Professional Documents

Culture Documents

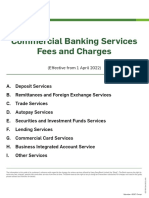

FandC FLYER CORE

Uploaded by

tech.filnipponOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FandC FLYER CORE

Uploaded by

tech.filnipponCopyright:

Available Formats

CREDIT CARDS TABLE OF FEES & CHARGES

Standard / Choose Your Payment Channels:

Fees & Charges ShopMore Mastercard Bench Mastercard Gold Cards Diners Club International

Classic / Lucky Cat

• BDO Online Banking*

Principal Card Membership Fee P150 / month P200 / month P250 / month • BDO Branches

• Auto-Debit Arrangement (ADA) Payment Facility**

Supplementary Card Membership Fee P75 / month P100* / month P125 / month • BancNet

• Save More Market Branches

2.00% • SM Bills Payment Counters

(MEIR) Retail and Cash Advance transactions (inclusive of cash advance fee)** For Dollar Charge Cards and accounts with Dual Currency feature, USD payments for your Dollar

account/s are accepted only via: BDO Branches, BDO Online Banking (USD) account) and ADA Payment

P200 for every approved Cash Availment / Cash-It-Easy transaction Facility (USD account).

Installment Availment Fee

P250 for every approved Balance Convert / Balance Transfer transaction * Enrollment with BDO is required via bdo.com.ph

** Enrollment via any BDO Branch

Cash Advance Fee*** P200 / US$4

Late Payment Charge P850 / US$20 or unpaid minimum amount due, whichever is lower

This is the sum of the following: a) 3% of the outstanding balance less installment amortizations and When making credit card payments, please be reminded of the following:

Minimum Amount Due new transactions posted within the current statement period, or P200 / US$5, whichever is higher; • To pay at any BDO branch, present the upper portion of the statement and keep

b) 3% of installment amortization; c) Overdue Amount; d) Over-limit Amount. the machine validated copy as proof of payment or you may accomplish a

transaction slip and indicate the applicable Institution Code to ensure that

Returned Check Fee / ADA Return Fee P1,250 or US$35 per returned check / payment will be properly posted to the account.

Sales Slip Retrieval Fee

P300 for each sales slip retrieved for Local transactions or Institution Code

Payment Type

P500 for each sales slip retrieved for International transactions

Peso Payment to Peso Card 0800

Lost Card Replacement Fee P400 for each card Dollar Payment to Dollar Card 0802

Peso Payment to Dollar Card 0803

Gambling or Gaming Fee 5% of transacted amount or P500 / US$10, whichever is higher .”.

1% Cross Border Fee (except 0.80% for retail transactions and 0.10% for Cash Advance for UnionPay) and 1.5% Foreign • For check payments*, please make the check payable to “BDO Unibank, Inc

Foreign Currency Transaction Fee Exchange Conversion Fee shall be applied on the converted amount based on the prevailing rate of Indicate the Account Name, Account Number/Card Number and Contact

Mastercard/Visa/JCB/Diners Club International and BDO respectively at the time of posting. The Foreign Exchange Number at the back of the check.

Conversion Fee is subject to change at the sole discretion of BDO.

Installment Processing Fee 5% of the total remaining balance or P300, whichever is higher • Pay at least the Minimum Amount Due on or before your Payment Due Date to avoid

late payment charges.

SOA Reprint Fee P30 or US$1.00 per SOA request

* Normal banking regulations on the acceptance and clearing or collection of check payments

Refund Fee 1% of the amount to be refunded or P100 / US$2.50, whichever is higher apply. Post dated checks and foreign checks drawn on banks outside the Philippines are not

accepted as payments.

Overseas Card Delivery Fee P2,500

* First Supplementary Credit Card is FREE for Life IMPORTANT REMINDER

** Finance charges will be imposed at the current interest rate on the unpaid Cash Advance balance (inclusive of fees) from acquisition date

until both the Cash Advance balance and its related charges are paid in full 1. Paying less than the total amount due will increase the amount of interest and other charges you pay and

*** If Cash Advance is availed through an International ATM, a separate withdrawal fee will be charged and may vary per ATM owner. the time it takes to repay your balance.

