Professional Documents

Culture Documents

Ffs Ttecrmfa en

Uploaded by

wutthicsaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ffs Ttecrmfa en

Uploaded by

wutthicsaCopyright:

Available Formats

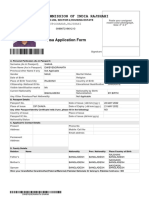

As of 30 December 2020

TISCO Technology Equity RMF Class A

(TTECHRMF-A) Fund Risk Level: Level 7 High Risk

General Information Details of Portfolio

Fund Type : Foreign Investment Fund (Feeder Fund) Assets Allocation

Technology Sector Fund, Retirement Fund

AIMC Category : Global Equity

Registered Date : 15 October 2020

Subscription & Redemption Period : Every working day

during 8:30 - 15:00

Minimum Amount for Subscription : 1,000 Baht

Minimum Amount for Redemption : None

Settlement Day : T+4 (after the redemption date)

Dividend Policy : None

Investment Policy

The fund shall invest at least 80% of its NAV in iShares Expanded Tech Top 5 Holding (By Company)

Sector ETF (master fund), an Exchange Traded Fund listed and traded on Securities/Issuer Proportion

the NYSE Arca Stock Market, USA. The master fund is managed by BlackRock iShares Expanded Tech Sector ETF 95.61%

Fund Advisors LLC and has an Investment objective to track the investment Remarks: The information is as of December 30, 2020. Current information can be found on the website

results (before fees and expenses) of the S&P North American Expanded www.tiscoasset.com

Technology Sector Index. The S&P North American Expanded Technology Past Performance of iShares Expanded Tech Sector ETF

Sector Index which measures the performance of U.S.-traded stocks from

the technology sector and select technology-related companies from the

communication services and consumer discretionary sectors in the U.S. and

Canada.

Remarks: The information is as of December 30, 2020.

The fund may invest in derivatives for hedging purpose, depending on the

discretion of the management company as appropriate to the circumstances Fund Performance (%)

of each moment. Past Performance and Benchmark Return

% % p.a.

Fees and Expenses Year to

Date

3 Months Percentile 6 Months Percentile 1 Years Percentile 3 Years Percentile 5 Years Percentile 10 Years Percentile

Since

Inception

Fund Return n.a. n.a. n.a. n.a. n.a. n.a. n.a. 6.93%

• Fee Charged to the Fund (% p.a. of NAV) Benchmark Return n.a. n.a. n.a. n.a. n.a. n.a. n.a. 3.43%

Management Fee 0.5350% Benchmark Return (Hedging) n.a. n.a. n.a. n.a. n.a. n.a. n.a. 7.22%

Trustee Fee 0.028890% Fund Standard Deviation n.a. n.a. n.a. n.a. n.a. n.a. n.a. 20.72%

Registrar Fee 0.171200% Benchmark Standard Deviation n.a. n.a. n.a. n.a. n.a. n.a. n.a. 18.35%

• Fee Charged to Unit holders (% of investment unit value) Benchmark: Benchmark: Master fund's performance, calculating in THB term

Front-end Fee None Remarks: The information is as of December 30, 2020.

Back-end Fee None

Switching In Fee None Calendar year performance

Switching Out Fee 1.00% of investment unit value the day before transaction but

not less than 200 baht

Note: The fees and expenses charged above include VAT, specific business tax or

any other taxes related with fees and expenses.

Warnings & Recommendation

1. Investment contains some degree of risks. The investor should study the fund's prospectus

before investing.

2. Investors of Retirement Mutual Fund not being complied with investment conditions shall

not be entitled to receive tax benefits and have to return such benefits within specified

period or will be subject to surcharge and penalties according to the Revenue Code.

3. Investors should study terms and conditions before investing in Retirement Mutual Fund,

and seek additional details and ask for the investment guidebook from the Management

Company or selling agents.

4. The fund has specific investment in technology sector, so it may has risk and price

volatility higher than general mutual funds with diversification in several industries. Investors *The calendar year performance of the year that the fund was set up is the performance

should study the technology sector information for investment decisions.

5. The fund does not have fully hedging policy against foreign exchange rate, therefore, it from the inception date until the last business day of that year.

may have opportunity loss or receive additional gain from a decrease or an increase in **Past performance do not determine future performance.

foreign exchange rate and investors may receive redemption proceeds less than their initial ***Current information can be found on the website www.tiscoasset.com.

investment amount.

6. The Management Company reserves the right to reject or halt the subscription order,

allocation and/or transferring of investment units directly or indirectly for US citizens.

You might also like

- Wealth Insight - Jan 2024Document108 pagesWealth Insight - Jan 2024vinodNo ratings yet

- The 10 Best Non-Ivy League UniversitiesDocument17 pagesThe 10 Best Non-Ivy League UniversitieswutthicsaNo ratings yet

- SOP - 0400 - 10 - Design Qualification SOPDocument13 pagesSOP - 0400 - 10 - Design Qualification SOPsandipkumardshahNo ratings yet

- QAD 002 Change Control ProcedureDocument14 pagesQAD 002 Change Control ProcedureShejil BalakrishnanNo ratings yet

- CRMS Security Training Cycle 1 - Student Notes Issue 1 Revision 1 01.07.20Document23 pagesCRMS Security Training Cycle 1 - Student Notes Issue 1 Revision 1 01.07.20Petra StefanescuNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Project Engineer CV TemplateDocument2 pagesProject Engineer CV TemplateCleber SilvaNo ratings yet

- TR SupermanDocument77 pagesTR SupermanZerohedge80% (10)

- 23 11Document68 pages23 11merkellian100% (1)

- BDO Equity FundDocument4 pagesBDO Equity FundKurt YuNo ratings yet

- 31.29.60.31-Special Purpose Steam TurbineDocument29 pages31.29.60.31-Special Purpose Steam Turbinemansih457No ratings yet

- Villegas Vs Hu Chong Tsai Pao HoDocument7 pagesVillegas Vs Hu Chong Tsai Pao HoAriel LunzagaNo ratings yet

- Roman V GrimaltDocument2 pagesRoman V GrimaltClarence ProtacioNo ratings yet

- Office of The Ombudsman - Mayor VergaraDocument9 pagesOffice of The Ombudsman - Mayor Vergaragulp_burp100% (2)

- Ffs TCHRMF enDocument1 pageFfs TCHRMF enwutthicsaNo ratings yet

- Defined Risk Strategy (DRS) : "Prophesy As Much As You Like, But Always Hedge." - Oliver Wendell Holmes, 1861Document4 pagesDefined Risk Strategy (DRS) : "Prophesy As Much As You Like, But Always Hedge." - Oliver Wendell Holmes, 1861Hasita VinodNo ratings yet

- Sound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Document2 pagesSound Investment+Time+Patience Wealth Creation - HDFC Top 100 Fund Leaflet (As On 31st Oct 2022)Rajat GuptaNo ratings yet

- ATARAXIA FUND LP Inception August 2019Document8 pagesATARAXIA FUND LP Inception August 2019JBPS Capital ManagementNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- CB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Document3 pagesCB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Rhb InvestNo ratings yet

- NBP Funds: NBP Savings Fund (NBP-SF)Document1 pageNBP Funds: NBP Savings Fund (NBP-SF)Mian Abdullah YaseenNo ratings yet

- 5.1 Project Evaluation ExerciseDocument17 pages5.1 Project Evaluation ExerciseHTNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- NBP Financial Sector Income Fund (Nfsif)Document1 pageNBP Financial Sector Income Fund (Nfsif)HIRA -No ratings yet

- Vanguard Global Stock Index FundDocument4 pagesVanguard Global Stock Index FundjorgeperezsidecarshotmailomNo ratings yet

- Tatton Tracker Active Quarterly Report Oct-Dec 19Document6 pagesTatton Tracker Active Quarterly Report Oct-Dec 19Danny DawsonNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Portugal Golden Visa Investment Funds - IMI - Investment Migration InsiderDocument12 pagesPortugal Golden Visa Investment Funds - IMI - Investment Migration InsiderCyril EsedoNo ratings yet

- Mink Blankets Manufacturing Industry-372161Document66 pagesMink Blankets Manufacturing Industry-372161Mohammed ImamuddinNo ratings yet

- Affin Hwang Aiiman Growth Fund: Performance Record As at 29 May 2020 Performance Table As at 29 May 2020Document1 pageAffin Hwang Aiiman Growth Fund: Performance Record As at 29 May 2020 Performance Table As at 29 May 2020NURAIN HANIS BINTI ARIFFNo ratings yet

- Teletech Corporation: The DivisionsDocument8 pagesTeletech Corporation: The Divisionsbrita_2550% (1)

- PNB Peso Fixed Income Fund PDFDocument3 pagesPNB Peso Fixed Income Fund PDFJj PahudpodNo ratings yet

- Schroder Dana IstimewaDocument1 pageSchroder Dana IstimewaDadang SuhermanNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- Wealth Insight - November 2023Document72 pagesWealth Insight - November 2023yoyo661999kumarNo ratings yet

- Frontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingDocument52 pagesFrontlit, Backlit & Vinyl Flex Banner Manufacturing For AdvertisingSusheel GautamNo ratings yet

- Vanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundDocument4 pagesVanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundYanto TanNo ratings yet

- TA Global Technology Fund (TAGTF) - MYR ClassDocument7 pagesTA Global Technology Fund (TAGTF) - MYR ClassJ&A Partners JANNo ratings yet

- Faber Group Berhad: Full-Year Core Earnings Boosted by UAE Contract - 01/03/2010Document3 pagesFaber Group Berhad: Full-Year Core Earnings Boosted by UAE Contract - 01/03/2010Rhb InvestNo ratings yet

- Fund Fact Sheet Jan 2021Document21 pagesFund Fact Sheet Jan 2021Yunus MohamadNo ratings yet

- Ngsscef Myr Class Ffs Nov 2023Document2 pagesNgsscef Myr Class Ffs Nov 2023ming09075225No ratings yet

- Know How On WealthDocument68 pagesKnow How On Wealthchatdoll44No ratings yet

- IDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Document273 pagesIDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Sourabh PorwalNo ratings yet

- Wealth-Insight - Nov 2023Document68 pagesWealth-Insight - Nov 2023Amit KauriNo ratings yet

- HDFC SWAP Balanced Advantage Fund - 1 Crore Investment (As of Aug 31 2023)Document2 pagesHDFC SWAP Balanced Advantage Fund - 1 Crore Investment (As of Aug 31 2023)Tanuj BhattNo ratings yet

- Axis Equity FundDocument44 pagesAxis Equity FundyogeshgharpureNo ratings yet

- Risk Measures: Risk Analysis Distribution of ReturnsDocument7 pagesRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementNo ratings yet

- Wealth-Insight - Nov 2023Document68 pagesWealth-Insight - Nov 2023drew77770No ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- Affin Hedy FfsDocument1 pageAffin Hedy Ffsming09075225No ratings yet

- NBP Income Opportunity Fund (Niof)Document1 pageNBP Income Opportunity Fund (Niof)HIRA -No ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- 2 Charts Show How Much The World Depends On Taiwan For: Revenue RecognitionDocument5 pages2 Charts Show How Much The World Depends On Taiwan For: Revenue RecognitionDuong Trinh MinhNo ratings yet

- 12-8-2020 TR No End in Sight - FinalDocument93 pages12-8-2020 TR No End in Sight - FinalZerohedge100% (4)

- Faber Group Berhad: Still A Good Buy-01/04/2010Document3 pagesFaber Group Berhad: Still A Good Buy-01/04/2010Rhb InvestNo ratings yet

- NBP Riba Free Savings Fund (NRFSF)Document1 pageNBP Riba Free Savings Fund (NRFSF)HIRA -No ratings yet

- 23 OctlDocument6 pages23 Octlkandhass123No ratings yet

- Notion Vtec Berhad: Moving Up The Value Chain - 15/03/2010Document11 pagesNotion Vtec Berhad: Moving Up The Value Chain - 15/03/2010Rhb InvestNo ratings yet

- Wire Nail: WWW - Entrepreneurindia.coDocument69 pagesWire Nail: WWW - Entrepreneurindia.coAnonymous Y2J3QRfdNo ratings yet

- Alliance Financial Group Berhad: Boosted by Low Impairment Allowance For Loans - 23/08/2010Document5 pagesAlliance Financial Group Berhad: Boosted by Low Impairment Allowance For Loans - 23/08/2010Rhb InvestNo ratings yet

- Media Chinese Int'l: Corporate HighlightsDocument4 pagesMedia Chinese Int'l: Corporate HighlightsRhb InvestNo ratings yet

