Professional Documents

Culture Documents

Index

Uploaded by

ansgroupofunique2013Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Index

Uploaded by

ansgroupofunique2013Copyright:

Available Formats

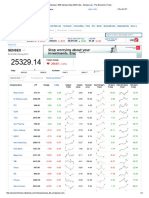

6 शेयर बाजार नई दिल्ी | सोमवार, 25 मार्च 2024

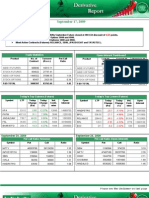

एिएसई िेररवेनटव में एफआईआई निवेश निफटी सिैपशॉट एिएसई सूचकांक बीएसई सूचकांक

Week ended Mar 15 Week ended Mar 22 Mar 18 Mar 19 Mar 20 Mar 21 Mar 22 Mar 15 Mar 22 % Chg Mar 15 Mar 22 Change % Chg

Contract (Nos) Tovr (`bn)Contract (Nos) Tovr (`bn) Nifty 50 Spot 22055.7 21817.4 21839.1 22011.9 22096.8 SPOTNifty 50 22023.3 22096.8 0.3 Sensex 72643.4 72831.9 188.5 0.3

Index Future 636791 552.2 273040 224.7 Nifty 50 Future 22135.5 21886.5 21910.1 22102.5 22165.5 Bank Nifty 46594.1 46863.8 0.6 OUTPERFORM SENSEX

Stock Future 3474336 2930.1 1365662 1102.8 Prem/Discount 79.8 69.1 71.0 90.6 68.7 Metal 26535.7 27839.4 1303.7 4.9

Nifty IT 37500.7 35188.4 -6.2

Index Option 327813986 284623.6 186762644 155742.7 Fut(Open Int) 16692 17073 16403 16473 16115 Auto 46319.8 48250.0 1930.2 4.2

Futures (LTP)

Stock Option 5800352 5242.2 2896825 2500.7 Fut(Contract) 154025 192210 180307 168845 225611 Cap. Goods 56820.1 58726.4 1906.3 3.4

Nifty 50 22133.2 22165.4 0.1

Total 337725465 293348.1 191298171 159326.1 Fut(Value Rs Cr) 17070.5 21136.5 19794.7 18679.8 25007.7 PSU 17555.3 17990.4 435.1 2.5

Bank Nifty 46694.7 46929.0 0.5

PCR(Open Int) 0.9 0.7 0.8 1.0 1.2 Smallcap 42012.8 42771.3 758.5 1.8

बीएसई 500 कंपनियों में एफआईआई शेयरधाररता

Nifty IT 46694.7 46929.0 0.5 Healthcare 33910.4 34489.2 578.8 1.7

PCR(Contract) 0.9 1.0 0.9 1.0 1.0

Major Call(Strike Price) 23000.0 22000.0 22000.0 22050.0 23000.0 Open Interest Midcap 38250.4 38801.2 550.8 1.4

IN % Dec -22 Mar -22 Jun -22 Sep -23 Dec -23 Major Call(LTP) 1.1 40.5 21.7 0.3 1.0 Nifty 50 16142950.0 16115150.0 -0.2 Oil & Gas 26886.3 27164.8 278.5 1.0

General Insurance Corp of India0.6 0.7 0.8 0.9 1.0 Bank Nifty 5461305.0 5578830.0 2.2 Cons Durable 50559.1 51003.9 444.8 0.9

Major Put(Strike Price) 21000.0 21000.0 21500.0 22000.0 22000.0

Gillette India 4.2 3.2 2.4 2.4 2.4 BSE-500 31360.7 31622.7 262.0 0.8

Major Put(LTP) 1.6 1.0 4.1 2.7 60.6 Nifty IT 5461305.0 5578830.0 2.2

Gland Pharma 5.0 4.6 3.1 5.2 4.3 BSE-200 9894.2 9966.5 72.3 0.7

Glaxosmithkline Pharmaceuticals2.7 2.7 2.9 3.0 3.4 BSE-100 22857.9 22989.0 131.1 0.6

पुट/कॉि रेनशयो तेजी / निरावट बीएसई

Glenmark Life Sciences 5.0 3.9 4.1 4.9 5.0

Bankex 52832.6 53105.8 273.2 0.5

Glenmark Pharmaceuticals 24.1 23.6 26.5 25.7 24.6

Global Health 29.2 29.7 30.2 30.2 30.7 UNDERPERFORM SENSEX

GMM Pfaudler 20.4 21.4 20.4 28.3 24.6 IT 37926.8 35824.7 -2102.0 -5.5

GMR Airports Infrastructure 28.2 28.6 28.4 28.3 27.7 TECk 17026.2 16207.2 -819.0 -4.8

Go Fashion (India) 16.7 16.7 11.2 11.2 12.3 FMCG 19384.4 19292.6 -91.8 -0.5

Godawari Power & Ispat 4.0 4.3 4.4 5.5 6.3

Godfrey Phillips India 10.4 10.6 10.6 10.4 10.6 Dollex-30 7198.2 7173.3 -24.9 -0.3

Godrej Consumer Products 24.4 24.1 23.9 23.9 23.3 Dollex-100 2854.0 2853.0 -0.9 0.0

Godrej Industries 10.1 10.7 0.3 10.7 10.6 Dollex-200 1988.1 1990.6 2.4 0.1

Godrej Properties 27.8 27.5 29.2 29.6 30.0

माक्केट एगीिेट्स

Granules India 26.1 25.6 23.1 23.2 20.5

Graphite India 6.2 5.3 5.4 5.6 5.5

Grasim Industries 15.4 15.2 15.1 15.0 15.3

Great Eastern Shipping Co. 26.4 27.2 27.4 28.4 27.7 WEEK END WEEK END

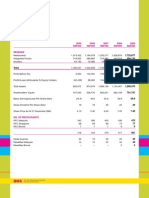

सेकटर पर िजर माक्केट पोजीशि BSE Mar 15 Mar 22 NSE Mar 15 Mar 22

Grindwell Norton 9.3 9.2 9.2 9.3 9.3

Gujarat Alkalies & Chemicals 2.6 2.7 2.6 2.5 2.7

Gujarat Ambuja Exports 6.3 6.0 5.3 5.3 5.4 Shares(In Lakhs) 49011 32221 Shares(In Lakhs) 241624 169125

Gujarat Fluorochemicals 6.4 5.5 7.1 5.5 5.2 TOP GAINERS OI ‘000 % chg TOP LOSERS OI ‘000 % chg HIGHEST OI % of MWL LOWEST OI % of MWL Turnover(In Crore) 62516 39231 Turnover(In crore) 590652 427834

Textiles 7490 32.5 Oil & gas 135895 -8.6 Nestle India 7220400 100.56 ICICI Lombard 3484500 6.82 Traded(000) 24011 15611 Traded(000) 216345 153381

IT - Software 298082 19.3 Sugar 17123 -8.2

एफआईआई / िीआईआई निवेश Non Ferrous Metals 237516 16.1 Pharmaceuticals 227174 -7.2

HAL

Hind Copper

18524700

62603600

97.67

95.60

L &T

Coromndl Int

27122400

2566900

9.77

10.25

Packaging

FMCG

13386

91169

15.2

14.8

Castings, Forgings & Fas 11127

Power Generation & Dist583864

-6.2

-5.9 Nat Alum 167670000 93.69 Godrej Cons 8032000 10.67 निनिवरी

Plantation & Plantation 22879 12.7 Hotels & Restaurants 33464 -5.9 India Cement 39906900 89.95 ICICI Bank 121312100 10.75

Cement 154799 12.2 Retail 5584 -5.7 BSE NSE

SAIL 259648000 89.80 Titan Company 9023525 10.79

Gas Distribution 412114 11.8 Diversified 26955 -5.1 DATE Trd. shares (bn) % Delivery Trd. shares (bn) % Delivery

RBL Bank 107065000 89.27 Infosys 70079200 11.20

Alcoholic Beverages 11481 11.4 Crude Oil & Natural Gas 203080 -5.1 Mar 22, 2024 6828.3 59.1 35862.4 36.0

Capital Goods-Non Elect 32572 8.8 Automobile 466830 -4.9 Aditya Bir Fa 72852000 87.21 Torrent Phar 2209500 11.35

Mar 21, 2024 5837.7 63.7 30320.9 39.7

Auto Ancillaries 336206 8.1 Metal 62604 -4.8 Bandhan Bank 166722500 6.23 Reliance Ind 74846250 11.44

Mar 20, 2024 7569.5 55.9 31845.3 32.1

OI As on Mar 22

Mar 19, 2024 6146.6 61.1 29777.7 36.4

कीमत में बढोतरी के साथ ओपि इंटरेसट कीमत में निरावट के साथ ओपि इंटरेसट Mar 18, 2024

Mar 15, 2024

5887.2

8047.6

55.2

51.7

31038.4

51929.6

34.8

38.6

Mar 14, 2024 10526.8 51.8 51525.7 32.9

Open Int as on Price as on Open Int as on Price as on Mar 13, 2024 13734.8 68.0 54943.4 37.5

Mar 15 Mar 22 % Chg Mar 15 Mar 22 % Chg Mar 15 Mar 22 % Chg Mar 15 Mar 22 % Chg Mar 12, 2024 7879.6 58.1 35495.1 38.2

Mar 11, 2024 8845.5 60.3 33290.2 41.3

Dr Lal PathLabs 1977300 2806800 42.0 2022.2 2128.8 5.3 TCS 13816250 18680725 35.2 4219.3 3910.9 -7.3

GAIL 132894600 182894775 37.6 173.8 174.1 0.2 Infosys 30305600 40550800 33.8 1634.0 1508.9 -7.7

SRF

Ipca Labs

3358875 4580625

2295150 3110900

36.4

35.5

2428.6

1165.6

2551.0

1196.1

5.0

2.6

HUL 14056200 18573000 32.1 2327.7 2256.6 -3.1

शेयर सूचकांकों में उतार चढाव

सपताह का शेयर (एबीबी इंनिया)

