Professional Documents

Culture Documents

Affin Hedy Ffs

Uploaded by

ming09075225Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Affin Hedy Ffs

Uploaded by

ming09075225Copyright:

Available Formats

Best Asset Management, Malaysia

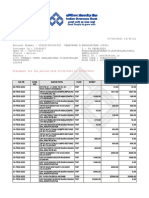

Affin Hwang Enhanced Deposit Fund

A money market fund that targets to provide enhanced yield over deposit rates while providing a high level of liquidity.

Fund Category Performance Record as at 31 October 2019* Performance Table as at 31 October 2019*

Money Market Cumulative Return Over The Period (%)

Total Since

Return (%) 1 Month 1 Year 3 Year Inception

Fund Type

Fund 0.3 3.6 11.3 60.7

Income

Benchmark 0.1 1.8 5.5 34.8

Benchmark Source: Lipper

Maybank Overnight Repo

Rate Annualised Since

Return (%) 1 Year 3 Year 5 Year Inception

Launch Date / IOP Fund 3.6 3.6 3.7 3.4

18 April, 2005 / MYR1.00

Benchmark 1.8 1.8 1.9 2.1

Maturity Date Source: Lipper

N/A

Calendar

Financial Year End

Year Year To

30 April

Return (%) Date 2018 2017 2016

June, 2005 to October, 2019 NAV-NAV prices and assuming reinvestment of distributions Fund 3.0 3.7 3.7 3.8

Initial Sales Charge into the Fund, gross investment based in RM. The value of Units may go down as well as

Nil up. Past performance is not indicative of future performance. Benchmark 1.4 1.9 1.8 1.9

Source: Lipper

Source: Lipper

Subscription

Cash / EPF

Annual Management Fee Maturity Profile as at 31 October 2019* Income Distribution History (past 10 years)

Up to 0.5% per annum Gross Distribution Yield

(Sen) (%)

Minimum Investment

MYR10,000 2010 2.26 2.3

2011 2.11 2.1

Minimum Subsequent

Investment 2012 3.62 3.7

MYR10,000 2013 1.33 1.3

2014 0.89 0.9

As at 31 October 2019*

Fund Size 2015 0.96 0.9

MYR2728.7million 2016 1.16 1.1

NAV Per Unit 2017 1.20 1.1

MYR1.1760 2018 1.30 1.1

Portfolio Yield 2019 2.50 2.2

3.6%

¹ Distribution Policy : Distribution of income, if any, would be on monthly basis

Portfolio Duration

63 days Asset Allocation

Deposit 98.7%

Cash 1.3%

Overall Rating**

* The data provided above are that of the Fund and are a percentage of NAV as at 31 October 2019. All figures are subject to frequent changes on a daily basis. The total for Credit Profile and Maturity Profile might not add up to 100% due to rounding.

**The Morningstar Rating is an assessment of a Fund's past performance-based on both return and risk-which shows how similar investments compare with their competitors. A high rating alone is insufficient basis for an investment decision.

¹ Where a distribution is declared, investors are advised that following the issue of additional Units/distribution, the NAV per Unit will be reduced from cum-distribution NAV to ex-distribution NAV. The yield of the distributions are calculated based on the

total dividend payout/ex-distribution NAV.

Based on the Fund's portfolio returns as at 30 September 2019, the Volatility Factor (VF) for this Fund is 0.1 and is classified as Very Low (source: Lipper). Very Low includes Funds with VF that are not more than 1.885.

The VF means there is a possibility for the Fund in generating an upside return or downside return around this VF. The Volatility Class (VC) is assigned by Lipper based on quintile ranks of VF for qualified funds. The Fund's portfolio may have changed

since this date and there is no guaranteed that the Fund will continue to have the same VF or VC in the future. Presently, only funds launched in the market for at least 36 months will display the VF and its VC.

This document is prepared by Affin Hwang Asset Management Bhd (199701014290 (429786-T)). It is not intended to be an offer or invitation to subscribe or purchase any securities. The information contained herein has been obtained from sources

believed in good faith to be reliable, however, no guarantee is given in its accuracy or completeness. Past performance of the Fund is not an indicative of its future performance. Prices and distribution payable, if any, can go down as well as up. A

Product Highlights Sheet (PHS) is available for the Fund and investors have the right to request for a copy of it. The Prospectus dated 31 March 2017 has been registered as well as the PHS has been lodged with the Securities Commission Malaysia,

who takes no responsibility for its contents. Investors are advised to read and understand the contents of the PHS and the Prospectus before investing. Application for Units can only be made on receipt of a form of application referred to in and

accompanying the PHS and the Prospectus. Investors should also consider the fees and charges involved. A copy of the PHS and the Prospectus can be obtained at our office or any of our sales offices. The Fund may not be suitable for all and if in

doubt, investors should seek independent advice.

19 NOVEMBER 2019 | FUNDamentals

You might also like

- Affin Hwang Aiiman Growth Fund: Performance Record As at 29 May 2020 Performance Table As at 29 May 2020Document1 pageAffin Hwang Aiiman Growth Fund: Performance Record As at 29 May 2020 Performance Table As at 29 May 2020NURAIN HANIS BINTI ARIFFNo ratings yet

- factsheetMYHWSOF PDFDocument1 pagefactsheetMYHWSOF PDFPG ChongNo ratings yet

- Ubs Cash PDFDocument2 pagesUbs Cash PDFPeterNo ratings yet

- NBP Funds: NBP Savings Fund (NBP-SF)Document1 pageNBP Funds: NBP Savings Fund (NBP-SF)Mian Abdullah YaseenNo ratings yet

- 2q19 Eaof LetterDocument13 pages2q19 Eaof LetterDavid BriggsNo ratings yet

- NBP Financial Sector Income Fund (Nfsif)Document1 pageNBP Financial Sector Income Fund (Nfsif)HIRA -No ratings yet

- Fund Fact Sheet Jan 2021Document21 pagesFund Fact Sheet Jan 2021Yunus MohamadNo ratings yet

- JC07 Contrarian Sentiment Strategy Fact SheetDocument1 pageJC07 Contrarian Sentiment Strategy Fact SheetFounder InteraxinesiaNo ratings yet

- Fact Sheet Affin Hwang World Series - China Allocation Opportunity FundDocument1 pageFact Sheet Affin Hwang World Series - China Allocation Opportunity FundHenry So E DiarkoNo ratings yet

- 23 OctlDocument6 pages23 Octlkandhass123No ratings yet

- Fund Fact Sheet June 2020Document21 pagesFund Fact Sheet June 2020Devi TinawatiNo ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50patsan007No ratings yet

- MP - 3 - Peso Growth FundDocument2 pagesMP - 3 - Peso Growth FundFrank TaquioNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- NBP Balanced Fund monthly report April 2020Document1 pageNBP Balanced Fund monthly report April 2020HIRA -No ratings yet

- NBP Sarmaya Izafa Fund (Nsif) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.15.6356Document1 pageNBP Sarmaya Izafa Fund (Nsif) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.15.6356HIRA -No ratings yet

- Haier Smart Home Co., Ltd. 2023 Third Quarter ReportDocument23 pagesHaier Smart Home Co., Ltd. 2023 Third Quarter Reportanahita110228No ratings yet

- Factsheet NiftyFinancialServicesExBankDocument2 pagesFactsheet NiftyFinancialServicesExBankpatsan007No ratings yet

- ffs_ttecrmfa_enDocument1 pageffs_ttecrmfa_enwutthicsaNo ratings yet

- Financial Results For The Year Ended March 2019: 2-3-1 Marunouchi, Chiyoda-Ku, Tokyo, JAPAN 100-8086Document35 pagesFinancial Results For The Year Ended March 2019: 2-3-1 Marunouchi, Chiyoda-Ku, Tokyo, JAPAN 100-8086renytereNo ratings yet

- USD Fixed Income Fund Fact SheetDocument20 pagesUSD Fixed Income Fund Fact SheetAfthon Ilman Huda Isyfi100% (1)

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- Singapore Dynamic Bond Fund: Investment ObjectiveDocument2 pagesSingapore Dynamic Bond Fund: Investment ObjectiveXavier Alexen AseronNo ratings yet

- PUBLIC ISLAMIC ASIA LEADERS EQUITY FUND (PIALEFDocument1 pagePUBLIC ISLAMIC ASIA LEADERS EQUITY FUND (PIALEFEileen LauNo ratings yet

- Nifty FactsheetDocument2 pagesNifty FactsheetTudou patelNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Aswin PoomangalathNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Anil KumarNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- NBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Document1 pageNBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Sajid rasoolNo ratings yet

- NBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.10.7997Document1 pageNBP Savings Fund (NBP-SF) : MONTHLY REPORT (MUFAP's Recommended Format) April 2020 Unit Price (30/04/2020) : Rs.10.7997HIRA -No ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- IDR Equity Syariah Fund - AIA Fund Fact Sheet Jan 2020Document1 pageIDR Equity Syariah Fund - AIA Fund Fact Sheet Jan 2020Siti NurhayatiNo ratings yet

- Nifty Midcap Select index methodology and performanceDocument2 pagesNifty Midcap Select index methodology and performanceSumitNo ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty AutoDharmendra Singh GondNo ratings yet

- April2016 PDFDocument1 pageApril2016 PDFjeb38293No ratings yet

- NBP Riba Free Savings Fund (NRFSF)Document1 pageNBP Riba Free Savings Fund (NRFSF)HIRA -No ratings yet

- Ffs EdfhcfDocument1 pageFfs EdfhcfPrasen RajNo ratings yet

- Factsheet Nifty500 Multicap50-25-25 IndexDocument2 pagesFactsheet Nifty500 Multicap50-25-25 Indexramesh kumarNo ratings yet

- ind_nifty_midcap50Document2 pagesind_nifty_midcap50swaroopr8No ratings yet

- Factsheet Nifty FinServ 25 50Document2 pagesFactsheet Nifty FinServ 25 50Sakshi SharmaNo ratings yet

- MASIF FactsheetDocument3 pagesMASIF Factsheethello.easygiftsNo ratings yet

- JPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIDocument4 pagesJPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIsidharth guptaNo ratings yet

- Public Aggressive Growth Fund (PAGF) - April 2011 Fund ReviewDocument1 pagePublic Aggressive Growth Fund (PAGF) - April 2011 Fund ReviewMun YiNo ratings yet

- Philequity Peso Bond Fund: Navps As of Dec 27, 2019Document1 pagePhilequity Peso Bond Fund: Navps As of Dec 27, 2019Marlon DNo ratings yet

- NIFTY Auto Index OverviewDocument2 pagesNIFTY Auto Index OverviewPrabhakar DalviNo ratings yet

- Nifty100 Quality30 PDFDocument2 pagesNifty100 Quality30 PDFGita ThoughtsNo ratings yet

- Prulink-Dynamic-Income-Fund BrochureDocument2 pagesPrulink-Dynamic-Income-Fund BrochureboscoNo ratings yet

- Ind Nifty MidSmallcap 400Document2 pagesInd Nifty MidSmallcap 400GovindarajanVaradachariNo ratings yet

- FMR Faaf SepDocument1 pageFMR Faaf SepAli RazaNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Ind Nifty AutoDocument2 pagesInd Nifty AutoTasal DosuNo ratings yet

- NIFTY Alpha Quality Value Low-Volatility 30 Index Fact SheetDocument2 pagesNIFTY Alpha Quality Value Low-Volatility 30 Index Fact SheetdrsubramanianNo ratings yet

- Ers. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewDocument10 pagesErs. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewVolcaneum100% (2)

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFSantanu Mitra RayNo ratings yet

- 9-17-19 TR Presentation (9!16!19 Market Update) - UnlockedDocument58 pages9-17-19 TR Presentation (9!16!19 Market Update) - UnlockedZerohedge100% (3)

- Ind Nifty AutoDocument2 pagesInd Nifty AutoJackNo ratings yet

- Sebi Consultation PaperDocument19 pagesSebi Consultation Paperblack venomNo ratings yet

- Portfolio Management in IndiaDocument12 pagesPortfolio Management in IndiaiammonelNo ratings yet

- A CAT Corp MRP SolnDocument12 pagesA CAT Corp MRP Solnakshay kushNo ratings yet

- Assignment: Strategic Financial ManagementDocument7 pagesAssignment: Strategic Financial ManagementVinod BhaskarNo ratings yet

- Accounting FinanceDocument4 pagesAccounting FinanceAni ChristyNo ratings yet

- Chap 7Document27 pagesChap 7Joanne Chau100% (1)

- Uti Equity Portfolio Breakup PDFDocument8 pagesUti Equity Portfolio Breakup PDFSaiVamsiNo ratings yet

- QUICK STUDY 12-1 True Statement: 1,3 and 4Document3 pagesQUICK STUDY 12-1 True Statement: 1,3 and 4denixngNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Statement 028201000028352Document6 pagesStatement 028201000028352Saravanan 75No ratings yet

- Investor Presentation Q1 FY21Document25 pagesInvestor Presentation Q1 FY21jay raiNo ratings yet

- Valuation & Accounting of InventoryDocument21 pagesValuation & Accounting of InventoryPrasad BhanageNo ratings yet

- (Notice, Agenda and Minutes) : Submitted By: Priyanka MaheshwariDocument5 pages(Notice, Agenda and Minutes) : Submitted By: Priyanka Maheshwaripri6819907864No ratings yet

- Property Plant and EquipmentDocument10 pagesProperty Plant and Equipmentrt2222100% (1)

- Overview of Dupont Analysis: Net Profit - Net Sales - Net Profit MarginDocument4 pagesOverview of Dupont Analysis: Net Profit - Net Sales - Net Profit Margin0asdf4No ratings yet

- Kaplan ACCA Goodwill ArticleDocument3 pagesKaplan ACCA Goodwill ArticleKodwoPNo ratings yet

- Ges 300 - 2017-1Document51 pagesGes 300 - 2017-1G2zapper gamingNo ratings yet

- Topic 3 - Impairment - SVDocument4 pagesTopic 3 - Impairment - SVHuỳnh Minh Gia Hào100% (2)

- Maybank2017 PDFDocument356 pagesMaybank2017 PDFChee Haw YapNo ratings yet

- Quiz 4Document8 pagesQuiz 4Ma Sophia Mikaela EreceNo ratings yet

- Leverages - 42.5 (2ND Version) - Main Material0201Document17 pagesLeverages - 42.5 (2ND Version) - Main Material0201Sampath SanguNo ratings yet

- Ultimate Guide To Procurement Cost SavingsDocument38 pagesUltimate Guide To Procurement Cost SavingsLcl KvkNo ratings yet

- Investment Decision CreteriaDocument74 pagesInvestment Decision CreteriaMahadgeedi BashkaNo ratings yet

- Assurance PC 1 PDFDocument2 pagesAssurance PC 1 PDFrui zhangNo ratings yet

- Ey New Accounting Standards and Interpretations Pbe 31 Mar 2022 FinalDocument13 pagesEy New Accounting Standards and Interpretations Pbe 31 Mar 2022 FinalsefanitNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsSudhanshu Kumar SinghNo ratings yet

- C o n p a s2 0 2 2 A c c o u n t a n c y S e t Q u e s t i o n P a p e rDocument10 pagesC o n p a s2 0 2 2 A c c o u n t a n c y S e t Q u e s t i o n P a p e rJabez JeenaNo ratings yet

- The Review For The Development of IRR's Implication: Linxue ZhangDocument5 pagesThe Review For The Development of IRR's Implication: Linxue Zhangruirego19No ratings yet

- ACCT 575quiz 1 PDFDocument16 pagesACCT 575quiz 1 PDFMelNo ratings yet

- Estatement20230706 000233440Document3 pagesEstatement20230706 000233440Mia NahilaNo ratings yet