Professional Documents

Culture Documents

IMPQ 2018-Batch-2021m-Tax

Uploaded by

Kiran AmateOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMPQ 2018-Batch-2021m-Tax

Uploaded by

Kiran AmateCopyright:

Available Formats

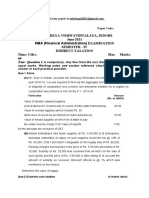

LAW OF TAXATION

MARCH/APRIL 2021

1. Discuss the scope of the total income with reference to residential status

of an Assessee.

2. Explain the incomes assessable as income from Business and Profession.

3. Explain the factors that are to be considered for assessing the taxable

income from House Property.

4. Which are the Income Tax Authorities? Explain the Provisions relating to

collection and recovery of Income Tax.

5. What are the items of Incomes that would be assessed to tax under the

head income from other sources? State the admissible deductions.

6. Explain the Provisions as to assessment of duty and valuation of goods

under the Customs Act, 1962.

7. Who is entitled to take input tax credit? State the conditions for claiming

input tax credit under GST.

8. Explain any two of the following:

(a) Best Judgement Assessment.

(b) GST Council.

(c) Deemed Wealth.

9. Solve any two of the following problems:

(a) A hospital which is established solely for philanthropic purposes and

subsequently financed by Government and approved by the

Prescribed authority, treats the persons suffering from illness or

mental disability and receives Rs. 5 crores annually. Whether the

income is exempted? Give reasons.

(b) Ramakrishnan of Chennai visited Mumbai and there decides to buy a

Washing Machine and a Air Conditioner for his house at Chennai. He

visited a showroom of Karthik in Mumbai. Karthik agreed to transport

and deliver the Washing Machine and Air conditioner to Ramakrishna

at his house in Chennai for a sum of Rs. 48,000/- including

transportation charges. Decide what shall be the place of supply and

kind of GST.

(c) An Engineer from Dharwad (India) went to U.S.A. on job visa and sent

Rs. 10,00,000/- to his father in Dharwad for the purpose of

performing his sister’s marriage expenses. Whether this amount is

taxable in the hands of the father in India. Decide.

You might also like

- Indirect Taxation Finals Question PaperDocument3 pagesIndirect Taxation Finals Question PaperShubham NamdevNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- First Test On Law 5 TopisDocument15 pagesFirst Test On Law 5 TopisShrikant RathodNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- Bils - Paper 1vDocument4 pagesBils - Paper 1vlegallyindia100% (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Law PPR FinalDocument4 pagesLaw PPR FinalMariumm ParusNo ratings yet

- Tax MCQsDocument173 pagesTax MCQsHarleen Kaur100% (1)

- Accounts Final Exam of BCADocument6 pagesAccounts Final Exam of BCAAtul Kumar100% (1)

- QP 1Document7 pagesQP 1Shankar ReddyNo ratings yet

- Questions Bank Accounts ClassDocument5 pagesQuestions Bank Accounts ClassRidhesh SharmaNo ratings yet

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Consolidated CsDocument43 pagesConsolidated Cssarathindia22No ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- MTP 1Document7 pagesMTP 1Aman VithlaniNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Interesting Aspects in Non-Resident TaxationDocument39 pagesInteresting Aspects in Non-Resident TaxationKANNAPPAN NAGARAJANNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Suppy PNo ratings yet

- Question IDT GM 2Document12 pagesQuestion IDT GM 2Prajwal AradhyaNo ratings yet

- Theory Questions For PracticeDocument2 pagesTheory Questions For Practice04 Sourabh BaraleNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- Income Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Document17 pagesIncome Tax - I Previous Years Question Papers: Short Answer Questions (2marks Each)Prabhakar BhattacharyaNo ratings yet

- Class Xii Cbse Question Bank AccountancyDocument23 pagesClass Xii Cbse Question Bank AccountancyBinoy TrevadiaNo ratings yet

- Read The Following Hypothetical Text and Answer The Given QuestionsDocument12 pagesRead The Following Hypothetical Text and Answer The Given QuestionsRoshan KardaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- Tax Planning CasesDocument68 pagesTax Planning CasesHomework PingNo ratings yet

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- Volume 1 - 50 Pages MN23Document52 pagesVolume 1 - 50 Pages MN23Kajal KanduNo ratings yet

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- Lecture Synopsis-5, For Overall Discussion On Principles of TaxationDocument3 pagesLecture Synopsis-5, For Overall Discussion On Principles of TaxationProgga MehnazNo ratings yet

- Income Tax IndiaDocument4 pagesIncome Tax IndiaRupesh PatilNo ratings yet

- Volume 1 - 75 PagesDocument75 pagesVolume 1 - 75 PagesMarsNo ratings yet

- Question Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or FalseDocument69 pagesQuestion Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or Falselakshit_gupta100% (1)

- CS 3Document12 pagesCS 3Mallika VermaNo ratings yet

- Paper 7: Direct Tax Laws & International Taxation: Questions and AnswersDocument19 pagesPaper 7: Direct Tax Laws & International Taxation: Questions and Answersneeraj sharmaNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsAtiaTahiraNo ratings yet

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- Icai 3Document14 pagesIcai 3Raghav TibdewalNo ratings yet

- MCQ IdtDocument30 pagesMCQ IdtkartikNo ratings yet

- Final New Indirect Tax Laws Test 1 Test 1617180196Document9 pagesFinal New Indirect Tax Laws Test 1 Test 1617180196CAtestseriesNo ratings yet

- MCQ'S Practies: Direct TaxDocument12 pagesMCQ'S Practies: Direct TaxTina AggarwalNo ratings yet

- DT AY 2022 23 Vol 1Document416 pagesDT AY 2022 23 Vol 1Muskan AgrawalNo ratings yet

- Sample Qn.Document3 pagesSample Qn.meNo ratings yet

- Basics (DT) Revision P Ques Jan 23Document10 pagesBasics (DT) Revision P Ques Jan 23Grave diggerNo ratings yet

- Final Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDocument13 pagesFinal Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDiwakar GiriNo ratings yet

- Test Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other LawsDocument8 pagesTest Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other Lawssunil1287No ratings yet

- MCQ CH 14 - TDS and TCS - Nov 23Document18 pagesMCQ CH 14 - TDS and TCS - Nov 23NikiNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDocument8 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariNo ratings yet

- Accounts Preliminary Paper No 9 PDFDocument6 pagesAccounts Preliminary Paper No 9 PDFAMIN BUHARI ABDUL KHADERNo ratings yet

- GST Law (Set 2)Document4 pagesGST Law (Set 2)studywagishaNo ratings yet

- CA Inter Tax RTP May22Document26 pagesCA Inter Tax RTP May22karnimasoni12No ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Taxation Short Questions AnswersDocument4 pagesTaxation Short Questions AnswersSheetal IyerNo ratings yet

- Mid Sem TaxationDocument6 pagesMid Sem Taxationakash tiwariNo ratings yet

- TAXATION - Various ConceptsDocument19 pagesTAXATION - Various Conceptslc17358No ratings yet

- BANKING LAW April, May 2022 (Dec 2021)Document4 pagesBANKING LAW April, May 2022 (Dec 2021)Kiran AmateNo ratings yet

- LAW OF EVIDENCE April, May 2022 (Dec 2022)Document4 pagesLAW OF EVIDENCE April, May 2022 (Dec 2022)Kiran AmateNo ratings yet

- Torts - Vicarious Laibility and Remoteness OfdamageDocument37 pagesTorts - Vicarious Laibility and Remoteness OfdamageKiran AmateNo ratings yet

- Law of Evideance September (June 2021)Document3 pagesLaw of Evideance September (June 2021)Kiran AmateNo ratings yet

- ಭಾರತೀಯ ಸಂವಿಧಾನ (ಕನ್ನಡ)Document331 pagesಭಾರತೀಯ ಸಂವಿಧಾನ (ಕನ್ನಡ)Kiran AmateNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Tax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfFrom EverandTax Preparation for Beginners: The Easy Way to Prepare, Reduce, and File Taxes YourselfRating: 5 out of 5 stars5/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesFrom EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo ratings yet

- Beyond Frontiers: U.S. Taxes for International Self-Published AuthorsFrom EverandBeyond Frontiers: U.S. Taxes for International Self-Published AuthorsRating: 1 out of 5 stars1/5 (1)

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)