Alkem Labs 1107400 1429800 29.1 5045.2 4789.8 -5.1

Siemens 1057500 1421850 34.5 4771.3 4991.6 4.6 Dabur India 22286250 28698750 28.8 526.6 520.8 -1.1

1Mothersons S 156760900 209719800 33.8 111.4 116.3 4.4 CGCEL 18464400 23776200 28.8 275.5 269.4 -2.2

Hits new all-time high at Rs 6,021, Surged 43 per cent in last 6 months

SBI Life Ins 8737500 11319750 29.6 1500.0 1501.1 0.1 Oracle Fin 1179400 1501400 27.3 8453.3 8379.0 -0.9

MCX 2743200 3418000 24.6 3258.6 3336.9 2.4 Ambuja Cem 46535400 57870000 24.4 600.8 589.4 -1.9

Canara Bank 53082000 65874600 24.1 549.2 573.2 4.4 ACC 4937100 6004200 21.6 2503.0 2443.3 -2.4

Nat Alum 79035000 97762500 23.7 136.4 148.8 9.1 Atul 347550 421725 21.3 5993.9 5874.0 -2.0

Shriram TrFn 6557100 8024400 22.4 2266.8 2330.7 2.8 Adani Ports 45601600 54903200 20.4 1283.0 1281.6 -0.1

ITC 126968000 152956800 20.5 419.1 428.6 2.3 NIIT Techno 1415250 1691100 19.5 6116.4 5540.1 -9.4

Cadila Healt 7670700 9207000 20.0 983.9 999.8 1.6 Asian Paints 7774800 9281400 19.4 2867.6 2841.5 -0.9

Metropolis Heal 1455200 1725200 18.6 1594.0 1602.0 0.5 HDFC AMC 3266700 3879000 18.7 3818.7 3773.4 -1.2

Eicher Motor 3613050 4280150 18.5 3745.7 3988.4 6.5 Marico 14191200 16844400 18.7 500.2 497.8 -0.5

Glenmark 13598100 16095725 18.4 926.5 951.0 2.6 Abbott India 206560 244440 18.3 28404.4 27067.1 -4.7

Biocon 55305000 45345000 -18.0 251.7 252.2 0.2 Max Fin Sre 9548800 11152800 16.8 962.8 944.1 -1.9

Muthoot Finance 6856850 8087750 18.0 1341.3 1424.4 6.2 United Brew 2534000 2953200 16.5 1738.5 1730.6 -0.5

बीएसई 500 सेकटर सूचकांक वैश्वक सूचकांक

Mar 15 Mar 22 % chg Return (%) Sep 28, '19 1 week 1 month 3 month 6 month 1 year Return (%) Sep 28, '19 1 week 1 month 3 month 6 month 1 year

मुिाफे में BSE Sensex 72,831.9 0.3 -0.4 2.4 10.3 25.1 FTSE 100 7,930.9 2.6 3.2 3.0 3.2 4.8

S&P CNX Nifty 22,096.8 0.3 -0.5 3.5 12.3 28.8 Nikkei 255 40,888.4 5.6 4.6 23.3 26.2 48.9

Sobha 1244.2 1474.0 18.5

Swan Energy 570.4 665.5 16.7 BSE-100 22,989.0 0.6 -0.6 4.6 14.1 32.0 Hang Seng 16,499.5 -1.3 -1.5 1.0 -8.6 -15.8

Praj Industries 459.7 531.7 15.7 Nasdaq 16,428.8 2.9 2.4 9.6 24.3 40.8

BSE-200 9,966.5 0.7 -0.8 5.4 15.7 36.0

Macrotech Devel. 1002.0 1158.4 15.6 Dow Jones 39,475.9 2.0 1.0 5.6 16.2 23.2

Five-Star Bus.Fi 618.2 713.3 15.4 BSE-500 31,622.7 0.8 -1.4 5.0 15.6 37.5

Rs/$ 83.4 -0.6 -0.7 -0.3 -0.6 0.0

Star Cement 203.1 232.5 14.5 CNX Midcap 47,312.9 1.3 -3.7 4.9 17.9 57.5

Brent Crude (spot)$/Bbl 85.5 0.9 0.0 7.2 -9.4 15.2

Global Health 1123.0 1281.6 14.1 CNX Nifty Junior 59,188.9 1.9 0.3 13.9 31.0 55.9

CG Power & Indu. 470.3 535.8 13.9

ओपि इंटरेसट बेकअप

Carborundum Uni. 1095.8 1246.8 13.8 S&P CNX 500 19,994.6 0.9 -1.4 4.9 15.8 38.3

Rainbow Child. 1106.5 1251.3 13.1 BSE-Auto 48,250.0 4.2 1.7 19.2 31.1 71.7

Motil.Oswal.Fin. 1479.9 1672.5 13.0

BSE-Bankex 53,105.8 0.5 -0.5 -0.8 5.8 17.2 Price as on Mar 22 Open interest % of Open interest

Thermax 3482.4 3898.8 12.0

Chalet Hotels 734.2 818.2 11.4 BSE-Cap. Goods 58,726.4 3.4 4.7 8.1 25.7 70.2 Close (cash) LTP (future) Shares ` crore Futures Call Put

Torrent Power 1160.8 1284.3 10.6 BSE-Cons Durable 51,003.9 0.9 -0.1 3.6 11.0 34.3 Adani Enter 3107.7 3119.8 36504 11344.3 57.7 24.4 17.9

Finolex Inds. 214.0 236.1 10.3

BHEL 216.7 239.1 10.3 BSE-FMCG 19,292.6 -0.5 -1.7 -2.7 3.4 19.0 Adani Ports 1281.6 1284.9 82336 10552.2 66.7 19.3 14.0

Sapphire Foods 1441.8 1587.6 10.1 BSE-Healthcare 34,489.2 1.7 -3.4 12.2 24.2 59.5 Apollo Hosp 6375.9 6379.6 4301 2742.4 56.8 26.0 17.3

Ramkrishna Forg. 619.0 681.0 10.0 BSE-IT Sector 35,824.7 -5.5 -7.4 -1.0 8.6 27.7 Asian Paints 2841.5 2850.9 15644 4445.1 59.3 26.9 13.8

Poly Medicure 1423.5 1557.7 9.4 Axis Bank 1033.3 1035.3 86728 8961.6 68.0 21.5 10.5

Avenue Super. 3934.4 4294.8 9.2 BSE-TECk 16,207.2 -4.8 -5.2 2.1 9.5 26.6

Oberoi Realty 1327.1 1448.1 9.1 Bajaj Auto 8945.3 8946.7 6527 5838.3 42.7 32.3 25.0

BSE Realty 6,906.3 5.3 -3.9 14.6 53.7 119.3

Natl. Aluminium 136.5 148.8 9.0 Bajaj Fin 6760.9 6781.4 14376 9719.1 52.9 25.6 21.5

BSE-Metal 27,839.4 4.9 1.3 7.3 22.6 45.9

FSN E-Commerce 149.9 163.4 9.0 Bajaj Finsrv 1587.6 1592.8 14530 2306.7 69.6 18.7 11.7

Varroc Engineer 470.1 512.0 8.9 BSE-Oil & Gas 27,164.8 1.0 -5.0 20.8 42.9 54.0 Bharti Airtel 1236.1 1240.3 83014 10261.3 48.5 28.3 23.3

Zomato Ltd 159.9 174.1 8.9 BSE-PSU 17,990.4 2.5 -4.2 19.1 44.5 89.0 BPCL 592.8 594.2 73166 4337.3 39.4 39.9 20.7

SPARC 344.7 375.0 8.8

Ratnamani Metals 2632.1 2861.9 8.7 Britannia 4865.0 4879.6 3569 1736.3 68.6 20.9 10.5

Esab India

One 97

4798.5

370.9

5208.2

402.5

8.5

8.5

मोटा सौदा Cipla

Coal India

1481.3

432.0

1486.2

432.5

16613

135895

2460.8

5870.0

62.9

49.5

20.4

33.9

16.7

16.6

Indus Towers 249.5 270.7 8.5

Hitachi Energy 6608.1 7167.8 8.5

Date Stock Client Type Quantity Price (`) Divis Lab 3431.5 3443.1 6039 2072.4 65.3 23.5 11.1

Mar 22 Shriram Finance Shriram Value Services BUY 7778000 2310.0 Dr Reddys 6203.2 6213.7 4029 2499.1 55.8 27.7 16.4

Jindal Steel 768.1 832.7 8.4

RHI Magnesita 528.6 572.9 8.4 Mar 22 Shriram Finance Shriram Ownership Trust SELL 7778000 2310.0 Eicher Motor 3988.4 3996.1 7080 2823.8 60.5 22.2 17.3

Cummins India 2709.1 2935.1 8.3 Mar 19 Star Health ICICI Prudential Mutual Fund BUY 3574074 540.0 Grasim Ind 2223.6 2227.1 10774 2395.5 72.9 17.7 9.4

Sona BLW Precis. 640.8 691.9 8.0 Mar 20 National Highw Infra Trust Larsen And Toubro BUY 12000000 124.7 HCL Techno 1557.9 1556.6 28071 4373.1 61.0 27.2 11.8

RBL Bank 224.4 242.2 7.9

Mar 22 Sundaram Finance Holdings Sundaram Finance SELL 5556529 191.0 HDFC Bank 1442.9 1449.1 301839 43550.8 68.5 20.0 11.5

Timken India 2679.6 2891.6 7.9

Mar 22 Savita Oil Technologies SBI Mutual Fund BUY 2073000 408.0 HDFC Std Life 623.9 625.5 46754 2916.8 60.0 26.9 13.1

घाटे में Mar 22

Mar 22

Savita Oil Technologies

Capacite Infra

Mehra Syndicate

Valiant Mauritius Partners Offshore

SELL

BUY

2073000

2765547

408.0

274.9

Hero MotoCorp

Hindalco

4684.0

547.8

4696.6

548.5

8612

69846

4033.9

3825.8

50.4

58.2

31.2

24.4

18.3

17.5

Tata Inv.Corpn. 7540.2 5960.2 -21.0 Mar 22 Sundaram Finance Holdings Trichur Sundaram Santhanam & Family . BUY 3973529 191.0 HUL 2256.6 2265.8 29330 6618.5 63.3 22.4 14.2

Guj. Ambuja Exp 180.0 160.0 -11.1 Mar 22 D B Realty Pinnacle Investments SELL 3000000 205.4 ICICI Bank 1090.3 1090.2 121312 13226.7 72.0 17.2 10.8

Coforge 6117.0 5544.2 -9.4 Mar 19 LT Foods Abakkus Asset Manager Llp BUY 3393543 162.0 IndusInd Bank 1512.1 1512.7 39978 6045.0 67.2 16.2 16.6

IIFL Finance 366.9 334.3 -8.9 Mar 22 Capacite Infra Subir Malhotra SELL 1825000 275.0

BLS Internat. 353.1 324.8 -8.0 Infosys 1508.9 1514.4 70079 10573.9 57.9 29.5 12.7

Mar 22 Ind-Swift Labs Wilson Holdings BUY 4945000 100.3 ITC 428.6 428.8 306938 13155.3 49.8 33.5 16.7

Infosys 1634.9 1508.9 -7.7

Tata Consumer 1213.8 1121.8 -7.6 Mar 22 Sundaram Finance Holdings Sundaram Finance SELL 2395000 188.6

JSW Steel 824.8 827.2 35607 2936.9 63.0 23.7 13.3

Tata Chemicals 1128.1 1046.1 -7.3 Mar 21 JSW Holdings Vikasa India Eif I Fund BUY 59210 6253.3

Kotak Mah Bank 1776.4 1778.5 50492 8969.3 71.0 16.6 12.5

TCS 4217.5 3913.1 -7.2 Mar 21 Krystal Integrated Nomura Singapore SELL 500000 736.7

L &T 3617.8 3624.9 27122 9812.3 65.2 22.0 12.9

MRF 141380.8 131324.4 -7.1 Mar 22 Ind-Swift Labs Edelweiss India Special Situations Fund Ii SELL 3209400 100.3

Elgi Equipments 632.6 589.1 -6.9 LTIMindtree 5005.0 5026.4 4791 2398.0 63.6 24.9 11.5

Mar 22 Capacite Infra Valiant Mauritius Partners BUY 1003561 274.9

Relaxo Footwear 891.0 830.0 -6.8 Mar 18 Repco Home Finance S Gupta Family Investments BUY 600000 395.0 Mah & Mah 1878.8 1885.0 25891 4864.4 61.1 27.3 11.6

Phoenix Mills 2734.2 2548.3 -6.8 Maruti Suzuki 12337.7 12314.8 7935 9790.3 40.1 28.4 31.5

Wipro 516.8 487.1 -5.8

Mar 22 Ind-Swift Labs Ec Special Situations Fund SELL 2100000 100.3

Mar 22 Capacite Infra Paragon Partners Growth Fund SELL 750000 275.0 Nestle India 2573.4 2580.7 7220 1858.1 73.0 18.7 8.3

Persistent Sys 8425.8 7966.7 -5.4

HCL Technologies 1647.6 1558.1 -5.4 Mar 18 Repco Home Finance Sg Sports SELL 500000 395.0 NTPC 324.8 325.8 229806 7462.9 50.7 39.5 9.8

Adani Total Gas 990.9 939.2 -5.2 Mar 20 GMR Power & Urban Jainam Broking BUY 4456041 43.3 ONGC 263.3 263.8 203080 5346.1 48.5 38.5 13.0

Welspun Living 149.0 141.7 -4.9 Mar 22 Capacite Infra Subir Malhotra SELL 700000 275.1 Power Grid 275.8 276.9 122530 3378.8 53.7 31.5 14.8

Aditya AMC 479.0 455.5 -4.9 Mar 19 Bharat Bijlee Ratnabali Investment BUY 36500 5124.9 Reliance Ind 2910.1 2919.6 74846 21780.6 58.9 28.5 12.6

Alkem Lab 5038.9 4793.4 -4.9

Mar 19 Bharat Bijlee Nishtha Investment And Consultancy Services SELL 36500 5124.9 SBI 746.7 748.2 218319 16301.9 49.9 30.8 19.3

Abbott India 28423.3 27078.6 -4.7

Suzlon Energy 39.1 37.4 -4.4 Mar 22 K P Green Engineering Ankush Kedia BUY 841000 207.4 SBI Life Ins 1501.1 1503.0 14996 2251.0 75.5 16.9 7.6

Astral 2029.6 1941.0 -4.4 Mar 22 Sundaram Finance Holdings Arjun Rangarajan BUY 900000 191.0 Sun Pharma 1608.9 1611.6 26686 4293.5 59.4 26.0 14.5

Hatsun Agro 1131.5 1083.1 -4.3 Mar 19 Lords Chloro Alkali Madhav Dhir BUY 1150000 127.8 Tata Consumer P 1122.8 1125.1 22879 2568.7 49.0 35.1 15.9

Indian Bank 510.4 488.7 -4.3 Mar 19 Lords Chloro Alkali Shiva Consultants SELL 1150000 127.8 Tata Motors 979.8 981.9 188845 18503.1 37.3 40.2 22.5

Century Plyboard 666.4 638.4 -4.2 Mar 22 Sundaram Finance Holdings Srivats Ram BUY 683000 191.0

360 ONE 695.3 666.7 -4.1 Tata Steel 151.8 152.0 725951 11019.9 45.7 34.5 19.8

Mar 21 Osia Hyper Retail Dhirendra Gautamkumar Chopra SELL 4000000 30.7 TCS 3910.9 3922.2 36472 14263.7 51.2 35.1 13.6

Sterlite Tech. 123.0 118.0 -4.0

Guj Pipavav Port 205.9 197.7 -4.0

Mar 21 Osia Hyper Retail Minerva Ventures Fund BUY 3500000 30.7

Tech Mahindra 1262.7 1264.5 21226 2680.1 66.5 20.5 12.9

Mphasis 2488.7 2390.5 -3.9 Mar 21 Anzen India Energy Edelweiss Broking BUY 1000000 100.0

Titan Company 3706.7 3713.1 9024 3344.8 57.9 25.1 17.0

GSFC 208.7 200.5 -3.9 Mar 21 Anzen India Energy Edelweiss Infrastructure Yield Plus SELL 1000000 100.0

UltraTech 9681.8 9702.9 3385 3277.6 61.8 26.2 12.0

JK Paper 341.4 328.6 -3.7 Mar 21 Rishabh Instruments Yaduka Financial Services BUY 220500 428.9

Tejas Networks 713.6 687.4 -3.7 UPL 470.0 471.9 64900 3050.3 61.4 24.0 14.6

Mar 21 Krystal Integrated Barclays Merchant Bank (Singapore) SELL 123787 758.2

LTIMindtree 5191.8 5005.2 -3.6 Mar 21 Rishabh Instruments Ashika Global Securities SELL 216000 428.9 Wipro 487.1 487.6 114543 5579.4 48.9 36.4 14.7

You might also like

- PHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities September 28, 2021Document3 pagesPHEI Yield Curve: Daily Fair Price & Yield Indonesia Government Securities September 28, 2021Oki TriangganaNo ratings yet

- 8 QTR ResultsDocument2 pages8 QTR ResultsGopi nathNo ratings yet

- Indian Stock Markets - Aug 31Document6 pagesIndian Stock Markets - Aug 31bhavnesh_muthaNo ratings yet

- Derivative Eod 17 Sep 2009Document4 pagesDerivative Eod 17 Sep 2009ktarunNo ratings yet

- Indian Stock Market Update - 02 Sep 2010Document7 pagesIndian Stock Market Update - 02 Sep 2010bhavnesh_muthaNo ratings yet

- Indian Stock Markets - Sep 21Document7 pagesIndian Stock Markets - Sep 21bhavnesh_muthaNo ratings yet

- Indian Stock Markets Sep 07Document6 pagesIndian Stock Markets Sep 07bhavnesh_muthaNo ratings yet

- IndiaMorningBrief 7jul2023Document11 pagesIndiaMorningBrief 7jul2023Ranjan JainNo ratings yet

- Daily Market Outlook-8 Nov - LKPDocument16 pagesDaily Market Outlook-8 Nov - LKPAjit ParanjpeNo ratings yet

- 26oct 16 PDFDocument3 pages26oct 16 PDFasifNo ratings yet

- Market 11 Aug 2014 3.30 PMDocument2 pagesMarket 11 Aug 2014 3.30 PMasifNo ratings yet

- Indian Stock Markets Sep 08Document6 pagesIndian Stock Markets Sep 08bhavnesh_muthaNo ratings yet

- Corporate Performance AnalysisDocument217 pagesCorporate Performance Analysisroy_kohinoorNo ratings yet

- NSE India - Nov22 - EUDocument9 pagesNSE India - Nov22 - EUpremalgandhi10No ratings yet

- Indian Market Research Daily Market Summary: Paterson Securities PVT LTDDocument3 pagesIndian Market Research Daily Market Summary: Paterson Securities PVT LTDmuthu_theone6943No ratings yet

- Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG YtdDocument10 pagesIndian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG Ytdvikalp123123No ratings yet

- ResearchDocument1 pageResearchshaalimNo ratings yet

- Adani8 QTR ResultsDocument2 pagesAdani8 QTR ResultsGopi nathNo ratings yet

- Dividend Per Equity Share: HUL DaburDocument8 pagesDividend Per Equity Share: HUL DaburSuraj Singh YadavNo ratings yet

- Watch List: Short Finalists Width 300 and Text 700 RefreshDocument7 pagesWatch List: Short Finalists Width 300 and Text 700 Refreshaximaccount7624No ratings yet

- 1st Dec NewsletterDocument23 pages1st Dec NewsletterPrashant BhanotNo ratings yet

- Indian Stock Markets - 06 Sep 2010Document6 pagesIndian Stock Markets - 06 Sep 2010bhavnesh_muthaNo ratings yet

- Project No 1 DCF 2 DCF 3 DCF 4 DCF 5 Initial Investment: Exhibit 1 Project Free Cash Flows (Dollars in Thousands)Document5 pagesProject No 1 DCF 2 DCF 3 DCF 4 DCF 5 Initial Investment: Exhibit 1 Project Free Cash Flows (Dollars in Thousands)jk kumarNo ratings yet

- Scalping ControlDocument4 pagesScalping ControlFede BracaNo ratings yet

- Vertex Trading Bell 04 Feb 2022Document4 pagesVertex Trading Bell 04 Feb 2022dinilaNo ratings yet

- Option Chain (Equity Derivatives)Document3 pagesOption Chain (Equity Derivatives)MGNo ratings yet

- Saving For Retirement PDFDocument1 pageSaving For Retirement PDFShriya MNo ratings yet

- Weekly Derivatives, 2010 Sep 24Document2 pagesWeekly Derivatives, 2010 Sep 24Vijay GandeNo ratings yet

- 0552Document1 page0552Aman GargNo ratings yet

- Book 1Document13 pagesBook 1Sabab MunifNo ratings yet

- Mutual Fund: SEPTEMBER, 2020Document58 pagesMutual Fund: SEPTEMBER, 2020farron_vNo ratings yet

- My PortfolioDocument11 pagesMy PortfolioSk nouman Sid 2012No ratings yet

- Daily Derivative Report: Nifty TrackerDocument7 pagesDaily Derivative Report: Nifty TrackerRatish NairNo ratings yet

- Option Nifty - BankDocument41 pagesOption Nifty - Banksawsac9No ratings yet

- Pi To Ami SetupDocument3 pagesPi To Ami SetupAnt TradersNo ratings yet

- Session XX-classDocument9 pagesSession XX-classswaroop shettyNo ratings yet

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Document6 pagesChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhNo ratings yet

- Introduction To Nepali Stock Market Final FinalDocument75 pagesIntroduction To Nepali Stock Market Final FinalAadarsh AkshyataNo ratings yet

- FM Graphs and Ratios TableDocument10 pagesFM Graphs and Ratios TableNehal SharmaNo ratings yet

- Personal Finance Research ProjectDocument14 pagesPersonal Finance Research ProjectRAJAT MAHESHWARINo ratings yet

- Daily Market Update 3 January 2023 File-202301031742097186877 PDFDocument5 pagesDaily Market Update 3 January 2023 File-202301031742097186877 PDFChandan BaggaNo ratings yet

- BHEL One PagerDocument1 pageBHEL One PagerdidwaniasNo ratings yet

- Indian Stock Markets Sep 30Document6 pagesIndian Stock Markets Sep 30bhavnesh_muthaNo ratings yet

- Market 8 Aug 2014 3.30 PMDocument2 pagesMarket 8 Aug 2014 3.30 PMasifNo ratings yet

- 5 Dec 16Document3 pages5 Dec 16asifNo ratings yet

- BSE Capital Goods IndexDocument7 pagesBSE Capital Goods Indexmadhur_chhabraNo ratings yet

- Company DataDocument10 pagesCompany DataAvengers HeroesNo ratings yet

- Dobanzi Ipotecar 2024Document7 pagesDobanzi Ipotecar 2024SorinNo ratings yet

- FM II Assignment 3Document12 pagesFM II Assignment 3TestNo ratings yet

- Name of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Document15 pagesName of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Adarsh JainNo ratings yet

- 01 FinancialhighlightDocument2 pages01 FinancialhighlightmanijehalizadehNo ratings yet

- HSL - Daily Derivative Overview 11092023-202309110910404544703Document10 pagesHSL - Daily Derivative Overview 11092023-202309110910404544703vikash.4051591No ratings yet

- Watch List: 2/19 Level Width 300 and Text 700 RefreshDocument30 pagesWatch List: 2/19 Level Width 300 and Text 700 Refreshaximaccount7624No ratings yet

- Lbex-Ll 1950670-1950681Document12 pagesLbex-Ll 1950670-1950681Tim XUNo ratings yet

- 9jan 17Document3 pages9jan 17asifNo ratings yet

- Key Ratios: Years Mar-09 Mar-08 Mar-07 Mar-06 Mar-05Document3 pagesKey Ratios: Years Mar-09 Mar-08 Mar-07 Mar-06 Mar-05md_ali19862968No ratings yet

- Restando Cruzando Al Cero: MatemáticasDocument3 pagesRestando Cruzando Al Cero: MatemáticasDanielaTroncosoRiveraNo ratings yet

- Civilab: Dynamic Cone Penetration TestDocument1 pageCivilab: Dynamic Cone Penetration TestMike MatshonaNo ratings yet

- Book 6Document3 pagesBook 6salvi_2079No ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Bus Rout IstYear July2023010923033115Document27 pagesBus Rout IstYear July2023010923033115ansgroupofunique2013No ratings yet

- Bus Rout IstYear July2023010923033115Document27 pagesBus Rout IstYear July2023010923033115ansgroupofunique2013No ratings yet

- Admit Card 8th SemDocument1 pageAdmit Card 8th Semansgroupofunique2013No ratings yet

- Real AnalysisDocument29 pagesReal Analysisansgroupofunique2013No ratings yet

- Memorandum of Understanding - FC Cincinnati (West End) (00255535xC2130)Document9 pagesMemorandum of Understanding - FC Cincinnati (West End) (00255535xC2130)WCPO 9 NewsNo ratings yet

- Islamic Banking and Finance in Sri Lanka: A Paradigm of Success by Riyazi FarookDocument2 pagesIslamic Banking and Finance in Sri Lanka: A Paradigm of Success by Riyazi FarookRiyazi FarookNo ratings yet

- MBAZC415 - Quiz 3: Periodicity Is Also Known As The Time Period AssumptionDocument5 pagesMBAZC415 - Quiz 3: Periodicity Is Also Known As The Time Period AssumptionrudypatilNo ratings yet

- Consequences of An Ultra-Vires ActDocument57 pagesConsequences of An Ultra-Vires ActSawan AcharyNo ratings yet

- Company Rescue Under UK Administration and US Chapter 11Document4 pagesCompany Rescue Under UK Administration and US Chapter 11vidovdan9852No ratings yet

- South African Insurer Downgrades: David Laxton Neil Gosrani Trevor BarsdorfDocument8 pagesSouth African Insurer Downgrades: David Laxton Neil Gosrani Trevor BarsdorfPaul RadomskyNo ratings yet

- Types of Accounts and Rules For AccountingDocument5 pagesTypes of Accounts and Rules For AccountingROSHAN KUMAR SHAHNo ratings yet

- Gilead Sciences Inc (Gild-O) : Average ScoreDocument12 pagesGilead Sciences Inc (Gild-O) : Average ScoreInvest StockNo ratings yet

- Accounting For LeasesDocument8 pagesAccounting For LeasesAdhiyanto PL100% (1)

- Moneylife 9 July 2015Document68 pagesMoneylife 9 July 2015dhavalmeetsNo ratings yet

- The Trend Intensity Indicator: by Richard LieDocument2 pagesThe Trend Intensity Indicator: by Richard Liepderby1No ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartbidyuttezuNo ratings yet

- Sesbreno vs. Court of AppealsDocument12 pagesSesbreno vs. Court of AppealsKyohyunNo ratings yet

- Review of Accounting ProcessDocument2 pagesReview of Accounting ProcessSeanNo ratings yet

- BFM Sem Vi 1920Document8 pagesBFM Sem Vi 1920Hitesh BaneNo ratings yet

- Reyes vs. Court of AppealsDocument11 pagesReyes vs. Court of AppealsaudreyracelaNo ratings yet

- NISM - Mutual Fund Distribution Certification ExaminationDocument169 pagesNISM - Mutual Fund Distribution Certification ExaminationPMNo ratings yet

- Corporate Finance - Fall 2015Document3 pagesCorporate Finance - Fall 2015Shamaas HussainNo ratings yet

- P2Document20 pagesP2Jemson YandugNo ratings yet

- Assignment On NYDocument2 pagesAssignment On NYAksh BansalNo ratings yet

- Advanced Financial ManagementDocument201 pagesAdvanced Financial ManagementNarendra Reddy LokireddyNo ratings yet

- Investments and Portfolio ManagementDocument6 pagesInvestments and Portfolio ManagementDonatas JocasNo ratings yet

- Venture Capital FinancingDocument31 pagesVenture Capital FinancingkumbharnehaNo ratings yet

- Bancassurance Guidelines 2019Document5 pagesBancassurance Guidelines 2019Anonymous FnM14a0No ratings yet

- CAS 706 Emphasis of MatterDocument10 pagesCAS 706 Emphasis of MatterzelcomeiaukNo ratings yet

- Financial Analysis On GOPAL GROUP Group: Submitted To Prof. D.V RamanaDocument60 pagesFinancial Analysis On GOPAL GROUP Group: Submitted To Prof. D.V RamanaSumit PandeyNo ratings yet

- p2p Lending Business Model PDFDocument9 pagesp2p Lending Business Model PDFGiancarlo Di VonaNo ratings yet

- Decree Number 19-2002: The Congress of The Republic of GuatemalaDocument65 pagesDecree Number 19-2002: The Congress of The Republic of GuatemalaEstudiantes por DerechoNo ratings yet

- 9706 s11 QP 42Document8 pages9706 s11 QP 42Diksha KoossoolNo ratings yet