Professional Documents

Culture Documents

SCHEME - G (Tier-I) - 0

Uploaded by

krishnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SCHEME - G (Tier-I) - 0

Uploaded by

krishnaCopyright:

Available Formats

NPS SCHEME - G (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF TATA PF MAX LIFE PF AXIS PF

Assets (Rs in crore ) 12,436.80 3,676.62 1,312.97 5,575.75 874.57 14,011.03 219.90 27.38 24.34 70.55

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17 19-Aug-22 12-Sep-22 21-Oct-22

28-Feb-23 32.8107 24.5665 29.3680 30.3855 30.3402 22.7255 15.2366 10.278 10.3019 10.2286

NAV

52 Week High 32.9153 24.6419 29.4475 30.4864 30.4661 22.8229 15.8662 10.3322 10.3457 10.2602

52 Week Low 30.7321 22.9086 27.2630 28.5386 28.4212 21.2959 15.023 9.9635 9.9892 10.0000

3 Months 1.18% 1.18% 1.30% 1.11% 1.09% 1.01% 1.12% 0.85% 1.01% 0.86%

6 Months 2.41% 2.54% 2.90% 2.33% 2.29% 2.36% 2.74% 3.08% NA NA

1 Year 3.07% 3.67% 3.74% 3.52% 3.46% 3.45% 3.90% NA NA NA

2 Years 4.39% 4.78% 4.49% 4.59% 4.72% 4.48% 4.81% NA NA NA

RETURNS

3 Years 5.20% 5.37% 5.13% 5.20% 5.28% 5.34% 5.46% NA NA NA

5 Years 8.32% 9.21% 8.18% 8.29% 8.50% 8.55% 8.47% NA NA NA

7 Years 8.71% 9.29% 8.10% 8.43% 8.59% 8.54% NA NA NA NA

10 Years 8.30% NA 8.07% 8.39% 8.36% NA NA NA NA NA

Since Inception 8.99% 9.81% 8.13% 8.39% 8.37% 8.94% 7.52% 2.78% 3.02% 2.29%

7.26% Gsec 2032, 5.74% Gs 2026, 7.16% Gsec 2050, (1) 7.54% GS 2036 (2) G-sec 7.41% 2036 7.26% GOI 2032 Goi 7.41% Gsec 1. 7.41% GOI 1) 7.26% GOI

6.54% Gsec 2032, 6.22% Gs2035, 6.10% Gsec 2031, 6.99% GS 2051 G-Sec 7.10% 2029 7.38% GOI 2027 2036, 2036 2032

7.54% Gsec 2036, 6.64% Gsec 2035, 6.22% Gsec 2035, (3) 7.26% GOI 2029 G-Sec 7.26% 2032 6.54% GOI 2032 7.54% Gsec 2. 7.38% GOI 2) 7.36% GOI

6.64% Gs 2035, 6.54% Gs 2032, 7.41% Gsec 2036, (4) 7.61% GOI 2030 G-Sec 7.54% 2036 7.10% GOI 2029 2036, 2027 2052

7.10% Gs 2029 7.41% Gs 2036 7.57% Gsec 2033 (5) 6.67% GS 2035 GSEC STRIP 2028 6.64% GOI 2035 7.26% Gsec 3. 7.26% GOI 3) 7.38% GOI

Top 5 Holdings 2032, 2033 2027

07.10% 4. 7.74% 4) 7.10% GOI

Gsec 2029, Maharashtra 2029

7.38% Gsec 2033 5) 7.40% GOI

2027 5. 7.26% GOI 2062

PORTFOLIO

2032

Weigtage of top 5

25.10 22.30 30.04 26.08 38.41 46.35 38.23 74.65 59.77 84.41

Holdings,%

Government Govt Securities, , Activities Of Basic 1.Central Govt Government 1)Central Government of Govt. Securities GOVERNM 1. Central 1) Central

Securities,State Telecom Services: industry Collection And India Loans ENT Government Government

Development Telephone, Telex 2. Activities of basic Distribution Of Electric 2)State Development SECURITIES Securities Loans

Loans,Activities Of And Telegraph telecom services Energy To Households, Loans , 2. State 2) Regulation

Top 3 Sectors Basic Telecom 3. Management of Industrial, Commercial 3)Activities of basic Manageme Government of and

Services: mutual funds And Other Users N.E.C. telecom services: nt of Securities contribution

Telephone, Telex State Government telephone, telex and mutual 3. Mutual to more

And Telegr telegraph (includes funds Fund - efficient

the activities of STD/ISD Overnight operation of

booths) Schemes businesses

* Scheme Returns for more than 01 year are annualised

SCHEME BENCHMARK RETURN

3 month 1.22%

6 month 3.02%

1 year 3.41%

2 years 4.34%

3 years 4.63%

5 years 7.98%

7 Years 7.72%

10 Years 7.87%

You might also like

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme G 1 September 2019Document1 pageScheme G 1 September 2019deesingNo ratings yet

- Central Payout Structure Schemes of IndiaDocument1 pageCentral Payout Structure Schemes of Indiakanna275No ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- SchemeTaxSaver TierIIDocument1 pageSchemeTaxSaver TierIIAnjali DahiyaNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Real GDP (Growth Rate) Current GDP Period Real GDP Current GDP (Growth Rate) GDP DeflatorDocument5 pagesReal GDP (Growth Rate) Current GDP Period Real GDP Current GDP (Growth Rate) GDP DeflatorAcid KaleemNo ratings yet

- Sio2 (%) Me-Xrf21Document5 pagesSio2 (%) Me-Xrf21roberthNo ratings yet

- India Retail ForecastDocument2 pagesIndia Retail Forecastapi-3751572No ratings yet

- Nps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Document1 pageNps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Kolluri VenkataraoNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- October 2022 Monthly Gold CompassDocument84 pagesOctober 2022 Monthly Gold CompassburritolnxNo ratings yet

- AssignmentData1 - With AnalysisDocument28 pagesAssignmentData1 - With AnalysisAditya JandialNo ratings yet

- Ejercicio 1 AnálisisDocument7 pagesEjercicio 1 AnálisisscawdarkoNo ratings yet

- SImulador Tasas OCMDocument11 pagesSImulador Tasas OCMDIEGO ALEJANDRO CARVAJAL AGUILARNo ratings yet

- Comisiones Multiproductos.Document3 pagesComisiones Multiproductos.larry.01.laysNo ratings yet

- Colombia Tasa Inflacion PIB Real Salarios Variacion Del SalarioDocument5 pagesColombia Tasa Inflacion PIB Real Salarios Variacion Del SalarioBrenda MarroquinNo ratings yet

- Libro 1Document10 pagesLibro 1holamundoNo ratings yet

- Libro 1Document4 pagesLibro 1Cesar E. RodriguezNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Students - Purdue Agribusiness Simulation Spreadsheets Group 2 (Period 3)Document65 pagesStudents - Purdue Agribusiness Simulation Spreadsheets Group 2 (Period 3)Ifechukwu AnunobiNo ratings yet

- Equity AutoDocument33 pagesEquity AutoHashith SNo ratings yet

- Total Population, Age 18+, and Children Under 18, 2010: Montgomery County, MarylandDocument5 pagesTotal Population, Age 18+, and Children Under 18, 2010: Montgomery County, MarylandM-NCPPCNo ratings yet

- Fase 1Document63 pagesFase 1Isabel CastilloNo ratings yet

- MSSP - Guaranteed Surrender Value Factors - tcm47-71735Document9 pagesMSSP - Guaranteed Surrender Value Factors - tcm47-71735Sheetal KumariNo ratings yet

- Gantt - Brisas de Pencahue II 284 Viv (DS 49) - REPROGRAMACION 13-10Document424 pagesGantt - Brisas de Pencahue II 284 Viv (DS 49) - REPROGRAMACION 13-10jneiracNo ratings yet

- Final Report Kiran 1Document154 pagesFinal Report Kiran 1Muhammad Zahid Muhammad ZahidNo ratings yet

- Calculadora CDBxLCIDocument4 pagesCalculadora CDBxLCILima PereiraNo ratings yet

- Salinan REVISI Window Dressing CalcDocument148 pagesSalinan REVISI Window Dressing CalcPTPN XIIINo ratings yet

- UntitledDocument6 pagesUntitledKunal NakumNo ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Woodbury County JailDocument3 pagesWoodbury County JailDiana BormannNo ratings yet

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocument6 pagesCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNo ratings yet

- Elecrticity Sector in IndiaDocument10 pagesElecrticity Sector in IndiaSAPTADEEP ACHARYANo ratings yet

- Total Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixDocument12 pagesTotal Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixLorenaNo ratings yet

- GVSU Enrollment Report 2021-2022Document15 pagesGVSU Enrollment Report 2021-2022WWMTNo ratings yet

- DCF ModelDocument51 pagesDCF Modelhugoe1969No ratings yet

- Countryid Country Name Region: Brunei Burma Cambodia Indonesia Laos Malaysia Philippines Singapore Thailand VietnamDocument9 pagesCountryid Country Name Region: Brunei Burma Cambodia Indonesia Laos Malaysia Philippines Singapore Thailand VietnamLion HunterNo ratings yet

- Analysis P & LDocument1 pageAnalysis P & LChris DaemonNo ratings yet

- Harga OTR Total Bayar Tenor Asuransi Tunai Asuransi Kredit Bunga Administrasi TJH 3 IndexDocument12 pagesHarga OTR Total Bayar Tenor Asuransi Tunai Asuransi Kredit Bunga Administrasi TJH 3 IndexRevly NicoNo ratings yet

- CountyMA RateDocument2 pagesCountyMA RateTheCullmanTribuneNo ratings yet

- Preparatory Examination Provincial Results Analysis 2023Document5 pagesPreparatory Examination Provincial Results Analysis 2023Agnes MmathaboNo ratings yet

- 08 - 12 - 2022 Florida Department of Health Covid19 - Data - LatestDocument10 pages08 - 12 - 2022 Florida Department of Health Covid19 - Data - LatestWTXL ABC27No ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- TARIF Website PDFDocument1 pageTARIF Website PDFArsenal HolicNo ratings yet

- Loss History DATA For The New Century Deal With Chase and The JPMAC2006-NC1 Securities TrustDocument3 pagesLoss History DATA For The New Century Deal With Chase and The JPMAC2006-NC1 Securities Trust83jjmackNo ratings yet

- Cla 2Document22 pagesCla 2Ranjan KoiralaNo ratings yet

- Analisis Keputusan Ujian 3 Pt3 2018Document1 pageAnalisis Keputusan Ujian 3 Pt3 2018Yusfalina Mohd Yusoff0% (1)

- Pencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Document1 pagePencapaian Mengikut Model Keseluruhan (Perdana) PPD Langkawi JUN 2019Johari AbdullahNo ratings yet

- Total Population, Age 18+, and Children Under 18, 2010: Montgomery County, MarylandDocument6 pagesTotal Population, Age 18+, and Children Under 18, 2010: Montgomery County, MarylandM-NCPPCNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Approved AD BT EXTNDocument2 pagesApproved AD BT EXTNkrishnaNo ratings yet

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- LIC's Jeevan Lakshya (Plan No. 933) : Benefit IllustrationDocument3 pagesLIC's Jeevan Lakshya (Plan No. 933) : Benefit IllustrationkrishnaNo ratings yet

- Sub: Press Release - Tata Motors Total Sales in Q4 FY22-23: Encl: As AboveDocument3 pagesSub: Press Release - Tata Motors Total Sales in Q4 FY22-23: Encl: As AbovekrishnaNo ratings yet

- Karnataka Bank LTD.: Secretarial DepartmentDocument2 pagesKarnataka Bank LTD.: Secretarial DepartmentkrishnaNo ratings yet

- LIC's New Endowment Plus (Plan No. 935) : Benefit IllustrationDocument6 pagesLIC's New Endowment Plus (Plan No. 935) : Benefit IllustrationkrishnaNo ratings yet

- MCLR Website Updation - English06012023Document1 pageMCLR Website Updation - English06012023krishnaNo ratings yet

- Ravinder Pant CVDocument4 pagesRavinder Pant CVQueens HotelNo ratings yet

- MGT312-Assignment 1-1st-2022-23Document8 pagesMGT312-Assignment 1-1st-2022-23saidNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting Entriesitsayuhthing100% (1)

- Philippine Metal Foundries v. CADocument2 pagesPhilippine Metal Foundries v. CAMarcus AureliusNo ratings yet

- Cooperative OutputDocument9 pagesCooperative OutputPEARL THERESE SUDARIONo ratings yet

- The Level of Satisfaction On The Electronic Filing and Payment System of Bir by The Public Practitioner Cpas in Baguio CityDocument14 pagesThe Level of Satisfaction On The Electronic Filing and Payment System of Bir by The Public Practitioner Cpas in Baguio Cityjovelyn labordoNo ratings yet

- RSI BasicDocument93 pagesRSI BasicDinesh C0% (1)

- Business Facilitation ActDocument31 pagesBusiness Facilitation ActcybervediNo ratings yet

- Op Transaction History UX527!05!2023Document8 pagesOp Transaction History UX527!05!2023srm finservNo ratings yet

- Bachelor ManagementDocument23 pagesBachelor ManagementYara ChehadeNo ratings yet

- Sales and CRM Overview (Pathstream) Quiz AnswersDocument10 pagesSales and CRM Overview (Pathstream) Quiz AnswersChinmay Bhate67% (9)

- Organization BehaviourDocument12 pagesOrganization BehaviourBishal SinghNo ratings yet

- Chapter 2: Salaries.: Computation of Income Under The Head Income From "Salaries"Document8 pagesChapter 2: Salaries.: Computation of Income Under The Head Income From "Salaries"Varun AadarshNo ratings yet

- 2000 2001 PDFDocument1,272 pages2000 2001 PDFmuhammad aliNo ratings yet

- Application Submitted For: Oxford Manor: Basic InformationDocument14 pagesApplication Submitted For: Oxford Manor: Basic InformationHa shtNo ratings yet

- HSE Management System PresentationDocument16 pagesHSE Management System PresentationAshraf AboeleninNo ratings yet

- Perancangan Pabrik Fenol Dan AsetonDocument9 pagesPerancangan Pabrik Fenol Dan Asetontesa agustinNo ratings yet

- Detailed Order Regarding Approval of The Resolution Plan by NCLT MumbaiDocument60 pagesDetailed Order Regarding Approval of The Resolution Plan by NCLT MumbaiAkash VichuNo ratings yet

- Erp Case Study With Solution PDFDocument2 pagesErp Case Study With Solution PDFJazmine40% (5)

- QMS 2nd Assignment - 14apr R2Document9 pagesQMS 2nd Assignment - 14apr R2hariNo ratings yet

- The Death of Inflation Roger BootleDocument5 pagesThe Death of Inflation Roger BootleFrederico SoteroNo ratings yet

- Elements of PlanningDocument6 pagesElements of PlanningMaha AmilNo ratings yet

- Causal Relationship Between CSR and FB in Banks: SciencedirectDocument6 pagesCausal Relationship Between CSR and FB in Banks: SciencedirectAji PurboNo ratings yet

- How Is Entrepreneurship Good For Economic Growth?: Zoltan AcsDocument22 pagesHow Is Entrepreneurship Good For Economic Growth?: Zoltan AcsshuchiroyNo ratings yet

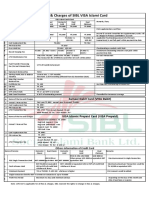

- Fees and Charges of SIBL Islami CardDocument1 pageFees and Charges of SIBL Islami CardMd YusufNo ratings yet

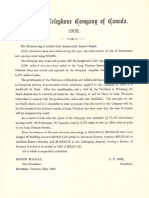

- 1908 Bell Annual ReportDocument1 page1908 Bell Annual ReportCTVWinnipegNo ratings yet

- Saic H 2024Document2 pagesSaic H 2024usmanNo ratings yet

- Misc Payments 08-03-2022Document108 pagesMisc Payments 08-03-2022Namratha DevelopersNo ratings yet

- Lesson 4 Agile Estimating Planning Monitoring and ControllingDocument51 pagesLesson 4 Agile Estimating Planning Monitoring and Controllingbharath S SNo ratings yet

- Devry CatalogDocument182 pagesDevry Cataloglove457744No ratings yet