Professional Documents

Culture Documents

RMC No. 25-2024

Uploaded by

Anostasia NemusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 25-2024

Uploaded by

Anostasia NemusCopyright:

Available Formats

3

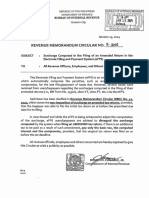

REPUBLIC O F T H E PHILIPPINES

DEPARTMENT OF FINANCE

Kf ■ra 1

p I e*

/pri

BUREAU O F INTERNAL REVENUE

National Office Building

Quezon City

r

FEB 1 3 2024

REVENUE MEMORANDUM CIRCULAR NO. 3 g - 2024

SUBJECT : Amending the Pertinent Provisions of Revenue Memorandum Circular

No. 16-2024 Extending the Deadline of Submission of Alphabetical List of

Employees/Payees from Whom Taxes Were Withheld

TO : All Internal Revenue Officials, Employees and Others Concerned

This Circular is hereby issued to amend the pertinent provisions of Revenue

Memorandum Circular No. 16-2024, more particularly, on the extension of the deadline of

submission of the Alphabetical List of Employees/Payees from Whom Taxes Were Withheld

(alphalist for brevity) for the taxable year 2023.

In this connection, those taxpayers with their own extract program shall strictly observe

the attached revised file structures and standard naming convention (see Annexes “A” and “B”).

Moreover, in order to provide all concerned taxpayers sufficient time to submit the alphalist for

the taxable year 2023, the deadline of submission thereof shall be thirty (30) days from the date

of posting of a tax advisory on the BIR website announcing the availability of the updated

version of the Alphalist Data Entry and Validation Module.

In cases where alphalists were submitted using the old version of the said data entry

module, the concerned taxpayers shall re-submit the same using the updated version of the

module upon its availability thereof.

All internal revenue officers, employees, and others concerned are hereby enjoined to

give this Circular as wide a publicity as possible.

R<

Conn

p.i 't ,p

I

i |pj\

.. - ». 11 p

i

/ FEB 13 2fe4

1 cCO-WS WGT. Ob'iSION

You might also like

- They Came From Beneath The Sea RPG (Storypath) - CC PDFDocument287 pagesThey Came From Beneath The Sea RPG (Storypath) - CC PDFAlessio100% (7)

- PM600 Unit 1 IPDocument6 pagesPM600 Unit 1 IPdiya allieNo ratings yet

- Focus 1 TBDocument5 pagesFocus 1 TBMaria GeltzNo ratings yet

- RMC No. 16-2021Document2 pagesRMC No. 16-2021Leichelle BautistaNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- RMC No. 131-2020Document1 pageRMC No. 131-2020nathalie velasquezNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Advisory Re MC Re Reminders On The Preparation of The BFDP - 0613Document38 pagesAdvisory Re MC Re Reminders On The Preparation of The BFDP - 0613sadzNo ratings yet

- RMC No. 92-2020Document1 pageRMC No. 92-2020Brian TomasNo ratings yet

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadNo ratings yet

- RMC No. 7-2021Document1 pageRMC No. 7-2021nathalie velasquezNo ratings yet

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RMC No. 117-2021 Clarification On Submission of 2307 and 2316Document2 pagesRMC No. 117-2021 Clarification On Submission of 2307 and 2316Gerald SantosNo ratings yet

- Of The of The Act: Republic of Philippines Department FinanceDocument3 pagesOf The of The Act: Republic of Philippines Department FinanceRon loyolaNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon City July 17, 2018Document1 pageBureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon City July 17, 2018Ramon EldonoNo ratings yet

- RMC No 19-2019 PDFDocument2 pagesRMC No 19-2019 PDFRobea Marie GaspayNo ratings yet

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- Dilg Memocircular 2014724 - 235e18bc66Document17 pagesDilg Memocircular 2014724 - 235e18bc66Rg PerolaNo ratings yet

- RMC No. 88-2021Document1 pageRMC No. 88-2021Jogenn Karla GagarinNo ratings yet

- RMC No. 14-2021Document1 pageRMC No. 14-2021nathalie velasquezNo ratings yet

- RR 10-2019Document2 pagesRR 10-2019Jackie PadasasNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- Fficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Document1 pageFficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Maureen PascualNo ratings yet

- Rmo - No. 2-2019Document2 pagesRmo - No. 2-2019Xhris ChingNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- March: Republic Philippines Department of Finance OI-RevenueDocument2 pagesMarch: Republic Philippines Department of Finance OI-Revenueantonio espirituNo ratings yet

- Commissioner Oflnterial O35eDocument4 pagesCommissioner Oflnterial O35eMartin SandersonNo ratings yet

- Dtir41: Ili :F' 1Document9 pagesDtir41: Ili :F' 1Rieland CuevasNo ratings yet

- RMC No. 117-2020-MergedDocument15 pagesRMC No. 117-2020-Mergednathalie velasquezNo ratings yet

- RMC 2020 No. 16 Availability of Oflline eBIR Forms Version 7.6Document2 pagesRMC 2020 No. 16 Availability of Oflline eBIR Forms Version 7.6Bien Bowie A. CortezNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021lara.zestoNo ratings yet

- RMC No. 68-2021Document1 pageRMC No. 68-2021REX FABERNo ratings yet

- NR ZBG: Republic Department Finance of InternalDocument1 pageNR ZBG: Republic Department Finance of InternalAlden Christopher LumotNo ratings yet

- RR No. 5-2022Document1 pageRR No. 5-2022Premiumly SoloNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument2 pagesBureau of Internal Revenue: Republic of The Philippines Department of Financelantern san juanNo ratings yet

- RMC No. 57-2021Document1 pageRMC No. 57-2021Enrryson SebastianNo ratings yet

- 1 - Kagiso Mmusi Uif - 20230711 - 0001Document8 pages1 - Kagiso Mmusi Uif - 20230711 - 0001Kagiso Kagi MmusiNo ratings yet

- Ol Of: Ai) Ditional ManilaDocument17 pagesOl Of: Ai) Ditional ManilaJeremy RyanNo ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- Updates (Company Update)Document3 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- RMC No. 55-2021Document1 pageRMC No. 55-2021Enrryson SebastianNo ratings yet

- RMC No 54-18 Interest and Penalty PDFDocument2 pagesRMC No 54-18 Interest and Penalty PDFGil PinoNo ratings yet

- gL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalDocument2 pagesgL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalKe VinNo ratings yet

- ®eptlrtmettt Ot ®butat (Ott: Iffi#Va .D.,CesolvDocument3 pages®eptlrtmettt Ot ®butat (Ott: Iffi#Va .D.,CesolvMelbenPalEspereSaligueNo ratings yet

- RMC No. 9-2024Document1 pageRMC No. 9-2024Anostasia NemusNo ratings yet

- Department Administrative Order No. 3, S. 1995Document5 pagesDepartment Administrative Order No. 3, S. 1995Edward MagatNo ratings yet

- RR 9-2018 Tax On StockDocument2 pagesRR 9-2018 Tax On StockRomer LesondatoNo ratings yet

- RR 22-2020Document2 pagesRR 22-2020Christopher ArellanoNo ratings yet

- RR No. 8 2016Document4 pagesRR No. 8 2016Jay Mark ReponteNo ratings yet

- RMC No. 62-2018 Estate TaxDocument2 pagesRMC No. 62-2018 Estate TaxJade MarkNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- SBN-1007: PNR RehabilitationDocument4 pagesSBN-1007: PNR RehabilitationRalph RectoNo ratings yet

- BIR RMC No. 84-2022 - Sworn Declaration Template For RBEsDocument1 pageBIR RMC No. 84-2022 - Sworn Declaration Template For RBEsMaricris MendozaNo ratings yet

- RR No. 26 - 2020Document3 pagesRR No. 26 - 2020Bobby LockNo ratings yet

- RMC No. 45-2017Document3 pagesRMC No. 45-2017Nigel Lorenzo ReyesNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- RMC No 72-2015Document1 pageRMC No 72-2015GoogleNo ratings yet

- RMC No 35-2016Document2 pagesRMC No 35-2016Rodel Ryan YanaNo ratings yet

- RMC No. 18-2021Document2 pagesRMC No. 18-2021Marvin Coming MoldeNo ratings yet

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- RR No. 3-2023Document6 pagesRR No. 3-2023Anostasia NemusNo ratings yet

- RR No. 2-2021Document3 pagesRR No. 2-2021Anostasia NemusNo ratings yet

- RR No. 16-2023Document7 pagesRR No. 16-2023Anostasia NemusNo ratings yet

- RMC No. 160-2022Document1 pageRMC No. 160-2022Anostasia NemusNo ratings yet

- RMO No. 6-2023Document11 pagesRMO No. 6-2023Anostasia NemusNo ratings yet

- RMC No. 11-2024 - Tax Treatment of Lease Accounting by LesseesDocument9 pagesRMC No. 11-2024 - Tax Treatment of Lease Accounting by LesseesAnostasia NemusNo ratings yet

- Digest Full TextDocument4 pagesDigest Full TextAnostasia NemusNo ratings yet

- RA No. 11976 - Ease of Paying Taxes ActDocument22 pagesRA No. 11976 - Ease of Paying Taxes ActAnostasia NemusNo ratings yet

- RA No. 11861 - Expanded Solo Parents Welfare ActDocument12 pagesRA No. 11861 - Expanded Solo Parents Welfare ActAnostasia NemusNo ratings yet

- Presentation, Analysis, and Interpretation of DataDocument16 pagesPresentation, Analysis, and Interpretation of DataAnostasia NemusNo ratings yet

- For Thesis USC BSADocument3 pagesFor Thesis USC BSAAnostasia NemusNo ratings yet

- How To Get AD Users Password Expiration DateDocument3 pagesHow To Get AD Users Password Expiration Datebczeon27No ratings yet

- Incident Report ADocument2 pagesIncident Report Aapi-389205029No ratings yet

- Thyr Care: The Trust. The TruthDocument27 pagesThyr Care: The Trust. The TruthShadabNo ratings yet

- Seameo Post TestDocument6 pagesSeameo Post TestEgi CaguisanoNo ratings yet

- How Is A Cohort Study Designed? Cite A Specific Example (Aside From The One in The Reference)Document12 pagesHow Is A Cohort Study Designed? Cite A Specific Example (Aside From The One in The Reference)Jeremy PaatanNo ratings yet

- MIT Open Course Ware - Toy Product DesignDocument3 pagesMIT Open Course Ware - Toy Product Designbatros1No ratings yet

- CBSE Sample Paper - 01 Summative Assessment - I Class - X MathematicsDocument3 pagesCBSE Sample Paper - 01 Summative Assessment - I Class - X MathematicsArin ChatterjeeNo ratings yet

- Proud MaryDocument3 pagesProud Maryeomo_usohNo ratings yet

- Cannes Pitch 2023.Document7 pagesCannes Pitch 2023.Diego SeniorNo ratings yet

- Reduction of Workdays SchemeDocument2 pagesReduction of Workdays SchemeAndrew GallardoNo ratings yet

- Sa Lang Hindi 27 12 18 S2Document64 pagesSa Lang Hindi 27 12 18 S2ThirupathaiahNo ratings yet

- Distillation: C H E 2 4 6 Separation ProcessDocument29 pagesDistillation: C H E 2 4 6 Separation ProcessnorazifahNo ratings yet

- IOBM Question PaperDocument2 pagesIOBM Question PaperAtif AslamNo ratings yet

- 101 - System ArgumentsDocument16 pages101 - System ArgumentsMurali VarathanNo ratings yet

- TP LivingProofLongevityChallenge 2024Document107 pagesTP LivingProofLongevityChallenge 2024Marie CharcuterieNo ratings yet

- Worksheet 12: Past Simple PassiveDocument3 pagesWorksheet 12: Past Simple PassiveDayana Huaranca100% (1)

- LQS ManualDocument38 pagesLQS ManualVindyanchal Kumar100% (1)

- Bagewadikar Price List Inside Pages 30-03-2022Document8 pagesBagewadikar Price List Inside Pages 30-03-2022PNo ratings yet

- D1.05 - Matthew Ibrahim - Isometrics For Tendon Health Gains PDFDocument1 pageD1.05 - Matthew Ibrahim - Isometrics For Tendon Health Gains PDFok okNo ratings yet

- Festival Dancing and Fitness: 3 QuarterDocument25 pagesFestival Dancing and Fitness: 3 QuarterJohnahdijusto MateoNo ratings yet

- The Lion and The AntDocument4 pagesThe Lion and The AntDebby Jean ChavezNo ratings yet

- Effect of Recitation Method To The Students Inter PDFDocument5 pagesEffect of Recitation Method To The Students Inter PDFVeeNo ratings yet

- Final Draft Remarkable Race Essay WeeblyDocument4 pagesFinal Draft Remarkable Race Essay Weeblyapi-608440469No ratings yet

- Biosensors and Internet of Things in Smart Healthcare Applications - Challenges and Opportunities - ScienceDirectDocument3 pagesBiosensors and Internet of Things in Smart Healthcare Applications - Challenges and Opportunities - ScienceDirectAna JuliaNo ratings yet

- Kuku Bima Ener-G Marketing Strategy AnalysisDocument11 pagesKuku Bima Ener-G Marketing Strategy Analysisariefakbar100% (1)

- RiceTalk Rice Blast Detection Using Internet of Things and Artificial Intelligence TechnologiesDocument10 pagesRiceTalk Rice Blast Detection Using Internet of Things and Artificial Intelligence TechnologiesAnali GalindosNo ratings yet

- Level 2 Skills Lab PresentationDocument24 pagesLevel 2 Skills Lab PresentationJamie HaravataNo ratings yet