Professional Documents

Culture Documents

Acquisition

Uploaded by

Nicole ParasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acquisition

Uploaded by

Nicole ParasCopyright:

Available Formats

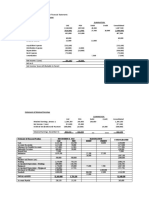

Consolidated Statement of Financial Position

As of January 1, 20x1

ABC Co. XYZ, Inc. WPE Consolidated

Assets

Cash 41,000 67,750 108,750

Accounts Receivable 75,000 22,000 97,000

Inventory 97,000 10,400 8,000 115,400

Investment in Subsidiary (at cost) 75,000 -75,000 --

Equipment 200,000 50,000 10,000 260,000

Accumulated Depreciation (60,000) (20,000) -2,000 (82,000)

TOTAL ASSETS 428,000 130,150 (59,000) 499,150

Liabilities and Equity

Accounts Payable 43,000 30,000 73,000

Bonds Payable 30,000 30,000

Total Liabilities 73,000 30,000 - 103,000

Share capital 170,000 50,000 - 50,000 170,000

Share premium 65,000 65,000

Retained Earnings 120,000 50,150 -24,000 146,150

NCI 15,000 15,000

Total Equity 355,000 100,150 - 59,000 396,150

TOTAL LIAB & EQUITY 428,000 130,150 - 59,000 499,150

Journal Entries

PARENT'S BOOK

JANUARY 1, 20X1 Investment in Subsidiary 75,000.00

Cash 75,000.00

SUBSIDIARY'S BOOK WORKING PAPER ENTRI

JANUARY 1, 20X1 ***NO ENTRY 1.) Adjust BV to FV

Inventory

Equipment

2.) Eliminate Share capital of Subs

Share capital, XYZ, Inc.

Retained Earnings

3.) Recognize goodwill

Goodwill

4.) Amortization of Excess FV

COGS

Depreciation Expense

5.) Impairment of Goodwill

***no impairment

6.)Eliminate Dividend Income

***no dividend declared

7.) Close NCINIS to NCINAS

NCINIS

8.) Eliminate intercompany sale

Sales (downstream)

Sales (upstream)

9.) Eliminate Intercompany receivable

***no receivable/payable

10.)Recognize Realized profit from be

***no RPBI because conso

11.) To eliminate UPEI during the year

COGS

ORKING PAPER ENTRIES

just BV to FV

Inventory 8,000

Equipment 10,000

Accumulated Dep'n 2,000

Investment in Subs 12,800

NCI 3,200

minate Share capital of Subs

Share capital, XYZ, Inc. 50,000

Retained Earnings 24,000

Investment in Subs 59,200

NCI 14,800

cognize goodwill Computation of goodwill

Goodwill 3,000 Consideration transferred

Investment in Subs 3,000 NCI

Total Aggregate

Fair Value of Net Assets

BVNA, XYZ (50,000 + 24,000)

FV adjustments

mortization of Excess FV Goodwill

8,000

Inventory 8,000

Depreciation Expense 2,000

Equipment 2,000 (10,000-2,000= 8,000 / 4 years)

pairment of Goodwill

***no impairment Computation of Retained Earnings, XYZ

XYZ Retained Earnings, Jan 1

minate Dividend Income Add: Net Income

***no dividend declared Less: Dividends declared (SQUEEZED)

XYZ Retained Earnings, Dec 31

ose NCINIS to NCINAS

NCINIS 3,070

NCINAS 3,070 Parent's income, ABC Co.

Subsidiary's income, XYZ Inc.

Dividend-P

Dividend-S

Amortization-Inventory (thru sale)

Amortization-Equipment (thru Dep'n)

Impairment-Goodwill

UPEI - DS

UPEI - Ups

RPBI - DS

RPBI - Ups

Realized Gain in Fixed Asset (DS)

Realized Gain in Fixed Asset (US)

UG/UL (DOWNSTREAM)

UG/UL (UPSTREAM)

ADJUSTED NET INCOME

minate intercompany sale

Sales (downstream) 20,000

COGS 20,000 40% on selling price=12,000/60%

Sales (upstream) 12,000

COGS 12,000 25% above its cost = 12,000 * 125%

minate Intercompany receivable/payable

***no receivable/payable

ecognize Realized profit from beginning inventory (RPBI)

***no RPBI because consolidation is in its first year

o eliminate UPEI during the year

2,800

Inventory 2,800

75,000

18,000

93,000

74,000

16,000 90,000

3,000

24,000

26,150

red (SQUEEZED) -

50,150

CNI-CI CNI-NCI CNI

(80%) (20%)

