Professional Documents

Culture Documents

Building Model

Uploaded by

qxcars1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Building Model

Uploaded by

qxcars1Copyright:

Available Formats

Description

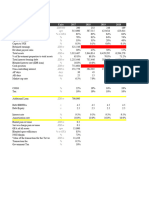

Property Valuation Analysis

Property Name Building I Want

Units 160

Total Sq Ft 2,58,656

Transaction Date 31/03/2017

Scenario 1 1 2 3 Must cycle through all options for returns (B30:M54) to work.

Purchase Price $ 8,00,00,000 $ 8,00,00,000 $ 7,50,00,000 $ 7,00,00,000

Loan $ 5,20,00,000 $ 5,20,00,000 $ 4,87,50,000 $ 4,55,00,000

LTV 65% 65% 65% 65%

Equity $ 2,80,00,000 $ 2,80,00,000 $ 2,62,50,000 $ 2,45,00,000

Hold Period 7 Years

Unleveraged Return 6.03%

Leveraged Return 9.00%

Returns Summary ‐ Current Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

Unleveraged 7 YR IRR 6.03%

Leveraged 7 YR IRR 9.00%

Capitalization Rate 6.12% 6.41% 6.59% 6.79% 6.99% 7.20% 7.42% 7.64% 7.87% 8.10% 8.35%

Leveraged Cash Return 9.40% 10.22% 10.74% 8.28% 8.85% 9.43% 10.04% 21.43% 22.07% 22.73% 23.42%

7 YR AVG Cash Return 9.57%

Returns Summary ‐ Scenario Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

Scenario 1

Unleveraged 7 YR IRR 6.03%

Leveraged 7 YR IRR 9.00%

Capitalization Rate 6.12% 6.41% 6.59% 6.79% 6.99% 7.20% 7.42% 7.64% 7.87% 8.10% 8.35%

Leveraged Cash Return 9.40% 10.22% 10.74% 8.28% 8.85% 9.43% 10.04% 21.43% 22.07% 22.73% 23.42%

7 YR AVG Cash Return 9.57%

Scenario 2

Unleveraged 7 YR IRR 7.21%

Leveraged 7 YR IRR 12.05%

Capitalization Rate 6.52% 6.83% 7.03% 7.24% 7.46% 7.68% 7.91% 8.15% 8.39% 8.64% 8.90%

Leveraged Cash Return 10.55% 11.42% 11.97% 9.54% 10.15% 10.78% 11.43% 22.86% 23.54% 24.25% 24.98%

7 YR AVG Cash Return 10.83%

Scenario 3

Unleveraged 7 YR IRR 8.51%

Leveraged 7 YR IRR 15.18%

Capitalization Rate 6.99% 7.32% 7.53% 7.76% 7.99% 8.23% 8.48% 8.73% 8.99% 9.26% 9.54%

Leveraged Cash Return 11.85% 12.79% 13.38% 11.00% 11.65% 12.32% 13.01% 24.49% 25.22% 25.98% 26.76%

7 YR AVG Cash Return 12.29%

Confidential 22/03/2024 Page 1

Projection

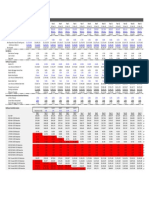

Cash Flow Projections

SCENARIO 1

High Mid Low

Pricing Total Scenario 1 Scenario 2 Scenario 3 Per Unit PSF

Purchase Price 8,00,00,000 8,00,00,000 7,50,00,000 7,00,00,000 5,00,000 309

Acquisitions Reserves ‐ ‐ ‐ ‐ ‐ ‐

Loan Amount (5,20,00,000) (5,20,00,000) (4,87,50,000) (4,55,00,000) (3,25,000) (201)

Loan Origination Fee (1%) 5,20,000 5,20,000 4,87,500 4,55,000 3,250 2

Total Equity Required 2,85,20,000 2,85,20,000 2,67,37,500 2,49,55,000 1,78,250 110

New Loan Scenario 1 Scenario 2 Scenario 3

New Loan Amount 5,20,00,000 5,20,00,000 4,87,50,000 4,55,00,000

LTV 65% 65% 65% 65%

Interest Rate 4.25% 4.25% 4.25% 4.25%

Start Date Mar‐17 Mar‐17 Mar‐17 Mar‐17

Maturity Mar‐24 Mar‐24 Mar‐24 Mar‐24

Term 7 Years 7 Years 7 Years 7 Years

Amortization 30 Years 30 Years 30 Years 30 Years

Years of Interest Only 3 Years 3 Years 3 Years 3 Years

First Year Principal Payment Required 4 Years 4 Years 4 Years 4 Years

Amortization Period Years 4‐7 Years 4‐7 Years 4‐7 Years 4‐7

Annual Payment $30,69,705

Loan Constant 5.90%

Calculation of Residual Per Unit

Holding Period 7 Years

Exit Year 8 Years

Residual Cap Rate 8.00%

Gross Residual 7,63,91,801 4,77,449

Cost of Sale (% of Gross Residual) 1.50%

Cost of Sale (11,45,877) (7,162)

Net Residual Value 7,52,45,924 4,70,287

Outstanding Loan Balance (4,82,58,788) (3,01,617)

Net Residual After OLB 2,69,87,136 1,68,670

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

Gross Residual Value Calc. 6,11,50,145 6,40,71,483 6,58,96,239 6,78,73,126 6,99,09,319 7,20,06,599 7,41,66,797 7,63,91,801 7,86,83,555 8,10,44,062 8,34,75,383

Confidential 22/03/2024 Page 2

Projection

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

INCOME

Effective Rental Income

Current Market Rents 95,58,520 99,40,861 1,03,38,496 1,06,48,650 1,09,68,110 1,12,97,153 1,16,36,068 1,19,85,150 1,23,44,704 1,27,15,046 1,30,96,497

Loss to Lease ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐

Gross Potential Income 95,58,520 99,40,861 1,03,38,496 1,06,48,650 1,09,68,110 1,12,97,153 1,16,36,068 1,19,85,150 1,23,44,704 1,27,15,046 1,30,96,497

Vacancy (3,82,341) (3,97,634) (5,16,925) (5,32,433) (5,48,405) (5,64,858) (5,81,803) (5,99,257) (6,17,235) (6,35,752) (6,54,825)

Concessions / Discounts (4,779) (4,970) (5,169) (5,324) (5,484) (5,649) (5,818) (5,993) (6,172) (6,358) (6,548)

Bad Debt (19,117) (19,882) (20,677) (21,297) (21,936) (22,594) (23,272) (23,970) (24,689) (25,430) (26,193)

Effective Rental Income 91,52,283 95,18,375 97,95,725 1,00,89,596 1,03,92,284 1,07,04,053 1,10,25,174 1,13,55,930 1,16,96,607 1,20,47,506 1,24,08,931

Other Income 5,65,600 5,82,568 6,00,045 6,18,046 6,36,588 6,55,685 6,75,356 6,95,617 7,16,485 7,37,980 7,60,119

GROSS INCOME 97,17,883 1,01,00,943 1,03,95,770 1,07,07,643 1,10,28,872 1,13,59,738 1,17,00,530 1,20,51,546 1,24,13,093 1,27,85,485 1,31,69,050

YOY Growth (%) 3.9% 2.9% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

EXPENSES

Variable Expenses 38,36,800 39,51,904 40,70,461 41,92,575 43,18,352 44,47,903 45,81,340 47,18,780 48,60,343 50,06,154 51,56,338

Management Fee 4,85,894 5,05,047 5,19,788 5,35,382 5,51,444 5,67,987 5,85,027 6,02,577 6,20,655 6,39,274 6,58,452

Real Estate Taxes 3,19,177 3,28,753 3,38,615 3,48,774 3,59,237 3,70,014 3,81,115 3,92,548 4,04,324 4,16,454 4,28,948

Property/Liability Insurance 1,44,000 1,48,320 1,52,770 1,57,353 1,62,073 1,66,935 1,71,944 1,77,102 1,82,415 1,87,887 1,93,524

Total Fixed Expenses 9,49,072 9,82,120 10,11,173 10,41,509 10,72,754 11,04,936 11,38,085 11,72,227 12,07,394 12,43,616 12,80,924

TOTAL EXPENSES 47,85,872 49,34,024 50,81,635 52,34,084 53,91,106 55,52,839 57,19,424 58,91,007 60,67,737 62,49,769 64,37,263

% of Gross Income 49.2% 48.8% 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 48.9% 48.9%

NET OPERATING INCOME 49,32,012 51,66,919 53,14,135 54,73,559 56,37,766 58,06,899 59,81,106 61,60,539 63,45,355 65,35,716 67,31,787

CAPITAL EXPENDITURES

Capital Expenditures [Capital Reserves] 40,000 41,200 42,436 43,709 45,020 46,371 47,762 49,195 50,671 52,191 53,757

CASH FLOW FROM OPERATIONS 48,92,012 51,25,719 52,71,699 54,29,850 55,92,746 57,60,528 59,33,344 61,11,344 62,94,684 64,83,525 66,78,031

DEBT FINANCING

Debt Service 22,10,000 22,10,000 22,10,000 30,69,705 30,69,705 30,69,705 30,69,705 ‐ ‐ ‐ ‐

CASH FLOW AFTER DEBT FINANCING 26,82,012 29,15,719 30,61,699 23,60,145 25,23,041 26,90,823 28,63,639 61,11,344 62,94,684 64,83,525 66,78,031

Debt Service Coverage Ratio 1.59 1.67 1.72 1.77 1.82 1.88 1.93

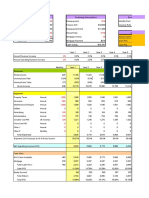

ASSUMPTIONS Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

Market Rent Growth 6.0% 4.0% 4.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

Loss to Lease 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Vacancy ‐4.0% ‐4.0% ‐5.0% ‐5.0% ‐5.0% ‐5.0% ‐5.0% ‐5.0% ‐5.0% ‐5.0% ‐5.0%

Non Revenue / Respite Units 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Concessions / Discounts ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1% ‐0.1%

Bad Debt ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2% ‐0.2%

Inflation Factor 0.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0%

Management Fee 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0%

Confidential 22/03/2024 Page 3

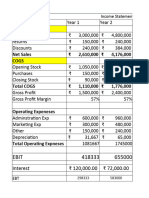

Projection

Unleveraged Return Acquisition Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

CF (8,00,00,000) 48,92,012 51,25,719 52,71,699 54,29,850 55,92,746 57,60,528 59,33,344

Capital Events 7,52,45,924

6.03% (8,00,00,000) 48,92,012 51,25,719 52,71,699 54,29,850 55,92,746 57,60,528 8,11,79,268 ‐ ‐ ‐ ‐

Leveraged Return Acquisition Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

CF (2,85,20,000) 26,82,012 29,15,719 30,61,699 23,60,145 25,23,041 26,90,823 28,63,639

Capital Events 2,69,87,136

9.00% (2,85,20,000) 26,82,012 29,15,719 30,61,699 23,60,145 25,23,041 26,90,823 2,98,50,774 ‐ ‐ ‐ ‐

Returns

Unleveraged 7 YR IRR 6.03%

Leveraged 7 YR IRR 9.00%

Capitalization Rate 6.12% 6.41% 6.59% 6.79% 6.99% 7.20% 7.42% 7.64% 7.87% 8.10% 8.35%

Leveraged Cash Return 9.40% 10.22% 10.74% 8.28% 8.85% 9.43% 10.04% 21.43% 22.07% 22.73% 23.42%

7 YR AVG Cash Return 9.57%

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

7 YR AVG Cash Return Calculation 9.40% 10.22% 10.74% 8.28% 8.85% 9.43% 10.04%

Confidential 22/03/2024 Page 4

You might also like

- Property Valuation Analysis: Building I Want 160Document21 pagesProperty Valuation Analysis: Building I Want 160yhcdyhdNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- Shorenstein Yale Slides 2Document15 pagesShorenstein Yale Slides 2Anton FortichNo ratings yet

- Refinance Analysis v1.01Document1 pageRefinance Analysis v1.01AlexNo ratings yet

- Students Reference - TVM Case - GMUDocument8 pagesStudents Reference - TVM Case - GMUChelsi SinghalNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Refinance Risk Analysis Tool: Visit This Model's WebpageDocument4 pagesRefinance Risk Analysis Tool: Visit This Model's WebpageAyush PandeNo ratings yet

- Meezan Bank Installments Calculation & RequirementsDocument2 pagesMeezan Bank Installments Calculation & RequirementsImran JavedNo ratings yet

- Financial Projections Template 08Document26 pagesFinancial Projections Template 08Clyde SakuradaNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Infra FinanceDocument40 pagesInfra FinanceJatin AroraNo ratings yet

- 8.25 - ReturnsDocument2 pages8.25 - ReturnsAliasgar RNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Sigma Property ManagementDocument11 pagesSigma Property ManagementMark Earl Santos100% (4)

- FD Shareable - PartnerDocument10 pagesFD Shareable - PartnerkhareanamiNo ratings yet

- FRB - H15 Assignment 1Document4 pagesFRB - H15 Assignment 1Wambui Isaac KimNo ratings yet

- DTTC - Trần Gia BửuDocument29 pagesDTTC - Trần Gia BửuGia BửuNo ratings yet

- Period Beginning Balance Principal InterestDocument5 pagesPeriod Beginning Balance Principal InterestLong AnhNo ratings yet

- Assignment 1 - SolutionDocument5 pagesAssignment 1 - SolutionHassan Ali TayyabNo ratings yet

- Assumptions and DriversDocument1 pageAssumptions and DriversMangani IsaacNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- Caps and FloorsDocument12 pagesCaps and Floorsdry_madininaNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Atlas HondaDocument15 pagesAtlas HondaQasim AkramNo ratings yet

- Stock Valuation TempDocument5 pagesStock Valuation TempANH Nguyen TrucNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaNo ratings yet

- Case Study: Capital Budgeting: Sigma Property Management, IncDocument11 pagesCase Study: Capital Budgeting: Sigma Property Management, IncMark Earl Santos80% (5)

- Balance Sheet (Vertical & Horizontal Analysis)Document7 pagesBalance Sheet (Vertical & Horizontal Analysis)Nguyen Dac ThichNo ratings yet

- PE Exit AnalysisDocument5 pagesPE Exit AnalysisgNo ratings yet

- FD Customer Leaflet-A4 - WEBDocument1 pageFD Customer Leaflet-A4 - WEBmyloan partnerNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- FDIC Certificate # 9092 Salin Bank and Trust CompanyDocument31 pagesFDIC Certificate # 9092 Salin Bank and Trust CompanyWaqas Khalid KeenNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Bond ValuationDocument9 pagesBond ValuationVamsidhar AmbatipudiNo ratings yet

- SexDocument6 pagesSexpiawsibolanjiaoNo ratings yet

- DCF TLKM Full Year 2020Document4 pagesDCF TLKM Full Year 2020i wayan suputraNo ratings yet

- AMT Geninterest STD 2018Document9 pagesAMT Geninterest STD 2018Mai SuwanchaiyongNo ratings yet

- Single Statment Income StatementDocument13 pagesSingle Statment Income StatementDishanth GowdaNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- Income Value para Real EstateDocument13 pagesIncome Value para Real EstateJuan G ScharffenorthNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- ARN Transfer FormDocument2 pagesARN Transfer FormSaurav PrakashNo ratings yet

- 12 40Document10 pages12 40Gonçalo AlmeidaNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Kellorgs - Customer Lifetime ValueDocument8 pagesKellorgs - Customer Lifetime ValuejatinNo ratings yet

- Bonnie Road ModelDocument14 pagesBonnie Road Modelmzhao8100% (1)

- Ceres Gardening - Case (1) ProfesorDocument1 pageCeres Gardening - Case (1) Profesorpeta8805No ratings yet

- Macaulay Duration CalculationDocument11 pagesMacaulay Duration CalculationSaksham BavejaNo ratings yet

- Maruti CaseDocument7 pagesMaruti Caseratneshdubey3No ratings yet

- Financial Markets and Institutions: EthiopianDocument35 pagesFinancial Markets and Institutions: Ethiopianyebegashet88% (24)

- DCF ValuationDocument2 pagesDCF ValuationRithik TiwariNo ratings yet

- In This Model We Allow A Variable Number of Years of OperationDocument1 pageIn This Model We Allow A Variable Number of Years of OperationShubhangiNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- Tutorial 2Document2 pagesTutorial 2Puvithera A/P GunasegaranNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- Partnership Dissolution: Problem FDocument7 pagesPartnership Dissolution: Problem FJoeneil DamalerioNo ratings yet

- Lehman Brothers Yr 2007 Annual ReportDocument132 pagesLehman Brothers Yr 2007 Annual ReportMWGENERALNo ratings yet

- Financial Statement Analysis and Valuation 4th Edition Easton Test BankDocument44 pagesFinancial Statement Analysis and Valuation 4th Edition Easton Test Bankmrsbrianajonesmdkgzxyiatoq100% (30)

- Sebi (Icdr), 2018Document63 pagesSebi (Icdr), 2018Vedant KshatriyaNo ratings yet

- The Effect of Income and Earnings Management On Firm Value - Empirical Evidence From Indonesia PDFDocument8 pagesThe Effect of Income and Earnings Management On Firm Value - Empirical Evidence From Indonesia PDFHafiz MamailaoNo ratings yet

- Financial Structure Analysis of Indian Companies: A Review of LiteratureDocument9 pagesFinancial Structure Analysis of Indian Companies: A Review of LiteratureVįňäý Ğøwđã VįñîNo ratings yet

- Capital Stroke - Best Trading Tips Service ProviderDocument15 pagesCapital Stroke - Best Trading Tips Service Providercapitalstroke1No ratings yet

- Bhit 2022 - 06Document139 pagesBhit 2022 - 06adrian.8800No ratings yet

- Cathy-Sumamrizing and InterpretingDocument16 pagesCathy-Sumamrizing and InterpretingElinet AldovinoNo ratings yet

- MCX Factsheet 2016Document4 pagesMCX Factsheet 2016Profit CircleNo ratings yet

- Intercompany TransactionsDocument5 pagesIntercompany TransactionsJessica IslaNo ratings yet

- Glencore: Revised Guidance Highlights Cash Flow Underpin. BUYDocument13 pagesGlencore: Revised Guidance Highlights Cash Flow Underpin. BUYMudit KediaNo ratings yet

- Fsav4e Mod02Document56 pagesFsav4e Mod02Abdisamed AllaaleNo ratings yet

- Canfin Annual Report FY 2022-23Document320 pagesCanfin Annual Report FY 2022-23OneappNo ratings yet

- Prasentation On SHCILDocument18 pagesPrasentation On SHCILsrpvicky0% (1)

- Worldwide Regulated Open-End Fund Assets and Flows - First Quarter 2020Document46 pagesWorldwide Regulated Open-End Fund Assets and Flows - First Quarter 2020ace hoodNo ratings yet

- Cash Flow Statement Cpale BoardDocument2 pagesCash Flow Statement Cpale BoardSharon CarilloNo ratings yet

- FN107-1342 - Footnotes Levin-Coburn Report.Document1,037 pagesFN107-1342 - Footnotes Levin-Coburn Report.Rick ThomaNo ratings yet

- UT Dallas Syllabus For Fin6381.001.09f Taught by Alain Bensoussan (Axb046100)Document4 pagesUT Dallas Syllabus For Fin6381.001.09f Taught by Alain Bensoussan (Axb046100)UT Dallas Provost's Technology GroupNo ratings yet

- Typeofinstr - Shortname Typeofinstr - Name Dealtypeinkplus30: Cap Caps Cap & Floor DealsDocument9 pagesTypeofinstr - Shortname Typeofinstr - Name Dealtypeinkplus30: Cap Caps Cap & Floor DealsvenubabukusuNo ratings yet

- Chapter 7 Case - Valuation Ratios in The Restaurant IndustryDocument2 pagesChapter 7 Case - Valuation Ratios in The Restaurant IndustrySarah Ihugo40% (5)

- Mutual Funds: Rajkumar PR Aju JohnDocument12 pagesMutual Funds: Rajkumar PR Aju Johnanon_113615062No ratings yet

- Chapter 18Document9 pagesChapter 18Selena JungNo ratings yet

- 3 o 1 VKMWP 6 JDocument15 pages3 o 1 VKMWP 6 JVinay KumarNo ratings yet

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Sana Khan100% (1)

- Short Strangle OptionsDocument5 pagesShort Strangle Optionsmikeyg2xNo ratings yet

- Karthickkesavan 8@gmail DotcomDocument2 pagesKarthickkesavan 8@gmail DotcomGengaraj PothirajNo ratings yet

- Liquidation 1Document28 pagesLiquidation 1Noemi T. LiberatoNo ratings yet