Professional Documents

Culture Documents

4f1b0a895e O-2

Uploaded by

Creativ0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

13600908455_4f1b0a895e_o-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 page4f1b0a895e O-2

Uploaded by

CreativCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

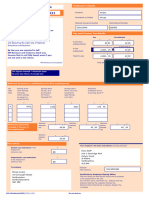

HM Revenue

& Customs Your Annual Tax Summary 2013-14

Mrs AN Smith

1 Anystreet

Anytown

WX1 2YZ

Dear Mrs Smith

For the first time we are sending you an Annual Tax For more information

Summary. This is to show you how your Income Tax and go to www.gov.uk/

National Insurance contributions (NICs) are calculated and annual-tax-summary

how your money is spent by the government. Go to our website to find out more about

your Tax Summary, and for a list of

This is for your information. You do not need to contact indirect taxes such as VAT.

us as this is not a demand for payment.

Your taxable income

This is how we worked out your tax for 2013-14

Your taxable income

Total income from employment £45000.00

£45000.00

We know this from information supplied

Your income before tax £45000.00 to us by you, your employer(s) or your

pension provider(s).

Less your 2013-14 tax free amount £9440.00

You pay tax on £35560.00

Tax free amount

Your tax was calculated as

Income Tax

£9440.00

After your allowances, deductions and

Basic rate Income Tax £32010.00 at 20% £6402.00

expenses your total tax free amount

Higher rate Income Tax £3550.00 at 40% £1420.00 for 2013-14 is £9440.00. This is the

Total Income Tax £7822.00 amount you received in the 2013-14

tax year without paying tax.

National Insurance contributions (NICs) £4114.56

Total Income Tax and NICs £11936.56

Your tax and NICs

Your income after tax and NICs £33063.44

Your employer pays

£11936.56

This is 27% of your taxable income.

National Insurance contributions (NICs) £5148.60 For every £1 of income, you paid 27p

in Income Tax and NICs.

Your income after tax

and NICs

£33063.44

This is your income after Income Tax

and NICs.

The table on the other side of this page shows how the government has spent

your taxes.

Tax Summary for Mrs A N Smith for the tax year 2013-14 HMRC 08/14

You might also like

- Tax-Dictionary v01 PDFDocument1,378 pagesTax-Dictionary v01 PDFMunir HussainNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Sa302 2021-22Document2 pagesSa302 2021-22Viktoria VasevaNo ratings yet

- Net Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!Document7 pagesNet Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!abhi1648665No ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Oracle Fusion HCM For UK-Payroll Setup White Paper REL10Document130 pagesOracle Fusion HCM For UK-Payroll Setup White Paper REL10Malik Al-WadiNo ratings yet

- Application For A National Insurance Number: Personal DetailsDocument2 pagesApplication For A National Insurance Number: Personal DetailsSheila Ali50% (2)

- SSPDocument2 pagesSSPMihaela GrosuNo ratings yet

- Sage Payroll CSV TemplatesDocument50 pagesSage Payroll CSV TemplatesJosh Moore33% (3)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- HMRC - Tax Years 2021Document2 pagesHMRC - Tax Years 2021mxpskdff7cNo ratings yet

- P 85Document5 pagesP 85asheeshmNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Private and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duDocument1 pagePrivate and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duElaine HicksNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Comparative Matrix of The Salient Features of SSS, Gsis, and Ecsif g07 Group 4Document18 pagesComparative Matrix of The Salient Features of SSS, Gsis, and Ecsif g07 Group 4Ruby Santillana50% (2)

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Health InsuranceDocument36 pagesHealth Insurancevijaya lakshmi100% (1)

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- AAT ITAX Focus Notes FA2015 No. 1 - EXTERNAL TUTORDocument90 pagesAAT ITAX Focus Notes FA2015 No. 1 - EXTERNAL TUTORLindaBakóNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- 4f1b0a895e O-3Document1 page4f1b0a895e O-3CreativNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- 2013 2014 CalculationsDocument1 page2013 2014 CalculationsKhawar MahmoodNo ratings yet

- 2014 015 CalculationsDocument1 page2014 015 CalculationsKhawar MahmoodNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Income Tax Calculator - TaxScoutsDocument1 pageIncome Tax Calculator - TaxScoutsnadine.massabkiNo ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- PAYE Tax 2022 - Anand Chennai2LondonDocument34 pagesPAYE Tax 2022 - Anand Chennai2Londonpremkumar krishnanNo ratings yet

- Value of The NHS Pension Scheme FINALDocument62 pagesValue of The NHS Pension Scheme FINALpboletaNo ratings yet

- MG 3027 TAXATION - Week 2 Introduction To Income TaxDocument39 pagesMG 3027 TAXATION - Week 2 Introduction To Income TaxSyed SafdarNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Mock 1Document14 pagesMock 1Simon YossefNo ratings yet

- Advanced Financial Accounting IDocument21 pagesAdvanced Financial Accounting IAbdiNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Income Tax: Syllabus Study GuideDocument34 pagesIncome Tax: Syllabus Study GuideSam NalliNo ratings yet

- Individual Tax Payer - Part 2Document18 pagesIndividual Tax Payer - Part 2Ems TeopeNo ratings yet

- F6 Tec ArticlesDocument140 pagesF6 Tec ArticlesFloyd DaltonNo ratings yet

- TX NotesDocument157 pagesTX Notessahalacca123No ratings yet

- Tax Credit Certificate 2023 9753768935878Document2 pagesTax Credit Certificate 2023 9753768935878Rogério LimaNo ratings yet

- Name Date Company: Total Deductions 0.00Document1 pageName Date Company: Total Deductions 0.00Cristian PîrnăuNo ratings yet

- P60-Alberto AndreiDocument1 pageP60-Alberto AndreiAndrei AlbertoNo ratings yet

- A1C019118 Jurati Latihan10Document6 pagesA1C019118 Jurati Latihan10juratiNo ratings yet

- P60-Mircea AndreiDocument1 pageP60-Mircea AndreiAndrei AlbertoNo ratings yet

- Finance Act 2018 UK-TaxDocument77 pagesFinance Act 2018 UK-TaxSolongo DavaakhuuNo ratings yet

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- Tax Data Card 30 June 2014Document9 pagesTax Data Card 30 June 2014api-300877373No ratings yet

- Daniela Felippini Month Ending 30 Apr 2023: Payments Deductions Employee DetailsDocument1 pageDaniela Felippini Month Ending 30 Apr 2023: Payments Deductions Employee Detailsdanielafelippini.dfNo ratings yet

- Professional PracticeDocument2 pagesProfessional PracticeJago0% (1)

- Att 1Document3 pagesAtt 1shankharisohag007No ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- TaxationDocument20 pagesTaxationBienna CuebillasNo ratings yet

- Advance I Ch-IDocument63 pagesAdvance I Ch-IUtban Ashab100% (1)

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- CPD Course: 30 MinsDocument12 pagesCPD Course: 30 MinsDavid BriggsNo ratings yet

- Tax Rates, Allowances and Amounts Tax-Free Income and AllowancesDocument4 pagesTax Rates, Allowances and Amounts Tax-Free Income and AllowancesdttquyNo ratings yet

- Ias 12Document33 pagesIas 12samrawithagos2002No ratings yet

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDocument18 pagesTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNo ratings yet

- PIT03 The Taxation of InterestDocument10 pagesPIT03 The Taxation of InterestAlellie Khay D JordanNo ratings yet

- ENG Salary CalculatorDocument4 pagesENG Salary CalculatorPankaj MittalNo ratings yet

- Finance Act 2020 - ACCA GlobalDocument65 pagesFinance Act 2020 - ACCA GlobalRaza AliNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Chapter 2 - SolutionDocument12 pagesChapter 2 - SolutionAk AlNo ratings yet

- Legal Update 13-2016 Additional Retirement Fund Contributions Sept2016Document5 pagesLegal Update 13-2016 Additional Retirement Fund Contributions Sept2016Madzhiya HulisaniNo ratings yet

- Coi - A.Y. 2017-2018 - Bharti GohilDocument2 pagesCoi - A.Y. 2017-2018 - Bharti GohilSuman jhaNo ratings yet

- Codul Fiscal (In Limba Engleza)Document65 pagesCodul Fiscal (In Limba Engleza)Cristina CiobanuNo ratings yet

- C11984569 Signed OfferLetterDocument10 pagesC11984569 Signed OfferLetterSiriNo ratings yet

- A Review of The State Pension Scheme in Ghana PDFDocument59 pagesA Review of The State Pension Scheme in Ghana PDFTAKUNDANo ratings yet

- Allogenic Guidebook English PDFDocument118 pagesAllogenic Guidebook English PDFTim CarterNo ratings yet

- Ministry of Absorption Life Cycle BookletDocument30 pagesMinistry of Absorption Life Cycle BookletEnglishAccessibilityNo ratings yet

- How To Access and Understand Your PayslipDocument9 pagesHow To Access and Understand Your PayslipbucalaeteclaudialoredanaNo ratings yet

- AGPP Guide 1Document36 pagesAGPP Guide 1drefdrefNo ratings yet

- Report Income TaxDocument6 pagesReport Income TaxLudmila DorojanNo ratings yet

- P46: Employee Without A Form P45: Section OneDocument2 pagesP46: Employee Without A Form P45: Section Onedeepika505No ratings yet

- Grade 8 - Social Studies Consolidated CurriculumDocument184 pagesGrade 8 - Social Studies Consolidated CurriculumDavid HenryNo ratings yet

- UPHL Human Resource ManualDocument41 pagesUPHL Human Resource ManualKathamuthu KottaichamyNo ratings yet

- Project RESTOR FAQ 2Document4 pagesProject RESTOR FAQ 2KALB DIGITALNo ratings yet

- Bituach Leumi Programs 2011Document68 pagesBituach Leumi Programs 2011EnglishAccessibilityNo ratings yet

- HC1 December 2019Document20 pagesHC1 December 2019TomNo ratings yet

- Little Elms Employee HandbookDocument15 pagesLittle Elms Employee HandbookDivineNo ratings yet

- My Uk Nursing Salaries-1Document89 pagesMy Uk Nursing Salaries-1Wekesa kima lvan0% (1)

- Vocabulary For TOEIC - 9 - Earnings, Rewards and BenefitsDocument2 pagesVocabulary For TOEIC - 9 - Earnings, Rewards and BenefitsTeacherNo ratings yet

- Bectu Freelance Survival Guide 8pp Aug17 2Document8 pagesBectu Freelance Survival Guide 8pp Aug17 2Dougal WallaceNo ratings yet

- Experis Key InformationDocument11 pagesExperis Key InformationTahir SamadNo ratings yet

- t2 Past Paper PoiletDocument15 pagest2 Past Paper Poiletburaque100% (1)

- Pensions ExplainedDocument5 pagesPensions ExplainedEnock Sekamanje KasasaNo ratings yet