Professional Documents

Culture Documents

Ep60 384 Ye43911 2022 20220406

Uploaded by

thomas.rohanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ep60 384 Ye43911 2022 20220406

Uploaded by

thomas.rohanCopyright:

Available Formats

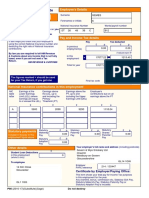

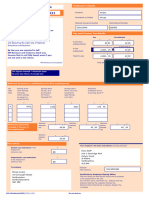

26302

Mr Thomas Rohan

Flat 2

105 Egerton Road

Manchester

M14 6RD

O215

Voyager House (DNU)

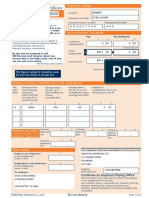

This is a printed copy of an eP60

P60 End of Year Certificate 2022-23

Please tell your HM Revenue and Customs office and employer if there are any changes to your personal details, for example your address

Tax Year to 5 April 2023

Employer’s name and address

Pay As You Earn

THG Nutrition Ltd

Employer PAYE Reference

ICON 1 Sunbank Lane

Altrincham

120/YE43911

WA15 0AF

Employee's details United Kingdom

National Insurance Number Employee Works/Payroll Number

JZ 67 41 77 B 26302/O215

Surname First two forenames/initials

Rohan Thomas

National Insurance contributions in this employment Statutory payments

included in pay 'In this employment'

NIC Earnings at the LEL Earnings above Earnings above the Employee's

table (where earnings the LEL, up to and PT, up to and contributions due on Statutory Maternity

letter are equal to or including the PT including the UEL all earnings above Pay (SMP) 0.00

exceed the LEL) (whole £s only) (whole £s only) the PT

Statutory Adoption

(whole £s only) 0.00

Pay (SAP)

A 6396 5505 17861 2277.05 Statutory Paternity

Pay (SPP) 0.00

Statutory Shared

Parental Pay (ShPP) 0.00

Statutory Parental

(Note LEL = Lower Earnings Limit, PT = Primary Threshold, UEL = Upper Earnings Limit) Bereavement Pay 0.00

(SPBP)

Pay and Income Tax details Other details

Pay Tax deducted Student Loan deductions

£ p £ p Enter 'R' in In this employment

this box if (whole £s only) 198

In previous employment(s) 0.00 0.00 refund

Postgraduate Loan deductions

▼ In this employment

In this employment (Figures shown here (whole £s only) 0

should be used for your tax return if you get one) 29762.04 3460.40

Total for year 29762.04 3460.40

Final Tax Code 1245L

To the employee:

Please keep this certificate in a safe place as you will need it if you have to fill in a tax return. You also need it to make a claim for tax credits and Universal Credit or to renew your claim.

It also helps you check that your employer is using the correct National Insurance number and deducting the right rate of National Insurance contributions.

By law you are required to tell HM Revenue and Customs about any income that is not fully taxed, even if you are not sent a tax return.

HM Revenue and Customs

Certificate by Employer/Paying Office: This form shows your total pay for Income Tax purposes in this employment for the year. Any overtime, bonus, commission etc, Statutory Sick Pay,

Statutory Maternity Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Statutory Parental Bereavement Pay or Statutory Adoption Pay is included.

Do not destroy P60(2023)eADP(Substitute)

You might also like

- P60 For Year 2021/22Document1 pageP60 For Year 2021/22gd9pnygr27No ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Downloads My Downloads 673Document1 pageDownloads My Downloads 673Katalin GemesNo ratings yet

- Tax Year To 5 April: P60 End of Year CertificateDocument1 pageTax Year To 5 April: P60 End of Year CertificateВолодимир МельникNo ratings yet

- Ep60 2023Document1 pageEp60 2023Bogdan AlecsaNo ratings yet

- Office of The Dy District Education Officer (M) Haroonabad: GPS Chak 00/1.R BY6 0 0 0 Description 0 0 0 0 0 0 0 0 1 4Document6 pagesOffice of The Dy District Education Officer (M) Haroonabad: GPS Chak 00/1.R BY6 0 0 0 Description 0 0 0 0 0 0 0 0 1 4Ammar Bin QasimNo ratings yet

- P60-Mircea AndreiDocument1 pageP60-Mircea AndreiAndrei AlbertoNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Tan Koon Aik PayslipDocument3 pagesTan Koon Aik PayslipDaniel GuanNo ratings yet

- P60-Alberto AndreiDocument1 pageP60-Alberto AndreiAndrei AlbertoNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- Nicolae Greurus - p60 (2023-24)Document1 pageNicolae Greurus - p60 (2023-24)danielagonciulea6No ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- Arrears TR-22Document2 pagesArrears TR-22Ana LisaNo ratings yet

- 5867 Increment LetterDocument2 pages5867 Increment LetterShivam SinghNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- 05 07 2017 12 53 04suryaprakashDocument1 page05 07 2017 12 53 04suryaprakashA C MADHESWARANNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- RMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Document2 pagesRMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Leo R.No ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- Payslip For NOV 2022: Advance Chicken Processing (M) Sdn. BHDDocument1 pagePayslip For NOV 2022: Advance Chicken Processing (M) Sdn. BHD温顺王No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Unihunt Consulting Private Limited: Salary Slip of FebDocument1 pageUnihunt Consulting Private Limited: Salary Slip of FebSiddesh MorjeNo ratings yet

- Tax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2022 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsduhgyusdfuiosNo ratings yet

- ITPSDocument1 pageITPSMounika PurushothamNo ratings yet

- JBTS7958 Increment110620220438AMDocument1 pageJBTS7958 Increment110620220438AMSagar SwainNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- 1604C Alphalist Format Jan 2018 Final2Document2 pages1604C Alphalist Format Jan 2018 Final2Mikho RaquelNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Chandan Kumar YadavNo ratings yet

- Salary Slip FormatDocument1 pageSalary Slip FormatAsmita MoonNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- 1 RotatedDocument3 pages1 Rotated10techtopNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)Document1 pageCertificate of Compensation Payment/Tax Withheld: January 2018 (ENCS)jacotesaluna09No ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- Gertificate: P60-s6g of YearDocument3 pagesGertificate: P60-s6g of Year13KARATNo ratings yet

- Salary CertificateDocument1 pageSalary Certificateitechnological100% (15)

- Unknown PDFDocument2 pagesUnknown PDFbijoytvknrNo ratings yet

- Copy For Employee: P45 Part 1A Details of Employee Leaving WorkDocument3 pagesCopy For Employee: P45 Part 1A Details of Employee Leaving WorkSteve OrtonNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- Gorakhnath Construction Company: SALARY SLIP (01-Oct-2019)Document2 pagesGorakhnath Construction Company: SALARY SLIP (01-Oct-2019)pardeep sanwalNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Salary Slip MayDocument1 pageSalary Slip MayselvaNo ratings yet

- Gross Earning Gross DeductionDocument2 pagesGross Earning Gross Deductionavisinghoo7No ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- 1109021 (1)Document1 page1109021 (1)Cms Stl CmsNo ratings yet

- Ecr Mar 2023 Chaudhary ConstructionDocument2 pagesEcr Mar 2023 Chaudhary ConstructionVikram SinghNo ratings yet

- BSP00657Document1 pageBSP00657Shamini SasetharanNo ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- Incometaxstatement2009 2010Document2 pagesIncometaxstatement2009 2010api-3725541No ratings yet

- Attendance Leave: Aslenah12 00days)Document2 pagesAttendance Leave: Aslenah12 00days)Vishnu DattNo ratings yet

- Salary Tds Computation Sheet Sec 192bDocument1 pageSalary Tds Computation Sheet Sec 192bpradhan13No ratings yet

- Lim Yaw Cheng at Ainnie Lim-Aug-22-PayslipDocument1 pageLim Yaw Cheng at Ainnie Lim-Aug-22-PayslipannNo ratings yet

- Schedule 1 - Alphalist of Employees (Declared and Certified Using BIR Form No. 2316) P R E S E N T E M P L O Y E RDocument2 pagesSchedule 1 - Alphalist of Employees (Declared and Certified Using BIR Form No. 2316) P R E S E N T E M P L O Y E RJoanne Pauline Tenedero - RuelaNo ratings yet

- Labour Law Course WorkDocument5 pagesLabour Law Course WorkUncle BrianNo ratings yet

- Women in The Workplace 2020 - McKinsey PDFDocument63 pagesWomen in The Workplace 2020 - McKinsey PDFgogojamzNo ratings yet

- 13 Philippine OSH StandardDocument2 pages13 Philippine OSH StandardPrincess LumadayNo ratings yet

