Professional Documents

Culture Documents

Hai 01 2024 Housing Affordability Index 2024 03 08

Uploaded by

api-737532809Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hai 01 2024 Housing Affordability Index 2024 03 08

Uploaded by

api-737532809Copyright:

Available Formats

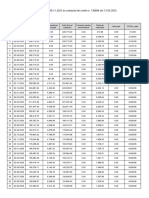

NATIONAL ASSOCIATION OF REALTORS: HOUSING AFFORDABILITY INDEX

Median Priced Monthly Payment Median Affordability Indexes

Existing Single- Mortgage P&I as a % Family Qualifying

Year Family Home Rate* Payment of Income Income Income** Fixed

2021 357,100 3.01 1206 16.9 85,806 57,888 148.2

2022 392,800 5.40 1765 23.0 92,148 84,720 108.8

2023 394,100 6.88 2072 25.4 97,699 99,456 98.2

2023 Jan 365,400 6.35 1,819 22.9 95,377 87,312 109.2

2023 Feb 368,100 6.34 1,830 22.9 95,976 87,840 109.3

2023 Mar 379,500 6.62 1,943 24.2 96,508 93,264 103.5

2023 Apr 390,200 6.42 1,957 24.3 96,790 93,936 103.0

2023 May 401,500 6.51 2,032 25.1 97,166 97,536 99.6

2023 Jun 415,700 6.79 2,166 26.7 97,401 103,968 93.7

2023 Jul 411,200 6.92 2,171 26.6 97,865 104,208 93.9

2023 Aug 410,200 7.15 2,216 27.1 98,291 106,368 92.4

2023 Sep 397,400 7.28 2,175 26.4 98,705 104,400 94.5

2023 Oct 396,000 7.70 2,259 27.4 99,109 108,432 91.4

2023 Nov 392,200 7.52 2,198 26.5 99,432 105,504 94.2

2023 Dec r 385,800 6.90 2,033 24.5 99,767 97,584 102.2

2024 Jan p 383,500 6.72 1,984 23.7 100,472 95,232 105.5

This Month Year

Month Ago Ago

Northeast 443,600 6.72 2,295 24.5 112,390 110,160 102.0 101.4 111.6

Midwest 273,900 6.72 1,417 17.4 97,908 68,016 143.9 139.3 153.3

South 350,700 6.72 1,814 23.5 92,529 87,072 106.3 102.1 108.7

West 585,200 6.72 3,027 33.1 109,662 145,296 75.5 72.6 79.1

*Effective rate on loans closed on existing homes - Federal Housing Finance Agency. Adjustable mortgage rates are not available since 2010.

Note: Starting in May 2019, FHFA discontinued the release of several mortgage rates and only published an adjustable rate mortgage called

PMMS+ based on Freddie Mac Primary Mortgage Market Survey. With these changes, NAR will no longer release the HAI Composite Index

(based on 30-year fixed rate and ARM) and will only release the HAI based on a 30-year mortgage. NAR calculates the 30-year effective fixed rate

based on Freddie Mac's 30-year fixed mortgage contract rate, 30-year fixed mortgage points and fees, and a median loan value based on the NAR

median price and a 20 percent down payment.

**Based on a 25% qualifying ratio for monthly housing expense to gross monthly income with a 20% down payment.

p Preliminary r Revised

©2024 National Association of REALTORS®.

All Rights Reserved.

May not be reprinted in whole or in part without permission of the National Association of REALTORS®.

For reprint information, contact data@realtors.org.

You might also like

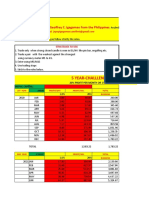

- 5 Year Challlenge Forex Trading: 20% Profit Per Month or 1% Per Day Versus Your Capital Initial CapitalDocument6 pages5 Year Challlenge Forex Trading: 20% Profit Per Month or 1% Per Day Versus Your Capital Initial CapitalMostNo ratings yet

- PF Table Installment BM Nov Debt Cons 2022Document1 pagePF Table Installment BM Nov Debt Cons 2022MUHAMMAD AL AMIN AZMANNo ratings yet

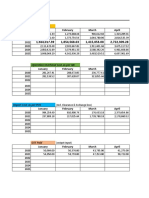

- THE COMPOUNDING POWER OF FOREX TRADING - XLSX ($1000)Document6 pagesTHE COMPOUNDING POWER OF FOREX TRADING - XLSX ($1000)georgeNo ratings yet

- NMH - CCS Rev12.3 - NMH Design & Construction Schedule - S CurveDocument8 pagesNMH - CCS Rev12.3 - NMH Design & Construction Schedule - S CurveKhadijaNo ratings yet

- PF Table Installment BM Nov Pakej Program 2022Document1 pagePF Table Installment BM Nov Pakej Program 2022Mr FarukNo ratings yet

- Type of Loan Short TermDocument10 pagesType of Loan Short TermAhmed AwaisNo ratings yet

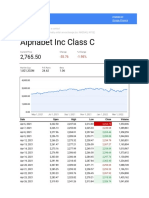

- Alphabet Inc Class C: Google FinanceDocument7 pagesAlphabet Inc Class C: Google FinanceBat TrungNo ratings yet

- Tourism Statistics 2015Document5 pagesTourism Statistics 2015Wen-Hsuan HsiaoNo ratings yet

- P N L Industry1Document14 pagesP N L Industry1Manmeet SinghNo ratings yet

- Alphabet Inc Class C: Google FinanceDocument8 pagesAlphabet Inc Class C: Google FinanceBat TrungNo ratings yet

- Project Budget - Monthly TEMPLATE SIMPLEDocument5 pagesProject Budget - Monthly TEMPLATE SIMPLEAthirah OmarNo ratings yet

- BRI Kredit Investasi May 2023Document2 pagesBRI Kredit Investasi May 2023armanNo ratings yet

- All Order Costing Report by Ship Date: CommentsDocument39 pagesAll Order Costing Report by Ship Date: Commentsshayne lafsNo ratings yet

- Google Finance Investment TrackerDocument13 pagesGoogle Finance Investment TrackerSwaraj NayseNo ratings yet

- Anexa nr.1 Din 28.11.2023 La Contractul de Credit Nr. 136694 Din 13.05.2023Document2 pagesAnexa nr.1 Din 28.11.2023 La Contractul de Credit Nr. 136694 Din 13.05.2023Grădinari TatianaNo ratings yet

- Taksit Sayısı Tarih Taksit Anapara Faiz KKDF BSMV Kalan Ana paraDocument1 pageTaksit Sayısı Tarih Taksit Anapara Faiz KKDF BSMV Kalan Ana paraPasha BlackAxe TurkOgameNo ratings yet

- Dib Profit Sheet (New)Document6 pagesDib Profit Sheet (New)Arsalan Feroz KhanNo ratings yet

- All Order Costing Report by Ship Date: CommentsDocument38 pagesAll Order Costing Report by Ship Date: Commentsshayne lafsNo ratings yet

- Formula PracticeDocument11 pagesFormula PracticeSoud Al FaysalNo ratings yet

- Tourism Statistics 201909Document8 pagesTourism Statistics 201909Aubrey LabardaNo ratings yet

- Table Rate PF JULY 2020 Debt Cons BMDocument1 pageTable Rate PF JULY 2020 Debt Cons BMwaliqutubNo ratings yet

- Repayment PDFDocument5 pagesRepayment PDFRamesh ReddyNo ratings yet

- Malaysia's Export of Natural Rubber by GradeDocument1 pageMalaysia's Export of Natural Rubber by GradeZAIRUL AMIN BIN RABIDIN (FRIM)No ratings yet

- Repayment Schedule - 164454650Document3 pagesRepayment Schedule - 164454650arunghodke12No ratings yet

- Loan Repayment Schedule: Customer DetailsDocument3 pagesLoan Repayment Schedule: Customer DetailsJasbind yadavNo ratings yet

- Base Dados Excel TreinamentoDocument104 pagesBase Dados Excel Treinamentokly15oNo ratings yet

- Amort Sched TCH SampleDocument1 pageAmort Sched TCH SampleJaypee AustriaNo ratings yet

- Year 2018-1Document5 pagesYear 2018-1Vũ Ngọc BíchNo ratings yet

- Consumer Price Index (February 2019 100)Document8 pagesConsumer Price Index (February 2019 100)rzvendiya-1No ratings yet

- 5X5Y - Business Plan: January February March AprilDocument7 pages5X5Y - Business Plan: January February March AprilZubairNo ratings yet

- Cálculo IndicadoresDocument5 pagesCálculo IndicadoresDaniel RodriguezNo ratings yet

- Summary Coal HaulingDocument12 pagesSummary Coal HaulingAryo Prastyo AjiNo ratings yet

- Assignment 2 DataDocument68 pagesAssignment 2 Dataliveknightmare7No ratings yet

- AaminDocument1 pageAaminDeden FachrudinNo ratings yet

- Precios Medios Estacionales MEM y TDF 2019 2024 WEBDocument5 pagesPrecios Medios Estacionales MEM y TDF 2019 2024 WEBEduardo lopez garciaNo ratings yet

- ProjektDocument7 pagesProjekticzech1506No ratings yet

- Amortization ScheduleDocument1 pageAmortization Schedulevishal2k5No ratings yet

- Cambodia Tourism Statistics 2017Document5 pagesCambodia Tourism Statistics 2017Thông NguyễnNo ratings yet

- 3 Year Payroll 2019 2020 2021Document4 pages3 Year Payroll 2019 2020 2021Candy ValentineNo ratings yet

- Evidencia 2Document34 pagesEvidencia 2Edgar Francisco Hernandez PeñuelasNo ratings yet

- Tourism Statistics: Kingdom of CambodiaDocument8 pagesTourism Statistics: Kingdom of CambodiaAubrey LabardaNo ratings yet

- KuramathiDocument3 pagesKuramathiSubani GunarathnaNo ratings yet

- Grand Park - Weather ReportsDocument4 pagesGrand Park - Weather ReportsChang NgốcNo ratings yet

- Year 2019Document5 pagesYear 2019Master SearNo ratings yet

- Ie Table A-3-1 Money Supply - Irish ResidentDocument33 pagesIe Table A-3-1 Money Supply - Irish ResidentKhurram Sadiq (Father Name:Muhammad Sadiq)No ratings yet

- 001 067000756769 0Document1 page001 067000756769 0Aristides Pardo CarhuapomaNo ratings yet

- A B C D e F G H 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29Document4 pagesA B C D e F G H 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29Manoj JosephNo ratings yet

- FredgraphDocument2 pagesFredgraphnghitran.31211021469No ratings yet

- Billing & DisbursmentDocument4 pagesBilling & Disbursmenttsung sheng chenNo ratings yet

- DM Car Rental CalculatorDocument5 pagesDM Car Rental CalculatorNisarvurdRehhman AkrumButtNo ratings yet

- DM Car Rental CalculatorDocument5 pagesDM Car Rental CalculatorNisarvurdRehhman AkrumButtNo ratings yet

- Amortization ScheduleDocument1 pageAmortization ScheduleDrahneel MarasiganNo ratings yet

- JadualTransaksiSelangor2020Document53 pagesJadualTransaksiSelangor2020Venice ChenNo ratings yet

- Retirement Withdrawal CalculatorDocument17 pagesRetirement Withdrawal CalculatorSanjeev NehruNo ratings yet

- Amort Sched TCH Sample 2Document1 pageAmort Sched TCH Sample 2Jaypee AustriaNo ratings yet

- BNB HistoryDocument1 pageBNB HistoryRichCrypto RapNo ratings yet

- Mortgage Loan Payments: Enter Values Loan SummaryDocument1 pageMortgage Loan Payments: Enter Values Loan SummaryMuhammad RaheelNo ratings yet

- Repayment Schedule: Askari Bank LTDDocument2 pagesRepayment Schedule: Askari Bank LTDAzhar QureshiNo ratings yet

- Loanchart Apr 06 2023 14 17 45Document3 pagesLoanchart Apr 06 2023 14 17 45luckyNo ratings yet

- Mortgage Commitment DobleDocument4 pagesMortgage Commitment DobleHarvey SpiegelNo ratings yet

- Other Laws Inter Ca: Book - IiDocument304 pagesOther Laws Inter Ca: Book - IiNeel HatiNo ratings yet

- Mortgage Deed (Mortgage Deed by Small Farmer For Agrl - Loans in F/O Pac/Bank)Document3 pagesMortgage Deed (Mortgage Deed by Small Farmer For Agrl - Loans in F/O Pac/Bank)JC WARGAL100% (1)

- Ex-India Leave Performa 4444Document7 pagesEx-India Leave Performa 4444raman kumarNo ratings yet

- 14 - Cruz vs. Filipinas Investment & Finance Corp.Document1 page14 - Cruz vs. Filipinas Investment & Finance Corp.Juvial Guevarra BostonNo ratings yet

- Unit 13 Ending - Termination of ContractsDocument12 pagesUnit 13 Ending - Termination of ContractsGift chipetaNo ratings yet

- Geofredo E. Mabunga and Froilan D. Cabaltera For Petitioners. Gella, Danguilan, Fuentes, Ferrer, Samson & Associates For Private RespondentDocument49 pagesGeofredo E. Mabunga and Froilan D. Cabaltera For Petitioners. Gella, Danguilan, Fuentes, Ferrer, Samson & Associates For Private RespondentRuth HephzibahNo ratings yet

- Some Imp. Question of Business LawDocument4 pagesSome Imp. Question of Business LawPraman PoudelNo ratings yet

- Loan Agreement TemplateDocument5 pagesLoan Agreement TemplatePratik UdaniNo ratings yet

- Ucl Consid in Ten 1213Document5 pagesUcl Consid in Ten 1213Andreea TomaNo ratings yet

- A. Autonomy of Contract-The Contracting Parties May Establish SuchDocument12 pagesA. Autonomy of Contract-The Contracting Parties May Establish SuchcykenNo ratings yet

- Mailbox RuleDocument6 pagesMailbox RuleBhavya Verma100% (2)

- Discharge of ContractDocument8 pagesDischarge of ContractRubeya RashidNo ratings yet

- 189 Cases With Area of Law and Ratio BriefsDocument54 pages189 Cases With Area of Law and Ratio BriefsRahul sagarNo ratings yet

- Case Laws of Contract Chaper 1Document8 pagesCase Laws of Contract Chaper 1gohangokuson1No ratings yet

- Indemnification PresentationDocument17 pagesIndemnification PresentationAmr Ismail100% (1)

- Unenforceable Contract Art 1403 1408Document13 pagesUnenforceable Contract Art 1403 1408Zen ArinesNo ratings yet

- Chapter 2 Indian Contract Act, 1872 Nature of ContractDocument24 pagesChapter 2 Indian Contract Act, 1872 Nature of ContractIshika AgarwalNo ratings yet

- Credit TransactionsDocument12 pagesCredit TransactionsMark Tano100% (3)

- Reviewer For Midterms in Civil Law Review2 (ObliCon)Document4 pagesReviewer For Midterms in Civil Law Review2 (ObliCon)Harold B. LacabaNo ratings yet

- Section 37, para 1, of The Contract Act Lays Down That, "The Parties To A Contract Must Either PerformDocument1 pageSection 37, para 1, of The Contract Act Lays Down That, "The Parties To A Contract Must Either PerformRabbi Al RahatNo ratings yet

- Notes On Insurance Code Sec.1 31 Reference Sec. Hernando Perez For Fair Use OnlyDocument12 pagesNotes On Insurance Code Sec.1 31 Reference Sec. Hernando Perez For Fair Use OnlyTamayao, Guada Antonette B.No ratings yet

- Past Year DEC 2016 Q3Document2 pagesPast Year DEC 2016 Q3Jannah KhairahNo ratings yet

- Battery Rejection LetterDocument2 pagesBattery Rejection LetterRajput A SinghNo ratings yet

- James Baird Co. v. Gimbel Brothers, Inc.Document2 pagesJames Baird Co. v. Gimbel Brothers, Inc.crlstinaaaNo ratings yet

- Jardenil vs. SolasDocument2 pagesJardenil vs. SolasDenise Jane DuenasNo ratings yet

- Modelo Seasonal Rental AgreementDocument4 pagesModelo Seasonal Rental Agreementeva ferrerasNo ratings yet

- Buslaw 1 - SyllabusDocument9 pagesBuslaw 1 - SyllabusStephanie Head AmbrosioNo ratings yet

- Outline Sales UCC - Article2-1Document26 pagesOutline Sales UCC - Article2-1Kim BoSlice100% (6)

- CIDB Model Terms For SubContract 2006Document36 pagesCIDB Model Terms For SubContract 2006Yee YenNo ratings yet