Professional Documents

Culture Documents

Valuasi Perusahaan

Uploaded by

Maya Andriani A HarryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuasi Perusahaan

Uploaded by

Maya Andriani A HarryCopyright:

Available Formats

VALUASI PERUSAHAAN

Pelatihan VCO, 21 -23 Juni 2016

Dit. Pengembangan Anak Usaha

PT Bahana Artha Ventura

Outline

Pendahuluan

Free Cash Flow

Cost of Capital

Continuing Value

Kesimpulan

Dit. PAU - PT Bahana Artha Ventura 2

Pendahuluan

Dit. PAU - PT Bahana Artha Ventura 4

Value …...

Value perusahaan ≠

Laba “akuntansi”

Kinerja masa lalu

Value perusahaan ≈

Dampak business strategy

Proyeksi pertumbuhan

Masa depan

Nilai bersedia dibayar oleh Investor

Face value ● book value ● market value

Dit. PAU - PT Bahana Artha Ventura 5

Value come from…

Dit. PAU - PT Bahana Artha Ventura 6

Metode Valuasi

Metode Valuasi

Asset Based Cash Flow Relative Contingent Claim

Liquidation Value Firm Models Patent

Undeveloped

Replacement Cost Equity Models

Reserves

Dit. PAU - PT Bahana Artha Ventura 7

Discounted Cash Flow (DCF)

Nilai perusahaan dilihat dari present value dari arus kas masa

yang akan datang pada rate tertentu yang mencerminkan

tingkat resiko dari arus kas tsb.

Hal-2 yang harus diperhatikan dalam DCF :

Bagaimana memproyeksikan arus kas masa depan

Berapa discount rate yang sesuai

Berapa panjang proyeksi arus kas harus dibuat

Dit. PAU - PT Bahana Artha Ventura 8

Framework of DCF

Perusahaan diasumsikan

tumbuh konstan

Continuing Value

CF1 CF2 CF3 CF4 ……………………. CFn CFn+1 CFn+2 …….

∞

Panjang periode proyeksi

Value of Firm

or

Value of Equity

Dit. PAU - PT Bahana Artha Ventura 9

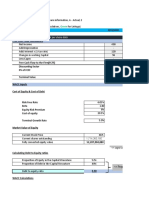

Valuation - example

Free Cash Discount Factor

Tahun PV

Flow @ 11,5%

1 2017 85 0.8969 76

2 2018 110 0.8044 88

3 2019 121 0.7214 87

4 2020 133 0.6470 86

5 2021 146 0.5803 85

6 2022 161 0.5204 84

7 2023 177 0.4667 83

8 2024 195 0.4186 82

9 2025 214 0.3754 80

10 2026 235 0.3367 79

Continuing Value 4,583 0.3367 1,543

Value of operations 2,373

Value of debt (254)

Equity Value 2,119

Dit. PAU - PT Bahana Artha Ventura 10

Value of Equity

After-tax operating earnings of company plus non-

Free Cash Flow cash charges less investment in working capital,

property, plant and equipment, and other assets.

Discounted value of expected future free cash flow

Value of operations at a discount rate which reflect the opportunity cost

to all the capital providers (weighted).

Present value of the cash flow to the debtholders

Value of debt discounted at a certain rate. In practice, only debt

outstanding on the valuation date must be valued.

Value of equity Value of operations less value of debt

Dit. PAU - PT Bahana Artha Ventura 11

Dit. PAU - PT Bahana Artha Ventura 12

Free Cash Flow

Value of Firm or Equity

Dit. PAU - PT Bahana Artha Ventura 14

Firm vs Equity Valuation

Debt

Firm method :

• Discounting expected future cash

flow available to equity & debt

holders

Firm

• Discounted at a rate of weighted

average cost of capital (WACC)

• Value of equity’s company obtained

by subtracting debt value to firm Equity method :

value • Discounting expected future

Equity cash flow available to equity

holders

• Discounted at a rate of cost of

equity

Dit. PAU - PT Bahana Artha Ventura 15

Firm Valuation

Cash flow :

• After-tax cash flow from operating assets

available to share & debt holders

• Exclude any financing-related cash flow Perusahaan diasumsikan

(interest expense, repayment debt, dividends, tumbuh konstan

repurchase stock)

Continuing Value

CF1 CF2 CF3 CF4 ……………………. CFn CFn+1 CFn+2 …….

∞

Discount rate :

Value of Firm • Reflect the opportunity cost to all the capital

providers (weighted - WACC)

• Capital providers :

• Share holder → cost of equity

• Debt holder → borrowing rate

Dit. PAU - PT Bahana Artha Ventura 16

Equity Valuation

Cash flow :

• Cash flow to equity holder only

• Include cash flow from operating assets and Perusahaan diasumsikan

debt financing-related cash flow tumbuh konstan

Continuing Value

CF1 CF2 CF3 CF4 ……………………. CFn CFn+1 CFn+2 …….

∞

Discount rate → Cost of Equity

Value of Equity

Dit. PAU - PT Bahana Artha Ventura 17

NOPLAT (Net Operating Profit less Adjusted Taxes)

Total after-tax operating profit

NOPLAT generated by invested capital

available to all financial investor

+

Free cash flow Non-cash operating expenses Depreciation expenses

-

Include :

• Increase in working capital

Investment in Invested Capital • Capital expenditures

• Investment in goodwill

• Increase in net other assets

Free cash flow = NOPLAT - Net Investment

Dit. PAU - PT Bahana Artha Ventura 18

Free Cash Flow (1)

Accountant’s report

Accountant's Balance Sheet Y-1 Y-2 Accountant's Income Statement Y-2

Assets Revenues 1,000

Inventory 200 225 Operating Cost (700)

Net FA 300 350 Depreciation (20)

Equity Investments 15 25 Operating Profit 280

Total Assets 515 600

Interest (20)

Liabilities & Equity Non-operating income 4

Accounts payable 125 150 Earnings before taxes 264

Interest-bearing debt 225 200

Common stock 50 50 Taxes 25% (66)

R/E 115 200 Net Income 198

Total Liabilities & Equity 515 600

Accountant's Retained Earnings Y-2

R/E at beginning of year 115

Net Income 198

Dividends (113)

R/E at end of year 200

Dit. PAU - PT Bahana Artha Ventura 19

Free Cash Flow (2)

Invested Capital

Accountant's Balance Sheet Y-1 Y-2 Invested Capital Y-1 Y-2

Assets Assets

Inventory 200 225 Inventory 200 225

Net FA 300 350 Accounts payable (125) (150)

Equity Investments 15 25 Operating working capital 75 75

Total Assets 515 600

Net FA 300 350

Liabilities & Equity Invested Capital 375 425

Accounts payable 125 150

Interest-bearing debt 225 200 Interest-bearing debt 225 200

Common stock 50 50 Common stock 50 50

R/E 115 200 R/E 115 200

Total Liabilities & Equity 515 600 390 450

Equity Investments (non-operating assets) (15) (25)

Invested Capital 375 425

Dit. PAU - PT Bahana Artha Ventura 20

Free Cash Flow (3)

Re-organize accountant’s report

Accountant's Income Statement Y-2 Free Cash Flow from Operations Y-2

Revenues 1,000 EBIT 280

Operating Cost (700) Taxes on EBIT 25% (70)

Depreciation (20) NOPLAT 210

Operating Profit 280

Depreciation + 20

Interest (20) Gross Cash Flow 230

Non-operating income 4

Earnings before taxes 264 Increase in Working Capital -

Capital Expenditures 70

Taxes 25% (66) Investment in goodwill -

Net Income 198 Increase in net other assets -

Gross Investment 70

Free Cash Flow from Operations 160

Subtract investments in operating

items from gross cash flow

Dit. PAU - PT Bahana Artha Ventura 21

Free Cash Flow (4)

Investment in operating items

Increase in Working Capital Y-1 Y-2 Capital Expenditures Y-1 Y-2

Total C/R Assets 200 225 Net Fixed Assets 300 350

Less Non Operating Assets - - Increase Net Fixed Assets 50

Operating C/R Assets 200 225 Depreciation expense + 20

Capital Expenditures 70

Total Short-term Liabilities 125 150

Less Interest-bearing Liabilities - -

Short-term Liabilites 125 150 Investment in goodwill Y-2

Goodwill - book value - -

Working Capital 75 75 Increase goodwill - book value -

Increase in Working Capital - Goodwill amortization -

Investment in goodwill -

Dit. PAU - PT Bahana Artha Ventura 22

Free Cash Flow (5)

Check free cash flow

Free Cash Flow from Operations 160 Financial Flow Y-2

Decrease in debt + 25

Non-operating cash flow After-tax interest expense + 15

After-tax non-operating income 25% 3 Dividends + 113

Decrease (increase) in non-operating assets (10) Share repurchase + -

Non-operating cash flow (7) Total financial flow 153

Total cash flow before financing 153

check

Include non-operating income/expenses and

investment in non-operating assets

Dit. PAU - PT Bahana Artha Ventura 23

Dit. PAU - PT Bahana Artha Ventura 24

Dit. PAU - PT Bahana Artha Ventura 25

Cost of Capital

Cost of capital

Must be consistent with the overall valuation approach → firm

method or equity method

Comprise cost of all sources of capital

Be computed after corporate tax, since the free cash-flow is stated

after tax

Include the company’s systematic risk

Use market value for each financing element

Be subject to change across the forecast period (change in inflation,

systematic risk, or capital structure)

Dit. PAU - PT Bahana Artha Ventura 27

WACC (weighted average cost of capital)

Source of Target Cost of Tax After-tax Weighted

capital weight capital cost average

Debt 31.5% 6.8% 37.6% 4.2% 1.3%

Equity 68.5% 10.4% 10.4% 7.1%

WACC 8.5%

Cost of equity ks = rf + (rm x beta)

Ks : cost of equity

Rf : Risk-free rate of return

Rm : Risk premium

Beta : Systematic risk of equity

Cost of debt :

• Calculated as a after-tax cost → tax shield from

interest expense

Dit. PAU - PT Bahana Artha Ventura 28

Continuing Value

Continuing Value

Continuing Value

CF1 CF2 CF3 CF4 ……………………. CFn CFn+1 CFn+2 …….

∞

Periode proyeksi

Continuing value or terminal value :

• Future value pada tahun ke-n dari serangkaian (∞) free

cash fow setelah masa proyeksi

• Perusahaan diasumsikan exist (going concern)

• Tidak berlaku untuk asumsi perusahaan yang akan

dilikuidasi atau sejenisnya

• Cara perhitungannya harus hati-hati karena memiliki

porsi yang cukup besar dari total value

Dit. PAU - PT Bahana Artha Ventura 30

Portion of CV

Free Cash Discount Factor

Tahun PV

Flow @ 11,5%

140%

1 2017 85 0.8969 76 Period cash flow (8 yr)

2 2018 110 0.8044 88 120% continuing value

3 2019 121 0.7214 87

100%

4 2020 133 0.6470 86

5 2021 146 0.5803 85 80%

6 2022 161 0.5204 84 830

60%

7 2023 177 0.4667 83

8 2024 195 0.4186 82 40%

9 2025 214 0.3754 80

20%

10 2026 235 0.3367 79

Continuing Value 4,583 0.3367 1,543 65% 0%

Tobacco Sporting Skin care High tech

Value of operations 2,373 -20% goods

Value of debt (254)

Equity Value 2,119 -40%

Dit. PAU - PT Bahana Artha Ventura 31

Metode CV

Long explicit forecast

Memperpanjang periode proyeksi sehingga meniadakan continuing

value

Growing free cash flow perpetuity

FCFn+1 FCFn+1 : normalized free cash flow 1 th setelah

Continuing value = masa proyeksi

WACC - g g : growth rate setelah masa proyeksi

Value driver formula

NOPLATn+1 : normalized NOPLAT, 1 th setelah

NOPLATn+1 ( 1 - g/r)

Continuing value = masa proyeksi

WACC - g r : expected rate of return terhadap

net new investment

( NOPLATn+2 - NOPLATn+1 )

r=

Net new investmentn

Dit. PAU - PT Bahana Artha Ventura 32

Dit. PAU - PT Bahana Artha Ventura 33

Dit. PAU - PT Bahana Artha Ventura 34

Kesimpulan

Frame work of valuation

DCF – valuation of firm

Analisa past Komponen Proyeksi struktur Normalized Present value dari

performance FCF kapital FCF FCF & CV

Proyeksi Free cash Continuing

WACC Equity Value

Keuangan flow Value

Strategi bisnis & Risk-free rate & Evaluasi periode

Evaluasi hasil

assumptions premium proyeksi

Dit. PAU - PT Bahana Artha Ventura 36

Midyear factor

CF1 CF2

1

Discount factor, PV =

(1 + WACC)n

CF1 CF2

1

Discount factor, PV =

(1 + WACC)(n - 0.5)

Midyear factor

Dit. PAU - PT Bahana Artha Ventura 37

Degree of Complexity

Listed Company

• Track Record

• Reliable data gathering

Private Company • Comparable company

Start-up Company More complicated analysis

Dit. PAU - PT Bahana Artha Ventura 39

EBITA for NOPLAT

Why use EBITA and not EBITDA? When a company purchases a physical asset such as

equipment, it capitalizes the asset on the balance sheet and depreciates the asset over

its lifetime. Since the asset loses economic value over time, depreciation must be

included as an operating expense when determining NOPLAT.

Why use EBITA and not EBIT? After all, the same argument could be made for the

amortization of acquired intangibles: They, too, have fixed lives and lose value over time.

But the accounting for intangibles differs from the accounting for physical assets. Unlike

capital expenditures, organic investment in intangibles such as brands are expensed and

not capitalized. Thus, when the acquired intangible loses value and is replaced through

further investment, the reinvestment is expensed, and the company is penalized twice:

once through amortization and a second time through reinvestment. Using EBITA avoids

double-counting amortization expense in this way.

Dit. PAU - PT Bahana Artha Ventura 40

You might also like

- Contract of Employment For Call Center AgentDocument10 pagesContract of Employment For Call Center Agentbantucin davooNo ratings yet

- Study Case StarbucksDocument8 pagesStudy Case StarbucksAZRUL ASWAD BIN A. KARIM MoeNo ratings yet

- Insur XDocument15 pagesInsur XJuan CumbradoNo ratings yet

- Pharma and Project ManagementDocument8 pagesPharma and Project ManagementAlexandar123100% (1)

- Frameworks For Valuation: Adjusted Present Value (APV) : InstructorsDocument14 pagesFrameworks For Valuation: Adjusted Present Value (APV) : InstructorsRimpy SondhNo ratings yet

- Valuation of Banks: Garima, Jeetesh, Laxmi, NilanjanaDocument30 pagesValuation of Banks: Garima, Jeetesh, Laxmi, NilanjanaRonak ChoudharyNo ratings yet

- TV18 BroadcastDocument30 pagesTV18 Broadcastrishabh jainNo ratings yet

- DCF Valuation Course Notes 365 Financial AnalystDocument12 pagesDCF Valuation Course Notes 365 Financial AnalystArice BertrandNo ratings yet

- Discounted Cash FlowDocument36 pagesDiscounted Cash Flowapi-3838939100% (12)

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Ias 19 Employee BenefitsDocument21 pagesIas 19 Employee BenefitszulfiNo ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- Damodaran - Discounted Cash Flow ValuationDocument198 pagesDamodaran - Discounted Cash Flow ValuationYến NhiNo ratings yet

- Firm Valuation: A Summary: P.V. ViswanathDocument23 pagesFirm Valuation: A Summary: P.V. ViswanathLewmas UyimisNo ratings yet

- UntitledDocument8 pagesUntitledPravin AmirthNo ratings yet

- Class 3 Part 2Document12 pagesClass 3 Part 2Lehar GabaNo ratings yet

- 1 Valpacket1spr23Document344 pages1 Valpacket1spr23parenteNo ratings yet

- Basics PDFDocument19 pagesBasics PDFGriffith GohNo ratings yet

- Intrinsic Valuation - Aswath Damodaran PDFDocument19 pagesIntrinsic Valuation - Aswath Damodaran PDFramsiva354No ratings yet

- Valuation Adv SummaryDocument51 pagesValuation Adv SummaryLewmas UyimisNo ratings yet

- EVADocument34 pagesEVAMuhammad GulzarNo ratings yet

- S3 - DCF and Discount RatesDocument33 pagesS3 - DCF and Discount RatesGustavoNo ratings yet

- Corporate ValuationDocument353 pagesCorporate ValuationShashank SinglaNo ratings yet

- Valpacket 1 SPR 20Document360 pagesValpacket 1 SPR 20set_hitNo ratings yet

- M/s. XYZ: About Your Valuation ReportDocument16 pagesM/s. XYZ: About Your Valuation ReportBhushan GowdaNo ratings yet

- 20007Document5 pages20007Archana J RetinueNo ratings yet

- AirThread Class 2020Document21 pagesAirThread Class 2020Son NguyenNo ratings yet

- 2018 - Session11 - 12 FSA - PGP - SentDocument40 pages2018 - Session11 - 12 FSA - PGP - SentArty DrillNo ratings yet

- Valpacket 1 SPR 21Document369 pagesValpacket 1 SPR 21luvie melatiNo ratings yet

- Cash Flows and Discount RatesDocument34 pagesCash Flows and Discount RatesElliNo ratings yet

- Fcffginzu - Xls Using The Valuation SpreadsheetDocument13 pagesFcffginzu - Xls Using The Valuation SpreadsheetMuhammad Zeeshan SaleemNo ratings yet

- Module 2 - Slides - Introducing Financial StatementsDocument12 pagesModule 2 - Slides - Introducing Financial StatementsElizabethNo ratings yet

- Valuation & Macroeco Finance Session - 131016Document59 pagesValuation & Macroeco Finance Session - 131016Vivek AnandanNo ratings yet

- Estimating Cash Flows: L RamprasathDocument4 pagesEstimating Cash Flows: L RamprasathMayank RanjanNo ratings yet

- Full DCF ValuationDocument376 pagesFull DCF ValuationNinad BhatkarNo ratings yet

- Financial Ratio AnalyisisDocument16 pagesFinancial Ratio AnalyisisNeil Jasper CorozaNo ratings yet

- Applicability of Free Cash Flow To Equity Model For Equity Valuation Evidence From Pakistan Tobacco Company LimitedDocument15 pagesApplicability of Free Cash Flow To Equity Model For Equity Valuation Evidence From Pakistan Tobacco Company LimitedTaleya FatimaNo ratings yet

- Capital Budgeting: Dr. Akshita Arora IBS-GurgaonDocument24 pagesCapital Budgeting: Dr. Akshita Arora IBS-GurgaonhitanshuNo ratings yet

- Hindu Predictive Astrology of B V RamanDocument353 pagesHindu Predictive Astrology of B V RamanGauravNo ratings yet

- Chapter 6Document22 pagesChapter 6Apex TechnologyNo ratings yet

- Frameworks For Valuation: Enterprise DCF and Discounted Economic Profit ModelsDocument22 pagesFrameworks For Valuation: Enterprise DCF and Discounted Economic Profit ModelsLuismy VacacelaNo ratings yet

- New Changes in Company Balance SheetDocument12 pagesNew Changes in Company Balance SheetSBMG & AssociatesNo ratings yet

- Heritage Foods CaseDocument14 pagesHeritage Foods CasePriya DurejaNo ratings yet

- Assessing Cash Returned To StockholdersDocument37 pagesAssessing Cash Returned To StockholdersJinzhi FengNo ratings yet

- Discounted Cash Flow Valuation SlidesDocument260 pagesDiscounted Cash Flow Valuation Slidesgambino03100% (2)

- 03 DCF Valuation M&ADocument47 pages03 DCF Valuation M&AI DNo ratings yet

- AkuisiDocument33 pagesAkuisiAndreas RendraHadiNo ratings yet

- FMCF - Unit 2Document20 pagesFMCF - Unit 2Deepak VermaNo ratings yet

- Reviewer Financial ManagementDocument7 pagesReviewer Financial Managementldeguzman210000000953No ratings yet

- Val Indonesia 2014Document151 pagesVal Indonesia 2014Carlos Jesús Ponce AranedaNo ratings yet

- Week 3Document61 pagesWeek 3王振權No ratings yet

- 3 Valsession3Document38 pages3 Valsession3parenteNo ratings yet

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- Name ID: Md. Samit Hossain Md. Ibna Alam Refat Md. Rahmatullah Tanvir Shaike RahmanDocument19 pagesName ID: Md. Samit Hossain Md. Ibna Alam Refat Md. Rahmatullah Tanvir Shaike RahmanAnjan kunduNo ratings yet

- Valuation Concepts and Methods: Chapter 1: IntroductionDocument9 pagesValuation Concepts and Methods: Chapter 1: Introductionharley_quinn11No ratings yet

- Capital Budgeting & Cost Analysis: OutlineDocument15 pagesCapital Budgeting & Cost Analysis: OutlineLưu Hồng Hạnh 4KT-20ACNNo ratings yet

- ACC314 Business Finance Management Resit Answers (SEPT) R 19-20Document8 pagesACC314 Business Finance Management Resit Answers (SEPT) R 19-20Rukshani RefaiNo ratings yet

- Management AccountingDocument101 pagesManagement AccountingKartikNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Discounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingFrom EverandDiscounted Cash Flow Demystified: A Comprehensive Guide to DCF BudgetingNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- Muthoot Finance LTDDocument17 pagesMuthoot Finance LTDTushar Dabhade33% (6)

- Partnership DissolutionDocument5 pagesPartnership DissolutionKathleenNo ratings yet

- Nanosonics-AR2020 Web PDFDocument108 pagesNanosonics-AR2020 Web PDFjo moNo ratings yet

- Special Studies MarketingDocument85 pagesSpecial Studies MarketingUmesh JagushteNo ratings yet

- Material Handling and PackagingDocument30 pagesMaterial Handling and PackagingShivkarVishalNo ratings yet

- Lean Manufacturing BasicsDocument29 pagesLean Manufacturing Basicssunilkhairnar38No ratings yet

- Scopia Capital Presentation On Forest City Realty Trust, Aug. 2016Document19 pagesScopia Capital Presentation On Forest City Realty Trust, Aug. 2016Norman OderNo ratings yet

- Partnership AgreementDocument6 pagesPartnership AgreementDevendren SathasivamNo ratings yet

- Customer Relationship Management EbookDocument371 pagesCustomer Relationship Management EbookShubham kumar100% (3)

- CTM Macau v6 - May 17Document4 pagesCTM Macau v6 - May 17gopiv2020No ratings yet

- Centralized vs. Decentralized Organizational Structure - ImpDocument2 pagesCentralized vs. Decentralized Organizational Structure - ImpRavi Kumar RabhaNo ratings yet

- TQM by Dale H. Besterfield Et Al (066-095)Document30 pagesTQM by Dale H. Besterfield Et Al (066-095)Zamien edanNo ratings yet

- KPIT Technologies (KPISYS) : Optimistic RecoveryDocument11 pagesKPIT Technologies (KPISYS) : Optimistic RecoverygirishrajsNo ratings yet

- Clelland (2014) The Core of The Apple Dark Value and Degrees ofDocument31 pagesClelland (2014) The Core of The Apple Dark Value and Degrees ofTales FernandesNo ratings yet

- Corpuz, Aily F-Fm2-2-Midterm Practice ProblemDocument5 pagesCorpuz, Aily F-Fm2-2-Midterm Practice ProblemAily CorpuzNo ratings yet

- 24-Hour Call Center: 16221 For Overseas Callers: +880 2 55668056Document8 pages24-Hour Call Center: 16221 For Overseas Callers: +880 2 55668056Number ButNo ratings yet

- Manual Return 2023Document28 pagesManual Return 2023arsalanghuralgtNo ratings yet

- Week 2 Lecture SlidesDocument32 pagesWeek 2 Lecture SlidesMike AmukhumbaNo ratings yet

- Performance Evaluation and CompensationDocument34 pagesPerformance Evaluation and CompensationarunprasadvrNo ratings yet

- Intro To IADocument29 pagesIntro To IAWan Nur MahfuzahNo ratings yet

- Incident Management TrainingDocument30 pagesIncident Management TrainingUsman Hamid100% (1)

- Operations On Functions Worksheet 6Document4 pagesOperations On Functions Worksheet 6Johnmar FortesNo ratings yet

- Sarah Chey's ResumeDocument1 pageSarah Chey's Resumeca8sarah15No ratings yet

- Packaging Specification in Embedded EWM - SAP BlogsDocument20 pagesPackaging Specification in Embedded EWM - SAP BlogsAbhishek NandiNo ratings yet

- Sample Trading LogDocument10 pagesSample Trading LogVilas ParabNo ratings yet