Professional Documents

Culture Documents

CG On Stock Performance

Uploaded by

Vinay MOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CG On Stock Performance

Uploaded by

Vinay MCopyright:

Available Formats

Impact of Corporate Governance on Stock Performance-Evidence from BSE Sensex

Author(s): Raghu Kumari P.S. and Yash Shantilal Jain

Source: Indian Journal of Industrial Relations , January 2020, Vol. 55, No. 3 (January

2020), pp. 543-558

Published by: Shri Ram Centre for Industrial Relations and Human Resources

Stable URL: https://www.jstor.org/stable/10.2307/27199283

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide

range of content in a trusted digital archive. We use information technology and tools to increase productivity and

facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at

https://about.jstor.org/terms

Shri Ram Centre for Industrial Relations and Human Resources is collaborating with JSTOR to

digitize, preserve and extend access to Indian Journal of Industrial Relations

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock

Performance-Evidence from BSE Sensex

Raghu Kumari P.S. & Yash Shantilal Jain

Introduction

Volatility in stock markets is

caused by many external and in- The efficient functioning of capital

ternal factors, one of them being market is important for the country’s

governance in Indian companies. economic development, having a chain-

This study is to ascertain the vari- link effect on all the stakeholders of any

ous company-specific elements economy. The stock market provides the

affecting the stock performance opportunity for companies to easily ac-

along with corporate governance cess capital from the public. These funds

(CG). The dependent variable is have a huge impact on the company’s

market price of shares and the growth as it helps them effectively ex-

independent variables considered ecute their expansion and diversification

are: CG, return on equity (ROE), strategies and even reduce their lever-

enterprise value, earnings per age position and relieve from financial

share (EPS) and dividends (DPS) distress. On the other hand, the perfor-

for the FY 2017-18, for SENSEX mance of stocks impacts the investor’s

(BSE 30) companies. The study growth and ultimately guides the move-

concludes that the share price of ment of consumer markets, as higher

a company is influenced by gov- profits generated from stocks enables

ernance (CG), ROE, EPS and the investors to possess higher dispos-

DPS. The study highlights that able income leading to higher spending,

companies with improved gover- whereas the losses cause lower spend-

nance achieve better stock perfor- ing. This in turn, impacts the industry and

mance. commerce of the economy, leading to the

fluctuating cycles of inflation and reces-

sion and thereby impacts share prices.

A breakdown in the securities exchange

Raghu Kumari P.S. (E-mail: psrkumari@gmail.com) could detrimentally affect the economy

is Assistant Professor (Finance) K J Somaiya Institute

of Management Studies and Research, Vidyavihar, as it has the capability of causing a far-

Mumbai. Yash Shantilal Jain is Financial Planner reaching monetary disturbance. The fa-

at Financial Hospital, Andheri (e), Mumbai mously known case in the global finan-

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 543

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

cial market history, the great depression tion. The significance of governance

of 1930s, was predominantly caused by principles and management have been

the stock market crash in 1929. highlighted in recent years in the Indian

context, and the corporate India has un-

It is very important for analyzing the dergone an evolution, starting from the

performance of stocks on a regular ba- “‘Desirable Voluntary Corporate Gover-

sis for the stability of markets and the nance’ code by Confederation of Indian

overall economy. Many scholars have Industry (CII) under Rahul Bajaj (1998)

attributed the stock performance to be to several stage wise amendments in

predominantly based upon several inter- Corporate Governance regulations by

nal and external factors. The company- Kumar Mangalam Birla Committee Re-

specific internal factors like their gover- port (1999), Naresh Chandra Committee

nance and management leadership, finan- Report (2002), Narayana Murthy Com-

cial performance, growth strategies and mittee Report (2003), J.J. Irani Commit-

prospects, profitability, dividend policies, tee Report (2005), major Amendments

valuation, and other factors have a con- under Companies Act, 2013 and the most-

siderable effect on stock performance recent Uday Kotak Committee Report

(Dow & Ibrahim, 2012).The companies (2017 / 2018). These amendments have

and investors should be wary of and be been made to converge towards globally

knowledgeable about these factors to accepted best practices built around the

make informed decisions to mitigate risk Organization of Economic Cooperation

and maximize returns. The government, and Development (OECD) or G20 Prin-

regulators and policymakers have a ciples of corporate governance, pertinent

close-eye on these factors to analyze the to the context and regulatory framework

stock performances and their consequent in India”. As per the International Fi-

impacts, for effective and timely deci- nance Corporation (IFC) Report (2018),

sion-making for countering the the Indian companies having good cor-

unpredictability of stock market and porate governance have fared well dur-

maintaining the stability of the overall ing the financial year FY2017-18, despite

economy. Thus, it becomes imperative to high uncertainties in the stock market.

study the factors impacting the stock During the past couple of years, the gov-

performance to manage these factors ernance considerations have been at the

efficiently and maximize the gains. core of several events. In recent years,

Corporate governance (CG) is one

of the crucial company-specific internal In recent years, many large Indian

factors, determining the company’s prin- companies have faced corporate

ciples and conduct, and in turn reflected governance issues which have

through the investor’s perception about been reflected in their market

the companies. It impacts the overall price of shares and market capi-

corporate excellence and also is an im- talization too.

portant instrument for investor protec-

544 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

many large Indian companies have faced demand and supply forces in the securi-

corporate governance issues which have ties markets (Christopher, Rufus &

been reflected in their market price of Ezekiel, 2009). The market price reflects

shares and market capitalization too. The the cumulative knowledge and wisdom

predominant reasons for governance fail- of the market. The price of the stock is

ure include issues related to management, the reflection of the kind of balance ob-

leadership, board independence, trans- tained between the suppliers and buyers

parency, disclosures, number of director- of that stock at that moment of time. The

ships and other external variables demand behavior of the investors in the

(Metrick, 2003)). Literature says that markets is generally guided by the fac-

company specific performance factors tors like government policies, company’s

and corporate governance, both, individu- public affairs and company’s and

ally affect the stock prices. As corpo- industry’s performance among the other

rate governance calculation is very com- factors. The factors affecting stock

plicated and tedious, so far scholars have prices are predominantly categorized as

not included it in stock performance mod- macroeconomic and microeconomic. The

els in the Indian context. For seeking macroeconomic factors include politics,

comprehensive insights into the overall company’s economic scenario, govern-

health of the companies, it is imperative ment regulations and other such factors.

to understand the impact of all the inter- The microeconomic factors include the

nal company-specific factors together, management and performance factors of

laying emphasis on both the economic the companies. There are many com-

performance factors and the company’s pany-specific factors ascribed to the

governance. This study is to examine the stock price fluctuations. The significant

overall influence of both the factors con- determinants of stock price, identified by

sidered together, on the stock perfor- Collins (1957) were dividend, PAT, book

mance by analyzing their impact on the value and EBIT. Also, Sharma (2011)

changes in the stock prices in the finan- says DPS, EPS and book value per share

cial year 2017-18. The study employs a have a significant influence on the stock

model developed for the Indian context, prices.

by considering the proxies for the com-

pany-specific internal factors involving Return on Equity (ROE)

corporate governance, financial perfor-

mance, profitability, dividend policy and ROE is a financial performance mea-

firm’s valuation on the stocks of the 30 sure indicating the amount (in percent-

constituents of SENSEX (S&P BSE 30) age) of net profit earned on the share-

for the period FY2017-18. holders’ equity. This reflects the effi-

ciency of the company in utilizing the

Background Literature shareholders’ funds for generating prof-

its. ROE holds an important place for in-

The market prices of stocks are pre- vestors as it assures them the amounts

dominantly impacted and governed by the earned over their investments. ROE di-

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 545

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

rectly impacts the stock prices as it re- stock. From these literature evidences it

flects the intrinsic value of the shares, can be hypothesized that:

and significantly influences the stock

prices. ROE effects company’s stock H2: EV has a significant impact on stock

price when company’s management ef- performance

ficiency and firm performance is high

Earnings Per Share (EPS)

(Liu & Hu, 2005; Raaballe & Hedensted,

2008; Habib et al. 2012). Also, Azeem &

The EPS is a measure of profitabil-

Kouser (2002) in their study indicated a

ity of the company, indicating the earn-

significantly positive relation between the

ings of the company after making pay-

stock price and ROE, explaining that

ments of all obligations and dividends, and

companies employing the finances pro-

to be distributed among all the sharehold-

vided by shareholders effectively will

ers. EPS helps in projecting the future

have a positive effect on stock price, oth-

value of stocks, taking into account the

erwise the effect on stock prices will be

future benefits and associated risks in the

negative. Hence it is hypothesized that

company. The higher the quantum of fu-

ture benefits, the higher will be the stock

H1: ROE has a significant impact on

value and contrariwise. The increase in

stock performance.

EPS generally indicates the company’s

Enterprise Value (EV) growth and thus reflects in the higher

stock prices, assuring a better return to

The EV is a measure of a company’s the investors on the stocks. The EPS has

total value, going beyond the boundaries a positive relation with the stock prices

of market capitalization. This measure (Ball & Brown, 1968; Baskin, 1989). This

includes the company’s market capitali- result was also supported by the studies

zation, debt obligations (long-term and from Liu & Hu (2005) and Adesola and

short-term debts) and the cash compo- Okwong (2009) which found a positive

nent of the company. This is a metric relation between stock prices and EPS,

generally used to value a company and the shareholders rating the companies

used for evaluating its worth during po- higher, having high values of EPS. There-

tential takeovers and by investors to un- fore, it can be hypothesized that:

derstand the overall financial health of

the company to maintain its stability. H3: EPS has a significant impact on stock

Loughran & Wellman (2011) found that performance.

enterprise value is a strong factor for

Dividend Per Share (DPS)

determining the stock returns. Accord-

ing to Will-Marshall blog (www.will-

The DPS is the proxy for measuring

marshall.com), the stock price of the com-

the effect of dividend policy on stock

pany is equally guided by the changes in

prices. This amount paid is governed by

enterprise value of the company and the

the dividend policy of the company. The

market demand-supply fluctuation of the

stability in the dividend policy helps in

546 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

countering uncertainties in the investors set of governance mechanisms having

psyche and helps in developing a stable varied degree of impacts on corporate

investment environment. The dividend governance. Study conducted on Japa-

rate significantly influences the stock nese firms found that firm’s having bet-

prices. The dividends generally positively ter corporate governance practices have

impact the stock prices as demonstrated fared well up to 15% more than the firms

in many empirical studies (Gordon, 1959; that are not practicing well in terms of

Desai, 1965; Nishat, Irfan, 2003). The better share price and firm value (Bauer

two main themes of dividends are divided et al., 2007). Gupta & Sharma (2014)

into relevance and irrelevance. The ir- found that there are differences in cor-

relevance theory proposed by Miller and porate governance practices followed in

Modigliani (1961) says that dividends India and South, predominantly related to

have no significant impact on stock price mandatory disclosures, stakeholder’s

and firm value. This theory was sup- consideration and board independence,

ported by others like Adesola and however, the impact of corporate gover-

Okwong (2009), finding no relation be- nance on the company share prices have

tween share prices and dividend policy. been limited, and should be studied in

Irrelevant was also supported by Baskin combination with other factors affecting

(1989) which says there was a negative company’s stock performance and finan-

relationship found between dividend and cial performance, and not in isolation.

share price. From these arguments, it can Aljifri and Moustafa (2007) attribute the

be hypothesized that corporate governance factors having

strong impact on the firm performance

H4: DPS has a significant impact on of Malaysian listed companies, to gov-

stock performance. ernmental ownership, debt management

policy and dividend policy, amongst many

Corporate Governance (CG)

of the considered governance mecha-

nisms.

According to Tricker (1994), “Cor-

porate Governance is related with the

Research on NYSE listed companies

way corporates are governed, distinguish-

show that influence of corporate gover-

able from the way business within such

nance on manufacturing and service

corporations is managed”. As per Stan-

firms was different (Obradovich & Gill,

dard & Poor (2002), “Corporate Gover-

2013). Gompers, Ishii and Metrick (2003)

nance is the way a company is organized

argue that corporate governance is

and managed to ensure that all financial

strongly correlated with stock returns.

stakeholders receive their fair share of a

Some sector wise studies by Baumann,

company’s earnings and assets”. The

and Nier (2004) on banks, found out that

impact of corporate governance on the

information disclosure could be useful for

firm’s performance differs from indus-

both investors and banks and suggested

try to industry and from one country to

that banks disclosing more information on

another, with consideration of different

important aspects of disclosure show

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 547

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

lower stock volatility than the banks dis- years 2017 and 2018. The annual reports

closing lesser information. Brown and of these companies and other disclosure

Caylor (2004) found that the firms hav- reports submitted to BSE, for the years

ing weaker governance in comparison to 2016, 2017 and 2018 were collected for

firms with stronger corporate gover- this research and the corporate gover-

nance, were less profitable, riskier, per- nance score is generated by a model de-

formed more poorly and had lower re- veloped, and by analyzing the governance

turn on asset, return on equity and return mechanism and practices followed in

on investment. Berman, Wicks, Kotha these companies, through the company

and Jones (1999) asserts that there is a websites, company reports and other dis-

strong positive connection between treat- closed documents. The data for this re-

ment towards stakeholders and the firm’s search has also been collected from well-

financial performance. Therefore, it can known financial and news websites like

be hypothesized that: Moneycontrol (www.moneycontrol.

com) and Bloomberg terminal. The share

H4: CG has a significant impact on stock price has been considered as the depen-

performance. dent variable as a proxy for stock per-

formance, for which, the percentage

Data Sample & Collection

change in share price has been calcu-

lated by considering the stock prices of

This research is based upon the sec-

each of the companies for the ending

ondary data involving thirty companies

date of the months across the period be-

listed on the Bombay Stock Exchange

tween the financial year ends 2017 and

(BSE). The sample comprises 30 con-

2018. The average annual share price is

stituents of BSE SENSEX (BSE 30), an

then calculated by taking the average of

index of S&P BSE, as it represents the

all twelve months considered, and then

entire Indian market, spread across dif-

percentage change in the share price is

ferent sectors, and accounting for about

determined by comparing the annual av-

40% of the entire market capitalization.

erage share price with the share price at

The companies considered for this re-

the start of this period.

search is listed in Annexure A. This re-

search includes the independent variables

Corporate Governance Score

(corporate governance score, ROE, en-

Model

terprise value (EV), DPS) and MPS and

dependent variable (stock prices) for the

The proxy model for the corporate

considered companies for the FY 2017-

governance score has been developed on

18.

the basis of the ‘Corporate Governance

Scorecard’ framework developed by In-

The financial data for the considered

ternational Finance Corporation (IFC),

companies has been collected from the

BSE Ltd and Investor Advisory Services

financial terminal, Bloomberg and BSE

Ltd (IiAS), together in 2016 for the In-

India website www.bseindia.com, for the

dian context. This framework consists of

548 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

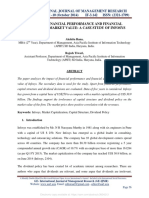

questions divided across four categories, tices is recognized under three levels,

corresponding to the respective OECD which is in accordance with the response

or G20 principles. These four categories key mentioned under the framework given

are: (1) Rights and equitable treatment by IFC, BSE and IiAS. Scoring is as fol-

of shareholders (2) Role of stakeholders lows

(3) Disclosure & Transparency (4)

Board’s responsibilities. These catego- • 0 Point: If the company needs im-

ries have different questions under each provement in that element of corpo-

of them and the total number of ques- rate governance

tions considered is 33. We have consid-

• 1 Point: If the company follows rea-

ered the questions related to the principles

sonably good practices or meets only

which are most important for good cor-

the Indian standard for that element

porate governance, recognized in the

of corporate governance

OECD/G20 Principles and also in accor-

dance with the recent recommendations • 2 Point: If the company follows glo-

and amendments under the Kotak Com- bally accepted best practices for that

mittee recommendation (2017). The list element of corporate governance

of questions considered for this research

is mentioned in the Annexure B. For the The weightage of each of the cat-

scoring purpose on each question, the egories is as per the consideration under

quality of corporate governance prac- the model, as mentioned in Fig. 1

Fig. 1 Corporate Governance Score Model

Source: BSE India

The total corporate governance (CG) • Corporate Governance Score (CG)

score is arrived at by the weighted addi- Score = Addition of all category

tion of each category score. scores

• CG Score = (Category 1 Score +

• Category score = (Aggregate score

Category 2 Score + Category 3 Score

of all questions in category/ Max.

+ Category 4 Score)

Possible Category score) * Category

weightage

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 549

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

Methodology dividend per share and earnings per

share) and the stock performance of the

According to the objective of the company is measured. Fig.2 provides the

study, the relationship between the com- overview of the variables and their rep-

pany-specific internal factors (gover- resentation for the company’s internal

nance, return on equity, enterprise value, factors.

Fig. 2 Summary of the Proxy Variables

In accordance with the prior studies where, β0, β1, β2, β3, β4, β5 are the

and our hypothesis that examine the re- regression coefficients, signifying the

lationship between the company’s inter- degree of impact of each independent

nal factors and the stock performance, variable on the dependent variable (mar-

the following regression relationship is ket price of shares) under the proposed

employed. model. Notations used in the table are

CGS (Corporate governance score),

MPS = f (Internal Factors) ROE(Return on equity),EV(Enterprise

value), EPS(Earnings per share), DPS

This study employs multiple-linear (Dividend per share).

regression test for ascertaining the im-

pact of all the internal factors considered Multiple linear regression analysis us-

in our study, under the hypothesized ing Microsoft Excel is used in this study.

model. The general model proposed in our The first analysis (Statistical data) of all

study to test the alternate hypothesis, is the independent variables gives the spread

demonstrated in the regression equation, of the range of output and the mean, me-

which is as follows: dian and the deviation in the values of all

the considered variables. The correlation

∆Market price of shares =β 0 +β 1 matrix (Table 2) signifies the relationship

CGS+β2ROE+β3EV+β4EPS+β5DPS between the variables.

550 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

Table 1 Descriptive Statistics of the Independent Variables

Table 2 Regression Analysis (Model Summary) Correlation analysis explains the direc-

tion and magnitude of correlation be-

Regressios Statistics

tween each variable with one another.

Multiple R 0.845

In this study, R2 being 0.713 implies that

R Square 0.713 71.3% of the variations can be explained

Adjusted R Square 0.653 by the variables considered under our

Standard Error 0.162 proposed model, with the rest explana-

Observations 30 tion owed to other externalities unex-

plained in this model. Also, the Adjusted

R2 indicates the goodness of fit of the

model in the population. The closeness

Table 3 ANOVA in the values of Adjusted R2 (0.653) and

Table 4 Model Coef ficients

The Indian Journal of Industrial Relations , Vol. 55, No. 3, January 2020 551

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

R2 (0.713), shows a better model fit. This should keep working on consistently and

signifies that the proposed model and data keep improving, since it has a strongly

considered are fit to be used. positive effect on the stock prices; bet-

ter governed companies experience

In the ANOVA table, the significance higher appreciation in their stock per-

F statistic should be lower than 0.05, formance. Also, the study reveals that,

which in our analysis come out to be though all the corporate governance

7.08E-06 (=0.0000007). This implies that principles considered have a significant

the independent variables excellently ex- correlation with the stock prices, disclo-

plained the variation in the dependent sure and transparency is the utmost im-

variable. Table 4 explains the regression portant practice, which has a strong

coefficients of each variable in the model impact on the market price of shares.

and the impact of variation in each of the The companies should lay higher empha-

factor on the dependent variable. It should sis on this aspect of their governance

be noted that the test is analyzed at 95% for achieving higher governance excel-

confidence level. The p-value of each lence. The study also points out that

variable should be less than (α = 0.05) to corporate governance, in solitude con-

have a significant impact on the depen- sideration, does not have significant in-

dent variable. fluence on share prices, but should be

considered in association with other in-

Thus, on the basis of the above analysis, ternal factors, which provide a robust

the regression equation can be stated as: framework for company analysis.

∆Market price of shares = -0.943+ The empirical findings reveal a posi-

0.014(CGS)+0.0009(ROE)+0.004(EPS) tive and significant relationship between

-0.01(DPS) ROE and EPS with share prices, suggest-

ing that these factors act as active causal

Table 4 results show that CGS, ROE, factors for steering the stock prices. How-

EPS and DPS have significant impact on ever, a significant negative relationship be-

share price indicating the need to focus tween dividends per share (DPS) with

on corporate governance practices along share prices, is in support of dividend irrel-

with financial parameters to enhance evance theory. This suggests that inves-

share price and firm value. H1, H3, H4 tors are interested in companies providing

supported as p value is below 0.05 and lower or no dividends and having an ex-

H2 is not supported. pectation to gain higher capital gains in the

long term, would seek to save taxes on the

Conclusion dividends, and rather prefer companies re-

investing for their growth, which is aligned

This study highlights that corporate with the findings of Walter Model on Divi-

governance is one of the very important dend Policy about the growth firms and

factors among other internal factors of from the study of Sharif, Purohit and Pillai

the company, on which the company (2015). The study also reveals that the en-

552 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

terprise value does not have a significant a small sample of large-cap corporations

impact on the share prices. as CG calculations were done manually

and they are very tedious and time tak-

Theoretical & Practical ing calculations. Future scholars can in-

Implications corporate more listed companies for

achieving more accurate results. The

Larger corporations, have the poten- corporate governance model does not

tial to create tremendous impact on the include all the governance attributes, con-

stock markets as well as the economy, sidered under BSE Corporate Gover-

in the broader perspective, due to high nance Score model, which could influ-

fluctuations in their stock performance. ence the results. The variables consid-

This study acts as guide for the differ- ered are only firm-specific internal fac-

ent stakeholders of the firm from dif- tors and does not incorporate other ex-

ferent standpoints in varied measures. ternal market factors which can have an

The governance model and other firm impact on the stock performance of the

performance factors provide a bench- company. This study has been conducted

mark for companies for self-evaluation with an outlook to understand the need

for periodic measures for improvement for improving governance in companies

in comparison to the company’s and and its reflection on the company’s stock

other globally accepted governance prin- performance, with recent regulations by

ciples. On the other hand, it also helps SEBI based on amendments made by the

the investors to independently evaluate ‘Kotak Committee’ recommendations in

the companies on the basis of the pro- corporate governance in the Indian con-

posed model to check the performance text. There is scope for carrying out fur-

criteria and identify the leading indica- ther research, after SEBI regulations on

tors which would impact their stock per- ‘Kotak Committee’ recommendations are

formance in future, and accordingly fully effective, to analyze the effect of

make timely investment decisions. This these recommendations in the light of

framework also assists the policymakers performance of the corporations on the

and regulatory bodies in analyzing most basis of developments in their corporate

effective factors impacting the compa- governance mechanism.

nies in specific sectors and markets, and

accordingly formulate policies and regu- References

lations based on the globally accepted

best practices to improve the overall Adesola, W. A. & Okwong, A. E. (2009), “An

efficiency, effectiveness and gover- Empirical Study of Dividend Policy of

Quoted Companies in Nigeria”, Global

nance in the Indian stock market. Journal of Social Sciences, 8(1): 85-101.

Limitations & Future Research Aljifri, K. & Moustafa, M. (2007), “The Impact

of Corporate Governance Mechanisms on

the Performance of UAE Firms: An Em-

This study has been conducted for a pirical Analysis”, Journal of Economic and

limited time period. The study is done for Administrative Sciences, 23(2): 71-93.

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 553

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

Ararat, M., Black, B. S. & Yurtoglu, B. B. (2017), nal of Political Economy, 81(3),: 637-654.

“The Effect of Corporate Governance on

Firm Value and Profitability: Time-series Brown, L. D. & Caylor, M. L. (2004), “Corpo-

Evidence from Turkey”, Emerging Markets rate Governance and Firm Performance”,

Review, 30:113-32. available at SSRN 586423.

Azeem, M. & Kouser, R. (2011), “International Brown, L. D. & Caylor, M. L. (2006), “Corpo-

Accounting Standards and Value Relevance rate Governance and Firm Valuation”, Jour-

of Book Value and Earnings: Panel Study nal of Accounting and Public Policy, 25(4):

from Pakistan”, International Journal of 409-34.

Contemporary Business Studies, 1(9): 18- Christopher, S. R. O., Rufus, A. I. & Ezekiel, O.

35. J. (2009), “Determinants of Equity Prices

Balachandran, B. & Faff, R. (2015), “Corporate in the Stock Markets”, International Re-

Governance, Firm Value and Risk: Past, search Journal of Finance and Econom-

Present, and Future”, Pacific-Basin Finance ics, 30: 177-89.

Journal, 35: 1-12. Collins, J. (1957), “How to Study the Behavior

Ball, R. & Brown, P. (1968). “An Empirical Evalu- of Bank Stocks”, Financial Analysts Jour-

ation of Accounting Income Numbers.” nal, 13(2): 109-13.

Journal of Accounting Research. Autumn, 1, Demihan, H. G. & Anwar, W. (2014), “Factors

59-78. Affecting the Financial Performance of the

Baskin, J. (1989), “Dividend Policy and the Vola- Firms during the Financial Crisis: Evidence

tility of Common Stock”, Journal of Port- From Turkey”, Ege Stratejik Araþtýrmalar

folio Management, 3 (15): 19-25. Dergisi, 5(2): 65-80.

Bauer, R., Frijns, B., Otten, R. & Tourani-Rad, Di Berardino, D. (2016), “Corporate Governance

A. (2008), “The Impact of Corporate Gov- and Firm Performance in New Technology

ernance on Corporate Performance: Evi- Ventures”, Procedia Economics and Fi-

dence from Japan”, Pacific-Basin Finance nance, 39: 412-21.

Journal, 16(3): 236-51. Gompers, P., Ishii, J. & Metrick, A. (2003), “Cor-

Baumann, U. & Nier, E. (2004), “Disclosure, porate Governance and Equity Prices”, The

Volatility, and Transparency: An Empiri- Quarterly Journal of Economics, 118(1):

cal Investigation into the Value of Bank 107-56.

Disclosure”, Economic Policy Re- Gupta, P. & Sharma, A. M. (2014), “A Study of

view, 10(2): 31-45. the Impact of Corporate Governance Prac-

Berman, S. L., Wicks, A. C., Kotha, S. & Jones, tices on Firm Performance in Indian and

T. M. (1999), “Does Stakeholder Orienta- South Korean Companies”, Procedia-Social

tion Matter? The Relationship Between and Behavioral Sciences, 133: 4-11.

Stakeholder Management Models and Firm Habib, Y., Kiani, Z. I. & Khan, M. A. (2012),

Financial Performance”, Academy of Man- “Dividend Policy and Share Price Volatil-

agement Journal, 42(5): 488-506. ity: Evidence from Pakistan”, Global Jour-

Black, B. S., Jang, H. & Kim, W. (2006), “Does nal of Management and Business Research,

Corporate Governance Predict Firms’ Mar- 12 (5): 1-7.

ket Values? Evidence from Korea”, The Haldar, A. (2012), “Corporate Governance Index

Journal of Law, Economics, and Organi- for Listed Indian Companies”, Indian In-

zation, 22(2): 366-413. stitute of Technology SJMSOM Working Pa-

Black, F. & Scholes, M. (1973). “The Pricing of per, December.

Options and Corporate Liabilities”, Jour-

554 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

Hunjra, AI, Ijaz, M. S, Chani, MI, Hassan, S. & Paniagua, J, Rivelles, R. & Sapena, J. (2018),

Mustafa, U. (2014), “Impact of Dividend “Corporate Governance and Financial Per-

Policy, Earning per Share, Return on Eq- formance: the Role of Ownership and Board

uity, Profit after Tax on Stock Prices”, In- Structure”, Journal of Business Research,

ternational Journal of Economics and Em- 89: 229-234.

pirical Research, 2(3): 109-15.

Raaballe, J., & Hedensted, J. S. (2008). Dividend

Jhandir, S. U. (2012), “Relationship between determinants in Denmark, Available at

Corporate Governance Score and Stock SSRN 1123436.

Prices: Evidence from KSE-30 Index Com-

panies”, International Journal of Business Sami, H., Wang, J. & Zhou, H. (2011), “Corpo-

and Social Science, 3(4). rate Governance and Operating Performance

of Chinese Listed Firms”, Journal of Inter-

Liu, S. & Hu, Y. (2005), “Empirical Analysis of national Accounting, Auditing and Taxation,

Cash Dividend Payment in Chinese Listed 20(2): 106-14.

Companies”, Nature and Science, 1(3): 65-

70. Samontaray, D. P. (2010), “Impact of Corporate

Governance on the Stock Prices of the Nifty

Loughran, T. & Wellman, J. W. (2011), “New 50 Broad Index Listed Companies”, Inter-

Evidence on the Relation Between the En- national Research Journal of Finance and

terprise Multiple and Average Stock Re- Economics, 41: 7-18.

turns”, Journal of Financial and Quantita-

tive Analysis, 46(6); 1629-50. Sharif, T., Purohit, H. & Pillai, R. (2015), “Analy-

sis of Factors Affecting Share Prices: The

McGuire, J., Dow, S. & Ibrahim, B. (2012), “All Case of Bahrain Stock Exchange”, Interna-

in the Family? Social Performance and Cor- tional Journal of Economics and Finance,

porate Governance in the Family 7(3): 207-16.

Firm”, Journal of Business Re-

search, 65(11): 1643-50. Sharma, S. (2011), “Determinants of Equity Share

Prices in India”, Researchers World, 2(4):

Miller, M. H. & Modigliani, F. (1961), “Divi- 51.

dend Policy, Growth and Valuation of

Shares”, Journal of Business, 34(4): 411- Standard & Poor’s Company (2002), Corporate

33. Governance Scores: Criteria, Methodology

and Definitions

Nishat, M. & Irfan, C. M. (2004). “Dividend

Policy and Stock Price Volatility in Paki- Tricker, R. I. (1994), International Corporate

stan,” In Pide-19th Annual General Meet- Governance: Text, Readings, and Cases.

ing and Conference . New York; London: Prentice Hall, 1994.

Obradovich, John and Gill, Amarjit, “The Impact Walter, J. E. (1963), “Dividend Policy: Its Influ-

of Corporate Governance and Financial ence on the Value of the Enterprise”, The

Leverage on the Value of American Firms” Journal of Finance, 18(2): 280-91.

(2013),. Faculty Publications and Presen- Zabri, S. M., Ahmad, K. & Wah, K. K. (2016),

tations, 25 “Corporate Governance Practices and Firm

Performance: Evidence from Top 100 Pub-

lic Listed Companies in Malaysia”,

Procedia Economics and Finance, 35: 287-

96.

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 555

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

Annexure A – List of BSE-30 Companies

556 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Impact of Corporate Governance on Stock Performance

Annexure B Corporate Governance Questionnaire

The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020 557

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

Raghu Kumari P.S & Yash Shantilal Jain

558 The Indian Journal of Industrial Relations, Vol. 55, No. 3, January 2020

This content downloaded from

13.234.96.8 on Fri, 16 Feb 2024 14:31:51 +00:00

All use subject to https://about.jstor.org/terms

You might also like

- Asset Management - DeloitteDocument8 pagesAsset Management - DeloittevyshnavigujralNo ratings yet

- Capital Structure Pattern of Companies in India: With Special Reference To The Companies Listed in National Stock ExchangeDocument10 pagesCapital Structure Pattern of Companies in India: With Special Reference To The Companies Listed in National Stock ExchangeSREEVISAKH V SNo ratings yet

- Raju Research Paper 28Document10 pagesRaju Research Paper 28Sanju ChopraNo ratings yet

- Leverage BhayaniDocument8 pagesLeverage BhayaniANJALI AGRAWALNo ratings yet

- Paper 2Document13 pagesPaper 2Richard SesaNo ratings yet

- Corporate Governance and Disclosure Practices of Indian Firms: An Industry PerspectiveDocument17 pagesCorporate Governance and Disclosure Practices of Indian Firms: An Industry PerspectivemadhpanNo ratings yet

- Analisis Pengaruh Fundamental Makro Dan Fundamental Mikro TerhadapDocument9 pagesAnalisis Pengaruh Fundamental Makro Dan Fundamental Mikro TerhadapIlham JefriNo ratings yet

- 2021 001 A Critical Assessment of Interrelationship Among CG, Financial Performance, Refined Economic VA To Firm ValueDocument42 pages2021 001 A Critical Assessment of Interrelationship Among CG, Financial Performance, Refined Economic VA To Firm ValueNidia Anggreni DasNo ratings yet

- Idris, Ekundayo, Yunusa - Firm Attributes and Share Price FluctuationDocument16 pagesIdris, Ekundayo, Yunusa - Firm Attributes and Share Price FluctuationDavidNo ratings yet

- Impact of Financial Variables On Share Price of Selected Indian Automobile CompaniesDocument5 pagesImpact of Financial Variables On Share Price of Selected Indian Automobile CompaniesYASHWANTH PATIL G JNo ratings yet

- Stock Market Capitalization and Its Macroeconomic Determinants: An Empirical Investigation From Emerging EconomyDocument17 pagesStock Market Capitalization and Its Macroeconomic Determinants: An Empirical Investigation From Emerging Economytubanaz0213No ratings yet

- Ma'ruf Syaban, Tri Ratnawati, Slamet Riyadi: American International Journal of Business Management (AIJBM)Document16 pagesMa'ruf Syaban, Tri Ratnawati, Slamet Riyadi: American International Journal of Business Management (AIJBM)aijbmNo ratings yet

- Jurnal Konsentrasi Manajemen KeuanganDocument12 pagesJurnal Konsentrasi Manajemen Keuanganangelina chandraNo ratings yet

- Corporate Governance Codes in IndiaDocument9 pagesCorporate Governance Codes in IndiaJeeta SarkarNo ratings yet

- Impact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysisDocument8 pagesImpact of Financial Leverage On Firm'S Performance and Valuation: A Panel Data AnalysissaefulNo ratings yet

- Article A9Document13 pagesArticle A9fisayobabs11No ratings yet

- Jurnal TugasDocument6 pagesJurnal TugasPutri Puspa AlkotdriyahNo ratings yet

- IMFI 2020 02 SantosaDocument13 pagesIMFI 2020 02 Santosahedrywan8No ratings yet

- Revealing The Structure of Financial Performance oDocument13 pagesRevealing The Structure of Financial Performance otejaguggilam20No ratings yet

- Nexus Between Working Capital Management and Sectoral PerformanceDocument17 pagesNexus Between Working Capital Management and Sectoral Performancemohammad bilalNo ratings yet

- The Impact of Covid-19 On The Capital Structure in Emerging Economies Evidence From India (10-1108 - AJAR-05-2022-0144)Document14 pagesThe Impact of Covid-19 On The Capital Structure in Emerging Economies Evidence From India (10-1108 - AJAR-05-2022-0144)cuonghienNo ratings yet

- Begum, M. M., Sarker, N., & Nahar, S. (2023)Document14 pagesBegum, M. M., Sarker, N., & Nahar, S. (2023)Nur HafizahNo ratings yet

- MPRA Paper 15003Document10 pagesMPRA Paper 15003Saumik BaruaNo ratings yet

- iJARS 520Document16 pagesiJARS 520Sasi KumarNo ratings yet

- Determinant Factor of Firm's Value On Manufacturing Company in Indonesian Stock ExchangeDocument10 pagesDeterminant Factor of Firm's Value On Manufacturing Company in Indonesian Stock ExchangeCoco ElhabadNo ratings yet

- Jabs202010 (2) 192 203Document12 pagesJabs202010 (2) 192 203q3004657275No ratings yet

- Impact of Capital StructureDocument26 pagesImpact of Capital StructureiqraNo ratings yet

- Corporate Governance in An Emerging Market - What Does The Market Trust?Document23 pagesCorporate Governance in An Emerging Market - What Does The Market Trust?karlmedhoraNo ratings yet

- Nse Research Initiative: Paper No.: 5Document20 pagesNse Research Initiative: Paper No.: 5Prerana BhavsarNo ratings yet

- Quantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesDocument6 pagesQuantitative Analysis On Financial Performance of Merger and Acquisition of Indian CompaniesPoonam KilaniyaNo ratings yet

- Measuring Financial Health of A Public Limited Company Using Z' Score Model - A Case StudyDocument18 pagesMeasuring Financial Health of A Public Limited Company Using Z' Score Model - A Case Studytrinanjan bhowalNo ratings yet

- Jurnal Inggris LalaDocument12 pagesJurnal Inggris LalaRAFIF fadhlurrahmanNo ratings yet

- Analysis of Financial InvestmentsDocument9 pagesAnalysis of Financial InvestmentsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Capital Structure and Financial Performance: Case Study From Pakistan Pharmaceutical SectorDocument17 pagesCapital Structure and Financial Performance: Case Study From Pakistan Pharmaceutical SectorMUHAMMAD REHANNo ratings yet

- 2 9 40 367 PDFDocument7 pages2 9 40 367 PDFAnish BhatNo ratings yet

- Jebv Vol 3 Issue 1 2023 8Document11 pagesJebv Vol 3 Issue 1 2023 8Journal of Entrepreneurship and Business VenturingNo ratings yet

- The Impact of Dividend Policy On Firm Performance Under High or Low Leverage Evidence From PakistanDocument34 pagesThe Impact of Dividend Policy On Firm Performance Under High or Low Leverage Evidence From PakistanDevikaNo ratings yet

- Munawar 2018 The Effect of Leverage, Dividend Policy, Effectiveness, Efficiency, and Firm Size On Firm ValueDocument9 pagesMunawar 2018 The Effect of Leverage, Dividend Policy, Effectiveness, Efficiency, and Firm Size On Firm ValueGufranNo ratings yet

- Research Work Halimat-OriginalDocument83 pagesResearch Work Halimat-Originalibrodan681No ratings yet

- Corporate Governance in Indian Banking Industry: An Experience With SBI and HDFC BankDocument12 pagesCorporate Governance in Indian Banking Industry: An Experience With SBI and HDFC BankSumit RatnaniNo ratings yet

- Shah Wan 2020Document28 pagesShah Wan 2020Annisa SophiaNo ratings yet

- 2 Ijhrmroct20192Document14 pages2 Ijhrmroct20192TJPRC PublicationsNo ratings yet

- 6 The Impact of Capital StructureDocument11 pages6 The Impact of Capital Structurephan nguyenNo ratings yet

- 5784 14518 1 PBDocument10 pages5784 14518 1 PBMariam AlraeesiNo ratings yet

- Antecedents of Corporate Sustainability Performance in Turkey,, The Effect of Ownership Structure and Board Atributes On Non Financial CompaniesDocument11 pagesAntecedents of Corporate Sustainability Performance in Turkey,, The Effect of Ownership Structure and Board Atributes On Non Financial CompaniesAfnizal ZulfanNo ratings yet

- Roa CR Der THP Hs Inter DividenDocument15 pagesRoa CR Der THP Hs Inter Dividenumar YPUNo ratings yet

- Corporate Governanceand Firm ValueDocument19 pagesCorporate Governanceand Firm ValueAbinash MNo ratings yet

- The Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableDocument8 pagesThe Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Assessing Working Capital Management Efficiency of Indian Manufacturing ExportersDocument19 pagesAssessing Working Capital Management Efficiency of Indian Manufacturing ExportersPutri ainun jariaNo ratings yet

- 66 105 1 SMDocument9 pages66 105 1 SMs3979517No ratings yet

- Casus - Joseph ConradDocument25 pagesCasus - Joseph ConradOlsunNo ratings yet

- The Influence of the Structure of Ownership and Dividend Policy of the Company (The Quality of the Earnings and Debt Policies are Intervening Variable): Empirical Study on Manufacturing Companies Listed on the Indonesia Stock ExchangeDocument22 pagesThe Influence of the Structure of Ownership and Dividend Policy of the Company (The Quality of the Earnings and Debt Policies are Intervening Variable): Empirical Study on Manufacturing Companies Listed on the Indonesia Stock ExchangeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Current Asset Management As The Driver of Financial EfficiencyDocument18 pagesCurrent Asset Management As The Driver of Financial Efficiencyfenny maryandiNo ratings yet

- The Effect of Corporate Governance, Ownership Structure and Firms Characteristics On Financial PerformanceDocument9 pagesThe Effect of Corporate Governance, Ownership Structure and Firms Characteristics On Financial PerformanceBazNo ratings yet

- Corporate Governance and Financial LeverDocument9 pagesCorporate Governance and Financial LeverRika Ircivy Agita YanguNo ratings yet

- JPSP - 2022 - 479 PDFDocument11 pagesJPSP - 2022 - 479 PDFMohamed EL-MihyNo ratings yet

- Role of Venture Capital Financing in IndiaDocument5 pagesRole of Venture Capital Financing in IndiaAasheesh BeniwalNo ratings yet

- Determinant of Profitability in Indian Cement Industry: An Economic AnalysisDocument15 pagesDeterminant of Profitability in Indian Cement Industry: An Economic AnalysiselchaNo ratings yet

- SSRN Id3834213Document14 pagesSSRN Id3834213Ranveer kumarNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Whistleblower ImplicationsDocument25 pagesWhistleblower ImplicationsVinay MNo ratings yet

- Speech by SEC OfficialDocument10 pagesSpeech by SEC OfficialVinay MNo ratings yet

- ParametersDocument10 pagesParametersVinay MNo ratings yet

- Insider TradingDocument6 pagesInsider TradingVinay MNo ratings yet

- BlockchainDocument12 pagesBlockchainVinay MNo ratings yet

- Chapter-Iii - RRL Effectiveness of DamathDocument5 pagesChapter-Iii - RRL Effectiveness of DamathJojie T. DeregayNo ratings yet

- Levine Smume6 01Document14 pagesLevine Smume6 01Hamis Rabiam Magunda100% (1)

- A Study On Awareness of Human Rights Among Teacher Trainees'Document6 pagesA Study On Awareness of Human Rights Among Teacher Trainees'emie marielle marceloNo ratings yet

- Te Unter 2008Document9 pagesTe Unter 2008Matus GoljerNo ratings yet

- MLRBy SKJDocument4 pagesMLRBy SKJvishwas guptaNo ratings yet

- The in Uence of Internet Usage On Student's Academic PerformanceDocument16 pagesThe in Uence of Internet Usage On Student's Academic PerformanceJan Iriesh EspinosaNo ratings yet

- ProblemSet Random VariablesDocument4 pagesProblemSet Random VariablesAmandeep Grover0% (1)

- 6305: Applied Econometrics For Policy Analysis: 1 Oaxaca-Blinder DecompositionDocument3 pages6305: Applied Econometrics For Policy Analysis: 1 Oaxaca-Blinder DecompositionSumit ShekharNo ratings yet

- Salary Satisfaction As An Antecedent of Job SatisfactionDocument12 pagesSalary Satisfaction As An Antecedent of Job SatisfactionavispeedNo ratings yet

- 2011 Afl Gps ReportDocument36 pages2011 Afl Gps ReportIrleanDover01No ratings yet

- Americans, Politics and Science Issues - PEWDocument175 pagesAmericans, Politics and Science Issues - PEWelshofNo ratings yet

- The Boston Housing DatasetDocument4 pagesThe Boston Housing DatasetSwastik Mishra100% (1)

- Chap 5 Discrete Probability - StudentsDocument40 pagesChap 5 Discrete Probability - StudentsLinh NguyễnNo ratings yet

- Linear Least SquaresDocument10 pagesLinear Least Squareswatson191No ratings yet

- NSE ReportDocument11 pagesNSE ReportnihalNo ratings yet

- 05 - Demand Estimation and ForecastingDocument52 pages05 - Demand Estimation and ForecastingRistianiAniNo ratings yet

- Null and Alternative HypothesisDocument4 pagesNull and Alternative HypothesisGercel MillareNo ratings yet

- Impact of Leadership Styles in Organizational Commitment - 3Document13 pagesImpact of Leadership Styles in Organizational Commitment - 3gedleNo ratings yet

- Exercises ClassificatiwqeonDocument7 pagesExercises ClassificatiwqeonPascDoinaNo ratings yet

- Board of The Foundation of The Scandinavian Journal of StatisticsDocument7 pagesBoard of The Foundation of The Scandinavian Journal of StatisticslacisagNo ratings yet

- Measures of Central TendencyDocument27 pagesMeasures of Central TendencyRosemarie AlcantaraNo ratings yet

- Lecture No.10Document8 pagesLecture No.10Awais RaoNo ratings yet

- Stat 139 Syllabus - Fall 2016Document3 pagesStat 139 Syllabus - Fall 2016Jerry LinNo ratings yet

- Oil PriceDocument18 pagesOil PriceRajesh HmNo ratings yet

- 02 15 Muh Alsyar MandatDocument35 pages02 15 Muh Alsyar MandatMuh AlsyarNo ratings yet

- Bayesian Networks SlidesDocument56 pagesBayesian Networks Slidesসুনীত ভট্টাচার্যNo ratings yet

- RMS QuizDocument12 pagesRMS QuizSara peelNo ratings yet

- Bcom 8818Document30 pagesBcom 8818mayank guptaNo ratings yet

- 07 Confidence IntervalsDocument10 pages07 Confidence IntervalsAyush SinghNo ratings yet

- Elementary Statistics in Social ResearchDocument3 pagesElementary Statistics in Social ResearchMyk Twentytwenty NBeyondNo ratings yet