Professional Documents

Culture Documents

Contract Adjustment Effective Date: Option Symbol

Uploaded by

inforamtionsymmetryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contract Adjustment Effective Date: Option Symbol

Uploaded by

inforamtionsymmetryCopyright:

Available Formats

#53923

Date: January 09, 2024

Subject: iShares Core S&P Mid-Cap ETF - 5 For 1 Stock Split

Option Symbol: IJH

Ex-Date: 02/22/2024

iShares Core S&P Mid-Cap ETF (IJH) has announced a 5 for 1 stock split. The Ex-distribution Date is

February 22, 2024. The Payable Date is February 21, 2024. The Record Date is February 16, 2024.

Pursuant to Article VI, Section 11A, of OCC's By-Laws, all iShares Core S&P Mid-Cap ETF options will

be adjusted as follows:

Contract Adjustment

Effective Date: February 22, 2024

Option Symbol: IJH remains IJH

New Multiplier: 100 (e.g., for premium or strike dollar extensions 1.00 will equal $100)

Contract Multiplier: 5.00

Strike Divisor: 5.00

New Deliverable

Per Contract: 100 iShares Core S&P Mid-Cap ETF (IJH) Shares

CUSIP: 464287507

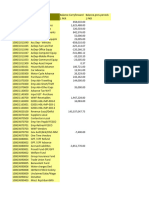

Old Strike New Strike

120.00 24.00

125.00 25.00

130.00 26.00

135.00 27.00

140.00 28.00

145.00 29.00

150.00 30.00

155.00 31.00

160.00 32.00

165.00 33.00

170.00 34.00

175.00 35.00

180.00 36.00

185.00 37.00

190.00 38.00

195.00 39.00

196.00 39.20

197.00 39.40

198.00 39.60

199.00 39.80

200.00 40.00

205.00 41.00

210.00 42.00

215.00 43.00

220.00 44.00

225.00 45.00

230.00 46.00

235.00 47.00

240.00 48.00

245.00 49.00

250.00 50.00

255.00 51.00

260.00 52.00

265.00 53.00

270.00 54.00

275.00 55.00

280.00 56.00

285.00 57.00

290.00 58.00

295.00 59.00

300.00 60.00

305.00 61.00

310.00 62.00

315.00 63.00

320.00 64.00

325.00 65.00

330.00 66.00

335.00 67.00

340.00 68.00

345.00 69.00

350.00 70.00

355.00 71.00

360.00 72.00

365.00 73.00

370.00 74.00

375.00 75.00

380.00 76.00

385.00 77.00

These strikes reflect strikes that are active as of the publication date of this information memo and will be

adjusted on the ex-date. Any strikes added after the publication of this memo and prior to the ex-date

will be adjusted using the strike divisor stated above.

Disclaimer

This Information Memo provides an unofficial summary of the terms of corporate events affecting listed

options or futures prepared for the convenience of market participants. OCC accepts no responsibility for

the accuracy or completeness of the summary, particularly for information which may be relevant to

investment decisions. Option or futures investors should independently ascertain and evaluate all

information concerning this corporate event(s).

The determination to adjust options and the nature of any adjustment is made by OCC pursuant to OCC

By-Laws, Article VI, Sections 11 and 11A. The determination to adjust futures and the nature of any

adjustment is made by OCC pursuant to OCC By-Laws, Article XII, Sections 3, 4, or 4A, as applicable.

For both options and futures, each adjustment decision is made on a case by case basis. Adjustment

decisions are based on information available at the time and are subject to change as additional

information becomes available or if there are material changes to the terms of the corporate event(s)

occasioning the adjustment.

ALL CLEARING MEMBERS ARE REQUESTED TO IMMEDIATELY ADVISE ALL BRANCH OFFICES

AND CORRESPONDENTS ON THE ABOVE.

For questions regarding this memo, please email the Investor Education team at options@theocc.com.

Clearing Member Firms of OCC may contact Member Services at 1-800-544-6091 or, within Canada, at 1-

800-424-7320, or email memberservices@theocc.com.

