Professional Documents

Culture Documents

2016 Jun Ans-3

Uploaded by

何健珩Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 Jun Ans-3

Uploaded by

何健珩Copyright:

Available Formats

Marks

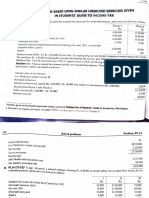

2 Mr Ma

Property tax assessment

Year of assessment 2014/15 (original)

$

Rental (32,000 x 7) 224,000 0·5

Premium (27,000 x 8/36) 6,000 1

Repair to water pipe 5,000 0·5

––––––––

Assessable value 235,000

Less: 20% statutory allowance (47,000) 0·5

––––––––

Net assessable value 188,000

––––––––

––––––––

Tax at 15% 28,200 0·5

––––––––

––––––––

Non-adjusted items: rental deposit $64,000, management fee $16,000, property agency fee $16,000, mortgage

interest $57,000.

0·5 marks each, maximum 1·5

Property tax assessment

Year of assessment 2015/16 (original)

$

Rental (32,000 x 2 (April to May 2015)) 64,000 0·5

Premium (27,000 – 6,000) 21,000 1

Less: Irrecoverable rent ((32,000 x 5) – 64,000) (96,000) 1

–––––––

Irrecoverable rent carried back (11,000)

–––––––

–––––––

Property tax assessment

Year of assessment 2014/15 (revised)

$

Rental 224,000

Premium 6,000

Repair to water pipe 5,000

––––––––

235,000 0·5

Less: Irrecoverable rent carried back (11,000) 1

––––––––

Assessable value 224,000

Less: 20% statutory allowance (44,800) 0·5

––––––––

Net assessable value 179,200

––––––––

––––––––

Tax at 15% 26,880 0·5

Less: Tax paid (28,200)

––––––––

Tax refunded (1,320) 0·5

––––––––

–––––––– –––

10

–––

3 Mrs Li

(a) Any person who without reasonable excuse makes an incorrect return by omitting or understating their

taxable income is guilty of an offence (s.80(2)). The Commissioner of Inland Revenue (CIR) may institute

proceedings in the court, which may impose a fine of $10,000 plus treble the amount of tax which has or

would have been undercharged as a result of the omission or understatement. The CIR may also compound

the offence (s.80(5)). 1

Where the taxpayer is suspected of having evaded tax with fraud and wilful intention, the CIR can prosecute

him/her (s.82). Fraud and wilful evasion include:

(1) an omission from a return;

(2) a false entry or statement in a return;

(3) a false statement in a claim for a deduction or an allowance; and

(4) signing a statement or return without reasonable grounds for believing that it is true. 2

18

You might also like

- McGraw Hill Connect Question Bank Assignment 4Document2 pagesMcGraw Hill Connect Question Bank Assignment 4Jayann Danielle MadrazoNo ratings yet

- Chapter III - Delegation of Authority MatrixDocument5 pagesChapter III - Delegation of Authority MatrixMuhammad WasiNo ratings yet

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Document4 pagesComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonNo ratings yet

- FirstStrike PlusDocument5 pagesFirstStrike Plusartus14No ratings yet

- Startup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternDocument4 pagesStartup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternFrank Gruber50% (2)

- Template For Accounting ManualDocument4 pagesTemplate For Accounting ManualKent TacsagonNo ratings yet

- 705 - PGBP AdjustmentsDocument10 pages705 - PGBP AdjustmentsKumar SwamyNo ratings yet

- Joint Stock CompaniesDocument16 pagesJoint Stock CompaniesJoynul Abedin100% (8)