70,000 70,000

20,920 5,230 26,150

- - -

- - -

(6,400) (1,600) (8,000)

(1,600) (400) (2,000)

- - -

(2,000.00) - (2,000.00)

(640.00) (160.00) (800.00)

- - -

- - -

- - -

- - -

- - -

- - -

80,280.00 3,070.00 83,350.00

Sales, DS 100% 20,000 quarter remains in XYZ

Cost 60% 12,000

GP 40% 8,000 UPEI = 8,000 x 1/4 = 2,000

Sales, Ups 125% 12,000 4,000 of 12,000 remains or 1/3

Cost 100% 9,600

GP 25% 2,400 UPEI = 2,400 x 1/3 = 800

You might also like

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Sol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsDocument13 pagesSol. Man. Chapter 6 Consolidated Fs Part 3 Acctg For Bus. CombinationsFery Ann100% (5)

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Answers To Quiz 1 Period 3Document4 pagesAnswers To Quiz 1 Period 3trishaNo ratings yet

- AirThread ConnectionDocument26 pagesAirThread ConnectionAnandNo ratings yet

- Business Plan in Jewelry FieldDocument18 pagesBusiness Plan in Jewelry FieldsimalauraNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Consolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsDocument4 pagesConsolidated Financial Statements (Part 3) : XYZ, Inc. Carrying Amounts Fair Values Fair Value AdjustmentsMaryjoy Sarzadilla Juanata100% (1)

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- BusinessCombi (Chapter 6)Document5 pagesBusinessCombi (Chapter 6)richmond naragNo ratings yet

- Profe03 - Chapter 5 Consolidated FS Intercompany TopicsDocument8 pagesProfe03 - Chapter 5 Consolidated FS Intercompany TopicsSteffany RoqueNo ratings yet

- Consolidation - Cost vs. Equity MethodDocument8 pagesConsolidation - Cost vs. Equity MethodzaounxosakubNo ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Authoritative Status of Push-Down AccountingDocument9 pagesAuthoritative Status of Push-Down AccountingToni Rose Hernandez LualhatiNo ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- Buscom DiscussionDocument3 pagesBuscom DiscussionLorie Grace LagunaNo ratings yet

- Cost Model To Record Share in Net Income Not ApplicableDocument41 pagesCost Model To Record Share in Net Income Not ApplicableJohn Stephen PendonNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Buscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodDocument46 pagesBuscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodJohn Stephen PendonNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- SFP - Notes (Problem A-C)Document22 pagesSFP - Notes (Problem A-C)The Brain Dump PHNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document11 pagesChapter 6 - Consolidated Financial Statements (Part 3)Kim GarciaNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Activity Chapter 5Document3 pagesActivity Chapter 5Randelle James FiestaNo ratings yet

- Corporate ReportingDocument5 pagesCorporate ReportingZANGINA Nicholas NaaniNo ratings yet

- 4-02 - 03 - Andika Fivaldi - Latihan Soal Pertemuan 7Document9 pages4-02 - 03 - Andika Fivaldi - Latihan Soal Pertemuan 7Andika FivaldiNo ratings yet

- Consolidated Working PaperDocument6 pagesConsolidated Working PaperChaCha Delos Reyes AguinidNo ratings yet

- ABC Sample ProbDocument4 pagesABC Sample ProbangbabaeNo ratings yet

- Raine SDocument6 pagesRaine Sapi-664248097No ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- In Philippine PesoDocument4 pagesIn Philippine PesoAitanna Sophia LagunaNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Working Paper Part 3Document2 pagesWorking Paper Part 3KEITH JEROME VIERNESNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Use The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionDocument15 pagesUse The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionJacqueline OrtegaNo ratings yet

- 6 PracticeProblems-IntercompanyExDocument6 pages6 PracticeProblems-IntercompanyExtheheckwithitNo ratings yet

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubNo ratings yet

- Total Assets 335,000 80,000: Additional InformationDocument8 pagesTotal Assets 335,000 80,000: Additional InformationHohohoNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Quiz 2 ABC SolutionsDocument3 pagesQuiz 2 ABC SolutionsAndrew wigginNo ratings yet

