Professional Documents

Culture Documents

Pre-Lecture-Note

Pre-Lecture-Note

Uploaded by

rakshitsumit08Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pre-Lecture-Note

Pre-Lecture-Note

Uploaded by

rakshitsumit08Copyright:

Available Formats

Pre-Lecture Note

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

2

Option - Definition

Option is a financial agreement giving buyer (of the option) the right (but not

the obligation) to buy/sell a specified amount of underlying asset at a

specified price on or before a specified date

• Compare it to a forward:

A Financial Contract whereby the owner has the obligation to buy/sell a

specified amount of underlying at a specified price on a specified date

An option is a security, just like a stock or bond, and constitutes a binding

contract with strictly defined terms and properties

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

3

Call Option - Example

Say, you have bought a call option of strike 100 with a maturity of 1 month.

What this means is that at the end of month, whatever the price of underlying

asset be, the buyer of the call option can BUY the underlying asset for $100.

Scenario 1: The price of the stock at the end of the month is $107.5

Scenario 2: The price of the stock at the end of the month is $97

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

4

Put Option - Example

Say, you have bought a put option of strike 100 with a maturity of 1 month.

What this means is that at the end of month whatever the price underlying

asset be, the buyer of the option can SELL the underlying asset for $100.

Scenario 1: The price of the stock at the end of the month is $107.5

Scenario 2: The price of the stock at the end of the month is $97

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

5

Definitions

Call Option Gives buyer the right to BUY the underlying

Put Option Gives buyer the right to SELL the underlying

Strike Price of the underlying at which the option can

be exercised

Expiry Date The date at which the option can be exercised

Premium Upfront payment made by the buyer to the

seller (writer) of the option

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

6

Types of Options

CALL OPTION PUT OPTION

B

U The right (but not The right (but not

Y the obligation) to the obligation) to

E buy sell

R

S

E The potential The potential

L obligation to sell obligation to buy

L

E

R

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

7

Types of Options

European Options Option only exercisable on expiry date

American Options Option exercisable any time before or on expiry

Bermudan Option exercisable on specific dates until

Options expiry

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

8

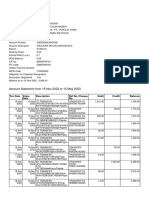

Payoffs – Call Option

Consider a Call Option on XYZ stock with strike = 30, expiry date = 30th

April 201X.

At Expiry, the payoff of the call option for the buyer is as shown below:

Payoff of a Call Option

Will only exercise the

14 call option if underlying

at expiry is more than

12 the strike

10 For e.g., if the

Strike at 30 underlying price is at

36, the buyer of the

8 option can buy the

underlying at 30.

6 Hence, a payoff of 6.

0

20 22 24 26 28 30 32 34 36 38 40 42

Underlying price at expiry

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

9

Payoffs – Put Option

Consider a Put Option on XYZ stock with strike = 30, expiry date = 30th

April 201X.

At Expiry, the payoff of the put option for the buyer is as shown below:

Payoff of a Put Option

12

Will only exercise the

put option if underlying

10 at expiry is less than

the strike

8

Strike at 30

6

For e.g., if the

underlying price is at

4

23, the buyer of the

option can sell the

2 underlying at 30.

Hence, a payoff of 7.

0

20 22 24 26 28 30 32 34 36 38 40 42

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

10

Terminology : Moneyness

Terminology Call Option Put Option

In the Money (ITM) Underlying Price > Strike Underlying Price < Strike

At the Money (ATM) Underlying Price = Strike Underlying Price = Strike

Out the Money (OTM)

Underlying Price < Strike Underlying Price > Strike

• If the underlying price used is the spot price, then ATM is at-the money-spot etc

• If the underlying price used is the future price, then ATM is at-the money-future etc

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

11

Option Premium : Two Components

• Intrinsic Value

• Time Value

For Eg.,

If stock is at 100, and a Call option of strike 90 is priced at 12,

then the price of the option can be broken down in 2 parts:

Call price = (100-90) + 2

Intrinsic Value Time value

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

12

Intrinsic Value

Intrinsic value is the current worth of the option that

depends on the option strike price and the current stock price

as shown below:

– For a call option, intrinsic value = stock price – strike

– For a put option, intrinsic value = strike – stock price

– Intrinsic value cannot be < zero

• More on Intrinsic value

– An option with no intrinsic value is out-of-the-money

– In the money options have intrinsic value

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

13

Time Value

The chance or probability element in option premium.

Even an option that is out-of-the-money (with zero

intrinsic value) will have time value if it has any time

remaining until expiry and assuming the share price can

fluctuate. There is a chance that the option might move

into the money before it expires.

Premium of an Option = Intrinsic Value + Time Value

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

14

Revisiting payoffs

Payoff - Buy Call Option Payoff - Sell Call Option

12

4

10

Breakeven Point 2

8

0

Premium

6 -2 20 22 24 26 28 30 32 34 36 38 40 42

4 -4

2 -6 Premium

Strike

0 -8

-2 -10

20 22 24 26 28 30 32 34 36 38 40 42

-4 -12

Underlying price at expiry Underlying price at expiry

Payoff - Buy Put Option Payoff - Sell Put Option

10 4

8 2

6 0

4 20 22 24 26 28 30 32 34 36 38 40 42

-2

2

-4

0

-6

-2

20 22 24 26 28 30 32 34 36 38 40 42 -8

-4

Underlying Price at Expiry

-10

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

15

Put-Call Parity

There is an important relation between call price, c, and put price, p.

Consider a portfolio A -

Portfolio A: One European call option of strike X plus an amount of cash X

What is the value of Portfolio A at expiry?

Scenario 1: The price of the stock at the end of the month is greater than X

Portfolio A’s value -> (ST-X) + X = ST ; ST is the stock price at expiry

Scenario 2: The price of the stock at the end of the month is less than X

Portfolio A’s value -> 0 + X = X

Therefore, portfolio A is worth max(ST,X)

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

16

Put-Call Parity

Consider a portfolio B –

Portfolio B: One European put option with strike X plus one share

What is the value of Portfolio B at expiry?

Scenario 1: The price of the stock at the end of the month is greater than X

Portfolio B’s value -> 0 + ST = ST

Scenario 2: The price of the stock at the end of the month is less than X

Portfolio B’s value -> (X-ST) + ST = X

Therefore, portfolio B is also worth max(ST,X)

Therefore, both portfolios should have identical values today. This means

c + Xe-rt = p + So where e-rt is the discounting factor

v10.0.1 © Copyright QuantInsti Quantitative Learning Private Limited

You might also like

- Guidance Note On Accounting For Equity Index and Equity Stock Futures and OptionsDocument22 pagesGuidance Note On Accounting For Equity Index and Equity Stock Futures and Optionsshyamsunder bajajNo ratings yet

- Solutions OptionsDocument215 pagesSolutions OptionsManton Yeung50% (2)

- TT Textile Case Assignment - Rashi JainDocument2 pagesTT Textile Case Assignment - Rashi JainKushal AdaniNo ratings yet

- HMV AnalysisDocument76 pagesHMV Analysisagat22100% (2)

- Project On MonginisDocument33 pagesProject On MonginisYugant Karane40% (5)

- Derivatives-How-to-navigate-volatile-markets IDBI STKMKT V V V IMP GOOOOD 220622Document26 pagesDerivatives-How-to-navigate-volatile-markets IDBI STKMKT V V V IMP GOOOOD 220622jig3309No ratings yet

- Options Summary Notes by CA Gaurav Jain SirDocument14 pagesOptions Summary Notes by CA Gaurav Jain Sirqamaraleem1_25038318No ratings yet

- Derivative Risk Management: BY Ca Umesh KolapkarDocument42 pagesDerivative Risk Management: BY Ca Umesh KolapkarBhakti KhannaNo ratings yet

- Primer On OptionsDocument145 pagesPrimer On OptionsSivaramakrishna SobhaNo ratings yet

- Chapter 15docxDocument6 pagesChapter 15docxrezzaqNo ratings yet

- Basics of OptionsDocument5 pagesBasics of OptionsJESSICA ONGNo ratings yet

- Option, Swap and BlackscholeDocument9 pagesOption, Swap and BlackscholeVISHAL KUMARNo ratings yet

- CME Options On FuturesDocument18 pagesCME Options On FuturesAtlantic Pacific Trading GroupNo ratings yet

- Amity Global Business School: MBA Options Mr. Sachin RohatgiDocument37 pagesAmity Global Business School: MBA Options Mr. Sachin RohatgisachinremaNo ratings yet

- Options Iraa KorkeDocument9 pagesOptions Iraa KorkemicfabfmlyNo ratings yet

- StudentDocument23 pagesStudentSmartunblurrNo ratings yet

- FX Options FundamentalsDocument52 pagesFX Options Fundamentalspb024No ratings yet

- Option BasicsDocument19 pagesOption BasicsomprakashNo ratings yet

- Application of Options in Hedging of Crude Oil Price RiskDocument8 pagesApplication of Options in Hedging of Crude Oil Price Riskankur111865952No ratings yet

- Part 16Document100 pagesPart 16api-3848722No ratings yet

- Preface: National Institute of Financial Market (NIFMDocument65 pagesPreface: National Institute of Financial Market (NIFMSankitNo ratings yet

- Hedging With A Put Option PDFDocument4 pagesHedging With A Put Option PDFTf ChungNo ratings yet

- Derivatives: - Dr. Rana SinghDocument95 pagesDerivatives: - Dr. Rana SinghDinesh SugumaranNo ratings yet

- Part 19Document89 pagesPart 19api-3848722No ratings yet

- Derivatives: Futures & Options: (Practical Aspects)Document48 pagesDerivatives: Futures & Options: (Practical Aspects)shubhagyaldh6253No ratings yet

- Hedging With A Put OptionDocument4 pagesHedging With A Put OptionAayush GaurNo ratings yet

- Derivative Contracts: ..The Instrument For Future TradingDocument28 pagesDerivative Contracts: ..The Instrument For Future Tradingjinu2691No ratings yet

- Options Trading Starter KitDocument18 pagesOptions Trading Starter Kitdazzling.amazonfbaNo ratings yet

- Option Markets Option Terminology Buy - Long Sell - Short Call PutDocument5 pagesOption Markets Option Terminology Buy - Long Sell - Short Call PutCejay MilNo ratings yet

- Learning Outcomes: 2.1 OptionsDocument10 pagesLearning Outcomes: 2.1 OptionsRajesh GargNo ratings yet

- An Investor's Guide To Trading Options Kindle Version - The OptionsDocument6 pagesAn Investor's Guide To Trading Options Kindle Version - The OptionsNelsonNo ratings yet

- S8 Options Online VersionDocument51 pagesS8 Options Online Versionconstruction omanNo ratings yet

- 1 - NISM ED CPE - PPT (v4.0)Document155 pages1 - NISM ED CPE - PPT (v4.0)Prashant PatadiaNo ratings yet

- 05.option FaqsDocument15 pages05.option FaqsAMAN KUMAR KHOSLANo ratings yet

- Options TheoryDocument8 pagesOptions TheoryKondalaRav MaduriNo ratings yet

- Options I UploadDocument3 pagesOptions I UploadManav DhimanNo ratings yet

- Mechanics of Options MarketsDocument31 pagesMechanics of Options MarketsPriyank PipaliaNo ratings yet

- Derivatives and HedgingDocument13 pagesDerivatives and HedgingDeo Corona100% (1)

- Options and Option ValuationDocument78 pagesOptions and Option ValuationCijil DiclauseNo ratings yet

- 7 - Exotic OptionsDocument39 pages7 - Exotic OptionsAman Kumar SharanNo ratings yet

- Options Part Onev0.1Document10 pagesOptions Part Onev0.1Pavana RamaiahNo ratings yet

- Index Basic of Derivatives .2 Option .9 Terminology of Option ..14 Moneyness .17Document66 pagesIndex Basic of Derivatives .2 Option .9 Terminology of Option ..14 Moneyness .17nikomaso tesNo ratings yet

- Part-01: To Futures and ForwardsDocument185 pagesPart-01: To Futures and ForwardsSivaramakrishna SobhaNo ratings yet

- DerivativeDocument25 pagesDerivativeHari KrishnanNo ratings yet

- Option Basics: A Crash Course in Option Mechanics: Chapter #Document10 pagesOption Basics: A Crash Course in Option Mechanics: Chapter #Reynel Isla AlboNo ratings yet

- Option: Offers The Right (But Imposes No Obligation)Document3 pagesOption: Offers The Right (But Imposes No Obligation)meetwithsanjayNo ratings yet

- Option Trading Strategies - 2-1Document33 pagesOption Trading Strategies - 2-1Aravind SNo ratings yet

- Options Presentation-FinalDocument23 pagesOptions Presentation-FinalPrakriti ThapaNo ratings yet

- Option BasicsDocument4 pagesOption Basicsbhavnesh_muthaNo ratings yet

- Chapt 21 ER-OPTIONS QUESDocument5 pagesChapt 21 ER-OPTIONS QUESKomal AdvaniNo ratings yet

- OptionsDocument57 pagesOptionssinghdharmendra137No ratings yet

- Understanding OptionsDocument40 pagesUnderstanding OptionskayenatsamiNo ratings yet

- Option Trading StrategiesDocument3 pagesOption Trading StrategiesVIVEK GUPTANo ratings yet

- TerminologiesDocument4 pagesTerminologiesKeval ModiNo ratings yet

- Options MSCFIÂ DECÂ 2022Document8 pagesOptions MSCFIÂ DECÂ 2022kenedy simwingaNo ratings yet

- DerivativesDocument45 pagesDerivativesNeeraj KumarNo ratings yet

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsFrom EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNo ratings yet

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- Options Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)From EverandOptions Trading: How to Start Investing Consciously with this Ultimate and Practical Guide. Learn How to Become a Smart Investor by Using Technical Analysis Before Purchasing Options (2022)No ratings yet

- SWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)From EverandSWING TRADING OPTIONS: Maximizing Profits with Short-Term Option Strategies (2024 Guide for Beginners)No ratings yet

- I QFP Pa Eu Ak 39 BR NVDocument15 pagesI QFP Pa Eu Ak 39 BR NVrakshitsumit08No ratings yet

- ? - The - Ultimate - Guide - Thread - by - Opsec - Crypto - Apr 30, 23 - From - RattibhaDocument32 pages? - The - Ultimate - Guide - Thread - by - Opsec - Crypto - Apr 30, 23 - From - Rattibharakshitsumit08No ratings yet

- Chapter 3 Qualitative Analysis of A Company - Recognized TG @MDiscordDocument15 pagesChapter 3 Qualitative Analysis of A Company - Recognized TG @MDiscordrakshitsumit08No ratings yet

- Chapter 2 Choosing The Right Sector - Recognized TG @MDiscordDocument19 pagesChapter 2 Choosing The Right Sector - Recognized TG @MDiscordrakshitsumit08No ratings yet

- Option-Trading-Session-oneDocument70 pagesOption-Trading-Session-onerakshitsumit08No ratings yet

- Option-Trading-Session-4Document52 pagesOption-Trading-Session-4rakshitsumit08No ratings yet

- Analysis & Interpretation of Financial StatementsDocument10 pagesAnalysis & Interpretation of Financial StatementsJeff LacasandileNo ratings yet

- 134-Analysis of Mutual Fund Scheme With Special Reference To ICICI Prudential Mutual FundDocument49 pages134-Analysis of Mutual Fund Scheme With Special Reference To ICICI Prudential Mutual Fundshree nathNo ratings yet

- CSM IiDocument9 pagesCSM IiKartik ChellNo ratings yet

- Market Research QuestionsDocument4 pagesMarket Research QuestionsJoe P PokaranNo ratings yet

- MM Flour MillDocument8 pagesMM Flour MillSulman HabibNo ratings yet

- Lesson 4 ContinuationDocument2 pagesLesson 4 ContinuationTyro PaulNo ratings yet

- Draft Letter of Offer (Company Update)Document36 pagesDraft Letter of Offer (Company Update)Shyam SunderNo ratings yet

- DCX Past-Attendees-List 2022 V1Document9 pagesDCX Past-Attendees-List 2022 V1Ravi ReadsNo ratings yet

- BM1 Sybcom A 001 NamanDocument10 pagesBM1 Sybcom A 001 NamanNaman AgrawalNo ratings yet

- Fin Past Years December 2019Document3 pagesFin Past Years December 2019Khairi HuzaifiNo ratings yet

- Investment Policy StatementDocument4 pagesInvestment Policy StatementKazi Ajwad Ahmed0% (1)

- Comparitive Study of Royal Enfield-1Document92 pagesComparitive Study of Royal Enfield-1Kush Jain50% (2)

- Percentage Taxation2Document5 pagesPercentage Taxation2Ahleeya Ramos100% (3)

- 324-Theme Based Papers (TBP) - 643-1-10-20200323Document5 pages324-Theme Based Papers (TBP) - 643-1-10-20200323vaniNo ratings yet

- Global, Multinational International, and Transnational CompaniesDocument8 pagesGlobal, Multinational International, and Transnational CompaniesDhirendra Kumar Sharma100% (1)

- Macroeconomics Canadian 14th Edition Mcconnell Solutions ManualDocument25 pagesMacroeconomics Canadian 14th Edition Mcconnell Solutions ManualStephenChavezgkze100% (60)

- David Ruiz Tarea 12-13Document33 pagesDavid Ruiz Tarea 12-131006110950No ratings yet

- ECN358Document3 pagesECN358reddepedoNo ratings yet

- Swot Analysis - FlipkartDocument2 pagesSwot Analysis - FlipkartAbhay YadavNo ratings yet

- 5.1 Cash DiscountsDocument15 pages5.1 Cash DiscountsPearl DavidNo ratings yet

- Accounting QuestionsDocument12 pagesAccounting QuestionsFLORENCE DE CASTRONo ratings yet

- Foreign Currency Transactions and TranslationsDocument5 pagesForeign Currency Transactions and TranslationsKenneth PimentelNo ratings yet

- EconomicsDocument129 pagesEconomicsIslamiaNo ratings yet

- Chapter 1 Corporate FinanceDocument11 pagesChapter 1 Corporate FinanceYuk SimNo ratings yet

- m9.0 SCM Customer ServiceDocument28 pagesm9.0 SCM Customer ServiceDwaraka MayeeNo ratings yet

- Compensation Management - Chapter 7Document13 pagesCompensation Management - Chapter 7Wantip SusubNo ratings yet

- Paper - 2: Strategic Financial Management: © The Institute of Chartered Accountants of IndiaDocument20 pagesPaper - 2: Strategic Financial Management: © The Institute of Chartered Accountants of IndiaManikandan VasudevanNo ratings yet

- Presentation On Logistic System Analysis and DesignDocument9 pagesPresentation On Logistic System Analysis and DesignAnshuman ParasharNo ratings yet