USD Fees and Charges are only applicable to cards with Dual Currency feature 2. Applicable MEIR will be imposed on the account if:

Note:

a. No payment was made on the Card on Payment Due Date,

the provisions of these reminders and the Terms and Conditions Governing the Issuance and Use of BDO Credit Cards, the latter shall b. Payment made was less than the Total Outstanding Balance stated in the Statement of Account (SOA),

prevail. All fees and charges are subject to change upon notice. BDO reserves the right to re-impose waived fees/charges. c. Outstanding Balance is paid in full by its Payment Due Date, but with unsettled balances from the previous SOA

To view the complete Terms and Conditions and for the complete definition of Statement of Account terms, visit bdo.com.ph

reflected in the current SOA, or

d. There is a cash advance transaction.

SAMPLE FINANCE CHARGE (FC) COMPUTATION FOR RETAIL AND CASH ADVANCE TRANSACTIONS

OPENING BALANCE none FC Computation - Month 1

MONTHLY EFFECTIVE INTEREST RATE (MEIR) 2.00% (Interest is computed on the Cash Advance and Cash Advance Fee)

NO. OF DAYS

CASH OUTSTANDING

RETAIL

MONTH STATEMENT PAYMENT DATE PURCHASE CASH ADVANCE TOTAL INTEREST PRINCIPAL Interest = P10,200 x 2% / 30 days x 31 days = P210.80

DATE TO TO CYCLE ADVANCE FEE PAYMENT

BALANCE

PAYMENT DATE CUT OFF DATE

FC Computation - Month 2

1 - 10,000 200 - 210.80 10,410.80 (No Interest Charges for Retail Purchase transactions made during the statement cycle)

2 24 4 10,000 - - (2,100.00) 188.73 18,499.53

1) Outstanding Balance x Interest Rate / 30 days x

3 24 7 - - - (2,100.00) 372.52 16,772.06 No. of days (From Statement Date to Payment Date)

4 24 6 - - - (2,100.00) 327.04 14,999.10 Interest = P10,410.80 x 2% / 30 days x 24 days = P166.57

5 24 7 - - - (2,100.00) 300.18 13,199.28

2) Outstanding Balance less Payments x Interest Rate / 30 days x

6 24 6 - - - (2,100.00) 255.59 11,354.86 No. of days

7 24 7 - - - (2,100.00) 224.87 9,479.73

Interest = (P10,410.80 - P2,100) x 2% / 30 days x 4 days = P22.16

8 24 7 - - - (2,100.00) 186.11 7,565.85

Total Interest = P188.73

9 24 6 - - - (2,100.00) 142.92 5,608.76

10 24 7 - - - (2,100.00) 106.11 3,614.88 FC Computation - Month 12

11 24 6 - - - (2,100.00) 63.90 1,578.77 (Cardholder fully paid the Outstanding Balance)

12 24 7 - - - (1,578.77) 25.26 25.26 Cardholder will be billed interest even after paying the total outstanding

balance from statement date up to date of full payment

13 24 7 - - - (25.26) - -

Outstanding Balance x Interest Rate / 30 days x

Total (22,604.03) 2,404.03 No. of days (From Statement Date up to Full Payment Date)

Assumptions:

• Cardholder has no beginning balance on his 1st statement and makes a Cash Advance transaction of P10,000 on the 1st day of the month NOTE: Applicable MEIR will vary depending on the amount

• Cardholder makes a retail transaction of P10,000 on the 1st day of the 2nd month of transaction made within the statement cycle. Interest = P1,578.77 x 2% / 30 days x 24 Days = P25.26

• Cardholder is paying every due date, which is every 25th of the month

BDO Unibank, Inc. is regulated by the Bangko Sentral ng Pilipinas: Tel. No. (02) 8708-7087; Email: consumeraffairs@bsp.gov.ph; Webchat: bsp.gov.ph. BDO CORE: REVISED AS OF AUGUST 2021

You might also like

- Choose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageChoose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingElibom DnegelNo ratings yet

- When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageWhen Making Credit Card Payments, Please Be Reminded of The FollowingJohn Paolo DionisioNo ratings yet

- FC EliteDocument1 pageFC Elitejpdeleon20No ratings yet

- FC EliteDocument1 pageFC EliteNoli BenongoNo ratings yet

- English CCDocument6 pagesEnglish CCdsouzan071No ratings yet

- SOB Indus PartnerDocument2 pagesSOB Indus Partnerrajprince26460No ratings yet

- Quick Guide To PaymentsDocument16 pagesQuick Guide To PaymentsAriel DicoreñaNo ratings yet

- Prepaid Travel COB E FNLDocument1 pagePrepaid Travel COB E FNLBobNo ratings yet

- Schedule of Charges-MDB Visa Credit CardsDocument2 pagesSchedule of Charges-MDB Visa Credit CardsBM TASINNo ratings yet

- SOC Credit Card MayDocument20 pagesSOC Credit Card MayBDT Visa PaymentNo ratings yet

- Savings Charges PDFDocument2 pagesSavings Charges PDFPramod NaikareNo ratings yet

- DownloadDocument2 pagesDownloadSourav mNo ratings yet

- DownloadDocument2 pagesDownloadsatendraNo ratings yet

- ABBL SOC Debit Credit CardsDocument3 pagesABBL SOC Debit Credit Cardsalaminshorkar76No ratings yet

- VISA Credit Cards Fees Charges 01 Dec 21Document2 pagesVISA Credit Cards Fees Charges 01 Dec 21RailyNo ratings yet

- Super Shakti Savings AccountDocument2 pagesSuper Shakti Savings Accountrcosmic1980No ratings yet

- Kfs LTFDocument1 pageKfs LTFsamarth guptaNo ratings yet

- Kfs 3000Document1 pageKfs 3000PAVAN GHOLAPNo ratings yet

- HSBC Select Fees & ChargesDocument2 pagesHSBC Select Fees & Chargesshirin.at70No ratings yet

- Private-Banking-Signature-July-Dec-23 JS BankDocument4 pagesPrivate-Banking-Signature-July-Dec-23 JS BankMuhammad Aasim HassanNo ratings yet

- HSBC Select Fees Charges Dec 2023Document2 pagesHSBC Select Fees Charges Dec 2023mail.bdoaa2022No ratings yet

- SOC RuPay Select Debit CardDocument4 pagesSOC RuPay Select Debit Cardrichards.prabhu1817No ratings yet

- Pubali Bank Visa Credit Card BrochureDocument5 pagesPubali Bank Visa Credit Card Brochuresamin3shohelNo ratings yet

- Corporate Finance: Credit CardsDocument24 pagesCorporate Finance: Credit Cardsusmanahmadqadri100% (2)

- Credit Card UPI PresentationDocument9 pagesCredit Card UPI PresentationAde SulaemanNo ratings yet

- FC Installment CardDocument1 pageFC Installment CardKim Lloyd AtienzaNo ratings yet

- Pds Lifestyle-0223en PDFDocument5 pagesPds Lifestyle-0223en PDFWilfred ImangNo ratings yet

- Fees N Charges CreditcardDocument12 pagesFees N Charges Creditcard郭芷洋No ratings yet

- Service Charges Scheduled AcDocument8 pagesService Charges Scheduled AcAmir mushtaqNo ratings yet

- HBL Credit Card - Basic Charges Sheet (Version 2 W.E.F July 01 2019)Document2 pagesHBL Credit Card - Basic Charges Sheet (Version 2 W.E.F July 01 2019)shani908No ratings yet

- Reviewer of Humms ExamDocument1 pageReviewer of Humms ExamAliso EnerycNo ratings yet

- Annual Fees: (Per Month)Document2 pagesAnnual Fees: (Per Month)placido diasNo ratings yet

- Product Disclosure Sheet Apr 22Document13 pagesProduct Disclosure Sheet Apr 22Admin SMKPekanKBNo ratings yet

- CC Products Disclosure SheetDocument13 pagesCC Products Disclosure SheetLoVe YiYiNo ratings yet

- Service ChargesDocument24 pagesService ChargesIsaacNo ratings yet

- Prestige BankingDocument6 pagesPrestige BankingobakkandoNo ratings yet

- Fees and Charges For Debit CardDocument2 pagesFees and Charges For Debit CardSanjeev SharmaNo ratings yet

- Handbook On DIGITAL Products 20210818110220Document29 pagesHandbook On DIGITAL Products 20210818110220omvir singhNo ratings yet

- Handbook On DIGITAL Products 20210815125103Document29 pagesHandbook On DIGITAL Products 20210815125103Neos EonsNo ratings yet

- ADV Europe Virtual UsdDocument2 pagesADV Europe Virtual UsdDemian MolinariNo ratings yet

- Fees and Charges For Debit CardDocument2 pagesFees and Charges For Debit CardShivam guptaNo ratings yet

- EStmtPDFServlet PDFDocument3 pagesEStmtPDFServlet PDFYi Shu LowNo ratings yet

- Fees and Charges For Debit CardDocument3 pagesFees and Charges For Debit Cardmani kantaNo ratings yet

- BT BAU Feb28Document1 pageBT BAU Feb28PSC.CLAIMS1No ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- SFLF 720320418 enDocument1 pageSFLF 720320418 enMelinda R. FranciscoNo ratings yet

- Payment Reminders BDODocument1 pagePayment Reminders BDOJan ManriqueNo ratings yet

- DocumentaryDocument2 pagesDocumentaryJessly Jeon Montefalco DelegeroNo ratings yet

- Account Information: Danielle D. PascuaDocument2 pagesAccount Information: Danielle D. PascuaKaye AnnNo ratings yet

- Í - !, (È0Â Corriente Antoineâdom . Ç/B Î Mr. Antoine Dominic - CorrienteDocument2 pagesÍ - !, (È0Â Corriente Antoineâdom . Ç/B Î Mr. Antoine Dominic - CorrienteMarcus FlintNo ratings yet

- DownloadDocument2 pagesDownloadsmitasahoo9609No ratings yet

- Proposal For Online Payment Gateway Service - SampleDocument6 pagesProposal For Online Payment Gateway Service - SampleSh p100% (2)

- Schedule of Bank Charges: (Excluding FED)Document60 pagesSchedule of Bank Charges: (Excluding FED)Muhammad Zubair AbbasNo ratings yet

- UOB BIBPlus Pricing GuideDocument3 pagesUOB BIBPlus Pricing GuideTalitha El IbrasaNo ratings yet

- Tariff Guide PremierDocument9 pagesTariff Guide PremierJesse Kojo Appiah Baffoe-DansoNo ratings yet

- Credit Card Service and Price Guide: (Prices Are Exclusive of VAT)Document2 pagesCredit Card Service and Price Guide: (Prices Are Exclusive of VAT)Jismin JosephNo ratings yet

- E-Statement of Account: Hans Rudolf Begonte TamidlesDocument4 pagesE-Statement of Account: Hans Rudolf Begonte TamidlesKal LymNo ratings yet

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- Product-Features-and-Applicable - Charges-AL Habib-RDADocument4 pagesProduct-Features-and-Applicable - Charges-AL Habib-RDAmaroof mNo ratings yet

- Invoice To CCSRF Smart - WatchDocument2 pagesInvoice To CCSRF Smart - WatchRAVI RANJANNo ratings yet

- BRAC Bank Statement 10052023 PDFDocument7 pagesBRAC Bank Statement 10052023 PDFMd Mizanur RahmanNo ratings yet

- Detailed Ongoing Works Record Under RHDDocument7 pagesDetailed Ongoing Works Record Under RHDdpmgumtiNo ratings yet

- New Balance $113,073.22 Payment Due Date 07/05/22: Business Platinum CardDocument17 pagesNew Balance $113,073.22 Payment Due Date 07/05/22: Business Platinum Cardshamim0008No ratings yet

- APGLI Refund Form (Other Than Death Claim)Document3 pagesAPGLI Refund Form (Other Than Death Claim)ch s naiduNo ratings yet

- Beer Game Report Template GPDocument6 pagesBeer Game Report Template GPgotihereNo ratings yet

- Oragadam Payslip 5C Aug-22-101Document1 pageOragadam Payslip 5C Aug-22-101Yogith SharmaNo ratings yet

- Serprobot Invoice 145787Document1 pageSerprobot Invoice 145787Merchandiser JmknitwearNo ratings yet

- Fi - KDSDocument31 pagesFi - KDSManjunathreddy Seshadri100% (1)

- June - JulyDocument1 pageJune - Julynaveen kumarNo ratings yet

- Davčne Utaje S Pomočjo Slamnatih PodjetijDocument68 pagesDavčne Utaje S Pomočjo Slamnatih Podjetijmladenoviczoran8No ratings yet

- 7 PsDocument7 pages7 PsChristine LlorenNo ratings yet

- Phnom PenhDocument1 pagePhnom PenhJinky Mae Palit-AngNo ratings yet

- 7000 Saudi Riyals Per Month A Good Salary in RiyadhDocument2 pages7000 Saudi Riyals Per Month A Good Salary in RiyadhDediNo ratings yet

- GST IntroductionDocument42 pagesGST IntroductionAnant singhNo ratings yet

- DV Appendix 32-DECEMBER 2019 JHSDocument7 pagesDV Appendix 32-DECEMBER 2019 JHSRomel BayabanNo ratings yet

- Payment VoucherDocument1 pagePayment Voucherشاہ زر علیNo ratings yet

- Yohanes TampubolonDocument8 pagesYohanes TampubolonTOT BandungNo ratings yet

- ACCO 30033 ExercisesDocument8 pagesACCO 30033 ExercisesGenevieve ArponNo ratings yet

- Savings Account Statement: Capitec B AnkDocument1 pageSavings Account Statement: Capitec B AnkFikile Eem100% (1)

- Bank Statement Template 1 - TemplateLabDocument1 pageBank Statement Template 1 - TemplateLabAida BrackenNo ratings yet

- Workbook - Letters of CreditDocument35 pagesWorkbook - Letters of CreditPrashant VishwakarmaNo ratings yet

- Iphone X PDFDocument2 pagesIphone X PDFArpit UndhadNo ratings yet

- 2016-2016 Order Form From 591371316@Document196 pages2016-2016 Order Form From 591371316@Nepumoseno PalmaNo ratings yet

- Estatement - 01 Feb 2024 - 1708262406490Document8 pagesEstatement - 01 Feb 2024 - 1708262406490Hammad KhanNo ratings yet

- Edi Implementation Guideline Logprozesse enDocument38 pagesEdi Implementation Guideline Logprozesse enMirek GodzwonNo ratings yet

- CL Invoice SampleDocument4 pagesCL Invoice SampleRanjita08No ratings yet

- Authority To Travel: Emeliano S. Fontanares Sr. National High SchoolDocument6 pagesAuthority To Travel: Emeliano S. Fontanares Sr. National High SchoolDanica Cascabel LptNo ratings yet

- Schedule Charges City BankDocument11 pagesSchedule Charges City BankSumon Emam HossainNo ratings yet

- Containers On A Train: Lecture ObjectivesDocument3 pagesContainers On A Train: Lecture ObjectivesKarlos EstévezNo ratings yet