Professional Documents

Culture Documents

2018 Jun Q-6

2018 Jun Q-6

Uploaded by

何健珩Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2018 Jun Q-6

2018 Jun Q-6

Uploaded by

何健珩Copyright:

Available Formats

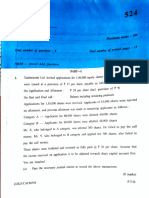

5 Peter Jones, an American citizen, is single and does not have any relatives in Hong Kong.

Peter is employed by a

US‑operated entity, JK Technology Inc (JK). His employment contract, which is enforceable in the US, requires Peter to

travel to Asian countries to oversee the operations of JK’s subsidiaries. During the year ended 31 March 2018, Peter’s

travelling schedule was as follows:

Hong Kong 210 days

Singapore 90 days

USA 65 days (including 15 days’ annual leave)

––––––––

365 days

––––––––

For the year ended 31 March 2018, Peter’s remuneration from JK together with his relevant personal expenditures

were as shown below (all amounts are denominated in Hong Kong dollars):

(1) Annual salary of $2,400,000.

(2) A hardship allowance of $10,000 per month.

(3) A company car and a driver for use in Hong Kong. The car is worth $400,000 and is registered in the name of

JK. The driver was hired by JK at $20,000 per month. Peter incurred $50,000 for petrol and car maintenance

during the year, for which he was fully reimbursed by JK. Peter estimated that about 20% of the car’s usage was

for his personal use.

(4) Peter lives in a hotel room during his stays in Hong Kong. The total hotel charges of $300,000 were paid by JK.

Peter agreed that 5% of the hotel charges would be deducted from his salary in return for an upgrade of the hotel

package.

(5) In June 2017, Peter had a car accident on his way to a client meeting in Hong Kong and was hospitalised for

three weeks. The total hospital bill of $440,000 was paid by Peter. He subsequently made a claim to JK to

recover these costs. In January 2018, Peter obtained a full refund from JK, comprising $300,000 reimbursed by

JK’s insurance company under JK’s employees’ group insurance policy and $140,000 subsidised directly by JK.

(6) Peter received a bonus of $160,000, 30% of which he donated to the US Red Cross.

(7) On 1 February 2018, Peter was granted an option to acquire 60,000 shares in JK, at $5 each. He paid $6,000

for this option. On 1 March 2018, Peter sold one-third of the share option for $45,000 and on the same day,

exercised the balance of the option himself. On 31 March 2018, Peter sold all of the shares acquired. The fair

market values per share were as follows:

1 February 2018 $8

1 March 2018 $9

31 March 2018 $10

(8) Peter paid an annual subscription of $10,000 to the Hong Kong Jockey Club.

(9) JK settled Peter’s Hong Kong and Singapore tax bills of $240,000 and $10,000, respectively.

(10) No mandatory provident fund contribution was made in Hong Kong.

Required:

Calculate the Hong Kong salaries tax payable by Peter Jones for the year of assessment 2017/18.

Note: You should ignore overseas tax, including the effect of any comprehensive double taxation agreement between

Hong Kong and other countries.

(15 marks)

11 [P.T.O.

You might also like

- USPS Mail GuideDocument1 pageUSPS Mail GuideBo KoNo ratings yet

- Ilovepdf MergedDocument40 pagesIlovepdf Merged何健珩No ratings yet

- Investment in Equity SecuritiesDocument19 pagesInvestment in Equity SecuritiesNicholai NonanNo ratings yet

- Quiz 3 ProblemsDocument11 pagesQuiz 3 ProblemsRiezel PepitoNo ratings yet

- Swing Trading The Speculator Way 124Document10 pagesSwing Trading The Speculator Way 124KL RoyNo ratings yet

- Copy Paste Copy PasteDocument68 pagesCopy Paste Copy PasteHiba MunawarNo ratings yet

- Accounting For Investments in AssociatesDocument90 pagesAccounting For Investments in AssociatesJay-L TanNo ratings yet

- World Trade OrganizationDocument122 pagesWorld Trade OrganizationmanpreetsinghmandayNo ratings yet

- ACC110 P2 Q2 Answer - Docx 2Document13 pagesACC110 P2 Q2 Answer - Docx 2Sherwin SarzueloNo ratings yet

- CONFRACS - Module 7 - Non-Current Assets Held For SaleDocument14 pagesCONFRACS - Module 7 - Non-Current Assets Held For SaleMatth FlorezNo ratings yet

- Deed of Sale CorpDocument2 pagesDeed of Sale CorpJessa Marie Landero67% (3)

- 2019 Dec Q-11Document1 page2019 Dec Q-11何健珩No ratings yet

- 2016 Dec Q-6Document1 page2016 Dec Q-6何健珩No ratings yet

- 2021 Unit - 3 - QuestionsDocument2 pages2021 Unit - 3 - Questions日日日No ratings yet

- 2021 Unit 4 Tutorial QuestionsDocument6 pages2021 Unit 4 Tutorial Questions日日日No ratings yet

- 2016 Jun Q-6Document1 page2016 Jun Q-6何健珩No ratings yet

- 2017 Dec Q-7-8Document2 pages2017 Dec Q-7-8何健珩No ratings yet

- 2019 Jun Q-10-11Document2 pages2019 Jun Q-10-11何健珩No ratings yet

- The Institute of Administration and CommerceDocument4 pagesThe Institute of Administration and CommercebensonNo ratings yet

- Soal Kuis Uas - AklDocument3 pagesSoal Kuis Uas - AklBastian Nugraha SiraitNo ratings yet

- Hong Kong Shue Yan University Bus 405 Tax Planning 3 Homework 1Document2 pagesHong Kong Shue Yan University Bus 405 Tax Planning 3 Homework 1陈浩贤No ratings yet

- Case 1 Q1Document2 pagesCase 1 Q1Talha SajadNo ratings yet

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- T03 - Source of IncomeDocument10 pagesT03 - Source of Incometing ting shihNo ratings yet

- CBE June 2021 - QDocument10 pagesCBE June 2021 - QNguyễn Hồng NgọcNo ratings yet

- Annual Report 09-10Document42 pagesAnnual Report 09-10rvaidya2000No ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- 2015 Jun Q-10Document1 page2015 Jun Q-10何健珩No ratings yet

- (Template) MME 308 Mid Term ExaminationDocument1 page(Template) MME 308 Mid Term ExaminationPrashant Kesharwani 5-Yr IDD Metallurgical Engg., IIT(BHU), VaranasiNo ratings yet

- Arithmetic Compound InterestDocument2 pagesArithmetic Compound InterestTejasree 416No ratings yet

- TQ U3 Salaries 1 2019 PDFDocument2 pagesTQ U3 Salaries 1 2019 PDFhelenNo ratings yet

- Name of The Issue: NTPC: Particulars %Document0 pagesName of The Issue: NTPC: Particulars %Akshat NautiyalNo ratings yet

- 12 Altprob 8eDocument4 pages12 Altprob 8eRama DulceNo ratings yet

- Drill 2 Partnership OperationDocument1 pageDrill 2 Partnership OperationcpacpacpaNo ratings yet

- f6hkg_2011_dec_qDocument9 pagesf6hkg_2011_dec_qconniechan530.ccNo ratings yet

- Comprehensive Exam QuestionsDocument33 pagesComprehensive Exam QuestionsTrisha Mae LandichoNo ratings yet

- Prelim Take-Home ExamDocument8 pagesPrelim Take-Home ExamMelanie SamsonaNo ratings yet

- 1 Year 2 Year 3 Year 4Document3 pages1 Year 2 Year 3 Year 4alexNo ratings yet

- MODADV3 Handouts 1 of 2Document23 pagesMODADV3 Handouts 1 of 2Dennis ChuaNo ratings yet

- Overview of Current Investment Scenario in IndiaDocument7 pagesOverview of Current Investment Scenario in IndiakarnvatsNo ratings yet

- HKALE PACCT Question Book 2001 Paper 1Document15 pagesHKALE PACCT Question Book 2001 Paper 1Elien ZosNo ratings yet

- Portfolio Investment: Submitted by Group 21 at Money Mirage at Thrive 2011Document16 pagesPortfolio Investment: Submitted by Group 21 at Money Mirage at Thrive 2011Deepak PoddarNo ratings yet

- 5.rensing, IncDocument1 page5.rensing, IncFranz AppleNo ratings yet

- University Week Series Asynchronous Act 2 10.12.2022Document2 pagesUniversity Week Series Asynchronous Act 2 10.12.2022Elize NapuliNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Corporation DividendsDocument2 pagesCorporation DividendsAlcyra SantosNo ratings yet

- Activity 1 Audit of Shareholders EquityDocument4 pagesActivity 1 Audit of Shareholders EquityAnna Carlaine PosadasNo ratings yet

- Mid-Term Test QuestionDocument6 pagesMid-Term Test QuestionCYNo ratings yet

- 9706 w10 QP 41Document8 pages9706 w10 QP 41Diksha KoossoolNo ratings yet

- Actuarial Society of India Examinations: Subject 102 - Financial MathematicsDocument5 pagesActuarial Society of India Examinations: Subject 102 - Financial MathematicsbrcsNo ratings yet

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliNo ratings yet

- Quiz Shareholders Equity TH With Questions PDFDocument4 pagesQuiz Shareholders Equity TH With Questions PDFMichael Angelo FangonNo ratings yet

- ForexDocument20 pagesForexmail2piyush0% (2)

- Summer 2010 QuestionsDocument5 pagesSummer 2010 QuestionstaubushNo ratings yet

- FFM - FINAL - SPRING 2020 - SECTION 1047 - Muhammad MansoorDocument3 pagesFFM - FINAL - SPRING 2020 - SECTION 1047 - Muhammad MansoorAbdul Muqsit KhanNo ratings yet

- Lecture_Problems_Investment_in_Debt_Securities.xlsxDocument5 pagesLecture_Problems_Investment_in_Debt_Securities.xlsxcalliemozartNo ratings yet

- Lecture # 58Document5 pagesLecture # 58HussainNo ratings yet

- TEST Paper 1Document7 pagesTEST Paper 1Abhu ArNo ratings yet

- FPDocument20 pagesFPRadhika ParekhNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Deal Tracker Annual Edition 2010 - Test VersionDocument116 pagesDeal Tracker Annual Edition 2010 - Test Versionraghu552012No ratings yet

- Deal Tracker Annual Edition 2010 Test VersionDocument116 pagesDeal Tracker Annual Edition 2010 Test VersiondidwaniasNo ratings yet

- Summer_2014.pdfDocument11 pagesSummer_2014.pdfAssassin GodNo ratings yet

- Accounting Textbook Solutions - 50Document19 pagesAccounting Textbook Solutions - 50acc-expertNo ratings yet

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaNo ratings yet

- 2017 Jun Q-7Document1 page2017 Jun Q-7何健珩No ratings yet

- 2016 Dec Q-7-8Document2 pages2016 Dec Q-7-8何健珩No ratings yet

- 2017 Dec Q-9-10Document2 pages2017 Dec Q-9-10何健珩No ratings yet

- 2017 Dec Q-7-8Document2 pages2017 Dec Q-7-8何健珩No ratings yet

- (Revised Solution) Take Home Assignment 4 (2023S)Document5 pages(Revised Solution) Take Home Assignment 4 (2023S)何健珩No ratings yet

- 2018 Jun Ans-5Document1 page2018 Jun Ans-5何健珩No ratings yet

- 2018 Jun Q-7-8Document2 pages2018 Jun Q-7-8何健珩No ratings yet

- 2016 Jun Q-4Document1 page2016 Jun Q-4何健珩No ratings yet

- Acct4410 2022 Spring - Profit TaxDocument2 pagesAcct4410 2022 Spring - Profit Tax何健珩No ratings yet

- 2018 Dec Q-14-15Document2 pages2018 Dec Q-14-15何健珩No ratings yet

- 2019 Jun Q-12-13Document2 pages2019 Jun Q-12-13何健珩No ratings yet

- Take Home Exercise No 1 - Tax Administration (2023S) - 1Document3 pagesTake Home Exercise No 1 - Tax Administration (2023S) - 1何健珩No ratings yet

- 2015 Dec Ans-5Document1 page2015 Dec Ans-5何健珩No ratings yet

- Source of ProfitsDocument1 pageSource of Profits何健珩No ratings yet

- 2016 Jun Ans-3Document1 page2016 Jun Ans-3何健珩No ratings yet

- Take Home Exercise No 2 - Property Tax (2023S)Document2 pagesTake Home Exercise No 2 - Property Tax (2023S)何健珩No ratings yet

- Take Home Exercise No 4 - Salaries Tax Computation (2023S)Document3 pagesTake Home Exercise No 4 - Salaries Tax Computation (2023S)何健珩No ratings yet

