Professional Documents

Culture Documents

Final Exam Semester

Uploaded by

Prashant Bhatia0 ratings0% found this document useful (0 votes)

3 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageFinal Exam Semester

Uploaded by

Prashant BhatiaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

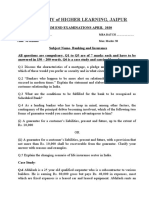

Final Exam Semester- III September (23-24)

Part A- 40 Marks

Attempt Any 10 Questions- Each Question carries 4 marks.

1. Explain the Term ULIP in Insurance.

2. Explain Acturial science in brief.

3. Explain the term NAV and how it is calculated?

4. List 5 fee based services in bank.

5. List 4 differences between Life Insurance and Non-life Insurance.

6. What is CRR and Repo rate?

7. What is fiduciary responsibility in financial services and explain with examples.

8. Explain Physical evidence as one of the “P” in financial services.

9. List 3 difference between NBFC and Bank

10. Explain Term Life Insurance

11. What is Mutual Banking

12. What are niche products in General Insurance.

Part B- 40 Marks

Attempt Any 4 Questions- Each Question carries 10 marks.

1. Write short note on Keyman and Employer-Employee

2. Explain the term called Cash Management Services and list type of services.

3. Write types of Mutual funds and explain.

4. Write a note on BancAssurance.

5. Explain the term- Bill discounting, Working Capital, Term Loan and LC.

6. State the importance of digitization and Artificial Intelligence in Banking.

Part C- 20 Marks

Case Study

Company called ABC is into manufacturing of toys in India. His existing turnover is 100 crores.He is

looking to expand his business in other segments like school bags and school kits and looking for

funding. His projected turnover is approx. 200 crores. He has hired around 50 new staff. He will train

them and look for long term associations with his employees.

a. How will he raise funds for new Project?

b. Which social security and employee retention tool will he use for current employees?

c. How will he hedge the risk in case something happens to director or key person?

d. How will he market new products and through which distribution channels?

All the best

You might also like

- Unit 5 Essential Questions and Vocab ExamplesDocument5 pagesUnit 5 Essential Questions and Vocab Examplesjonathan dycusNo ratings yet

- Iilm Academy of Higher Learning, Jaipur: ROLL NO. .. MBA BATCH . Time: 90 Minutes Max. Marks: 50Document2 pagesIilm Academy of Higher Learning, Jaipur: ROLL NO. .. MBA BATCH . Time: 90 Minutes Max. Marks: 50DrSwati BhargavaNo ratings yet

- LRM QDocument2 pagesLRM QJibon JainNo ratings yet

- Ba5011 Merchant Banking and Financial Services Reg 17 Question BankDocument5 pagesBa5011 Merchant Banking and Financial Services Reg 17 Question BankAnusha kanmaniNo ratings yet

- FSBI Important QuestioinsDocument6 pagesFSBI Important QuestioinsNagarjuna SunkaraNo ratings yet

- COMPLETE Important BcomDocument13 pagesCOMPLETE Important BcomImmad AhmedNo ratings yet

- C01CMT04 Banking and InsuranceDocument1 pageC01CMT04 Banking and InsuranceKarthika RajeshNo ratings yet

- FBLA Securities & Investments CompetenciesDocument3 pagesFBLA Securities & Investments CompetenciesSuhansh BijlaniNo ratings yet

- Final All Important Question of Mba IV Sem 2023Document11 pagesFinal All Important Question of Mba IV Sem 2023Arjun vermaNo ratings yet

- Que Bank PFMDocument5 pagesQue Bank PFMAmit KesharwaniNo ratings yet

- BA7202-Financial Management Question BankDocument10 pagesBA7202-Financial Management Question BankHR HMA TECHNo ratings yet

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNo ratings yet

- Group-B 2010Document4 pagesGroup-B 2010Mudassir Ahsan AnsariNo ratings yet

- 1 - Credit & Lending - Tutorial Questions Set 1 - 2022Document3 pages1 - Credit & Lending - Tutorial Questions Set 1 - 2022Abdulkarim Hamisi KufakunogaNo ratings yet

- Class XI (Commerce) Holiday Home Work 2023-24Document9 pagesClass XI (Commerce) Holiday Home Work 2023-24Nivedan SainiNo ratings yet

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDocument3 pagesMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereSolvedSmuAssignmentsNo ratings yet

- 6th Yr 2015 Revision ShortDocument18 pages6th Yr 2015 Revision Shortapi-248388979No ratings yet

- Applied Economics 2Document14 pagesApplied Economics 2Johnwilliam PluralNo ratings yet

- Banking 3rd SemesterDocument9 pagesBanking 3rd SemesterMrinal KalitaNo ratings yet

- Principles & Practice of Banking and Insurance Q&ADocument3 pagesPrinciples & Practice of Banking and Insurance Q&Arupeshdahake100% (1)

- ECO-01 NojDocument3 pagesECO-01 NojDon't Mess With MeNo ratings yet

- Maganjo Institute of Career Education: Unit ThreeDocument17 pagesMaganjo Institute of Career Education: Unit ThreewonueNo ratings yet

- Lending Operations and Risk ManagementDocument3 pagesLending Operations and Risk ManagementratannubdNo ratings yet

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDocument3 pagesMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereRajesh SinghNo ratings yet

- Job Analysis For The Post Head (Executive Director) of HR Department' of IDLC Finance LimitedDocument15 pagesJob Analysis For The Post Head (Executive Director) of HR Department' of IDLC Finance LimitedMohammed Iqbal HossainNo ratings yet

- Fundamentals of Corporate Governance - BBA-VIII - BBA (2Y) - IV-Spring 2021 - SMCHS - Paper BDocument3 pagesFundamentals of Corporate Governance - BBA-VIII - BBA (2Y) - IV-Spring 2021 - SMCHS - Paper BBalOchi videozNo ratings yet

- Model Solution: PGDM (2016-18) Term - IV End-Term ExaminationDocument20 pagesModel Solution: PGDM (2016-18) Term - IV End-Term ExaminationqwertyNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- BLP AssignmentDocument2 pagesBLP AssignmentSekar MuruganNo ratings yet

- Pre-Induction Assignment: MBA - Batch of 2019-2021Document12 pagesPre-Induction Assignment: MBA - Batch of 2019-2021Santu BiswaaNo ratings yet

- Important Questions-Financial Planning & Wealth ManagementDocument4 pagesImportant Questions-Financial Planning & Wealth ManagementGokula KrishnanNo ratings yet

- 15 Year 10 Commercial Studies QPDocument17 pages15 Year 10 Commercial Studies QPTiñ Şäm PäñäpäNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Section - A Answer The Following Questions. Each Question Carries 2 Marks Each (2 5 10) Q1)Document3 pagesSection - A Answer The Following Questions. Each Question Carries 2 Marks Each (2 5 10) Q1)limu123No ratings yet

- Ignou AssignmentsDocument18 pagesIgnou Assignmentshelp2012No ratings yet

- ABM 118 Investment ManagementDocument114 pagesABM 118 Investment ManagementJulieto ZubradoNo ratings yet

- Important Questions in Banking Insurance.Document3 pagesImportant Questions in Banking Insurance.Chandra sekhar VallepuNo ratings yet

- B.B.A.Model PapersDocument3 pagesB.B.A.Model PapersHemanshu GhanshaniNo ratings yet

- Role of The Professional Accountant in The Economy?Document104 pagesRole of The Professional Accountant in The Economy?unknown nooneNo ratings yet

- BBA HR SpecializationDocument7 pagesBBA HR SpecializationmeenakshiduhanNo ratings yet

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocument2 pagesCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksSuhana ShresthaNo ratings yet

- Financial Planning - Dec 09Document2 pagesFinancial Planning - Dec 09abhimani5472No ratings yet

- Bsba-Fm 3C: Instructor: Jan Kathleen O. LapitanDocument1 pageBsba-Fm 3C: Instructor: Jan Kathleen O. LapitanJan Kathleen LapitanNo ratings yet

- Banking and InsuranceDocument13 pagesBanking and InsuranceKiran Kumar50% (2)

- SAMPLE PAPER-1 (Solved) Business Studies Class - XI: General InstructionsDocument2 pagesSAMPLE PAPER-1 (Solved) Business Studies Class - XI: General InstructionsSanjay StarkNo ratings yet

- Assignment Drive FALL 2016 Program MBA Semester IV Subject Code & Name MA0043 Corporate Banking BK Id B1817 Credit 4 Marks 60Document2 pagesAssignment Drive FALL 2016 Program MBA Semester IV Subject Code & Name MA0043 Corporate Banking BK Id B1817 Credit 4 Marks 60Bipul BiplavNo ratings yet

- Velammal Engineering College CHENNAI - 600 066 Corporate Finance - Question Bank Part.ADocument2 pagesVelammal Engineering College CHENNAI - 600 066 Corporate Finance - Question Bank Part.AVinusha SooraNo ratings yet

- Iilm Academy of Higher Learning, Jaipur: Ii Mid - Term End Examinations April 2020Document2 pagesIilm Academy of Higher Learning, Jaipur: Ii Mid - Term End Examinations April 2020DrSwati BhargavaNo ratings yet

- Assignment 5 - Sources and Uses of Funds - 323711041Document3 pagesAssignment 5 - Sources and Uses of Funds - 323711041MA. ANGELA NISSI QUIROZNo ratings yet

- BA7024 CorporateFinancequestionbankDocument5 pagesBA7024 CorporateFinancequestionbankNorman MberiNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsAkash ModiNo ratings yet

- CBM Question BankDocument34 pagesCBM Question BankHimanshu AroraNo ratings yet

- Vishal Bhosale 2Document49 pagesVishal Bhosale 2alone WalkerNo ratings yet

- General Mathematics: Quarter 2 - Module 11: Business and Consumer LoansDocument27 pagesGeneral Mathematics: Quarter 2 - Module 11: Business and Consumer Loansshadow girirjek100% (2)

- RMI-UNIT-3 & 4 Question Bank PDFDocument2 pagesRMI-UNIT-3 & 4 Question Bank PDFBushra AhtabNo ratings yet

- Executive SummaryDocument36 pagesExecutive SummaryAnchal TrikhaNo ratings yet

- Sapm QBDocument8 pagesSapm QBSiva KumarNo ratings yet

- Research ReportDocument48 pagesResearch Reportbonat07No ratings yet