- 2018 Dec Ans-5Document1 page2018 Dec Ans-5何健珩No ratings yet

- 2018 Dec Ans-5-6Document2 pages2018 Dec Ans-5-6何健珩No ratings yet

- 2018 Jun Ans-4Document1 page2018 Jun Ans-4何健珩No ratings yet

- 2019 Dec Ans-5-6Document2 pages2019 Dec Ans-5-6何健珩No ratings yet

- 2017 Jun Ans-6Document1 page2017 Jun Ans-6何健珩No ratings yet

- 2016 Dec Ans-6Document1 page2016 Dec Ans-6何健珩No ratings yet

- 2017 Dec Ans-4Document1 page2017 Dec Ans-4何健珩No ratings yet

- 2016 Jun Ans-6-7Document2 pages2016 Jun Ans-6-7何健珩No ratings yet

- 2017 Dec Ans-6Document1 page2017 Dec Ans-6何健珩No ratings yet

- 2015 Jun Ans-7Document1 page2015 Jun Ans-7何健珩No ratings yet

- 2015 Jun Ans-5Document1 page2015 Jun Ans-5何健珩No ratings yet

- 2015 Jun Ans-8Document1 page2015 Jun Ans-8何健珩No ratings yet

- 2019 Dec Ans-7Document1 page2019 Dec Ans-7何健珩No ratings yet

- 2017 Dec Ans-4-5Document2 pages2017 Dec Ans-4-5何健珩No ratings yet

- 2019 Jun Ans-8Document1 page2019 Jun Ans-8何健珩No ratings yet

- 2018 Dec Ans-6-7Document2 pages2018 Dec Ans-6-7何健珩No ratings yet

- 6int 2004 Dec ADocument8 pages6int 2004 Dec Aapi-19836745No ratings yet

- 6gbr 2004 Dec ADocument8 pages6gbr 2004 Dec Aapi-19836745No ratings yet

- 2015 Dec Ans-8Document1 page2015 Dec Ans-8何健珩No ratings yet

- P6uk 2018 Jun ADocument11 pagesP6uk 2018 Jun ADilawar HayatNo ratings yet

- 2017 Jun Ans-5Document1 page2017 Jun Ans-5何健珩No ratings yet

- 2015 Dec Ans-5Document1 page2015 Dec Ans-5何健珩No ratings yet

- 6int 2005 Dec ADocument7 pages6int 2005 Dec Aapi-19836745No ratings yet

- 2016 Jun Ans-5-6Document2 pages2016 Jun Ans-5-6何健珩No ratings yet

- 2-3mwi 2004 Dec ADocument13 pages2-3mwi 2004 Dec Aanga100% (1)

- F6CYP AnsDocument11 pagesF6CYP AnsVasunNo ratings yet

- 6int 2008 Dec ADocument6 pages6int 2008 Dec ACharles_Leong_3417No ratings yet

- J17 DipIFR - AnswersDocument8 pagesJ17 DipIFR - Answers刘宝英No ratings yet

- Daily Journal 080723Document2 pagesDaily Journal 080723Usmän MïrżäNo ratings yet

- Finals Assignment 1Document1 pageFinals Assignment 1Mary Kris CaparosoNo ratings yet

- Uk3 2010 Jun ADocument7 pagesUk3 2010 Jun AApple ChinNo ratings yet

- CSCIDocument4 pagesCSCIАннаNo ratings yet

- Financial Statements For Sole Partnership - KatDocument12 pagesFinancial Statements For Sole Partnership - KatKathryn ParadisosNo ratings yet

- MJ17 - Hybrids - P6UK - AMENDED AnswersDocument12 pagesMJ17 - Hybrids - P6UK - AMENDED AnswersHassan jalilNo ratings yet

- Financial Accounting: Enter Your Name HereDocument2 pagesFinancial Accounting: Enter Your Name HereNasrullah IqbalNo ratings yet

- TXPOL 2019 Dec ADocument8 pagesTXPOL 2019 Dec AKAH MENG KAMNo ratings yet

- F6mys 2017 Marjun ADocument7 pagesF6mys 2017 Marjun AChan HF PktianNo ratings yet

- Txmwi 2018 Jun ADocument6 pagesTxmwi 2018 Jun AangaNo ratings yet

- ATXUK 2018 Sept ADocument10 pagesATXUK 2018 Sept ARaza AliNo ratings yet

- Dipifr 2006 Jun ADocument12 pagesDipifr 2006 Jun ARishiaendra CoolNo ratings yet

- AssignmentDocument1 pageAssignmentwajihaabid441No ratings yet

- F6MWI 2013 Jun AnsDocument8 pagesF6MWI 2013 Jun AnsangaNo ratings yet

- Atxuk 2018 Dec ADocument10 pagesAtxuk 2018 Dec ARaza AliNo ratings yet

- Adjusting Entries - ProblemDocument1 pageAdjusting Entries - ProblemRianne NavidadNo ratings yet

- Certificate of Payment: tJ6/IlDocument6 pagesCertificate of Payment: tJ6/IlAjay MedikondaNo ratings yet

- Irc Kit JJ20Document35 pagesIrc Kit JJ20Amir ArifNo ratings yet

- S20 TX ZAF Sample AnswersDocument8 pagesS20 TX ZAF Sample AnswersKAH MENG KAMNo ratings yet

- 07 Cash Flow PDFDocument1 page07 Cash Flow PDFAbrarNo ratings yet

- 2019 Jun Ans-7-8Document2 pages2019 Jun Ans-7-8何健珩No ratings yet

- ScreenshotDocument1 pageScreenshotKalyanGurramNo ratings yet

- Txmwi 2018 Dec ADocument7 pagesTxmwi 2018 Dec AangaNo ratings yet

- Example of Workpaper FlowDocument17 pagesExample of Workpaper FlowDharmendra SinghNo ratings yet

- Uk3 2009 Dec ADocument6 pagesUk3 2009 Dec AApple ChinNo ratings yet

- P6MYS 2012 Dec ADocument15 pagesP6MYS 2012 Dec AFakhrul Azman NawiNo ratings yet

- Sum On House PropertyDocument9 pagesSum On House PropertyVaishnaviNo ratings yet

- F6RUS AnsDocument9 pagesF6RUS AnsСветлана КозловаNo ratings yet

- Problems On Income From House Property - 2023 2024Document3 pagesProblems On Income From House Property - 2023 2024goli pandeyNo ratings yet

- TXUK 2019 MarJun ADocument11 pagesTXUK 2019 MarJun AmdNo ratings yet

- Acct4410 2022 Spring - Profit TaxDocument2 pagesAcct4410 2022 Spring - Profit Tax何健珩No ratings yet

- 2017 Dec Q-7-8Document2 pages2017 Dec Q-7-8何健珩No ratings yet

- 2016 Dec Q-7-8Document2 pages2016 Dec Q-7-8何健珩No ratings yet

- 2018 Dec Q-14-15Document2 pages2018 Dec Q-14-15何健珩No ratings yet

- 2015 Dec Ans-5Document1 page2015 Dec Ans-5何健珩No ratings yet

- 2016 Jun Q-4Document1 page2016 Jun Q-4何健珩No ratings yet

- 2018 Jun Q-7-8Document2 pages2018 Jun Q-7-8何健珩No ratings yet

- Lecture Note 4aDocument5 pagesLecture Note 4a何健珩No ratings yet

- Take Home Exercise No 4 - Salaries Tax Computation (2023S)Document3 pagesTake Home Exercise No 4 - Salaries Tax Computation (2023S)何健珩No ratings yet

- Business Plan: Social Impact Project - ShinyhkDocument24 pagesBusiness Plan: Social Impact Project - Shinyhk何健珩No ratings yet

- Take Home Exercise No 2 - Property Tax (2023S)Document2 pagesTake Home Exercise No 2 - Property Tax (2023S)何健珩No ratings yet

- Free The FoodDocument18 pagesFree The Food何健珩No ratings yet

- Lecture 7 - E-Commerce (FinTech)Document30 pagesLecture 7 - E-Commerce (FinTech)何健珩No ratings yet

