Professional Documents

Culture Documents

Nps Scheme - E (Tier-I)

Uploaded by

VenkateshMedidiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nps Scheme - E (Tier-I)

Uploaded by

VenkateshMedidiCopyright:

Available Formats

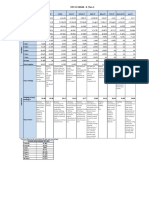

NPS SCHEME - E (Tier-I)

Particulars SBIPF LICPF UTIRSL ICICI PF KOTAK PF HDFC PF BIRLA PF TATA PF MAX LIFE PF Axis PF

Assets (Rs in crore ) 10,410.82 3,166.00 1,441.71 5,968.51 1,082.04 18,071.30 292.24 22.91 8.33 54.62

Scheme Inception Date 15-May-09 23-Jul-13 21-May-09 18-May-09 15-May-09 1-Aug-13 9-May-17 19-Aug-22 12-Sep-22 21-Oct-22

31-Jan-23 38.8499 30.1342 45.9353 46.4345 43.6372 35.3646 18.8903 10.0474 9.4805 9.7566

NAV

52 Week High 41.2479 31.8673 48.5774 49.2367 45.7457 37.4758 20.0675 10.7172 10.0578 10.3499

52 Week Low 33.4070 25.7882 39.5448 39.9622 37.0095 30.3948 16.3809 9.7677 9.1851 9.7277

3 Months -2.29% -1.86% -2.42% -2.50% -1.55% -2.21% -2.48% -3.07% -2.43% NA

6 Months 3.42% 4.00% 3.10% 3.27% 4.51% 3.39% 2.75% NA NA NA

1 Year 2.44% 4.37% 3.15% 2.48% 2.96% 3.00% 2.83% NA NA NA

2 Years 13.87% 16.52% 14.80% 14.93% 15.98% 14.93% 13.76% NA NA NA

RETURNS

3 Years 14.05% 15.27% 14.70% 14.72% 15.05% 14.93% 13.93% NA NA NA

5 Years 9.65% 9.64% 9.83% 9.99% 10.21% 10.82% 9.83% NA NA NA

7 Years 13.11% 12.93% 13.51% 13.41% 13.70% 14.34% NA NA NA NA

10 Years 12.13% NA 12.47% 12.25% 12.34% NA NA NA NA NA

Since Inception 10.39% 12.27% 11.77% 11.85% 11.33% 14.21% 11.73% 0.47% -5.20% -2.43%

Reliance Reliance Icici Bank Equity, (1) HDFC Bank HDFC Bank Ltd Reliance Industries Reliance Reliance 1. Reliance 1) Reliance

Industry Industries Reliance Industries Limited Infosys Ltd. Industries, Icici Industry Industries Industries Ltd

Limited, Ltd., Equity, Infosys Tech (2) ICICI Bank Technologies Ltd. ICICI Bank Ltd Bank, Hdfc Limited, Limited 2) HDFC Bank Ltd

Hdfc Bank Ltd., Icici Bank Equity, Limited ICICI Bank Ltd. HDFC Bank Ltd Bank, Infosys Hdfc Bank Ltd., 2. HDFC Bank 3) ICICI Bank Ltd

Icici Equity, Ltd., Hdfc Bank Equity, (3) Reliance Reliance Infosys Ltd Limited, Icici Equity, Limited 4) Infosys Ltd

Infosys Hdfc Bank Hdfc Equity Industries Limited Industries Ltd. Housing Larsen And Infosys 3. ICICI Bank 5) Housing

Technologies Limited, (4) Infosys Axis Bank Ltd Development Toubro Limited Technologies Limited Development

Limited, Infosys Limited Finance Limited, 4. Infosys Finance

Top 5 Holdings Axis Bank Equity Technologies (5) State Bank Of Corporation Ltd Bhartiartl Limited Corporation Ltd

Ltd, India Equity 5. Housing

Larsen And

Development

Toubro Ltd

Finance Corp

Limited

Weigtage of top 5

31.84 32.23 30.09 31.60 34.00 32.02 33.41 29.30 31.06 37.97

PORTFOLIO

Holdings,%

Monetary Banks, It - Monetary 1. Monetary Monetary 1)Monetary Oil & Gas, Monetary 1. Banking 1) Monetary

Intermediation Software, Intermediation Of intermediation of Intermidiation Of intermediation of Bank & Finance, intermediation 2. FMCG Intermediation of

Of Commercial Oil & Gas Banks, commercial banks, Com Bank commercial banks, It, Infra of commercial 3. IT Commercial

Banks, Saving Writing , Modifying, saving banks, Writing , saving banks. postal banks, saving Banks, Saving

Banks. Testing Of Computer postal savings. Modifying, Testing savings bank and banks. postal, Banks. Postal

Postal,Writing , Program To Meet The 2. Writing , Of Computer discount houses Writing , Savings Bank and

Modifying, Needs Of A Particular modifying, testing Program To Meet 2)"Writing , modifying, Discount Houses

Testing Of Client, of computer The Needs Of A modifying, testing of testing of 2) Manufacture of

Computer Manufacture Of Other program. Particular Client computer program computer Other Petroleum

Program To Petroleum N.E.C. 3. Manufacture of Manufacture Of to meet the needs program to n.e.c.

Top 3 Sectors Meet The other petroleum Other Petroleum of a meet the 3) Writing ,

Need,Manufact n.e.c. N.E.C. particular client need,Manufact Modifying, Testing

excluding web-page of Computer

designing" Program to Meet

3)Manufacture of the Needs of a

other petroleum Particular Client

n.e.c.

* Scheme Returns for more than 01 year are annualised

SCHEME BENCHMARK RETURN

3 month -3.36%

6 month 1.93%

1 year 2.49%

2 years 15.10%

3 years 15.31%

5 Years 10.75%

7 Years 13.98%

10 Years 12.40%

You might also like

- SCHEME - E (Tier-I) - 0Document1 pageSCHEME - E (Tier-I) - 0krishnaNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)SRIKANTA ROUTNo ratings yet

- Nps Scheme - E (Tier-I)Document1 pageNps Scheme - E (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - E (Tier-Ii)Document1 pageNps Scheme - E (Tier-Ii)VenkateshMedidiNo ratings yet

- Scheme E - Tier IIDocument1 pageScheme E - Tier IIRaghu MNo ratings yet

- Scheme E2 - 2Document1 pageScheme E2 - 2SanjayNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)glorymatrixNo ratings yet

- SCHEME - A (Tier-I) - 0Document1 pageSCHEME - A (Tier-I) - 0krishnaNo ratings yet

- Scheme A - 9Document1 pageScheme A - 94296tNo ratings yet

- Nps Scheme - C (Tier-I)Document1 pageNps Scheme - C (Tier-I)Kolluri VenkataraoNo ratings yet

- Nps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedDocument1 pageNps Scheme - G (Tier-I) : Scheme Returns For More Than 01 Year Are AnnualisedsatishNo ratings yet

- Scheme A - 6Document1 pageScheme A - 6SRIKANTA ROUTNo ratings yet

- Scheme A 1 July 2021Document1 pageScheme A 1 July 2021amar srinivasNo ratings yet

- Nps Scheme - A (Tier-I)Document1 pageNps Scheme - A (Tier-I)Kolluri VenkataraoNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- Scheme C - Tier I - 0Document1 pageScheme C - Tier I - 0Kumar AlokNo ratings yet

- Scheme C - Tier IDocument1 pageScheme C - Tier INitesh TirkeyNo ratings yet

- Key Tenets To Reduce Risks While Investing in EquitDocument8 pagesKey Tenets To Reduce Risks While Investing in EquitdigthreeNo ratings yet

- ACE - Fundtech LargeCap BA-FOTMDocument16 pagesACE - Fundtech LargeCap BA-FOTMMotilal Oswal Financial ServicesNo ratings yet

- Company 1 Company 2 Company 3 Company 4: SectorDocument27 pagesCompany 1 Company 2 Company 3 Company 4: SectorAlba GlenNo ratings yet

- Jupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFDocument4 pagesJupiter UK Smaller Companies Focus Fund FACT-PRO-NCO-jupiter-uk-smaller-companies-focus-fund-l-gbp-inc-ie00blp58f76-en-GB-eu PDFSaif MonajedNo ratings yet

- Kingfisher School of Business and Finance: Lucao District, Dagupan City, PangasinanDocument8 pagesKingfisher School of Business and Finance: Lucao District, Dagupan City, Pangasinansecret 12No ratings yet

- Investment Approach Key Features & Portfolio AttributesDocument3 pagesInvestment Approach Key Features & Portfolio AttributesAkash JoshiNo ratings yet

- MO IOP-One-Pager Oct'22Document2 pagesMO IOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- Jupiter India Select Factsheet PA Retail LU0329071053 en GB PDFDocument4 pagesJupiter India Select Factsheet PA Retail LU0329071053 en GB PDFAlly Bin AssadNo ratings yet

- Scheme NPS Lite September 2019Document1 pageScheme NPS Lite September 2019Kuntal DasNo ratings yet

- TS - MSCI Indonesia Nov-21 Rebalancing PreviewDocument6 pagesTS - MSCI Indonesia Nov-21 Rebalancing PreviewAdri KhosasihNo ratings yet

- Scheme CG July 2020-MinDocument1 pageScheme CG July 2020-MinSandipan MukherjeeNo ratings yet

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocument1 pageShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNo ratings yet

- Manulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFDocument2 pagesManulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFHetanshNo ratings yet

- Collective Insights: Minutes From Our Morning MeetingDocument2 pagesCollective Insights: Minutes From Our Morning Meetingapi-63645244No ratings yet

- Strategy: Portfolio Perspectives: Safe and SelectiveDocument15 pagesStrategy: Portfolio Perspectives: Safe and SelectiveRecrea8 EntertainmentNo ratings yet

- Analysts Meeting BM Q2-2019 (LONG FORM)Document104 pagesAnalysts Meeting BM Q2-2019 (LONG FORM)RadiSujadi24041977No ratings yet

- SCHEME - G (Tier-I) - 0Document1 pageSCHEME - G (Tier-I) - 0krishnaNo ratings yet

- And Investment Holdings 32015Document10 pagesAnd Investment Holdings 32015Milan PetrikNo ratings yet

- Annual Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument3 pagesAnnual Returns - Mutual Fund Screener Mutual Fund Screening and Analysis Toolashish singhNo ratings yet

- Scheme NPS Lite May 2019Document1 pageScheme NPS Lite May 2019Ayanendu SanyalNo ratings yet

- MO NTDOP One Pager Oct'22Document3 pagesMO NTDOP One Pager Oct'22Himanshu TamrakarNo ratings yet

- JP Morgan FundsDocument118 pagesJP Morgan FundsArmstrong CapitalNo ratings yet

- Nps Scheme - G (Tier-I) : 7.22% NA NA NADocument1 pageNps Scheme - G (Tier-I) : 7.22% NA NA NAKolluri VenkataraoNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- Bei 3Document25 pagesBei 3Anggih Nur HamidahNo ratings yet

- REIT FundsDocument8 pagesREIT FundsArmstrong CapitalNo ratings yet

- MO BOP-One-Pager Oct'22Document3 pagesMO BOP-One-Pager Oct'22Himanshu TamrakarNo ratings yet

- Central Payout Structure Schemes of IndiaDocument1 pageCentral Payout Structure Schemes of Indiakanna275No ratings yet

- Short Term Funds Comparision - Fund CompareDocument7 pagesShort Term Funds Comparision - Fund CompareANmolNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- State Government Scheme - 0Document1 pageState Government Scheme - 0Vishwajeet DasNo ratings yet

- Nps Scheme - Central GovernmentDocument1 pageNps Scheme - Central GovernmentArya MalikNo ratings yet

- PBRXDocument29 pagesPBRXMoe EcchiNo ratings yet

- Scheme NPS Lite December - 2020-MinDocument1 pageScheme NPS Lite December - 2020-MinRahulNo ratings yet

- Value Research Fundcard - Aditya Birla Sun Life New Millennium Fund-2018 Apr 16Document4 pagesValue Research Fundcard - Aditya Birla Sun Life New Millennium Fund-2018 Apr 16hotalamNo ratings yet

- PICU Guidelines Final December 6 2017Document220 pagesPICU Guidelines Final December 6 2017nascitech-222No ratings yet

- Historic Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Multi Cap Fund, Multi Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Historic Returns - Mid Cap Fund, Mid Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDocument3 pagesHistoric Returns - Mid Cap Fund, Mid Cap Fund Performance Tracker Mutual Funds With Highest ReturnsAayushNo ratings yet

- Analyzing Financial Statement of Vinamilk Group 2Document24 pagesAnalyzing Financial Statement of Vinamilk Group 2Phan Thị Hương TrâmNo ratings yet

- Salinan REVISI Window Dressing CalcDocument148 pagesSalinan REVISI Window Dressing CalcPTPN XIIINo ratings yet

- ValueResearchFundcard SBIBluechipFund 2019aug30 PDFDocument4 pagesValueResearchFundcard SBIBluechipFund 2019aug30 PDFSachin JawaleNo ratings yet

- Fundcard: SBI Bluechip FundDocument4 pagesFundcard: SBI Bluechip FundSachin JawaleNo ratings yet

- Handbook of Singapore — Malaysian Corporate FinanceFrom EverandHandbook of Singapore — Malaysian Corporate FinanceTan Chwee HuatNo ratings yet

- Horoscope Matching: Venkat.. LakshmiDocument6 pagesHoroscope Matching: Venkat.. LakshmiVenkateshMedidiNo ratings yet

- Horoscope Matching: Vikas LakshmiDocument6 pagesHoroscope Matching: Vikas LakshmiVenkateshMedidiNo ratings yet

- 5 6154413776952099627Document5 pages5 6154413776952099627VenkateshMedidiNo ratings yet

- Bharat Air Fiber PDFDocument102 pagesBharat Air Fiber PDFPratap MohapatraNo ratings yet

- Persons in NewsDocument4 pagesPersons in NewsVenkateshMedidiNo ratings yet

- Revised Key ECEDocument1 pageRevised Key ECEVenkateshMedidiNo ratings yet

- 1 5035191148390383688Document26 pages1 5035191148390383688Nallanki Raja KumarNo ratings yet

- Notice On Final KeyDocument1 pageNotice On Final Keysrikanth mukkeraNo ratings yet

- OTPRDocument29 pagesOTPRSIVAKUMAR REDDY GOTIKENo ratings yet

- Final Syllabus Group-IDocument10 pagesFinal Syllabus Group-Iprasadttvs115No ratings yet

- Salvo Chemical Industry Limited: Bank Code Br. Code Bank & Branch NameDocument6 pagesSalvo Chemical Industry Limited: Bank Code Br. Code Bank & Branch NameihshourovNo ratings yet

- Raiffeisen International Directory: August 2005Document16 pagesRaiffeisen International Directory: August 2005shenkee-1No ratings yet

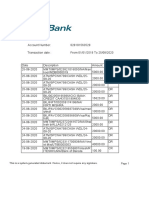

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument4 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signatureyour mdrahamanNo ratings yet

- Account Statement2Document31 pagesAccount Statement2Parminder SinghNo ratings yet

- Pere 2013 Top 50Document15 pagesPere 2013 Top 50brettgrobNo ratings yet

- Modelo de Planilla para Arbitraje IdealDocument121 pagesModelo de Planilla para Arbitraje IdealFranco DaloffNo ratings yet

- Commercial BankingDocument36 pagesCommercial Bankingkhatiwada2005No ratings yet

- Admissions - Uo.edu - PK Home Print Challan MS06231Document1 pageAdmissions - Uo.edu - PK Home Print Challan MS06231Jalal khanNo ratings yet

- Mutual Funds Association of Pakistan: Asset Management Companies (Amcs) in PakistanDocument5 pagesMutual Funds Association of Pakistan: Asset Management Companies (Amcs) in PakistanMuhammad Khuram ShahzadNo ratings yet

- SRI 12 Brochure SJB DiscountDocument18 pagesSRI 12 Brochure SJB DiscountMateusz WodzinskiNo ratings yet

- ARN Code of The Bank and Financial Companies of IndiaDocument10 pagesARN Code of The Bank and Financial Companies of IndiaNirbhay KumarNo ratings yet

- C L Feldman Martin Financial Disclosure Report For 2009Document15 pagesC L Feldman Martin Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- AccountStatement01-10-2022 To 27-12-2022Document26 pagesAccountStatement01-10-2022 To 27-12-2022Amit KumarNo ratings yet

- Banks ListDocument1 pageBanks Listledia shenoudaNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument15 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitNo ratings yet

- Statement 1700313960560Document28 pagesStatement 1700313960560Arun MuniNo ratings yet

- Dividend History of Quoted CompaniesDocument37 pagesDividend History of Quoted CompaniesOLU DAVIESNo ratings yet

- Folio Detail ReportDocument50 pagesFolio Detail ReportBaljit kaurNo ratings yet

- Share RegistarDocument4 pagesShare RegistarBishwa ShikharNo ratings yet

- Merger of Citi N TravelersDocument17 pagesMerger of Citi N TravelersSonica ShetNo ratings yet

- Company Name Data1Document314 pagesCompany Name Data1Ewaste RecyclingNo ratings yet

- 2020 10 01 - 2020 12 31 - 20022023134410 PDFDocument2 pages2020 10 01 - 2020 12 31 - 20022023134410 PDFbhavya shahNo ratings yet

- Mutual FundsDocument18 pagesMutual FundsAyushi Singh. 214 - BNo ratings yet

- Sbi HistoryDocument6 pagesSbi HistoryVishh ChennNo ratings yet

- Statement (Apr-2022 To Nov-2023) 0920XXXXXX217527-11-2023Document32 pagesStatement (Apr-2022 To Nov-2023) 0920XXXXXX217527-11-2023vkintouch1987No ratings yet

- Venture CapitalDocument18 pagesVenture CapitalAbhishek GuptaNo ratings yet

- KPLC - Prepaid - Vendors - List of Easy Pay Partners 23 - 05 - 2017Document1 pageKPLC - Prepaid - Vendors - List of Easy Pay Partners 23 - 05 - 2017Reagan MbitiruNo ratings yet

- Total Amount: Inr 1.07 L: Top MerchantsDocument8 pagesTotal Amount: Inr 1.07 L: Top MerchantsRitik raj ChaudharyNo ratings yet

- EquityDocument247 pagesEquitySumit GuptaNo ratings yet

- Fria List of CasesDocument2 pagesFria List of CasesJhomel Delos ReyesNo ratings yet