- Quiz 2Document11 pagesQuiz 2Sophia Anne MonillasNo ratings yet

- Consolidated Financial Statement-Part 3Document6 pagesConsolidated Financial Statement-Part 3JINKY TOLENTINONo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Abuscom Final Output 4Document3 pagesAbuscom Final Output 4Mac b IBANEZNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Cash Flow Statements Interim Check 1 Yolo LTD Question and AnswerDocument5 pagesCash Flow Statements Interim Check 1 Yolo LTD Question and AnswerjunaidahNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Discussion and Solutions For Investment in Associate - Hand - Out 1Document19 pagesDiscussion and Solutions For Investment in Associate - Hand - Out 1Teresa AlbertoNo ratings yet

- ConsolidationDocument25 pagesConsolidationAEDRIAN LEE DERECHONo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Aborigine Company Dec31,2020 Debit CreditDocument2 pagesAborigine Company Dec31,2020 Debit CreditAnonnNo ratings yet

- Additional ProblemDocument3 pagesAdditional ProblemLabLab ChattoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- CH 14Document35 pagesCH 14Shaneen AdorableNo ratings yet

- (PWC) Up Jpia Asset Audit Case Xyz Retail CompanyDocument7 pages(PWC) Up Jpia Asset Audit Case Xyz Retail CompanyJoyce BelenNo ratings yet

- Christian Paul D. Legaspi Easy Problem 1, CCEDocument16 pagesChristian Paul D. Legaspi Easy Problem 1, CCELyca Mae CubangbangNo ratings yet

- EduX.F3A 1 01-CAIXINDocument10 pagesEduX.F3A 1 01-CAIXINvetNo ratings yet

- COA Unit 4 Amalgamation ProblemsDocument7 pagesCOA Unit 4 Amalgamation ProblemsGayatri Prasad BirabaraNo ratings yet

- FM2 Cheat Sheet From CREsDocument2 pagesFM2 Cheat Sheet From CREstrijtkaNo ratings yet

- ApaDocument2 pagesApaPaula Villarubia100% (1)

- TB21 PDFDocument33 pagesTB21 PDFJi WonNo ratings yet

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNo ratings yet

- Orca Share Media1579219923157Document10 pagesOrca Share Media1579219923157leejongsuk44% (9)

- Mba ReportDocument89 pagesMba ReportRiddhi KakkadNo ratings yet

- Chapter 1: The Accounting EquationDocument2 pagesChapter 1: The Accounting EquationLysss EpssssNo ratings yet

- Eacc1614 Test 2 Memo 2021 AdjDocument10 pagesEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiNo ratings yet

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisRaijo PhilipNo ratings yet

- Student JournalDocument95 pagesStudent JournalfbuameNo ratings yet

- Business Loan ServiceDocument4 pagesBusiness Loan ServicevikashNo ratings yet

- QP Preboard Term 1 Accounts 2021-22Document22 pagesQP Preboard Term 1 Accounts 2021-22dev sharmaNo ratings yet

- Ratio Analysis DaburDocument19 pagesRatio Analysis DaburPramod ShingNo ratings yet

- TEST BANK For Government and Not For Profit Accounting Concepts and Practices 6th Edition by Granof Khumawala20190702 86031 1d2i3lg PDFDocument16 pagesTEST BANK For Government and Not For Profit Accounting Concepts and Practices 6th Edition by Granof Khumawala20190702 86031 1d2i3lg PDFMaria Ceth SerranoNo ratings yet

- LCD European Quarterly 1Q16Document11 pagesLCD European Quarterly 1Q16Shawn PantophletNo ratings yet

- UAS ALK Dinda Azzahra Salsabilla Contoh Forecasting and Valuation AnalysisDocument9 pagesUAS ALK Dinda Azzahra Salsabilla Contoh Forecasting and Valuation AnalysisDinda AzzahraNo ratings yet

- FAR - Module 2 - The Accounting EquationDocument5 pagesFAR - Module 2 - The Accounting EquationEva Katrina R. Lopez100% (1)

- Hsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPDocument6 pagesHsslive-XI ACCOUNTING WITH AFS - ANSWERKEY - RAMESH VPrehankedhenNo ratings yet

- Preparing SFP of Single Propriertorship BusinessDocument18 pagesPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Hitung ProyeksiDocument3 pagesHitung ProyeksiDwinanda HarsaNo ratings yet

- Format of Financial StatementsDocument11 pagesFormat of Financial StatementssarlagroverNo ratings yet

- Ind As 103Document45 pagesInd As 103Kshitija JoshiNo ratings yet

- Kendriya Vidyalaya Sangathan, Chennai Region: Model Paper AccountancyDocument12 pagesKendriya Vidyalaya Sangathan, Chennai Region: Model Paper AccountancyJoanna GarciaNo ratings yet