- Lecture 10. The Goods (And Services) Market in An Open EconomyDocument35 pagesLecture 10. The Goods (And Services) Market in An Open Economy何健珩No ratings yet

- Lecture 13 - Big Data (Analytics For Text and Network)Document31 pagesLecture 13 - Big Data (Analytics For Text and Network)何健珩No ratings yet

- Lecture 9 - Digital Platform (Basics)Document30 pagesLecture 9 - Digital Platform (Basics)何健珩No ratings yet

- LABU2040 Business Case Analysis: Wk. 8-9 Writing SkillsDocument21 pagesLABU2040 Business Case Analysis: Wk. 8-9 Writing Skills何健珩No ratings yet

- Sohrabi 2019Document42 pagesSohrabi 2019Brayan TillaguangoNo ratings yet

- Karla Company P-WPS OfficeDocument14 pagesKarla Company P-WPS OfficeKris Van HalenNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Document39 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNo ratings yet

- 4 1ComparingAlternativesDocument59 pages4 1ComparingAlternativestouhidNo ratings yet

- Electronic Trading ConceptsDocument98 pagesElectronic Trading ConceptsAnurag TripathiNo ratings yet

- Ihsedu Itoh Green Chemicals Marketing Pvt. LTD 8 Annual Report 2017-18Document50 pagesIhsedu Itoh Green Chemicals Marketing Pvt. LTD 8 Annual Report 2017-18William Veloz DiazNo ratings yet

- Q1. Write Down The Accounting Entries Passed While Issuing A Dd/Po ? AnsDocument6 pagesQ1. Write Down The Accounting Entries Passed While Issuing A Dd/Po ? Ansabhishek gautamNo ratings yet

- Act 3122 Intermediate Financial Accounting Ii: Lecturer: Dr. Mazrah Malek Room: A302Document10 pagesAct 3122 Intermediate Financial Accounting Ii: Lecturer: Dr. Mazrah Malek Room: A302Shahrul FadreenNo ratings yet

- A Case Study On Moser BaerDocument13 pagesA Case Study On Moser BaerShubham AgarwalNo ratings yet

- Philander Anver Francois-5k01014Document1 pagePhilander Anver Francois-5k01014ShaneNo ratings yet

- Meta Reports Fourth Quarter and Full Year 2022 Results 2023Document12 pagesMeta Reports Fourth Quarter and Full Year 2022 Results 2023Fady EhabNo ratings yet

- Ssi FinancingDocument7 pagesSsi FinancingAnanya ChoudharyNo ratings yet

- Dear Sir/Madam, My Full Name Is Abdullahi Yusuf Moalim NurDocument1 pageDear Sir/Madam, My Full Name Is Abdullahi Yusuf Moalim Nurmucaashaq ibnu maxamedNo ratings yet

- Simple and Compound InterestDocument2 pagesSimple and Compound InterestJeffrey Del MundoNo ratings yet

- Effects of A High CAD EssayDocument2 pagesEffects of A High CAD EssayfahoutNo ratings yet

- Financial Report (October 2017)Document2 pagesFinancial Report (October 2017)Marija DukićNo ratings yet

- Acc CH 3Document7 pagesAcc CH 3Tajudin Abba RagooNo ratings yet

- A Simple Get Rich Quick IdeaDocument2 pagesA Simple Get Rich Quick Ideaversalas24No ratings yet

- Jabatan Bendahari: Tarikh Kredit Debit Keterangan Nombor Rujukan KampusDocument1 pageJabatan Bendahari: Tarikh Kredit Debit Keterangan Nombor Rujukan KampusArief HakimiNo ratings yet

- ECM - Registration Form PDFDocument1 pageECM - Registration Form PDFJohn MegryanNo ratings yet

- Tr3ndy Jon's Trading StrategiesDocument3 pagesTr3ndy Jon's Trading Strategieshotdog10No ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet