.05540443 0.22400452 0.01468003 0.01122375 0.06682098

#N/A 19,196 -0.15719217 -0.25116354 0.04143024 0.01934444 0.26090964

0.2 15,224 -0.05012745 -0.57408310 -0.19590724 0.00717360 -0.75004612

0.8 4,716 -0.14653498 -0.15678811 0.60163164 0.13207547 -0.03568867

4.7 10,994 0.05275869 -0.26387697 0.04621828 0.03164775 0.05823891

5.6 9,113 0.43345010 -0.33176840 0.22914387 0.04084084 0.16176714

3.7 45,903 0.03669572 0.08388483 0.64901125 0.01762088 0.09421971

1.2 257,430 0.03740549 0.16117573 0.02074254 0.02995767 0.01448125

#N/A 22,095 -0.11405891 0.14586926 0.25326930 0.03042276 0.57180314

3.2 36,654 0.09855771 0.15361464 0.06361866 0.03047182 0.10248082

1.3 48,169 -0.05109173 0.15627372 -0.12788749 0.04409171 0.06358135

4.8 13,474 0.02570462 -0.04016858 0.26442206 0.02734623 0.04618259

5.5 97,004 -0.30484772 -0.02721489 0.57358610 0.02355404 0.56522146

1.6 11,146 0.06390035 0.69593640 0.35502028 0.00057562 0.09010033

#N/A 70,877 -0.03439355 -0.00032717 0.19670117 0.01274885 0.16426334

2.2 7,578 -0.10640144 0.36726964 0.16603136 0.01059829 0.01867056

2.8 5,033 -0.36367500 0.18152559 0.16594756 0.03679369 0.12600912

2.9 39,765 0.22076309 -0.29193430 0.05038238 0.01499688 -0.02818093

3.8 9,713 -0.18252629 0.22511661 0.57178116 0.01736672 0.07482358

3.0 10,195 0.18869913 -0.23194635 0.04189718 0.02305085 0.12546398

3.2 5,574 -0.26272923 0.03607762 0.34143913 0.01597262 0.05079481

1.9 11,024 0.15529561 0.16610825 0.15088236 0.01962870 0.04606937

#N/A 16,662 -0.02800936 0.18955590 0.19517374 0.01794105 0.09163608

4.7 10,460 0.11258899 0.37056077 0.14984620 0.02352524 0.10138335

2.0 28,675 0.11251629 -0.01798719 0.48599923 0.00000000 0.05365694

#N/A 16,015 -0.01936466 -0.10697633 0.10304976 0.08149466 -0.20255611

3.2 6,820 0.17795849 -0.32645202 0.14909327 0.04463568 0.13271389

5.4 12,204 -0.01654476 0.26393414 0.06759763 0.00000000 0.04506780

6.4 15,534 0.18463695 -0.05401003 -0.01370233 0.02433933 0.06944321

1.4 15,191 -0.12983108 -0.32672986 0.05646551 0.02101724 -0.45002992

1.2 37,425 0.54547310 #N/A #N/A 0.00943801 0.04748124

#N/A 9,990 -0.07334024 0.48377240 0.17050278 0.00000000 0.11677904

6.8 150,752 0.00690341 0.29407870 0.27943670 0.02048518 0.07918074

3.6 83,590 0.09166538 0.09621704 0.13020146 0.02101545 0.12363863

8.3 20,374 0.15727961 0.27495372 0.26134562 0.01667625 0.07406068

#N/A 11,494 -0.06057018 -0.22370265 0.29466295 0.04854369 0.10358270

2.1 24,791 0.23096752 -0.23276407 0.50080180 0.03135272 0.04461032

#N/A 25,569 -0.03357655 0.29509044 0.52091410 0.00600445 0.02350384

#N/A 11,499 -0.00616211 0.13153660 0.14977324 0.02393162 0.21779718

5.3 39,864 0.26284635 0.03228128 0.17974068 0.01856186 0.14166356

11.4 19,958 -0.04983246 -0.25599754 1.05945900 0.00000000 0.20793175

