0% found this document useful (0 votes)

109 views31 pagesT24 Customer Record Management Guide

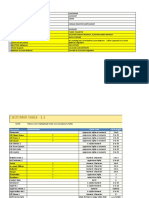

The CUSTOMER application contains basic information about entities the bank has dealings with, including customers, banks, and brokers. It holds descriptive details like contact and demographic information, while financial details are stored elsewhere. Customer records can be created before accounts and used across business applications. Records are updated in a single place and various classifications and default values can be applied based on defined sectors.

Uploaded by

Suraj JPCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

109 views31 pagesT24 Customer Record Management Guide

The CUSTOMER application contains basic information about entities the bank has dealings with, including customers, banks, and brokers. It holds descriptive details like contact and demographic information, while financial details are stored elsewhere. Customer records can be created before accounts and used across business applications. Records are updated in a single place and various classifications and default values can be applied based on defined sectors.

Uploaded by

Suraj JPCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd