Professional Documents

Culture Documents

2023 Notice of Appraised Value: Collin Central Appraisal District 250 Eldorado Pkwy MCKINNEY, TX 75069-8023

Uploaded by

Fuzzy PandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 Notice of Appraised Value: Collin Central Appraisal District 250 Eldorado Pkwy MCKINNEY, TX 75069-8023

Uploaded by

Fuzzy PandaCopyright:

Available Formats

SETPERF:00

921559

This is NOT a Tax Do Not Pay From

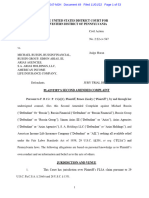

Statement 2023 Notice of Appraised Value This Notice

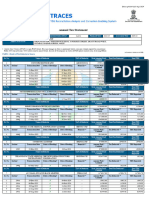

COLLIN CENTRAL APPRAISAL DISTRICT Property ID: 2628984

250 ELDORADO PKWY Ownership %: 100.00

MCKINNEY, TX 75069-8023 Geo ID: R-9336-00D-0230-1

Phone: 469.742.9200 866.467.1110 Legal: WREN CREEK ADDITION PHASE II-B (CMC), BLK D, LOT

23

Legal Acres:

DATE OF NOTICE: April 14, 2023 Situs: 1600 LANDON LN MCKINNEY, TX 75071

Appraiser:YJL

Owner ID: 921559

Efile PIN: XXXXXXXXXXXXXXXXXXXXXXX

Property ID: 2628984 - R-9336-00D-0230-1

GENTILE JAMES E JR & MINDY W

1600 LANDON LN

MCKINNEY, TX 75071-7658

Dear Property Owner,

We have appraised the property listed above for the tax year 2023. As of January 1, our appraisal is outlined below.

Appraisal Information Last Year - 2022 Proposed - 2023

Market Value of Improvements (Structures / Buildings, etc.) 425,387 529,889

Market Value of Non Ag/Timber Land 110,000 140,000

Market Value of Ag/Timber Land 0 0

Market Value of Personal Property/Minerals 0 0

Total Market Value 535,387 669,889

Productivity Value of Ag/Timber Land 0 0

Appraised Value** (possible homestead limitations, see below) 458,363 504,199

Exemptions (DV - Disabled Vet; DP-Disabled Person; HS-Homestead; OV65 - Over 65) HS HS

2022 2022 2023 2023 2023 Scan the QR code below to

Exemption Taxable Taxing Unit Proposed Exemption Taxable schedule an in-person informal

Amount Value Appraised Value Amount Value review of your appraised value

with the appraisal staff.

0 458,363 MCKINNEY CITY 504,199 0 504,199

26,769 431,594 COLLIN COUNTY 504,199 33,494 470,705 review.CollinCAD.org

5,354 453,009 COLLIN COLLEGE 504,199 6,699 497,500

40,000 418,363 MCKINNEY ISD 504,199 40,000 464,199 jcbZAgpPDBGtJS:jcbZ

ZlXZYjLn84IBBHPZlXZ

czaSURuvYvYWSSXzczP

JT3qDwp54jbR:D9IxI8

elFbIZ9u98hr;MuaDOR

L4QHWPvVrlR3VmfIwuX

aRTfP7QahICOCo4Nx3Z

ULPIa:b4JRrbBgsDcl:

xFFW2kViuT161qRft5R

Xvt87n7FyL38vHxpNZP

jcbZXhKzCiAfCyuSxWP

ZlXZFy8MNaJAthKUGdZ

zzzPz0zz00z00PP0P0P

See the "Informal Appraisal Review"

insert for more information.

The difference between the 2018 appraised value and the 2023 appraised value is 28.50%.

** Your residence homestead is protected from future appraisal value increases in excess of 10% per year PLUS the value of any new improvements.

* This indicates a tax ceiling exists for that taxing unit. If you qualified your home for an age 65 and older or disabled person homestead exemption for school taxes, the school

taxes on that home cannot increase as long as you own and live in that home. The tax ceiling is the amount that you pay in the year that you qualified for the 65 and older or

disabled person exemption. The school taxes on your home may not go above the amount of the ceiling, unless you improve the home (other than normal repairs and

maintenance).

You or your property may qualify for one of these residence homestead exemptions, if not already indicated above. Visit our website or contact our office for more information.

* HS – General Residence Homestead * DVHS – 100 Percent Disabled Veteran, or Surviving Spouse

* OV65 – Age 65 Or Older, or Surviving Spouse * MASSS – Surviving Spouse of Member of Armed Forces Killed In Action

* DP – Disabled Person * FRSS – Surviving Spouse of First Responder Killed in the Line of Duty

Beginning August 7th, visit Texas.gov/PropertyTaxes to find a link to your local property tax database where you can easily access information regarding your property taxes,

including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax

database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in

property taxes.

The governing body of each unit decides whether or not property taxes will increase. The appraisal district only determines the value of your property. The Texas Legislature

does not set the amount of your local taxes. Your property tax burden is decided by your locally elected officials, and all inquiries concerning your taxes should be directed to

those officials.

Property owners who file a notice of protest with the Appraisal Review Board (ARB) may request an informal conference with the appraisal district to attempt to resolve a

dispute prior to a formal ARB hearing. In counties with populations of 1 million or more, property owners may request an ARB special panel for certain property protests.

To file a protest, you must file a written protest with the ARB. To file a written protest, complete the Notice of Protest form by following the instructions included in the form and,

no later than the deadline indicated below, mail or deliver the form to the ARB at the address indicated below. The ARB will notify you of the date & time of your hearing.

Deadline for filing a protest: May 15, 2023

Location of Hearings: 250 Eldorado Pkwy, McKinney TX 75069

ARB will begin hearings: May 22, 2023

Enclosed are copies of the following documents published by the Texas Comptroller of Public Accounts: (1) Property Taxpayer Remedies; and (2) Notice of Protest form.

If you have any questions or need more information, please contact the appraisal district office at the phone numbers or at the address shown above.

Marty Wright, Chief Appraiser

Bfu:eVZbwYJvwJFZJdwX

You might also like

- WP - 9512 - 2003 - Yanala Malleshwari & OthersDocument120 pagesWP - 9512 - 2003 - Yanala Malleshwari & Othersabctandon100% (1)

- 2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal DescriptionDocument1 page2023 Web Tax Statement: Owner ID: Parcel ID: Sequence: Account #: Owner Interest: Legal Descriptionp13607091No ratings yet

- Occidental Mindoro - FAAS For Land and Other ImprovementsDocument2 pagesOccidental Mindoro - FAAS For Land and Other ImprovementsNormel DecalaoNo ratings yet

- 2021 Douglas County Budget PresentationDocument43 pages2021 Douglas County Budget PresentationinforumdocsNo ratings yet

- BP Top 05-015911Document2 pagesBP Top 05-015911Bplo CaloocanNo ratings yet

- A 8Document6 pagesA 8hopecomfort29No ratings yet

- BP Top 21-M0601-00006Document1 pageBP Top 21-M0601-00006Bplo CaloocanNo ratings yet

- Appraisal Card For BBC LandDocument1 pageAppraisal Card For BBC LandKBTXNo ratings yet

- Maintenance and R & R Funds BillDocument1 pageMaintenance and R & R Funds BillChetan BhasinNo ratings yet

- Tax Sale Certificate Assignment Auction Jan. 10, 2023Document3 pagesTax Sale Certificate Assignment Auction Jan. 10, 2023NewzjunkyNo ratings yet

- Vjay InsuDocument1 pageVjay InsuRajveer AutoNo ratings yet

- Ropa - Aug 2014Document65 pagesRopa - Aug 2014Mich FelloneNo ratings yet

- Tax Sale Certificate Assignment Auction Booklet December 2022Document5 pagesTax Sale Certificate Assignment Auction Booklet December 2022NewzjunkyNo ratings yet

- Bill No. 092502056683Document3 pagesBill No. 092502056683Nil OnlyNo ratings yet

- Capital Gain CaseDocument2 pagesCapital Gain Casecasamba306No ratings yet

- DownloadDocument1 pageDownloadSam BojanglesNo ratings yet

- DM Realty Developers Private LimitedDocument1 pageDM Realty Developers Private LimitedsimplepannuNo ratings yet

- Iffco - Tokio General Insurance Co. LTD: Signature Not VerifiedDocument28 pagesIffco - Tokio General Insurance Co. LTD: Signature Not VerifiedFrisk Consulting Pvt LtdNo ratings yet

- Financial Year 2021-22Document3 pagesFinancial Year 2021-22Sandeep KumarNo ratings yet

- Majeed SB - COMPUTATION and WEALTH STATEMENT 2022Document5 pagesMajeed SB - COMPUTATION and WEALTH STATEMENT 2022Muhammad SherazNo ratings yet

- CRM StatementofAccountDocument1 pageCRM StatementofAccountRahul E ChoudharyNo ratings yet

- Robinhood Markets Inc 85 Willow Road Menlo Park, CA 94025 650-940-2700Document30 pagesRobinhood Markets Inc 85 Willow Road Menlo Park, CA 94025 650-940-2700bob LastNo ratings yet

- Transport ProjectionDocument2 pagesTransport Projectionmanohar michaelNo ratings yet

- 3800 Main Tax Parcel 1Document2 pages3800 Main Tax Parcel 1gauravNo ratings yet

- UnlockedDocument5 pagesUnlockedKush SharmaNo ratings yet

- Signing Date: 13/12/2023 04:13:18 SGT Signed By: Ds CWT India PVT LTD 2Document3 pagesSigning Date: 13/12/2023 04:13:18 SGT Signed By: Ds CWT India PVT LTD 2Himanshu MishraNo ratings yet

- StatementDocument5 pagesStatementbiswajitnandi611No ratings yet

- 2022 Ococ0594962002Document1 page2022 Ococ0594962002john yorkNo ratings yet

- HTBill PDFDocument1 pageHTBill PDFDta FnbnrNo ratings yet

- Form 26ASDocument10 pagesForm 26ASdhaval.shahNo ratings yet

- TANGEDCO Online PaymentDocument1 pageTANGEDCO Online PaymentAyyanzeroNo ratings yet

- Stansberry 2nd Homestead in DCDocument2 pagesStansberry 2nd Homestead in DCAnonymous Pb39klJNo ratings yet

- SDAT Real Property Data Search - SDAT Real Property Data Search-1-1Document1 pageSDAT Real Property Data Search - SDAT Real Property Data Search-1-1ideal homesNo ratings yet

- Ezy Bzly DocumentDocument2 pagesEzy Bzly DocumentMd JasimuddinNo ratings yet

- BP002758 PermitDocument1 pageBP002758 PermitExcelNo ratings yet

- NDQ Tax Statement 2023Document2 pagesNDQ Tax Statement 2023Jonno CapaldiNo ratings yet

- Office of The City Assessor City of Muntinlupa Ocular Inspection ReportDocument1 pageOffice of The City Assessor City of Muntinlupa Ocular Inspection ReportRon KiramNo ratings yet

- DPC9 1208160094828106 05032024235148Document2 pagesDPC9 1208160094828106 05032024235148dk031353No ratings yet

- Sri Sai Kisan Sewa Kendra Audit FY 2018-19Document5 pagesSri Sai Kisan Sewa Kendra Audit FY 2018-19Ca Nishikant mishraNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223120444927 Proposal/Covernote No: R09022242303Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 920222223120444927 Proposal/Covernote No: R09022242303imtiyazNo ratings yet

