Professional Documents

Culture Documents

Prime Entry Books - Revision Tute

Uploaded by

Pramodh fernandoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prime Entry Books - Revision Tute

Uploaded by

Pramodh fernandoCopyright:

Available Formats

Prime entry books – Revision 2022

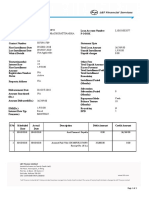

01.Uditha had commenced a business of whole sale distribution of stationery items with the name of

“Medawaththa Traders” as at 01.01.2021. He invested 1 250 000 in cash, 50 000 worth furniture and Rs. 4 500

000 worth delivery van as initial capital

1. Following are the details of sales for the January month

a) Credit Sales

Date Organization Value (Rs.) Invoice Number

2021/01/06 Sammani Book shop 170 000 001

2021/01/10 Sri Devi Book shop 250 000 002

2021/01/12 Sarathi Book shop 100 000 003

2021/01/20 Senani Book shop 150 000 004

b) Cash sales

Date Organization Value (Rs.) Cash receipt Number

2021/01/03 Gamage Traders 20 000 010020

2021/01/07 Ranasinghe Trade Center 30 000 010021

2021/01/13 Jayawardana Traders 40 000 010022

2021/01/28 Kannagara Traders 25 000 010026

2. Details of return inwards items

Date Organization Value (Rs.) Credit note

number

2021/01/10 Sammani Book shop 10 000 0025

2021/01/15 Sarath Book shop 5 000 0026

2021/01/28 Senani Book shop 20 000 0027

3. Details of debtors settlements

Date Organization Amount paid after Discount Cash receipt

deducting the Allowed number

discount (Rs.) %

2021/01/18 Sammani Book shop 152 000 5% 010023

2021/01/20 Sri Devi Book shop 237 500 5% 010024

2021/01/28 Sarath Book shop 10 000 - 010025

2021/01/30 Senani Book shop 50 000 - 010027

4. Stocks worth of Rs. 90 000 purchased on 02.01. 2021 from “Richard Trading Limited” Rs. 10 000 paid on

same date and (Payment voucher number 001001) the rest was agreed to pay later (invoice number 007653)

In settlement the business was offered 10% discount from Richard Trading Limited, if the debt is settled fully

within a month.

The payment was done after deducting the respective discount on 29th January (payment voucher No 001004)

5. Done following expenses on 25th January

Electricity bills Rs. 4 000 (Payment voucher no 001002)

Telephone bills Rs. 3 000 (Payment voucher no 001003)

6. Purchased Rs. 45 000 worth computer from “Singer Limited” on credit

Lakshitha Rathnayake Page 1

You are required to prepare following:

1. Cash receipt journal & cash payment Journal

2. Sales and return inwards journal

3. Relevant ledger accounts in the general ledger and subsidiary ledger

4. Trial balance as at 31.01.2021

(Total 20 Marks)

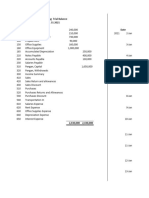

02.The ledger account balances of Akbar‟s Business as at 01.08.2021 and the transactions occurred during the

month of august have given below:

(i) Balances as at 01.08.2021

Description Rs. ‘000

Land and Building 12 500

Motor Vehicle 1 100

Equipment 500

Debtor - Ranga 250

Debtor - Suranga 125

Inventories 75

Investments 150

Petty Cash 15

Bank overdraft 10

Bank loan 200

Creditor - Amara 15

Creditor - Pala 30

(ii) Transactions and events occurred during the month of August 2021

Date Source Document No Transaction/Event

01/08 Voucher No: 001 Purchase Rs. 15 400 stocks (including 10% VAT) -

Cheque No: 0112563

02/08 Receipt No: 003 Rs. 150 000 cash has invested by the owner

05/08 Receipt No: 004 Sold inventories for the invoice price of

Rs. 77 000 (including 10%)

10/08 Purchase goods on credit (including 10% VAT)

Invoice No: 001 Amara - Rs. 110 000

Invoice No: 002 Pala - Rs. 330 000

Invoice No: 003 Vasantha – Rs. 11 000

12/08 Debit No: 10 & 11 Goods returns due to incorrect sizes (including VAT)

Amara - Rs. 11 000

Pala - Rs. 55 000

15/08 Petty Cash Payments

Petty Cash Voucher No: 004 Entertainment expenses Rs. 1 250

Petty Cash Voucher No: 005 Transport Expenses Rs. 2 500

Petty Cash Voucher No: 006 Stationery Expenses Rs. 2 000

Petty Cash Voucher No: 007 Toner for computer Rs. 1 200

Petty Cash Voucher No: 008 Other expenses Rs. 950

Petty Cash Voucher No: 009 Owner‟s Expenses Rs. 1 050

Lakshitha Rathnayake Page 2

Date Source Document No Transaction/Event

16/08 Receipt No: 005 Cash Sales Rs. 100 000 (VAT free)

20/08 Voucher No: 002 Paid fully and settle Amara - Cheque No: 0112564

received discount was Rs. 2 000

Voucher No: 003 Paid Vasantha to settle half of his amount Cheque No:

0112565

22/08 Purchases Rs. 225 000 equipment for business use from

Exsa Marketing on credit

23/08 The cheque issued to Vasantha has dishonoured

24/08 Credit sales(including 10%VAT)

Invoice No: 004 Suranga - Rs. 77 000

Invoice No: 005 Sumana - Rs. 121 000

Invoice No: 006 Ranga – Rs. 110 000

25/08 Sales returns due to damages (including VAT)

Credit No: 007 Suranga - Rs. 5 000

Credit No: 008 Sumana - Rs. 22 000

26/08 Voucher No: 004 Paid telephone bill Rs. 5 500 Cheque No: 0112566

27/08 Receipt No: 006 Suranga settle his amount of debt and business allowed

him Rs. 3 000 discount

30/08 Voucher No: 005 Issued a cheque No: 0112567 to reimburse the petty

cash imprest

Required:

i. Record the above transactions and events in relevant prime entry books of Akbar‟s

Business

ii. Post these transactions to the general ledger

iii. Prepare debtors and creditors list in the subsidiary ledgers

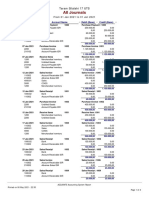

03. Details about Tharupabha Trader for the month of April 2018 are given below.

Cash Payment Journal

Date DetailsCheque Discount Amount Analysis Column

No allowed Cash Receipts Income

Sales from

debtors

2018.04.02 Kusal 20947 2 000 78 000 78 000

2018.04.03 Sales 510302 40 000 40 000

2018.04.05 Vihan 201322 50 000 50 000

2018.04.09 Baratha 208480 4 000 116 000 116 000

2018.04.15 Commission 402899 30 000 30 000

2018.04.30 Sales 702651 70 000 70 000

6 000 384 000 110 000 244 000 30 000

Lakshitha Rathnayake Page 3

Cash Payment Journal

Date Details Cheque Discount Amount Analysis Column

No allowed Cash Payment Expenses Other

Purchased to credit

2018.04.03 Purchases 824634 46 000 46 000

2018.04.04 Sirimath 824635 1 000 49 000 49 000

2018.04.05 Drawings 824636 18 000 18 000

2018.04.10 Furniture 824637 2 000 200 000 200 000

2018.04.15 Suranga 824638 78 000 78 000

2018.04.25 Wages 824639 50 000 50 000

2018.04.30 Standing 10 000 10 000

orders

Insurance 3 000 451 000 46 000 127 000 60 000 218 000

The bank statement for the month of April 2018 is as follows:-

Date Details Debit Credit Balance

2018.04.01 Balance 180 000 130 000

2018.04.04 209470 78 000 208 000

2018.04.04 824634 46 000 162 000

2018.04.05 824633 16 000 146 000

2018.04.05 824636 18 000 128 000

2018.04.05 510302 40 000 168 000

2018.04.08 824635 49 000 119 000

2018.04.08 201322 50 000 169 000

2018.04.12 208480 116 000 285 000

2018.04.12 824637 200 000 85 000

2018.04.19 402899 30 000 115 000

2018.04.22 Dishonored 402899 30 000 85 000

2018.04.25 824639 50 000 35 000

2018.04.30 Cheque Book charges 2 000 33 000

2018.04.30 Standing orders insurance 10 000 23 000

2018.04.30 Credit transfers Fixed deposits interest 120 000 11 000

Additional Information:

1. The balances of the cash control account and the of the bank statement as the 01.04.2018 were not

agreed. The reason for this was un-presented cheques below:

Cheque Number Amount

524531 - 32 000

524523 - 16 000

2. Dishonoured cheque charges and the interest on fixed deposits were not recorded in the cash control

account until the bank statement is received from April 2018.

3. Purchase of furniture and equipment are recorded in the cash control account as Rs. 20 000.

Required:

1. Cash control account before business received bank statement for the month of April

2. Adjusted the cash control

Lakshitha Rathnayake Page 4

04.The debit balance of the bank statement for t he month ended October 2021 sent by Sampath Bank

to Sanjali‟s Business was Rs. 55 000. It was not tally with the cash control account due to the

following reasons.

i. The cash control account balance has been over casted by Rs. 5 000

ii. The total of cash receipt journal Rs. 15 000 has been posted to the cash control account as

Rs. 1 500

iii. The following issued cheques to the creditors have not been presented to the bank till 31 st

October

Cheque Number Amount (Rs.)

0112656 15 000

0112657 8 500

iv. The total of Rs. 3 000 in the discount received column in the cash payments journal has been

debited to cash control account and correctly recorded in the creditor control account.

v. The deposited cheque Rs. 10 000 which was received from a debtor has not been realized

vi. The bank charges of Rs. 1 000 and he standing order payment for insurance premium of

Rs. 1 500 have not been recorded in the cash control account.

Required:

i. Cash control account balance before adjusting

ii. Adjusted cash control account

iii. Bank Reconciliation Statement for the month of October

(10 Marks)

05. Sasmanmal Trades cash control account balance on 31.03.2021 amounted to Rs. 28 000 and did not agree

with the bank statement balance as at that date. Subsequently following errors and omissions were found

out.

i. A cheque issued on 18th March Rs. 8 650 was recorded in cash payment journal total column as

6 850 but correctly recorded in the analysis column

ii. Standing orders paid by the bank 8 500 rates and 750 bank charges were not recorded in

payment journal

iii. Out of the total cheques issued in March two cheques amounting to 2 800 and 2 350 were not

presented for payments

iv. Two cheques from the deposited cheques for 8 500 and 5 200 had not been realized yet.

v. 8 100 investment income collected by the bank has not recorded in business cash control

account.

vi. A deposited cheque of 15 500 was dishonored but not entered in the cash control account

vii. Two cheques issued in February in amounting to Rs. 2 850 and Rs. 3 500 were not presented for

payments in February. But as per the bank statement for march Rs. 2 850 cheque was presented

for payment

Required:

i. Adjusted cash control account

ii. Prepare the bank reconciliation statement based on adjusted cash control balance

Lakshitha Rathnayake Page 5

06.The following transactions related to bank account were extracted from the books of Ranasura Ltd

for the months of April and May

1. Balance as per the bank account as at 01.04.2021 Rs. 800 000

Balance as per the bank statement as at 01.04.2021 Rs. 800 000

There were no un presented cheques or un realized cheques as at 01.04.2021

April May

Rs. „000 Rs. „000

2. Cheques deposited in the bank as per the bank account

of the business 2 400 3 000

Cheques issued during the month as per the bank Account 1 800 1 600

Realized cheques (excluding the dishonoured cheques) 2 000 2 800

Cheques presented for payments 1 400 1 200

Unpresented cheques as at 31.04.2021 were presented for payments during the month of May

2021 and un-realized cheques as at 30.4.2021 were realized during the month of May 2021.

3. The following transactions appeared in the bank statements as at 30.04.2021 and 31.05.2021 have

not been recorded to the bank account of the business

As at 30.04.2021 As at 31.05.2021

Direct remittance 160 000 120 000

Dishonored cheques received from debtors 100 000 60 000

Bank charges 40 000 20 000

4. Only the above transactions were took place relevant to the bank account during the months of April

and May.

Required:

(1) Balance as per the bank statement as at 30.04.2021

(2) Balance to be shown in the statement of financial position as at 31.05.2021

(3) Bank reconciliation statement as at 31.05.2021

07. Dhinu traders is registered for value added tax (VAT) and summary of the transactions took place during the

month of January 2018 as follows:

i.

Cash Receipts Journal

Analysis Columns

Receipt

Date Details C/N D/A Amount Sales Debtors VAT Other

No

Income

25 000 720 000 450 000 150 000 67 500 52 500

ii.

Cash Payment Journal

Voucher Analysis Columns

Date Details C/N D/R Amount

No Purchase Creditors VAT Expenses

20 000 447 500 250 000 120 000 37 500 40 000

iii. Total of other Journals

Lakshitha Rathnayake Page 6

Prime entry book VAT (Excluded) VAT VAT (Included)

Purchase Journal 300 000 45 000 345 000

Sales Journal 450 000 67 500 517 500

Purchase return Journal 20 000 3 000 23 000

Sales return journal 30 000 4 500 34 500

Additional Information:

The balances of the debtors control account as 1st January Rs. 500 000 creditors control account

Rs. 200 000 and the cash control account Rs. 100 000

Required:

Following ledger accounts in the general ledger Expense account

Cash control account Discount allowed account

VAT control account Sales account

Income account Purchase account

Debtors control account Discount received account

Creditors control account

Lakshitha Rathnayake Page 7

You might also like

- Journalizing, Posting and BalancingDocument21 pagesJournalizing, Posting and Balancinganuradha100% (1)

- Test Bank Intacc InventoriespdfDocument344 pagesTest Bank Intacc InventoriespdfRNo ratings yet

- E-Naira White PaperDocument27 pagesE-Naira White PaperSimon AlkaliNo ratings yet

- General JournalDocument11 pagesGeneral JournalZaheer Ahmed Swati100% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Prime Entry Books ActivitiesDocument12 pagesPrime Entry Books ActivitiesHiruni Mallawa arachchiNo ratings yet

- Conrol Accounts Questions201Document8 pagesConrol Accounts Questions201Rasalee AnjaleenaNo ratings yet

- Keseluruhan Jurnal: Dari 01 Jan 2018 Ke 31 Jan 2018Document8 pagesKeseluruhan Jurnal: Dari 01 Jan 2018 Ke 31 Jan 2018kenNo ratings yet

- Sample Journal To Trial BalanceDocument14 pagesSample Journal To Trial BalancePrecious Jewel BantasanNo ratings yet

- Worksheet Cash BookDocument3 pagesWorksheet Cash BookJaijeet SinghNo ratings yet

- AAT Model Paper 2019 JulDocument6 pagesAAT Model Paper 2019 JulShihan HaniffNo ratings yet

- Date: 26/11/2018 FILE No.: 875146: Instrument Type Instrument No. Instrument Date Amount (INR) Infavour ofDocument21 pagesDate: 26/11/2018 FILE No.: 875146: Instrument Type Instrument No. Instrument Date Amount (INR) Infavour ofYogesh WadhwaNo ratings yet

- Incomplete Records (Single Entry)Document15 pagesIncomplete Records (Single Entry)Kabiir RathodNo ratings yet

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

- ABC Supermarket Accounting DataDocument7 pagesABC Supermarket Accounting Datawaweru karanjaNo ratings yet

- Tally PracticalDocument5 pagesTally PracticalArchana DeyNo ratings yet

- Tobongbanua Aliza WEEN TradingDocument8 pagesTobongbanua Aliza WEEN TradingJan Leo EgamenNo ratings yet

- Soa L10181002077Document3 pagesSoa L10181002077imranNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- Module I Basic AccountingDocument11 pagesModule I Basic Accountingpaul amo100% (1)

- Audit of Cash and Cash EquivalentsDocument5 pagesAudit of Cash and Cash Equivalentsdummy accountNo ratings yet

- Problem 5Document42 pagesProblem 5aliyah1999hajNo ratings yet

- MBA I Semester Supplementary Examinations December/January 2018/19Document2 pagesMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- Cash BookDocument4 pagesCash BookDivyanka RanjanNo ratings yet

- Statement of Account PDFDocument2 pagesStatement of Account PDFASHU ARYANo ratings yet

- Workbook Week 7 SolutionsDocument11 pagesWorkbook Week 7 SolutionsThi Van Anh VUNo ratings yet

- Cebu Car-Tech CenterDocument17 pagesCebu Car-Tech CenterAlbert Moreno100% (2)

- 2.2 Financial and Non-Financial Transactions - 2Document9 pages2.2 Financial and Non-Financial Transactions - 2Vikas PANDEYNo ratings yet

- Topic 4 Class ExerciseDocument5 pagesTopic 4 Class ExerciseAzim OthmanNo ratings yet

- Tugas Prak - Software P9 All JournalDocument1 pageTugas Prak - Software P9 All JournalTry ElisaNo ratings yet

- Balance Sheet - NHDocument42 pagesBalance Sheet - NHnurulNo ratings yet

- Keseluruhan JurnalDocument3 pagesKeseluruhan JurnalFebriyantoNo ratings yet

- 7 Account Current FTDocument3 pages7 Account Current FTShweta BhadauriaNo ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- Bank Statement: Zone Industrielle, Souss-Massa Drâa Ait Melloul, 80125, MoroccoDocument1 pageBank Statement: Zone Industrielle, Souss-Massa Drâa Ait Melloul, 80125, Moroccomohamed elmakhzniNo ratings yet

- 37e8ce4b6f 20240129192042Document1 page37e8ce4b6f 20240129192042bkishorkumar903No ratings yet

- BAC 211 Assignment 2018Document4 pagesBAC 211 Assignment 2018vincentNo ratings yet

- G9-Recording Transactions in The Ledger Unit 10Document8 pagesG9-Recording Transactions in The Ledger Unit 10liamlouis982No ratings yet

- Single EntryDocument5 pagesSingle EntryAMIN BUHARI ABDUL KHADERNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Chapter 01 Transaction AnalysisDocument28 pagesChapter 01 Transaction Analysistanvir ahmedNo ratings yet

- Keisya Precilia 024032201032 All JurnalDocument1 pageKeisya Precilia 024032201032 All JurnalParksejongNo ratings yet

- Cash Budget TutorialDocument2 pagesCash Budget TutorialThando Majola-MasondoNo ratings yet

- Chapter 6 Smart Accounting QuestionDocument5 pagesChapter 6 Smart Accounting QuestionDanish AqashahNo ratings yet

- Revision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownDocument5 pagesRevision Exam Question Paper 2015/2016 Sem 2: Answer All Questions. All Workings Must Be ShownKys AlinaNo ratings yet

- 37e7826a96 20240107135138Document1 page37e7826a96 20240107135138dhirajbanswar24No ratings yet

- Assignment 1Document12 pagesAssignment 1anniekohliNo ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementMichael BwireNo ratings yet

- All Jurnal - Esra UTSDocument2 pagesAll Jurnal - Esra UTSrio silalahiNo ratings yet

- All Jurnal - Taram UTSDocument2 pagesAll Jurnal - Taram UTSrio silalahiNo ratings yet

- Cash Book WorksheetDocument11 pagesCash Book WorksheetRaashiNo ratings yet

- Dissolution + Single EntryDocument18 pagesDissolution + Single EntryOm JainNo ratings yet

- Question Bank-Accountancy 11thDocument26 pagesQuestion Bank-Accountancy 11thshaurya goyalNo ratings yet

- Accounting For Managers - Practical ProblemsDocument33 pagesAccounting For Managers - Practical ProblemsdeepeshmahajanNo ratings yet

- Group1 (Nur Arisha Binti Salman) - S2 - Assignment 1 - Mac2073Document19 pagesGroup1 (Nur Arisha Binti Salman) - S2 - Assignment 1 - Mac2073NUR ARISHA BINTI SALMANNo ratings yet

- Acc 3 Revision Questions 18Document6 pagesAcc 3 Revision Questions 18Danielle WatsonNo ratings yet

- Class ExerciseDocument1 pageClass ExerciseChristina KaukareNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- C Inetpubwwwrooterp Icmabreports113967Document1 pageC Inetpubwwwrooterp Icmabreports113967sohelNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Business Finance MCQ Exam Questions and AnswersDocument4 pagesBusiness Finance MCQ Exam Questions and AnswersPramodh fernandoNo ratings yet

- 24th SCM ServiceDocument26 pages24th SCM ServicePramodh fernandoNo ratings yet

- Short Note (Chap 01 - 16)Document40 pagesShort Note (Chap 01 - 16)Pramodh fernandoNo ratings yet

- BusinessStudies - ALs 2021 PaperDocument35 pagesBusinessStudies - ALs 2021 PaperPramodh fernandoNo ratings yet

- 26as Ay 21-22Document4 pages26as Ay 21-22Madhu MohanNo ratings yet

- Personal Banking General Fees ChargesDocument20 pagesPersonal Banking General Fees ChargesmikeNo ratings yet

- Bank Account Management - Cash PoolDocument10 pagesBank Account Management - Cash PoolDillip Kumar mallickNo ratings yet

- 1.2 Introduction To Cash ManagementDocument8 pages1.2 Introduction To Cash Managementasmamatha23No ratings yet

- Project Report On Financial Analysis of Reliance Industry Limited PDF FreeDocument85 pagesProject Report On Financial Analysis of Reliance Industry Limited PDF FreeKanika singhNo ratings yet

- FX Merge Risk Tool MT4-MT5Document3 pagesFX Merge Risk Tool MT4-MT5Tungamirai MapinduNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash Equivalentsforuse insitesNo ratings yet

- Final Project ACC406 - Accounting SimulationDocument18 pagesFinal Project ACC406 - Accounting SimulationanisaqilahzainalNo ratings yet

- Business Studies Form 4 Schemes of WorkDocument15 pagesBusiness Studies Form 4 Schemes of WorkDavi Kapchanga KenyaNo ratings yet

- HFO HomeworkDocument2 pagesHFO HomeworkAna May Durante BaldelomarNo ratings yet

- Trial Balance QuesDocument2 pagesTrial Balance QuesHimank SaklechaNo ratings yet

- Central Finance 1709Document38 pagesCentral Finance 1709Romain DepNo ratings yet

- CV of Abul HasanDocument3 pagesCV of Abul HasanB.M. Ashikur RahmanNo ratings yet

- MNC Cash ManagementDocument25 pagesMNC Cash ManagementbitunmouNo ratings yet

- ACCO 30093_ Integrated Review Course in Financial Accounting & ReportingDocument41 pagesACCO 30093_ Integrated Review Course in Financial Accounting & ReportingSarah LumapagNo ratings yet

- Counter TradeDocument38 pagesCounter TradethomasNo ratings yet

- Timed Reading For Fluency 2 - AKDocument9 pagesTimed Reading For Fluency 2 - AKlong vichekaNo ratings yet

- Cash and Credit ManagementDocument11 pagesCash and Credit Managementaoishic2025No ratings yet

- Billing SoftwareDocument42 pagesBilling SoftwareMercifulServentNo ratings yet

- E StatementDocument4 pagesE StatementMuhammad Basit Mujahid. 105No ratings yet

- Resume Petty Cash and Bank ReconcilliationDocument3 pagesResume Petty Cash and Bank ReconcilliationYuliaNo ratings yet

- Key Fact Statement and MITCDocument23 pagesKey Fact Statement and MITCSumeet ShelarNo ratings yet

- Cash Bank Recon and ReceivablesDocument16 pagesCash Bank Recon and ReceivablesBilkie MinalidNo ratings yet

- Ancile Tamal SarkarDocument4 pagesAncile Tamal SarkarTamal Basu SarkarNo ratings yet

- Accounting Terminologies: Elements of AccountsDocument12 pagesAccounting Terminologies: Elements of AccountsJoy SantosNo ratings yet

- Policy 9Document27 pagesPolicy 9sachinash664No ratings yet

- Century Bank - I II IIIDocument33 pagesCentury Bank - I II IIIMADHU KHANALNo ratings yet

- Haloo Cupcake VMDocument17 pagesHaloo Cupcake VMboema.ifNo ratings yet