Professional Documents

Culture Documents

BLaw - Law of Business Organisations

Uploaded by

gwyneth.goi.2023Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BLaw - Law of Business Organisations

Uploaded by

gwyneth.goi.2023Copyright:

Available Formats

8/20/20

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

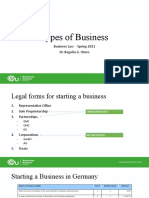

Forms of Business Organisations

[refer to Figure 9.1 on p.200 text]

1. Sole Proprietorship

LAW OF BUSINESS 2. Partnership

• Ordinary Partnership

• Limited Partnership (LP)

ORGANISATIONS • Limited Liability Partnership (LLP)

3. Company

• Private Limited Company (Pte Ltd Co)

• Public Company

(c) 2020 Ngee Ann Polytechnic 1 (c) 2020 Ngee Ann Polytechnic 2

1 2

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Main distinction between forms of Unlimited Liability

business organisations - Liability

• Sole Proprietor (SP)

• Liability of the people operating the business form

may be limited or unlimited • Partners in an Ordinary Partnership (OP)

• Limited liability refers to the personal liability of the • General Partners in a Limited Partnership (LP)

person concerned to pay the creditors of the business Effects of unlimited liability

form upon the business being dissolved • Personal assets of the person operating the business (SP or OP or the

• Generally the business form itself has unlimited general partner in an LP) can be seized to pay off the business debts

liability to its creditors; it’s liability in the event of a of the business form

dissolution is not limited in any way; creditors may • If personal assets are insufficient, the person can even be made a

seize its assets and claim the amount owing to them bankrupt

subject to proof of their debt

(c) 2020 Ngee Ann Polytechnic 3 (c) 2020 Ngee Ann Polytechnic 4

3 4

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Limited Liability Forms of Business Organisations

[refer to Figure 9.1 on p.200 text]

• Liability is capped at the amount invested in the business; no further 1. Sole Proprietorship

personal liability to the creditors of the business 2. Partnership

• Partners in a Limited Liability Partnership (LLP), except for the partner • Ordinary Partnership

who has committed a personal wrongdoing (e.g. negligence)

• Limited Partnership

• Members in a Limited Liability Company (either public or private

company/ single member company) • Limited Liability Partnership

• Limited Partners in a Limited Partnership (LP) 3. Company

• Private Limited Company

• Public Company

(c) 2020 Ngee Ann Polytechnic 5 (c) 2020 Ngee Ann Polytechnic 6

5 6

(c) 2019 Ngee Ann Polytechnic 1

8/20/20

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Sole Proprietorship Sole Proprietorship

[refer to pages 201 – 205 text]

• Can be dissolved easily by giving notice to ACRA, or if

• Business operated by 1 person proprietor dies or is made bankrupt

• Law: Business Names Registration Act (Cap 32 Singapore Statutes) • Not a separate legal entity from the proprietor:

• The debts and rights of the business belong to the

• Registration: required unless exempted under s.4 (see 1st Schedule sole proprietor

of the Act for list of exempted businesses) • Though easy to set up, run and dissolve, proprietor is

• Effect of failure to register: Offence and sole proprietor will not be not protected from business debts

able to enforce contracts entered into relating to the business • Proprietor has personal and unlimited liability for

the business debts of the sole proprietorship and can

• Registration at ACRA: simple, cheap and can be done online – refer be made bankrupt if he fails to settle the debts of the

to Figure 9.2 on p.203 text business

• Additional licences may be required from appropriate authorities

depending on the type of business - e.g. HDB or URA approval What are the advantages & disadvantages of a

required to run business from home sole proprietorship? (see Figure 9.3 on p.204 text)

(c) 2020 Ngee Ann Polytechnic 7 (c) 2020 Ngee Ann Polytechnic 8

7 8

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Partnership - Ordinary

Partnership - Ordinary

[refer to pages 205 – 210 text]

• Formalities

• A partnership is a relationship which subsists between

persons carrying on business in common with a view to • Partnership agreement: can be oral or

profit - s. 1 Partnership Act(PA) written

• The partnership firm is not a separate entity from the

• Registration: required under the Business

partners Names Registration Act (Cap 32)

• Minimum: 2 partners

• Maximum: 20 partners • Persons running a partnership (partners)

• Exception: Professional firms (e.g. lawyers, doctors, can be collectively called the firm

accountants) - no maximum limit

(c) 2020 Ngee Ann Polytechnic 9 (c) 2020 Ngee Ann Polytechnic 10

9 10

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Relationship Between Ordinary Partners

Relationship Between Ordinary Partners and Outsiders(third parties)

• Partnership Act provisions can be overridden by the [refer to Figure 9.4 on p. 206 text]

partners if they agree otherwise

• Profits and losses: shared equally amongst the • Every partner is an agent of the firm and the other

partner(s) – what a partner does can bind the firm and

partners the other partner(s)

• Management: Every partner has the right to take part • S. 5 PA – to enable any partner to bind the firm to a third

in the management of the firm party the following must exist:

• Decisions on ordinary business matters: based on 1. the act done by the partner appears to be in the usual

majority of the partners course of business of the firm;

• Remuneration: Partners are not entitled to salary for 2. unless, the partner so acting has no authority to act for

their services the firm in that matter; and

3. the person with whom he is dealing (3rd party) either

• Relationship between partners: utmost good faith knows that he has no authority or does not know or

(c) 2020 Ngee Ann Polytechnic 11

believe him to be a partner 12

11 12

(c) 2019 Ngee Ann Polytechnic 2

8/20/20

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Types of authority of a partner to enter into contracts on Relationship Between Ordinary Partners and

behalf of the partnership Outsiders (suing and being sued)

• Liability of partners: joint and several – S.9 PA

• Express authority: authority expressly conferred on a partner by the • One partner is liable for the wrongdoings of another

other partner(s).

• If a partner is sued, and if the claim is not paid the claimant may subsequently

• Implied authority: authority a partner would usually have for the still sue the other partners

particular type of business; any act done by a partner in the usual way

of business will bind the partnership and the other partner(s), unless • Easier alternative:

the third party knew that the partner had no actual authority - • A single action may be brought against all the partners at once by suing in the

Mercantile Credit Co Ltd v Garrod (p.208 text).

name of the firm

• Apparent authority: arises if the firm represents to the third party that • Once the firm is held liable the judgment can be enforced against the firm

the partner has authority to do certain acts and that person relies on • If the firm’s assets are insufficient, the partners’ personal property may be

that representation – Freeman & Lockyer (Law of agency case) – p.142

text. seized to satisfy the partnership firm’s debts since the partners have unlimited

(c) 2020 Ngee Ann Polytechnic 13

liability (c) 2020 Ngee Ann Polytechnic 14

13 14

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Dissolution (termination) of Ordinary Forms of Business Organisations

Partnership [refer to Figure 9.1 on p.200 text]

• Dissolution may be by agreement or under the 1. Sole Proprietorship

Partnership Act (PA) or by the court

• Examples under the PA 2. Partnership

• S 32 PA: partnership for a fixed term will dissolve at the • Ordinary Partnership

end of the term; partnership for a particular purpose • Limited Partnership

will dissolve upon the achievement of that purpose; or

by notice given by a partner

• Limited Liability Partnership

• S 33 PA: partnership is dissolved when a partner dies or 3. Company

becomes bankrupt • Private Limited Company

• Public Company

What are the advantages & disadvantages of a

partnership? (see Figure 9.5 on p.209 text)

(c) 2020 Ngee Ann Polytechnic 15 (c) 2020 Ngee Ann Polytechnic 16

15 16

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Limited Partnership (LP) Limited Partnership (LP)

[refer to Figure 9.6 on page 212 text]

General partner

• Law: Limited Partnership Act •manages the LP

• Not a separate legal entity from the partners

• Minimum: 1 general partner and 1 limited •liable for all the debts and obligations

partner of the LP; thus has unlimited liability

• No maximum number of partners

• Generally similar to an ordinary partnership •benefits from the investment by the

with a notable difference on the liability of limited partners, but remains liable for

limited partner(s) all the debts of the LP

(c) 2020 Ngee Ann Polytechnic 17 (c) 2020 Ngee Ann Polytechnic 18

17 18

(c) 2019 Ngee Ann Polytechnic 3

8/20/20

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Limited Partnership (LP) Limited Liability Partnership (LLP)

Limited partner [refer to pages 211 – 212 text]

•liability for the firm’s debts is limited - capped at the • Law: Limited Liability Partnership Act

amount of his agreed contribution to the LP provided • Combines features of an ordinary partnership and a

he does not take part in the management of the LP company

•once he takes part in the management of the LP he • Individual partner’s liability is generally limited

loses his limited liability • Distinguishing characteristic from other partnerships -

•does not have the power to bind the LP; is not an Separate legal entity

agent of the firm • The LLP firm is a separate legal entity from its partners

•ideal for investors who do not want active roles in • Minimum: 2 partners and at least 1 manager, who may

the management of the business or incur liability also be a partner

beyond what they have invested • No maximum limit on the number of partners

19 (c) 2020 Ngee Ann Polytechnic 20

19 20

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Limited Liability Partnership (LLP) Dissolution of LLP

• Internal relations between partners are very much like an

ordinary partnership It can be dissolved by

• In external relations it is very much like a company: • (i) winding up – voluntarily by partners or creditors; or

• Body corporate – s.4 LLP Act (separate legal entity) compulsorily by the Court

• Has perpetual succession

• Can sue and be sued in its own name • (ii) Striking off from the ACRA register

• Can acquire, own and hold property in its own name

• Partners have limited liability – limited to their investment; • The above is similar to a company

Except: own wrongdoing – s.8 LLP Act

(c) 2020 Ngee Ann Polytechnic 21 (c) 2020 Ngee Ann Polytechnic 22

21 22

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Advantages of LLP over Ordinary COMPANIES

Partnership Regulated by the Companies Act (Cap 50)

1. Limited liability of partners

Foreign Singapore incorporated companies

• Upon dissolution or winding up of LLP, liability is limited to companies

the amount of capital contributed registered in

• No personal liability of partners for the debts of the firm or Singapore Limited liability company Unlimited company

for another partner’s wrongdoing

• Only personally liable - incurring unlimited liability for their Company limited by guarantee Company limited by shares

own wrongdoing – e.g. negligence

2. Perpetual succession Public company Private company

• The LLP continues to exist despite the death, bankruptcy, or

change in partners, unlike an ordinary partnership which

may end abruptly Unlisted Listed (SGX) Exempt Non- exempt

(c) 2020 Ngee Ann Polytechnic 23 24

23 24

(c) 2019 Ngee Ann Polytechnic 4

8/20/20

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Effects of incorporation of a company Members and Directors

[refer to pages 213 – 224 text]

• A company is an artificial person with a legal personality which is • S.20A CA: Every company (public or private) must have

separate from its shareholders and directors at least 1 member (shareholder)

• Private company: max limit of 50 members [S.18(1) CA]

• S.19(5) Companies Act :

• Public company: no max limit for number of members

• Company is a body corporate (separate legal entity) [S.18(1) CA]

• May sue and be sued in its own name • Exempt private company: max limit of 20 members and all

its shares must be held by natural persons and not

• Has perpetual succession corporations [S.4(1) CA]

• Has a common seal • S.157A: The board of directors manage the company

and members (shareholders) cannot interfere or

• Has power to own land and other property in its own name represent the company

• Limited liability of members • the directors (and not the members) are the agents of

Must Read Salomon v Salomon & Co Ltd [1897] House of Lords – the company who can represent the company

page 214 text (c) 2020 Ngee Ann Polytechnic 25 (c) 2020 Ngee Ann Polytechnic 26

25 26

Official (Closed) - Non Sensitive Official (Closed) - Non Sensitive

Incorporation Process Forms of Business Organisations

[see figure 9.7 on p.216 text]

1. Check availability of name (ACRA website) 1. Sole Proprietorship

2. Reserve name and apply for its approval

2. Partnership

3. Prepare/adopt the relevant model constitution • Ordinary Partnership

4. Submit relevant documents (which can be done • Limited Partnership

online via Bizfile in the ACRA website) together

with the registration fee (currently S$300) • Limited Liability Partnership

5. Registrar issues notice of incorporation if all in 3. Company

order • Private Limited Company

How is a single-member company different • Public Company

from a sole proprietorship since both are

owned by one person? 27 (c) 2020 Ngee Ann Polytechnic 28

27 28

Official (Closed) - Non Sensitive

Summary of Lecture

[refer to Comparison Table on p. 225 – 228 text

Factors that will affect the choice of a business

structure:

1. Liability

2. Capital

3. Management rights

4. Type of business activity

5. Expansion plans

6. Maximum number of members

(c) 2020 Ngee Ann Polytechnic 29

29

(c) 2019 Ngee Ann Polytechnic 5

You might also like

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- Neca Labor Factor Score SheetDocument1 pageNeca Labor Factor Score SheetEng Waseem SamsodienNo ratings yet

- What is Reliability Centered Maintenance and its principlesDocument7 pagesWhat is Reliability Centered Maintenance and its principlesRoman AhmadNo ratings yet

- 1 Million Email Subscriber PlaybookDocument29 pages1 Million Email Subscriber PlaybookGabriel Ramos100% (4)

- 16 University of Mindanao v. BSP (Dos Santos)Document3 pages16 University of Mindanao v. BSP (Dos Santos)Tippy Dos SantosNo ratings yet

- BA OutlineDocument17 pagesBA OutlineCarrie AndersonNo ratings yet

- IB Business Management VocabularyDocument16 pagesIB Business Management VocabularyJacob KwonNo ratings yet

- LTE Feature Up To FL15ADocument146 pagesLTE Feature Up To FL15AYoucef BelhadiaNo ratings yet

- Entity ComparisonDocument3 pagesEntity Comparisoncthunder_1No ratings yet

- Forms of Business Ownership Lesson 1Document9 pagesForms of Business Ownership Lesson 1Aghaanaa JaiganeshNo ratings yet

- IU - Legal Forms of Business - Private EnterpriseDocument8 pagesIU - Legal Forms of Business - Private EnterpriseQuỳnh DungNo ratings yet

- Shreesha .R Faculty Montfort CollegeDocument47 pagesShreesha .R Faculty Montfort CollegeShreesha RNo ratings yet

- Lecture 01 FM - Chapter1Document5 pagesLecture 01 FM - Chapter1NamanNo ratings yet

- Chapter 4Document24 pagesChapter 4John DoeNo ratings yet

- Paul Hype Page & CoDocument39 pagesPaul Hype Page & CoArunKumarNo ratings yet

- IU - Legal Forms of Business - PartnershipDocument8 pagesIU - Legal Forms of Business - PartnershipQuỳnh DungNo ratings yet

- Law 3.1Document10 pagesLaw 3.1gilldarcNo ratings yet

- 02FM SM Ch2 1LPDocument8 pages02FM SM Ch2 1LPjoebloggs1888No ratings yet

- HW - Comparative Analysis of EntitiesDocument6 pagesHW - Comparative Analysis of EntitiesRaul AxotlaNo ratings yet

- Forms: of Business StructureDocument39 pagesForms: of Business Structureনাফিস ইকবাল আকিলNo ratings yet

- Quiz 1 ReviewDocument4 pagesQuiz 1 ReviewHibbah OwaisNo ratings yet

- Limited Liability PartnershipDocument19 pagesLimited Liability PartnershipMariam munirahNo ratings yet

- Business Law & Practice FINAL NOTESDocument129 pagesBusiness Law & Practice FINAL NOTESZohair SadiNo ratings yet

- Finance (Introduction)Document6 pagesFinance (Introduction)nericuevas1030No ratings yet

- Types of Business Ownership ExplainedDocument27 pagesTypes of Business Ownership Explainedmaria cacaoNo ratings yet

- Advanced Accounting Chapter 9 2020Document67 pagesAdvanced Accounting Chapter 9 2020Uzzaam HaiderNo ratings yet

- Accounting For Partnerships: Powerd By: Ma7moud Sala7 Mob:0104118340 E-MailDocument33 pagesAccounting For Partnerships: Powerd By: Ma7moud Sala7 Mob:0104118340 E-MailhaithomaNo ratings yet

- Accounting For PartnershipsDocument37 pagesAccounting For PartnershipsTsigereda MulugetaNo ratings yet

- BM Aos 1Document25 pagesBM Aos 1Nguyễn Huy QuânNo ratings yet

- Types of Business OwnershipDocument34 pagesTypes of Business OwnershipKyla CavasNo ratings yet

- Comparison of The Features of Different Types of Business OrganizationsDocument2 pagesComparison of The Features of Different Types of Business Organizationsgavin adrianNo ratings yet

- Pengantar Akuntansi Ii 3 SKS: Minggu 13Document47 pagesPengantar Akuntansi Ii 3 SKS: Minggu 13Nabila SyahlaNo ratings yet

- 02 ACCT 126 - Company Types and StakeholdersDocument2 pages02 ACCT 126 - Company Types and Stakeholdersdalaiah walkerNo ratings yet

- Understanding Business Entities and Company TypesDocument25 pagesUnderstanding Business Entities and Company TypeskkNo ratings yet

- Partnership DefinitionDocument5 pagesPartnership DefinitionJesus Of SuburbiaNo ratings yet

- ACC 113 - CH 12Document33 pagesACC 113 - CH 12ahmed.alaradi88No ratings yet

- Types of Business EntitiesDocument4 pagesTypes of Business EntitiesAini SyafiqahNo ratings yet

- Forms of Business Organization TypesDocument33 pagesForms of Business Organization TypesKatrina EustaceNo ratings yet

- Four Bsns TypesDocument1 pageFour Bsns TypesRazel Joy De JesusNo ratings yet

- PowerPoint - Chapter 04 - Limited Partnerships - AccessibleDocument106 pagesPowerPoint - Chapter 04 - Limited Partnerships - Accessiblehaley.kilpatrickNo ratings yet

- Analyzing Differences Between Three Organization Types: Apple, EVN, and VietJet AirDocument15 pagesAnalyzing Differences Between Three Organization Types: Apple, EVN, and VietJet Airphuc waytoodankNo ratings yet

- April 3&4 Business Management Lectures AnandiDocument94 pagesApril 3&4 Business Management Lectures AnandiNishita AroraNo ratings yet

- Sole Proprietor Vs LLP Vs General Partnership Vs Company in MalaysiaDocument4 pagesSole Proprietor Vs LLP Vs General Partnership Vs Company in MalaysiaJonathan TengNo ratings yet

- IU - Legal Forms of Business - Private EnterpriseDocument5 pagesIU - Legal Forms of Business - Private EnterpriseVân MinhNo ratings yet

- Accounting For PartnershipsDocument58 pagesAccounting For PartnershipsAmy MurphyNo ratings yet

- Module 1 NotesDocument4 pagesModule 1 Notesdimpy dNo ratings yet

- Form company with LLC, partnership or corporationDocument4 pagesForm company with LLC, partnership or corporationGloria TaiNo ratings yet

- Partnership - Corporation ReviewerDocument12 pagesPartnership - Corporation ReviewerJulianna MaballoNo ratings yet

- 1.4 Obligations of PartnersDocument3 pages1.4 Obligations of PartnersXyril MañagoNo ratings yet

- Chapter 4: Types of Business Organization: Business Organisations: The Private SectorDocument10 pagesChapter 4: Types of Business Organization: Business Organisations: The Private SectorDhrisha GadaNo ratings yet

- Legal Aspects of Incorporation and Separate Legal EntityDocument4 pagesLegal Aspects of Incorporation and Separate Legal Entitysharifah izzatiNo ratings yet

- At The End of The Lesson, The Learners Will Be Able ToDocument5 pagesAt The End of The Lesson, The Learners Will Be Able ToAries Venlym TanolaNo ratings yet

- Understanding Business and Entrepreneurship - 2024 v2 PDF-1Document37 pagesUnderstanding Business and Entrepreneurship - 2024 v2 PDF-1Nomvuma GubesaNo ratings yet

- Chapter 5.1 - Corporate Finance - Sv3.0Document65 pagesChapter 5.1 - Corporate Finance - Sv3.0levukhanhlinh2262004No ratings yet

- Introduction Accounting and FinancingDocument5 pagesIntroduction Accounting and FinancingHong TrnhNo ratings yet

- Types of Business OwnershipDocument2 pagesTypes of Business Ownershipprelovedseller bnNo ratings yet

- Chapter 5 SlideDocument50 pagesChapter 5 Slidekhanhly2k41107No ratings yet

- Accounting For PartnershipsDocument38 pagesAccounting For PartnershipsLeticia AvelynNo ratings yet

- Session 4 - 2.14.2023Document7 pagesSession 4 - 2.14.2023LucíaNo ratings yet

- ML 292 Topic 1 - Lecture 1 - SlidesDocument16 pagesML 292 Topic 1 - Lecture 1 - Slidestpotera8No ratings yet

- Unit 2 Types of BusinessDocument23 pagesUnit 2 Types of BusinessRiyana RayNo ratings yet

- Companies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorDocument15 pagesCompanies Act, 2013: Legal Aspects of Business Prof. Mehek KapoorAman jaiNo ratings yet

- Sole Proprietorship and CooperativesDocument4 pagesSole Proprietorship and CooperativesSw00per100% (1)

- Types of Business Ownership: What Is?Document3 pagesTypes of Business Ownership: What Is?Nurin Nabila RoslanNo ratings yet

- Individual Assignment 1 - JosephineDocument2 pagesIndividual Assignment 1 - JosephineKatherine BloomNo ratings yet

- Ielts Vocabulary 1Document2 pagesIelts Vocabulary 1Rizki SalamiNo ratings yet

- IBP Cable and Pressure Transducers IncavDocument6 pagesIBP Cable and Pressure Transducers Incaveng_seng_lim3436No ratings yet

- Roadmap, Iquame, Ched Rquat and Others: Corazon M. NeraDocument27 pagesRoadmap, Iquame, Ched Rquat and Others: Corazon M. NeraJhun LeabresNo ratings yet

- Journal of Cleaner Production: Peide Liu, Baoying Zhu, Mingyan Yang, Xu ChuDocument12 pagesJournal of Cleaner Production: Peide Liu, Baoying Zhu, Mingyan Yang, Xu ChuccNo ratings yet

- Max14920 Max14921Document30 pagesMax14920 Max14921Enrique Sanchez (KicKeWoW)No ratings yet

- United International University: Post Graduate Diploma in Human Resource Management Course TitleDocument20 pagesUnited International University: Post Graduate Diploma in Human Resource Management Course TitleArpon Kumer DasNo ratings yet

- SWOT Analysis of Standard Chartered BankDocument4 pagesSWOT Analysis of Standard Chartered BankparthNo ratings yet

- Scf-Capital Structure Questions (Tybfm)Document2 pagesScf-Capital Structure Questions (Tybfm)TFM069 -SHIVAM VARMANo ratings yet

- Final E-Portfolio AssignmentDocument7 pagesFinal E-Portfolio Assignmentapi-302594281No ratings yet

- Product Specifications Product Specifications: SBNHH SBNHH - 1D45C 1D45C - SR SRDocument6 pagesProduct Specifications Product Specifications: SBNHH SBNHH - 1D45C 1D45C - SR SRjorgeerestrepoNo ratings yet

- Paf-Karachi Institute of Economics & Technology Spring - 2021Document3 pagesPaf-Karachi Institute of Economics & Technology Spring - 2021Basic Knowledge Basic KnowledgeNo ratings yet

- Ijcisim 20Document13 pagesIjcisim 20MashiroNo ratings yet

- Local Government Powers and StructureDocument2 pagesLocal Government Powers and StructureRachel LeachonNo ratings yet

- Complainant Vs Vs Respondent: Third DivisionDocument7 pagesComplainant Vs Vs Respondent: Third DivisionervingabralagbonNo ratings yet

- Buses and PortsDocument3 pagesBuses and PortsHuma Rashid80% (5)

- Sindh Agriculture University Tandojam: ADMISSION / REGISTRATION FORM (For Subsequent Semester)Document2 pagesSindh Agriculture University Tandojam: ADMISSION / REGISTRATION FORM (For Subsequent Semester)Lochi GmNo ratings yet

- ENGINE OVERHAUL 2.6 4cylDocument24 pagesENGINE OVERHAUL 2.6 4cylalbertoNo ratings yet

- ISO 1735 Cheese Determination of Fat Content - Gravimetric MethodDocument20 pagesISO 1735 Cheese Determination of Fat Content - Gravimetric MethodJocilene DantasNo ratings yet

- Leather Agra - JD WelfareDocument25 pagesLeather Agra - JD WelfareManjeet KumarNo ratings yet

- Notes On ME (2) Unit 1Document16 pagesNotes On ME (2) Unit 1Shashwat SinhaNo ratings yet

- Hotel Room Booking System Use-Case DiagramDocument5 pagesHotel Room Booking System Use-Case DiagramCalzita Jeffrey0% (1)

- Green Buildings and Rating Systems PDFDocument106 pagesGreen Buildings and Rating Systems PDFHarsheen kaurNo ratings yet

- CBM4Document11 pagesCBM4Nathalie CapaNo ratings yet

- Slides 06 PDFDocument71 pagesSlides 06 PDFLoai MohamedNo ratings yet

- Integrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemDocument8 pagesIntegrating In-House IEC61850 Technology Into Existing Substation: A Case of EGAT Substation Control SystemMarko KojicNo ratings yet