Professional Documents

Culture Documents

Scheme C - Tier I

Uploaded by

Nitesh TirkeyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scheme C - Tier I

Uploaded by

Nitesh TirkeyCopyright:

Available Formats

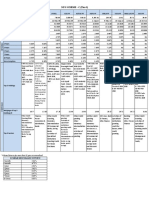

NPS SCHEME - C (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF TATA PF MAX LIFE PF AXIS PF

Assets (Rs in crore ) 6,220.59 2,103.46 751.03 3,475.34 544.87 8,999.46 146.67 20.27 33.38 34.74

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17 19-Aug-22 12-Sep-22 21-Oct-22

31-Mar-23 36.0621 23.3107 31.8983 35.8523 34.5068 23.7373 15.9921 10.2420 10.2923 10.2659

NAV

52 Week High 36.0621 23.3107 31.8983 35.8523 34.5068 23.7373 15.9921 10.2420 10.2923 10.2659

52 Week Low 33.9633 21.8123 29.9250 33.7589 32.4094 22.3319 15.023 9.9859 9.933 10.0000

3 Months 1.43% 1.42% 1.49% 1.39% 1.48% 1.44% 1.46% 0.97% 1.58% 1.62%

6 Months 3.43% 3.59% 3.56% 3.41% 3.47% 3.39% 3.48% 1.59% NA NA

1 Year 3.41% 3.60% 3.38% 3.43% 3.53% 3.72% 3.71% NA NA NA

2 Years 4.88% 4.87% 4.62% 4.86% 4.85% 5.18% 5.07% NA NA NA

RETURNS

3 Years 6.62% 6.90% 6.32% 6.78% 6.02% 7.01% 6.65% NA NA NA

5 Years 7.80% 7.78% 7.34% 7.70% 6.96% 8.12% 7.93% NA NA NA

7 Years 8.18% 8.04% 7.79% 8.18% 7.64% 8.44% NA NA NA NA

10 Years 8.65% NA 8.43% 8.87% 8.37% NA NA NA NA NA

Since Inception 9.68% 9.12% 8.72% 9.64% 9.33% 9.35% 8.29% 2.42% 2.92% 2.66%

6.45% Icici Senior 8.37% Hudco 6.89% Irfc 2031, (1) Axis 7.75% SIDBI 7.44% Indian Oil Reliance 8.12% Aditya 1. UTI 1) 8.36% NHAI

Unsecured Bond Unsec Goi 7.70% Sbi 2038, Overnight Fund 2025 Corp Ltd Industries ,Axis Birla Finance Overnight Ltd NCD 2029

2028, Serviced 2029 (SR – XXV) 2027 Bank ,Irfc, HDFC Ltd Series H3 Fund - Direct 2) Bandhan

7.15%Bajaj - Direct Plan - 8.22 NABARD

Sbi Overnight Series Vi 2018, 7.11% SIDBI NCD Ltd, Axis 2032, Plan Growth Overnight

Finance Limited Growth Option 2028 (GOI

Fund - Direct Plan, 8.12% Sec. Nhpc Series IV 2026 Overnight Fund - 08.27% Nhai Fund - Direct

2031, (2) 7.65% PFC Serviced Bond)

6.44% Hdfc Bank Ltd. Goi Fully 6.87% Muthoot Direct Plan- Series 6 2029, 2. 7.725% L&T Plan - Growth

2028, Serviced Bonds 6.45% Icici Bank 2037 8.55% HDFC Ltd Finance Ltd. Growth Option Axis Overnight Ltd 2028 3) 7.59% NHPC

7.65% Axis Bank Series I, 7.49% 2028, 7.65% Axis (3) 8.12% ABFL 2029 Series 20A Option Fund - Direct Ltd NCD 2027

2027, Sec National Bank 2027 2032 (4) 7.02% 7.38% NHPC Ltd II Tranche I 2025 Plan - Growth 3. 7.97% Hdfc 4) 7.98% NIIF

6.25% Lic Housing Hihway Authority Bajaj Finance STRRP Y1 2029 7.15% SIDBI NCD Option, 2033 Infrastructure

Top 5 Holdings Finance Ltd 2025 Of India, 8.24% 2031 (5) 7.84% 7.32% NTPC Series I 2025 8.40% Canara Finance Ltd

Sec Power Grid 7.32% Bank 2026, 4. 7.70% Sbi NCD 2028

Bajaj Housing 2029

Corporation

Finance Cholamandalam 7.97% Kotak 2038 5) 8.40%

Bonds -Series-I,

Limited 2032 Invt & Fin Co. Ltd. Infra Debt Fund Nuclear Power

7.48% Sec Indian

Series 621 Option 2027 5. 9.05% Ril Corp (Series-

Railway Finance

II NCD 2026 2028 XXIX(E)) NCD

Corporation

2029

Bonds

PORTFOLIO

Weigtage of top 5

11.78 13.41 17.48 11.52 14.51 15.50 23.52 26.75 68.82 30.33

Holdings,%

Other Monetary Finance, Other Credit 1. Other credit Other Credit 1)Other credit Oil & Gas, Other credit 1. Mutual 1) Other

Intermediation Power Granting, granting Gran ng granting Bank & granting,Activi Fund - Credit

Services Generation & Monetary 2. Activities of Other 2)Other Finance, Infra ties of Overnight Granting

N.E.C.,Other specialized

Distribution, Intermediation Monetary monetary Finance, specialized Schemes 2) Activities

Credit institutions

Banks Of Commercial Intermediation intermediation Mutual Fund institutions 2. Banking of

Granting,Monetar granting credit

y Intermediation

Banks, Saving for house

Serv services n.e.c. Liquid granting 3. Power Specialized

Of Commercial Banks. Postal purchases Activities Of 3)Monetary credit for Institutions

Top 3 Sectors Banks, Saving Savings Bank 3. Monetary Splzed Inst intermediation house Granting

Banks. Postal And Discount intermediation Granting of commercial Credit for

Houses, of commercial banks, saving House

Activities Of banks, saving banks. postal Purchases

Specialized banks, postal savings bank that also

Institutions savings. and discount Take

Granting Credit houses Deposits

For House 3) Electric

* Scheme Returns for more than 01 year are annualised

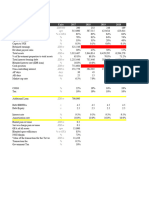

SCHEME BENCHMARK RETURN

3 month 1.52%

6 month 3.66%

1 year 4.00%

2 years 5.22%

3 years 7.61%

5 years 8.37%

7 Years 8.48%

10 Years 8.97%

You might also like

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- NPS Scheme Returns and HoldingsDocument1 pageNPS Scheme Returns and HoldingsKolluri VenkataraoNo ratings yet

- NPS Scheme Comparison TableDocument1 pageNPS Scheme Comparison TablekrishnaNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- SchemeTaxSaver TierIIDocument1 pageSchemeTaxSaver TierIIAnjali DahiyaNo ratings yet

- Nps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Document1 pageNps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Kolluri VenkataraoNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)glorymatrixNo ratings yet

- Scheme G 1 September 2019Document1 pageScheme G 1 September 2019deesingNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- NPS Scheme ComparisonDocument1 pageNPS Scheme ComparisonsatishNo ratings yet

- ICICI Prudential MF Head Start 15012024Document6 pagesICICI Prudential MF Head Start 15012024LAKHAN TRIVEDINo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Scheme A - 9Document1 pageScheme A - 94296tNo ratings yet

- ICICI Prudential MFDocument2 pagesICICI Prudential MFDOLLY KHAPRENo ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- Central Payout Structure Schemes of IndiaDocument1 pageCentral Payout Structure Schemes of Indiakanna275No ratings yet

- ICICI Prudential MF Head Start - 08062022Document2 pagesICICI Prudential MF Head Start - 08062022Chucha LullNo ratings yet

- Scheme A 1 July 2021Document1 pageScheme A 1 July 2021amar srinivasNo ratings yet

- ICICI Prudential MF Headlines August Equity and Debt SummaryDocument2 pagesICICI Prudential MF Headlines August Equity and Debt Summaryshailendra kumarNo ratings yet

- ICICI Prudential MF Head Start - 06062022Document2 pagesICICI Prudential MF Head Start - 06062022Chucha LullNo ratings yet

- ICICI Prudential MF Head Start - 07062022Document2 pagesICICI Prudential MF Head Start - 07062022Chucha LullNo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- KEY FINANCIALSDocument83 pagesKEY FINANCIALSSanket AndhareNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- Compare SBI and HDFC Balanced FundsDocument5 pagesCompare SBI and HDFC Balanced Fundssandeep aryaNo ratings yet

- KTC's 3Q18 Performance Highlights Growth in Membership and ProfitsDocument40 pagesKTC's 3Q18 Performance Highlights Growth in Membership and ProfitssanyalukNo ratings yet

- Nomura - Jun 8 - India Insurance May-22 VolumesDocument10 pagesNomura - Jun 8 - India Insurance May-22 VolumesSpam NestNo ratings yet

- Vajiram Ravi Installment From HDFC BANK Cards KYCDocument4 pagesVajiram Ravi Installment From HDFC BANK Cards KYCSatyam MakwanaNo ratings yet

- Building ModelDocument4 pagesBuilding Modelqxcars1No ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- NPS Scheme ComparisonDocument1 pageNPS Scheme ComparisonshrikanhaiyyaNo ratings yet

- Contact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniDocument17 pagesContact Hour 17 Valuation (Contd.) 08/10/2017: BITS PilaniNarendran NareshNo ratings yet

- Life Insurance Update For November 2023Document6 pagesLife Insurance Update For November 2023rajautoprincNo ratings yet

- Property Valuation AnalysisDocument21 pagesProperty Valuation AnalysisyhcdyhdNo ratings yet

- SBM - Global Perception of Life InsuranceDocument37 pagesSBM - Global Perception of Life InsuranceISHIKA CHAUDHARY IIIBNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- Imf CDocument12 pagesImf Cerich canaviriNo ratings yet

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocument6 pagesCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNo ratings yet

- GrowthDocument6 pagesGrowthpap.prastiyoNo ratings yet

- Citizens Budget 2022Document17 pagesCitizens Budget 2022Kristi DuranNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- L&T Mutual Fund Views on Indian and Global Markets PerformanceDocument19 pagesL&T Mutual Fund Views on Indian and Global Markets PerformancekundansudNo ratings yet

- REIT FundsDocument8 pagesREIT FundsArmstrong CapitalNo ratings yet

- Fund Performance Individual JuneDocument4 pagesFund Performance Individual JuneSai Deepak NNo ratings yet

- Meezan Bank Income Distribution Report for September 2020Document3 pagesMeezan Bank Income Distribution Report for September 2020AamirNo ratings yet

- UntitledDocument6 pagesUntitledKunal NakumNo ratings yet

- China Health & Wellness MarketDocument57 pagesChina Health & Wellness MarketYuqingNo ratings yet

- Meezan Bank August 2020 Income Distribution Rates for Savings Accounts and Financing ProductsDocument3 pagesMeezan Bank August 2020 Income Distribution Rates for Savings Accounts and Financing ProductsM Ramzan khanNo ratings yet

- Transaksi Energi 2020 11Document25 pagesTransaksi Energi 2020 11Ahmad SutaNo ratings yet

- Dynamic-Asset Allocation FundDocument8 pagesDynamic-Asset Allocation FundArmstrong CapitalNo ratings yet

- India Economy, Resi and Office DataDocument20 pagesIndia Economy, Resi and Office Datamahika bellaneyNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- NONCURRENT ASSET HELD FOR SALE AND DISCONTINUED OPERATIONDocument10 pagesNONCURRENT ASSET HELD FOR SALE AND DISCONTINUED OPERATIONXNo ratings yet

- DSE Corporate Brochure 2017-18 PDFDocument64 pagesDSE Corporate Brochure 2017-18 PDFVishvas JaiswalNo ratings yet

- ACC Topic 5.1 Statement of Comprehensive Income Financial Position (Notes)Document16 pagesACC Topic 5.1 Statement of Comprehensive Income Financial Position (Notes)Romzy RahmatNo ratings yet

- Quiz 1: Introduction To Accounting and BookkeepingDocument37 pagesQuiz 1: Introduction To Accounting and BookkeepingDiana Rose BassigNo ratings yet

- Definition of PledgeDocument3 pagesDefinition of PledgeWhoopiJaneMagdozaNo ratings yet

- Internship Report On Allied Bank of PakistanDocument86 pagesInternship Report On Allied Bank of Pakistanshrewd_tycoon94% (17)

- Karen Moving Co. WorksheetDocument9 pagesKaren Moving Co. WorksheetDanica OnteNo ratings yet

- Specpro CasesDocument31 pagesSpecpro CasesJoy DalesNo ratings yet

- Chapter 7 Acctg For Financial InstrumentsDocument32 pagesChapter 7 Acctg For Financial InstrumentsjammuuuNo ratings yet

- Meet Your Strawman by David E RobinsonDocument83 pagesMeet Your Strawman by David E RobinsonTheOfficialBeZiiNo ratings yet

- 2207o2314s123d84439e1Document27 pages2207o2314s123d84439e1Ascentech ProductionNo ratings yet

- Credit AppraisalDocument11 pagesCredit AppraisalKunal GoelNo ratings yet

- CPAB 2016 Annual Report enDocument24 pagesCPAB 2016 Annual Report ensekar raniNo ratings yet

- Fiscal and Interim Accounting PeriodsDocument20 pagesFiscal and Interim Accounting Periodskareem abozeedNo ratings yet

- Study Guide Topic A: European CouncilDocument9 pagesStudy Guide Topic A: European CouncilAaqib ChaturbhaiNo ratings yet

- Contemporary Issues in Banking Sector in BangladeshDocument8 pagesContemporary Issues in Banking Sector in Bangladeshangel100% (5)

- Maximum Volume: Annual Report & AccountsDocument104 pagesMaximum Volume: Annual Report & Accountslodhi12No ratings yet

- Estate Planning AttorneyDocument26 pagesEstate Planning Attorneyzrawa100% (2)

- Guía Banca v5-2Document94 pagesGuía Banca v5-2raffaeleNo ratings yet

- Module 8 Blm1 Week 7Document23 pagesModule 8 Blm1 Week 7sheinamae quelnatNo ratings yet

- KPMG Semiconductor Outlook 2018 Web PDFDocument24 pagesKPMG Semiconductor Outlook 2018 Web PDFDavid MorganNo ratings yet

- UNIT FOUR - AccountingDocument32 pagesUNIT FOUR - AccountingCristea GianiNo ratings yet

- Cyber TaxDocument26 pagesCyber TaxMahesh ChandrashekarNo ratings yet

- UBS Global Wealth Report 2018 enDocument60 pagesUBS Global Wealth Report 2018 enDavid KwokNo ratings yet

- People v. Franklin: Surety Company Liable for Bail Bond Despite Issuance of Accused's PassportDocument1 pagePeople v. Franklin: Surety Company Liable for Bail Bond Despite Issuance of Accused's PassportluigimanzanaresNo ratings yet

- Invoice 1955484Document2 pagesInvoice 1955484Sundararajan JagannathanNo ratings yet

- Most Important One Liner Questions and Answers, July 2022Document16 pagesMost Important One Liner Questions and Answers, July 2022HarishankarsoniNo ratings yet

- Advanced Part 2 Solman MillanDocument320 pagesAdvanced Part 2 Solman Millanlily janeNo ratings yet

- Group Assignment Question May 2016Document6 pagesGroup Assignment Question May 2016王虢綸No ratings yet

- Investasi Sementara Pada ObligasiDocument34 pagesInvestasi Sementara Pada ObligasiAli-ImronNo ratings yet