Professional Documents

Culture Documents

Terms Conditions-Term Deposits Revised

Uploaded by

Sunny Kumar0 ratings0% found this document useful (0 votes)

1 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesTerms Conditions-Term Deposits Revised

Uploaded by

Sunny KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Unity Small Finance Bank Limited- Term Deposits – Rules date of maturity till the date of payment.

rity till the date of payment. In case of splitting of the

amount of term deposit at the request from the claimant/s of

& Regulations

deceased depositors or Joint account holders, no penalty for

1. Minimum period: 7 days. Maximum period: 10 years. premature withdrawal of the term deposit shall be levied if the period

and aggregate amount of the deposit do not undergo any change.

2. Types of Term Deposits:

6. Premature withdrawal of Term Deposit

(a) Short Term Deposit (STD): Period from 7 days to less than 2

Premature withdrawal is permitted for term deposits below ₹ 2 crores,

quarters. Simple interest paid.

on request of the depositor. For Term Deposits of amount ₹ 2 crores

(b) Monthly Interest Certificate (MIC): Interest calculated with and above, the Bank offers both deposits with/without premature

monthly pay-out at discounted value for general customers and withdrawal facility; customer shall be given the option to choose

simple interest for senior citizens. between the two facilities. For term deposits without premature

(c) Quarterly Interest Certificate (QIC): Simple Interest paid on withdrawal facility, the Bank may offer differential rate of interest. The

quarterly basis. Interest is calculated on the principal amount for Bank, at its discretion, may also levy penalty for premature / partial

completed quarters and then for the balance period, interest is withdrawal of term deposit as per internal policy displayed on the

calculated for completed months and further for incomplete month website of the Bank and branches. For term deposits withdrawn

on actual number of days reckoning the year at 365 days. before maturity date (i) the deposit should have remained with the

bank at least for the minimum period which presently is 7 days; (ii)

(d) Re-investment Certificate (RIC): Applicable only for tenor more

interest shall be paid at the rate applicable to the amount and period

than 6 months. Interest reinvested on quarterly basis with pay-out on

for which the deposit remained with the Bank. Interest is calculated

maturity. Interest is compounded quarterly on completion of exact on the principal amount for completed quarters and then for the

quarters and then for the balance period, interest is calculated for balance period, interest is calculated for completed months and

completed months and further for incomplete month on actual further for incomplete month on actual number of days reckoning the

number of days reckoning the year at 365 days. year at 365 days.

(e) Bulk Term Deposit: Single rupee term deposits of Rs. 2 core and Premature termination of term deposit on demise of account

above. Bank may offer differential rates of interest. holder/s shall be permitted as per the terms of contract subject to

(f) Recurring Deposit: Customer deposits fixed amount on monthly necessary verifications and submission of proof of death of the

basis. Tenure may range from 6 months to 10 years. Repayment with depositor/s. In the case of Term Deposit of deceased depositor/s with

nomination, premature termination shall be permitted as per terms of

interest on maturity.

contract at the request of the nominee on verification of his/her OVD

(such as Election ID Card, PAN Card, Passport etc.) and proof of death

3. Interest on Term Deposits: Interest applicable as per schedule of of depositor. In the case of Term Deposit of deceased depositor/s

interest rates applicable for different periods as displayed on Bank’s without nomination, premature termination will be permitted on joint

website and branches and not subject to negotiation. However, Bank request by all legal heirs (or any of them as mandated by all the legal

at its discretion may offer differential rates of interest only on bulk heirs) as per the terms of the contract on verification of the authority

deposits i.e. single deposit of Rs. 2 crore and above. Interest is of the legal heirs and proof of death of depositor.

calculated and applied at quarterly intervals. Where term deposit is

repayable in less than 3 months or where the terminal quarter is 7. Repayment of Term Deposits:

incomplete, interest shall be paid proportionately for the actual a) The depositor/s may provide advance instructions for disposal of

deposits on maturity on the Term Deposit application form itself.

number of days reckoning the year at 365 days irrespective of a leap

b) The following are enabling clauses to facilitate easy and hassle-

year. All transactions, involving payment of interest on deposits shall

free closure of term deposits held in joint names with

be rounded off to the nearest rupee for rupee deposits. Interest for a survivorship clause / nomination:

month/ quarter shall be credited at the end of month/quarter and (i) In the event of disposal instructions being ‘Either or

shall be calculated till previous date of such credit. For the last day of Survivor’ or ‘Anyone or Survivor’, and a premature

the month/quarter, interest shall be credited in the next withdrawal is required by either / any one of the joint

month/quarter. holders, even when both are alive: In case either one / any

one of us requests the Bank to allow either / any of us to

4. Deposits maturing on holidays and non-business working days: prematurely withdraw the said deposit, in part or in full,

Where a term deposit matures for payment on a holiday/ non- the Bank is entitled to honour the same. We, further, affirm

business working day, depositor is entitled to interest at originally that such payment of proceeds of the deposit to either one

contracted rate on the original principal deposit amount for the / any one of us shall represent a valid discharge from all of

holiday / non-business working day intervening between the date of us to the Bank with respect to its liability, provided there is

the maturity and the date of payment of deposit proceeds on the no order from a competent court restraining the Bank from

succeeding working day. In reinvestment deposits and recurring making the payment from the said account to either one /

deposits, customer is entitled to interest as above, but calculated on any one of us.

the maturity value. (ii) Where the mode of operation of the term deposit is ‘Either

or Survivor' / ‘Anyone or Survivor’ / ‘Former or Survivor' /

5. Interest Payable on Term Deposit of Deceased Holder/s ‘Latter or Survivor’, in the event of the death of any of us,

In case of death of the depositor/s before date of maturity of the the deposit holders, premature withdrawal shall be

deposit and the proceeds thereof is claimed after the date of maturity, permitted by the Bank to the survivor/s on request,

customer is entitled to interest at the contracted rate till the date of without seeking the concurrence of the legal heirs of the

maturity. Thereafter, the bank at its discretion shall pay simple deceased joint deposit holder/s. We further affirm that

interest at the applicable TD rate operating on the date of maturity, such payment of the proceeds of the deposit to the

for the period the deposit remained with the bank beyond the date of survivor/s shall represent a valid discharge of the bank's

maturity. If the amount of deposit is claimed before the date of liability provided: (i) There is no order from a competent

maturity, interest at the rate applicable to the period for which the court restraining the bank from making the payment from

deposit has actually remained with the bank shall be paid, without any the said account; (ii) That the survivor/s would be receiving

penal charge. However, in case of death of the depositor after the date the payment from the bank as trustee/s of the legal heirs

of maturity of the deposit, interest shall be paid at the contracted rate of the deceased depositor/s and that such payment to the

till the date of maturity and for the period thereafter, customer will be survivor/s shall not affect the right or claim that any

entitled to interest at savings account rate or the contracted rate of person/s may have against the survivor/s to whom the

interest on the matured term deposit, whichever is lower, from the payment is made. Such premature withdrawal shall not

attract any penal charge. However, the interest rate shall

be the rate applicable for the period the deposit has b) TDS in respect of interest earned on fixed deposits, is deducted

remained with the bank or the contracted rate, whichever on the basis of the total interest projected on the aggregate of

is lower. fixed deposits of the customer, for the financial year. Thus, if the

(iii) Where the deposit is held singly or jointly and premature total projected interest in a financial year crosses the threshold

withdrawal is required by the nominee in the event of limit as applicable from time to time, TDS is deducted

death of the deposit holder/s / all the joint holders: (i) In proportionately from the existing fixed deposits at the time of

the event of my/our death, the nominee named for the interest application. The bank will issue a tax deduction

deposit is entitled to prematurely withdraw the said certificate (TDS certificate) for the amount of tax deducted.

deposit, if he/she so requests the bank, without seeking c) The depositor, if entitled to exemption from TDS can submit

the concurrence of my/our legal heirs. I/We further affirm applicable declaration in the prescribed format (Form 15G/ Form

that payment of the proceeds of such deposit to the 15H / Tax Exemption Certificate) at the beginning of every

nominee shall represent a valid discharge of the bank's financial year for existing term deposits and later on for term

liability (ii) That the nominee would be receiving the deposits created subsequently, failing which bank shall proceed

payment from the bank as a trustee of the legal heirs of the to deduct tax as applicable.

deceased depositor/s and that such payment to the

nominee shall not affect the right or claim that my legal

12. Advances against Term Deposits: The Bank may consider request of

heirs may have against the nominee to whom the payment

the depositor(s) for availing loan / overdraft facility against term

is made.

deposits maintained with the Bank and duly discharged by the

depositor(s) on execution of necessary security documents, subject to

8. Premature Renewal of Term Deposit: The depositor can renew the

RBI directives in force from time to time. The Bank may also consider

deposit by seeking premature closure of an existing term deposit

loan against deposit in the name of minor, however, a suitable

account in order to avail of the benefit of interest rates. The bank will

declaration stating that loan is for the benefit of the minor, is to be

permit such renewal at the rate of interest applicable on the date of

furnished by the depositor–applicant. The Bank will offer such

renewal, provided that the deposit remains with the bank after

advances at a margin as decided from time and time and ensuring the

reinvestment for a period longer than the remaining period of the

necessary margins are maintained so as to ensure that the due

original contract, or as may be decided by Bank from time to time.

amount outstanding is never over the principle maintained in the

While prematurely closing a deposit for the purpose of renewal,

bank. The rate of interest applicable to such advances shall be as

interest on the deposit for the period it has remained with the bank

determined by the Bank as per internal policy and disclosed upfront

will be paid at the rate applicable on the date of deposit for the period

to the customer.

for which the deposit remained with the bank and not at the

contracted rate. Further, the bank may, at its discretion, levy penalty

13. General

for premature closure of an existing deposit at such rates as may be

a) Direct Credit facility: The repayments of Term Deposit having

decided by the bank from time to time.

instructions for direct credit to the linked account can be

9. Renewal of Overdue Term Deposit executed at any branch of Unity Small Finance Bank Ltd.

a) An overdue term deposit or it’s portion may be renewed by the b) Personal Information: Any updation of depositor details

depositor from the date of maturity, provided the overdue including personal information, change of address etc. shall be

period from the date of maturity till the date of renewal does not provided by the depositor to the bank, along with documents of

exceed 14 days. proof within 2 weeks of such change.

b) The rate of interest payable on the amount of the deposit so c) Deposit Insurance: The deposits in the Bank are insured with

renewed shall be the appropriate rate of interest for the period DICGC for a total amount of Rs. 5 lakh (principal + interest) per

of renewal as prevailing on the date of maturity.

depositor.

c) If request for renewal is received after the date of maturity, such

overdue deposits will be renewed with effect from the date of

The Bank may disclose information about the depositor if required or

maturity at interest rate applicable as on the due date, provided

permitted by any law, rule or regulations or at the request of any public or

such request is received within 14 days from the date of

regulatory authority or if such disclosure is required for the purposes of

maturity.

preventing fraud, without any specific consent of the depositor.

d) In respect of overdue deposits renewed after 14 days from the

date of maturity, interest for the overdue period will be paid at

the savings account rate or the contracted rate of interest on the

matured term deposit, whichever is lower. Such term deposit

must have run for a minimum tenor of 7 days from the date of

request for renewal by the depositor, in order to earn any

interest. Premature withdrawals before this minimum tenor will

result in zero interest payment to the depositor.

e) For all new reinvestment term deposits, interest reinvested

would be net of TDS and hence the maturity value would vary to

that extent.

10. Interest on Overdue Domestic Term Deposits

If the Term Deposit (TD) matures and proceeds are unpaid, the

amount left unclaimed with the bank shall attract rate of interest as

applicable to savings account or the contracted rate of interest on the

matured TD, whichever is lower.

11. Tax Deducted at Source (TDS

a) If the total interest paid / payable on all term deposits held by a

person exceeds the threshold amount specified under the

Income Tax Act, 1961 and Income Tax Rules, during a financial

year, TDS shall accordingly be deducted at applicable rates.

You might also like

- Money Multiplier Deposits Rules: 1. Minimum DepositDocument3 pagesMoney Multiplier Deposits Rules: 1. Minimum DepositSanjeev MiglaniNo ratings yet

- Fixed Deposit RulesDocument3 pagesFixed Deposit Rulesvin123keshriNo ratings yet

- Auto FD DeclarationDocument2 pagesAuto FD DeclarationsumitNo ratings yet

- Opening of AccountsDocument6 pagesOpening of AccountswubeNo ratings yet

- Muthoot Gold Loan T&ADocument6 pagesMuthoot Gold Loan T&AfinaarthikaNo ratings yet

- Banking Principle,,,Ch - 2Document11 pagesBanking Principle,,,Ch - 2Mubarik AhmedinNo ratings yet

- Customer AccountsDocument32 pagesCustomer AccountsJitendra VirahyasNo ratings yet

- FD Terms-and-Conditions 0Document10 pagesFD Terms-and-Conditions 0iamtom101516No ratings yet

- Terms Deposit Rules Terms & ConditionDocument2 pagesTerms Deposit Rules Terms & ConditionKrrish LaraieNo ratings yet

- FOREX Cir1684 12Document12 pagesFOREX Cir1684 12sunilNo ratings yet

- Overdraft Against Property Loan AgreementDocument56 pagesOverdraft Against Property Loan Agreementkirubaharan2022No ratings yet

- Credit Principles of Lending: Jayant Panwar BBA (B&I) 2 ShiftDocument18 pagesCredit Principles of Lending: Jayant Panwar BBA (B&I) 2 ShiftRam Lal opNo ratings yet

- Amended RBPF PolicyDocument2 pagesAmended RBPF Policynfk roeNo ratings yet

- Processing and Operation of Cash Credit1 FinalDocument42 pagesProcessing and Operation of Cash Credit1 Finalrajin_rammsteinNo ratings yet

- Knowledge Bank - Advances Against DepositsDocument4 pagesKnowledge Bank - Advances Against DepositsKajeev KumarNo ratings yet

- Enash 24 FormDocument2 pagesEnash 24 FormmukeshNo ratings yet

- CreditCard Sanction Letter 918217097145Document4 pagesCreditCard Sanction Letter 918217097145Maha RajaNo ratings yet

- ECB Practical ApproachDocument4 pagesECB Practical ApproachCryosave100% (1)

- Mitc To Be Signed by Customer OldDocument4 pagesMitc To Be Signed by Customer Oldstevenjones5001No ratings yet

- Bob Auto Renewal Sanction Letter 1167708Document6 pagesBob Auto Renewal Sanction Letter 1167708Navin DongreNo ratings yet

- Revised Guidelines On The Pag-IBIG Multi-Purpose Loan (MPL) Program Under The STLMS - IISPDocument8 pagesRevised Guidelines On The Pag-IBIG Multi-Purpose Loan (MPL) Program Under The STLMS - IISPjohnarbhen23velardeNo ratings yet

- Cir 56-I - Implementing Guidelines of The Pag-IBIG MPL Program For Non-IISP BranchesDocument7 pagesCir 56-I - Implementing Guidelines of The Pag-IBIG MPL Program For Non-IISP Branchesmaxx villaNo ratings yet

- Terms and Conditions Personal Loan 1683192229857Document2 pagesTerms and Conditions Personal Loan 1683192229857AkkiNo ratings yet

- SBI Reverse Mortgage LoanDocument5 pagesSBI Reverse Mortgage LoanVishwa Prasanna Kumar100% (1)

- Fixed DepositDocument37 pagesFixed DepositMinal DalviNo ratings yet

- Most Important Terms and ConditionsDocument17 pagesMost Important Terms and ConditionsReddaiah YedotiNo ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- Circular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramDocument8 pagesCircular No. 449 - Modified Guidelines On The Pag-IBIG Fund Calamity Loan ProgramJaybie SabadoNo ratings yet

- It Can Be Identified 4 Basic Scenarios When Rescheduling A LoanDocument4 pagesIt Can Be Identified 4 Basic Scenarios When Rescheduling A LoanMd Salah UddinNo ratings yet

- Brief Note On Covid-19 SahayataDocument3 pagesBrief Note On Covid-19 SahayataSonal GodambeNo ratings yet

- STMLPCP Terms and Conditions 33711498201643518958228Document4 pagesSTMLPCP Terms and Conditions 33711498201643518958228marlou gatilaNo ratings yet

- Directive 2Document69 pagesDirective 2Manish BhandariNo ratings yet

- SIB's Policy On Bank Deposits: PreambleDocument8 pagesSIB's Policy On Bank Deposits: PreamblenithiananthiNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsThatukuru LakshmanNo ratings yet

- Unit 8n9Document7 pagesUnit 8n92050221 KUSHAGRA SHAHINo ratings yet

- Terms and Conditions Personal Loan 1694167502237Document9 pagesTerms and Conditions Personal Loan 1694167502237LAXMIDHAR BEHERANo ratings yet

- Terms and Conditions Personal Loan 1687845092306Document7 pagesTerms and Conditions Personal Loan 1687845092306vishal kademaniNo ratings yet

- Terms and Conditions Personal Loan 1684313861330Document2 pagesTerms and Conditions Personal Loan 1684313861330bleo02490No ratings yet

- RML Application FormDocument17 pagesRML Application Formkirubaharan2022No ratings yet

- Pricing of Liability Products Dec2021Document9 pagesPricing of Liability Products Dec2021Aditya SharmaNo ratings yet

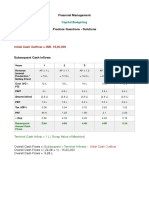

- Financial ManagementDocument18 pagesFinancial ManagementindhumathigNo ratings yet

- Overdraft Facility To Housing Loan Borrowers For Personal NeedsDocument3 pagesOverdraft Facility To Housing Loan Borrowers For Personal NeedsSaurabh KumarNo ratings yet

- Action RequireDocument10 pagesAction RequireAsma SaeedNo ratings yet

- Terms and Conditions Personal Loan 1687412522532Document2 pagesTerms and Conditions Personal Loan 1687412522532Bably SinghNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC)Document5 pagesPhilippine Deposit Insurance Corporation (PDIC)Angelo Raphael B. DelmundoNo ratings yet

- 2 Weeks Maturity DepositDocument2 pages2 Weeks Maturity DepositStorm CastleNo ratings yet

- Memorandum of Agreement For Livelihood Loan FacilityDocument9 pagesMemorandum of Agreement For Livelihood Loan Facilityglenn padernal100% (1)

- Chapter 6 Securities Operations and Risk ManagementDocument27 pagesChapter 6 Securities Operations and Risk ManagementMRIDUL GOELNo ratings yet

- Policy On Bank Deposits: PreambleDocument6 pagesPolicy On Bank Deposits: PreambleLukumoni GogoiNo ratings yet

- Most Important Document: CustomerDocument8 pagesMost Important Document: CustomermasumsojibNo ratings yet

- NEW PAY DAY FORM 2018 - Ammeded 03.06.2019Document3 pagesNEW PAY DAY FORM 2018 - Ammeded 03.06.2019chipiNo ratings yet

- BH Current Cheque Savings Account TermDocument27 pagesBH Current Cheque Savings Account TermBasem AhmedNo ratings yet

- BP Unit 4Document7 pagesBP Unit 4Nandhini VirgoNo ratings yet

- Yes FD Sunil Kumar (3) - 240201 - 205332Document2 pagesYes FD Sunil Kumar (3) - 240201 - 205332abdulvajidparuthikkattilNo ratings yet

- 1.1 Introduction To Reverse MortgageDocument20 pages1.1 Introduction To Reverse MortgageSandeep SandhuNo ratings yet

- Policy On Bank Deposits PreambleDocument8 pagesPolicy On Bank Deposits PreambleJOGA SINGHNo ratings yet

- Credit Appraisal and Non-Performing Assets Dr.P.Shanmukha Rao Dr.N.V.S.SuryanarayanaDocument8 pagesCredit Appraisal and Non-Performing Assets Dr.P.Shanmukha Rao Dr.N.V.S.SuryanarayanaImam AnnigeriNo ratings yet

- Sbi Home Loan InfoDocument4 pagesSbi Home Loan InfoBhargavaSharmaNo ratings yet

- Summer Vacation 2023-24 - 685831Document1 pageSummer Vacation 2023-24 - 685831Sunny KumarNo ratings yet

- EM-2 - Re-Remid Syllabus - April2024Document1 pageEM-2 - Re-Remid Syllabus - April2024Sunny KumarNo ratings yet

- Placement Cell Rules and Regulations 2024Document2 pagesPlacement Cell Rules and Regulations 2024Sunny KumarNo ratings yet

- Annual Report 2022 Financial Services CompanyDocument206 pagesAnnual Report 2022 Financial Services CompanySunny KumarNo ratings yet

- SCR - Review of Higher Education InstitutesDocument1 pageSCR - Review of Higher Education InstitutesSunny KumarNo ratings yet

- Gujcet Round 2 Rank Wise Institute Wise Opening Closing1664343641 - XZGTCZLDocument29 pagesGujcet Round 2 Rank Wise Institute Wise Opening Closing1664343641 - XZGTCZLSunny KumarNo ratings yet

- TextDocument1 pageTextSunny KumarNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- Payslip 2020 2021 1 hf004071 HDBFSDocument1 pagePayslip 2020 2021 1 hf004071 HDBFSsriram kumar100% (1)

- D20BB003 - Financial AccountingDocument2 pagesD20BB003 - Financial Accountingmba departmentNo ratings yet

- Long Quiz 2 Lease Answer KeyDocument3 pagesLong Quiz 2 Lease Answer KeyMia FayeNo ratings yet

- Corporate - TreasuryDocument49 pagesCorporate - TreasuryArif AhmedNo ratings yet

- Corporate Financial Management IntroDocument17 pagesCorporate Financial Management IntroADEYANJU AKEEMNo ratings yet

- The Pensford Letter - 8.31.15Document4 pagesThe Pensford Letter - 8.31.15Pensford FinancialNo ratings yet

- GST WS1Document2 pagesGST WS1AE BarasatNo ratings yet

- ExtAud 3 Midterm Exam W AnswersDocument12 pagesExtAud 3 Midterm Exam W AnswersJANET ILLESESNo ratings yet

- Asian Financial Crisis - The Domino Effect of ThailandDocument3 pagesAsian Financial Crisis - The Domino Effect of ThailandYovan OtnielNo ratings yet

- Role of EXIM Bank in International BusinessDocument5 pagesRole of EXIM Bank in International BusinessHarry02rocksNo ratings yet

- JSW Steel Financial AssessmentDocument32 pagesJSW Steel Financial AssessmentMAHIPAL CHANDANNo ratings yet

- DividendsDocument27 pagesDividendsJoyce Bernardo AdlaoNo ratings yet

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- Yes Bank ScamDocument3 pagesYes Bank ScamanchitNo ratings yet

- Redemption Form - CoreDocument1 pageRedemption Form - CoreNesesi TeaNo ratings yet

- Stock Present Fair Value CalculatorDocument5 pagesStock Present Fair Value Calculatorsamcool87No ratings yet

- Vivriti CapitalDocument4 pagesVivriti CapitalAnsuman MohapatroNo ratings yet

- Akeel Hussain 11022720-130Document58 pagesAkeel Hussain 11022720-130Akeel ChoudharyNo ratings yet

- Accounts Theory Q&A - CA Zubair KhanDocument16 pagesAccounts Theory Q&A - CA Zubair KhanAnanya SharmaNo ratings yet

- Growth & Changing Structure of Non-Banking Financial InstitutionsDocument12 pagesGrowth & Changing Structure of Non-Banking Financial InstitutionspremdeepsinghNo ratings yet

- FU Money - Dan Lok (Updated)Document284 pagesFU Money - Dan Lok (Updated)Siddharth Kalyani98% (45)

- Binomial Option Pricing Model: T-1 T, U T, DDocument4 pagesBinomial Option Pricing Model: T-1 T, U T, DVincent AlexNo ratings yet

- All Countries Flags of CountriesDocument6 pagesAll Countries Flags of CountriesWelkin Sky100% (1)

- Silicon Valley Bank Fiasco Simply ExplainedDocument21 pagesSilicon Valley Bank Fiasco Simply ExplainedGoMarkhaArjNo ratings yet

- Project Appraisal TechniquesDocument6 pagesProject Appraisal TechniquesChristinaNo ratings yet

- 2 Introduction To Accounting Sample ExercisesDocument3 pages2 Introduction To Accounting Sample ExercisesXia AlliaNo ratings yet

- Punjab National Bank - Banking ReportDocument36 pagesPunjab National Bank - Banking ReportGoutham SunilNo ratings yet

- Ju Ly 13, 2021: Ear N in G Season "Officially"Document9 pagesJu Ly 13, 2021: Ear N in G Season "Officially"Hitesh LNo ratings yet

- C 10: T T Q: Hapter HE Money Market Extbook UestionsDocument6 pagesC 10: T T Q: Hapter HE Money Market Extbook UestionsMalinga LungaNo ratings yet