2.5 17,383 0.15895080 -0.03657484 0.17624962 0.01648424 0.05179427

4.2 164,970 0.06338108 0.02518582 0.43826902 0.02947125 0.20630476

#N/A 32,213 0.08525133 0.22657347 0.09473634 0.01173333 0.27210594

4.0 146,137 0.13920629 -0.12226194 -0.06185687 0.03348422 0.16349201

5.6 10,409 0.14784515 0.19185448 0.22053741 0.01959460 0.13867707

1.7 18,516 0.10203505 -0.13061225 0.18595469 0.03854577 0.04194053

1.5 8,889 0.00109375 0.20899223 0.17686199 0.02582691 0.05970737

9.6 28,048 0.12932575 0.11935891 0.24527729 0.01113306 0.17170856

22.5 26,041 0.35336292 0.00161362 0.33458945 0.00000000 0.24768635

#N/A 11,476 -0.12078697 -0.15843743 0.23130894 0.03525641 0.18613506

#N/A 8,879 0.16753842 -0.09442347 0.57636260 0.06150920 0.04068882

1.8 15,287 0.14235473 0.15579140 -0.04249054 0.02172202 0.08778421

5.7 9,155 0.08057892 -0.03305829 0.07379723 0.00970008 0.06904645

3.4 6,263 0.28500260 -0.15405690 -0.21982896 0.00000000 0.02500827

5.1 317,334 0.18090248 -0.03548908 0.19657338 0.02616696 0.21950142

#N/A 37,731 0.20735477 -0.13382941 0.19419253 0.02003660 -0.02303976

#N/A 250,166 0.11001039 0.09106313 0.20493305 0.02399270 0.24408935

2.0 10,087 -0.14735949 0.51398860 0.13524127 0.01574183 0.13045000

2.2 9,441 0.07694459 -0.31775070 0.02026022 0.01608775 0.19989251

2.8 26,315 0.09453368 0.13647532 0.04120708 0.02786207 0.04538399

#N/A 15,279 0.16755521 -0.04006672 0.07233942 0.01959584 0.20571043

4.3 40,977 -0.01657850 0.12839282 0.09108567 0.03223807 0.05448873

#N/A 11,310 0.02998793 0.11519980 0.21083295 0.03989050 0.53559662

0.6 45,607 -0.23222160 -0.25375020 0.14961660 0.02421308 0.01724386

3.6 11,741 0.15462148 0.09069133 0.24097526 0.02756427 0.23579618

3.9 7,857 -0.00832135 -0.12436080 -0.01905042 0.03664036 0.03504478

1.2 108,276 0.18378305 0.73416030 0.07633364 0.02862948 0.03456925

4.7 29,250 -0.17020780 0.37218547 0.32035600 0.01297733 0.01840117

4.6 20,644 -0.20654530 0.39004663 0.19946098 0.03325141 0.10309363

2.6 10,587 0.10655297 0.06272590 0.23537791 0.01822037 0.02694439

2.2 12,910 0.02118301 0.12306701 0.08315158 0.00000000 0.05033352

3.2 15,772 0.28336227 -0.00409627 0.44238046 0.01230896 0.15524368

#N/A 2,976 -0.34219593 -0.12689412 0.36863290 0.02686281 -0.01036478

5.0 6,134 0.04779649 0.17588627 0.37440407 0.02756892 0.08261912

2.7 8,192 -0.16437280 0.16606915 0.21676100 0.00387879 0.08387294

0.5 6,722 -0.05328589 -0.14929736 -0.15289235 0.01203080 0.02412554

0.8 20,187 0.10206091 0.08612240 0.53551555 0.00000000 0.41718313

#N/A 11,430 -0.06041992 -0.00835443 0.22115539 0.01663617 0.08493980

21.9 14,753 0.38955855 0.06445468 0.06663513 0.02092676 0.34716869

4.7 9,926 0.09017218 0.03640187 -0.13502872 0.00000000 0.05884118

2.6 72,184 0.15324580 0.18927634 0.47734820 0.02546591 0.07814532

#N/A 14,506 0.18776321 -0.15852845 -0.09241331 0.00575904 0.01932798

4.3 58,296 -0.08184994 0.30963063 0.16844727 0.01806970 0.04289535

4.6 33,071 -0.10885202 0.04807210 0.26357675 0.03965937 0.13658432

#N/A 19,021 0.04297447 0.00921893 0.11160350 0.02058824 0.21727489

#N/A 10,166 -0.09119856 0.24232781 0.23913838 0.03896848 0.06741850

2.7 11,256 -0.25462157 -0.09916562 0.27880250 0.03566248 0.03958787

0.8 6,383 -0.09760928 -0.28758955 1.19423960 0.00000000 0.09133825

1.0 11,167 -0.27083874 -0.46323820 0.02588403 0.01343183 -0.40860215

2.9 23,007 -0.12973285 0.16355823 0.29467928 0.03002730 0.04418792

5.0 26,796 -0.09078800 0.02538705 0.70261884 0.01498842 0.05933960

#N/A 32,684 0.16172934 0.04705322 0.21295965 0.01917970 0.12365633

2.9 11,760 0.20636356 0.34173380 0.20834577 0.00705145 0.08123586

#N/A 10,138 0.07821858 0.51635600 0.05974352 0.01231212 #N/A

9.7 114,457 0.08988595 0.19039011 0.17469670 0.00726439 0.39391745

3.7 10,785 0.35138726 -0.16140354 -0.27189136 0.04922280 0.06422266

4.1 10,983 0.16206992 0.21189165 0.04458344 0.01879371 0.09347578

5.2 93,483 0.03374243 0.24007870 0.00399840 0.03116792 0.17822768

4.3 28,751 -0.28428286 -0.11692322 0.30803800 0.00783053 0.01199681

4.4 13,812 -0.06898254 -0.15949416 0.23633110 0.02298050 0.16009628

2.8 113,346 0.13178301 0.10490047 0.21025145 0.01973925 0.12270662

2.9 161,899 0.11028743 -0.02618134 0.32641673 0.02877248 0.11456426

#N/A 51,615 -0.03404015 -0.04529810 0.17575550 0.02886944 0.07857878

7.8 10,704 0.29933440 0.20319569 0.04449201 0.00000000 0.14728775

16.1 8,960 0.31418216 -0.50833440 0.02131248 0.00000000 0.17807347

3.3 13,036 0.29142130 0.15505195 0.03544593 0.02275535 0.14914045

1.7 17,873 0.03623188 -0.49954670 0.87160635 0.00000000 -0.02225986

3.3 465,899 0.16961978 0.15125442 0.36388670 0.02439851 0.19833520

3.4 13,666 -0.05728900 0.37637293 0.07264757 0.00000000 0.07620680

2.9 20,142 0.19854260 0.21040653 0.40981555 0.01655730 0.09967765

2.3 69,406 -0.01036954 0.33018398 0.06489956 0.01699442 0.24520853

3.8 44,136 0.10556830 -0.17395103 0.11387814 0.02206333 0.09777613

64.9 27,480 0.05883217 0.35130858 0.76271176 0.00000000 0.20081548

6.1 19,219 0.06120455 -0.01888472 0.42324530 0.01443648 0.27013919

#N/A 62,871 0.04302812 -0.04212308 0.22990370 0.01818654 0.16197889

2.5 8,240 -0.27587658 -0.21940655 -0.01325584 0.04013134 0.11246389

2.6 12,046 0.06163883 0.10826694 0.05219853 0.02040309 0.11237928

1.1 4,455 -0.03955579 -0.45027047 -0.09568310 0.04742795 -0.84865608

2.4 19,524 -0.17214787 -0.17665732 0.41423476 0.00000000 0.08950748

#N/A 10,584 0.12491775 0.35992578 0.23846770 0.01715834 0.12577138

2.4 12,122 -0.12140566 -0.46229422 0.01108122 0.03059388 -0.05217804

#N/A 3,874 0.01922751 -0.30845570 #N/A 0.03753666 0.18544033

1.6 9,458 0.02547896 -0.18931818 0.12091875 0.02185470 0.04128358

4.8 53,587 0.15214992 0.93156290 0.21796691 0.00000000 0.01808995

2.9 23,155 0.15086663 0.29717028 0.14822197 0.01601686 0.04384942

0.9 8,073 0.00995278 0.23244393 0.07093597 0.00000000 -2.15928067

1.3 19,659 0.91024756 0.04252255 -0.30019880 0.00316556 0.02497089

1.9 4,626 -0.20031631 0.00259817 -0.12020456 0.01650165 0.01874929

1.9 2,475 -0.18669260 0.03654480 -0.16085863 0.01619433 0.01874929

1.0 59,810 0.28422856 0.05508876 0.21933258 0.02976924 0.17414415

1.6 16,088 -0.03035939 0.14573967 0.09890771 0.02676344 0.09235256

9.0 67,050 -0.22583866 0.42500138 0.24246693 0.01260587 0.11582060

0.5 7,494 0.24838425 0.19306720 0.37115026 0.02989257 0.04269315

0.9 14,811 -0.02950263 -0.36710942 -0.22270232 0.01327801 -0.80216891

2.8 9,019 -0.17807865 -0.01942867 0.22468102 0.02520436 0.04155988

1.7 27,151 0.19670083 -0.25931072 0.30832790 0.02338718 0.14746456

#N/A 16,398 0.05039811 0.08269239 0.19937408 0.01827742 0.19626073

3.1 40,364 0.24037898 0.38684800 0.31140232 0.01373737 0.08458727

0.7 3,351 -0.15758616 -0.55730575 0.06971574 0.02122855 -0.42509825

3.7 15,552 0.19303405 -0.19083303 0.07414925 0.02553191 0.02166428

5.8 38,071 1.53784850 0.47661030 0.31119084 0.00522906 0.12255489

5.1 25,050 -0.04278583 0.57073010 0.42056382 0.00000000 0.11688893

2.9 55,698 0.02051437 -0.09145731 -0.04740942 0.04634334 -0.64177105

2.1 18,828 0.09350586 0.07118452 0.08182060 0.02582073 0.07145972

0.9 10,191 0.52933060 -0.38839167 0.23351586 0.05133556 0.03268084

3.1 157,739 0.00456083 0.00856495 0.17995380 0.01520913 0.24026237

1.0 3,130 -0.10440838 -0.16375637 -0.18936771 0.00000000 0.02257960

2.4 19,255 0.09385050 -0.17066717 0.20999324 0.01622444 0.08391316

3.9 16,421 0.19951652 -0.15795171 0.10595094 0.01816347 0.07101994

4.2 4,231 -0.08033347 0.11944628 0.03292382 0.01972304 0.03403235

3.9 19,963 0.10635174 0.13576448 0.14914990 0.03105152 0.25638593

2.5 50,269 0.15690088 #N/A #N/A 0.00000000 0.13545114

1.8 10,019 0.01013017 -0.14777517 0.01485443 0.02253995 -0.01007908

#N/A 5,057 0.06415141 0.13891542 0.05974960 0.03706236 0.18568970

4.0 153,744 0.07942021 0.09312689 0.17650235 0.02820041 0.08646694

3.3 5,567 -0.00914371 0.19623816 0.14885986 0.00550098 0.09401160

1.9 11,920 -0.46989927 -0.02022851 0.17409493 0.00627310 0.00202144

2.4 192,342 -0.02831191 0.16760397 0.00973511 0.03620743 0.14224888

0.8 31,412 0.20079184 0.09876132 0.25322890 0.03231874 0.05275352

4.9 149,612 0.13853598 0.04391599 0.04469907 0.04609331 0.25704635

3.6 42,267 -0.06120915 0.16545450 0.24704278 0.02894673 0.04963955