- City Council Approves Pay Raises For Honolulu Police OfficersDocument6 pagesCity Council Approves Pay Raises For Honolulu Police OfficersHonolulu Star-AdvertiserNo ratings yet

- BHRM625 Topic: Traditional Pay and Incentive Pay: Spring 2019 - 2020Document7 pagesBHRM625 Topic: Traditional Pay and Incentive Pay: Spring 2019 - 2020Zahraa FarhatNo ratings yet

- Yrasuegui V PalDocument5 pagesYrasuegui V PalLet Leni LeadNo ratings yet

- 1.1 Background of The Study: Human Resource Practices of Jamuna Bank LimitedDocument72 pages1.1 Background of The Study: Human Resource Practices of Jamuna Bank LimitedNafiz FahimNo ratings yet

- Human - Resource - Management - in - Banking - Sector - in - STATE - BANK - OF - INDIA - by - RAHUL GUPTADocument86 pagesHuman - Resource - Management - in - Banking - Sector - in - STATE - BANK - OF - INDIA - by - RAHUL GUPTAabhishek guptaNo ratings yet

- C3 Global Application Form FillableDocument1 pageC3 Global Application Form FillableMajesty GiftaNo ratings yet

- 1 - 2267225 - Appointment - Letter - 1 - 22 - 2022 9 - 47 - 14 AMDocument7 pages1 - 2267225 - Appointment - Letter - 1 - 22 - 2022 9 - 47 - 14 AMNand kishore guptaNo ratings yet

- A Golden Handshake-CiteHRDocument5 pagesA Golden Handshake-CiteHRArun BalajiNo ratings yet

- General Milling Corp. v. Torres, G.R. No. 9366Document3 pagesGeneral Milling Corp. v. Torres, G.R. No. 9366dominiqueNo ratings yet

- ANGELINA FRANCISCO vs. NLRCDocument2 pagesANGELINA FRANCISCO vs. NLRCJoseph GabutinaNo ratings yet

- LABOUR LAW Mumbai UniversityDocument98 pagesLABOUR LAW Mumbai Universityhandevishal444No ratings yet

- 1Document1 page1Drinkwell AccountsNo ratings yet

- TUP Manila Admission FormDocument2 pagesTUP Manila Admission FormJosephus GallardoNo ratings yet

- 185 Action Verbs That'll Make Your Resume Shine - The Muse PDFDocument12 pages185 Action Verbs That'll Make Your Resume Shine - The Muse PDFRahul K MistryNo ratings yet

- HRM Report CIA 3Document5 pagesHRM Report CIA 3SUNIDHI PUNDHIR 20221029No ratings yet

- Niraj ParabDocument9 pagesNiraj ParabnickNo ratings yet

- CCM Assignment On WallmartDocument13 pagesCCM Assignment On Wallmartbindu8920No ratings yet

- SUBJECT: Technical Intern OfferDocument2 pagesSUBJECT: Technical Intern OfferJemie JaleaNo ratings yet

- Concept, Nature and Importance of HRP Factors Affecting HRP Methods of Human Resource PlanningDocument32 pagesConcept, Nature and Importance of HRP Factors Affecting HRP Methods of Human Resource PlanningMayank YadavNo ratings yet

- Challenges of Teaching and Learning of AccountingDocument10 pagesChallenges of Teaching and Learning of AccountingRahimi SaadNo ratings yet

- Từ vựng TOEIC bản cập nhật 1 5 2022Document10 pagesTừ vựng TOEIC bản cập nhật 1 5 2022Marco PhoenixNo ratings yet

- IELTS Practice Test AudioscriptDocument4 pagesIELTS Practice Test AudioscriptEdu Lamas GallegoNo ratings yet

- Leadership Styles in Mediating The Relationship Between Quality of Work Life and Employee CommitmentDocument26 pagesLeadership Styles in Mediating The Relationship Between Quality of Work Life and Employee CommitmentBunga Herlin DwitiyaNo ratings yet

- Updated Pravalika Resume2022Document3 pagesUpdated Pravalika Resume2022Manisha NerellaNo ratings yet

- The Development of Human ResourcesDocument48 pagesThe Development of Human ResourcesStephanie AndalNo ratings yet

- Book of Yusuf Group PDFDocument32 pagesBook of Yusuf Group PDFmaka stationeryNo ratings yet

- Leyte Land Transpo Co Vs Leyte Farmers and WorkersDocument11 pagesLeyte Land Transpo Co Vs Leyte Farmers and WorkersEm AlayzaNo ratings yet