Professional Documents

Culture Documents

P60-Alberto Andrei

Uploaded by

Andrei AlbertoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P60-Alberto Andrei

Uploaded by

Andrei AlbertoCopyright:

Available Formats

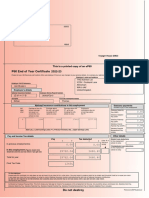

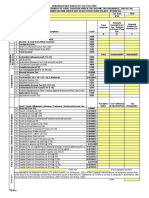

Employee's Details

P60 End of Year Certificate

Tax Year to 5 April 2022 Surname Andrei

Forenames or Initials Alberto Marian

To the employee:

Please keep this certificate in a safe place as National Insurance Number Works/Payroll Number

you will need it if you have to fill in a tax

return. You will also need it to make a SY536348A 105985

claim for tax credits and Universal Credit or

to renew your claim. Pay and Income Tax details

Pay Tax deducted

It also helps you check that your employer is

£ p £ p

using the correct National Insurance number

In previous

and deducting the right rate of National £0 00 £0 00

employment(s)

Insurance contributions.

If refund mark "R"

In this

By law you are required to tell * £35661 29 £4272.20

employment

HM Revenue and Customs about any

Income that is not fully taxed, even if you £4272.20

Total for year £35661 29

are not sent a tax return.

HM Revenue and Customs Final tax code 1198L

The figures marked * should be used

for your tax return, if you get one

National Insurance contributions in this employment

NIC Earnings at the Earnings above Earnings above Employee's

table Lower Earnings the LEL, up to the PT, up to and contribution due on

letter Limit (LEL) and including including the all earnings above PT

(where earnings the Primary Upper Earings

are equal to or Threshold (PT) Limit (UEL)

exceed the LEL)

£ £ £ £ p

A £472 £192 £637 £1992.40

Statutory £ p Statutory £ p Statutory £ p

Statutory payments Maternity Paternity Shared

included in the pay 'in Pay £0 00 Pay £0 00 Parental £0 00

this employment' Pay

Statutory £ p

Adoption

Pay £0 00

Other details

Your employer's full name and address (including postcode)

Student Loan deductions in this £

employment

GXO LOGISTICS LTD

(whole £s only) £0

SAXON AVE

GRANGE PARK

Postgraduate Loan deductions £

NORTHAMPTON

in this employment

NORTHAMPTONSHIRE

(whole £s only) £0

NN4 5EZ

To employee Employer

PAYE reference 951/AZ32390

Alberto Marian Andrei

1A Connaught Street Certificate by Employer/Paying Office:

This form shows your total pay for income and tax purposes

Northampton

in this employment for the year.

Northamptonshire

Any overtime, bonus, commission etc. Statutory Sick Pay,

NN1 3BP Statutory Maternity Pay, Statutory Paternity Pay,

Statutory Shared Parental Pay or Statutory Adoption Pay

is included.

P60 (Substitute)(RRS) 2020 to 2021 Do not destroy

You might also like

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- Tax Credit Certificate 2023 9553776791212Document2 pagesTax Credit Certificate 2023 9553776791212Mariana SurduNo ratings yet

- Private and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duDocument1 pagePrivate and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duElaine HicksNo ratings yet

- 2024 01 26 - StatementDocument4 pages2024 01 26 - StatementAndrei AlbertoNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Tax Year To 5 April: P60 End of Year CertificateDocument1 pageTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- UK Legal Entity: Assets TransferredDocument3 pagesUK Legal Entity: Assets Transferredshu1706No ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- P60 End of Year Certificate 10 05 19 16 14 16 5273Document1 pageP60 End of Year Certificate 10 05 19 16 14 16 527313KARATNo ratings yet

- 2023 11 26 - StatementDocument5 pages2023 11 26 - StatementAndrei AlbertoNo ratings yet

- FBR Tax FilingDocument48 pagesFBR Tax FilingMuhammad Waqas Hanif100% (1)

- InsuranceDocument3 pagesInsuranceAndrei AlbertoNo ratings yet

- P60-Mircea AndreiDocument1 pageP60-Mircea AndreiAndrei AlbertoNo ratings yet

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosNo ratings yet

- Downloads My Downloads 673Document1 pageDownloads My Downloads 673Katalin GemesNo ratings yet

- P60 For Year 2021/22Document1 pageP60 For Year 2021/22gd9pnygr27No ratings yet

- Ep60 2023Document1 pageEp60 2023Bogdan AlecsaNo ratings yet

- x6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfDocument1 pagex6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfAdemuyiwa OlaniyiNo ratings yet

- Nicolae Greurus - p60 (2023-24)Document1 pageNicolae Greurus - p60 (2023-24)danielagonciulea6No ratings yet

- P60 Single Sheet 2022 To 2023Document1 pageP60 Single Sheet 2022 To 2023Manuel Brites FerreiraNo ratings yet

- P60 End of Year Certificate: Tax Year To 5 AprilDocument1 pageP60 End of Year Certificate: Tax Year To 5 Apriladrianhooo89No ratings yet

- Coi - A.Y. 2017-2018 - Bharti GohilDocument2 pagesCoi - A.Y. 2017-2018 - Bharti GohilSuman jhaNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- Income Tax CalcDocument7 pagesIncome Tax Calckarthik.ragu9101No ratings yet

- 7B Form GRA Original - Part499 PDFDocument1 page7B Form GRA Original - Part499 PDFRicardo SinghNo ratings yet

- 4f1b0a895e O-2Document1 page4f1b0a895e O-2CreativNo ratings yet

- 4f1b0a895e O-3Document1 page4f1b0a895e O-3CreativNo ratings yet

- Income Tax CalculatorDocument4 pagesIncome Tax CalculatorAchin AgarwalNo ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- Name Date Company: Total Deductions 0.00Document1 pageName Date Company: Total Deductions 0.00Cristian PîrnăuNo ratings yet

- Self Employed FormDocument10 pagesSelf Employed FormAdam KhanNo ratings yet

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- Ep60 384 Ye43911 2022 20220406Document1 pageEp60 384 Ye43911 2022 20220406thomas.rohanNo ratings yet

- Individual Paper Return For Tax Year 2019: SignatureDocument10 pagesIndividual Paper Return For Tax Year 2019: SignatureEngr Saad Bin SarfrazNo ratings yet

- Taxation Notes-DoneDocument3 pagesTaxation Notes-DonePgumballNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- Bond - Fact FindDocument13 pagesBond - Fact FindEnos PhillipsNo ratings yet

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Aman Sharma ITR AY2021Document3 pagesAman Sharma ITR AY2021Abhishek SaxenaNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- P6uk 2007 Dec Q PDFDocument12 pagesP6uk 2007 Dec Q PDFHassan BilalNo ratings yet

- Income Tax Credits - ReviewerDocument10 pagesIncome Tax Credits - Reviewer버니 모지코No ratings yet

- Mashood K ITR COMPUTATION AY 2022-23Document3 pagesMashood K ITR COMPUTATION AY 2022-23sidvikventuresNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- Multiurban Infra Services Pvt. Ltd. Salary Slip: This Is A Computer Generated Document and Does Not Require Any SignatureDocument1 pageMultiurban Infra Services Pvt. Ltd. Salary Slip: This Is A Computer Generated Document and Does Not Require Any Signaturesurya gtiblyNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Real Estate Business PlanDocument13 pagesReal Estate Business PlanAlex MichaelNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Payslip Alberto - Andrei 10 03 2022Document1 pagePayslip Alberto - Andrei 10 03 2022Andrei AlbertoNo ratings yet