- LT Emerging Business FundDocument2 pagesLT Emerging Business FundSankalp BaliarsinghNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- AMC8 Entrance test (September) (学生版)Document7 pagesAMC8 Entrance test (September) (学生版)wutthicsaNo ratings yet

- AMC8 Entrance test (September) (答案版)Document1 pageAMC8 Entrance test (September) (答案版)wutthicsaNo ratings yet

- AMC 8 Mock Exam 3-AnswerDocument1 pageAMC 8 Mock Exam 3-AnswerwutthicsaNo ratings yet

- AMC 8 Mock Exam 4Document7 pagesAMC 8 Mock Exam 4wutthicsaNo ratings yet

- AMC 8 Mock Exam 2-AnswerDocument1 pageAMC 8 Mock Exam 2-AnswerwutthicsaNo ratings yet

- KMT Syllabus & PapersDocument2 pagesKMT Syllabus & PaperswutthicsaNo ratings yet

- AMC 8 Mock Exam 2Document7 pagesAMC 8 Mock Exam 2wutthicsaNo ratings yet

- Trends College Pricing Presentation 2022Document29 pagesTrends College Pricing Presentation 2022wutthicsaNo ratings yet

- Bindex E-188 Speciality Polymer: Technical Data SheetDocument2 pagesBindex E-188 Speciality Polymer: Technical Data SheetfNo ratings yet

- BGDRV1368F22DW800701Document2 pagesBGDRV1368F22DW800701alamgir80100% (1)

- United States Court of ClaimsDocument22 pagesUnited States Court of ClaimsScribd Government DocsNo ratings yet

- Lecture 2 - Terminal Settling VelocityDocument8 pagesLecture 2 - Terminal Settling VelocityMuhammad NaeemNo ratings yet

- Company Law PDFDocument3 pagesCompany Law PDFJaspreet SinghNo ratings yet

- Semler Aff W Exs in Anti-SLAPP Motion Gerald Waldman Vs Capitol Intelligence Group Libel and Slander Civil Action Case No. 2018-CA-005052Document222 pagesSemler Aff W Exs in Anti-SLAPP Motion Gerald Waldman Vs Capitol Intelligence Group Libel and Slander Civil Action Case No. 2018-CA-005052CapitolIntelNo ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- Company Account Review Questions-1Document3 pagesCompany Account Review Questions-1JustineNo ratings yet

- FDP Form 9 - Statement of Cash FlowsDocument1 pageFDP Form 9 - Statement of Cash FlowsNoel Jr BuenafeNo ratings yet

- Competition Commission of IndiaDocument5 pagesCompetition Commission of IndiaMehak joshiNo ratings yet

- Bastion User Guide enDocument54 pagesBastion User Guide engfcentral.storeNo ratings yet

- Dress Code Proposal 8.3.21Document11 pagesDress Code Proposal 8.3.21Mindy WadleyNo ratings yet

- Work of Investment Banking (Repaired)Document12 pagesWork of Investment Banking (Repaired)Shivani Singh ChandelNo ratings yet

- NRI Address Change FormDocument4 pagesNRI Address Change Formsrinivasan431No ratings yet

- Department of Education: Cash Disbursement VoucherDocument90 pagesDepartment of Education: Cash Disbursement VoucherCARLOS FERNANDEZNo ratings yet

- Admin Project - 18075 - Group 4Document24 pagesAdmin Project - 18075 - Group 4RajkumarNo ratings yet

- Gruen V Gruen Case Brief PropertyDocument3 pagesGruen V Gruen Case Brief PropertyMissy MeyerNo ratings yet

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghNo ratings yet

- Birth Certificates For Children With Gay Parents. Paula Gerber and Phoebe Irving LindnerDocument53 pagesBirth Certificates For Children With Gay Parents. Paula Gerber and Phoebe Irving LindnerMiguel T. QuirogaNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument2 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelAsad SyedNo ratings yet

- Facts About Gandhi: The Gandhian Era (1917-47)Document2 pagesFacts About Gandhi: The Gandhian Era (1917-47)Habib Manzer100% (1)

- Mil-Std 3006C App KDocument3 pagesMil-Std 3006C App KsaddoukNo ratings yet