Professional Documents

Culture Documents

Unit 4 - Lesson 3 - Accounting

Uploaded by

halam29051997Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 4 - Lesson 3 - Accounting

Uploaded by

halam29051997Copyright:

Available Formats

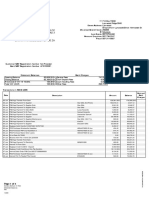

UNIT 4.

LESSON 3

I. Choose the best response.

1. A statement of _________ helps you keep track of your business's finances.

A. cash flow B. cash flowing C. money flow

2. What's the opposite of an asset?

A. Cash B. A liability C. A liaison

3. The breakeven point in sales dollars can be calculated by _________ a company's

fixed expenses by the company's contribution margin ratio.

A. dividing B. devising C. demising

4. Our company's _________________ ( = not fixed) expenses are approximately

$45,000 per month.

A. various B. variable C. veritable

5. "Liquid" assets often refer to _________.

A. credit B. cash C. checks

6. A flat-rate plan __________ marginal costs.

A. elaborates B. takes C. eliminates

7. In accounting, a cost that does not _________ ( = change) with the level of production

or sales is referred to as "……………..".

A. vary B. variable C. variety

8. There are two types of profit: gross profit and __________.

A. net profit B. non-gross profit C. netto profit

9. "Net profit after taxes" is what's called "the bottom line". It's the _________ after

everything has been subtracted.

A. netto income B. gross income C. net income

10. A __________ of an item in account books (because it no longer has any value) is

what's known as a "write-off".

A. cancel B. cancellation C. constellation

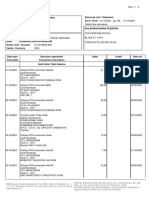

II. Match each definition with the letter of one of the following:

a - balance sheet, b - liquid assets, c - liability, d - net income, e - property, f - payroll, g -

equity, h - journal, i - cash flow, j - expense

1. a list of all employees and their wages

2. an accounting record where all business transactions are INITIALLY entered

3. money that is spent to purchase goods or services provided by someone else

4. a detailed summary of a person's or a company's financial condition at a specific point

in time, taking into account their assets, liabilities, etc.

5. something that is legally owned by a person or company

6. an obligation to settle a debt; money owed to someone

7. this word has 2 meanings: "stock (shares)" and "net worth"

8. the balance of cash receipts minus cash payments over a given period of time

9. cash or something that is easily convertible into cash

10. money remaining after all expenses and taxes have been paid

You might also like

- Unit 4 - Lesson 3 - Accounting - KeyDocument2 pagesUnit 4 - Lesson 3 - Accounting - Keyhalam29051997No ratings yet

- CFM Question BankDocument17 pagesCFM Question BankAshish Babu MathewNo ratings yet

- Fabm Summative 1Document3 pagesFabm Summative 1jelay agresorNo ratings yet

- Long Test in Fundamentals in AccountancyDocument2 pagesLong Test in Fundamentals in AccountancyAly CalingacionNo ratings yet

- Intermediate Acctg 1 - Receivables2Document3 pagesIntermediate Acctg 1 - Receivables2GraceNo ratings yet

- q4 Quiz 1Document2 pagesq4 Quiz 1mjagbanlogNo ratings yet

- Ch. 12 Review Sheet KeyDocument26 pagesCh. 12 Review Sheet KeyĐào Yến NhiNo ratings yet

- FBLA Accounting Test PrepDocument10 pagesFBLA Accounting Test PrepjhouvanNo ratings yet

- Chapter 15 16 Exam ADocument7 pagesChapter 15 16 Exam Aapi-312882401No ratings yet

- FAR Practice MCQDocument17 pagesFAR Practice MCQBea PahuyoNo ratings yet

- FABM1Document6 pagesFABM1Nhel ZieNo ratings yet

- Review of Accounting Cycle - w97Document17 pagesReview of Accounting Cycle - w97Ding CostaNo ratings yet

- 3 - Activities For ULO 7, 8, 9, 10 & 11Document8 pages3 - Activities For ULO 7, 8, 9, 10 & 11RJ 1No ratings yet

- Prelim Departmental Exam Reviewer With Answer Key PDFDocument11 pagesPrelim Departmental Exam Reviewer With Answer Key PDFAndrea Marie CalmaNo ratings yet

- Account Financial QuestionsDocument5 pagesAccount Financial QuestionsOrnet Studio100% (1)

- Qualifying Exam Practice Basic Accounting REVIEWERDocument26 pagesQualifying Exam Practice Basic Accounting REVIEWERApril Joy EspadorNo ratings yet

- Educ ExamDocument9 pagesEduc ExamBev Baltazar ChingNo ratings yet

- Mock Examination QuestionnaireDocument9 pagesMock Examination QuestionnaireRenabelle CagaNo ratings yet

- Asynchronous Class Fabm 1Document4 pagesAsynchronous Class Fabm 1barrettacarlyn.22No ratings yet

- Fabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesDocument17 pagesFabm1: Quarter 4 - Module 9: Preparing Adjusting EntriesIva Milli Ayson100% (3)

- ABM 11 Fundamentals-Of-ABM1 q3 CLAS4 Statement-Of-Financial-Position v1Document22 pagesABM 11 Fundamentals-Of-ABM1 q3 CLAS4 Statement-Of-Financial-Position v1Kim Yessamin Madarcos100% (1)

- FRA TYBBI Question BankDocument16 pagesFRA TYBBI Question BankPareshNo ratings yet

- Financial Accounting and Analysis - Question BankDocument18 pagesFinancial Accounting and Analysis - Question BankNMIMS GA50% (2)

- Quick StudyDocument8 pagesQuick StudyTrang Nguyễn thị minhNo ratings yet

- Chapter 2 Practice Questions - Part1Document1 pageChapter 2 Practice Questions - Part1Mohamed TahaNo ratings yet

- Exam Fabm1Document3 pagesExam Fabm1Mark Gil GuillermoNo ratings yet

- Achieve Test 01Document7 pagesAchieve Test 01Aldi HerialdiNo ratings yet

- Accounting 101 Sample ExercisesDocument12 pagesAccounting 101 Sample ExercisesFloidette JimenezNo ratings yet

- CP Accounting MIdterm Review 15-16Document11 pagesCP Accounting MIdterm Review 15-16jhouvanNo ratings yet

- Business Finance Final ExamDocument4 pagesBusiness Finance Final ExamEmarilyn Bayot100% (4)

- 12th Accountancy Study Material English MediumDocument41 pages12th Accountancy Study Material English Mediumsubashsb903No ratings yet

- Parallel Assessment: BookkeepingDocument1 pageParallel Assessment: BookkeepingLeigh LorinNo ratings yet

- Fabm1 Preparing Adjusting EntriesDocument19 pagesFabm1 Preparing Adjusting EntriesVenice0% (1)

- Basic Accounting McqsDocument20 pagesBasic Accounting McqsTahir ZamanNo ratings yet

- Banking Finance Tax Test SK2019 - 1Document4 pagesBanking Finance Tax Test SK2019 - 1Vishwas JNo ratings yet

- A222 - Tutorial - Topic 2 - QuestionDocument2 pagesA222 - Tutorial - Topic 2 - QuestionAisyah AliahNo ratings yet

- Sample Questions T. Y. B. Com. (SEM V) Financial Account VDocument7 pagesSample Questions T. Y. B. Com. (SEM V) Financial Account VSyed Faiz AliNo ratings yet

- In Time, Taking Into Account Their Assets, Liabilities, EtcDocument8 pagesIn Time, Taking Into Account Their Assets, Liabilities, EtcAustin WeaverNo ratings yet

- Fabm 12Document3 pagesFabm 12Lee GorgonioNo ratings yet

- Midterm Abm 11Document4 pagesMidterm Abm 11Emarilyn BayotNo ratings yet

- Chapter 19 Accounting and Financial StatementsDocument6 pagesChapter 19 Accounting and Financial Statementssekeresova.nikolaNo ratings yet

- EFAc Slide S-11 More Acc TerminologyDocument4 pagesEFAc Slide S-11 More Acc TerminologyPutri Nur AuraNo ratings yet

- BUSINESS MATH pt.2Document15 pagesBUSINESS MATH pt.2Antonette ColladoNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 2Document11 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 2JordanNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document2 pagesUse The Following Information To Answer Items 5 - 7Cyrus SantosNo ratings yet

- Befa II Mid ObjectiveDocument2 pagesBefa II Mid ObjectivetimepassNo ratings yet

- ACCOUNTING 101 - No.4 - Theories - QuestionsDocument3 pagesACCOUNTING 101 - No.4 - Theories - QuestionslemerleNo ratings yet

- Pre and Post of Accounting 2Document14 pagesPre and Post of Accounting 2Nancy AtentarNo ratings yet

- Accounting Principles CH 01+02 ExamDocument7 pagesAccounting Principles CH 01+02 ExamJames MorganNo ratings yet

- Summative FABM2Document3 pagesSummative FABM2Antonio SearesNo ratings yet

- Journal To Trial BalanceDocument8 pagesJournal To Trial BalanceRyou ShinodaNo ratings yet

- Chapter 1 Question Review Updated 11th Ed-1Document4 pagesChapter 1 Question Review Updated 11th Ed-1Emiraslan MhrrovNo ratings yet

- IcebreakerDocument5 pagesIcebreakerRyan MagalangNo ratings yet

- Finanacial Management Self Test 2Document7 pagesFinanacial Management Self Test 2damenegasa21No ratings yet

- Business Finance - Final ExamDocument3 pagesBusiness Finance - Final ExamRain VicenteNo ratings yet

- Simulated Midterm Exam. Far1 PDFDocument11 pagesSimulated Midterm Exam. Far1 PDFDyosang BomiNo ratings yet

- Financial Management 1Document9 pagesFinancial Management 1Herdanto UtamaNo ratings yet

- Unit 5. EthicsDocument4 pagesUnit 5. Ethicshalam29051997No ratings yet

- UNIT 2 - What Is The Right Supply Chain For Your ProductDocument5 pagesUNIT 2 - What Is The Right Supply Chain For Your Producthalam29051997No ratings yet

- Unit 5. Ethics. Further ReadingDocument2 pagesUnit 5. Ethics. Further Readinghalam29051997No ratings yet

- Unit 4 - Finance - Lesson 1 - KeyDocument2 pagesUnit 4 - Finance - Lesson 1 - Keyhalam29051997No ratings yet

- Topics For RevisionDocument2 pagesTopics For RevisionHuỳnh Thanh TuyềnNo ratings yet

- Unit 1 - L1Document2 pagesUnit 1 - L1K60 ĐỖ NGUYÊN HẠNH DUNGNo ratings yet

- Unit 3 - Marketing - Lesson 1Document6 pagesUnit 3 - Marketing - Lesson 1halam29051997No ratings yet

- Unit 2 - Writing PracticeDocument2 pagesUnit 2 - Writing Practicehalam29051997No ratings yet

- Unit 1. Lesson 4Document2 pagesUnit 1. Lesson 4Mai Thu HiềnNo ratings yet

- Unit 2. Sectors. Lesson 1Document2 pagesUnit 2. Sectors. Lesson 1Nhân Chí NguyễnNo ratings yet

- UNIT 1. Further Reading - Think Global Act LocalDocument4 pagesUNIT 1. Further Reading - Think Global Act Localhalam29051997No ratings yet

- Unit 4 - Unit QuizDocument4 pagesUnit 4 - Unit Quizhalam29051997No ratings yet

- Unit 4 - Finance - Lesson 1 - KeyDocument2 pagesUnit 4 - Finance - Lesson 1 - Keyhalam29051997No ratings yet

- Unit 5. Payment. L3Document2 pagesUnit 5. Payment. L3halam29051997No ratings yet

- Unit 5. Lesson 1Document2 pagesUnit 5. Lesson 1halam29051997No ratings yet

- COOPDocument8 pagesCOOPJohn Kenneth BoholNo ratings yet

- D Mercer - Private Client Case Study-V1Document5 pagesD Mercer - Private Client Case Study-V1kapoor_mukesh4uNo ratings yet

- United Bank of IndiaDocument5 pagesUnited Bank of IndiaRajesh DubeyNo ratings yet

- Star Gifts and Promotions CC Postnet Suite 435 Privatebag X Lynnwoodrif 0040 Samanthak@Decadentgp - Co.ZaDocument4 pagesStar Gifts and Promotions CC Postnet Suite 435 Privatebag X Lynnwoodrif 0040 Samanthak@Decadentgp - Co.ZaEmira FilaNo ratings yet

- SLLC - 2021 - Acc - Lecture Note - 01Document43 pagesSLLC - 2021 - Acc - Lecture Note - 01Chamela MahiepalaNo ratings yet

- Class 11 Accountancy NCERT Textbook Chapter 1 Introduction To AccountingDocument27 pagesClass 11 Accountancy NCERT Textbook Chapter 1 Introduction To AccountingAngela BinoyNo ratings yet

- Chapters 10 and 11Document51 pagesChapters 10 and 11Carlos VillanuevaNo ratings yet

- Why Would It Be Useful To Examine A Country's Balance-Of-Payments Data?Document2 pagesWhy Would It Be Useful To Examine A Country's Balance-Of-Payments Data?Picasales, Frenzy M.No ratings yet

- Loan Contract OrnopiaDocument5 pagesLoan Contract OrnopiaaizhelarcipeNo ratings yet

- Master Input Sheet: InputsDocument37 pagesMaster Input Sheet: Inputsminhthuc203No ratings yet

- Brief Notes National Income and Related AggregatesDocument1 pageBrief Notes National Income and Related AggregatesKeshvi AggarwalNo ratings yet

- Karvy Private Wealth - India Wealth ReportDocument28 pagesKarvy Private Wealth - India Wealth ReportKarvyPrivateWealth100% (1)

- The Principles of Lending and Lending BasicsDocument38 pagesThe Principles of Lending and Lending BasicsenkeltvrelseNo ratings yet

- We Won The Revolution & We Own The Knowledge of ItDocument311 pagesWe Won The Revolution & We Own The Knowledge of ItSusan100% (1)

- Simarleen Kaur 1222Document4 pagesSimarleen Kaur 1222simar leenNo ratings yet

- Technical MemorandumDocument2 pagesTechnical MemorandumChrispy ChickenNo ratings yet

- Mcom Exam Form Acknowledgment - Sem 3 PDFDocument2 pagesMcom Exam Form Acknowledgment - Sem 3 PDFMansi KotakNo ratings yet

- Business English Idioms & Idiomatic ExpressionsDocument2 pagesBusiness English Idioms & Idiomatic ExpressionsAnastasia AndreevnaNo ratings yet

- Group 4 - Banking Law Assignment - Forex BureausDocument24 pagesGroup 4 - Banking Law Assignment - Forex Bureausmoses machiraNo ratings yet

- Letter From TCI To ABN AmroDocument2 pagesLetter From TCI To ABN AmroF.N. HeinsiusNo ratings yet

- AntichresisDocument2 pagesAntichresiscrisypilNo ratings yet

- Fedai Rule - 2012 (Circular)Document15 pagesFedai Rule - 2012 (Circular)Ramam Remo RemoNo ratings yet

- SV39786361600 2023 10Document6 pagesSV39786361600 2023 10ioanateodorabaisanNo ratings yet

- Ripple + XRP HistoryDocument55 pagesRipple + XRP Historymikedudas100% (2)

- VPA Cheat SheetDocument5 pagesVPA Cheat SheetSharma comp71% (7)

- Starting A Financial PlanDocument4 pagesStarting A Financial PlanElishaNo ratings yet

- Finance PDFDocument125 pagesFinance PDFRam Cherry VMNo ratings yet

- FAR Assignment 5 Adjusting EntriesDocument2 pagesFAR Assignment 5 Adjusting EntriesPaula BautistaNo ratings yet

- Why Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabreraDocument2 pagesWhy Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabrerathecenseireportNo ratings yet

- Vikram Singh Negi SBI Bank StatementDocument4 pagesVikram Singh Negi SBI Bank StatementArushi SinghNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)