Professional Documents

Culture Documents

Activity 01 Questions

Uploaded by

Shania LiwanagOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 01 Questions

Uploaded by

Shania LiwanagCopyright:

Available Formats

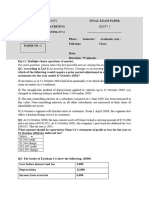

The following were derrived from the Records of OK Company:

2021 2022

Cash 760,000 830,000

Accounts Receivable 1,560,000 1,390,000

Inventory 1,200,000 940,000

Prepayments 500,000 560,000

Land and Building 5,000,000 6,900,000

Equipment 1,500,000 1,400,000

Investment Property 1,000,000 1,000,000

Accounts Payable (Trade) 400,000 580,000

Accrued Liabilities 280,000 340,000

Notes Payable (5 months) 2,100,000 1,980,000

Long-Term Bonds Payable 3,000,000 3,000,000

Ordinary Share Capital (P20 par) 3,000,000 3,500,000

Share Premium 800,000 920,000

*The new shares issued were released at the middle of the year.

1. What is the Net Book Value for 2021?

2. What is the Net Book Value for 2022?

3. What is the Book Value per share for 2021?

4. What is the Book Value per share for 2022?

Additional Info: The Land and Building pertains to the following:

Land # 1: purchased 5 years ago as of 2021 for half of the Land and Building amount. If it is replaced for

2021, it would cost 30% more than it did 5 years ago.

Building: The remainder for 2021 value pertains to a building that was built the same year as when the

land was purchased, and is depreciated for 25 years with no residual value

Land # 2: the new land was recently purchased this 2022. It has a similar cut, location and price as the

original land would if it was purchased now.

5. What is the replacement value of the Company for 2021?

6. What is the replacement value of the Company for 2022?

7. What is the replacement value per share of the Company for 2021?

8. What is the replacement value per share of the Company for 2022?

Additional Info:

The equipment was internally generated when the company started 5 years ago (As of 2021). If it is

reproduced as of 2021, it would csot 75% of its original materials and labor due to technological

advancement.

9. What is the reproduction value for 2021?

10. What is the reproduction value per share for 2021?

The equipment was internally generated when the company started 5 years ago (As of 2021). If it is

reproduced as of 2021, it would csot 75% of its original materials and labor due to technological

advancement.It will be 60% if reproduced for 2022.

11. What is the reproduction value for 2022?

12. What is the reproduction value per share for 2022?

The following information was derived from X Company:

Current Assets 1,500,000 Average Shares 97,500

Current Liabilities 800,000

Non-Current Assets 2,670,000 Equity: 2,370,000

Non-Current Liabilities 1,000,000

Shares Outstanding, Jan 1 80,000 BV per share 24.31

Additional 20,000 shares were issued last April 1 and 10,000 shares on October 1.

What is the Book Value per share of X Company?

The following information was derived from Y Company:

Current Assets 1,500,000 Average Shares 127,500

Current Liabilities 800,000

Non-Current Assets 2,670,000 Equity: 2,270,000

Non-Current Liabilities 1,000,000

Shares Outstanding, Jan 1 110,000 BV per share 17.80

Additional 20,000 shares were issued last April 1 and 10,000 shares on October 1.

Equipment with book value of 500,000 can be replaced at 80% of its value.

What is the Replacement Value per share of Y Company?

You might also like

- Activity Consolidated Financial StatementDocument2 pagesActivity Consolidated Financial StatementCynthia CanlasNo ratings yet

- Sha1 ACT 201 Final Exam-Fall 2021Document4 pagesSha1 ACT 201 Final Exam-Fall 2021Ifaz Mohammed IslamNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- Master BudgetDocument10 pagesMaster BudgetFareha Riaz0% (1)

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Conso FS SubsequentDocument1 pageConso FS SubsequentreiNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- ACC 226 Expanded OpportunityDocument4 pagesACC 226 Expanded OpportunityEllen MNo ratings yet

- Accounting+for+Business+Combination+HO+No 1Document7 pagesAccounting+for+Business+Combination+HO+No 1secretary.feujpia2324No ratings yet

- Arias, Kyla Kim B. - Garcia's Health Care - 2Document11 pagesArias, Kyla Kim B. - Garcia's Health Care - 2Kyla Kim AriasNo ratings yet

- Assessment Tasks 6Document4 pagesAssessment Tasks 6hahahahaNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Midterm - Quiz SolutionDocument4 pagesMidterm - Quiz SolutionANSLEY CATE C. GUEVARRANo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- Afar 3 Quiz 4 Stock AcquisitionDocument4 pagesAfar 3 Quiz 4 Stock AcquisitiondmangiginNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Audit of InvestmentsDocument6 pagesAudit of InvestmentsGiane Bernard PunayanNo ratings yet

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- Financing Equity ProblemsDocument14 pagesFinancing Equity ProblemsIris MnemosyneNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- Quiz Chapter 17Document1 pageQuiz Chapter 17Zaira UdtohanNo ratings yet

- 5th Year Buscom For DiscussionDocument5 pages5th Year Buscom For DiscussionAirille CarlosNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- (Ust-Jpia) Acc5115 Ifr Sce and SCF ReviewerDocument5 pages(Ust-Jpia) Acc5115 Ifr Sce and SCF Revieweraly kayleNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationLora Mae JuanitoNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- Reviewer Interm 2Document3 pagesReviewer Interm 2Mae DionisioNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- PART A: Prepare A Company's Financial Reports Tika Company LTD A Wholesaler CompanyDocument2 pagesPART A: Prepare A Company's Financial Reports Tika Company LTD A Wholesaler CompanyMakeleta VaenukuNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential AC/JUL 2022/FAR3202021202082No ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Advacc Midterm AssignmentsDocument11 pagesAdvacc Midterm AssignmentsAccounting MaterialsNo ratings yet

- 1 Partnership-YTDocument7 pages1 Partnership-YTSherwin DueNo ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- Endeavour Twoplise Ltd. - Question - 21355890Document7 pagesEndeavour Twoplise Ltd. - Question - 21355890Namita GoburdhanNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- AFAR Set CDocument12 pagesAFAR Set CRence GonzalesNo ratings yet

- CH02 ProblemDocument3 pagesCH02 ProblemTuyền Võ ThanhNo ratings yet

- Investments Shares Equity Method PDFDocument12 pagesInvestments Shares Equity Method PDFbobo kaNo ratings yet

- Consolidation QuestionsDocument16 pagesConsolidation QuestionsUmmar FarooqNo ratings yet

- 92 - Final Preaboard AFARDocument16 pages92 - Final Preaboard AFARCarlo AgravanteNo ratings yet

- June 2019Document182 pagesJune 2019shankar k.c.No ratings yet

- RTP June 19 QnsDocument15 pagesRTP June 19 QnsbinuNo ratings yet

- Account - 1Document6 pagesAccount - 1kakajumaNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- 2023 Valuations Chapter 04 ProblemsDocument4 pages2023 Valuations Chapter 04 ProblemsShania LiwanagNo ratings yet

- General: AssemblyDocument15 pagesGeneral: AssemblyShania LiwanagNo ratings yet

- 2023 Valuations Chapter 05 ProblemsDocument6 pages2023 Valuations Chapter 05 ProblemsShania LiwanagNo ratings yet

- Activity Sheet Adjusting Entries DeferralsDocument1 pageActivity Sheet Adjusting Entries DeferralsShania LiwanagNo ratings yet

- Department of Accountancy: Holy Angel University Intermediate Accounting 1Document13 pagesDepartment of Accountancy: Holy Angel University Intermediate Accounting 1Shania LiwanagNo ratings yet

- Midterm Quiz 2 - Problem and Answer KeyDocument6 pagesMidterm Quiz 2 - Problem and Answer KeyRynette Flores100% (1)

- Chater 5Document9 pagesChater 5Shania LiwanagNo ratings yet

- Accounting For FOH Part 11Document16 pagesAccounting For FOH Part 11Shania LiwanagNo ratings yet

- Wipo Unhchr Ip PNL 98 5Document44 pagesWipo Unhchr Ip PNL 98 5Shania LiwanagNo ratings yet

- Midterm QuizDocument7 pagesMidterm QuizShania LiwanagNo ratings yet

- Reviewer Midterms Act 1 8Document4 pagesReviewer Midterms Act 1 8Shania LiwanagNo ratings yet

- Prelim ExaminationDocument14 pagesPrelim ExaminationShania LiwanagNo ratings yet

- Prelim QuizDocument5 pagesPrelim QuizShania Liwanag100% (2)

- Department of Accountancy: Holy Angel University Intermediate Accounting 1Document9 pagesDepartment of Accountancy: Holy Angel University Intermediate Accounting 1Shania LiwanagNo ratings yet

- 6 Uec ProgramDocument21 pages6 Uec Programsubramanyam62No ratings yet

- Community Resource MobilizationDocument17 pagesCommunity Resource Mobilizationerikka june forosueloNo ratings yet

- Vintage Airplane - May 1982Document24 pagesVintage Airplane - May 1982Aviation/Space History LibraryNo ratings yet

- Managemant PrincipleDocument11 pagesManagemant PrincipleEthan ChorNo ratings yet

- Tourbier Renewal NoticeDocument5 pagesTourbier Renewal NoticeCristina Marie DongalloNo ratings yet

- Phy Mock SolDocument17 pagesPhy Mock SolA PersonNo ratings yet

- Cosmic Handbook PreviewDocument9 pagesCosmic Handbook PreviewnkjkjkjNo ratings yet

- LSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDocument2 pagesLSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDilzoda Boytumanova.No ratings yet

- Book Speos 2023 R2 Users GuideDocument843 pagesBook Speos 2023 R2 Users GuideCarlos RodriguesNo ratings yet

- MN Rules Chapter 5208 DLIDocument24 pagesMN Rules Chapter 5208 DLIMichael DoyleNo ratings yet

- Nse 2Document5 pagesNse 2dhaval gohelNo ratings yet

- HPCL CSR Social Audit ReportDocument56 pagesHPCL CSR Social Audit Reportllr_ka_happaNo ratings yet

- Em FlexicokingDocument8 pagesEm FlexicokingHenry Saenz0% (1)

- 2432 - Test Solutions - Tsol - 2432 - 21702Document5 pages2432 - Test Solutions - Tsol - 2432 - 21702Anmol PanchalNo ratings yet

- Junos ErrorsDocument2 pagesJunos ErrorsrashidsharafatNo ratings yet

- Strategic Capital Management: Group - 4 Jahnvi Jethanandini Shreyasi Halder Siddhartha Bayye Sweta SarojDocument5 pagesStrategic Capital Management: Group - 4 Jahnvi Jethanandini Shreyasi Halder Siddhartha Bayye Sweta SarojSwetaSarojNo ratings yet

- Paper II - Guidelines On The Use of DuctlessDocument51 pagesPaper II - Guidelines On The Use of DuctlessMohd Khairul Md DinNo ratings yet

- P1 Chp12 DifferentiationDocument56 pagesP1 Chp12 DifferentiationbobNo ratings yet

- Arithmetic-Progressions - MDDocument8 pagesArithmetic-Progressions - MDJay Jay GwizaNo ratings yet

- Weg CFW500 Enc PDFDocument32 pagesWeg CFW500 Enc PDFFabio Pedroso de Morais100% (1)

- Course DescriptionDocument54 pagesCourse DescriptionMesafint lisanuNo ratings yet

- XU-CSG Cabinet Minutes of Meeting - April 4Document5 pagesXU-CSG Cabinet Minutes of Meeting - April 4Harold John LaborteNo ratings yet

- Helipal Tbs Powercube ManualDocument29 pagesHelipal Tbs Powercube Manualoualid zouggarNo ratings yet

- Mangement of Shipping CompaniesDocument20 pagesMangement of Shipping CompaniesSatyam MishraNo ratings yet

- Epistemology and OntologyDocument6 pagesEpistemology and OntologyPriyankaNo ratings yet

- SXV RXV ChassisDocument239 pagesSXV RXV Chassischili_s16No ratings yet

- What Is A Fired Heater in A RefineryDocument53 pagesWhat Is A Fired Heater in A RefineryCelestine OzokechiNo ratings yet

- What Is Product Management?Document37 pagesWhat Is Product Management?Jeffrey De VeraNo ratings yet

- 2.1 DRH Literary Translation-An IntroductionDocument21 pages2.1 DRH Literary Translation-An IntroductionHassane DarirNo ratings yet

- Check e Bae PDFDocument28 pagesCheck e Bae PDFjogoram219No ratings yet