Professional Documents

Culture Documents

Coursework 3

Uploaded by

Bình NGuyễn CôngCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coursework 3

Uploaded by

Bình NGuyễn CôngCopyright:

Available Formats

Module No: BAA6003

________________________________________________________

ASSESSMENT DATE: Week Beginning 11 March 2024

Scenario 3

TIME ALLOWED: 25 minutes

________________________________________________________

Learning Outcomes:

Students should be able to:

Understand the advanced theory and practice of auditing practice and

procedures.

Analyse and apply different audit approaches to structured and

unstructured problems.

BAA6003 Coursework 2024 Page 1

INSTRUCTIONS:

In your team prepare a presentation on Squirrel Fashions Ltd,

answering the parts (i) to (iii). You will have a maximum time

allocation of 15 minutes per group (excluding questions).

Following your presentation, your team will be asked additional

questions, so ensure that you make yourself aware of all relevant areas,

not just the area you are presenting on.

How you allocate the work to be presented is up to you, but bear in mind

that there are marks allocated for team work.

If a team member is asked a question to which you are able to add

supplementary, relevant information, then additional marks will be

allocated to you.

Marks will be allocated as shown in the table below:

Presentation Additional questions

40% content (slides and 30% if additional

verbal) question answered well

15% presentation style 15% extra marks if

supplement answer to

team mates question

The marking scheme that will be used to assess your presentation forms

part of this document. This coursework represents 50% of your final

module mark.

All groups will be recorded, for IV purposes.

The lecturer will need an electronic copy of your Powerpoint

presentation before your presentation. This should reach the lecturer no

later than Friday 15 March 2024 by 11am, via Turnitin on Moodle.

You will not be able to alter the presentation after this date and it will be

the copy the lecturer holds that you will use for your presentation.

BAA6003 Coursework 2024 Page 2

Squirrel Fashions Ltd (Squirrel) manufactures and distributes fashion

clothing to retail stores in the UK and Europe. There is a workforce of

175 employees who are engaged in either the manufacture or

distribution side of the business. These are all weekly paid. In addition,

there are between 30-40 employees who work in sales and

administration; the numbers vary according the sales campaign being

run by the company. These are salaried and paid monthly. All

employees, both weekly and monthly, are paid by direct transfer into

their bank accounts. Squirrel’s payroll requirements are dealt with by the

payroll clerk called Zac.

Squirrel operates three shifts a day with employees working eight hours

each. Each shift has a shift supervisor. The production workers are

required to clock in and out using an electronic identification card. The

card is scanned by the time recording system and each employee’s

identification number is read from their card by the scanner. On a

regular basis, the manufacturing and distribution workers may be

required to work overtime. This overtime may be taken as time off or can

be taken in a weekly payment. Each employee who has worked

overtime, emails Zac to let him know whether they wish to be paid for

their extra hours or whether they wish to take time off in lieu of payment.

The shift supervisor is not required to monitor the extent of any overtime

working although the supervisor does ensure that workers are not taking

any unnecessary or prolonged breaks which would automatically

increase the amount of overtime worked.

Zac accesses the payroll system using a password which is known to

him and two others; the Financial Accountant and Choi the purchase

order clerk, who covers for Zac’s leave of absences. On entering the

password, Zac imports the hours worked from the time recording

system. The system compares the hours worked per employee to the

standard hours per week and allocates the excess as overtime. Zac

checks his emails to see which option the employee has chosen with

regard to their overtime hours. If the employee chooses to be paid

overtime, Zac will phone the supervisor for approval if the overtime

exceeds 15% of the standard hours. No supervisor approval is required

if the overtime hours represent less than 15%. If no email has been sent

by the employee, Zac assumes that they have selected the time off in

BAA6003 Coursework 2024 Page 3

lieu of payment and enters a holiday code into the relevant programme

which, automatically reduces the overtime rate by the number of

holidays selected.

Following these modifications, a printout of the week’s payroll is

generated, detailing for each employee; hours paid, split between basic

and overtime, gross pay, deductions, net pay, employer’s tax and totals.

This information is produced in three different reports:

Summary: Cumulative details to date per employee

Payslips: Details of gross pay, deductions and net pay

Autopay list: Bank sort code, account number and net pay per

employee, and total net pay.

Salaries are paid on a monthly basis using standing data stored in the

monthly payroll system

On a weekly (wages) or monthly (salaries) basis, the Financial

Accountant reviews the autopay list before Zac uses the same password

to transmit the details via direct transfer to the company’s bank. Two

days later a printout, listing bank and net pay details per employee

together with the net pay total, is received from the bank.

Details of starters, leavers and amendments to hourly paid employee

details are recorded on standard forms by the supervisors and passed to

Zac for input into the system. Any amendments to salaried members of

staff are emailed by Human Resources (HR) directly to Zac. During the

year the hourly wage is increased by the HR department and Zac is

always notified of this by email. After updating the standing data on the

payroll system, he discards the forms and emails.

Required:

i Identify the objectives of exercising internal controls in a payroll

system and discuss the extent to which the procedures exercised

by Squirrel achieve these objectives; outlining both the strengths

and weaknesses.

ii Describe the procedures which would strengthen Squirrel’s payroll

system.

BAA6003 Coursework 2024 Page 4

Iii Evaluate the procedures you used to obtain evidence during your

audit of Squirrel, as prescribed by the relevant accounting

standards; including analytical review, reconciliation, inquiry,

inspection, observation and recalculation.

BAA6003 Coursework 2024 Page 5

Marking Scheme

As a group member

1. Did the presentation have a logical structure – an introduction, main body and conclusion?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 4

2. Was the presentation (excl. questions) to the point and timeliness adhered to?

More than 15 minutes or less 5-6 min or 7-10 min Between 11-15

than 5 minutes 16-17 min min

0 2 3 4

3. Was the font large enough to be read and the slides not overcrowded?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 4

4. Did the audit work performed clearly identify internal controls?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 4

5. Were the weaknesses clearly outlined?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 4

6. Were the recommendations appropriate to remedy the weaknesses?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 4

7. Was there evidence that six evidence collections methods were clearly understood?

Not evident Weak Satisfactory Good Very Good

0 2 6 9 12

BAA6003 Coursework 2024 Page 6

8. Was there evidence that the presentation was performed in a cohesive manner, that

indicated the group had worked together?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 4

As an individual

9. Was body language appropriate? e.g. eye contact, smile

Not evident Weak Satisfactory Good Very Good

-1 1 2 3 5

10. Was the dress code appropriate?

Weak Satisfactory Good Very Good

-1 3 4 5

11. Did the student speak clearly, confidently, concisely and at an appropriate speed?

Not evident Weak Satisfactory Good Very Good

0 1 2 3 5

12. Was the student’s additional question answered in a manner which displayed the

question was understood and relevant information brought in to support the answer?

Not answered Weak Satisfactory Good Very Good

0 5-14 15-19 20-24 25-30

13. Did the student supplement a team member’s question?

Not evident Weak Satisfactory Good Very Good

0-1 2-5 6-7 8-10 11-15

Mark out of 100 =

BAA6003 Coursework 2024 Page 7

You might also like

- Coursework 7Document7 pagesCoursework 7Bình NGuyễn CôngNo ratings yet

- Cousework 5Document7 pagesCousework 5Bình NGuyễn CôngNo ratings yet

- Coursework 6Document6 pagesCoursework 6Bình NGuyễn CôngNo ratings yet

- Coursework 4Document6 pagesCoursework 4Bình NGuyễn CôngNo ratings yet

- CourwoekDocument7 pagesCourwoekPhuoc TruongNo ratings yet

- BAA6003 Coursework 2Document7 pagesBAA6003 Coursework 2Bình NGuyễn CôngNo ratings yet

- Coursework 8Document7 pagesCoursework 8Bình NGuyễn CôngNo ratings yet

- Cross Cultural Management Podcast AssessmentDocument11 pagesCross Cultural Management Podcast AssessmentMeshack MateNo ratings yet

- Manager QuestionnaireDocument5 pagesManager QuestionnaireEdgar ManubagNo ratings yet

- Eapp Q4 Week4Document14 pagesEapp Q4 Week4Christine Sta AnaNo ratings yet

- The Formative Assessment Handbook: Resources to Improve Learning Outcomes for All StudentsFrom EverandThe Formative Assessment Handbook: Resources to Improve Learning Outcomes for All StudentsNo ratings yet

- Evaluation FormDocument2 pagesEvaluation FormAhmed RazaNo ratings yet

- Validation FormatDocument7 pagesValidation FormatClarice Mae Caingles PerezNo ratings yet

- Canadian Border Services Test PrepFrom EverandCanadian Border Services Test PrepRating: 3 out of 5 stars3/5 (1)

- ISO 22000 The Ultimate Step-By-Step GuideFrom EverandISO 22000 The Ultimate Step-By-Step GuideRating: 5 out of 5 stars5/5 (2)

- The Traits of Today's CFO: A Handbook for Excelling in an Evolving RoleFrom EverandThe Traits of Today's CFO: A Handbook for Excelling in an Evolving RoleNo ratings yet

- EIAT Test Prep: Complete Elevator Industry Aptitude Test study guide and practice test questionsFrom EverandEIAT Test Prep: Complete Elevator Industry Aptitude Test study guide and practice test questionsRating: 1 out of 5 stars1/5 (1)

- BYOS — Build Your Own Server Complete Self-Assessment GuideFrom EverandBYOS — Build Your Own Server Complete Self-Assessment GuideNo ratings yet

- Handout  - How To Stand Out From The CrowdDocument38 pagesHandout  - How To Stand Out From The CrowdSaquib Ul HaqueNo ratings yet

- Engineering Economics Questions Problem SolvingDocument4 pagesEngineering Economics Questions Problem SolvingLouie Jay LayderosNo ratings yet

- Lorelle CarenderiaDocument22 pagesLorelle CarenderiaShiela may AdlawonNo ratings yet

- Mba FT 2024-26Document27 pagesMba FT 2024-26Khushi BerryNo ratings yet

- Mini-Case SanyDocument2 pagesMini-Case SanyLeah C.100% (1)

- Ex Parte Petition To Assume JurisdictionDocument2 pagesEx Parte Petition To Assume JurisdictionNasir AhmedNo ratings yet

- Marketing Plan Final ReMarketing Plan of ACME Agrovet Beverage LTD PortDocument84 pagesMarketing Plan Final ReMarketing Plan of ACME Agrovet Beverage LTD PortNafiz FahimNo ratings yet

- Hypothesis-Driven DevelopmentDocument2 pagesHypothesis-Driven DevelopmentMuhammad El-FahamNo ratings yet

- Trade AgreementDocument6 pagesTrade AgreementFRANCIS EDWIN MOJADONo ratings yet

- PEPSI COLA vs. MolonDocument28 pagesPEPSI COLA vs. MolonChristle CorpuzNo ratings yet

- ARBURG Customer Service Contact List 2021Document2 pagesARBURG Customer Service Contact List 2021Moises GeberNo ratings yet

- CV of Afzal KhanDocument3 pagesCV of Afzal Khandawari123No ratings yet

- CIR v. PDI (Waiver)Document30 pagesCIR v. PDI (Waiver)Jerwin DaveNo ratings yet

- Bilderberg Report 1955Document12 pagesBilderberg Report 1955xlastexitNo ratings yet

- Commercial Law Case Digest: List of CasesDocument57 pagesCommercial Law Case Digest: List of CasesJean Mary AutoNo ratings yet

- Should a batch-wise reactor be replaced with a continuous reactorDocument2 pagesShould a batch-wise reactor be replaced with a continuous reactorNovia Mia Yuhermita100% (1)

- EssentialismDocument1 pageEssentialismMehrdad FereydoniNo ratings yet

- Exercise 1 Key PDF Cost of Goods Sold InvenDocument1 pageExercise 1 Key PDF Cost of Goods Sold InvenAl BertNo ratings yet

- Why Is Marketing Research So Important?Document9 pagesWhy Is Marketing Research So Important?Ada Araña DiocenaNo ratings yet

- The Impact of Employee Training and Development On EmployeeDocument4 pagesThe Impact of Employee Training and Development On EmployeehinaNo ratings yet

- Course Code Course Name Lecturer Assignment TitleDocument11 pagesCourse Code Course Name Lecturer Assignment TitleMuhd ArifNo ratings yet

- Zudio Marketing PlanDocument2 pagesZudio Marketing PlanAmir KhanNo ratings yet

- MAS BackgroundDocument2 pagesMAS BackgroundJie FifieNo ratings yet

- FISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Document18 pagesFISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Harlanrizki PraoktaNo ratings yet

- Principles of Engineering EconomyDocument14 pagesPrinciples of Engineering Economyabhilash gowdaNo ratings yet

- IncentiveDocument7 pagesIncentiveSwetaNo ratings yet

- LRT Transit PrioritiesDocument6 pagesLRT Transit PrioritiesAnonymous NbMQ9YmqNo ratings yet

- AICPA Problem Set LiabilitiesDocument3 pagesAICPA Problem Set LiabilitiesElla Rence TablizoNo ratings yet

- Intermediate Accounting 1: Receivable Financing Forms and ExamplesDocument34 pagesIntermediate Accounting 1: Receivable Financing Forms and ExamplesChen HaoNo ratings yet

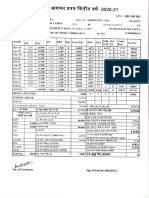

- Income Tax Agadan PrapatraDocument3 pagesIncome Tax Agadan Prapatraat.amitkumarbstNo ratings yet