Professional Documents

Culture Documents

Inv Accounting

Uploaded by

ppimarkb0 ratings0% found this document useful (0 votes)

2 views2 pagesInventory accounting refers to the process of recording, valuing, and reporting a company's inventory. It is crucial for accurately assessing a company's financial position and profitability. Key aspects of inventory accounting include recording inventory transactions, using valuation methods like FIFO and LIFO to value inventory, calculating cost of goods sold by subtracting inventory costs from sales revenue, and reporting inventory values in financial statements to comply with accounting standards.

Original Description:

Original Title

inv accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInventory accounting refers to the process of recording, valuing, and reporting a company's inventory. It is crucial for accurately assessing a company's financial position and profitability. Key aspects of inventory accounting include recording inventory transactions, using valuation methods like FIFO and LIFO to value inventory, calculating cost of goods sold by subtracting inventory costs from sales revenue, and reporting inventory values in financial statements to comply with accounting standards.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesInv Accounting

Uploaded by

ppimarkbInventory accounting refers to the process of recording, valuing, and reporting a company's inventory. It is crucial for accurately assessing a company's financial position and profitability. Key aspects of inventory accounting include recording inventory transactions, using valuation methods like FIFO and LIFO to value inventory, calculating cost of goods sold by subtracting inventory costs from sales revenue, and reporting inventory values in financial statements to comply with accounting standards.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Inventory accounting refers to the process of recording, valuing, and reporting a

company's inventory of goods held for sale. Proper inventory accounting is crucial for

accurately assessing a company's financial position and profitability. Here are some key

aspects of inventory accounting:

1. Recording Inventory Transactions: Inventory accountants record all inventory-related

transactions, including purchases, sales, returns, and adjustments. This includes keeping

track of the quantity and cost of inventory items entering and leaving the company's

possession.

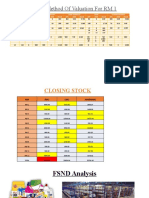

2. Valuation Methods: There are several methods for valuing inventory, including:

First-In, First-Out (FIFO): Assumes that the first items purchased are the first

ones sold.

Last-In, First-Out (LIFO): Assumes that the last items purchased are the first

ones sold.

Weighted Average Cost: Calculates the average cost of all inventory items.

Specific Identification: Identifies and tracks the cost of each individual inventory

item. The choice of valuation method can significantly impact a company's

financial statements and tax liabilities.

3. Cost of Goods Sold (COGS): Inventory accountants calculate the cost of goods sold,

which represents the cost of inventory items sold during a specific period. COGS is

subtracted from sales revenue to determine gross profit.

4. Inventory Turnover: Inventory turnover measures how quickly a company sells its

inventory within a given period. It is calculated by dividing the cost of goods sold by the

average inventory value. A higher inventory turnover ratio indicates efficient inventory

management.

5. Inventory Reserve: Companies may establish inventory reserves to account for

potential losses due to obsolescence, damage, or theft. These reserves are deducted

from the total inventory value to reflect a more accurate assessment of the inventory's

true worth.

6. Financial Reporting: Inventory values and related figures are reported in a company's

financial statements, including the balance sheet (as current assets) and income

statement (as COGS).

7. Compliance: Inventory accounting must comply with generally accepted accounting

principles (GAAP) or international financial reporting standards (IFRS), depending on the

jurisdiction and reporting requirements.

Proper inventory accounting helps businesses make informed decisions about

production, purchasing, pricing, and financial planning. It also ensures compliance with

accounting standards and provides transparency to investors, creditors, and other

stakeholders.

You might also like

- CHAPTER Four NewDocument16 pagesCHAPTER Four NewHace AdisNo ratings yet

- Financial Accounting-Unit-4-SYMBDocument35 pagesFinancial Accounting-Unit-4-SYMBGarima KwatraNo ratings yet

- Final Chapter 6Document8 pagesFinal Chapter 6Đặng Ngọc Thu HiềnNo ratings yet

- CH 4 - InventoriesDocument28 pagesCH 4 - InventoriesFarhadMohsinNo ratings yet

- Chapter 1 Accounting For InventoryDocument12 pagesChapter 1 Accounting For InventoryLee HailuNo ratings yet

- Mastering Inventory AccountingDocument5 pagesMastering Inventory AccountingMark Russel Sean LealNo ratings yet

- Lifo Fifo PDF NotesDocument38 pagesLifo Fifo PDF NotesBALAKUMARAN S 20MBA1061100% (2)

- Intermidet ch4Document90 pagesIntermidet ch4kqk07829No ratings yet

- Financial Accounting: Semester-IDocument38 pagesFinancial Accounting: Semester-IHoney SinghNo ratings yet

- Operating Cycle of A Merchandising BusinessDocument10 pagesOperating Cycle of A Merchandising BusinessJanelle FortesNo ratings yet

- Curs VI - Inventories - RetailDocument12 pagesCurs VI - Inventories - RetailSTANCIU DIANA-MIHAELANo ratings yet

- 08 Inventory Cost MeasurementDocument34 pages08 Inventory Cost MeasurementLeonilaEnriquezNo ratings yet

- Accounting For InventoriesDocument16 pagesAccounting For InventoriesLemma Deme ResearcherNo ratings yet

- Kelompok 6 Chapter 6Document11 pagesKelompok 6 Chapter 6leoni pannaNo ratings yet

- Chapter 5: Accounting and Finance Inventory in Quick Food Service Operation Learning ObjectiveDocument12 pagesChapter 5: Accounting and Finance Inventory in Quick Food Service Operation Learning ObjectiveGraceCayabyabNiduazaNo ratings yet

- Unit One: Accounting For Merchandising InventoriesDocument24 pagesUnit One: Accounting For Merchandising Inventoriesmelaku muka100% (1)

- Ch-1-Merchandising InventoriesDocument15 pagesCh-1-Merchandising Inventorieskenenisagetachew856No ratings yet

- Valuation of Inventories: A Cost-Basis ApproachDocument36 pagesValuation of Inventories: A Cost-Basis ApproachjulsNo ratings yet

- Valuation of Inventory: by Ishita Shah Bansari Shah Hiral Gala Kinjal Zalavadia Abhishek Rupareliya Ali AsgarDocument33 pagesValuation of Inventory: by Ishita Shah Bansari Shah Hiral Gala Kinjal Zalavadia Abhishek Rupareliya Ali AsgarIshita ShahNo ratings yet

- FINANCIAL ACCOUNTING 2020-2021 - MODULE 4 - RevisedDocument26 pagesFINANCIAL ACCOUNTING 2020-2021 - MODULE 4 - RevisedAnn CalabdanNo ratings yet

- Accounting For Merchandising OperationsDocument13 pagesAccounting For Merchandising OperationsAB Cloyd100% (1)

- Lacson 3Document5 pagesLacson 3mickaellacson5No ratings yet

- Fab IndiaDocument13 pagesFab IndiaSadhana YadavNo ratings yet

- 8 (A) - Master BudgetDocument4 pages8 (A) - Master Budgetshan_1299No ratings yet

- 2A Understanding The Balance SheetDocument7 pages2A Understanding The Balance SheetKevin ChengNo ratings yet

- Acc 102 4Document2 pagesAcc 102 4banhloc123321No ratings yet

- Accounting ReviewerDocument5 pagesAccounting ReviewerMeynard BatasNo ratings yet

- Chapter 3 - 103015Document5 pagesChapter 3 - 103015mickaellacson5No ratings yet

- Accounting For Merchandising OperationsDocument25 pagesAccounting For Merchandising OperationsLisa SmithNo ratings yet

- Week 017 - Practice SetDocument6 pagesWeek 017 - Practice SetJoana MarieNo ratings yet

- INVENTORYDocument5 pagesINVENTORYJenilyn CalaraNo ratings yet

- Resume CH 5 IFRSDocument6 pagesResume CH 5 IFRSDeswita CeisiNo ratings yet

- Inventories Valuation ConceptDocument13 pagesInventories Valuation ConceptSumit SahuNo ratings yet

- Give The Difference Between Service Provider and MerchandiserDocument4 pagesGive The Difference Between Service Provider and MerchandiserGmef Syme FerreraNo ratings yet

- Financial Accounting Practice and Review InventoryDocument3 pagesFinancial Accounting Practice and Review Inventoryukandi rukmanaNo ratings yet

- Inventory ValuationDocument1 pageInventory ValuationMd Amanullah QureshiNo ratings yet

- Chapter 3 Accounting For Merchandising OperationsDocument10 pagesChapter 3 Accounting For Merchandising OperationsSKY StationeryNo ratings yet

- Module 4 Inventory and Biological AssetsDocument19 pagesModule 4 Inventory and Biological AssetsAndrea Miles VasquezNo ratings yet

- Inventory ValuationDocument7 pagesInventory ValuationDurga PrasadNo ratings yet

- Aud ch4Document9 pagesAud ch4kitababekele26No ratings yet

- Accounting Assignment 3Document4 pagesAccounting Assignment 3Fariha pervaiz FarihaNo ratings yet

- Fabm2 Week 4Document28 pagesFabm2 Week 4Jeremy SolomonNo ratings yet

- Retail ManagementDocument34 pagesRetail Managementjai bakliyaNo ratings yet

- Inventories (PAS No. 2)Document14 pagesInventories (PAS No. 2)Da Eun LeeNo ratings yet

- Junior Associate in IBB PreparationDocument4 pagesJunior Associate in IBB PreparationGreeni MarcoNo ratings yet

- Fabm Module03 File01Document8 pagesFabm Module03 File01PREFIX THAT IS LONG - Lester LoutteNo ratings yet

- ACC 102 Chapter 6 Review QuestionsDocument2 pagesACC 102 Chapter 6 Review QuestionsKaitlyn MakiNo ratings yet

- Module 5 - Audit of InventoriesDocument23 pagesModule 5 - Audit of InventoriesIvan LandaosNo ratings yet

- FABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusDocument8 pagesFABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusVenus Ariate100% (1)

- Accounting For InventoryDocument3 pagesAccounting For InventoryReika OgaliscoNo ratings yet

- Accounting Terms and RegualtionDocument9 pagesAccounting Terms and RegualtionMaxinejoy JuareNo ratings yet

- Module 5Document16 pagesModule 5Ma Leah TañezaNo ratings yet

- CH 08Document83 pagesCH 08时家欣100% (1)

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotessibivjohnNo ratings yet

- Accounting 1 Accounting For InventoryDocument12 pagesAccounting 1 Accounting For InventoryAshraf AminNo ratings yet

- Trading P&L Balance SheetDocument15 pagesTrading P&L Balance Sheetmdhanjalah08No ratings yet

- CH 04Document61 pagesCH 04natiman090909No ratings yet

- Chapter 5-7 Pa FinalDocument9 pagesChapter 5-7 Pa FinalThái ÂnNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Lecture 1 SlidesDocument63 pagesLecture 1 Slidesnatasha carmichaelNo ratings yet

- LIFO or FIFO? That's The Question Case Summary and ISSUESDocument4 pagesLIFO or FIFO? That's The Question Case Summary and ISSUESBinodini SenNo ratings yet

- Materi - Kenal Profesi - Warehouse Supervisor - Latih - Co (Francisca Risti Aprilia)Document17 pagesMateri - Kenal Profesi - Warehouse Supervisor - Latih - Co (Francisca Risti Aprilia)syafiularif34No ratings yet

- Acct 101 SyllabusDocument8 pagesAcct 101 Syllabusapi-267728422No ratings yet

- Inventory ValuationDocument12 pagesInventory Valuationcooldude690No ratings yet

- IFT Notes For Level I CFA Program: R19 Introduction To Financial Statement AnalysisDocument44 pagesIFT Notes For Level I CFA Program: R19 Introduction To Financial Statement AnalysisSyrine BourbiauxNo ratings yet

- Ebook PDF Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFDocument42 pagesEbook PDF Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFmartha.keener953100% (30)

- 2021 Semester One Deferred & Supplementary Exam - Alternative Assessment TaskDocument16 pages2021 Semester One Deferred & Supplementary Exam - Alternative Assessment TaskGan ZhengweiNo ratings yet

- Index: S. NO. Topic Page NoDocument228 pagesIndex: S. NO. Topic Page NoMuskan NarulaNo ratings yet

- Cost and Management AccountingDocument2 pagesCost and Management AccountingSantosh ThakurNo ratings yet

- Cost of Production Report - FIFO Costing (Module On Cost Accounting)Document10 pagesCost of Production Report - FIFO Costing (Module On Cost Accounting)Khai Ed PabelicoNo ratings yet

- JAIIB Accounts MODULE - CDocument149 pagesJAIIB Accounts MODULE - CShashank Shekhar100% (1)

- Inventory Management TechniquesDocument11 pagesInventory Management TechniquesSamarth PachhapurNo ratings yet

- Week 8 Tutorial QuestionsDocument4 pagesWeek 8 Tutorial QuestionsShynia ChandNo ratings yet

- Foundation Acc Full Sol Set 15.11.2021Document245 pagesFoundation Acc Full Sol Set 15.11.2021adityatiwari122006No ratings yet

- 12 Activity 1Document2 pages12 Activity 1Jong-suk OppxrNo ratings yet

- ACCT Midterm 2Document26 pagesACCT Midterm 2Gene'sNo ratings yet

- Chap 009Document78 pagesChap 009Kiều Thảo AnhNo ratings yet

- Tong Hop Cau HoiDocument44 pagesTong Hop Cau HoiVu Truc Ngan (K17 HCM)No ratings yet

- AmritDocument5 pagesAmritShravanNo ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument37 pagesFinancial Statement Analysis: K.R. Subramanyamtiex hereNo ratings yet

- Wiley P2 Sec-A FlashcardDocument29 pagesWiley P2 Sec-A FlashcardnaxahejNo ratings yet

- Methods InventoryDocument12 pagesMethods InventoryJocelyn LimaNo ratings yet

- CA CPT June 2014 Paper With SolutionsDocument19 pagesCA CPT June 2014 Paper With SolutionsAnweshaBose100% (2)

- Lesson 12 15finalsDocument25 pagesLesson 12 15finalsREIMOND VINCE MENDOZANo ratings yet

- Accounts SbaDocument26 pagesAccounts SbaValentine Leamy100% (2)

- CA CPT WWW - Ca-Gyanguru - inDocument111 pagesCA CPT WWW - Ca-Gyanguru - inHimanshu PurohitNo ratings yet

- Assessment Cover Sheet: Sitxinv001 - QuizDocument35 pagesAssessment Cover Sheet: Sitxinv001 - QuizAmis2018 Amis2018No ratings yet

- CostDocument4 pagesCostAbraNo ratings yet

- CAC C3M1 Accounting For Raw MaterialsDocument9 pagesCAC C3M1 Accounting For Raw MaterialsKyla Mae AllamNo ratings yet