- GL MTCDocument16 pagesGL MTCMuhammad AqeelNo ratings yet

- Draft For Checking-Shree Amba Assets Liabilty CA CertificateDocument5 pagesDraft For Checking-Shree Amba Assets Liabilty CA CertificateMohit TiwariNo ratings yet

- Policy - MC PVC CBC 0012307Document5 pagesPolicy - MC PVC CBC 0012307Joshua CoronelNo ratings yet

- Saktipada Kayal All SoaDocument10 pagesSaktipada Kayal All Soabmfkolkata56No ratings yet

- Town of Newbury Actual Real Estate Tax Bill: Fiscal Year 2022 3Rd QuarterDocument1 pageTown of Newbury Actual Real Estate Tax Bill: Fiscal Year 2022 3Rd Quarterharsha.kNo ratings yet

- Computation of Income: Nazneen Mohammed Javed ShaikhDocument3 pagesComputation of Income: Nazneen Mohammed Javed ShaikhRahul RampalNo ratings yet

- 012-PSS - IGL - GorakhpurDocument1 page012-PSS - IGL - GorakhpurNishant KumarNo ratings yet

- Ks 02Document1 pageKs 02PARASHAR GULSHANNo ratings yet

- Chennai LBDocument1 pageChennai LBSatkar GarmentNo ratings yet

- 59428283Document2 pages59428283anshiNo ratings yet

- TNEB Online Payment - TRICHY KAMALA - CompressedDocument1 pageTNEB Online Payment - TRICHY KAMALA - Compressedmmassociates sivakasiNo ratings yet

- McLennan CAD Property Search - 1680711374747Document2 pagesMcLennan CAD Property Search - 1680711374747Rhoda TylerNo ratings yet

- Versosarichard SindejasDocument1 pageVersosarichard SindejasDorothy NaongNo ratings yet

- 59424276Document2 pages59424276anshiNo ratings yet

- NYIRABIZIMANADocument2 pagesNYIRABIZIMANAMunyangeri RegisNo ratings yet

- L2WGDG08386796 SoastatementnewDocument4 pagesL2WGDG08386796 SoastatementnewAkash MulagundmathNo ratings yet

- 1 SALN 2015 - 1oconDocument3 pages1 SALN 2015 - 1oconKarissaNo ratings yet

- Certificate Under Section 603: Council Chambers Telephone: Email: All Correspondence To: The Chief Executive OfficerDocument1 pageCertificate Under Section 603: Council Chambers Telephone: Email: All Correspondence To: The Chief Executive OfficerNir AlonNo ratings yet

- Work PaystubDocument1 pageWork Paystubjoelryan2019No ratings yet

- 26ASDocument4 pages26ASYash KavteNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2020-05Document21 pagesGlobe Life - AIL - Spotlight Magazine - 2020-05Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2023-03Document29 pagesGlobe Life - AIL - Spotlight Magazine - 2023-03Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2021-02Document27 pagesGlobe Life - AIL - Spotlight Magazine - 2021-02Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2019-03Document23 pagesGlobe Life - AIL - Spotlight Magazine - 2019-03Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2022-03Document29 pagesGlobe Life - AIL - Spotlight Magazine - 2022-03Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2019-04Document23 pagesGlobe Life - AIL - Spotlight Magazine - 2019-04Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2023-05Document33 pagesGlobe Life - AIL - Spotlight Magazine - 2023-05Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2021-05Document25 pagesGlobe Life - AIL - Spotlight Magazine - 2021-05Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2020-03Document25 pagesGlobe Life - AIL - Spotlight Magazine - 2020-03Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2020-01Document23 pagesGlobe Life - AIL - Spotlight Magazine - 2020-01Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2023-02Document35 pagesGlobe Life - AIL - Spotlight Magazine - 2023-02Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2002-12Document13 pagesGlobe Life - AIL - Spotlight Magazine - 2002-12Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2022-02Document33 pagesGlobe Life - AIL - Spotlight Magazine - 2022-02Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2018-01Document19 pagesGlobe Life - AIL - Spotlight Magazine - 2018-01Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2002-04Document13 pagesGlobe Life - AIL - Spotlight Magazine - 2002-04Fuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2002-10Document13 pagesGlobe Life - AIL - Spotlight Magazine - 2002-10Fuzzy PandaNo ratings yet

- NJDOI Order No. E23-22Document4 pagesNJDOI Order No. E23-22Fuzzy PandaNo ratings yet

- SCDOI File # 19-6742 Consent OrderDocument3 pagesSCDOI File # 19-6742 Consent OrderFuzzy PandaNo ratings yet

- Little v. AIL - Case No MID-L-000417-24 - Jan 2024Document42 pagesLittle v. AIL - Case No MID-L-000417-24 - Jan 2024Fuzzy PandaNo ratings yet

- Greg Rudolph Conviction Docket SheetDocument8 pagesGreg Rudolph Conviction Docket SheetFuzzy PandaNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2002-08Document13 pagesGlobe Life - AIL - Spotlight Magazine - 2002-08Fuzzy PandaNo ratings yet

- Michigan - Enforcement Case No 18-15426 (2019/8/1)Document6 pagesMichigan - Enforcement Case No 18-15426 (2019/8/1)Fuzzy PandaNo ratings yet

- Xcel - FL Insurance Dept v. Xcel - Case No. 212932-17-AGDocument11 pagesXcel - FL Insurance Dept v. Xcel - Case No. 212932-17-AGFuzzy PandaNo ratings yet

- Anthony Retone (Arias Agency - Hiring Manager) - Criminal DocketDocument9 pagesAnthony Retone (Arias Agency - Hiring Manager) - Criminal DocketFuzzy PandaNo ratings yet

- BKL Holdings v. Globe Life Inc - Case 4-22-Cv-00170-ALM (Doc 1-3)Document33 pagesBKL Holdings v. Globe Life Inc - Case 4-22-Cv-00170-ALM (Doc 1-3)Fuzzy PandaNo ratings yet

- CAInsuranceDept - 2019-01-04 - First Amended Accusation Against XCelDocument25 pagesCAInsuranceDept - 2019-01-04 - First Amended Accusation Against XCelFuzzy PandaNo ratings yet

- Ruiz V AIL New NJ Complaint Case No. MID-L-001967-24Document39 pagesRuiz V AIL New NJ Complaint Case No. MID-L-001967-24Fuzzy PandaNo ratings yet

- TXDOI Enforcement Case No. 2022-7499 (09/14/2022)Document15 pagesTXDOI Enforcement Case No. 2022-7499 (09/14/2022)Fuzzy PandaNo ratings yet

- Zinsky v. Russin - Second Amended Complaint - 2022-11-01 - Case No. 2:22-cv-00547-MJDocument60 pagesZinsky v. Russin - Second Amended Complaint - 2022-11-01 - Case No. 2:22-cv-00547-MJFuzzy PandaNo ratings yet

- Greenlight Training v. Xcel - NJ Case No. MON-L-002917-18 (Complaint v2 - Jan 2020)Document17 pagesGreenlight Training v. Xcel - NJ Case No. MON-L-002917-18 (Complaint v2 - Jan 2020)Fuzzy PandaNo ratings yet

- Property Law Final PDFDocument42 pagesProperty Law Final PDFRittik PrakashNo ratings yet

- Full Name: Jhon Fredy Vargas Arevalo: Social Security NumberDocument3 pagesFull Name: Jhon Fredy Vargas Arevalo: Social Security NumberArbey F ArtNo ratings yet

- Alba v. Dela CruzDocument13 pagesAlba v. Dela CruzVince MontealtoNo ratings yet

- KIONISALA v. HEIRS OF HONORIO DACUT, GR No. 147379, 2002-02-27Document9 pagesKIONISALA v. HEIRS OF HONORIO DACUT, GR No. 147379, 2002-02-27Radel LlagasNo ratings yet

- Search: Chanrobles On-Line Bar ReviewDocument8 pagesSearch: Chanrobles On-Line Bar ReviewKatherine DizonNo ratings yet

- 68 Heirs of Domingo Valientes vs. RamasDocument15 pages68 Heirs of Domingo Valientes vs. RamasTrisha Paola TanganNo ratings yet

- PHD - Evgeny Badredinov - Problems of Modernization in Late Imperial Russia Maksim M. Kovalevskii On Social and Economic Reform, 2005Document179 pagesPHD - Evgeny Badredinov - Problems of Modernization in Late Imperial Russia Maksim M. Kovalevskii On Social and Economic Reform, 2005geliboluNo ratings yet

- IncDocument2 pagesIncnhizza dawn DaligdigNo ratings yet

- Son - S Pious ObligationDocument7 pagesSon - S Pious ObligationTanya RajNo ratings yet

- HDBDocument17 pagesHDBFariz HusnaNo ratings yet

- Filipino Merchants Insurance Co. v. CA 179 SCRA 638 (1989)Document6 pagesFilipino Merchants Insurance Co. v. CA 179 SCRA 638 (1989)maronillaizelNo ratings yet

- Tenancy Agreement 408 Rotunda 150 New Street Birmingham b2 4paDocument14 pagesTenancy Agreement 408 Rotunda 150 New Street Birmingham b2 4papattaraweeNo ratings yet

- LTD Case Digest PDFDocument60 pagesLTD Case Digest PDFPduys16No ratings yet

- 10-Heirs of Protacio Go Sr. vs. Servacio & Go, G.R. No. 157537, Sept. 7, 2011Document5 pages10-Heirs of Protacio Go Sr. vs. Servacio & Go, G.R. No. 157537, Sept. 7, 2011Jopan SJNo ratings yet

- Dagdag Vs NepomucenoDocument4 pagesDagdag Vs NepomucenoRyan AcostaNo ratings yet

- Ta3b (Land Laws)Document3 pagesTa3b (Land Laws)Kalaiarasan SNo ratings yet

- 6 Endaya V CADocument4 pages6 Endaya V CAPatricia Anne GonzalesNo ratings yet

- Conflict Between Labor and CapitalDocument8 pagesConflict Between Labor and CapitalNneka LaurenteNo ratings yet

- Lm3241 Product Brief 6Mhz, 750ma Miniature, Adjustable, Step-Down DC-DC Converter For RF Power AmplifiersDocument6 pagesLm3241 Product Brief 6Mhz, 750ma Miniature, Adjustable, Step-Down DC-DC Converter For RF Power AmplifiersLeonardo SoaresNo ratings yet

- Succession MidtermsDocument24 pagesSuccession MidtermsJapoy Regodon EsquilloNo ratings yet

- Dumo Vs RepublicDocument12 pagesDumo Vs RepublicGladys BantilanNo ratings yet

- PartnershipDocument8 pagesPartnershipAnonymous 03JIPKRkNo ratings yet

- Trust Deed FormatDocument6 pagesTrust Deed Formatchandraadv100% (4)

- Filinvest Credit Corporation vs. Philippine Acetylene, GR L50449, Jan 1982Document4 pagesFilinvest Credit Corporation vs. Philippine Acetylene, GR L50449, Jan 1982Fides DamascoNo ratings yet

- Private International LawDocument7 pagesPrivate International LawShourya BhattNo ratings yet

- Outline 4 Corporation Code RomeroDocument47 pagesOutline 4 Corporation Code RomeroDkNarcisoNo ratings yet

- Servicewide Specialists v. CADocument2 pagesServicewide Specialists v. CAd2015memberNo ratings yet

- Performance Audit Division of Building & Codes: Code Enforcement OperationsDocument27 pagesPerformance Audit Division of Building & Codes: Code Enforcement OperationstulocalpoliticsNo ratings yet

- Consti 2 - 1ST ExamDocument98 pagesConsti 2 - 1ST ExamMilton PatesNo ratings yet