You might also like

- SERIES 66 EXAM STUDY GUIDE 2023+ TEST BANKFrom EverandSERIES 66 EXAM STUDY GUIDE 2023+ TEST BANKNo ratings yet

- Contract AdjustmentDocument6 pagesContract AdjustmenttehNo ratings yet

- Contract Adjustment Effective Date: Option SymbolDocument6 pagesContract Adjustment Effective Date: Option SymbolTautvydas ZigmantasNo ratings yet

- Contract Adjustment Effective Date: Option SymbolDocument5 pagesContract Adjustment Effective Date: Option SymbolSistel HuanucoNo ratings yet

- Contract Adjustment Effective Date: Option SymbolDocument5 pagesContract Adjustment Effective Date: Option SymbolSistel HuanucoNo ratings yet

- Q0212750 - Readings: Midnight SnapshotsDocument3 pagesQ0212750 - Readings: Midnight SnapshotsvirendramehraNo ratings yet

- Readings - Q0212750 - 01-May-2020 03-40-34-000 PM PDFDocument3 pagesReadings - Q0212750 - 01-May-2020 03-40-34-000 PM PDFvirendramehraNo ratings yet

- Readings - Q0212750 - 01-May-2020 03-40-34-000 PM PDFDocument3 pagesReadings - Q0212750 - 01-May-2020 03-40-34-000 PM PDFvirendramehraNo ratings yet

- LnAmortSchedule06 01 2024Document1 pageLnAmortSchedule06 01 2024Meet ArdeshnaNo ratings yet

- LnAmortSchedule02 12 2022Document2 pagesLnAmortSchedule02 12 2022Kaustubh ChaphalkarNo ratings yet

- Contract Adjustment Effective Date: Option SymbolDocument11 pagesContract Adjustment Effective Date: Option SymbolHitesh KushwahaNo ratings yet

- Q0212754 - Readings: Midnight SnapshotsDocument3 pagesQ0212754 - Readings: Midnight SnapshotsvirendramehraNo ratings yet

- Readings - Q0212754 - 01-May-2020 03-40-36-000 PM PDFDocument3 pagesReadings - Q0212754 - 01-May-2020 03-40-36-000 PM PDFvirendramehraNo ratings yet

- AgreementDocument6 pagesAgreementLokeshNo ratings yet

- Datos Históricos de Volcan Compania Minera SAA (VOLCAAC1) ULTIDocument2 pagesDatos Históricos de Volcan Compania Minera SAA (VOLCAAC1) ULTI47762442No ratings yet

- Repayment Calculation Project BaseDocument6 pagesRepayment Calculation Project BaseManoj SharmaNo ratings yet

- Attractive Bluechips 15 Mar 2023 1425Document5 pagesAttractive Bluechips 15 Mar 2023 1425P.g. SunilkumarNo ratings yet

- Bsaf 22 171Document2 pagesBsaf 22 171Muhammad HasnainNo ratings yet

- Readings - Q0212544 - 01-May-2020 03-44-44-000 PM PDFDocument3 pagesReadings - Q0212544 - 01-May-2020 03-44-44-000 PM PDFvirendramehraNo ratings yet

- ANGELDocument1 pageANGELjunior tenicela torresNo ratings yet

- Formato de Recaudacion 2024Document53 pagesFormato de Recaudacion 2024jose manuel negrin anguloNo ratings yet

- Readings - Q0212613 - 01-May-2020 03-43-41-000 PM PDFDocument3 pagesReadings - Q0212613 - 01-May-2020 03-43-41-000 PM PDFvirendramehraNo ratings yet

- SionofficeDocument2 pagesSionofficeALEXANDER FLORESNo ratings yet

- XA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Document6 pagesXA23472 GlobalP&LStatementof212EquityDerivativeCommodityCurrency 01072022 024852Mit NguNo ratings yet

- PortfolioDocument5 pagesPortfolio9911183111sNo ratings yet

- HWMonitor 1Document117 pagesHWMonitor 1neerajsakotwalNo ratings yet

- Black Week VolksDocument2 pagesBlack Week VolksmaxwenneNo ratings yet

- AIA HealthShield Gold MaxDocument11 pagesAIA HealthShield Gold Maxdaniel7tayNo ratings yet

- Option Chain (Equity Derivatives)Document3 pagesOption Chain (Equity Derivatives)MGNo ratings yet

- NSE - National Stock Exchange of India LTDDocument1 pageNSE - National Stock Exchange of India LTDsharath HpNo ratings yet

- ACCELSA 1T 2020 EstadosFinancierosDocument18 pagesACCELSA 1T 2020 EstadosFinancierosYamis VillegasNo ratings yet

- Analise Financeira Maio 2023Document1 pageAnalise Financeira Maio 2023Gustavo Martins KnoppNo ratings yet

- Month & Year Basic Salary Deductions Addtions Total For EPF & ETF AmountDocument6 pagesMonth & Year Basic Salary Deductions Addtions Total For EPF & ETF AmountPrabath MadusankaNo ratings yet

- Q0212559 - Readings: Midnight SnapshotsDocument3 pagesQ0212559 - Readings: Midnight SnapshotsvirendramehraNo ratings yet

- Readings - Q0212559 - 01-May-2020 03-35-51-000 PM PDFDocument3 pagesReadings - Q0212559 - 01-May-2020 03-35-51-000 PM PDFvirendramehraNo ratings yet

- Readings - Q0212559 - 01-May-2020 03-35-51-000 PM PDFDocument3 pagesReadings - Q0212559 - 01-May-2020 03-35-51-000 PM PDFvirendramehraNo ratings yet

- Q0212441 - Readings: Midnight SnapshotsDocument3 pagesQ0212441 - Readings: Midnight SnapshotsvirendramehraNo ratings yet

- Readings - Q0212441 - 01-May-2020 03-36-22-000 PM PDFDocument3 pagesReadings - Q0212441 - 01-May-2020 03-36-22-000 PM PDFvirendramehraNo ratings yet

- PlantsDetails HistoryDocument12 pagesPlantsDetails HistoryBrian FoxNo ratings yet

- Grow Acc FX Dari Usd 5 Jadi Lebih Usd150kDocument10 pagesGrow Acc FX Dari Usd 5 Jadi Lebih Usd150kAmir HakimNo ratings yet

- Readings - Q0212451 - 01-May-2020 03-36-22-000 PM PDFDocument3 pagesReadings - Q0212451 - 01-May-2020 03-36-22-000 PM PDFvirendramehraNo ratings yet

- Readings - Q0212451 - 01-May-2020 03-36-22-000 PM PDFDocument3 pagesReadings - Q0212451 - 01-May-2020 03-36-22-000 PM PDFvirendramehraNo ratings yet

- Q0212451 - Readings: Midnight SnapshotsDocument3 pagesQ0212451 - Readings: Midnight SnapshotsvirendramehraNo ratings yet

- Liberty - July 12 2020Document1 pageLiberty - July 12 2020Lisle Daverin BlythNo ratings yet

- Readings - Q0212569 - 01-May-2020 03-43-41-000 PM PDFDocument3 pagesReadings - Q0212569 - 01-May-2020 03-43-41-000 PM PDFvirendramehraNo ratings yet

- Readings - Q0212569 - 01-May-2020 03-43-41-000 PM PDFDocument3 pagesReadings - Q0212569 - 01-May-2020 03-43-41-000 PM PDFvirendramehraNo ratings yet

- MelanieDwl - 183 - Praktikum Pengelolaan Keuangan D - Pertemuan 3Document15 pagesMelanieDwl - 183 - Praktikum Pengelolaan Keuangan D - Pertemuan 3almaira oktaviaNo ratings yet

- Worksheet in Basis 2021-22 BudgetDocument9 pagesWorksheet in Basis 2021-22 BudgetChief Of AuditNo ratings yet

- Contoh Laporan JurnalDocument8 pagesContoh Laporan JurnalRojaliNo ratings yet

- P4D3PTP6424659 RPSDocument4 pagesP4D3PTP6424659 RPSsrikanth2997No ratings yet

- Atap BajaDocument18 pagesAtap BajaDanang DwinNo ratings yet

- Liberty - April 18 2018Document1 pageLiberty - April 18 2018Tiso Blackstar GroupNo ratings yet

- International Financial StatisticsDocument12 pagesInternational Financial StatisticsKhurram Sadiq (Father Name:Muhammad Sadiq)No ratings yet

- 3 Junie Delute IIDocument2 pages3 Junie Delute IIJune Delfino DeluteNo ratings yet

- Plan de Financement 2023 2024Document4 pagesPlan de Financement 2023 2024Rahim DoudouNo ratings yet

- Nishant 1Document5 pagesNishant 1NishantNo ratings yet

- Fairbairn - April 6 2018Document2 pagesFairbairn - April 6 2018Tiso Blackstar GroupNo ratings yet

- Liberty - May 11 2021Document1 pageLiberty - May 11 2021Lisle Daverin BlythNo ratings yet

- Liberty - April 28 2020Document1 pageLiberty - April 28 2020Lisle Daverin BlythNo ratings yet

- Markets and Commodity FiguresDocument2 pagesMarkets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- PSIRA - Close Protection, Bodyguards, Armed EscortsDocument24 pagesPSIRA - Close Protection, Bodyguards, Armed EscortsHaroon SaderNo ratings yet

- Kinship, Marriage and The HouseholdDocument2 pagesKinship, Marriage and The Householdsarah fojasNo ratings yet

- Case StudiesDocument3 pagesCase StudiesStuti BaradiaNo ratings yet

- Shadow Scale by Rachel Hartman - Chapter SamplerDocument49 pagesShadow Scale by Rachel Hartman - Chapter SamplerRandom House Teens75% (8)

- Annexure A - Forms (ITT)Document14 pagesAnnexure A - Forms (ITT)Mohamed AlaaNo ratings yet

- Zachary Rehl Mistrial MotionDocument5 pagesZachary Rehl Mistrial MotionDaily Caller News FoundationNo ratings yet

- 1Document32 pages1CharlesNo ratings yet

- Registration Number Registration CertificateDocument3 pagesRegistration Number Registration CertificateAnis BoufaresNo ratings yet

- Sayani 19 WBCSDocument3 pagesSayani 19 WBCSSayonie BoseNo ratings yet

- Analisis Vertikal Dan Horizontal Terhada 3c46f443 PDFDocument14 pagesAnalisis Vertikal Dan Horizontal Terhada 3c46f443 PDFDellaNo ratings yet

- 5897-Article Text-28221-4-10-20220621Document14 pages5897-Article Text-28221-4-10-20220621Morinda Putri SinagaNo ratings yet

- Rohm Apollo v. CIRDocument3 pagesRohm Apollo v. CIRGelaine MarananNo ratings yet

- Legal Theory 2ND PROJECT PDFDocument13 pagesLegal Theory 2ND PROJECT PDFMOHAMAMD ZIYA ANSARINo ratings yet

- Article 1261 OBLICONDocument5 pagesArticle 1261 OBLICONGela PatalinghugNo ratings yet

- 1323844046xi Engl HHW - Article, Speech & Debate WritingDocument9 pages1323844046xi Engl HHW - Article, Speech & Debate WritingNeerajBooraNo ratings yet

- Reaction Paper On Dr. Jesus Lim Arranza About Squatting Problems and Its Social IllsDocument4 pagesReaction Paper On Dr. Jesus Lim Arranza About Squatting Problems and Its Social IllsMa. Normita ArceoNo ratings yet

- Anders LassenDocument12 pagesAnders LassenClaus Jørgen PetersenNo ratings yet

- Shareholding Pattern 31-12-2022Document11 pagesShareholding Pattern 31-12-2022Jaysukh N SapraNo ratings yet

- 20 ArrendamientosDocument87 pages20 ArrendamientosCarlos Eduardo LoveraNo ratings yet

- 01concept of Copyright-14Document20 pages01concept of Copyright-14Ian TorwaldsNo ratings yet

- Corp Garduce NotesDocument60 pagesCorp Garduce NotesKenette Diane CantubaNo ratings yet

- 2020 Ba I Reading ListDocument14 pages2020 Ba I Reading ListDaisy NNo ratings yet

- The Time Value of Money: Unit IiDocument31 pagesThe Time Value of Money: Unit IiMarifher Kate Dela CruzNo ratings yet

- Sime Darby Pilipinas, Inc. vs. NLRCDocument2 pagesSime Darby Pilipinas, Inc. vs. NLRCBalaod MaricorNo ratings yet

- Full Download Australian Financial Accounting 6th Edition Deegan Test BankDocument35 pagesFull Download Australian Financial Accounting 6th Edition Deegan Test Bankardellazusman100% (38)

- FIFA Forward Development Programme (Forward 3.0) RegulationsDocument62 pagesFIFA Forward Development Programme (Forward 3.0) RegulationsMarek Dragosz Keepers Foundation100% (1)

- Mabil Response in OppositionDocument7 pagesMabil Response in Oppositionaswarren77No ratings yet

- LetterDocument4 pagesLetterjj emmyNo ratings yet

- Basic Project Management Agreement SampleDocument53 pagesBasic Project Management Agreement SampleKhay Acosta-TanchocoNo ratings yet

- The Practice of Leadership in Higher EducationDocument7 pagesThe Practice of Leadership in Higher EducationMansourJafariNo ratings yet