Professional Documents

Culture Documents

Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are Annualised

Uploaded by

satishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are Annualised

Uploaded by

satishCopyright:

Available Formats

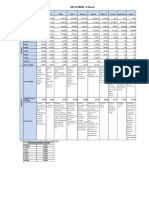

NPS SCHEME - G (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF

Assets (Rs in crore ) 5,461.24 1,291.00 607.66 2,186.61 449.37 4,549.00 71.49

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17

31-Dec-20 30.9726 23.0719 27.7205 28.6183 28.4942 21.4617 14.2738

NAV

52 Week High 30.9726 23.0719 27.7205 28.6183 28.4942 21.4617 14.4893

52 Week Low 27.1742 20.1734 24.4423 25.0972 25.0319 18.6641 12.6546

3 Months 3.56% 3.73% 3.74% 3.37% 3.49% 3.54% 3.50%

6 Months 3.97% 4.26% 3.95% 3.94% 4.05% 4.26% 4.15%

1 Year 13.46% 13.74% 12.95% 13.35% 13.18% 14.30% 13.45%

RETURNS

2 Years 12.98% 13.87% 12.93% 12.77% 13.00% 13.44% 13.12%

3 Years 11.52% 12.73% 11.19% 11.40% 11.47% 11.91% 11.50%

5 Years 10.82% 11.81% 10.27% 10.66% 10.82% 10.89% NA

7 Years 11.57% 12.33% 11.14% 11.44% 11.43% 11.47% NA

10 Years 10.05% NA 9.46% 10.03% 9.97% NA NA

Since Inception 10.20% 11.88% 9.17% 9.46% 9.41% 10.84% 10.24%

7.95% GOI 2032, 7.57 GSEC 2033 7.57% GSEC 2033, (1) 7.40% GOI GS 7.69% CG 2043 6.22% GOI 2035, 7.40% GOI 2035,

7.40 % GOI 2035, 6.19% GS 2034 6.68% GSEC 2031, 2035 (2) 7.95% 7.95% G-Sec 2032 6.19% GOI 2034, 6.83% GOI 2039,

7.57% GSEC 2033, 7.95% G-SEC 2032 7.16% GSEC 2050, GOI 2032 6.19% G-SEC 2034 5.77% GOI 2030, 7.06 % GOI 2046,

07.69 GS 2043, 7.73% G-SEC 2034 7.61% GSEC 2030, (3) 7.57% GS 2033 GS 6.57% 2033 7.40% GOI 2035, 7.61% GSEC 2030,

7.16% GSEC 2050 7.06% G-SEC 2046 8.17% GSEC 2044 (4) 7.64% Food GS CG 7.40% 2035 6.80% GOI 2060 7.95% GOI 2032

Top 5 Holdings Corporation of

India 2029

(5) 7.26% GOI

2029

PORTFOLIO

Weigtage of top 5

20.47 43.09 31.24 43.18 39.97 41.68 29.77

Holdings,%

Government Govt. Sec NA 1.Central Govt industry N.A. 1)Central Govt. Securities,

Securities,State 2. Activities of Government Loans Mutual Fund

commission agents,

Development brokers dealing in

2) State Liquid

Loans,Activities Of wholesale trade of Government Loans

Top 3 Sectors Commission agricultural raw 3) Management of

Agents, Brokers material mutual funds

3. Management of

Dealing In

mutual funds

Wholesale Tra

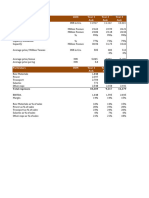

* Scheme Returns for more than 01 year are annualised

SCHEME BENCHMARK RETURN

3 month 3.01%

6 month 3.21%

1 year 12.08%

2 years 12.46%

3 years 10.81%

5 years 9.90%

7 Years 10.84%

10 Years 9.30%

You might also like

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- Scheme G 1 September 2019Document1 pageScheme G 1 September 2019deesingNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- SCHEME - G (Tier-I) - 0Document1 pageSCHEME - G (Tier-I) - 0krishnaNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Central Payout Structure Schemes of IndiaDocument1 pageCentral Payout Structure Schemes of Indiakanna275No ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- SchemeTaxSaver TierIIDocument1 pageSchemeTaxSaver TierIIAnjali DahiyaNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- Nps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Document1 pageNps Scheme - Central Government: 7.57% Gsec 2033, 6.67% Gsec 2050, 6.67% Gsec 2035, 6.10% Gsec 2031, 7.16% Gsec 2050Kolluri VenkataraoNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)VenkateshMedidiNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- Training and DevelopmentDocument12 pagesTraining and Developmentprashanth AtleeNo ratings yet

- NH Ten Year Transportation Improvement PlanDocument1 pageNH Ten Year Transportation Improvement PlanGrant BosseNo ratings yet

- FY 2017 PresentationDocument30 pagesFY 2017 PresentationtheredcornerNo ratings yet

- Monthly Activity Reports: Office of Research and Strategic PlanningDocument6 pagesMonthly Activity Reports: Office of Research and Strategic PlanningleejolieNo ratings yet

- Ringkasan Finansial Per September 2017Document3 pagesRingkasan Finansial Per September 2017Dwi UdayanaNo ratings yet

- Doddy Bicara InvestasiDocument34 pagesDoddy Bicara InvestasiAmri RijalNo ratings yet

- CAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Document22 pagesCAGR W.R.T First Year: (All Figures in INR Lakhs Unless Stated Otherwise)Garima GulatiNo ratings yet

- Life Insurance Update For November 2023Document6 pagesLife Insurance Update For November 2023rajautoprincNo ratings yet

- Doddy Bicara InvestasiDocument38 pagesDoddy Bicara InvestasiNur Cholik Widyan SaNo ratings yet

- Manappuram Finance Investor PresentationDocument43 pagesManappuram Finance Investor PresentationabmahendruNo ratings yet

- Cigniti - Group 3 - BFBVDocument24 pagesCigniti - Group 3 - BFBVpgdm22srijanbNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- 3 Statement Model - Blank TemplateDocument3 pages3 Statement Model - Blank Templated11210175No ratings yet

- Roches ExcelDocument4 pagesRoches ExcelJaydeep SheteNo ratings yet

- Update Harga: Real-Time: QualityDocument44 pagesUpdate Harga: Real-Time: QualityNul AsashiNo ratings yet

- MTAC - Business Data 2021 - For ParticipantDocument3 pagesMTAC - Business Data 2021 - For ParticipantDIDINo ratings yet

- Ceres Gardening - Case (1) ProfesorDocument1 pageCeres Gardening - Case (1) Profesorpeta8805No ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- Hero Model - Equivalue 2Document48 pagesHero Model - Equivalue 2Neha RadiaNo ratings yet

- Equity AutoDocument33 pagesEquity AutoHashith SNo ratings yet

- Intrinsic Value Calculator-1Document3 pagesIntrinsic Value Calculator-1Khursheed AlamNo ratings yet

- NG Debt Press Release June 2023 1Document2 pagesNG Debt Press Release June 2023 1Ma. Theresa BerdanNo ratings yet

- Original Comparables Valuation SolvedDocument26 pagesOriginal Comparables Valuation Solvedpashish817No ratings yet

- Nps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - C (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedshrikanhaiyyaNo ratings yet

- XLS EngDocument4 pagesXLS EngShubhangi JainNo ratings yet

- Cla 2Document22 pagesCla 2Ranjan KoiralaNo ratings yet

- Crowe Horwath 2013 Hotel Survey ResultsDocument2 pagesCrowe Horwath 2013 Hotel Survey ResultsVassos KoutsioundasNo ratings yet

- Group4 Project2Document17 pagesGroup4 Project2John Brian Asi AlmazanNo ratings yet

- Interest As Percent of GDPDocument12 pagesInterest As Percent of GDPJohn SarveyNo ratings yet

- ACC Cement: Reference ModelDocument21 pagesACC Cement: Reference Modelsparsh jainNo ratings yet

- FA1 SnikyjwpDocument48 pagesFA1 SnikyjwpAbhisek MohantyNo ratings yet

- Name of The Company Last Financial Year First Projected Year CurrencyDocument15 pagesName of The Company Last Financial Year First Projected Year CurrencygabegwNo ratings yet

- Macroeconomics Fiscal Policy 1Document13 pagesMacroeconomics Fiscal Policy 1Santhosh BalajiNo ratings yet

- Leadership PracticeDocument25 pagesLeadership PracticeTahir AhmadNo ratings yet

- Users4 2Document330 pagesUsers4 2eiulianoNo ratings yet

- 6 JIntell Prop Info Tech Elec CDocument22 pages6 JIntell Prop Info Tech Elec CAgent BlueNo ratings yet

- Project Report On Branding Strategies of Samsung Mobile PhonesDocument59 pagesProject Report On Branding Strategies of Samsung Mobile PhonesRaghavWatts80% (5)

- 8 Hybris HMC PCMDocument9 pages8 Hybris HMC PCMravikanchuNo ratings yet

- NSS Exploring Economics 2 (3rd Edition) Answers To Exercises Chapter 9 Production and Division LabourDocument14 pagesNSS Exploring Economics 2 (3rd Edition) Answers To Exercises Chapter 9 Production and Division LabourdizzelNo ratings yet

- Tradex Cs Project MFDocument35 pagesTradex Cs Project MFVibots TechnologyNo ratings yet

- Mahindra Tractors - Promotion of New Product Yuvraj215 - Summer Training ReportDocument85 pagesMahindra Tractors - Promotion of New Product Yuvraj215 - Summer Training Reportneha satish pawarNo ratings yet

- Documents of TitleDocument5 pagesDocuments of TitleNeil MayorNo ratings yet

- Course: Marketing Research: Faculty of International Economic Relations Semester 1, 2021 - 2022Document2 pagesCourse: Marketing Research: Faculty of International Economic Relations Semester 1, 2021 - 2022Thảo NguyễnNo ratings yet

- Unleash Your Trading Potential With FXDD by Investing - Com StudiosDocument2 pagesUnleash Your Trading Potential With FXDD by Investing - Com StudiosNutthakarn WisatsiriNo ratings yet

- Corporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesDocument14 pagesCorporate Law of Malaysia: Statutory Meetings in Malaysia CompaniesJitha RithaNo ratings yet

- SAP VC Variant Configuration ConsultantDocument2 pagesSAP VC Variant Configuration Consultantusman03071512No ratings yet

- Lembar Kerja Siklus Akuntansi: Praktek Akuntansi Keuangan (Manual)Document13 pagesLembar Kerja Siklus Akuntansi: Praktek Akuntansi Keuangan (Manual)Vanyssha kharismaNo ratings yet

- Dwnload Full Essentials of Management 9th Edition Dubrin Test Bank PDFDocument35 pagesDwnload Full Essentials of Management 9th Edition Dubrin Test Bank PDFisaack4iben100% (11)

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Commissioner of Internal Revenue v. ShinkoDocument16 pagesCommissioner of Internal Revenue v. ShinkoMarj BaquialNo ratings yet

- Design Thinking Ideate To TestDocument6 pagesDesign Thinking Ideate To TestAditya KarnikNo ratings yet

- SPEECH RECOGNITION SYSTEM FinalDocument16 pagesSPEECH RECOGNITION SYSTEM FinalMard GeerNo ratings yet

- Sinking Fund and AmortizationDocument8 pagesSinking Fund and AmortizationMay Jovi JalaNo ratings yet

- Assignment 1 MeasurementDocument8 pagesAssignment 1 Measurementashith.shajanNo ratings yet

- On Marketing Strategy of HaldiramDocument36 pagesOn Marketing Strategy of Haldiramsumit.avistar90% (10)

- Accounting Study PlanDocument9 pagesAccounting Study PlanOuis MistarihiNo ratings yet

- Clover Park Technical College Class Schedule For Spring Quarter 2014Document57 pagesClover Park Technical College Class Schedule For Spring Quarter 2014CloverParkTechNo ratings yet

- SR 6 VDA-6.3-2016-Potential-Analysis 2022.02.18 EN Global PDFDocument20 pagesSR 6 VDA-6.3-2016-Potential-Analysis 2022.02.18 EN Global PDFAmine ABASSINo ratings yet

- HR Data Governance Kick OffDocument6 pagesHR Data Governance Kick OffmemekriaNo ratings yet

- Basic Knowledge in Construction ManagementDocument32 pagesBasic Knowledge in Construction ManagementKhaing SuNo ratings yet

- SCA Annual Report 2013Document122 pagesSCA Annual Report 2013SCA - Hygiene and Forest Products CompanyNo ratings yet

- Best Practices Customer Interviews Focus Groups PDFDocument10 pagesBest Practices Customer Interviews Focus Groups PDFAlina MihailaNo ratings yet