Professional Documents

Culture Documents

Midterm Practice Q1

Uploaded by

Thanh PhuongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Practice Q1

Uploaded by

Thanh PhuongCopyright:

Available Formats

Practice in-class Question

PAINT Inc. purchased 60% of the voting shares of SAINT Inc for $420,000 on

January 1, 2009. On that date, SAINT’s commons stock and retained earnings were

valued at $220,000 and $260,000 respectively. PAINT uses the cost method to

account for its investment in SAINT Inc.

SAINT’s fair values approximated its carrying values with the following exceptions:

• SAINT’s trademark had a fair value which was $40,000 higher than its

carrying value. The trademark had a useful life of exactly ten years remaining

from the date of acquisition.

• SAINT’s inventory had a fair value which was $20,000 higher than their

carrying value, this inventory was sold during 2009.

The Financial Statements of both companies for the Year ended December 31, 2010

are shown below:

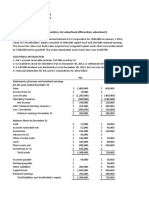

Income Statements

PAINT Inc. SAINT Inc.

Sales $947,000 $525,000

Other revenues $83,000 $60,000

Less: Expenses:

Cost of Goods Sold: $310,000 $256,000

Depreciation Expense $28,000 $14,000

Other Expenses $92,000 $40,000

Income Tax Expense $230,000 $130,000

Net Income $370,000 $145,000

Retained Earnings Statements

Balance, January 1, 2010 $133,000 $300,000

Net Income $370,000 $145,000

Less: Dividends ($60,000) ($50,000)

Retained Earnings $443,000 $395,000

Balance Sheet

PAINT Inc. SAINT Inc.

Cash $110,000 $120,000

Accounts Receivable $103,000 $120,000

Inventory $105,000 $140,000

Investment in SAINT Inc. $420,000 -

Equipment (net) $325,000 $260,000

Trademark - $205,000

Land - $20,000

Total Assets $1,063,000 $865,000

Current Liabilities $180,000 $150,000

Bonds Payable $140,000 $100,000

Common Shares $300,000 $220,000

Retained Earnings $443,000 $395,000

Total Liabilities and Equity $1,063,000 $865,000

Other Information:

• During 2010, SAINT sold inventory to PAINT for $30,000. The cost of these

goods to SAINT was $20,000. 30% of this inventory was resold in 2010 to

outside parties, the remaining balance remained in PAINT’s inventory as at year

December 31, 2010. PAINT paid SAINT for the entire invoice in 2011.

• During December 2009, PAINT sold inventory to SAINT for $60,000, the cost of

the inventory to PAINT was $40,000. 40% of these goods remained in SAINT’s

inventory at the end of 2009. SAINT eventually sold the entire remaining

inventory to an outside customer in 2010.

• On January 1, 2010, PAINT sold equipment originally purchased for $90,000 to

SAINT for $70,000. At the time of intercompany sale this equipment had a net

book value of $40,000 and a remaining useful life of 4 years.

• The effective tax rate for both companies is 40%.

Required:

a. Prepare a schedule showing the calculation of goodwill at the date of

acquisition of SAINT, and a purchase price discrepancy amortization

schedule for the period from January 1, 2009 to December 31, 2010.

b) Prepare the consolidated financial statements: Income statement and

Retained Earnings for the year ended December 31st, 2010, and Balance Sheet

as at December 31st, 2010. Show all supporting calculations.

c) Prepare a schedule reconciling non-controlling interests: include calculation

of non-controlling interest at the beginning of the year as well as all changes

during the year

You might also like

- Tax BillDocument1 pageTax BillBrenda SorensonNo ratings yet

- Darvas BoxDocument18 pagesDarvas Boxagung_awd100% (1)

- Strat Cost 8-24Document4 pagesStrat Cost 8-24Vivienne Rozenn LaytoNo ratings yet

- Cerberus LetterDocument5 pagesCerberus Letterakiva80100% (1)

- 1 This First Bank: Sample Account Statement and BalancingDocument2 pages1 This First Bank: Sample Account Statement and BalancingQuenie De la CruzNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- P4Document21 pagesP4nancy tomanda100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- P4Document21 pagesP4nancy tomanda100% (2)

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- P4Document21 pagesP4reviska100% (1)

- Tugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- E3-3 (Based On AICPA) General Problems: Balance Sheet AccountsDocument10 pagesE3-3 (Based On AICPA) General Problems: Balance Sheet AccountsSintia Marada Hutagalung50% (2)

- Copy of Broiler FinancialsDocument5 pagesCopy of Broiler Financialskevior2No ratings yet

- ShortproblemDocument2 pagesShortproblemLabLab ChattoNo ratings yet

- Cattle Fattening FinancialsDocument5 pagesCattle Fattening Financialsprince kupaNo ratings yet

- Tax Compliance MonitoringDocument44 pagesTax Compliance MonitoringAcademe100% (2)

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Tugas Aklan TM7Document7 pagesTugas Aklan TM7AdnanNo ratings yet

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- (Quiz Uas Take Home) Akl-1 PDFDocument7 pages(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNo ratings yet

- Question 1 - Pretend CorporationDocument6 pagesQuestion 1 - Pretend Corporationyusuf pashaNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- Midterm Summer 2021Document2 pagesMidterm Summer 2021Thanh PhuongNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- Chapter 7 in Class Practice SolutionDocument12 pagesChapter 7 in Class Practice Solution919282902No ratings yet

- Total Assets $ 1,520,000 $ 640,000 $ 880,000Document12 pagesTotal Assets $ 1,520,000 $ 640,000 $ 880,000Furi Fatwa DiniNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- Assigment Week 6 Laila Fitriana 12030120120020 DDocument17 pagesAssigment Week 6 Laila Fitriana 12030120120020 DLaila FitrianaNo ratings yet

- Financial Planning and ForecastingDocument20 pagesFinancial Planning and ForecastingSyedMaazNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Tugas AKL P3-2 P3-3 - Athaya Sekar - 120110190049Document4 pagesTugas AKL P3-2 P3-3 - Athaya Sekar - 120110190049AthayaSekarNovianaNo ratings yet

- Reyhan Ario - 041911333106Document3 pagesReyhan Ario - 041911333106Reyhan ArioNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Adv 2 Tugas 2Document5 pagesAdv 2 Tugas 2Daniel ReyhansNo ratings yet

- Michael Hermawan Yuwono MGMT6346 Ba10 UtpDocument36 pagesMichael Hermawan Yuwono MGMT6346 Ba10 UtpchristianNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Quiz 1 Final PeriodDocument10 pagesQuiz 1 Final PeriodCmNo ratings yet

- Enterpreneurship Finance Exercises 4-6Document6 pagesEnterpreneurship Finance Exercises 4-6Trang TranNo ratings yet

- Latihan Soal Akl CH 1 Dan 2Document12 pagesLatihan Soal Akl CH 1 Dan 2DheaNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced AccountingJulyaniNo ratings yet

- Abraar Dairy and Farming Financial Template-1Document13 pagesAbraar Dairy and Farming Financial Template-1Ganacsi KaabNo ratings yet

- Group 4 OL-groupproject Mar 26Document19 pagesGroup 4 OL-groupproject Mar 26Jessica HummelNo ratings yet

- Assessment in Double Entry AccountingDocument7 pagesAssessment in Double Entry AccountingLhaiela AmanollahNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- A) An Expense For The Current YearDocument2 pagesA) An Expense For The Current YearKyle Lee UyNo ratings yet

- TOPSUSDocument9 pagesTOPSUSDwi CandrawatiNo ratings yet

- FM1Document4 pagesFM1Minas SydNo ratings yet

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- Chapter 5 SpreadsheetDocument7 pagesChapter 5 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Tarea Contabilidad Ingles - Es.enDocument2 pagesTarea Contabilidad Ingles - Es.enLUIS ENRIQUE VELASCO MENDOZANo ratings yet

- Finance Problem Set 1Document4 pagesFinance Problem Set 1Hamid Yaghoubi0% (1)

- Abuscom:: Consolidated Financial Statements Subsequent To Date of AcquisitionDocument3 pagesAbuscom:: Consolidated Financial Statements Subsequent To Date of AcquisitionMarynelle SevillaNo ratings yet

- Soal Kuis 2Document6 pagesSoal Kuis 2Rahajeng SantosoNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Office Supplies, Stationery & Gift Store Revenues World Summary: Market Values & Financials by CountryFrom EverandOffice Supplies, Stationery & Gift Store Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Chap10 HedgeDocument5 pagesChap10 HedgeThanh PhuongNo ratings yet

- Chap2 - Connect Practice Cox & Other AssignmentsDocument8 pagesChap2 - Connect Practice Cox & Other AssignmentsThanh PhuongNo ratings yet

- Chapter 4 - Problem 4.7Document3 pagesChapter 4 - Problem 4.7Thanh PhuongNo ratings yet

- Career Mary Tax Summary PDFDocument1 pageCareer Mary Tax Summary PDFThanh PhuongNo ratings yet

- P.O Box 1770, Rahim Pur Khichian Said Pur Road Sialkot-Pakistanphone:-+92-52 - 4268188,4260850-1 Fax: - +92-52-4262852Document56 pagesP.O Box 1770, Rahim Pur Khichian Said Pur Road Sialkot-Pakistanphone:-+92-52 - 4268188,4260850-1 Fax: - +92-52-4262852adeelbajwaNo ratings yet

- Solved After Graduating From College Tina Works Briefly As A Salesperson PDFDocument1 pageSolved After Graduating From College Tina Works Briefly As A Salesperson PDFAnbu jaromiaNo ratings yet

- Assignment September 2020 Semester: Subject Code MKM602 Subject Title Marketing Management Level Master'S DegreeDocument15 pagesAssignment September 2020 Semester: Subject Code MKM602 Subject Title Marketing Management Level Master'S Degreemahnoor arifNo ratings yet

- Annual Report - Federal Bank 2019-20Document278 pagesAnnual Report - Federal Bank 2019-20Rakesh MoparthiNo ratings yet

- TBChap 005Document61 pagesTBChap 005trevorNo ratings yet

- SYLLBS2023Document6 pagesSYLLBS2023AMBenedicto - MCCNo ratings yet

- Chapter-7 Investment ManagementDocument7 pagesChapter-7 Investment Managementhasan alNo ratings yet

- Subsidize The Project To Bring Its IRR To 25%Document4 pagesSubsidize The Project To Bring Its IRR To 25%Aprva100% (1)

- ACCT 6011 Assignment #1 TemplateDocument8 pagesACCT 6011 Assignment #1 Templatepatel avaniNo ratings yet

- 5OFI GST Functional P2P Flow Phase1 PDFDocument57 pages5OFI GST Functional P2P Flow Phase1 PDFlkalidas1998No ratings yet

- Assignment II - Quiz 2Document5 pagesAssignment II - Quiz 2tawfikNo ratings yet

- IC Accounts Payable Ledger Template Updated 8552Document2 pagesIC Accounts Payable Ledger Template Updated 8552M Monjur MobinNo ratings yet

- Computational Methods For Compound SumsDocument29 pagesComputational Methods For Compound Sumsraghavo100% (1)

- F. National Economy and PatrimonyDocument51 pagesF. National Economy and Patrimonydnel13No ratings yet

- Ketan RathodDocument92 pagesKetan RathodKetan RathodNo ratings yet

- A History of BankingDocument3 pagesA History of BankinglengocthangNo ratings yet

- Audit of LiabilitiesDocument4 pagesAudit of LiabilitiesJhaybie San BuenaventuraNo ratings yet

- RayeesDocument52 pagesRayeesAnshid ElamaramNo ratings yet

- Training Material On West Bengal Service RulesDocument99 pagesTraining Material On West Bengal Service Rulesp2c9100% (2)

- DSTechStartupReport2015 PDFDocument70 pagesDSTechStartupReport2015 PDFKhairudiNo ratings yet

- InvoiceDocument1 pageInvoiceUdit jainNo ratings yet

- Crif Microlend Vol XXV Sept 2023Document20 pagesCrif Microlend Vol XXV Sept 2023saurav guptaNo ratings yet

- Steve Advanced Courses Part 3Document16 pagesSteve Advanced Courses Part 3Manuel NadeauNo ratings yet

- Haberberg and Rieple: Strategic ManagementDocument20 pagesHaberberg and Rieple: Strategic ManagementMilan MisraNo ratings yet

- Financial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarDocument4 pagesFinancial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet