Professional Documents

Culture Documents

Myb1 2009 Perlite

Uploaded by

HSE SGI CikandeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Myb1 2009 Perlite

Uploaded by

HSE SGI CikandeCopyright:

Available Formats

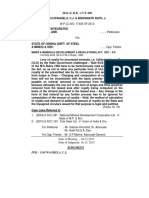

2009 Minerals Yearbook

PERLITE [ADVANCE RELEASE]

U.S. Department of the Interior April 2011

U.S. Geological Survey

PERLITE

By Wallace P. Bolen

Domestic survey data and tables were prepared by Maria Arguelles, statistical assistant, and the world production table was

prepared by Lisa D. Miller, international data coordinator.

In 2009, the amount of domestic processed crude perlite sold used. Production information for nonresponding companies

or used and the amount of expanded perlite sold or used both was estimated using previously reported data, with adjustments

decreased by about 20% compared with that of 2008. Domestic based on currently reported production trends. The top seven

production of processed crude perlite was about 348,000 metric producers of expanded perlite, each with production of more

tons (t), and the amount of expanded perlite sold or used was than 20,000 metric tons per year, accounted for about 79% of

about 439,000 t. Domestically produced processed crude perlite the expanded perlite sold or used in the United States in 2009.

sales declined for the third time in the past 4 years after a brief The remaining 21% was produced by 22 companies.

increase in 2008. The 348,000 t sold or used represent the

lowest level of domestic production since 1964, when 318,000 Consumption

t was produced. The 439,000 t of expanded perlite was the

In 2009, domestic apparent consumption of processed crude

smallest amount sold or used since 1984, when 439,000 t was

perlite was 468,000 t, a 20% decrease compared with that of

also recorded in this category.

2008. This was the lowest level of apparent consumption since

During the year, imports of processed crude perlite decreased

1983, when 447,000 t of processed crude perlite was consumed.

by 18% to 153,000 t compared with that of 2008. This was the

Expanded perlite consumed for construction-related uses, the

third consecutive year with falling perlite imports after a record

major market for expanded material, was about 232,000 t, a

high import level in 2006. Exports of crude processed perlite

decrease of 28% compared with that of 2008. Construction uses

were estimated to have been about 33,000 t, decreasing by about

of expanded perlite, which consisted of concrete aggregate,

11% compared with those of 2008. Trade data in this report are

formed products, masonry- and cavity-fill insulation, and plaster

from the U.S. Census Bureau and the Journal of Commerce’s

aggregate, accounted for about 53% of total domestic sales

Port Import Export Reporting Service. Percentages in this report

of expanded perlite in 2009. Expanded perlite consumption

were computed using unrounded data.

decreased in most markets, with the most pronounced decrease

Production by percentage reported for the formed products market (table

3). Expanded perlite consumption did increase for three

Domestic production data for perlite were derived by the of the smaller markets: concrete aggregate, laundries, and

U.S. Geological Survey (USGS) from two voluntary annual low-temperature insulation. Perlite was expanded, usually

surveys—one for domestic mine operations (processed crude for local consumption, in 28 States. The leading States in

perlite) and one for expanding plants. The expanding plants production of expanded perlite sold or used were, in descending

used domestic and imported processed crude perlite. All the order, Illinois, Georgia, Pennsylvania, Mississippi, California,

processed crude perlite described in table 1 was produced by Oregon, Michigan, and Florida. The amount of expanded perlite

seven companies from nine mines, eight of which responded sold or used by State was listed for those States with three

to the USGS survey, representing about 99% of the processed or more companies expanding in each State; for other States,

crude perlite sold or used in 2009. According to data collected individual data were withheld to avoid disclosing company

by the USGS, the 348,000 t of U.S.-processed crude perlite sold proprietary data (table 2).

or used in 2009 was valued at $17.1 million, a decrease of 18%

compared with that of 2008. The 439,000 t of expanded perlite Prices

sold or used by domestic producers was valued at $132 million,

Processed crude perlite was sold at an average value of $50

a decrease of 14% compared with that of 2008 (table 1).

per metric ton, which was a slight increase compared with that

The processed crude perlite reported in table 1 was mined in

of 2008. Perlite consumed by expanding plants operated by

Arizona, California, Idaho, Nevada, New Mexico, and Oregon.

the mining companies was valued at $47 per ton, which was a

The mines in Arizona, New Mexico, and Oregon accounted for

4% increase compared with that of 2008. The average price for

most of the tonnage mined. Ore producers were, in alphabetical

all perlite sold or used by mining companies was $49 per ton,

order by State, Harborlite Corp. in Arizona and New Mexico;

which was a slight increase compared with that of 2008. The

American Perlite Co. in California; Idaho Minerals, LLC in

average price of expanded perlite was $302 per ton, up from

Idaho; EP Minerals, LLC and Wilkins Mining and Trucking,

$279 per ton in 2008; the range in reported prices, however, was

Inc. in Nevada; Dicaperl Minerals Corp. in New Mexico; and

wide—from about $100 to more than $1,000 per ton.

Cornerstone Industrial Minerals Corp. in Oregon.

The average price by use of expanded perlite, in descending

Perlite was expanded at 55 plants throughout the United

order, was low-temperature insulation, $559 per ton; fillers,

States and two plants were reported as idle. Of the 55 active

$461 per ton; masonry- and cavity-fill insulation, $459 per ton;

plants, 28 plant operators (51%) responded to the USGS survey,

horticultural aggregate, $427 per ton; concrete aggregate, $398

representing about 75% of the total expanded perlite sold or

PERLITE—2009 [ADVANCE RELEASE] 55.1

per ton; filter aid, $391 per ton; plaster aggregate, $352 per major producing countries, such as China, which was probably

ton; laundries, $247 per ton; and formed products, $195 per ton the leading or second ranked producer in the world.

(table 3).

Outlook

Foreign Trade

Total consumption of processed and expanded perlite in the

Exports of processed crude and expanded perlite, primarily United States in 2010 was expected to remain at the historically

to Canada, were estimated to be 33,000 t, down by about 11% low levels of 2009. With the economic recession, which was

compared with those of 2008. This decrease was probably characterized by lackluster construction activity, including

related to the decline in demand for horticultural grade perlite. the continuing slump in housing and office construction, the

Peat is abundant in Canada, and perlite is commonly mixed historically low perlite consumption seen in 2009 is expected to

with peat and other ingredients to produce potting soils. The continue. Perlite imports in 2010 were expected to be essentially

Republic of Korea was probably the second largest recipient of unchanged from 2009 levels. Prices for crude processed perlite

U.S. exports, receiving nearly 9,000 t. Besides these 2 countries, increased only slightly in 2009, but prices for expanded perlite

perlite was exported to about 20 other countries, but the average increased substantially in 2009. For 2010, prices for crude

amount exported to each country was less than 1,000 t. The processed perlite and expanded perlite could remain near 2009

value of exports could not be calculated based on available levels because price increases might be difficult to achieve

information, but the average prices quoted previously could be amidst weak demand and strong competition.

applied. Perlite expanding plants, mostly in the Eastern United

Imports of processed crude perlite, almost exclusively from States, continued to purchase imported perlite and offer strong

Greece, decreased by 18% to about 153,000 t compared with competition to domestic perlite producers. Imported perlite has

those of 2008. S&B Industrial Minerals S.A., Kifissia, Greece, supplied about one-third of the demand for processed crude

reported in its annual report for 2009 that perlite revenues were perlite in the United States in 3 of the plast 4 years, and that

down by 18% compared with those of 2008 (S&B Industrial trend is expected to continue contingent upon the availability

Minerals, S.A., 2010, p. 8). S&B Industrial Minerals was and cost of ocean freight. This strong competition from other

the primary supplier of processed crude perlite imports to the countries is expected to continue in the coming years as

United States. Based on information from the U.S. Census domestic and foreign suppliers fight for market share amidst

Bureau, the average customs value of perlite imports in 2009 fluctuating transportation costs, whether rail or ocean freight.

was estimated to be $104 per ton, a decrease of nearly 21%

from that of 2008. If insurance and freight costs ($11.51 per Reference Cited

ton) were added to the value of the imports, the total average

S&B Industrial Minerals, S.A., 2010, Annual report—2009:

value of imports was $116 per ton, also a decrease of about 21%

Kifissia, Greece, S&B Industrial Minerals, S.A., 132 p.

compared with the total average value in 2008. These decreases

in the price of imported perlite were probably in response to GENERAL SOURCES OF INFORMATION

decreased fuel costs and an increased availability of ocean

transport during 2009. Most imported perlite arrives through U.S. Geological Survey Publications

the ports of Brunswick, GA; Mobile, AL; Philadelphia, PA; and

Wilmington, DE. After arriving at one of these ports, the perlite Lightweight Aggregates. Ch. in United States Mineral

is shipped to expanding plants throughout the States east of the Resources, Professional Paper 820, 1973.

Mississippi River. Perlite. Ch. in Mineral Commodity Summaries, annual.

World Review Other

Based on available information, the United States was Geology of the Industrial Rocks and Minerals. Dover

estimated to be the leading consumer of processed crude Publications Inc., 1969.

and expanded perlite in 2009. Greece was estimated to have Industrial Minerals Handybook, The. Industrial Minerals

produced about 525,000 t and sold or used the largest amount Information, 2002.

of perlite among the countries listed in table 4. Other leading Industrial Minerals—Geology and World Deposits. Metal

producers of processed crude perlite were, in descending order, Bulletin plc, 1990.

the United States, Turkey, and Japan. In 2009, 15 countries Industrial Minerals, monthly.

produced 1.65 million metric tons of perlite, down about 8% Perlite. Ch. in Industrial Minerals and Rocks (7th ed.), Society

compared with global production in 2008. Owing to a lack of for Mining, Metallurgy, and Exploration, Inc., 2006.

reliable information, however, this total does not include all Perlite. Ch. in Mineral Facts and Problems, U.S. Bureau of

Mines Bulletin 675, 1985.

55.2 [ADVANCE RELEASE] U.S. GEOLOGICAL SURVEY MINERALS YEARBOOK—2009

TABLE 1

PERLITE MINED, PROCESSED, AND EXPANDED IN THE UNITED STATES1

(Thousand metric tons and thousand dollars unless otherwise specified)

2005 2006 2007 2008 2009

Perlite mined2 606 516 516 524 304

Processed crude perlite:

Sold to expanders:

Quantity 406 360 324 337 263

Value 16,500 15,600 15,000 16,400 13,100

Average value dollars per metric ton 41 43 46 49 50

Used at own plants to make expanded perlite:

Quantity 103 95 85 98 85

Value 4,200 3,850 3,550 4,450 4,000

Average value dollars per metric ton 41 41 42 45 47

Total, sold and used:

Quantity 508 454 409 434 348

Value 20,700 19,500 18,500 20,800 17,100

Average value dollars per metric ton 41 43 45 48 49

Expanded perlite:

Production, quantity 677 646 577 554 450

Sold or used:

Quantity 677 644 575 548 439

Value 165,000 165,000 155,000 153,000 132,000

Average value dollars per metric ton 243 256 269 279 302

1

Data are rounded to no more than three significant digits, except average value; may not add to totals shown.

2

Crude ore mined and stockpiled for processing.

TABLE 2

EXPANDED PERLITE PRODUCED AND SOLD OR USED BY PRODUCERS IN THE UNITED STATES, BY STATE1

2008 2009

Sold or used Sold or used

Average Average

Production, value2 Production, value2

quantity Quantity Value (dollars per quantity Quantity Value (dollars per

State (metric tons) (metric tons) (thousands) metric ton) (metric tons) (metric tons) (thousands) metric ton)

California 33,200 33,000 $11,700 353 29,100 28,700 $10,800 376

Florida 25,600 25,300 7,470 295 21,300 21,000 7,120 338

Indiana 16,000 15,800 5,700 359 12,900 12,800 4,710 369

Michigan 21,700 21,700 5,750 265 21,800 21,200 5,460 258

Nevada 10,900 10,900 4,890 450 11,100 11,100 4,980 448

Pennsylvania 52,700 52,700 11,800 224 47,700 47,700 11,200 235

3

Other 393,000 389,000 106,000 272 306,000 296,000 88,100 292

Total or average 554,000 548,000 153,000 279 450,000 439,000 132,000 302

1

Data are rounded to no more than three significant digits; may not add to totals shown.

2

Average value is based on unrounded data and is rounded to the nearest dollar.

3

Includes Alabama, Arizona, Arkansas, Colorado, Georgia, Idaho, Illinois, Louisiana, Maine, Massachusetts, Minnesota, Mississippi, Missouri,

New Jersey, North Carolina, Ohio, Oklahoma, Oregon, Tennessee, Texas, Wisconsin, and Wyoming.

PERLITE—2009 [ADVANCE RELEASE] 55.3

TABLE 3

EXPANDED PERLITE SOLD OR USED BY PRODUCERS IN THE UNITED STATES, BY USE1

2008 2009

Average Average

value2 value2

Quantity Value (dollars per Quantity Value (dollars per

Use (metric tons) (thousands) metric ton) (metric tons) (thousands) metric ton)

Concrete aggregate 2,400 $836 348 2,440 $973 398

Fillers 68,800 32,100 467 62,700 28,900 461

Filter aid 44,200 16,900 383 37,200 14,500 391

Formed products3 310,000 57,800 186 222,000 43,200 195

Horticultural aggregate 71,400 27,100 380 63,600 27,100 427

Laundries 832 246 295 1,020 251 247

Low-temperature insulation 1,600 845 527 1,990 1,110 559

Masonry- and cavity-fill insulation 3,090 1,350 438 2,600 1,190 459

Plaster aggregate 5,400 1,800 333 4,880 1,720 352

4

Other 40,400 14,100 348 40,000 13,400 334

Total or average 548,000 153,000 279 439,000 132,000 302

1

Data are rounded to no more than three significant digits; may not add to totals shown.

2

Average value is based on unrounded data and is rounded to the nearest dollar.

3

Includes acoustic ceiling panels, pipe insulation, roof insulation board, and unspecified formed products.

4

Includes explosives, high-temperature insulation, paint, refractory, soap, steel, sugar manufacture, and unspecified uses.

TABLE 4

PERLITE: ESTIMATED WORLD PRODUCTION, BY COUNTRY1, 2

(Metric tons)

Country3 2005 2006 2007 2008 2009

Armenia 35,000 35,000 35,000 35,000 35,000

Australia4 6,000 6,500 7,000 7,000 6,500

Georgia 45,000 45,000 45,000 45,000 45,000

Greece5 525,000 525,000 525,000 525,000 525,000

Hungary4 65,000 71,000 67,000 67,000 r

65,000

Iran 31,000 40,000 30,000 30,000 30,000

Italy 60,000 60,000 60,000 60,000 60,000

Japan 240,000 240,000 230,000 230,000 220,000

6 6 6

Mexico4 91,724 41,219 41,000 54,405 54,400

6 6 6 r, 6

Philippines 4,410 4,352 4,515 4,593 4,600

r r

Slovakia 13,000 16,000 20,000 25,000 25,000

South Africa 400 400 400 400 400

Turkey4 156,935 6

260,000 270,000 270,000 230,000

7 6 6 6 6 6

United States 508,000 454,000 409,000 434,000 348,000

Zimbabwe 4,000 3,000 3,000 3,000 3,000

r

Total 1,790,000 1,800,000 1,750,000 1,790,000 1,650,000

r

Revised.

1

World totals, U.S. data, and estimated data are rounded to no more than three significant digits; may not add to totals shown.

2

Unless otherwise stated, figures represent processed ore output. Table contains data available through May 12, 2010.

3

In addition to the countries listed, Djibouti started perlite production in 2009, and Algeria, Bulgaria, China, Cyprus, Iceland,

Morocco, Mozambique, and Russia are thought to have produced perlite, but output is not reported, and available information

is inadequate to estimate output.

4

Crude ore.

5

Crude perlite screened and sold.

6

Reported figure.

7

Processed ore sold and used by producers.

55.4 [ADVANCE RELEASE] U.S. GEOLOGICAL SURVEY MINERALS YEARBOOK—2009

You might also like

- Alc and Yrophyllite: by Robert L. VirtaDocument7 pagesAlc and Yrophyllite: by Robert L. Virtaanon_14305396No ratings yet

- 2009 Minerals Yearbook: Zeolites (Advance Release)Document4 pages2009 Minerals Yearbook: Zeolites (Advance Release)mghaffarzadehNo ratings yet

- Soda Ash Year Book USGS 2008Document12 pagesSoda Ash Year Book USGS 2008Tarun Surana100% (1)

- Gypsumy 2004 by USGSDocument12 pagesGypsumy 2004 by USGSAbdullah ElcockNo ratings yet

- Clay and Shale, Robert L VirtaDocument24 pagesClay and Shale, Robert L VirtaRifqi Brilyant AriefNo ratings yet

- Xplosives: by Deborah A. KramerDocument6 pagesXplosives: by Deborah A. KramerMarius Van ZylNo ratings yet

- European Aniline ProductionDocument2 pagesEuropean Aniline ProductionheliselyayNo ratings yet

- Eolites: by Robert L. VirtaDocument3 pagesEolites: by Robert L. VirtaPuji LestariNo ratings yet

- FeldsparDocument7 pagesFeldsparRiChy KantuNo ratings yet

- 2008 Minerals Yearbook: Manganese (Advance Release)Document23 pages2008 Minerals Yearbook: Manganese (Advance Release)Onizes Araujo JuniorNo ratings yet

- 2011 Minerals Yearbook: Vermiculite (Advance Release)Document6 pages2011 Minerals Yearbook: Vermiculite (Advance Release)Peyman KhNo ratings yet

- Soda AshDocument8 pagesSoda AshmamadhadiNo ratings yet

- Antimony James F CarlinDocument8 pagesAntimony James F CarlinShivaNo ratings yet

- Barite 2018Document11 pagesBarite 2018Hassan AberdazeNo ratings yet

- Itrogen: by Deborah A. KramerDocument18 pagesItrogen: by Deborah A. KramernycNo ratings yet

- Beneficialuse of SlagDocument5 pagesBeneficialuse of SlagRobin PetalNo ratings yet

- Mineral Year Book - NigeriaDocument6 pagesMineral Year Book - NigeriaOpe-Oluwa FadipeNo ratings yet

- Report On Granite IndustryDocument10 pagesReport On Granite IndustryVamshiKrishna100% (4)

- Auxite and Lumina: by Patricia A. PlunkertDocument10 pagesAuxite and Lumina: by Patricia A. PlunkertfrankieNo ratings yet

- 2008 Minerals Yearbook: Ferroalloys (Advance Release)Document16 pages2008 Minerals Yearbook: Ferroalloys (Advance Release)böhmitNo ratings yet

- Auxite and Lumina: by Patricia A. PlunkertDocument10 pagesAuxite and Lumina: by Patricia A. PlunkertHoHo WindyantoNo ratings yet

- Daily Advisor (Feb 28, 2011)Document1 pageDaily Advisor (Feb 28, 2011)Kashif AliNo ratings yet

- Auxite AND Lumina: by Patricia A. PlunkertDocument11 pagesAuxite AND Lumina: by Patricia A. Plunkertinfinity iNo ratings yet

- Energy Conservation in The Pulp, Paper, and Wood Products IndustryDocument5 pagesEnergy Conservation in The Pulp, Paper, and Wood Products IndustryAbhishek GoelNo ratings yet

- RFA - 2008 US Ethanol Economic ContributionDocument13 pagesRFA - 2008 US Ethanol Economic ContributionWashingtonWatchNo ratings yet

- 2010 Forest Products Report For Turkey - Istanbul - Turkey - 5-5-2010Document15 pages2010 Forest Products Report For Turkey - Istanbul - Turkey - 5-5-2010davoodnavabiaslNo ratings yet

- Raphite: by Rustu S. KalyoncuDocument11 pagesRaphite: by Rustu S. KalyoncudimasNo ratings yet

- Sand and Gravel (Construction) : Domestic Production and UseDocument2 pagesSand and Gravel (Construction) : Domestic Production and UseAbhishek BanerjeeNo ratings yet

- MDMW Perlite03Document2 pagesMDMW Perlite03miningnovaNo ratings yet

- Rubber IndustryDocument3 pagesRubber Industrykencruz2011No ratings yet

- Fertilizer Sector: Industry AnalysisDocument18 pagesFertilizer Sector: Industry AnalysisZain Bin IshaqNo ratings yet

- Gas Monetization in NigeriaDocument8 pagesGas Monetization in NigeriasegunoyesNo ratings yet

- Raphite: by Rustu S. KalyoncuDocument7 pagesRaphite: by Rustu S. KalyoncuJaideep RajeNo ratings yet

- CoirDocument7 pagesCoirpasebanjatiNo ratings yet

- J Focat 2019 09 010Document1 pageJ Focat 2019 09 010Toni TanNo ratings yet

- Sector Case Study: Biomass Pellets: The Pellet Export Opportunity in The Near-TermDocument5 pagesSector Case Study: Biomass Pellets: The Pellet Export Opportunity in The Near-Termm0k123_112640140No ratings yet

- Graphite SummaryDocument11 pagesGraphite SummaryFamiloni LayoNo ratings yet

- The Mineral Industry ofDocument3 pagesThe Mineral Industry offwilliams31No ratings yet

- ETH, DJI, ERI, & SOM (East Africa Mineral 2002Document9 pagesETH, DJI, ERI, & SOM (East Africa Mineral 2002SENAITNo ratings yet

- BSEAA2 - Bioenergy in Cement Manufacturing Sector - Policy BriefDocument4 pagesBSEAA2 - Bioenergy in Cement Manufacturing Sector - Policy BriefOlumideNo ratings yet

- Lead MetalsDocument6 pagesLead MetalsDR. SOLOMONNo ratings yet

- Myb1 2011 CobalDocument22 pagesMyb1 2011 Cobaljsalamanca calderonNo ratings yet

- Case Study 2022.Document10 pagesCase Study 2022.Gowda GowdaNo ratings yet

- November 16th-December 5th 2007Document1 pageNovember 16th-December 5th 2007api-26343305No ratings yet

- Iron Ore FlyerDocument1 pageIron Ore FlyerMarcio OliveiraNo ratings yet

- Sector At-a-Glance: K E O PDocument6 pagesSector At-a-Glance: K E O Plazov808No ratings yet

- East Africa Mineral 2003Document10 pagesEast Africa Mineral 2003SENAITNo ratings yet

- Bauxite and AluminaDocument2 pagesBauxite and Aluminahobbiton04No ratings yet

- The Feasibility of Manufacturing Charcoal and Charcoal Briquettes by Converting Barks in GeorgiaDocument62 pagesThe Feasibility of Manufacturing Charcoal and Charcoal Briquettes by Converting Barks in GeorgiaRinaBenituaNo ratings yet

- U.S. Uranium Reserves Estimates: GlossaryDocument4 pagesU.S. Uranium Reserves Estimates: GlossaryrendytalionNo ratings yet

- Profitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers StateDocument8 pagesProfitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers StateInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Oil From A Critical Raw Material Perspective - Geological Survey of Finland (GTK) (12/22/19)Document510 pagesOil From A Critical Raw Material Perspective - Geological Survey of Finland (GTK) (12/22/19)CliffhangerNo ratings yet

- Business Talk: - Namita NaikDocument5 pagesBusiness Talk: - Namita NaikakmullickNo ratings yet

- Pigments: Focus OnDocument3 pagesPigments: Focus OnRoshni PattanayakNo ratings yet

- 670400Document14 pages670400annishayNo ratings yet

- Imerys To Buy Rio Tinto's LuzenacDocument3 pagesImerys To Buy Rio Tinto's Luzenac7kkqg42m6cNo ratings yet

- WP 130319 Methanol Resurgence DIGITAL FINALDocument4 pagesWP 130319 Methanol Resurgence DIGITAL FINALCamilo VillegasNo ratings yet

- Fdocuments - in Investment Office Anrs Embassy of Kraft Paper Company Name Maanshan HudongDocument26 pagesFdocuments - in Investment Office Anrs Embassy of Kraft Paper Company Name Maanshan HudongSuleman100% (1)

- Market Research, Global Market for Germanium and Germanium ProductsFrom EverandMarket Research, Global Market for Germanium and Germanium ProductsNo ratings yet

- RS3Webinar PI QADocument2 pagesRS3Webinar PI QArio354No ratings yet

- MN - 2020 02 25Document28 pagesMN - 2020 02 25mooraboolNo ratings yet

- Leachox Refractory ProcessDocument24 pagesLeachox Refractory ProcessAlejandro Valenzuela100% (1)

- El Gambrisino 2008-11Document8 pagesEl Gambrisino 2008-11ghosthikerNo ratings yet

- 2019.10.01 Updated Company Profile AstakaDocument15 pages2019.10.01 Updated Company Profile Astakalaode abdulkadirNo ratings yet

- 1050 Benefits Realised From Retrofitting A Gravity Gold Recovery CircuitDocument23 pages1050 Benefits Realised From Retrofitting A Gravity Gold Recovery CircuitdjabiaNo ratings yet

- 408 2012 Lec01 CourseInfoDocument11 pages408 2012 Lec01 CourseInfoThyago OliveiraNo ratings yet

- Firm vs. Environment: May Florence J. Yaranon Edric P. Oloresisimo Mba-IDocument28 pagesFirm vs. Environment: May Florence J. Yaranon Edric P. Oloresisimo Mba-IMay YaranonNo ratings yet

- Mineral Resource and Reserve Reporting Codes: Why They Are There and Which Ones Apply To Your CompanyDocument1 pageMineral Resource and Reserve Reporting Codes: Why They Are There and Which Ones Apply To Your CompanyalokNo ratings yet

- 2016 (I) ILR - CUT-208: Mines & Minerals (Development & Regulations) Act, 1957 - S.9Document230 pages2016 (I) ILR - CUT-208: Mines & Minerals (Development & Regulations) Act, 1957 - S.9boobay ghoshNo ratings yet

- MGB Form 29-13Document1 pageMGB Form 29-13chennieNo ratings yet

- Chapter 1Document6 pagesChapter 1Maura Dwi UtamiNo ratings yet

- Technical Report-IAMGOLD PDFDocument377 pagesTechnical Report-IAMGOLD PDFrolandoh1No ratings yet

- The Whittle InterfaceDocument63 pagesThe Whittle InterfacemanuelgltNo ratings yet

- Factors Affecting Mining-UpdatedDocument12 pagesFactors Affecting Mining-UpdatedFaryal KhanNo ratings yet

- Reflection Paper #3 - Overview of Mining IndustryDocument3 pagesReflection Paper #3 - Overview of Mining IndustrynerieroseNo ratings yet

- Mine & Mill Equipment Costs Estimator's Guide, Capital & Operating Costs - CostMine PDFDocument3 pagesMine & Mill Equipment Costs Estimator's Guide, Capital & Operating Costs - CostMine PDFArturo Allende0% (3)

- Indonesia Construction Equipment Market - April 2013Document83 pagesIndonesia Construction Equipment Market - April 2013girish_patkiNo ratings yet

- Energies 14 00029Document24 pagesEnergies 14 00029Claudia VélizNo ratings yet

- Urgent Need For A New Aggregate Standard: Point of ViewDocument8 pagesUrgent Need For A New Aggregate Standard: Point of ViewKanikaa B KaliyaNo ratings yet

- Viking Pump Product Selection GuideDocument32 pagesViking Pump Product Selection GuideEduardo EstradaNo ratings yet

- Practical Project Management (LinkedIn1) PDFDocument13 pagesPractical Project Management (LinkedIn1) PDFDon CowanNo ratings yet

- Case Studies in Open Pit Design Using Lerchs-Grossman Pit OptimizationDocument8 pagesCase Studies in Open Pit Design Using Lerchs-Grossman Pit OptimizationTerry ChongNo ratings yet

- Narra Nickel Mining Vs RedmontDocument5 pagesNarra Nickel Mining Vs RedmontSusan Sabilala MangallenoNo ratings yet

- NIKM Business Proposal FinalDocument8 pagesNIKM Business Proposal Finalcvardelia99No ratings yet

- Large Scale Slope Stability in Open Pit Mining - A ReviewDocument229 pagesLarge Scale Slope Stability in Open Pit Mining - A Reviewarief_7100% (1)

- Siemens PLC - Control For Grinding Mills General DescriptionDocument113 pagesSiemens PLC - Control For Grinding Mills General Descriptionnelson lopez cuestasNo ratings yet

- Quantus HydroengineeringDocument2 pagesQuantus HydroengineeringBlessed AccesoriesNo ratings yet

- ZYMA Proposal Final BikitaDocument31 pagesZYMA Proposal Final BikitaTafadzwa MarovekeNo ratings yet

- Uganda: State of The Nation Address 2016Document28 pagesUganda: State of The Nation Address 2016African Centre for Media ExcellenceNo ratings yet