Professional Documents

Culture Documents

Practice Exercise - Cobble Hill Part 3 Cash Flow - Blank

Practice Exercise - Cobble Hill Part 3 Cash Flow - Blank

Uploaded by

raazzaa8Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Exercise - Cobble Hill Part 3 Cash Flow - Blank

Practice Exercise - Cobble Hill Part 3 Cash Flow - Blank

Uploaded by

raazzaa8Copyright:

Available Formats

Practice Exercise - Cobble Hill Part 3 Strictly Confidential

Table of Contents

Cobble Hill Financial Statements

© 2015 to 2023 CFI Education Inc.

This Excel model is for educational purposes only and should not be used for any other reason. All content is Copyright material of CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected

under international copyright and trademark laws. No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any

form by any means, including photocopying, recording, or other electronic or mechanical methods, without prior written permission of the publisher,

except in the case of certain noncommercial uses permitted by copyright law.

https://corporatefinanceinstitute.com/

Construct the Cash Flow Statement for Cobble Hill Inc.

Produce a Cash Flow Statement for Cobble Hill Inc. for Year 2

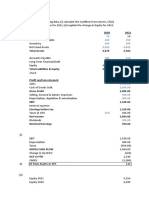

Cash Flow Statement

YEAR 1 YEAR 2

Operating Cash Flow

Net income 46 8

Depreciation 90 90

Change in Accounts Receivable (50) (70)

Change in Inventory (20) (20)

Change in Accounts Payable 10 20

Cash From Operations 76 28

Investing Cash Flow

Property, Plant & Equipment (100) –

Cash From Investing (100)

Financing Cash Flow

Issuance (Repayment) of Debt 100 (100)

Issuance (Repayment) of Equity – –

Payment of Dividends (30) (5)

Cash From Financing 70 (105)

Net Increase (Decrease) in Cash 46 (77)

Opening Cash Balance 450 496

Closing Cash Balance 496 419

PPE Start of Year 800 810

Capex 100

Depreciation (90) (90)

PPE End of Year 810 720

Practice Exercise - Cobble Hill Part 3 Page 3 of 4

Balance Sheet

ASSETS YEAR 1 YEAR 2

Current Assets

Cash 496 419 (77)

Accounts Receivable 80 150 70

Inventory 60 80 20

Total Current Assets 636 649 13

Non-Current Assets

Property, Plant & Equipment 810 720 -90

Total Non-Current Assets 810 720

Total Assets 1,446 1,369

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities

Accounts Payable 30 50 20

Total Current Liabilties 30 50

Non-Current Liabilities

Long-Term Debt 400 300 -100

Total Non-Current Liabilities 400 300

Shareholders' Equity

Common Shares 1,000 1,000 0

Retained Earnings 16 19 3

Total Shareholders' Equity 1,016 1,019

Total Liabilities & Equity 1,446 1,369

Total Assets 1,446 1,369

Total Liabilities & Equity 1,446 1,369

Difference – –

Income Statement

YEAR 1 YEAR 2

Revenues 510 550

Cost of Sales (290) (380)

Gross Profit 220 170

Other Operating Expenses (40) (50)

EBITDA 180 120

Depreciation (90) (90)

Operating Profit (EBIT) 90 30

Interest Expenses (Finance Cost) (24) (18)

Profit Before Tax (EBT) 66 12

Tax Expense at 30% (20) (4)

Net Income (EAT) 46 8

Dividends (30) (5)

Retained Earnings 16 3

Practice Exercise - Cobble Hill Part 3 Page 4 of 4

You might also like

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- JengaCashFlowSolution 1546983290175Document3 pagesJengaCashFlowSolution 1546983290175rexNo ratings yet

- JengaCashFlowExercise 1546983290168Document3 pagesJengaCashFlowExercise 1546983290168rex100% (1)

- Jenga Cashflow ExerciseDocument2 pagesJenga Cashflow ExerciseHue PhamNo ratings yet

- Practice Exercise - Ravensburger - SolutionDocument3 pagesPractice Exercise - Ravensburger - Solution155- Salsabila GadingNo ratings yet

- BT B Sung Chapter 45Document2 pagesBT B Sung Chapter 45Yến Nhi VũNo ratings yet

- C.F. Zambeze Q - ADocument5 pagesC.F. Zambeze Q - AthesaqibonlineNo ratings yet

- JengaCashFlowExercise 1546983290168Document2 pagesJengaCashFlowExercise 1546983290168Vibhuti BatraNo ratings yet

- Income Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Document3 pagesIncome Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Sathyanarayana GNo ratings yet

- 9 JengaCashFlowExerciseDocument1 page9 JengaCashFlowExerciseFadillah WSNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- Practice Exercise - Ravensburger - BlankDocument3 pagesPractice Exercise - Ravensburger - Blank155- Salsabila GadingNo ratings yet

- Jenga Inc ExerciseDocument3 pagesJenga Inc ExerciseHue PhamNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- FRS - 7 - Ie - (2016)Document9 pagesFRS - 7 - Ie - (2016)David LeeNo ratings yet

- Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionDocument9 pagesIllustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionjohnNo ratings yet

- Jenga Inc Exercise: Strictly ConfidentialDocument3 pagesJenga Inc Exercise: Strictly Confidentialanjali shilpa kajal100% (1)

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Sb-Frs 7: Statutory Board Financial Reporting StandardDocument11 pagesSb-Frs 7: Statutory Board Financial Reporting StandardLuthfiWaeLaahNo ratings yet

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- 11.1. Practice Exercise - Cumberland Inc - BlankDocument5 pages11.1. Practice Exercise - Cumberland Inc - Blank155- Salsabila GadingNo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- Consolidation Q55Document8 pagesConsolidation Q55Krishna 11No ratings yet

- AccntsDocument10 pagesAccntsLav RamgopalNo ratings yet

- Jenga Inc Exercise: Strictly ConfidentialDocument3 pagesJenga Inc Exercise: Strictly ConfidentialGaurav agrawalNo ratings yet

- Jenga Inc Solution: Strictly ConfidentialDocument3 pagesJenga Inc Solution: Strictly Confidentialanjali shilpa kajal100% (1)

- 89 F 4 EfsaDocument3 pages89 F 4 EfsaabhimussoorieNo ratings yet

- 2019-20 Man 310 Financial Management Midterm Prepatory QuestionsDocument9 pages2019-20 Man 310 Financial Management Midterm Prepatory QuestionsKinNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Step 5: Compute Net Income or Net LossDocument29 pagesStep 5: Compute Net Income or Net LossTanvir Islam100% (1)

- Llrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersDocument4 pagesLlrilriltilillilillliltilililllil: Sernester Examination, January/February (CBCS) & Onwards) Faper 1.3 ManagersKavithri ponnappaNo ratings yet

- CBCS Accounting For Managers (2019)Document4 pagesCBCS Accounting For Managers (2019)ROYAL COLLEGENo ratings yet

- Notes Before UTSDocument20 pagesNotes Before UTSdevina utamiNo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- FAWCM - Cash Flow 2Document29 pagesFAWCM - Cash Flow 2Jake RoosenbloomNo ratings yet

- Lesson 2Document5 pagesLesson 2kabaso jaroNo ratings yet

- Acc Cap M - 2019 - Exercise Pack - With SolutionsDocument26 pagesAcc Cap M - 2019 - Exercise Pack - With SolutionsValentinNo ratings yet

- Practice Exam - SolutionsDocument12 pagesPractice Exam - SolutionsSu Suan TanNo ratings yet

- Accounting 1Document2 pagesAccounting 1thu thienNo ratings yet

- Jenga Inc Solution Year 1 Year 2: © Corporate Finance InstituteDocument2 pagesJenga Inc Solution Year 1 Year 2: © Corporate Finance InstitutePirvuNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- Exercise 3 - Group Accounts - SolutionDocument5 pagesExercise 3 - Group Accounts - SolutionAnh TramNo ratings yet

- Çağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamDocument4 pagesÇağ University Economics & Administrative Sciences Faculty 2006-2007 SPRING SEMESTR Man 310 Financial Management Final ExamKinNo ratings yet

- Mock Exam FRPM SolutionDocument45 pagesMock Exam FRPM SolutionangelitayosecasetiawanNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Non-Current Assets Total Equity Current Assets: Cash Flow ExerciseDocument2 pagesNon-Current Assets Total Equity Current Assets: Cash Flow ExerciseJuan Diego del Prado SánchezNo ratings yet

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- CFI Accounting Fundementals Jenga Inc SolutionDocument3 pagesCFI Accounting Fundementals Jenga Inc SolutionsovalaxNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- AssetsDocument2 pagesAssetsShesha Nimna GamageNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Spring 2024 - ACC501 - 1Document3 pagesSpring 2024 - ACC501 - 1freebutterfly121No ratings yet

- D.1. Financial Statement AnalysisDocument4 pagesD.1. Financial Statement AnalysisCode BeretNo ratings yet

- Practice Questions For Ratio Analysis2Document13 pagesPractice Questions For Ratio Analysis2Crazy FootballNo ratings yet

- Ratios ExercisesDocument3 pagesRatios ExercisesQuân HoàngNo ratings yet

- 3 Beethoven Schubert Bach Text 2018Document11 pages3 Beethoven Schubert Bach Text 2018djaaaamNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- WCM 1Document12 pagesWCM 1155- Salsabila GadingNo ratings yet

- 1 SMDocument7 pages1 SM155- Salsabila GadingNo ratings yet

- 5th MEETING - RISK EVALUATIONDocument11 pages5th MEETING - RISK EVALUATION155- Salsabila GadingNo ratings yet

- We Are Intechopen, The World'S Leading Publisher of Open Access Books Built by Scientists, For ScientistsDocument13 pagesWe Are Intechopen, The World'S Leading Publisher of Open Access Books Built by Scientists, For Scientists155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- IFpaper 2020Document25 pagesIFpaper 2020155- Salsabila GadingNo ratings yet

- 11.1. Practice Exercise - Cumberland Inc - BlankDocument5 pages11.1. Practice Exercise - Cumberland Inc - Blank155- Salsabila GadingNo ratings yet

- Practice Exercise - Ravensburger - BlankDocument3 pagesPractice Exercise - Ravensburger - Blank155- Salsabila GadingNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Practice Exercise - Ship Shape Retail - SolutionDocument4 pagesPractice Exercise - Ship Shape Retail - Solution155- Salsabila GadingNo ratings yet

- Literature Review of The ImpacDocument23 pagesLiterature Review of The Impac155- Salsabila GadingNo ratings yet

- Murataj, Marsida - 508493 - Senior Project ThesisDocument55 pagesMurataj, Marsida - 508493 - Senior Project Thesis155- Salsabila GadingNo ratings yet

- Working Capital Management andDocument15 pagesWorking Capital Management and155- Salsabila GadingNo ratings yet

- Practice Exercise - Springbok - BlankDocument3 pagesPractice Exercise - Springbok - Blank155- Salsabila GadingNo ratings yet

- Pengaruh Motivasi Terhadap Kinerja Pegawai Badan Kepegawaian Dan Diklat Daerah Kabupaten Mamuju UtaraDocument12 pagesPengaruh Motivasi Terhadap Kinerja Pegawai Badan Kepegawaian Dan Diklat Daerah Kabupaten Mamuju Utara155- Salsabila GadingNo ratings yet

- Report On Financial Analysis of Textile Industry of BangladeshDocument39 pagesReport On Financial Analysis of Textile Industry of BangladeshSaidur0% (2)

- UntitledDocument193 pagesUntitledMillsRINo ratings yet

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Accounting ExamDocument10 pagesAccounting ExamILOVE MATURED FANSNo ratings yet

- 07 Bbfa4403 T3Document19 pages07 Bbfa4403 T3BABYNo ratings yet

- 01 Financial Reporting and Analysis - An IntroductionDocument29 pages01 Financial Reporting and Analysis - An IntroductionFariza MakhayNo ratings yet

- Accounting Exam SolnDocument17 pagesAccounting Exam SolnAsmara NoorNo ratings yet

- Business Analysis Strategy - Barrio FiestaDocument19 pagesBusiness Analysis Strategy - Barrio FiestasicorangelicaNo ratings yet

- Surecut Shears, Inc.: AssetsDocument8 pagesSurecut Shears, Inc.: Assetsshravan76No ratings yet

- Tugas Akuntansi P1 - 4A Esti FatmawatiDocument3 pagesTugas Akuntansi P1 - 4A Esti FatmawatiEsti FatmawatiNo ratings yet

- Problems & Solutions - Final Accounts - QuestionsDocument36 pagesProblems & Solutions - Final Accounts - QuestionsYerramsetti Sri HarshaNo ratings yet

- Oracle R12 Financials (GL, AP, AR, CE, FA, MOAC and EB Tax) Training ManualDocument209 pagesOracle R12 Financials (GL, AP, AR, CE, FA, MOAC and EB Tax) Training ManualHaroon Dar67% (3)

- Financial PlanningDocument10 pagesFinancial PlanningMuhammad Abbas SandhuNo ratings yet

- AFA Tut 2Document16 pagesAFA Tut 2Đỗ Kim ChiNo ratings yet

- Government Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BDocument10 pagesGovernment Accounting (Chapter 13 and 14) - Florentin, Shaniah Racelle D. - BSA 3BRacelle FlorentinNo ratings yet

- FAR Vol 2 Chapter 19 21Document13 pagesFAR Vol 2 Chapter 19 21Allen Fey De Jesus50% (4)

- Suggested CAP III Group I June 2023Document66 pagesSuggested CAP III Group I June 2023ranjanNo ratings yet

- Day-6 Cash FlowsDocument47 pagesDay-6 Cash FlowsRajsri RaajarrathinamNo ratings yet

- A by Case Analysis of Accounting Practices and IssuesDocument108 pagesA by Case Analysis of Accounting Practices and IssuesAnisa KodraNo ratings yet

- Midterm ReviewDocument40 pagesMidterm ReviewVanessa BatallaNo ratings yet

- Review MCQDocument2 pagesReview MCQKrista FloresNo ratings yet

- Alert Company S Shareholders Equity Prior To Any of The Following PDFDocument1 pageAlert Company S Shareholders Equity Prior To Any of The Following PDFHassan JanNo ratings yet

- Project 4 - Forecasting Financial StatementsDocument56 pagesProject 4 - Forecasting Financial StatementsTulasi ReddyNo ratings yet

- Ividend Ecisions: Learning OutcomesDocument48 pagesIvidend Ecisions: Learning OutcomesPranay GNo ratings yet

- IA2 06 - Handout - 1 PDFDocument5 pagesIA2 06 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- AcctgDocument14 pagesAcctgLara Lewis AchillesNo ratings yet

- Testbank: Applying Ifrs Standards 4eDocument11 pagesTestbank: Applying Ifrs Standards 4eSyed Bilal AliNo ratings yet

- Bab 4 Soal 4Document4 pagesBab 4 Soal 4Abel AbdallahNo ratings yet

- Understanding Financial Statements Solutions Chapter 2Document30 pagesUnderstanding Financial Statements Solutions Chapter 2adam_garcia_81100% (3)

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet