Professional Documents

Culture Documents

FC Elite

Uploaded by

Noli BenongoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FC Elite

Uploaded by

Noli BenongoCopyright:

Available Formats

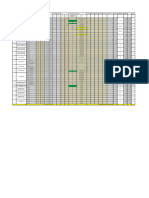

ELITE CREDIT CARDS TABLE OF FEES & CHARGES

Fees & Charges Titanium/Platinum Visa/JCB Diamond¹ Diners Club

Mastercard Platinum UnionPay Premiere Choose Your Credit Card Payment Channels:

Principal Card P4,500

Annual Membership Fee P5,000 P4,500 PAYMENT POSTED ON THE SAME BANKING DAY

• BDO Online Banking

Supplementary Card FREE for Life for P2,500 • BDO Branches & Network Bank Branches

Annual Membership Fee 6 Supplementary

• BDO Automated Teller Machines (ATMs)

3.00% • BDO Cash Acceptance Machines (CAMs)

Monthly Interest Rate

Retail and Cash Advance transactions (inclusive of cash advance fee)² • Auto-Debit Arrangement (ADA) Payment Facility

P200 for every approved Cash Installment transaction PAYMENT POSTED ON THE NEXT BANKING DAY

P250 for every approved Balance Transfer transaction • BancNet

• Savemore Market Branches

Installment Availment Fee P250 for every approved Balance Convert Peso transaction or • SM Bills Payment Counters (including SM Supermarket

and SM Hypermarket)

US$10 for every approved Balance Convert Dollar transaction

For American Express Dollar Charge Cards and accounts with Dual Currency feature, USD

P100 for every approved Purchase Convert Peso transaction or payments for your Dollar account/s are accepted only via: BDO Branches, BDO Online

Banking (USD account) and ADA Payment Facility (USD account). For American Express

US$5 for every approved Purchase Convert Dollar transaction Dollar Charge Cards, ADA payment is scheduled 25 days from Statement Date.

Notes:

Cash Advance Fee³ P200 / US$3.50 • Bills payments via BDO Online, CAMs and ATMs made after 10:00PM are considered next banking day transactions.

• For BDO Online Banking and ADA Payment Facility, enrollment is via any BDO Branch or bdo.com.ph.

• For Check Payment (Peso and Dollar), payment is subject to clearing cut-off.

Late Payment Charge P850 / US$20 or unpaid minimum amount due, whichever is lower

This is the sum of the following: a) 3% of the outstanding balance less

Minimum Amount Due installment amortizations, over-limit amount and new transactions posted When making credit card payments, please be reminded of the following:

within the current statement period⁴, or P850 / US$17, whichever is higher; • To pay at any BDO branch, present the upper portion of the statement and keep

b) 3% of Installment Amortization; c) Overdue Amount; and d) Over-limit the machine validated copy as proof of payment or you may accomplish a

Amount. transaction slip and indicate the applicable Institution Code to ensure that

payment will be properly posted to the account.

Returned Check Fee / P1,250 or US$35 per returned check / insufficient ADA account

ADA Return Fee Institution Code

Payment Type

Sales Slip Retrieval Fee P300 for each sales slip retrieved for Local transactions or Peso Payment to Peso Card 0800

P500 for each sales slip retrieved for International transactions Dollar Payment to Dollar Card 0802

Lost Card Replacement Fee P400 for each card Peso Payment to Dollar Card 0803

Gambling or Gaming Fee 5% of transacted amount or P500 / US$10, whichever is higher

• For check payments*, please make the check payable to “BDO Unibank, Inc.”.

1% Cross Border Fee (except 0.80% for retail transactions and 0.50% for Indicate the Account Name, Account Number/Card Number and Contact

Cash Advance for UnionPay) and 1.5% Foreign Exchange Conversion Fee Number at the back of the check.

shall be applied on the converted amount based on the prevailing rate of

Mastercard/Visa/JCB/UnionPay/Diners Club International and BDO • Pay at least the Minimum Amount Due on or before your Payment Due Date to avoid

Foreign Currency late payment charges.

Transaction Fee respectively at the time of posting. The Foreign Exchange Conversion Fee is

subject to change at the sole discretion of BDO.

* Normal banking regulations on the acceptance and clearing or collection of check payments

For foreign currency transactions converted to Philippine Peso or charged in apply. Post dated checks and foreign checks drawn on banks outside the Philippines are not

Philippine Peso by a foreign acquirer at point-of-sale, whether made in or accepted as payments.

outside the Philippines or online, 1% Cross Border Fee charged by the Card

Brand shall be applied on the converted amount or billed Philippine Peso

amount accordingly.

5% of the total remaining balance or P300 for PHP-denominated transactions

Installment Processing Fee

or USD10 for USD-denominated transactions, whichever is higher

SOA Reprint Fee P30 or US$1.00 per SOA request

Refund Fee 1% of the amount to be refunded or P100 / US$2.50, whichever is higher

Overseas Card Delivery Fee P2,500

1 For Diamond UnionPay Principal Cardholders, Membership Fee is free for the first 3 years.

2 Finance charges will be imposed at the current interest rate on the unpaid Cash Advance IMPORTANT REMINDER

balance (inclusive of fees) from acquisition date until both the Cash Advance balance and 1. Paying less than the total amount due will increase the amount of interest

its related charges are paid in full.

and other charges you pay and the time it takes to repay your balance.

2. Applicable Monthly Interest Rate will be imposed on the account if:

3 If Cash Advance is availed through an International ATM, a separate withdrawal fee will be

charged and may vary per ATM owner.

4 The new transactions posted within the current statement period will not be deducted from a. No payment was made on the Card on Payment Due Date,

the computation of the 3% of the Outstanding Balance in case the Credit Card account is in past

due status or has an over-limit amount.

b. Payment made was less than the Total Outstanding Balance stated in the

Statement of Account (SOA),

USD Fees and Charges are only applicable to cards with Dual Currency feature

c. Outstanding Balance is paid in full by its Payment Due Date, but with unsettled

Note: Interest rates are determined by BDO and are subject to change in accordance with balances from the previous SOA reflected in the current SOA, or

prevailing market rates. In case of conflict between the provisions of these reminders d. There is a cash advance transaction.

and the Terms and Conditions Governing the Issuance and Use of BDO Credit Cards,

the latter shall prevail. All fees and charges are subject to change upon notice. BDO

reserves the right to re-impose waived fees/charges.

SAMPLE FINANCE CHARGE (FC) COMPUTATION FOR RETAIL AND CASH ADVANCE TRANSACTIONS

OPENING BALANCE none FC Computation - Month 1

MONTHLY INTEREST RATE 3.00% (Interest is computed on the Cash Advance and Cash Advance Fee)

NO. OF DAYS

CASH OUTSTANDING

RETAIL

MONTH STATEMENT PAYMENT DATE PURCHASE CASH TOTAL INTEREST PRINCIPAL Interest = P10,200 x 3% / 30 days x 31 days = P316.20

DATE TO TO CYCLE ADVANCE ADVANCE

FEE PAYMENT

BALANCE

PAYMENT DATE CUT OFF DATE

FC Computation - Month 2

1 - 10,000 200 - 316.20 10,516.20 (No Interest Charges for Retail Purchase transactions made during the statement cycle)

2 24 4 10,000 - - (2,000.00) 286.45 18,802.65

1) Outstanding Balance x Interest Rate / 30 days x

3 24 7 - - - (2,000.00) 568.88 17,371.54 No. of days (From Statement Date to Payment Date)

4 24 6 - - - (2,000.00) 509.15 15,880.68 Interest = P10,516.20 x 3% / 30 days x 24 days = P252.39

5 24 7 - - - (2,000.00) 478.30 14,358.98

2) Outstanding Balance less Payments x Interest Rate / 30 days x

6 24 6 - - - (2,000.00) 418.77 12,777.75 No. of days

7 24 7 - - - (2,000.00) 382.11 11,159.86

Interest = (P10,516.20 - P2,000.00) x 3% / 30 days x 4 days = P34.06

8 24 7 - - - (2,000.00) 331.96 9,491.82

Total Interest = P286.45

9 24 6 - - - (2,000.00) 272.75 7,764.57

10 24 7 - - - (2,000.00) 226.70 5,991.27 FC Computation - Month 12

11 24 6 - - - (2,000.00) 167.74 4,159.01 (Cardholder fully paid the Outstanding Balance)

12 24 7 - - - (4,159.01) 99.82 99.82 Cardholder will be billed interest even after paying the total outstanding

balance from statement date up to date of full payment

13 24 7 - - - (99.82) - -

Outstanding Balance x Interest Rate / 30 days x

Total (24,258.83) 4,058.83 No. of days (From Statement Date up to Full Payment Date)

Assumptions:

• Cardholder has no beginning balance on his 1st statement and makes a Cash Advance transaction of P10,000 on the 1 day of the month

st Interest = P4,159.01 x 3% / 30 days x 24 Days = P99.82

• Cardholder makes a retail transaction of P10,000 on the 1st day of the 2nd month

• Cardholder is paying every due date, which is every 25 of the month

th

BDO Unibank, Inc. is regulated by the Bangko Sentral ng Pilipinas: https://www.bsp.gov.ph

The BDO, BDO Unibank and other BDO-related trademarks are owned by BDO Unibank, Inc. All Rights Reserved.

BDO Customer Contact Center: (+632) 8631-8000 BDO ELITE: REVISED AS OF FEBRUARY 2024

You might also like

- Account Statement CapitecDocument4 pagesAccount Statement CapitecVince Smart100% (1)

- Visa NotesDocument6 pagesVisa NotesAnu TourismNo ratings yet

- Globe BillDocument3 pagesGlobe BillJL D CT0% (1)

- Bill Airtel SampleDocument12 pagesBill Airtel Sampleraji50% (8)

- Air India Web Booking Eticket (Y7MZP) - KrishnanDocument3 pagesAir India Web Booking Eticket (Y7MZP) - KrishnanShankarNo ratings yet

- Cash SweepDocument5 pagesCash SweepWild FlowerNo ratings yet

- Handbook On DIGITAL Products 20210815125103Document29 pagesHandbook On DIGITAL Products 20210815125103Neos EonsNo ratings yet

- Contract of ServiceDocument6 pagesContract of ServiceCharmaine CasquejoNo ratings yet

- General Forms.1aDocument44 pagesGeneral Forms.1aNoli BenongoNo ratings yet

- Proposal For Online Payment Gateway Service - SampleDocument6 pagesProposal For Online Payment Gateway Service - SampleSh p100% (2)

- The Barangay Budget Operations Manual: Republic of The Philippines Department of Budget and ManagementDocument44 pagesThe Barangay Budget Operations Manual: Republic of The Philippines Department of Budget and ManagementCristine S. Dayao100% (1)

- MB Online - MSOA StatementDocument4 pagesMB Online - MSOA StatementDana SibalNo ratings yet

- Credit Card UPI PresentationDocument9 pagesCredit Card UPI PresentationAde SulaemanNo ratings yet

- Diagnostic Centers MOU FormDocument5 pagesDiagnostic Centers MOU FormMuhammad Usman Ghani100% (1)

- FC EliteDocument1 pageFC Elitejpdeleon20No ratings yet

- Choose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageChoose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingElibom DnegelNo ratings yet

- FandC FLYER COREDocument1 pageFandC FLYER COREtech.filnipponNo ratings yet

- When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageWhen Making Credit Card Payments, Please Be Reminded of The FollowingJohn Paolo DionisioNo ratings yet

- Quick Guide To PaymentsDocument16 pagesQuick Guide To PaymentsAriel DicoreñaNo ratings yet

- SOB Indus PartnerDocument2 pagesSOB Indus Partnerrajprince26460No ratings yet

- Pds Lifestyle-0223en PDFDocument5 pagesPds Lifestyle-0223en PDFWilfred ImangNo ratings yet

- English CCDocument6 pagesEnglish CCdsouzan071No ratings yet

- Corporate Internet BankingDocument9 pagesCorporate Internet BankingUma AgarwalNo ratings yet

- Assignment - I Fintech: Payment Gateway That Book My Show UsesDocument1 pageAssignment - I Fintech: Payment Gateway That Book My Show UsesVankishKhoslaNo ratings yet

- Private-Banking-Signature-July-Dec-23 JS BankDocument4 pagesPrivate-Banking-Signature-July-Dec-23 JS BankMuhammad Aasim HassanNo ratings yet

- DownloadDocument2 pagesDownloadlaxanboxerNo ratings yet

- 2022 Purchase Convert Special Rate - HomeDocument3 pages2022 Purchase Convert Special Rate - HomeOT PRACTICE TIMENo ratings yet

- Orbis FPI II ProposalDocument5 pagesOrbis FPI II ProposalBalakrishnan IyerNo ratings yet

- DownloadDocument2 pagesDownloadHNo ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- DownloadDocument2 pagesDownloadSourav mNo ratings yet

- DownloadDocument2 pagesDownloadsatendraNo ratings yet

- Easypay Form: Company ParticularsDocument3 pagesEasypay Form: Company Particularsanirban royNo ratings yet

- Prestige BankingDocument6 pagesPrestige BankingobakkandoNo ratings yet

- SOC RuPay Select Debit CardDocument4 pagesSOC RuPay Select Debit Cardrichards.prabhu1817No ratings yet

- FC Installment CardDocument1 pageFC Installment CardKim Lloyd AtienzaNo ratings yet

- Mobile Banking Services Provided by Bank of BarodaDocument3 pagesMobile Banking Services Provided by Bank of Barodakalpesh bhNo ratings yet

- Foreclosure 16-17-18Document3 pagesForeclosure 16-17-18Mizzba NisarNo ratings yet

- PesoPay Intro Deck '08Document10 pagesPesoPay Intro Deck '08ebiziseasy100% (1)

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Document4 pagesYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNo ratings yet

- Fees and Charges For Debit CardDocument2 pagesFees and Charges For Debit CardSanjeev SharmaNo ratings yet

- Fees and Charges For Debit CardDocument3 pagesFees and Charges For Debit Cardmani kantaNo ratings yet

- Prepaid Travel COB E FNLDocument1 pagePrepaid Travel COB E FNLBobNo ratings yet

- 408DPFJK048583 Foreclosure LetterDocument3 pages408DPFJK048583 Foreclosure Lettergmcpdbyv5fNo ratings yet

- SFLF 720320418 enDocument1 pageSFLF 720320418 enMelinda R. FranciscoNo ratings yet

- Deposit Accounts & Services For Individuals: Deposits GuideDocument23 pagesDeposit Accounts & Services For Individuals: Deposits GuideshubhraNo ratings yet

- Digital Nov 2021Document64 pagesDigital Nov 2021jagadish madiwalarNo ratings yet

- HSBC Select Fees & ChargesDocument2 pagesHSBC Select Fees & Chargesshirin.at70No ratings yet

- BDO Credit Card Points Redemption Online Form - HomeDocument2 pagesBDO Credit Card Points Redemption Online Form - HomeAmeer Marco LawanNo ratings yet

- Screenshot 2023-08-23 at 5.43.10 PMDocument1 pageScreenshot 2023-08-23 at 5.43.10 PMplukjustinemaerodriguezNo ratings yet

- Fees N Charges CreditcardDocument12 pagesFees N Charges Creditcard郭芷洋No ratings yet

- SOB Indus ProgressDocument2 pagesSOB Indus ProgressAMit PrasadNo ratings yet

- Reviewer of Humms ExamDocument1 pageReviewer of Humms ExamAliso EnerycNo ratings yet

- Fees and Charges PNB Credit CardsDocument3 pagesFees and Charges PNB Credit CardsbluevaltielNo ratings yet

- 4080CDJL956903 Foreclosure LetterDocument3 pages4080CDJL956903 Foreclosure LetterJanakiram TammineniNo ratings yet

- Savings Charges PDFDocument2 pagesSavings Charges PDFPramod NaikareNo ratings yet

- DBD 1Document20 pagesDBD 1Par MatyNo ratings yet

- Fees and Charges For Debit CardDocument2 pagesFees and Charges For Debit CardShivam guptaNo ratings yet

- CC Products Disclosure SheetDocument13 pagesCC Products Disclosure SheetLoVe YiYiNo ratings yet

- ForeclosureDocument3 pagesForeclosuremohammadafreed223No ratings yet

- Screenshot 2020-12-26 at 8.33.55 PM PDFDocument1 pageScreenshot 2020-12-26 at 8.33.55 PM PDFAlamgir AnsaryNo ratings yet

- Acquiring Presentation 2020 June 8 2020Document14 pagesAcquiring Presentation 2020 June 8 2020Salako JohnsonNo ratings yet

- Í - !, (È0Â Corriente Antoineâdom . Ç/B Î Mr. Antoine Dominic - CorrienteDocument2 pagesÍ - !, (È0Â Corriente Antoineâdom . Ç/B Î Mr. Antoine Dominic - CorrienteMarcus FlintNo ratings yet

- Handbook On DIGITAL Products 20210818110220Document29 pagesHandbook On DIGITAL Products 20210818110220omvir singhNo ratings yet

- Asif Ali: Account StatementDocument5 pagesAsif Ali: Account StatementASIF ALINo ratings yet

- BOP Asaan Current AccountDocument2 pagesBOP Asaan Current AccountAhmad CssNo ratings yet

- Payment Reminders BDODocument1 pagePayment Reminders BDOJan ManriqueNo ratings yet

- Foreclosure Letter - 20 - 26 - 19Document3 pagesForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanNo ratings yet

- PK Saadiq Soc Jan To July 2024 EngDocument48 pagesPK Saadiq Soc Jan To July 2024 Engwaqas wattooNo ratings yet

- SUBCON MeetingDocument22 pagesSUBCON MeetingNoli BenongoNo ratings yet

- Main Production Interior Painting Works Monitoring 4Document1 pageMain Production Interior Painting Works Monitoring 4Noli BenongoNo ratings yet

- FINAL January 2024 ASCE NewsletterDocument9 pagesFINAL January 2024 ASCE NewsletterNoli BenongoNo ratings yet

- Bdo TCSDocument7 pagesBdo TCSNoli BenongoNo ratings yet

- Steel Cleaning and Patching ChecklistDocument1 pageSteel Cleaning and Patching ChecklistNoli BenongoNo ratings yet

- HSP Daily Dashboard 20230810 1Document1 pageHSP Daily Dashboard 20230810 1Noli BenongoNo ratings yet

- Campus Date of Joining: Noida Institute of Engineering & Technology (NIET) July 18, 2022Document2 pagesCampus Date of Joining: Noida Institute of Engineering & Technology (NIET) July 18, 2022KESHAV JHANo ratings yet

- Moneague College Application Form 2012-13Document20 pagesMoneague College Application Form 2012-13Khalil GordonNo ratings yet

- Working Together Brochure LowRES PDFDocument22 pagesWorking Together Brochure LowRES PDFWajahat NoshairwanNo ratings yet

- Commission Chart Digital Seva KendraDocument28 pagesCommission Chart Digital Seva KendraDsl, DahejNo ratings yet

- Prospectus My RH Bib FDocument355 pagesProspectus My RH Bib FharizhamidonNo ratings yet

- FareharborDocument3 pagesFareharborSugumarNo ratings yet

- Eng - Record71-Fund CatalogueDocument26 pagesEng - Record71-Fund CatalogueTing ohnNo ratings yet

- HSBC Expat Tariff of ChargesDocument9 pagesHSBC Expat Tariff of ChargesDougNo ratings yet

- Academic Fee Receipt PDFDocument1 pageAcademic Fee Receipt PDFBNo ratings yet

- IU045849Document1 pageIU045849Luka UrushadzeNo ratings yet

- EBS Pitchbook RestDocument19 pagesEBS Pitchbook Restarun devaNo ratings yet

- Rigel Finance Whitepaper v1Document32 pagesRigel Finance Whitepaper v1Dan WolfgramNo ratings yet

- Jefferson Township OPRA Request FormDocument4 pagesJefferson Township OPRA Request FormThe Citizens CampaignNo ratings yet

- Bộ đề dự đoán Ielts Writing Forecast Quý 1-2024 - Bản FULLDocument31 pagesBộ đề dự đoán Ielts Writing Forecast Quý 1-2024 - Bản FULLNgan NguyenNo ratings yet

- MobileBill 1069691680Document8 pagesMobileBill 1069691680Sharret ShaNo ratings yet

- Notification SJVN LTD Field Officer JR Field Engineeer JR Field Officer PostsDocument7 pagesNotification SJVN LTD Field Officer JR Field Engineeer JR Field Officer PostsRakesh BidduNo ratings yet

- Citizen - S CharterDocument35 pagesCitizen - S CharterLoreto VillaNo ratings yet

- Bex Assignment GroupDocument16 pagesBex Assignment GroupJovias KelvinsunNo ratings yet

- Residential Rental Lease Agreement: Nome Partners LLCDocument35 pagesResidential Rental Lease Agreement: Nome Partners LLCJose medina carvajalNo ratings yet

- SamsungDocument162 pagesSamsungSachin KumarNo ratings yet

- Gmail - Your Air France Booking Is Pending Payment 2Document5 pagesGmail - Your Air France Booking Is Pending Payment 2shawn alexNo ratings yet