Professional Documents

Culture Documents

Jounalising

Uploaded by

KingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jounalising

Uploaded by

KingCopyright:

Available Formats

Financial Accounting : The process of preparing financial statements is known as financial Accounting.

Financial Statements;

1 Statement of Financial Position

2 Statement of Profit and loss and other comprehensive income

3 Statement of changes in Equity

4 Statement of Cash flows

5 Notes to the accounts/Financial statements

Accounting Cycle

1 Jounalizing The process of recording transaction into Journal.

2 Ledger Preparation

3 Trial Balance

Unadjusted Trial Balance

Adjusting Entries

Adjusted Trial Balance/Pre-closing Trial balance

4 Closing Entries

5 Post Closing Trial Balance

6 Preparation of Financial Statements

Rules for Debit and Credit Increase Decrease ALCER

1 Assets Dr. Cr.

2 Expenses Dr. Cr.

3 Capital Cr. Dr.

4 Revenue/Income Cr. Dr.

5 Liabilities Cr. Dr.

Assets Liabilities Expenses Capital Revenue/INCOME

Bank Trade payableSalaries Exp Sales Income

Cash on hand Taxes PayablesWages Exp Rental Income

Land Accounts Payable

Utilities Commission Income

Building Bills payable Transportataion Dividend income

Furniture and Fixtures Loan Rent Interest Income

Plant Debentures Freight in

Machinery Notes PayableFreight out

Vehicles Bank OD Admin Exp

Equipments Other PayableDepriciation exp

Copy rights Courier Exp

Goodwill Mis exp

Software

Inventory

Example#01 Mr. Abdullah Started a Trading business , details of the transactions thereof

are as follows Rs Charity

1-Jan Cash invested by owner 390,000 Loss

2-Jan Mr. Abdullah Opened a Bank account for Businesss & Deposited Cash 195,000 Theft

3-Jan Mr. Abdullah Purchased Goods for resale on Cash 91,000 Samples

4-Jan Cheq Paid for Furniture & Fixtures 19,500

5-Jan cheq Paid for Office Equipments 39,000

6-Jan Cash Sales 52,000

7-Jan Wages paid in cash 6,500

8-Jan Paid cheq for -

Utilities 1300

Mis. Expenses 2600

8-Jan Paid for Salaries 7,800

9-Jan Paid cheq for Office Rent 9,100

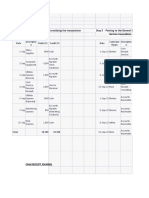

Mr. Abdullah

General Journal Page 01

For The Month Of Jan 20X1

Date Particulars Ref Debit Credit

1-Jan -22 Cash 390,000 Journal Entry 390,000.00

Capital 390,000 Simple Journal Entry (195,000)

(To record investment by Owner) Chart of Accounts (91,000)

2-Jan -22 Bank 195,000 1 Cash 52,000

Cash 195,000 2 Capital (6,500)

(To record Opening of Bank Account) 3 Bank (7,800)

3-Jan -22 Purchases 91,000 4 Purchases

Cash 91,000 5 Furniture & Fixture 141,700.00

(To record Cash Purchases) 6 Office Equipment

4-Jan -22 Furniture & Fixture 19,500 7 Wages EXP

Bank 19,500 8 Sales

(To record Chq paid for Furniture & Fixtures) 9 Utilities EXP

5-Jan -22 Office Equipment 39,000 10 Mis. Expenses

Bank 39,000 11 Salaries EXP

(To record Chq paid for Office Equipment) 12 Office Rent EXP

6-Jan -22 Cash 52,000

Sales 52,000

(To record Cash Sales)

7-Jan -22 Wages EXP 6,500

Cash 6,500

(To record wages paid)

8-Jan -22 Utilities EXP 1,300 Compound Jourenal Entry

Mis. Expenses 2,600

Bank 3,900

(To record chq paid for Office supplies)

9-Jan -22 Salaries EXP 7,800

Cash 7,800

(To record Salaries paid)

10-Jan -22 Office Rent EXP 9,100

Bank 9,100

(To record Chq paid for office rent)

Example#02

Mr. A. Rehman Strarted an Electronic items shop , where products as well Services are supplied to

Customers.

1-M ay Investment by Owner

Cash 1,200,000

Bank 1,500,000

Building 3,000,000

2-M ay Purchased Furniture & Fixtures 80,000

3-M ay Purchased goods for sale from Nahid Electronics 1,000,000

4-M ay Sold goods to Nadir Electronics 700,000

5-M ay Returned inappropriate items to Nahid Electronics 50,000

6-M ay Returns from Nadir Electronics 60,000

7-M ay Owner took Oven for personal use 15,000

8-M ay School fees was paid from business bank account 20,000

9-M ay Items given as charity 17,000

10-M ay Paid Chq for Delivery Van for business use 300,000

11-M ay Goods Lost by fire 5,000

12-M ay Goods Stolen from godown 3,000

13-M ay Goods given as Samples 2,500

Cash

Bank

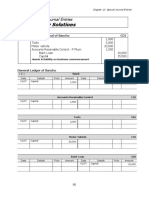

Mr. A. Rehman

General Journal

For The Month Of May 20X1

Date Particulars Ref Debit Credit Chart of Accounts

1-M ay Cash 1,200,000 1 Cash

Bank 1,500,000 2 Bank Contra-Account :

Building 3,000,000 3 Building An Account that off-sets another account is known as

Capital 5,700,000 4 Capital contra-account.

(To record investment by Owner) 5 Furniture & Fixtures

2-M ay Furniture & Fixtures 80,000 6 Purchases Account Contra account

Cash 80,000 7 A/P-Nahid Electronics 1 Purchases Purchases Returns/Returns Outward

(To record Furniture & Fixtures) 8 A/R-Nadir Electronics 2 Sales Sales Retuns/Returns inwards

3-M ay Purchases 1,000,000 9 Sales 3 Capital Drawings

A/P-Nahid Electronics 1,000,000 10 Purchases Returns

(To record credit Purchases) 11 Sales returns

4-M ay A/R-Nadir Electronics 700,000 12 Drawings

Sales 700,000 13 #REF!

(To record Credit Sales) 14 Van

5-M ay A/P-Nahid Electronics 50,000 15 Fire Loss

Purchases Returns 50,000 16 Theft Loss

(To record Purchases returns) 17 Samples Expense

6-M ay Sales returns 60,000 18 #REF!

A/R-Nadir Electronics 60,000 19 #REF!

(To record Sales Returns)

7-M ay Drawings 15,000

Purchases 15,000

(To record drawings)

8-M ay Drawings 20,000

Bank 20,000

(To record drawings)

9-M ay Charity Exp 17,000

Purchases 17,000

(To record Charity Expense)

10-M ay Van 300,000

Bank 300,000

(To record Purchase of Delivery Van)

11-M ay Fire Loss 5,000

Purchases 5,000

(To record Fire loss)

12-M ay Theft Loss 3,000

Purchases 3,000

(To record theft loss)

13-M ay Samples Expense 2,500

Purchases 2,500

(To record Samples Expense)

Example#03

Mr. Saad started a Electronics trading business details of the same are as follows

1-M ar Investment by Owner

Cash 600,000

Bank 750,000

Building 1,500,000

2-M ar Purchased Furniture & Fixtures 40,000

3-M ar Purchased goods for sale from Mr. Karim 500,000

4-M ar Sold goods to Mr. Ahsan 350,000

5-M ar Returned inappropriate items to Mr. Karim 25,000

6-M ar Returns from Mr. Ahsan 30,000

7-M ar Owner took Oven for personal use 7,500

8-M ar School fees was paid from business bank account 10,000

9-M ar Items given as charity 8,500

10-M ar Paid Chq for Delivery Van for business use 150,000

11-M ar Goods Lost by fire 2,500

12-M ar Goods Stolen from godown 1,500

13-M ay Goods given as Samples 1,250

Mr. Saad

General Journal

For The Month Of March 20X1

Date Particulars Ref Debit Credit

1-M ar Cash 600,000

Bank 750,000

Building 1,500,000

Capital 2,850,000

(To record investment by Owner)

2-M ar Furniture & Fixtures 40,000

Cash 40,000

(To record Furniture & Fixtures)

3-M ar Purchases 500,000

A/P-Mr. Karim 500,000

(To record credit Purchases)

4-M ar A/R-Mr.Ahsan 350,000

Sales 350,000

(To record Credit Sales)

5-M ar A/P-Mr. Karim 25,000

Purchases Returns 25,000

(To record Purchases returns)

6-M ar Sales returns 30,000

A/R-Mr.Ahsan 30,000

(To record Sales Returns)

7-M ar Drawings 7,500

Purchases 7,500

(To record drawings)

8-M ar Drawings 10,000

Bank 10,000

(To record drawings)

9-M ar Charity Exp 8,500

Purchases 8,500

(To record Charity Expense)

10-M ar Van 150,000

Bank 150,000

(To record Purchase of Delivery Van)

11-M ar Fire Loss 2,500

Purchases 2,500

(To record Fire loss)

12-M ar Theft Loss 1,500

Purchases 1,500

(To record theft loss)

13-M ar Samples Expense 1,250

Purchases 1,250

(To record Samples Expense)

Example#04

Mr. Inam Started business by investing

1-Jan Cash 700,000

Bank 800,000

3-Jan Purchased office Equipment 80,000

4-Jan Took bank loan for 5 years 500,000

Every Month following Cash Sales at mid of every month and Expenses at end of Every Month.

15th of

Every Sales 40,000

month

At end of

Salaries Expense 6,000

Month

At end of

Utilities Expenses 3,000

Month

Mr. Inam

General Journal

for the year ended 31 Dec 20x1

Date Particulars Ref Debit Credit Chart of Accounts

1-Jan Cash 700,000 1 Cash

Bank 800,000 2 Bank

Capital 1,500,000 3 Capital

(To record investment by Owner) 4 Office Equipment

3-Jan Office Equipment 80,000 5 Bank Loan

Cash 80,000 6 Sales

(To record Office Equipment Purchased) 7 Salaries Expense

4-Jan Bank 500,000 8 Utilities Expenses

Bank Loan 500,000

(To record Bank Loan)

15-Jan Cash 40,000 Nominal or Temporary Accounts

Sales 40,000 Monthly in k balances Carried down and Brought down hotay hain.

(To record Cash Sales) Ye wo Accounts hotay hain jo financial/fiscal year k end main

31-Jan Salaries Expense 6,000 close ho jate hain. In k balance next financial/fiscal year

Utilities Expenses 3,000 main Carry forward nhn hotay

Cash 9,000

(To record Salaries and Utilities Expense) Sare Revenue/Income accounts Nominal accounts hain

15-Feb Cash 40,000 Sare Expenses k accounts Nominal Accounts hain

Sales 40,000

(To record Cash Sales)

28-Feb Salaries Expense 6,000 Real Accounts

Utilities Expenses 3,000 Assest , Liabilities oar Capital k sare accounts real accounts hain.

Cash 9,000 In k balances next financial/fiscal year main carry forward hotay hain.

(To record Salaries and Utilities Expense)

15-M ar Cash 40,000

Sales 40,000

(To record Cash Sales)

31-M ar Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Apr Cash 40,000

Sales 40,000

(To record Cash Sales)

30-Apr Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-M ay Cash 40,000

Sales 40,000

(To record Cash Sales)

31-M ay Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Ju n Cash 40,000

Sales 40,000

(To record Cash Sales)

30-Ju n Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Ju l Cash 40,000

Sales 40,000

(To record Cash Sales)

31-Ju l Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Au g Cash 40,000

Sales 40,000

(To record Cash Sales)

31-Au g Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Sep Cash 40,000

Sales 40,000

(To record Cash Sales)

30-Sep Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Oct Cash 40,000

Sales 40,000

(To record Cash Sales)

31-Oct Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-N o v Cash 40,000

Sales 40,000

(To record Cash Sales)

30-N o v Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

15-Dec Cash 40,000

Sales 40,000

(To record Cash Sales)

31-Dec Salaries Expense 6,000

Utilities Expenses 3,000

Cash 9,000

(To record Salaries and Utilities Expense)

Example#05

Transaction data related to Asad Electronics as follows

1-Jan Asad's investment

Cash 1000

Bank 1500

2-Jan Paid cheque for Furniture 200

3-Jan Goods purchased from Mr.Karim 800

4-Jan Goods returned to Mr. Karim 50

5-Jan Sales to Mr. Asif 400

6-Jan Goods returned from Mr.Asif 30

7-Jan Wages paid 80

8-Jan Advance cash received for future sales 900

Required

1 Journalise the above transactions

2 Prepare Ledger accounts thereof.

Mr. Asad

General Journal

For the Month of Jan 20x1

Date Particulars Ref Debit Credit Chart of accounts

1-Jan Cash 1,000 1 Cash

Bank 1,500 2 Bank

Capital 2,500 3 Capital

(To record investment by Owner) 4 Furniture

2-Jan Furniture 200 5 Purchases

Bank 200 6 Purchases Returns

(To record Furniture Purchased) 7 A/P

3-Jan Purchases 800 8 A/R

A/P-Mr. Karim 800 9 Sales

(To record Credit Purchases) 10 Sales Returns

4-Jan A/P-Mr. Karim 50 11 Wages

Purchases Returns 50 12 Unearned Income

(To record Cash Sales)

5-Jan A/R-Mr. Asif 400

Sales 400

(To record credit Sales )

6-Jan Sales Returns 30

A/R-Mr. Asif 30

(To record Cash Sales)

7-Jan Wages Expenses 80

Cash 80

(To record Wages Expenses)

8-Jan Cash 900

Unearned Income 900

(To record unearned Income)

Example#06

Transaction data related to Sahil Traders as follows

1-Jan -22 Owner's investment

Cash 2000

Bank 3000

2-Jan -22 Paid cheque for Furniture 400

3-Jan -22 Goods purchased from Ms. Hina 1600

4-Jan -22 Goods returned to Ms. Hina 100

5-Jan -22 Sales to Ms. Ziba 800

6-Jan -22 Goods returned from Ms. Ziba 60

7-Jan -22 Wages paid 160

8-Jan -22 Advance cash received for future sales 1800

9-Jan -22 Goods taken by Owner for Personal use 300

10-Jan -22 Goods Destroyed by fire 100

11-Jan -22 School fees paid from Company Bank Accounts 150

12-Jan -22 Cheque received from Ms. Ziba after banking hours 300

13-Jan -22 Cheque paid to Ms. Hina 500

14-Jan -22 Chq received from Ms. Ziba deposited into bank 300

18-Jan -22 Chq of Ms.Ziba dishounered/bounced due to insufficient Balance

19-Jan -22 Advance chq paid against advertisment 400

Required

1 Journalise the above transactions

2 Prepare Ledger accounts thereof.

3 Trial Balance

Sahil Traders

General Journal

For the Month of Jan 2021

Date Particulars Ref Debit Credit

1-Jan -22 Cash 2,000

Bank 3,000

Capital 5,000

(To record investment by Owner)

2-Jan -22 Furniture 400

Bank 400

(To record Furniture Purchased)

3-Jan -22 Purchases 1,600

A/P Ms. Hina 1,600

(To record Credit Purchases)

4-Jan -22 A/P Ms. Hina 100

Purchases Returns 100

(To record Purchases returns)

5-Jan -22 A/R-Ms. Ziba 800

Sales 800

(To record credit Sales )

6-Jan -22 Sales Returns 60

A/R-Ms. Ziba 60

(To record Sales returns)

7-Jan -22 Wages Expenses 160

Cash 160

(To record Wages Expenses)

8-Jan -22 Cash 1,800

Unearned Income 1,800

(To record unearned Income)

9-Jan -22 Drawings 300

Purchases 300

(To record drawings )

10-Jan -22 fire loss 100

Purchases 100

(To record fire loss)

11-Jan -22 Drawings 150

Bank 150

(To record drawings by owner)

12-Jan -22 Cash 300

A/R-Ms. Ziba 300

(To record receipt of chq agaisnt A/R)

13-Jan -22 A/P Ms. Hina 500

Bank 500

(To record chq paid agaist payable)

14-Jan -22 Bank 300

Cash 300

(To record deposit of chq)

18-Jan -22 A/R-Ms. Ziba 300

Bank 300

(To record Dishounered Chq)

19-Jan -22 Prepaid Advertisement 400

Bank 400

(To record advance Chq against advertisment)

Example

Accounts Receivable- Mr. A 200

Sales 200

Purchases 300

Accounts Payable-Mr. B 300

Bank 100

Accounts Receivable- Mr. A 100

Accounts Payable-Mr. B 150

Bank 150

Example#07

Ms. Ozita Started a Trading Business, details of the same are as follows

1-M ay Owner's Investment

Cash 1,000

Bank 1,000

2-M ay Cash Paid for production plant 40

3-M ay Goods Purchased for resale from Ms. Anum 400

4-M ay Goods Sold to Ms. Hina 700

5-M ay Cheque paid to Ms. Anum 200

6-M ay Cheque Received from Ms. Hina 500

7-M ay Salaries Paid in Cash 80

8-M ay Finance Cost paid in Cash 10

9-M ay Commission Income in cash 30

Required

1 Journalise

2 Ledger

3 Trial Balance

4 Statement of Profit and Loss

5 Statement of Financial Position

Ms. Ozita

General Journal

For the Month of May 20x1

Date Particulars Ref Debit Credit

1-M ay Cash 1,000

Bank 1,000

Capital 2,000

(To record investment by Owner)

2-M ay Plant 40

Cash 40

To record purchase plant

3-M ay Purchases 400

A/P Ms. Anum 400

(To record Credit Purchases)

4-M ay A/R Ms. Hina 700

Sales 700

(To record Credit Sales)

5-M ay A/P Ms. Anum 200

Bank 200

(To record cheque paid to Ms. anum )

6-M ay Bank 500

A/R Ms. Hina 500

(To record cheque recived from Ms Hina)

7-M ay Wages Expenses 80

Cash 80

(To record Wages Expenses)

8-M ay Finance Cost 10

Cash 10

(To record finance cost )

9-M ay Cash 30

Commission Income 30

(To record comission Income)

Example#08

Transactions details of Usama Electronics Pvt Ltd

1-Au g Investment by Mr. Usama

Cash 60,000

2-Au g Opened Bank Account with company name and Deposited 40,000

3-Au g Office Equipment Purchased and paid Chq 3,000

4-Au g Purchased Merchandise for sale from Mr. Ahsan

5-Au g Sold good to Mr. Kashif

6-Au g Returns to Mr. Ahsan

7-Au g Returns from Mr. Kashif

8-Au g Repair Expeses paid

9-Au g Cheque Received from Mr. Kashif

Cash discount

Credit discount

Cheque received after banking hours

A/R-MR. A 1000

SALES 1000

Cash 500

A/R-MR. A 500

Bank 500

Cash 500

You might also like

- Exercises and Problem Debit 2-A May 2 CashDocument16 pagesExercises and Problem Debit 2-A May 2 CashRenz MoralesNo ratings yet

- Question No 1: Cash Capital StockDocument13 pagesQuestion No 1: Cash Capital StockBushra NazNo ratings yet

- AccountingDocument5 pagesAccountingPearl RagasajoNo ratings yet

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocument27 pagesBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1No ratings yet

- POA Assignment Week 4Document16 pagesPOA Assignment Week 4Rara Rarara30No ratings yet

- ACCT1101 Wk3 Tutorial 2 SolutionsDocument7 pagesACCT1101 Wk3 Tutorial 2 SolutionskyleNo ratings yet

- Tutorial Work With SolutionsDocument73 pagesTutorial Work With SolutionsAlison Mokla100% (1)

- Acctg ConstantinoDocument6 pagesAcctg ConstantinoKyla Lyn OclaritNo ratings yet

- Financial Statements Part BDocument29 pagesFinancial Statements Part Bhaleemafaizann2008No ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Journalizing Exercise:: Date Debit (DR) Credit (CR) ParticularsDocument1 pageJournalizing Exercise:: Date Debit (DR) Credit (CR) ParticularsCamille PasionNo ratings yet

- Ca Foundation Lacture 1 ppt-1Document23 pagesCa Foundation Lacture 1 ppt-1idealNo ratings yet

- Repair Phone LTD.: Date Particulars Debit CreditDocument9 pagesRepair Phone LTD.: Date Particulars Debit CreditShuvo ChowdhuryNo ratings yet

- Tutorial Week 5Document7 pagesTutorial Week 5Mai HoàngNo ratings yet

- Unit Iv - The Bookkeeping Cycle - Part 1 - Activities/AssessmentsDocument25 pagesUnit Iv - The Bookkeeping Cycle - Part 1 - Activities/AssessmentsareumNo ratings yet

- Tresha Borja 2Document11 pagesTresha Borja 2Keziah ChristineNo ratings yet

- Excel Chapter 6Document49 pagesExcel Chapter 6Rafia TasnimNo ratings yet

- Solution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsDocument15 pagesSolution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsmeepxxxNo ratings yet

- Running Head: Recording Business Transaction 1: Name of The Student Name of The University Assignment Title DateDocument8 pagesRunning Head: Recording Business Transaction 1: Name of The Student Name of The University Assignment Title DateSimran LakhwaniNo ratings yet

- Amaliya Quiz Tutor Finacc 1 Week 2Document8 pagesAmaliya Quiz Tutor Finacc 1 Week 2Amaliya MalikovaNo ratings yet

- Exercise Chap 2 NLKTDocument10 pagesExercise Chap 2 NLKTalexnguyen21007No ratings yet

- BT kế toán quốc tếDocument58 pagesBT kế toán quốc tếUyên Nguyễn Hoàng ThanhNo ratings yet

- Accounting Practice SetDocument8 pagesAccounting Practice SetZyn Marie OccenoNo ratings yet

- Accounting Practice SetDocument8 pagesAccounting Practice SetZyn Marie OccenoNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper - 1 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Tugas Kelompok 3 Pengantar AkuntansiDocument4 pagesTugas Kelompok 3 Pengantar AkuntansiYuni ArtaNo ratings yet

- Chapter 02-Acc 111-KuDocument5 pagesChapter 02-Acc 111-KushiieeNo ratings yet

- WEALTH STATEMENTDocument3 pagesWEALTH STATEMENTSaira KhalilNo ratings yet

- Accounting LessonsDocument2 pagesAccounting Lessonsmaryam nabaNo ratings yet

- Accounting LessonsDocument2 pagesAccounting Lessonsmaryam nabaNo ratings yet

- Shs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalDocument20 pagesShs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalKrize Colene dela CruzNo ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Mr. Addams' Financial StatementDocument10 pagesMr. Addams' Financial StatementKim KoalaNo ratings yet

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- Assignment 2465 - 02 PDFDocument2 pagesAssignment 2465 - 02 PDFAhsan KamranNo ratings yet

- Cash Flow Statement: Final ExamDocument4 pagesCash Flow Statement: Final ExamAiman Abdul QadirNo ratings yet

- CH 09Document69 pagesCH 09Jubaida Naznin Chowdhury JefrinNo ratings yet

- Trial Balance Lesson NotesDocument16 pagesTrial Balance Lesson NotesJada ThompsonNo ratings yet

- Accounting NotesDocument4 pagesAccounting NotesGhulam MustafaNo ratings yet

- Chapter 12: Special Journal EntriesDocument6 pagesChapter 12: Special Journal EntriessriNo ratings yet

- Exercises AccountingTransactionsDocument4 pagesExercises AccountingTransactionsRuneet Kaur AroraBD21036No ratings yet

- Business-Transactions-and-Their-Analysis-as-Applied-to-Service-BusinessDocument57 pagesBusiness-Transactions-and-Their-Analysis-as-Applied-to-Service-BusinessRhona Primne ServañezNo ratings yet

- Assignment Chap 8 Torres, Erica Bianca B111Document6 pagesAssignment Chap 8 Torres, Erica Bianca B111Erica Bianca TorresNo ratings yet

- Brief Exercises PDFDocument6 pagesBrief Exercises PDFRamzan AliNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument63 pagesAccounting For Receivables: Learning ObjectivesBayaderNo ratings yet

- Sample worksheet K204050266 P3.5Document16 pagesSample worksheet K204050266 P3.5Trâm Mai Thị ThùyNo ratings yet

- T Ran Sak Sijo U RN Alp O Stin G T Rial B Alan Ce A D Ju Stin G E N Tries A D Ju Sted Trial B Alan Cef in An Cial Statem en TC Lo Sin GDocument5 pagesT Ran Sak Sijo U RN Alp O Stin G T Rial B Alan Ce A D Ju Stin G E N Tries A D Ju Sted Trial B Alan Cef in An Cial Statem en TC Lo Sin GAnggelia TiyantiNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Mr. Addams' EditingDocument15 pagesMr. Addams' EditingKim KoalaNo ratings yet

- Basic AccountingDocument11 pagesBasic AccountingFarshad IslamNo ratings yet

- ACC 201 Final Project WorkbookDocument40 pagesACC 201 Final Project WorkbookSwapan Kumar SahaNo ratings yet

- X Company Financial ReportsDocument21 pagesX Company Financial ReportsChristian Gerard Eleria ØSCNo ratings yet

- Chapter 2 - The Recording Process Practice SolutionsDocument13 pagesChapter 2 - The Recording Process Practice SolutionsNguyễn Minh ĐứcNo ratings yet

- Management Accounting I: Debarati@xlri - Ac.inDocument22 pagesManagement Accounting I: Debarati@xlri - Ac.inSimran JainNo ratings yet

- Summarizing (Trial Balance) : (Go Through The Reference Books For Details)Document6 pagesSummarizing (Trial Balance) : (Go Through The Reference Books For Details)sujitNo ratings yet

- General Journal: Date Particulars PR Debit CreditDocument5 pagesGeneral Journal: Date Particulars PR Debit CreditRicky Cordova SierraNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Sociolinguistics complete mid term lecture notes BS5Document24 pagesSociolinguistics complete mid term lecture notes BS5KingNo ratings yet

- Ice Candy Man SummaryDocument15 pagesIce Candy Man SummaryUsama Javed100% (4)

- SociolinguisticsDocument22 pagesSociolinguisticsUbaid NadeemNo ratings yet

- Lecture 4 2Document9 pagesLecture 4 2Sameen JavedNo ratings yet

- Aristotle PoeticsDocument5 pagesAristotle Poeticsusama aliNo ratings yet

- Lecture 5Document7 pagesLecture 5Sameen JavedNo ratings yet

- How Is A Paragraph StructuredDocument2 pagesHow Is A Paragraph StructuredKingNo ratings yet

- Qurban Ali, Bridging - ES5 AssignmentDocument14 pagesQurban Ali, Bridging - ES5 AssignmentKingNo ratings yet

- Company Profile ToureziaDocument22 pagesCompany Profile ToureziaIstato HudayanaNo ratings yet

- Agenda DP Consultation Visit - Nov 2013Document2 pagesAgenda DP Consultation Visit - Nov 2013api-236337064No ratings yet

- OSHA3871Document3 pagesOSHA3871SHANE ANGEL BORBENo ratings yet

- ARTS8 Q4 MOD2Document32 pagesARTS8 Q4 MOD2eoghannolascoNo ratings yet

- ArmeenAhuja AyushiJain 1064 PoCoLitDocument7 pagesArmeenAhuja AyushiJain 1064 PoCoLitpankhuriNo ratings yet

- Sharing Economy Research on Uber, Airbnb ImpactsDocument14 pagesSharing Economy Research on Uber, Airbnb ImpactsChung NguyenNo ratings yet

- EN Flower Valley Shawl by Joanna GrzelakDocument20 pagesEN Flower Valley Shawl by Joanna GrzelaklunajakovNo ratings yet

- Unimac Technical Specifications UY180 UY240 UY280Document2 pagesUnimac Technical Specifications UY180 UY240 UY280mairimsp2003No ratings yet

- Archean Mafic Rocks and Their GeochemistryDocument12 pagesArchean Mafic Rocks and Their GeochemistrygajendraNo ratings yet

- THE DIGESTIVE SYSTEM 22 (Autosaved)Document141 pagesTHE DIGESTIVE SYSTEM 22 (Autosaved)Jairus ChaloNo ratings yet

- 500 Chess Exercises Special Mate in 1 MoveDocument185 pages500 Chess Exercises Special Mate in 1 MoveRégis WarisseNo ratings yet

- TurbineDocument14 pagesTurbineArjit GoswamiNo ratings yet

- Measuring Effectiveness of Airtel's CRM StrategyDocument82 pagesMeasuring Effectiveness of Airtel's CRM StrategyChandini SehgalNo ratings yet

- Individual and Market Demand: Chapter OutlineDocument57 pagesIndividual and Market Demand: Chapter OutlineAbdullahiNo ratings yet

- Analysis Report Bhuwan BhaskarDocument29 pagesAnalysis Report Bhuwan BhaskarKshitiz LamichhaneNo ratings yet

- Billy: Bookcase SeriesDocument4 pagesBilly: Bookcase SeriesDImkaNo ratings yet

- Rat King rules the sewersDocument1 pageRat King rules the sewerstartartartar80No ratings yet

- Peritonitis GuiaDocument28 pagesPeritonitis GuiaAndrea ClaudieNo ratings yet

- Air Asia Final ProjectDocument59 pagesAir Asia Final Projectmanaswini sharma B.G.No ratings yet

- Revised Revenue Code of Puerto Galera 2010Document157 pagesRevised Revenue Code of Puerto Galera 2010Jesselle MamintaNo ratings yet

- Nyeri County Youth PolicyDocument59 pagesNyeri County Youth Policyomondi bonfaceNo ratings yet

- Substation - NoaraiDocument575 pagesSubstation - NoaraiShahriar AhmedNo ratings yet

- Project Report TemplateDocument9 pagesProject Report TemplatePriyasha BanerjeeNo ratings yet

- Project ProposalDocument10 pagesProject ProposalMuhammad Ammar SohailNo ratings yet

- Minutes of 7th AC MeetingDocument4 pagesMinutes of 7th AC Meetingganesh15100% (1)

- Client CounsellingDocument9 pagesClient CounsellingApurva SukantNo ratings yet

- Inventory Costs and ControlDocument7 pagesInventory Costs and ControlEden Dela CruzNo ratings yet

- Comparison of Homeopathic MedicinesDocument14 pagesComparison of Homeopathic MedicinesSayeed AhmadNo ratings yet

- Top 10 Misconceptions About The Catholic Church - Listverse PDFDocument15 pagesTop 10 Misconceptions About The Catholic Church - Listverse PDFMaryvincoNo ratings yet

- Stress-Strain Behavior Concrete Confined Overlapping Hoops Strain Rates PDFDocument15 pagesStress-Strain Behavior Concrete Confined Overlapping Hoops Strain Rates PDFMaqMaikNo ratings yet