Professional Documents

Culture Documents

2021 Annual Tax Summary

Uploaded by

dany.cantaragiuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 Annual Tax Summary

Uploaded by

dany.cantaragiuCopyright:

Available Formats

NOT AN OFFICIAL INVOICE OR TAX DOCUMENT

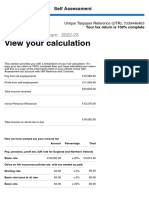

Tax summary for the period 2021

FLORIN CANTARAGIU

Many of the items listed below may be tax deductible. For more information, we recommend that you

seek guidance from a qualified tax site or service.

FARE BREAKDOWN OTHER INCOME BREAKDOWN

Miscellaneous €96.61

Gross Uber trips fares 1 €726.66

Referral / Incentives €272.53

Total €726.66

Total €369.14

VAT BREAKDOWN OTHER POTENTIAL DEDUCTIONS

VAT on Transportation €0.00

Value-added tax, or VAT, is a tax charged in

your country on transport services provided

by you via the Uber platform. The amount

mentioned here is what Uber invoiced on

your behalf.

VAT on Uber Service Fees €0.00

On Trip Mileage 246 km

The amount of VAT that Uber has charged

you on its service fees. Typically, no VAT is

charged on cross-border transactions.

VAT on Device Subscription €0.00

For device subscriptions (i.e. rent of a

device, phone) the same registers as

mentioned above for the Uber Service Fee.

1 Gross fares are calculated as base + time+ distance (this includes the Uber

Service Fee).

The information in this summary does not reflect your personal tax situation and is for information only. Nothing in this summary

constitutes tax advice nor an employment relationship between Uber and you, neither express nor implied. Please consult your

local tax adviser or tax administration for your personal tax obligations

You might also like

- Tax Return 2020 Checklist - L&a AccountingDocument1 pageTax Return 2020 Checklist - L&a AccountingMichele Dela Fuente AraujoNo ratings yet

- Sa302 2021-22Document2 pagesSa302 2021-22Viktoria VasevaNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Receipt 15nov2022 1065Document1 pageReceipt 15nov2022 1065chhabilaggarwalNo ratings yet

- SampleDocument2 pagesSamplekorean languageNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Sample PDFDocument2 pagesSample PDFkorean languageNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Einvoice 1694619077137Document1 pageEinvoice 1694619077137irfanali19815No ratings yet

- Bill Invoice #2848123157Document3 pagesBill Invoice #2848123157Benjytox BenjytoxNo ratings yet

- SIMPLIFIED TAX INVOICE / ﺔﻄﺴﺒﻤﻟا ﺔﻴﺒﻳﺮﻀﻟا ةرﻮﺗﺎﻔﻟاDocument1 pageSIMPLIFIED TAX INVOICE / ﺔﻄﺴﺒﻤﻟا ﺔﻴﺒﻳﺮﻀﻟا ةرﻮﺗﺎﻔﻟاalganainy brothersNo ratings yet

- HMRC - Tax Years 2021Document2 pagesHMRC - Tax Years 2021mxpskdff7cNo ratings yet

- July 2023Document1 pageJuly 2023heliaha266No ratings yet

- 2020 Annual Tax SummaryDocument1 page2020 Annual Tax SummaryGrowDigitaly MarketingNo ratings yet

- 1 UBER Tax Summary 2021 Jan-JunDocument1 page1 UBER Tax Summary 2021 Jan-JunAlexzz TomiskNo ratings yet

- Uber-Tax SummaryDocument1 pageUber-Tax SummaryKevin ValaniNo ratings yet

- 2022 Annual SummaryDocument2 pages2022 Annual SummaryTareqAFC 408No ratings yet

- MonthlyDocument1 pageMonthlyacftravel23No ratings yet

- 2020 Annual Tax SummaryDocument2 pages2020 Annual Tax SummaryGLO RellyNo ratings yet

- Nathalin Barrios Maradei: Tax Summary For 2020Document2 pagesNathalin Barrios Maradei: Tax Summary For 2020Nathalin De IsoldiNo ratings yet

- 2022 Annual SummaryDocument3 pages2022 Annual SummaryHectorNo ratings yet

- 2019 Annual SummaryDocument2 pages2019 Annual SummaryMELAKU HalikaNo ratings yet

- April 2022Document2 pagesApril 2022abul hasan nayemNo ratings yet

- Profitand LossDocument1 pageProfitand LossmcttsrnNo ratings yet

- 2023.2 Monthly SummaryDocument5 pages2023.2 Monthly SummaryHilston JoseNo ratings yet

- Enjoy Connection Globally.: Tax Invoice/ Tax Credit NoteDocument42 pagesEnjoy Connection Globally.: Tax Invoice/ Tax Credit NoteahsanukkakarNo ratings yet

- ALD Automotive - Fiscal Guide - ENGDocument15 pagesALD Automotive - Fiscal Guide - ENGFayard TCNo ratings yet

- Danils Gribanovs Week 22Document2 pagesDanils Gribanovs Week 22Danil GribanovNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument7 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill bylivefruitbazaar1122No ratings yet

- Analyze Company's Performance Using Ratios - Guided Project WorkbookDocument19 pagesAnalyze Company's Performance Using Ratios - Guided Project WorkbookAditya SeethaNo ratings yet

- Here's Your Receipt For Your Ride: Total 419.22Document1 pageHere's Your Receipt For Your Ride: Total 419.22Ronak AgrawalNo ratings yet

- MONTHLYDocument2 pagesMONTHLYBoulos NassarNo ratings yet

- Enjoy Connection Globally.: Tax Invoice/ Tax Credit NoteDocument37 pagesEnjoy Connection Globally.: Tax Invoice/ Tax Credit NoteahsanukkakarNo ratings yet

