Professional Documents

Culture Documents

2014 015 Calculations

Uploaded by

Khawar Mahmood0 ratings0% found this document useful (0 votes)

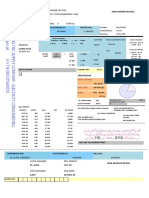

19 views1 pageThis document is a tax return summary for Khawar Mahmood for the 2014-2015 tax year. It shows that Mr. Mahmood reported £3,025 in self-employment profits but owed no income tax due to his income being below the personal allowance threshold of £10,000. The summary also indicates he does not owe any balancing payment by the January 31, 2016 deadline.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a tax return summary for Khawar Mahmood for the 2014-2015 tax year. It shows that Mr. Mahmood reported £3,025 in self-employment profits but owed no income tax due to his income being below the personal allowance threshold of £10,000. The summary also indicates he does not owe any balancing payment by the January 31, 2016 deadline.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 page2014 015 Calculations

Uploaded by

Khawar MahmoodThis document is a tax return summary for Khawar Mahmood for the 2014-2015 tax year. It shows that Mr. Mahmood reported £3,025 in self-employment profits but owed no income tax due to his income being below the personal allowance threshold of £10,000. The summary also indicates he does not owe any balancing payment by the January 31, 2016 deadline.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

HMRC: View your calculation - View your full calculation https://www.tax.service.gov.uk/self-assessment-file/1415/ind/391869974...

Home Cymraeg Contact HMRC Help Sign out

Khawar Mahmood's tax return: 2014-15 SUBMITTED

Your tax return is 100% complete

Unique Taxpayer Reference (UTR): 3918699743

View your calculation

This section provides you with a breakdown of your full calculation. If it says your tax return is 100% complete

then you have submitted your return and this is a copy of the information held on your official online Self

Assessment tax account with HM Revenue and Customs.

Profit from self-employment £3,025.00

Total income received £3,025.00

minus Personal Allowance £10,000.00

Total income on which tax is due £0.00

How we have worked out your income tax

Amount Percentage Total

Total income on which tax has been charged £0.00

Income Tax due £0.00

From all employments £0.00

Total Income Tax due £0.00

Estimated payment due by 31 January 2016

You must pay the total of any tax and class 4 NIC due for 2014-15 plus first payment on account due for

2015-16 by 31 January 2016 .

2014-15 balancing payment £0.00

1st payment on account for 2015-16 due 31 January 2016 £0.00

(Note: 2nd payment of £0.00 due 31 July 2016)

Total due by 31 January 2016 £0.00

This amount does not take into account any 2014-15 payments on account you may have already made

Print your full calculation

1 of 1 22/03/2017 05:46

You might also like

- POWERFUL MAGIC RING - GET POWER, WEALTH, PROTECTION, LOVE, HEALTH Etc Call/wattsapp +27717097145 MAMA LAKIADocument16 pagesPOWERFUL MAGIC RING - GET POWER, WEALTH, PROTECTION, LOVE, HEALTH Etc Call/wattsapp +27717097145 MAMA LAKIAProfmama Lakia0% (2)

- Sa302 2021-22Document2 pagesSa302 2021-22Viktoria VasevaNo ratings yet

- Amended Tax Credit Certificate 2020 7243210862511Document2 pagesAmended Tax Credit Certificate 2020 7243210862511Aurimas AurisNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

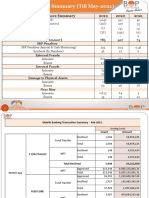

- Mancom Agenda MayDocument2 pagesMancom Agenda MayKhawar MahmoodNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- Mathcad - 1000 KL Tank1Document23 pagesMathcad - 1000 KL Tank1Zulfikar N JoelNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- VAT On Merchandise Purchased and SoldDocument5 pagesVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- British Gas Example BillDocument2 pagesBritish Gas Example BillYoutube Master13% (8)

- CITP SpecificationDocument21 pagesCITP SpecificationItay GalNo ratings yet

- Standard Kessel Cat - Gral.Document40 pagesStandard Kessel Cat - Gral.Marcelo ResckNo ratings yet

- SCC Comunicados Pi Batch0100151116c5897dc2c75000Document4 pagesSCC Comunicados Pi Batch0100151116c5897dc2c75000Thomas StanyardNo ratings yet

- Shahzad Haider: Declaration Acknowledgement SlipDocument2 pagesShahzad Haider: Declaration Acknowledgement SlipShehzad HaiderNo ratings yet

- 2013 2014 CalculationsDocument1 page2013 2014 CalculationsKhawar MahmoodNo ratings yet

- 4f1b0a895e O-2Document1 page4f1b0a895e O-2CreativNo ratings yet

- 4f1b0a895e O-3Document1 page4f1b0a895e O-3CreativNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- Declaration4110519073269 - ITR2015Document2 pagesDeclaration4110519073269 - ITR2015Saleemullah PathanNo ratings yet

- f1062 Guide To HMRC Tax CalcDocument7 pagesf1062 Guide To HMRC Tax CalcFake Documents of Simply Jodan's LLCNo ratings yet

- LU1 - Value-Added TaxDocument24 pagesLU1 - Value-Added Taxmandisanomzamo72No ratings yet

- Advanced Financial Accounting IDocument21 pagesAdvanced Financial Accounting IAbdiNo ratings yet

- VATDocument17 pagesVATSIRUI DINGNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- VATGuide2014 PDFDocument22 pagesVATGuide2014 PDFAkash TeeluckNo ratings yet

- WTAXESDocument31 pagesWTAXESlance757No ratings yet

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Income Tax Calculator - TaxScoutsDocument1 pageIncome Tax Calculator - TaxScoutsnadine.massabkiNo ratings yet

- INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per YearDocument1 pageINCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Yearpintoo23No ratings yet

- Declaration 3310586406613Document4 pagesDeclaration 3310586406613Muhammad WaqasNo ratings yet

- Value Added Tax. and Vat CalculationsDocument17 pagesValue Added Tax. and Vat CalculationsPrashanth GowdaNo ratings yet

- IncomeTax IAS 12 Revised Edited GD 2020Document46 pagesIncomeTax IAS 12 Revised Edited GD 2020yonas alemuNo ratings yet

- House No. A-900/102, Workshop Road, GHARIBABAD, Dadu, Dadu. Ali Ahmed BhattiDocument3 pagesHouse No. A-900/102, Workshop Road, GHARIBABAD, Dadu, Dadu. Ali Ahmed BhattiMohsin Ali Shaikh vlogsNo ratings yet

- 12lpa Tax ComputationDocument1 page12lpa Tax ComputationSai KrishnaNo ratings yet

- By B.P.CHOUDHARY (Tax Consultant) (CA Associate)Document17 pagesBy B.P.CHOUDHARY (Tax Consultant) (CA Associate)Hiren ShahNo ratings yet

- A-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanDocument2 pagesA-15 Block - 7/8 Kchs Union Karachi-78400 Karachi Usman Shahid KhanAnjum RasheedNo ratings yet

- Ias 12Document33 pagesIas 12samrawithagos2002No ratings yet

- Danils Gribanovs Week 22Document2 pagesDanils Gribanovs Week 22Danil GribanovNo ratings yet

- Tax Credit Certificate - 2018 : PPS No: 1793106MADocument4 pagesTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuNo ratings yet

- Declaration 1726107Document4 pagesDeclaration 1726107Hanzala NasirNo ratings yet

- Vat Guide EngDocument10 pagesVat Guide EngMohit GaurNo ratings yet

- Declaration4120159310489 PDFDocument2 pagesDeclaration4120159310489 PDFMohsin Ali Shaikh vlogsNo ratings yet

- How To Read A Salary Paper in Denmark: Tekst Grundlag Sats Udbetalt TrukketDocument1 pageHow To Read A Salary Paper in Denmark: Tekst Grundlag Sats Udbetalt TrukketCristian NastaseNo ratings yet

- Lecture 3Document57 pagesLecture 3Hoàng NhiNo ratings yet

- Individual Tax Payer - Part 2Document18 pagesIndividual Tax Payer - Part 2Ems TeopeNo ratings yet

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Declaration 3630294043517Document3 pagesDeclaration 3630294043517MuhammadWaqarNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Mixed Income EarnersDocument6 pagesMixed Income EarnersEzi AngelesNo ratings yet

- Sa Mar12 f6 Vat2Document7 pagesSa Mar12 f6 Vat2Mohammad Hisham BhawpalNo ratings yet

- TX NotesDocument157 pagesTX Notessahalacca123No ratings yet

- Meet 11-Accounting For Income Taxes-DYP PDFDocument19 pagesMeet 11-Accounting For Income Taxes-DYP PDFRENDY FILIANGNo ratings yet

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Advance I Ch-IDocument63 pagesAdvance I Ch-IUtban Ashab100% (1)

- BIR ComputationsDocument10 pagesBIR Computationsbull jackNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Mobile Topup June 22Document1 pageMobile Topup June 22Khawar MahmoodNo ratings yet

- 12 Aug 2020Document13 pages12 Aug 2020Khawar MahmoodNo ratings yet

- Priority Banking - BOP BoardDocument56 pagesPriority Banking - BOP BoardKhawar Mahmood100% (1)

- Final Arbitration ClaimDocument14 pagesFinal Arbitration ClaimKhawar MahmoodNo ratings yet

- User Guide: Xperia Z5 CompactDocument147 pagesUser Guide: Xperia Z5 CompactKhawar MahmoodNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- Operational Losses - Summary (Till May-2021)Document4 pagesOperational Losses - Summary (Till May-2021)Khawar MahmoodNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- June 2021Document1 pageJune 2021Khawar MahmoodNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- March 2021Document1 pageMarch 2021Khawar MahmoodNo ratings yet

- March 2021Document1 pageMarch 2021Khawar MahmoodNo ratings yet

- Web Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineDocument1 pageWeb Generated Bill: Feeder: Jail Road Sub Division: G.O.R Division: Civil LineKhawar MahmoodNo ratings yet

- Biological AndNon-biologicalMethods For Silver Nanoparticles SynthesisDocument10 pagesBiological AndNon-biologicalMethods For Silver Nanoparticles SynthesisHernan DmgzNo ratings yet

- Gov Chapter 3Document31 pagesGov Chapter 3Isaiah ValenciaNo ratings yet

- Apple Imac G4 800 - Apple - Q59 - MLB - DVT - 051-6497 - Rev13Document69 pagesApple Imac G4 800 - Apple - Q59 - MLB - DVT - 051-6497 - Rev13Raul Alexandru CuldaNo ratings yet

- Digitalization in The Financial StatementsDocument12 pagesDigitalization in The Financial Statementsrockylie717No ratings yet

- Materilaspresentation 151211133439Document13 pagesMaterilaspresentation 151211133439Ethan HuntNo ratings yet

- 10 Questions For Comprehensive Succession PlanningDocument2 pages10 Questions For Comprehensive Succession PlanningBESmithIncNo ratings yet

- Group 2 - Mini Project Slide (Currypuff Maker)Document24 pagesGroup 2 - Mini Project Slide (Currypuff Maker)Muhd Khairul AmriNo ratings yet

- AC Combiner Box Specification 400vac)Document7 pagesAC Combiner Box Specification 400vac)emilNo ratings yet

- Sound Doctrine An Interview With Walter MurchDocument8 pagesSound Doctrine An Interview With Walter MurchShashankk O TripathiNo ratings yet

- MCA Syllabus - 1st Sem PDFDocument32 pagesMCA Syllabus - 1st Sem PDFshatabdi mukherjeeNo ratings yet

- To Determine The Internal Resistance of A Given Primary Cell Using Potentiometer - Learn CBSEDocument11 pagesTo Determine The Internal Resistance of A Given Primary Cell Using Potentiometer - Learn CBSEAbhay Pratap GangwarNo ratings yet

- A8 HBR-01-WSX-MEC-DTS-0001 Rev B2Document12 pagesA8 HBR-01-WSX-MEC-DTS-0001 Rev B2ahmed.njahNo ratings yet

- Executive Order No. 459, S. 2005 - Official Gazette of The Republic of The PhilippinesDocument1 pageExecutive Order No. 459, S. 2005 - Official Gazette of The Republic of The PhilippinesCharlie AdonaNo ratings yet

- LP Unsung Heroes PDFDocument3 pagesLP Unsung Heroes PDFzfmf025366No ratings yet

- CTG 4080 Gypsum Board Systems Manual EngDocument52 pagesCTG 4080 Gypsum Board Systems Manual EngElmer Soroan BarrerasNo ratings yet

- 4 Types of Business OrganizationsDocument3 pages4 Types of Business OrganizationsAnton AndayaNo ratings yet

- ZumbroShopper15 10 07Document12 pagesZumbroShopper15 10 07Kristina HicksNo ratings yet

- Academic CV Working DraftDocument3 pagesAcademic CV Working Draftapi-548597996No ratings yet

- Lit Assessment Marking Scheme PlannersDocument2 pagesLit Assessment Marking Scheme PlannersAnaaya GuptaNo ratings yet

- Characters Numerals Size Number of Pages: Amrlipi (Amarlipi)Document183 pagesCharacters Numerals Size Number of Pages: Amrlipi (Amarlipi)ggn11No ratings yet

- Fashion - February 2014 CADocument144 pagesFashion - February 2014 CAAlmaMujanovićNo ratings yet

- The Verb To Be ExplanationsDocument5 pagesThe Verb To Be ExplanationsLuz Maria Batista MendozaNo ratings yet

- Gear RatiosDocument2 pagesGear RatiosNagu SriramaNo ratings yet

- Enterprise Resources Planning (ERP) 2610002Document2 pagesEnterprise Resources Planning (ERP) 2610002Virendra Arekar100% (1)

- AK4452VNDocument87 pagesAK4452VNJudon ArroyoNo ratings yet

- Computer Graphics and AnimationDocument3 pagesComputer Graphics and AnimationRajeev GairolaNo ratings yet