Professional Documents

Culture Documents

G.Income Tax-Kinds of Taxpayer

Uploaded by

VinteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

G.Income Tax-Kinds of Taxpayer

Uploaded by

VinteCopyright:

Available Formats

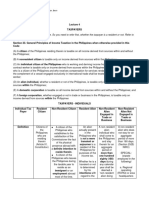

CENTURION NOTES Non-resident Taxable Within the

TAXATION alien income Philippines

engaged in

trade or

INCOME TAX business

(stays more

1. Kinds of Taxpayers than 180

days)

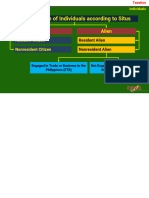

a. Individual Non-resident Gross Within the

b. Corporations alien not income Philippines

c. Partnership engaged in

trade or

Individual taxpayer Corporation business

Resident citizen Domestic corporation (stays 180

Alien Foreign corporation day or less)

Partnership

CORPORATION

INDIVIDUAL TAXPAYER Corporation Tax source Taxable

Citizens of the Alien income

Philippines Domestic Taxable Within and

Resident citizens of Resident of the income without the

the Philippines Philippines Philippines

(1) Filipinos residing Foreign Taxable Within the

in the Philippines. -engaged or income Philippines

(2)Filipinos living not engaged

abroad but without in trade

intention of residing Partnership

there permanently. GPP Non-taxable Individual

partners’

Non-resident citizen Non-resident of the income

of the Philippines Phillippines depending on

1.One has intention 1. Non-resident their

to reside permanently engaged in trade and classification.

abroad business in the Estate and Taxable Same basis

Philippines. Trust income as an

individual

OFW and seaman Aliens employed by

multinational

companies A resident citizen and domestic corporations-are

offshore, banking taxable in all income derived from sources within and

units without the Philippines.

Non-resident citizen and foreign corporation

(engage or not engaged business in Philippines)-

Citizens of Tax source Taxable is taxable only on income derived from sources within

the income the Philippines.

Philippines

Resident Taxable Within and

citizen income without the

Philippines

Non-resident Taxable Within the

citizen income Philippines

Aliens

Resident Taxable Within the

Alien income Philippines

You might also like

- Income Tax On Individuals PDFDocument20 pagesIncome Tax On Individuals PDFKaren Joy MagsayoNo ratings yet

- Income Taxation - Part 2Document12 pagesIncome Taxation - Part 2Prie DitucalanNo ratings yet

- Individual TaxpayersDocument3 pagesIndividual TaxpayersJoy Orena100% (2)

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Taxation 1 NotesDocument15 pagesTaxation 1 NotesTricia SandovalNo ratings yet

- Types of TaxpayerDocument23 pagesTypes of TaxpayerReina Rose LebrillaNo ratings yet

- InTax Unit 2Document3 pagesInTax Unit 2ElleNo ratings yet

- Income Taxation: Income Tax For IndividualsDocument8 pagesIncome Taxation: Income Tax For IndividualsJohnnoff Bagacina0% (1)

- Tax CompiledDocument379 pagesTax Compiledlayla scotNo ratings yet

- TSN By: Adil, Flores, Orquina, Dura-Butaslac, Tan, Besin From The Lecture of Atty. AbrantesDocument31 pagesTSN By: Adil, Flores, Orquina, Dura-Butaslac, Tan, Besin From The Lecture of Atty. AbrantesEmma PaglalaNo ratings yet

- Income Tax Prelims.Document13 pagesIncome Tax Prelims.Amber Lavarias BernabeNo ratings yet

- Classification of Individual Income TaxpayersDocument3 pagesClassification of Individual Income TaxpayersOdessa De JesusNo ratings yet

- TAX LAW BALA SA BAR SERIES ExportDocument10 pagesTAX LAW BALA SA BAR SERIES Exportmetrexz17.03No ratings yet

- Income Taxation Midterm ReviewerDocument16 pagesIncome Taxation Midterm ReviewerRAMIREZ, MARVIN L.No ratings yet

- Kinds of Taxpayers and Situs of IncomeDocument2 pagesKinds of Taxpayers and Situs of IncomeMelanie SamsonaNo ratings yet

- Tax 1 MidtermsDocument18 pagesTax 1 MidtermsElaine Yap100% (1)

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerMichael SanchezNo ratings yet

- Bar TaxDocument29 pagesBar TaxMaisie ZabalaNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- TAX Outline 2 1Document18 pagesTAX Outline 2 1Master GTNo ratings yet

- Individual TaxpayerDocument10 pagesIndividual TaxpayerLL. yangzNo ratings yet

- Citizenship and Residency Inside RP Outside RPDocument2 pagesCitizenship and Residency Inside RP Outside RPRhea Royce CabuhatNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Features of Philippine Income Tax SystemDocument9 pagesFeatures of Philippine Income Tax SystemPATRICIA ANGELICA VINUYANo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- Group - 2 - Individual Taxpayer Part 1Document45 pagesGroup - 2 - Individual Taxpayer Part 1Ems TeopeNo ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- TAX - Income Tax On IndividualsDocument10 pagesTAX - Income Tax On Individualsall about seventeenNo ratings yet

- University of Perpetual Help System DaltaDocument31 pagesUniversity of Perpetual Help System DaltaDerick Ocampo FulgencioNo ratings yet

- 6 11 18 Tax Summary in The Philippines EditedDocument117 pages6 11 18 Tax Summary in The Philippines EditedBianca PalomaNo ratings yet

- Individual TaxpayersDocument2 pagesIndividual TaxpayersKenneth CajileNo ratings yet

- Income Tax PDFDocument16 pagesIncome Tax PDFMay Tan100% (1)

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- Reviewer Chapter 2Document6 pagesReviewer Chapter 2Ken NavarroNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDocument4 pagesIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizensJul A.No ratings yet

- Income Taxation of Individuals: Citizens: Resident Non-Residents CitizensDocument2 pagesIncome Taxation of Individuals: Citizens: Resident Non-Residents CitizenshellomynameisNo ratings yet

- Personal Income Taxation 1Document29 pagesPersonal Income Taxation 1Rovic OrdonioNo ratings yet

- Income Taxation TaxationDocument4 pagesIncome Taxation TaxationJosiah DonatoNo ratings yet

- Person - Orporation: Income TaxDocument223 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- Taxation of IndividualsDocument22 pagesTaxation of IndividualsTurksNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa83% (24)

- Tax 2 TSNDocument38 pagesTax 2 TSNCamille EveNo ratings yet

- Taxation of Foreign Source Income by Philippine TaxpayersDocument1 pageTaxation of Foreign Source Income by Philippine TaxpayersMarlon Ty ManaloNo ratings yet

- Income Tax On Individuals - REVISED 2022Document141 pagesIncome Tax On Individuals - REVISED 2022rav dano100% (2)

- TAX Notes AdditionalDocument18 pagesTAX Notes AdditionalJoben Vernan CuencaNo ratings yet

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- Person - Orporation: Income TaxDocument138 pagesPerson - Orporation: Income TaxMich FelloneNo ratings yet

- Taxation Income TaxationDocument73 pagesTaxation Income TaxationB-an Javelosa0% (1)

- Summary Lesson 4Document6 pagesSummary Lesson 4Janien MedestomasNo ratings yet

- Taxation of IndividualsDocument6 pagesTaxation of IndividualsLyca V100% (1)

- 2016 Tax Aid Classification of TaxpayersDocument4 pages2016 Tax Aid Classification of TaxpayersDewm DewmNo ratings yet

- Module 3 Individual Taxpayers 1Document8 pagesModule 3 Individual Taxpayers 1Chryshelle Anne Marie LontokNo ratings yet

- 4 5A Persons Subject To Income TaxDocument11 pages4 5A Persons Subject To Income TaxArgie DeguzmanNo ratings yet

- Individual Taxpayers: Resident Citizens Nonresident Citizens AliensDocument22 pagesIndividual Taxpayers: Resident Citizens Nonresident Citizens AliensKrizza TerradoNo ratings yet

- PreFi Tax PDFDocument21 pagesPreFi Tax PDFJoesil Dianne SempronNo ratings yet

- Quickie PreFi Tax PDFDocument12 pagesQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- KLMinvoice 04062020Document1 pageKLMinvoice 04062020Jack RobinsonNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Bibek Pashu Tatha Machha PalanDocument44 pagesBibek Pashu Tatha Machha PalanBIBUTSAL BHATTARAINo ratings yet

- Towr LK TW I 2020Document153 pagesTowr LK TW I 2020cyndi noviaNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument12 pagesCambridge Ordinary Level: Cambridge Assessment International EducationBEeNaNo ratings yet

- Business Tax - Sat Prelim - 2ND Sem - 2019-2020Document4 pagesBusiness Tax - Sat Prelim - 2ND Sem - 2019-2020Renalyn ParasNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesMaximuzNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllergssNo ratings yet

- Example: Assume A Public Body Receives From MOFED A Transfer of Birr 100,000 ForDocument32 pagesExample: Assume A Public Body Receives From MOFED A Transfer of Birr 100,000 ForSentayehu GebeyehuNo ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- Tax Invoice: Get Educated Pty LTD T/A GetsmarterDocument1 pageTax Invoice: Get Educated Pty LTD T/A Getsmarterrichard patrickNo ratings yet

- BFZPS6321F-2022 AsDocument4 pagesBFZPS6321F-2022 AsAstral CorporationNo ratings yet

- Answer in The Activity-Property RelationsDocument4 pagesAnswer in The Activity-Property RelationsjenNo ratings yet

- IBM Payslip April 2012Document1 pageIBM Payslip April 2012NARESH KESAVANNo ratings yet

- Corporate Income TaxationDocument3 pagesCorporate Income TaxationKezNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRshammas PANo ratings yet

- 30 Apr 2021Document1 page30 Apr 2021Madhuri MadhuNo ratings yet

- Payslip PDFDocument1 pagePayslip PDFcapkarish67% (3)

- 1999 68 ITD 95 Mumbai 03 10 1997Document9 pages1999 68 ITD 95 Mumbai 03 10 1997shubhit shokeenNo ratings yet

- Assignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Document4 pagesAssignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Ivy KwokNo ratings yet

- Sindh Education Whatsapp Group #03103377322.: Inspector Inland Revenue Important McqsDocument10 pagesSindh Education Whatsapp Group #03103377322.: Inspector Inland Revenue Important McqsAMAZING VIDEOSNo ratings yet

- Incomplete Record - QuestionDocument4 pagesIncomplete Record - QuestionChandran Pachapan100% (3)

- Taxes and Levies (Approved List For Collection) ACT 1998 NO. 2, 1998Document4 pagesTaxes and Levies (Approved List For Collection) ACT 1998 NO. 2, 1998Shuaibu AhmadNo ratings yet

- Act CPRDocument5 pagesAct CPRshahzad_financeNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- P4 1Document1 pageP4 1Arnalistan Eka100% (1)

- University School of Business Bachelor of Business AdministrationDocument13 pagesUniversity School of Business Bachelor of Business AdministrationShivam GuptaNo ratings yet

- Imposto de Renda em InglesDocument5 pagesImposto de Renda em InglesIago MartinsNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Pirovano VS CirDocument1 pagePirovano VS CirMary Anne Guanzon VitugNo ratings yet