- 2018 Dec Q-12Document1 page2018 Dec Q-12何健珩No ratings yet

- Lecture Note 4aDocument5 pagesLecture Note 4a何健珩No ratings yet

- 2018 Jun Ans-4Document1 page2018 Jun Ans-4何健珩No ratings yet

- Lecture 13 - Big Data (Analytics For Text and Network)Document31 pagesLecture 13 - Big Data (Analytics For Text and Network)何健珩No ratings yet

- Free The FoodDocument18 pagesFree The Food何健珩No ratings yet

- Lecture 7 - E-Commerce (FinTech)Document30 pagesLecture 7 - E-Commerce (FinTech)何健珩No ratings yet

- Lecture 9 - Digital Platform (Basics)Document30 pagesLecture 9 - Digital Platform (Basics)何健珩No ratings yet

- Business Plan: Social Impact Project - ShinyhkDocument24 pagesBusiness Plan: Social Impact Project - Shinyhk何健珩No ratings yet

- Lecture 10. The Goods (And Services) Market in An Open EconomyDocument35 pagesLecture 10. The Goods (And Services) Market in An Open Economy何健珩No ratings yet

- LABU2040 Business Case Analysis: Wk. 8-9 Writing SkillsDocument21 pagesLABU2040 Business Case Analysis: Wk. 8-9 Writing Skills何健珩No ratings yet

- Bernie Report-1Document2 pagesBernie Report-1Patricia Dizon BulosanNo ratings yet

- 1901 Bir Form New Business Sole App - FormDocument4 pages1901 Bir Form New Business Sole App - Formneil dela penaNo ratings yet

- Bu8201 Tutorial 7 Presentation - FinalDocument32 pagesBu8201 Tutorial 7 Presentation - FinalArvin LiangdyNo ratings yet

- Case Study Real Estate Sector: Shubham SainiDocument4 pagesCase Study Real Estate Sector: Shubham Sainishubham sainiNo ratings yet

- Private Equity & Venture Capital: in The Middle East & AfricaDocument16 pagesPrivate Equity & Venture Capital: in The Middle East & AfricaLewoye BantieNo ratings yet

- The Retail Clothing IndustryDocument11 pagesThe Retail Clothing IndustryPriyesh GadaNo ratings yet

- CAFM Ques Paper Dec23Document15 pagesCAFM Ques Paper Dec23droom8521No ratings yet

- Chapter 1Document39 pagesChapter 1Haaromsaa Taayyee TolasaaNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument5 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions ManualChristopherDyerkczqw100% (15)

- EduFin Position PaperDocument88 pagesEduFin Position PaperComunicarSe-ArchivoNo ratings yet

- Disposal of Subsidiary Practice QuestionDocument3 pagesDisposal of Subsidiary Practice Questionademoji00No ratings yet

- Nature of MacroeconomicsDocument16 pagesNature of MacroeconomicsRegina LintuaNo ratings yet

- Long-Term Liabilities: True-FalseDocument43 pagesLong-Term Liabilities: True-Falsespur iousNo ratings yet

- How To Use This Competency-Based Learning MaterialDocument29 pagesHow To Use This Competency-Based Learning Materialaldren cedamon0% (1)

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- Chapter 15 - Answer-2Document7 pagesChapter 15 - Answer-2Matthew Robert DesiderioNo ratings yet

- Wage Order No. RBIII-23Document1 pageWage Order No. RBIII-23ECMH ACCOUNTING AND CONSULTANCY SERVICES100% (1)

- Accounting For Derivatives and Hedge Relationships (PFRS 9)Document9 pagesAccounting For Derivatives and Hedge Relationships (PFRS 9)Mary Yvonne AresNo ratings yet

- WindAcre Nielsen PresentationDocument70 pagesWindAcre Nielsen PresentationAndrei FilippovNo ratings yet

- Unit 1 WORKING CAPITAL MGTDocument22 pagesUnit 1 WORKING CAPITAL MGTsanthosh prabhu mNo ratings yet

- Eonnext Statement 2023 03 06Document3 pagesEonnext Statement 2023 03 06samirapamente01No ratings yet

- ACC LESSON 1 Balance SheetDocument38 pagesACC LESSON 1 Balance SheetRojane L. AlcantaraNo ratings yet