- Davisons Conveyancing Quote (No Gift Fee)Document1 pageDavisons Conveyancing Quote (No Gift Fee)Ollie HortonNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateArif RahmanNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateSope DalleyNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateSope DalleyNo ratings yet

- Uber Reciept 4632421115Document1 pageUber Reciept 4632421115SirsaNo ratings yet

- Tax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byDocument28 pagesTax Invoice/ Tax Credit Note: You Can Find More Information On Where and How To Pay Your Bill byahsanukkakarNo ratings yet

- Hyundai-2019-Veloster-Turbo ManualDocument6 pagesHyundai-2019-Veloster-Turbo ManualMoimoi TyNo ratings yet

- UberDocument1 pageUberSirsaNo ratings yet

- Salary Sacrifice Arrangements What Is Salary Sacrifice?Document4 pagesSalary Sacrifice Arrangements What Is Salary Sacrifice?alanNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- My Account - BillingDocument1 pageMy Account - BillinggreenrootfinancialservicesNo ratings yet

- Tax-Estimate 2022Document1 pageTax-Estimate 2022mdeecash042No ratings yet

- 2013 2014 CalculationsDocument1 page2013 2014 CalculationsKhawar MahmoodNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- Screenshot 2019-12-07 at 08.29.32Document1 pageScreenshot 2019-12-07 at 08.29.32amol ghuleNo ratings yet

- Profit and Loss Statement SampleDocument6 pagesProfit and Loss Statement SampleHeatman RobertNo ratings yet

- Profit and Loss by CustomerDocument4 pagesProfit and Loss by CustomerkelehostNo ratings yet

- Invoice 197Document2 pagesInvoice 197miroljubNo ratings yet

- Uber - Ahmedabad - Airport Pick Up - 20dec'19Document2 pagesUber - Ahmedabad - Airport Pick Up - 20dec'19Parijat MondalNo ratings yet

- Case Study ShrutiDocument115 pagesCase Study ShrutiMukund MalpaniNo ratings yet

- Receipt 19apr2023 392538Document1 pageReceipt 19apr2023 392538Hariom GoswamiNo ratings yet

- Jeddah To Airport 13 Dec 2022Document1 pageJeddah To Airport 13 Dec 2022Laraib MuzamilNo ratings yet

- 4f1b0a895e O-2Document1 page4f1b0a895e O-2CreativNo ratings yet

- Profitand LossDocument1 pageProfitand LossRyan EvaristoNo ratings yet

- Inv 004695Document1 pageInv 004695Shobhit BehalNo ratings yet

- OlaCabs Retun Airport To HomeDocument1 pageOlaCabs Retun Airport To HomeSai BharadwajNo ratings yet

- Í!"! (RWQ!!! T0#Ayaî: Hello DanielaDocument2 pagesÍ!"! (RWQ!!! T0#Ayaî: Hello Danieladany.cantaragiuNo ratings yet

- M NB MTA PackDocument7 pagesM NB MTA Packdany.cantaragiuNo ratings yet

- Marcopolo Luxury Colour Range - Krome RefurbishingDocument1 pageMarcopolo Luxury Colour Range - Krome Refurbishingdany.cantaragiuNo ratings yet

- Í!"! (Rwq!!!%!##Ay) Î: Hello DanielaDocument2 pagesÍ!"! (Rwq!!!%!##Ay) Î: Hello Danieladany.cantaragiuNo ratings yet

- Í!"! (RWQ!!!$S #Ay4Î: Hello DanielaDocument2 pagesÍ!"! (RWQ!!!$S #Ay4Î: Hello Danieladany.cantaragiuNo ratings yet

- HAP - Statement 2023 03 08 2023 09 08 PDFDocument1 pageHAP - Statement 2023 03 08 2023 09 08 PDFdany.cantaragiuNo ratings yet

- Í!"! (RWQ!!!$S #Ay4Î: Hello DanielaDocument2 pagesÍ!"! (RWQ!!!$S #Ay4Î: Hello Danieladany.cantaragiuNo ratings yet

- An Post Nov-23Document1 pageAn Post Nov-23dany.cantaragiuNo ratings yet

- Boarding Pass 2Document1 pageBoarding Pass 2dany.cantaragiuNo ratings yet

- 2nd Year PT Meeting December 7th 2023Document1 page2nd Year PT Meeting December 7th 2023dany.cantaragiuNo ratings yet

- Swimming Letter 2022Document1 pageSwimming Letter 2022dany.cantaragiuNo ratings yet

- Í!"! (Rwq!!!'.E#Ay - Î: Hello DanielaDocument2 pagesÍ!"! (Rwq!!!'.E#Ay - Î: Hello Danieladany.cantaragiuNo ratings yet

- Í!"! (RWQ!!!& C#Ay - Î: Hello DanielaDocument2 pagesÍ!"! (RWQ!!!& C#Ay - Î: Hello Danieladany.cantaragiuNo ratings yet

- Í!"! (Rwq!!!'Yg#Aybî: Hello DanielaDocument2 pagesÍ!"! (Rwq!!!'Yg#Aybî: Hello Danieladany.cantaragiuNo ratings yet

- Boarding PassDocument1 pageBoarding Passdany.cantaragiuNo ratings yet

- 29th November 2023Document4 pages29th November 2023dany.cantaragiuNo ratings yet

- Inv69116728 45926324Document1 pageInv69116728 45926324dany.cantaragiuNo ratings yet

- Just Eat Courier PortalDocument7 pagesJust Eat Courier Portaldany.cantaragiuNo ratings yet