Professional Documents

Culture Documents

Sro 504

Uploaded by

MuhammadIjazAslam0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

201361410630429022013sro504

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageSro 504

Uploaded by

MuhammadIjazAslamCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

GOVERNMENT OF PAKISTAN

MINISTRY OF FINANCE, ECONOMIC AFFAIRS,

STATISTICS AND REVENUE

(REVENUE DIVISION)

Islamabad, the 12th June, 2013.

NOTIFICATION

(SALES TAX)

S.R.O. 504(I)/2013. In exercise of the powers conferred by clause (c) of section 4

read with clause (b) of sub-section (2) and sub-section (6) of section 3, clause (b) of sub-

section (1) of section 8 and section 71 of the Sales Tax Act, 1990, the Federal Government is

pleased to direct the following amendments shall be made in its Notification No. S.R.O.

1125(I)/2011, dated the 31st December, 2011, namely:–

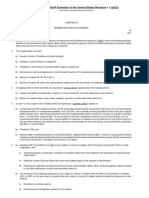

In the aforesaid Notification, in the Table, in column (1),–

(a) against serial numbers 1, 2, 3, 6 and 7, for the entries relating thereto in columns (2)

and (3) the following shall be substituted; namely:–

S.No. Description of goods PCT Heading No.

(1) (2) (3)

“01. Leathers and articles thereof, excluding Chapter 41 and heading

64.06

finished articles of leather and artificial leather

02. Textile and articles thereof, excluding Chapters 50, 51, 52, 53, 54

(excluding 5407.2000), 55,

(a) finished articles of textiles and textile

56 (excluding 56.08 and

made-ups;

56.09), 57(excluding made

(b) mono-filament of more than 67 decitex;

ups), 58, 59 (excluding

(c) sun shading;

59.05, 59.10) and 60

(d) fishing net of nylon or other material;

(e) rope of polyethylene or nylon; and

(f) tyre cord fabric

03. Chapter 57 (excluding made

Carpets, excluding those in finished condition

ups)

06. Sports goods, excluding those in finished Respective headings

excluding finished goods.

condition

07 Surgical goods, excluding those in finished Respective headings

excluding finished goods”.

condition

(b) against serial number 56, in column (2), after the word “preparations” the

word “excluding master batches” shall be added; and

(c) serial number 68 and the entries relating thereto in columns (2) and (3) shall

be omitted;

[C.NO.1/47-STB/2013]

(Mohammad Raza Baqir)

Additional Secretary

You might also like

- Finance Bill 2023-24Document121 pagesFinance Bill 2023-24Hussain AfzalNo ratings yet

- 61cdbb8ff11ef 645Document33 pages61cdbb8ff11ef 645Junaid iqbalNo ratings yet

- Chapter 63Document27 pagesChapter 63Abdeali KhozemaNo ratings yet

- cs12 2013Document5 pagescs12 2013stephin k jNo ratings yet

- Section XI Textiles and Textile ArticlesDocument7 pagesSection XI Textiles and Textile ArticlesFakrul HasanNo ratings yet

- REVISION OF MINIMUM WAGES FOR TANNERIESDocument6 pagesREVISION OF MINIMUM WAGES FOR TANNERIESVelmurugan ElumalaiNo ratings yet

- 06 - 2022 CTR EngDocument7 pages06 - 2022 CTR EngJGVNo ratings yet

- The Annaul Finance-Bill 2023 of PakistanDocument123 pagesThe Annaul Finance-Bill 2023 of PakistanJasmin NabeelNo ratings yet

- Title 5-Part III-Subpart D-Chapter 53-Subchapter III - GENERAL SCHEDULE PAY RATESDocument50 pagesTitle 5-Part III-Subpart D-Chapter 53-Subchapter III - GENERAL SCHEDULE PAY RATESapi-3753531No ratings yet

- Scoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018Document4 pagesScoial Welfare Surcharge 11-2018-Cus Dated 02.12.2018DRI HQ CINo ratings yet

- Laws of Ghana: The Public Procurement (Amendment) Act 2016 ACT 914Document48 pagesLaws of Ghana: The Public Procurement (Amendment) Act 2016 ACT 914Alphred Kojo YamoahNo ratings yet

- Section XI Textiles and Textile Articles NotesDocument7 pagesSection XI Textiles and Textile Articles NotesSakib Ex-rccNo ratings yet

- Finance ActDocument53 pagesFinance Actshahid farooq100% (1)

- Gazette NotificationDocument3 pagesGazette NotificationDSTE ConstructionNo ratings yet

- GST TEST - 2 DEC 22 and JUNE 23 Batch Without AnswerDocument6 pagesGST TEST - 2 DEC 22 and JUNE 23 Batch Without AnswerSanjana KashyapNo ratings yet

- Annex III.2 Exceptions To Articles III.2 and III.7 Section I - Canadian MeasuresDocument2 pagesAnnex III.2 Exceptions To Articles III.2 and III.7 Section I - Canadian Measurescfts94No ratings yet

- Patents (Amendment) Rules, 2006Document6 pagesPatents (Amendment) Rules, 2006Latest Laws TeamNo ratings yet

- Cost accounting records rules for textiles industryDocument93 pagesCost accounting records rules for textiles industrysubhashNo ratings yet

- 1.4 The Maharashtra Mathadi & Private Security Guards Amendment Bill 2023Document12 pages1.4 The Maharashtra Mathadi & Private Security Guards Amendment Bill 2023SurajNo ratings yet

- Amendment To Rubber Rules 2009Document5 pagesAmendment To Rubber Rules 2009Latest Laws TeamNo ratings yet

- MCSThird Amendment Final GazetteDocument15 pagesMCSThird Amendment Final GazetteFrank OpsNo ratings yet

- Bill To Amend Maharashtra Co-Operative Societies (Amendment) Act, 2019.Document19 pagesBill To Amend Maharashtra Co-Operative Societies (Amendment) Act, 2019.Pramod Bodne100% (1)

- Companies Amendment Act, 2020Document35 pagesCompanies Amendment Act, 2020Nagendra KumarNo ratings yet

- Dangerous Drugs ApplicationAmendment Order 2023Document3 pagesDangerous Drugs ApplicationAmendment Order 2023Tyler HiggsNo ratings yet

- Act No 7 The Finance Act 2023 230701 083832Document49 pagesAct No 7 The Finance Act 2023 230701 083832shaban AnzuruniNo ratings yet

- Chapter 903Document8 pagesChapter 903Zarzis RonyNo ratings yet

- 07 - 2022 CTR EngDocument2 pages07 - 2022 CTR EngSurendra SharmaNo ratings yet

- TEXTILES COMMITTEE ACTDocument13 pagesTEXTILES COMMITTEE ACTdigitalexpertmrgogoNo ratings yet

- Bill5 PDFDocument3 pagesBill5 PDFAnant KomalNo ratings yet

- The Tribunal Reforms Ordinance 2021Document22 pagesThe Tribunal Reforms Ordinance 2021KnP GamingNo ratings yet

- Asgt 7Document2 pagesAsgt 7asifiqbal00No ratings yet

- C) CA PL - Tax Palnning & Compliance Manual (Indirect Tax-Customs Portion)Document311 pagesC) CA PL - Tax Palnning & Compliance Manual (Indirect Tax-Customs Portion)johny SahaNo ratings yet

- MCS (Third Amendment) Ordinance, 2018Document17 pagesMCS (Third Amendment) Ordinance, 2018Moneylife Foundation93% (40)

- MCS Act 1960 (Third Amendment) Ordinance, 2018..aspx-20181031111031 PDFDocument17 pagesMCS Act 1960 (Third Amendment) Ordinance, 2018..aspx-20181031111031 PDFrajeshjadhav89No ratings yet

- Chapter 59Document11 pagesChapter 59mehtasahil21No ratings yet

- Sro 575 Updated 200313Document40 pagesSro 575 Updated 200313Asaad ZahirNo ratings yet

- AHTN2022 CHAPTER95 wNOTESDocument5 pagesAHTN2022 CHAPTER95 wNOTESdoookaNo ratings yet

- In Gov NBC 2016 Vol1 Digital PDFDocument1,226 pagesIn Gov NBC 2016 Vol1 Digital PDFRahul TomarNo ratings yet

- Imports duty changes for pulses, edible oils and moreDocument11 pagesImports duty changes for pulses, edible oils and moreUniversal CargoNo ratings yet

- SealstDocument31 pagesSealstKrit LaohakunvatitNo ratings yet

- The Maharashtra Value Added Tax Act, 2002Document27 pagesThe Maharashtra Value Added Tax Act, 2002Niraj DubeyNo ratings yet

- Merchant Shipping Solas Chapter III Life Saving Appliances and Arrangements Regulations 2017Document23 pagesMerchant Shipping Solas Chapter III Life Saving Appliances and Arrangements Regulations 2017Przemek SankowskiNo ratings yet

- 2 Annexestothe ProposalpdfDocument17 pages2 Annexestothe ProposalpdfdenshiyoriNo ratings yet

- Gazette Notification Extends EDLI Scheme BenefitsDocument6 pagesGazette Notification Extends EDLI Scheme BenefitsssvivekanandhNo ratings yet

- Motor Vehicles Amendment Bill 2017Document47 pagesMotor Vehicles Amendment Bill 2017Aryann GuptaNo ratings yet

- CGST Amendment Act 2018Document9 pagesCGST Amendment Act 2018sridharanNo ratings yet

- Operator Evaluation Programme in Spinning MillDocument43 pagesOperator Evaluation Programme in Spinning MillSENTHIL KUMAR100% (2)

- The Maharashtra Value Added Tax Act, 2002Document27 pagesThe Maharashtra Value Added Tax Act, 2002knowlardNo ratings yet

- Wadding, felt, nonwovens and special yarnsDocument4 pagesWadding, felt, nonwovens and special yarnsNorliah OmarNo ratings yet

- Chapter 40Document22 pagesChapter 40俞悅No ratings yet

- Section 140-Bridge Bearing SpecDocument22 pagesSection 140-Bridge Bearing Specnorfazlinda20No ratings yet

- Wild Life (Protection) Amendment Act, 2022Document165 pagesWild Life (Protection) Amendment Act, 2022Naresh KadyanNo ratings yet

- Notification No. 477 (E) Dated 25th July, 1991 of The Department of Industrial Policy and Promotion, Ministry of IndustryDocument39 pagesNotification No. 477 (E) Dated 25th July, 1991 of The Department of Industrial Policy and Promotion, Ministry of IndustryHarish100% (3)

- The Minister of Justice Is Responsible For The Application of This Act. Order in Council 385-2019 Dated 10 April 2019, (2019) 151 G.O. 2 (French), 1420Document10 pagesThe Minister of Justice Is Responsible For The Application of This Act. Order in Council 385-2019 Dated 10 April 2019, (2019) 151 G.O. 2 (French), 1420faizrummanNo ratings yet

- 04 - 2022 CTR EngDocument5 pages04 - 2022 CTR Enghello8434No ratings yet

- Statute Law Misc Amendmet Act No. 13 of 1988Document6 pagesStatute Law Misc Amendmet Act No. 13 of 1988gkaniuNo ratings yet

- Further To Amend Certain Tax Laws: LizirDocument14 pagesFurther To Amend Certain Tax Laws: Lizirsharif ud din KhiljiNo ratings yet

- Sro 213Document1 pageSro 213Farhan JanNo ratings yet

- Sro 213Document1 pageSro 213Farhan JanNo ratings yet

- EXpress LHR 25octDocument12 pagesEXpress LHR 25octMuhammadIjazAslamNo ratings yet

- DerivativesDocument7 pagesDerivativesMuhammadIjazAslamNo ratings yet

- Dev 2022-23.docxDocument7 pagesDev 2022-23.docxMuhammadIjazAslamNo ratings yet

- OB Personality and Emotions 11 - 04stDocument20 pagesOB Personality and Emotions 11 - 04stVinay VinuNo ratings yet

- PAKISTAN May Be Grappling With Devastating FloodsDocument1 pagePAKISTAN May Be Grappling With Devastating FloodsMuhammadIjazAslamNo ratings yet

- International PoliticsDocument1 pageInternational PoliticsMuhammadIjazAslamNo ratings yet

- Express Multan 29 DecDocument12 pagesExpress Multan 29 DecMuhammadIjazAslamNo ratings yet

- The Sexual AppealDocument1 pageThe Sexual AppealMuhammadIjazAslamNo ratings yet

- Failing Our MoniritiesDocument1 pageFailing Our MoniritiesMuhammadIjazAslamNo ratings yet

- The PTI Has Been Acting Coy Ever Since A Television HostDocument2 pagesThe PTI Has Been Acting Coy Ever Since A Television HostMuhammadIjazAslamNo ratings yet

- 1-Humor AppealDocument1 page1-Humor AppealMuhammadIjazAslamNo ratings yet

- King Is WaitingDocument1 pageKing Is WaitingMuhammadIjazAslamNo ratings yet

- The Personal AppealDocument1 pageThe Personal AppealMuhammadIjazAslamNo ratings yet

- The Romance AppealDocument1 pageThe Romance AppealMuhammadIjazAslamNo ratings yet

- 5Document1 page5MuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11080-87 Dated 2021-07-02Document1 pageNo. HR-Manager Admin-11080-87 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- 4-Music AppealDocument1 page4-Music AppealMuhammadIjazAslamNo ratings yet

- 3-Sexual AppealDocument1 page3-Sexual AppealMuhammadIjazAslamNo ratings yet

- The Music AppealDocument1 pageThe Music AppealMuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11064-71 Dated 2021-07-02Document1 pageNo. HR-Manager Admin-11064-71 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- The Fear AppealDocument1 pageThe Fear AppealMuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11048-55 Dated 2021-07-02Document1 pageNo. HR-Manager Admin-11048-55 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11259-63 Dated 2021-07-06Document1 pageNo. HR-Manager Admin-11259-63 Dated 2021-07-06MuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11274-80 Dated 2021-07-06Document1 pageNo. HR-Manager Admin-11274-80 Dated 2021-07-06MuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11040-47 Dated 2021-07-02Document1 pageNo. HR-Manager Admin-11040-47 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- No. HR-Manager-Admin-11024-31 Dated 2021-07-02Document1 pageNo. HR-Manager-Admin-11024-31 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11072-79 Dated 2021-07-02Document1 pageNo. HR-Manager Admin-11072-79 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- B01. Assistant Manager (Accounts & Finance) (BPS-17) Provisional ResultDocument214 pagesB01. Assistant Manager (Accounts & Finance) (BPS-17) Provisional ResultUzmaNo ratings yet

- Cymar International, Inc. v. Farling Industrial Co., Ltd.Document29 pagesCymar International, Inc. v. Farling Industrial Co., Ltd.Shienna Divina GordoNo ratings yet

- Vera vs. PeopleDocument7 pagesVera vs. PeopleAKNo ratings yet

- Communicative Effect Achieved Through Speech Acts of ManipulationDocument7 pagesCommunicative Effect Achieved Through Speech Acts of ManipulationlazarstosicNo ratings yet

- SociologyDocument3 pagesSociologyMuxammil ArshNo ratings yet

- Incident Management & Service Level Agreement: An Optimistic ApproachDocument6 pagesIncident Management & Service Level Agreement: An Optimistic ApproachServiceNow UsersNo ratings yet

- Mindmap: English Grade 5Document19 pagesMindmap: English Grade 5Phương HoàngNo ratings yet

- MANU/CI/0954/2019: RTI Complainant Seeks Info from NPCIDocument10 pagesMANU/CI/0954/2019: RTI Complainant Seeks Info from NPCIBhumica VeeraNo ratings yet

- RM BadjaoDocument123 pagesRM BadjaoMiGz Maglonzo71% (7)

- Similarities Between Public Finance and Private FinanceDocument18 pagesSimilarities Between Public Finance and Private FinanceMelkamu100% (2)

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 877Document26 pagesAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 877Justia.comNo ratings yet

- End of Schooling at the Village SchoolDocument7 pagesEnd of Schooling at the Village SchoolHelna CachilaNo ratings yet

- Truth in Lending ActDocument20 pagesTruth in Lending ActAbel Francis50% (2)

- Structure of Indian GovernmentDocument10 pagesStructure of Indian GovernmentNilesh Mistry (Nilesh Sharma)No ratings yet

- SBD Stanley Black & Decker Training: Brand Overview, Customer Service, Products, WarrantyDocument82 pagesSBD Stanley Black & Decker Training: Brand Overview, Customer Service, Products, WarrantyNatalia BaqueroNo ratings yet

- Perceptual Thinking StyleDocument5 pagesPerceptual Thinking StyleAmirul Faris50% (2)

- Salem Steel PlantDocument69 pagesSalem Steel PlantKavuthu Mathi100% (2)

- Lily Nunez Statement Regarding Harassment Complaint Against LAUSD School Board President Richard VladovicDocument1 pageLily Nunez Statement Regarding Harassment Complaint Against LAUSD School Board President Richard VladovicLos Angeles Daily NewsNo ratings yet

- Birthday Party AnalysisDocument1 pageBirthday Party AnalysisJames Ford100% (1)

- Deriv Investments (Europe) LimitedDocument9 pagesDeriv Investments (Europe) LimitedİHFKİHHKİCİHCİHCDSNo ratings yet

- What Is The Thesis of Federalist Paper 78Document6 pagesWhat Is The Thesis of Federalist Paper 78tonyastrongheartanchorage100% (2)

- Pride and PrejudiceDocument444 pagesPride and PrejudicePat Coyne100% (19)

- DRRM School Memo No. 7Document5 pagesDRRM School Memo No. 7Mime CarmleotesNo ratings yet

- Imagine by John LennonDocument3 pagesImagine by John Lennonmichelle12wong4000No ratings yet

- EAD 513 Kirk Summers Cultural Functions in PracticeDocument6 pagesEAD 513 Kirk Summers Cultural Functions in PracticeKirk Summers100% (1)

- TWDocument16 pagesTWDrago DragicNo ratings yet

- Strategic Management Journal Article Breaks Down Strategizing vs EconomizingDocument20 pagesStrategic Management Journal Article Breaks Down Strategizing vs EconomizingVinícius RodriguesNo ratings yet

- Questionnaire RAAM GroupDocument7 pagesQuestionnaire RAAM GroupVinayak ChaturvediNo ratings yet

- Business PlanDocument12 pagesBusiness PlanSaqib FayyazNo ratings yet

- f5 Pretrial Writing StatusDocument9 pagesf5 Pretrial Writing StatusAwin SeidiNo ratings yet

- Black Violet Pink 3D Company Internal Deck Business PresentationDocument16 pagesBlack Violet Pink 3D Company Internal Deck Business Presentationakumar09944No ratings yet