Professional Documents

Culture Documents

L00167bi 20231218 134415 0000777848

L00167bi 20231218 134415 0000777848

Uploaded by

Vikas Nimbrana0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

L00167BI.20231218.134415.0000777848

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageL00167bi 20231218 134415 0000777848

L00167bi 20231218 134415 0000777848

Uploaded by

Vikas NimbranaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

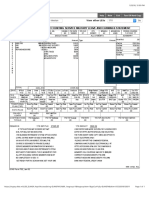

400 GLEN HUNTLY ROAD

ELSTERNWICK VIC 3185

Private & Confidential

VIKAS, Vikas

2/249 Lennox Street

RICHMOND VIC 3121

Client Id - 133720 Pay Point -

Seq No. Date Time Emp No. - 61 34026 1

(20 18/12/23 13:42:14)

EMPLOYEE PAY DETAILS

Weekly 1 Pay Date Number Name Status

11/12/2023 - 17/12/2023 19/12/2023 61 VIKAS, Vikas Casual

Pay Point Pay Advice

1 OF 1

PAY ELEMENTS ALLOWANCES, DEDUCTIONS AND CONTRIBUTIONS

Description Rate Hours Value TI Description Value TI

Base Hourly 24.9600 28.2500 705.12 B HOSTPLUS Superannuation Fund - Indu 125.75 *

Cas Load 25% 6.2400 28.2500 176.28 B

C/Sat >21 29.9200 7.0000 209.44 B

CasSatLdg>21 7.4800 7.0000 52.36 B

SUMMARY OF EARNINGS

Gross Pre Tax Allows Pre Tax Deds Taxable Income Post Tax Allow Post Tax Deds Tax Net Income

1143.20 0.00 0.00 1143.20 0.00 0.00 -212.00 931.20

PAY DISTRIBUTION DETAILS LEAVE ENTITLEMENTS/ACCRUALS AS AT 17/12/2023

Method BSB Code Account No Account Name Amount Description Entitlement Prorata Total

EFT1 063-019 12457176 Vikas 931.20 Annual Leave h h 0.00h

Personal Leave 0.00h

EMPLOYEE ANNUAL SALARY YTD EMPLOYER CONTRIBUTIONS

1657.80

EMPLOYER MESSAGE

Unless your pay rates have already been split, the hourly rates shown on your

pay advice incorporates all loadings and penalty rates if applicable.

YEAR TO DATE DETAILS

YTD Gross YTD Pre Tax All YTD Pre Tax Ded YTD Taxable Income YTD Post Tax All YTD Post Tax Ded YTD Tax YTD Net Income

15070.98 0.00 0.00 15070.98 0.00 0.00 -2052.00 13018.98

AVIV CONTINENTAL CAKES UNIT TRUST ABN : 36 281 086 381

A - Indicates After Tax Add/Ded B - Indicates Before Tax Add/Ded E - Indicates Employer Paid TI - Tax Indicator * - Indicates SGC Related Super

You might also like

- PayslipDocument1 pagePayslipRow Dizon0% (3)

- PayslipDocument1 pagePayslipJb SantosNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- 4133104Document1 page4133104Ann BenjaminNo ratings yet

- Agoda HRM Assignment - ISHITA SINGHDocument3 pagesAgoda HRM Assignment - ISHITA SINGHArpita GuptaNo ratings yet

- Alorica - Ms. Trina - ReviseDocument1 pageAlorica - Ms. Trina - Revisebktsuna0201100% (1)

- Alorica - Angelo May 13Document1 pageAlorica - Angelo May 13bktsuna0201No ratings yet

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- Document 2Document2 pagesDocument 2Trenika SwainNo ratings yet

- CURRICULUM VITAE (Orig) ...Document3 pagesCURRICULUM VITAE (Orig) ...marites mercedNo ratings yet

- 201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Document1 page201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Tera's TarotNo ratings yet

- Food Packaging Principles and PracticeDocument19 pagesFood Packaging Principles and PracticeVikas NimbranaNo ratings yet

- Aviva HRMDocument50 pagesAviva HRMJennz Monty100% (1)

- L01968bi 202275 15103 0001012596Document1 pageL01968bi 202275 15103 0001012596Tapan RajyaguruNo ratings yet

- Kristina - MAY 22Document1 pageKristina - MAY 22bktsuna0201No ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- MarchDocument1 pageMarchx62bzy8pktNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Epayslip 2024-02-27 30130850Document1 pageEpayslip 2024-02-27 30130850renatopertubaNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- Payslip_February (1) (1)Document1 pagePayslip_February (1) (1)itsmymail429No ratings yet

- HTMLReports 1Document1 pageHTMLReports 1kuldeeptawar250No ratings yet

- PayslipDocument1 pagePayslipwala meronNo ratings yet

- Salary Slip NOVDocument1 pageSalary Slip NOVdefinetrading2022.coNo ratings yet

- Axis Bank LTD Payslip For The Month of May - 2021Document2 pagesAxis Bank LTD Payslip For The Month of May - 2021Suman DasNo ratings yet

- Jason Matheson Paystub 2Document1 pageJason Matheson Paystub 2wadewilliamsperling1992No ratings yet

- 100000000704979Document3 pages100000000704979Wasim KhanNo ratings yet

- Jul 192017Document1 pageJul 192017Anonymous qqE8o5QNo ratings yet

- Sspofadv 2Document1 pageSspofadv 2freddieaddaeNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- LatestDocument3 pagesLatestAman SinghNo ratings yet

- Pay MarchDocument1 pagePay MarchAdwoa PrempehNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Deepika3Document1 pageDeepika3chanduazad8808No ratings yet

- Epayslip 2022-07-25 10369847Document1 pageEpayslip 2022-07-25 10369847aida.bungcasan.2020No ratings yet

- Sspofadv 4Document1 pageSspofadv 4freddieaddaeNo ratings yet

- LB US Online PayslipDocument2 pagesLB US Online PayslipJoali uwuNo ratings yet

- Concentrix Daksh Services India Private Limited Full and Final SettlementDocument1 pageConcentrix Daksh Services India Private Limited Full and Final Settlementsouraav.guptaaNo ratings yet

- SSPOFADVDocument1 pageSSPOFADVfreddieaddaeNo ratings yet

- RPT Pay Slip YTDDocument1 pageRPT Pay Slip YTDTomola BlessingNo ratings yet

- Paystub 202303Document1 pagePaystub 202303carinaNo ratings yet

- Riopel, Breanna Jul 30, 21Document1 pageRiopel, Breanna Jul 30, 21wadewilliamsperling1992No ratings yet

- Pay Slip - RS18222 - Feb-24Document1 pagePay Slip - RS18222 - Feb-24secret poetryNo ratings yet

- EmployeeData OctDocument2 pagesEmployeeData OctAnkit SinghNo ratings yet

- 114(1) (Return of Income filed voluntarily for complete year)_2023 (2)Document4 pages114(1) (Return of Income filed voluntarily for complete year)_2023 (2)ianveed64No ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- A Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaDocument2 pagesA Unit of Haryana Power Generation Corporation LTD.: Panipat Thermal Power Station Urja Bhawan, C-7, Sector - 6 PanchkulaRamchanderNo ratings yet

- Q000686a 2019917 8550 0003598919Document1 pageQ000686a 2019917 8550 0003598919Thirangana WeerasingheNo ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Document1 pageGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuNo ratings yet

- Wa0001.Document5 pagesWa0001.Pratyush Prateem BhattaNo ratings yet

- May_2023-2024-3Document1 pageMay_2023-2024-3drangulasaiNo ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- December Salary SlipDocument1 pageDecember Salary SlipVipul TyagiNo ratings yet

- Nett Pay 4222.87Document1 pageNett Pay 4222.87sacNo ratings yet

- COMPDocument2 pagesCOMPSairishi GhoshNo ratings yet

- For Stub Home DepotDocument1 pageFor Stub Home Depotraheemtimo1No ratings yet

- Employee Salary Slip For August, 2022: Lucky Cement LimitedDocument124 pagesEmployee Salary Slip For August, 2022: Lucky Cement LimitedAdeen MohsinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- CV 2023121613405042Document2 pagesCV 2023121613405042Vikas NimbranaNo ratings yet

- Vikas-CV (Food Technology)Document2 pagesVikas-CV (Food Technology)Vikas NimbranaNo ratings yet

- Receipt 18feb2024 062614Document1 pageReceipt 18feb2024 062614Vikas NimbranaNo ratings yet

- Your Statement: Smart AccessDocument26 pagesYour Statement: Smart AccessVikas NimbranaNo ratings yet

- Leavening Agents in Food IndustryDocument3 pagesLeavening Agents in Food IndustryVikas NimbranaNo ratings yet

- PhotoDocument1 pagePhotoVikas NimbranaNo ratings yet

- Tatts Rules of Authorised Lotteries 19 May 2023Document38 pagesTatts Rules of Authorised Lotteries 19 May 2023Vikas NimbranaNo ratings yet

- Uses of Honey: 10 Uses For Honey Your Doctor Doesn't Want You To KnowDocument11 pagesUses of Honey: 10 Uses For Honey Your Doctor Doesn't Want You To KnowVikas NimbranaNo ratings yet

- A Cross-Sectional Analysis of U.S. Yogurt DemandDocument10 pagesA Cross-Sectional Analysis of U.S. Yogurt DemandVikas NimbranaNo ratings yet

- Effect of Manufacturing Methods On The Quality of YoghurtDocument53 pagesEffect of Manufacturing Methods On The Quality of YoghurtVikas Nimbrana100% (1)

- Studies On Frozen Yogurt I. Manufacturing Method: February 1993Document11 pagesStudies On Frozen Yogurt I. Manufacturing Method: February 1993Vikas NimbranaNo ratings yet

- Case Study Teaching Notes For Introduction To Materials Management, 7eDocument6 pagesCase Study Teaching Notes For Introduction To Materials Management, 7eSandeep DoranadulaNo ratings yet

- IRLW 5th Unit NotesDocument5 pagesIRLW 5th Unit NotesSaravanan ShanmugamNo ratings yet

- Productivity ParadoxDocument5 pagesProductivity Paradoxronaldo271285No ratings yet

- Topic 1Document59 pagesTopic 1anesuNo ratings yet

- HR Policies ReportDocument544 pagesHR Policies ReportMonica HuangNo ratings yet

- Root Cause Analysis For Employee TurnoverDocument77 pagesRoot Cause Analysis For Employee TurnoverRani Gujari100% (4)

- Soal Bahasa InggirsDocument4 pagesSoal Bahasa Inggirsnurmalia ramadhonaNo ratings yet

- The Office: Procedures and TechnologyDocument27 pagesThe Office: Procedures and TechnologyPh0nG TrAnNo ratings yet

- Fringe Benefits and Job SatisfactionDocument19 pagesFringe Benefits and Job SatisfactionsonaalpuriNo ratings yet

- Labour Law-IIDocument4 pagesLabour Law-IISuditi TandonNo ratings yet

- Validation of The Organizational Commitment Questionnaire (OCQ) in Six LanguageDocument12 pagesValidation of The Organizational Commitment Questionnaire (OCQ) in Six LanguageCésar GarciaNo ratings yet

- RBI PBPP Business Research Dec 2012 (F)Document78 pagesRBI PBPP Business Research Dec 2012 (F)AmbreenNo ratings yet

- 6 Educ 206 Module For Chapter 8 - 9Document8 pages6 Educ 206 Module For Chapter 8 - 9Trisha Mae BocaboNo ratings yet

- Organisational Behaviour: Directorate of Distance & Continuing Education Utkal University, Bhubaneswar-7, OdishaDocument186 pagesOrganisational Behaviour: Directorate of Distance & Continuing Education Utkal University, Bhubaneswar-7, OdishaKrishan Kant MeenaNo ratings yet

- Essential Graphs For MicroeconomicsDocument12 pagesEssential Graphs For MicroeconomicsSayed Tehmeed AbbasNo ratings yet

- NESTLE Ba N inDocument17 pagesNESTLE Ba N inVivian KeeNo ratings yet

- Decision Support Systems: in LeeDocument10 pagesDecision Support Systems: in LeeMr-Mk MughalNo ratings yet

- TIPS Course Online TOEFLDocument10 pagesTIPS Course Online TOEFLJennifer Ponce Cori SjlNo ratings yet

- MGTO 324 Recruitment and Selections: Staffing Model, Strategy, & PlanningDocument39 pagesMGTO 324 Recruitment and Selections: Staffing Model, Strategy, & PlanningKRITIKA NIGAMNo ratings yet

- Leave EncashmentDocument1 pageLeave EncashmentParamita SarkarNo ratings yet

- Page 15Document220 pagesPage 15Adri MillerNo ratings yet

- 02 02 2012Document24 pages02 02 2012Bounna PhoumalavongNo ratings yet

- Chapter Two The Economizing ProblemDocument13 pagesChapter Two The Economizing ProblemHannah CaparasNo ratings yet

- Chapter One 1.1 Background To The StudyDocument142 pagesChapter One 1.1 Background To The StudyOla AdeolaNo ratings yet

- Dayalbagh Educational Institute: Project Report On "Wipro LTD"Document15 pagesDayalbagh Educational Institute: Project Report On "Wipro LTD"ayushi bansalNo ratings yet

- The African American Story Part 5Document38 pagesThe African American Story Part 5TimothyNo ratings yet

- OSHA Shipyard Industry StandardsDocument275 pagesOSHA Shipyard Industry Standardsovantovalle80% (5)